Tencent needs no introduction — it’s the world's largest game company and China’s largest company of any kind.

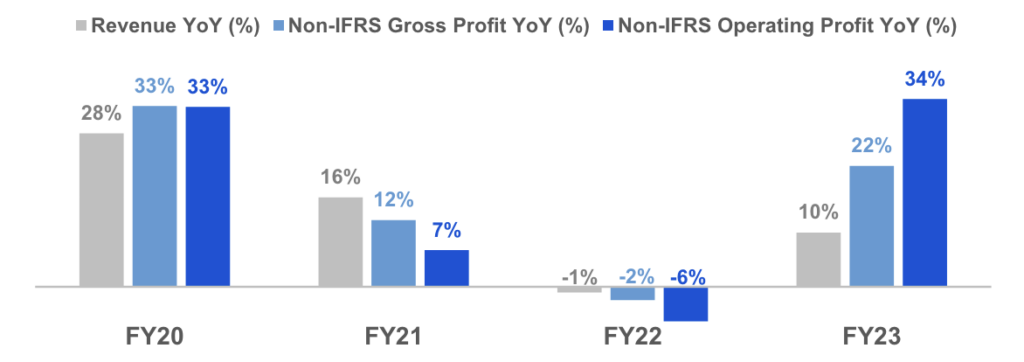

However, after its first ever annual revenue decline in 2022, along with tumultuous regulatory challenges and new developments in emerging businesses, Tencent’s future hinges on new strategies, rather than the same free-to-play gaming and social networking that’s core to its past success.

If we look at the company’s most recent earnings report, covering Q4 2023 and FY 23, it’s clear that even though more games are receiving regulatory approval now, the core gaming business is currently not a major catalyst for overall growth.

In Q4, domestic game sales decreased 3% year-over-year, while international game sales, which represent 30% of total gaming sales and includes subsidiaries like Riot and Supercell, slipped 1% excluding currency adjustments. In contrast, advertising, fintech, and other business services are all seeing double-digit growth. Tencent’s international business shows signs of bigger picture growth, as we’ll discuss later, but native mobile and PC games have slightly decreased as a percentage of overall revenue.

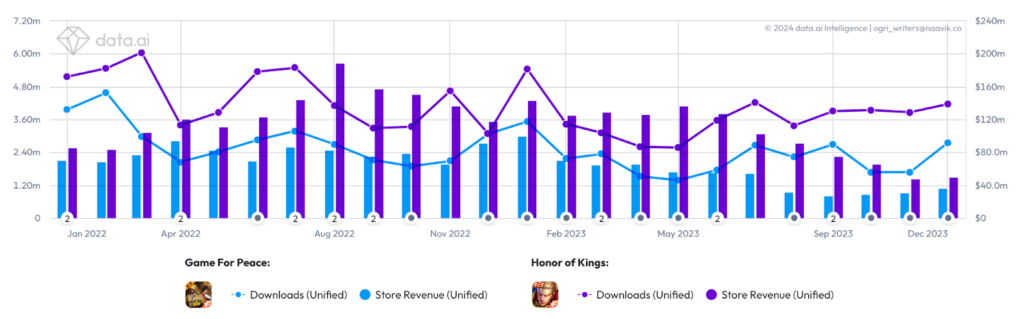

Tencent said it had two new “major hit games” to its gaming vertical in 2023 — likely League of Legends: Wild Rift and Teamfight Tactics: Fight of the Golden Spatula. However, the company simultaneously experienced steep revenue decline in its historic top performers: Game for Peace (aka Peacekeeper Elite) and Honor of Kings (aka Arena of Valor). Game for Peace’s monthly revenue dropped 80% from January to August 2023, according to Naavik’s analysis.

While these games are still among the highest grossing in the world, such a sharp decline in revenue clearly rang alarm bells in Shenzhen. “Monetisation has been unimaginative,” the company said, adding that it had “changed leadership of monetisation team.”

It is difficult to ascertain the exact causes of these diminished returns, but a tightening domestic regulatory environment, which limits certain monetization techniques that both games may have relied on, is a likely factor. Clearly, regulations have hampered Tencent in many ways.

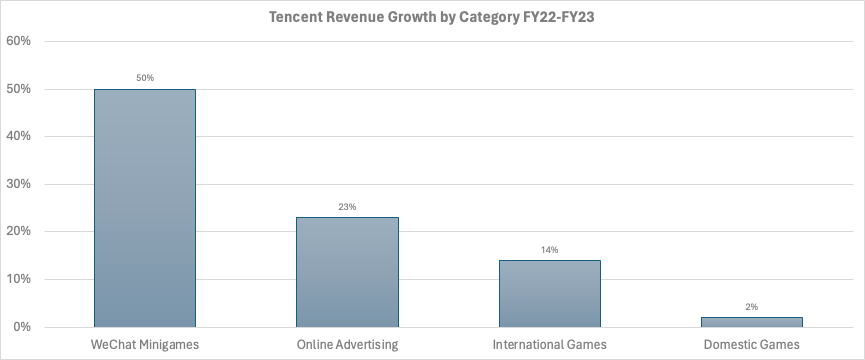

Tencent’s game live streaming business also declined in 2023, and its social networking division (which includes WeChat minigames' revenue) only grew 1%, even from 2022’s low performance. These challenges are real, but it’s also worth examining the gaming sectors in which Tencent is seeing momentum — and potentially future upside.

Sources of Growth: Minigames, Advertising, and International

WeChat’s minigames have existed since 2017, and in 2023, Tencent revealed that minigames collectively reach 400M MAUs (about 30% of WeChat’s overall MAU) via 300K developers. However, the top WeChat minigame charts are dominated by major developers of native apps, many of whom have ported existing games over to this format. Tencent offers first-party titles as well, including a minigame adaptation of recent release Dream Star (aka Yuanmeng Star).

The platform offers impressive capabilities, as minigames often feature rich 3D graphics and virtual worlds with high player counts, thanks to support for game engines like Unity, Cocos, and Laya. Monetization, formerly quite advertising heavy, has matured with many titles now featuring robust hybrid monetization strategies with IAPs, while advertising revenue for minigames as a whole has still grown 30% year-over-year. Some publishers are now reporting minigame ARPU at similar levels to those of native apps, and anecdotally, some individual minigames have even reached over 100M users.

Tencent president Martin Lau reported that minigame revenue grew over 50% in 2023, and that “growth in gross receipts drove an increase in high-margin platform fees.” He cited minigames’ user retention rates and time spent per user as being “notably higher than peer services,” attributing this clear win to “Weixin's (WeChat’s) platform stickiness, well-developed ecosystems such as social sharing and notifications, and game technology know-how.”

These platform fees include both a direct IAP revenue cut, as well as nongame fees from transactions, developer accounts, and bank transfers. Given that Tencent views minigames as a high-margin business, it's likely to prioritize the format’s continued growth. Founder Pony Ma recently said that while WeChat is the company’s ”most robust platform regarding daily user amount,” it is also “12 years of age.”

“How we can find new sprouts from the old tree that is WeChat is the big question for us,” he added. Minigames may be that sprout.

Tencent’s online advertising division is also growing nicely, and has benefited from Tencent’s pioneering work in large language models, namely its Hunyuan model. As Lau stated:

“Deploying AI technology in our existing businesses has begun to deliver significant revenue benefits. This is most obvious in our advertising business, where our AI-powered ad tech platform is contributing to more accurate ad targeting, higher ad click-through rates, and thus faster advertising revenue growth rates.”

Gaming is a key category for Tencent’s advertising business, which supports game-focused inventory like rewarded video, but advertisers across all segments buy ads on WeChat, QQ, and more.

Tencent’s opportunity in advertising is vast and largely untapped relative to its media subscription, payments, and IAP-oriented gaming businesses. Similar to American giants like Amazon and Chase, it is expected that advertising will become an increasing focus for the company.

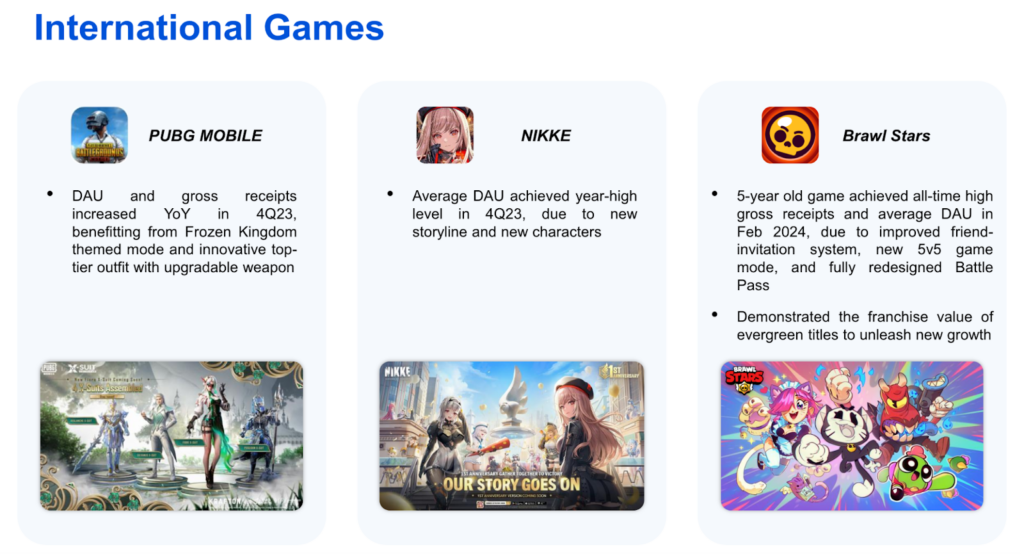

Despite a Q4 2023 slowdown, international gaming revenue also grew 14% year-over-year, continuing to grow the share of Tencent’s overall gaming business. In particular, strong results from PUBG Mobile, Brawl Stars, Goddess of Victory: Nikke, Valorant, and Lost Ark (an MMO developed by Tripod with publishing duties split across Smilegate, Tencent, and Amazon Games) delivered the most meaningful results. They are poised for continued strong performance in 2024, according to leadership.

All of these titles are either the products of co-development, partnership, or subsidiaries, instead of only Tencent internal studios. The company is likely viewing these results as an opportunity to stake a bigger claim outside of its core titles, and even beyond minigames, in novel ways.

New Types of Games

This has manifested in a pursuit of new genres beyond the PvP fare that has been Tencent’s internal studios’ bread and butter for years. For example, TiMi and Lightspeed, arguably Tencent’s top two studios, have been pursuing Palworld-esque titles.

Some of the company’s latest big releases are party game Dream Star (though it lags behind rival NetEase’s Eggy Party), a foray into the sports game market with NBA Infinite, along with the recent acquisition of top domestic MMORPG developer Wangyuan Shengtang, staking a bigger claim in another genre where NetEase leads.

Further diversification has also occurred opportunistically, as Tencent has snapped up two former ByteDance studios working in the action and anime genres. Negotiations between the two firms have been multifaceted; Tencent now permits live streaming and advertising of its titles on ByteDance’s Douyin platform. Tencent had previously restricted these activities, a common tactic among Chinese tech firms who often block links to each other’s platforms.

Tencent is also ramping up its international co-development activity. Given the success of Call of Duty: Mobile (and despite, or perhaps because of, the tense relationship with Activision and the failed partnership with EA), it’s no surprise to see Tencent working to adapt other global PC/console franchises.

The company has deals in place with Ubisoft and From Software (both of which it has minority stakes in) to bring Tom Clancy's The Division and Elden Ring to mobile, and Reuters reports the interesting phenomenon that Tencent has been both bargaining hard for low IP licensing rates and simultaneously has accumulated more IP rights than it may have the resources to adapt — an impressive negotiation feat. For example, it has had to pull staff away from Assassin’s Creed Jade to support the launch of Dream Star. However, the cancellation of high-profile projects like Nier and Apex Legends Mobile (relaunched as High Energy Heroes, which has struggled) emphasize that reliance on foreign IP and co-development projects is far from a risk-free growth strategy.

But Tencent’s biggest bet in new types of games is in Western-focused PC/console titles. Both the Lightspeed and TiMi studios (which have a competitive dynamic between them, common within Tencent) have established U.S. branches, developing games for this market — though TiMi’s was shuttered last year. Lightspeed LA made a splash at the 2023 Game Awards with a reveal trailer for Last Sentinel, a “narrative-focused, open-world action game set decades from now in a reconstructed Tokyo.” The company is also partnering with Remedy Entertainment (in which it holds a minority stake) for an upcoming game that has pivoted from a free-to-play game to a premium co-op title.

NetEase has also prioritized growth in the sector as well, which has been covered in a previous piece for Naavik. Tencent, of course, has had such expansionary zeal for decades, though these activities have taken on additional urgency in light of intensifying domestic regulations limiting gameplay, U.S. restrictions on Chinese tech investment, and increasing mobile user acquisition challenges. The development cycle and cost structures of PC/console titles can vary significantly from mobile. This approach may hold more risk than pure M&A or minority investments and takes longer to see returns given that teams are starting from scratch, but the financial upside is potentially much greater.

Looking (Slightly) Beyond Games

It’s important to remember that even though Tencent is the world’s largest game company, gaming only directly accounts for 30% of the company’s revenue. Though the potential of the advertising business has already been covered, several additional gaming-related lines of business are evolving in important ways.

Mixed reality is an area where Tencent is relying on its playbook of local partnerships with Western sector leaders. It is collaborating with Apple to bring some of its apps to the Vision Pro when it releases in China. Given the media-focused use cases (rather than gaming) with which Apple has promoted the device in the West, it's probable that Tencent’s properties released on the Vision Pro will be services like Tencent Video, Tencent Meeting, and Tencent Music.

Games and WeChat (including its minigames) seem unlikely to appear, though it's too early to rule anything out. The company had also been working to release Meta’s Quest VR devices in China, though the deal has reportedly been suspended.

Tencent’s cloud computing division also provides a wide variety of infrastructure and platform tools for game developers. Tencent has also been developing a platform for cloud-native games.

Given the breadth and expertise of game development within the company, marketing its tools to third-party developers has enormous potential — though there’s significant competition in the form of AWS, Azure, and domestic rival Alibaba. Tencent’s opportunity in cloud computing obviously extends far beyond serving game developers, but the company has potentially a unique advantage in serving that corner of the cloud market.

Final Challenges and Observations

Despite emerging opportunities, regulatory risk continues to pose significant challenges. A draft of new rules from China’s National Press and Publication Administration, severely restricted common monetization techniques and caused the stock prices of both Tencent and NetEase to crater. The proposed regulations have since been largely walked back, but the general history of China’s gaming restrictions will always loom over Tencent.

This extends beyond gaming directly to generative AI, a technology the government has also responded to tepidly. “The way China has treated gaming and generative AI is classically lukewarm,” said investor and analyst Kevin Xu. “You are allowed to exist and (kind of) grow, but don't expect support or endorsement from the top.” As such, the regulatory environment may hamper the potential of the Hunyuan model and its initial applications in advertising, and eventually games.

Competition and content risk are also difficulties Tencent will have to face as it embraces its minigames platform and expands into new genres. ByteDance’s Douyin has the second-highest market share of China’s overall minigames market and is fully intent on challenging WeChat’s dominance in the format. A battle for developers is clearly underway, with ByteDance offering 90%/10% revenue split for IAP on its platform (compared to Tencent’s hefty 40% take). Though Tencent is the current leader thanks to the ubiquity of WeChat, its status in this lucrative market is clearly under threat. The company’s move into Western-oriented PC/console games also comes with risks, as it attempts to break into an expensive market in which it has little experience or brand name recognition.

Tencent, the globe’s dominant gaming superpower, is well positioned to grow in several areas, but it isn’t the only entity — government or otherwise — posing a challenge to its position. Its ambition is likely for international game revenue to outpace domestic revenue, at least outside of the WeChat minigames format. Over time, perhaps by the end of the decade, this is likely feasible for the company. Its efforts in new PC/console titles are much less certain, however, given the early stages of this initiative.

Finally, Tencent is in a unique position to also bring generative AI to gaming in a variety of ways: through integration into its vast portfolio of first-party titles, as a marketing tool through its online advertising ecosystem (already a stated priority for the company), and through Tencent Cloud’s game development offerings. The evolution of this strategy is likely to become clearer over the next year or so, but even moderate success in this area could be a force multiplier for nearly all of Tencent’s game-related businesses.

A Word from Our Sponsor: ZBD

Where Fun Meets Bitcoin!

ZBD is a leader in payments innovation, pushing the boundaries of how we move money across the internet. Within gaming, ZBD has made a name for itself by powering instant real-money player rewards for partners ranging from indies like Fumb Games to giants like Square Enix. Game studios use ZBD’s rewards tech and payments APIs to reap massive retention boosts, while gamers use the ZBD app to get a simple and fun way to earn, spend, play and interact.

Game of the Week

Content Warning: Viral Marketing 101

Written by: Jordan Phang, Naavik Consulting Partner

Developer: Landfall Games

Publisher: Landfall Publishing

Platform: Steam

Status: Launched April 1

Genre: Survival horror with a twist

Gameplay: Link

What Is It?

Content Warning is a survival horror game with a twist — it’s a comedy. While there’ll be many comparisons to Lethal Company and Phasmophobia, this isn’t a game about surviving creepy environments and horrible monsters (though they’re there). It’s a game about something we’re all familiar with: how to get likes on social media.

You and a team of up to three others venture into the depths to explore the Old World. However, you’re not searching for resources or crafting tools, you’re scavenging for views.

The team is equipped with a camera to record happenings, which will be processed and uploaded to SpookTube. You can then watch the video and see how the audience reacts, how many views you’ve gotten, and how much ad money you’ve made. The ultimate goal is to reach 3K views in three days. And that’s the whole game.

How Is It Doing?

Thanks to an April 1 marketing stunt where the game was free for the first 24 hours, it has racked up 6.2M players, with a peak of 200K concurrent players.

Its viral success and the free giveaway means that review-based ownership and revenue estimates by sites such as VG Insights and Gamalytic are wildly inaccurate. However, we do have a more accurate steam ownership figure from Gaminganalytics.info, which uses Steam profiles to generate ownership numbers. As of April 12, the estimate is at 8.55M owners — or 2.35M owners who paid $8 for the game — giving us a final revenue estimate of $18.8M. Not bad, given it was built by a team of five in just six weeks as an April Fools game!

So what can we learn from Content Warning? How did it manage to hypercharge discovery?

Giving Away the Game for Free

Obviously people like free stuff, but it works for Landfall because they’ve established a sizable audience (around 40K Discord members, 222K YouTube subscribers, 40K X followers) for its tongue-in-cheek games since the studio released Air Brawl in 2015. It also used the same strategy for its 2022 April Fools game Knightfall (see gameplay video here). Though it “only” has 2.1M Steam owners, if we assume a similar 30% paid/free ratio as Content Warning, that gives us 634K users that paid $6 for the game, giving us a revenue of $3.8M. Pretty amazing for five weeks of work!

Giving away the game for free has also been leveraged by other studios, like Total Mayhem Games with its We Were Here series. It dropped a surprise sequel in September last year that was free for 30 days that resulted in 10M installs across PC and console.

Should new developers embrace this strategy? Not unless you’ve built up a large enough community, and even then, not every type of game will benefit from this, as Total Mayhem Games’ Geoff Van Den Ouden highlights.

Making a Game about Influencers for Influencers

What Content Warning has done really well is capture the current cultural zeitgeist. 57% of GenZers and 41% of adults would like to be influencers, given the chance. The game is also structured to almost be a game for content creators, and, boy have they jumped on the bandwagon. It was the No. 2 trending game on Twitch over the past two weeks and was also covered by big streamers like Jackfrags, xQc, and 8-BitRyan.

The fact that in the game you’re supposed to create videos that are entertaining for the views lends itself well to actual real-life content for the views, making it easy for the creators to express their personality and entertainment factor.

What’s Next?

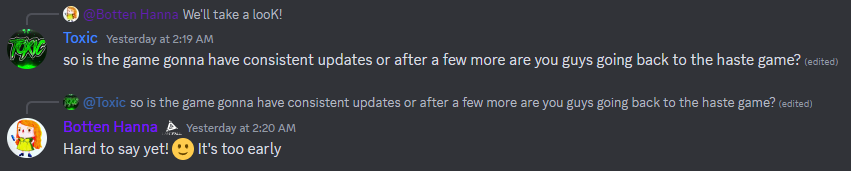

The success of Content Warning was a total surprise to the Landfall team, and it typically doesn’t support the April Fools games beyond a couple of updates and patches. It has also got an upcoming title, Haste: Broken Worlds, that’s still in development. However, it would be a waste not to leverage the audience it has acquired. In fact, Content Warning has been so popular with the community that Landfall had to create a new Discord server for it, which currently has 145K members, more than 3.5 times the main server. Based on a response from Landfall Game’s official community manager, it seems the studio itself is still torn between putting more resources into Content Warning, or continuing onto Haste.

If it were to continue to update Content Warning, the first step would be to add more depth, as the current loop is fine for a few playthroughs, but once you’ve hit your 3K views target, there’s not much else to do. The next update is centered around found footage, and players can submit their videos for others to find while in the Old World, but that’s unlikely to do the trick.

It’ll be interesting to see where Landfall takes Content Warning from here. It feels almost like a sliding doors moment here, and depending on its choice, it could change the future of the studio.

Our Gamification Consulting Services

Today, we’re highlighting our gamification consulting services! Applying game mechanics to all sorts of applications has proven to boost retention, engagement, and revenue — but doing it right can be harder than it seems. More specifically, Naavik offers constructive gamification deconstructions, gamification workshops, and ongoing flexible support. Here is what one of our clients had to say.

“I highly recommend Naavik's two-day workshop on gaming mechanics. Their AMA provided valuable insights on the fundamentals of gaming mechanics, and the hands-on session was very engaging. The knowledge gained from this workshop has helped our team think more intentionally about how we leverage gaming mechanics for growth at Grammarly.”

- Shane Fontane, Senior Manager of Growth Design, Grammarly

If you’d like to learn more, reach out here! Also check out our expanded consulting service portfolio here.