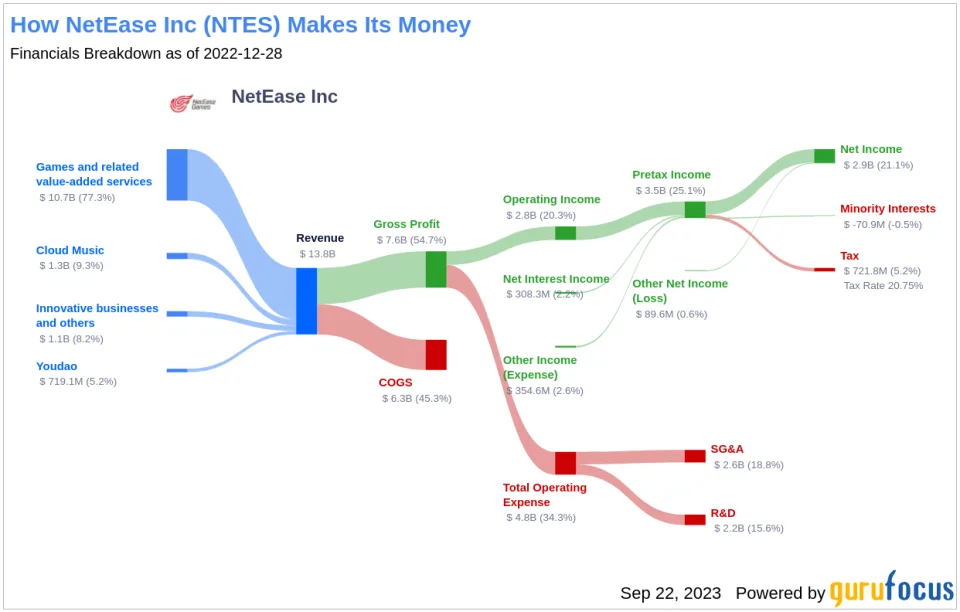

NetEase is the fifth-biggest gaming publisher in the world by revenue, currently offering over 140 live games in China and overseas. It is a nearly $72B company which does more than gaming, although games account for nearly 80% of the company’s revenue.

Founded in 1997 by William Ding – who remains the CEO and still owns 45% of the company – NetEase is also the largest provider of email in China with over 940M accounts. It also operates in cloud music, education, and e-commerce; has a lifestyle brand; operates a sizable agricultural affiliate specializing in high-end pork; and more.

Since NetEase is about 20% as big as Tencent and keeps a lower profile, it often seems to live in the shadow of its larger domestic rival. Outside of China, the company is often simply known as China’s second-biggest gaming company and Blizzard’s (former) local licensor (before the ugly breakup earlier this year). However, NetEase has been building its own differentiated, multipronged strategy – and is positioning itself to help shape the future of the industry.

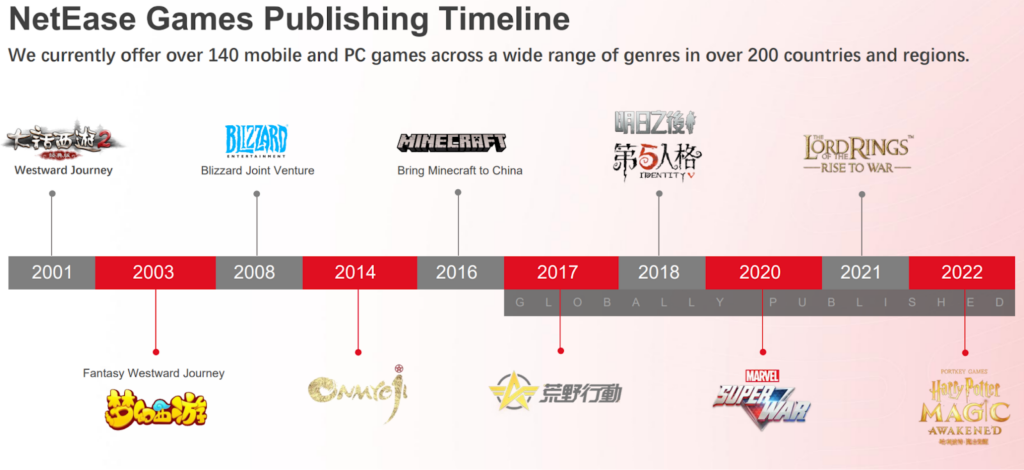

While mostly known in the West for its partnerships and licensing agreements, over 90% of the firm’s gaming revenue comes from self-developed games. In particular, the extended Westward Journey franchise, which launched as a PC MMO in 2002 before launching on mobile in 2013, has historically been NetEase's top franchise.

The company also has numerous partnerships with major Western and Japanese publishers and licensors which encompass various regional publishing and co-development deals. It is increasingly establishing its own presence in these regions through investments and new first-party studios too. Occasionally, its publishing partnerships also include an investment in the foreign entity, as was the case with NetEase’s deal with Behavior Interactive to publish Dead by Daylight in China.

Recent hits include Eggy Party, Diablo Immortal, Harry Potter: Magic Awakened, and Naraka: Bladepoint on PC and console. The upcoming Project Mugen is NetEase’s first cross-platform game, clearly modeled after miHoYo’s successful F2P titles. It’s also made a string of investments in recent years, such as in Dead by Daylight-developer Behavior Interactive and French studio Quantic Dream, which it later acquired.

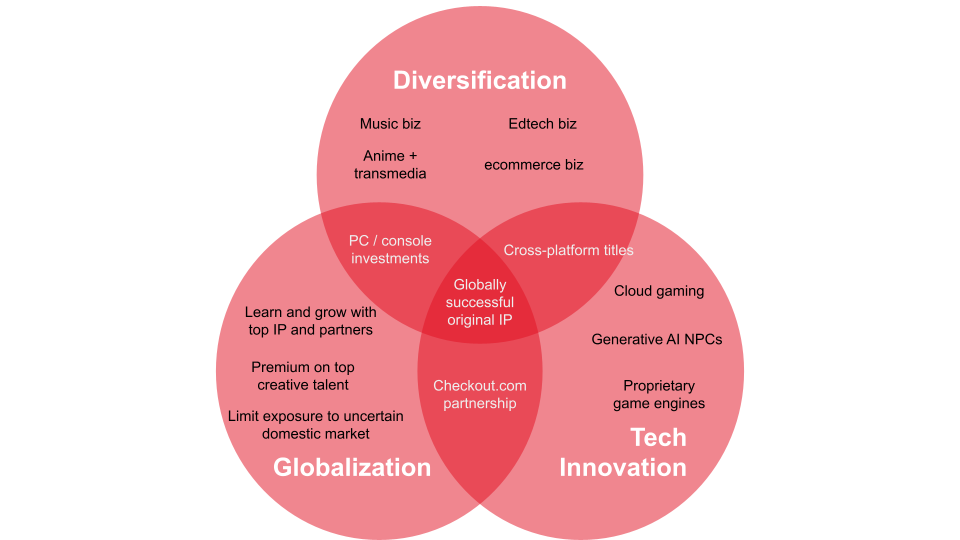

When considering its history, priorities, and recent activity, it’s clear NetEase’s core corporate strategies are 1) globalization, 2) diversification, and 3) technological innovation.

Let’s explore each in turn, including how they are integrated with each other, and what they might eventually lead to if NetEase executes its strategies well: a wholly owned, globally popular, and technologically differentiated IP.

Journey to the West

Though 90% of NetEase’s gaming revenue comes from China, and is heavily skewed toward mobile F2P, the company sees its future as a global, multiplatform publisher. According to Bloomberg, NetEase wants to back 25% of global AAA releases, while simultaneously generating half of the gaming revenue from outside China. These are ambitious — if not wildly far-fetched — goals.

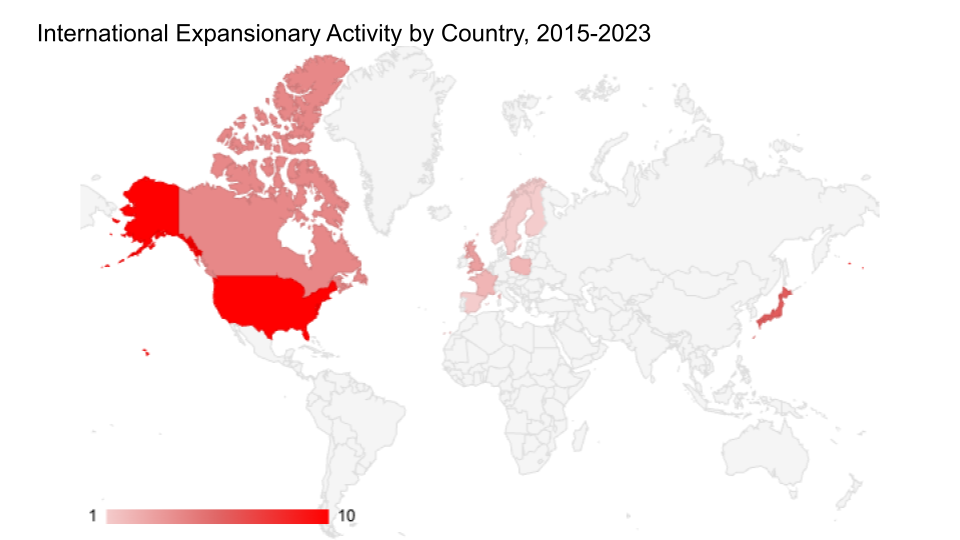

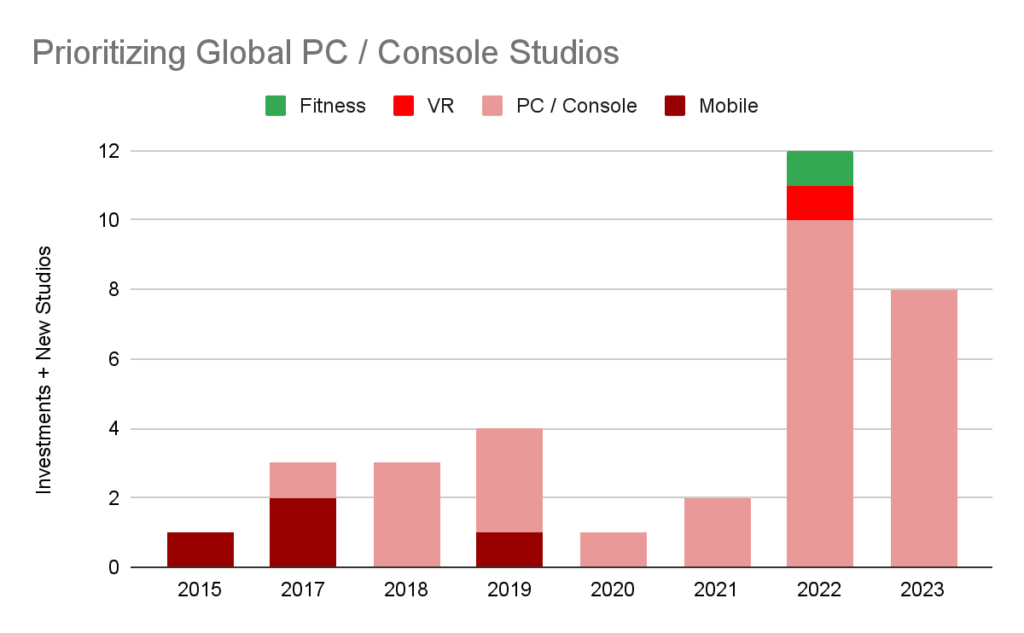

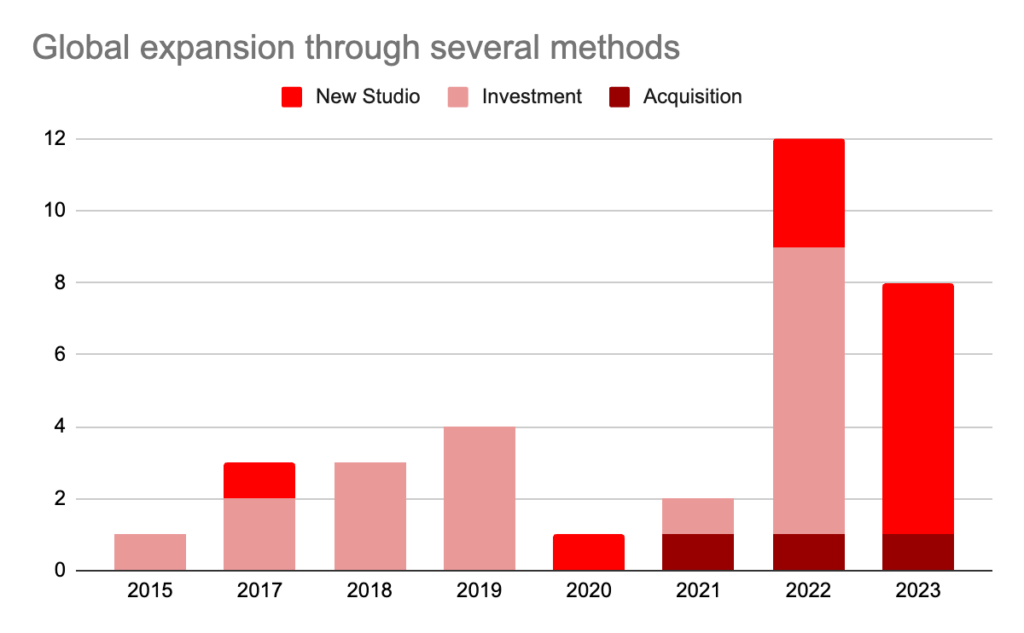

While NetEase has recently attracted more attention due to a leap in global expansion activity in the last two years, the firm has had an articulated policy of international growth since at least 2015, through initiatives like the Success Fund. Only recently, however, has NetEase’s new globalization strategy emerged: an enhanced focus on PC and console, genre and business model diversity, and the pursuit of creativity.

Pursuing global growth outside of mobile speaks to its other core strategy of diversification, by expanding into new markets and different platforms. If NetEase aims to be a globally dominant publisher, it knows it can’t be limited to mobile, especially in the PC and console-heavy markets of the West, Japan, and Korea. Growth outside of mobile is also likely more attractive lately due to a maturing of the mobile market and less effective mobile user acquisition.

Its PC and console strategy also reinforces the company’s explicit backing of top creative talent. Placing a premium on creative direction is both an artifact of NetEase’s history of internal game development, and a way to differentiate it from Tencent, with whom it frequently competes for deals.

Simon Zhu, Head of Global Investments and Partnerships at NetEase Games, said of its approach: “For a platform provider [like Tencent], games are just one of the many ways to monetize traffic. For us, content and talent are everything.”

Some entrepreneurs have said NetEase is an ideal partner that makes it “a priority to provide the support and creative freedom.” Still, the vast majority of NetEase’s expansion has been so recent that the degree of creative freedom afforded to developers is largely untested.

Seeking growth overseas has taken on a new urgency in the last two years due to domestic regulation limiting not only its gaming business, but also its edtech and tutoring platform, Youdao. These changes have also spurred Tencent, already a company with significant expansionary zeal, to further scale up its foreign investment activities, which may itself motivate NetEase to quicken deal making to compete with its rival for talent, markets, and content.

Tencent makes bigger bets, and owns equity stakes in publishers like Ubisoft and Epic Games; plus it wholly owns large subsidiaries like Riot and Supercell. NetEase does not invest at that scale, instead making smaller bets on creatively focused partnerships with the industry’s top talent, like ex-Riot MMO lead Greg Street and No More Heroes studio Grasshopper Manufacture. “Wherever talents are, we will become part of the developer community locally!” says Zhu.

The company has the balance sheet to keep acquiring and launching new studios, holding RMB 95.1B ($13.9B) in current assets. It is also rumored to be an LP in a number of gaming VC funds. However, while M&A was a core tactic in its global expansion in the past, the company has pivoted to launching new internal studios instead, likely as a result of greater restrictions in the United States on tech acquisitions by Chinese companies. Creating new U.S. studios out of whole cloth, however, is still viable, as is M&A in most other countries.

Creating multiple, independently led new studios from scratch is a higher risk than buying or investing in existing, semi-proven startups, since it will take longer for a brand new team to ramp up, and the possibility of failure is entirely borne by NetEase. But if the studios are successful, the upside will be much greater, since NetEase avoids paying a premium on investment or acquisition deals.

New Platforms and New Partnerships

While NetEase’s use of M&A and new internal studios as vehicles for foreign expansion is growing, the old ways aren’t going anywhere. Despite the end of its storied domestic publishing license with Blizzard, NetEase has recently begun major new partnerships with Warner Bros. Games and EA-owned Codemasters.

What’s new, however, is likely an intention not just to benefit financially from global collaborations, but to learn from and emulate successful Western and Japanese partners with big PC and console businesses, as NetEase moves into this space with its own studios and investments.

For example, NetEase serves as the co-developer for mobile titles Diablo Immortal and Harry Potter: Magic Awakened. That both franchises’ Western publishers also released PC and console titles for the same IP this year is notable, as this is the type of cross-platform IP NetEase likely aspires to fully own globally in the future.

The company’s new international studios have a wide variety of genres and business models, adding additional levels of diversification beyond geography and platform. Austin-based T-Minus Zero Entertainment is working on live service titles, while Montreal’s Bad Brain Games has an “open world, story-driven action-adventure” in the works. Other NetEase studios are building single-player RPGs and narrative adventures.

The company is also continuing to expand outside of gaming, with new anime and live streaming divisions that have obvious gaming synergies, especially from an IP perspective.

Onmyoji, NetEase’s newest MOBA franchise, “has spun off three mobile games in MOBA, card and simulation genres; been adapted into a feature motion picture, a musical and a network series; and inspired several themed coffee shops.” For Western audiences, this will sound similar to Riot’s transmedia strategy with League of Legends.

The Third Pillar: Technology

NetEase views its core technologies as an enabler in its diversification and internationalization efforts, but technological innovation is an important strategy in itself for the company. It has developed two internal engines: NeoX for PC and mobile development, and mobile-only engine Messiah.

The company has also stated that innovation in game development and game technology “reinforce each other and promote a virtuous cycle of innovation.”

“NeoX and Messiah enable us to systematically develop mobile games with the highest quality,” NetEase has said. “While our drive for better games in turn motivates development of more powerful engines.“

The company has also been pursuing 5G cloud gaming in partnership with Huawei, and F2P cross-platform titles – likely inspired by miHoYo’s success in the space – have been an area of recent focus. Many of NetEase’s upcoming and recent titles, like MMO shooter Ashfall and survival shooter Lost Light will launch on PC and mobile, with others even appearing on console.

Its technology and R&D efforts have also taken in AI integrations. One of NetEase’s biggest recent hits is wuxia MMO Justice Mobile, which features NPCs driven by generative AI.

In its latest investor report, the company said it created “intelligent NPCs that can join players’ in-game activities, simulate real-life interactions, facial expressions and body language and enable a more engaging gaming experience.”

“We also deploy multiple reinforcement learning technologies to produce NPCs with diverse styles and difficulty levels, catering to a wide range of player preferences,” the company said, also claiming to use natural language processing “to enable players to develop their own storyline by carrying out conversations with NPCs and explore hidden elements in the game.”

The company has been on a hiring spree in game tech and AI recently as well, with current and recent job postings for AI investors and tech directors in the United States.

What might come of this focus on developing and investing in game tech? Just like its PC and console approach, this strategy has a long-term horizon, the end result being unique differentiation in content. The more NetEase can provide a proprietary technology offering to its plethora of internal studios, the more likely those studios can make something that NetEase’s competitors can’t replicate.

Long-Term Market Impact

Nearly all of these initiatives indicate a long-term orientation. NetEase is rapidly sowing seeds that will take years to harvest, but the strategic themes it is investing in mutually strengthen each other and could result in the kind of industry-defining impact the company is clearly pursuing.

With studios around the world working across multiple platforms, utilizing its new tech, and benefiting from its worldwide reach and multimedia businesses, NetEase could create a globally compelling content and IP portfolio. Logically, this is where the company’s strategies, history, and long-term perspective point toward.

Along the way, the company is continuing to push out ambitious live service titles, grow its nongaming divisions, and invest in its expansionary goals. While it faces real obstacles in domestic regulation, restrictions on M&A in the US, and challenging prospects in its core mobile gaming business, NetEase has the capital to invest its way around these limitations in the long term, and a strong portfolio and operating model to push through in the meantime.

A Word from Our Sponsor: CODA

More Players. More Payers. Less Lift.

Since 2011, Coda has been the streamlined partner for secure, compliant monetization solutions and scalable, direct-to-consumer expertise across gaming, live streaming, and more. Trusted by some of the biggest names in publishing, including Activision Blizzard, Riot Games, Moonton, Garena, Tencent, and Tinder.

Coda offers both B2C and B2B solutions and products, such as Codashop and Codapay, helping partners grow revenue, profit margins, and customer engagement in 60-plus countries and territories with ease.

Wherever you are in your go-to-market and monetization strategies, let Coda do the heavy lifting so you don’t have to.

“How many games do PC/console players own, & do they 'main' just one?” (The GameDiscoverCo): “In discussions with a prospective client recently, they asked an interesting question: ‘How many games do most PC players own, and do they tend to play one particular game a lot?’ We didn’t know the answer to that - but we knew how to get it. So we did!”

“Launching PC & Console Titles in the Ever-Changing Games Market | Free report with TikTok” (NewZoo): “We’re excited to present our collaborative report with TikTok on gaming. Here we cover the role of community and culture in launching successful PC and console games.”

“M&A Master Class: Chris Petrovic Teaches Acquiring Great Gaming Companies” (DoF): “Get ready for a real treat if you've ever been curious about the M&A in the gaming industry. We're about to explore what a typical work-week looks like for a Mergers & Acquisitions executive, navigate through the major obstacles that can obstruct deals, and stay at the forefront of the latest trends in the gaming industry M&A. And there is more, of course.”

“Hybrid Casual Games: The Arcade Idle Playbook - How to build Game Systems & Mechanics” (Homa Games): “If you’re looking for a an exciting genre to explore in your game creation that can be a truly satisfying experience for your players, and of course profitable, then Arcade Idle should fit the bill.”

“Untangling the carbon complexities of the video gaming industry: A way forward” (Playing4ThePlanet): “Like a bag of cables left in a cupboard, trying to disentangle the ownership of emissions within the games industry is a slightly knotted affair. But for the past 12 months, members of the Playing for the Planet have been working with the Carbon Trust to try to bring clarity on where are the biggest sources of emissions in games, who is liable for them and what might be the new areas to address in the years ahead.”