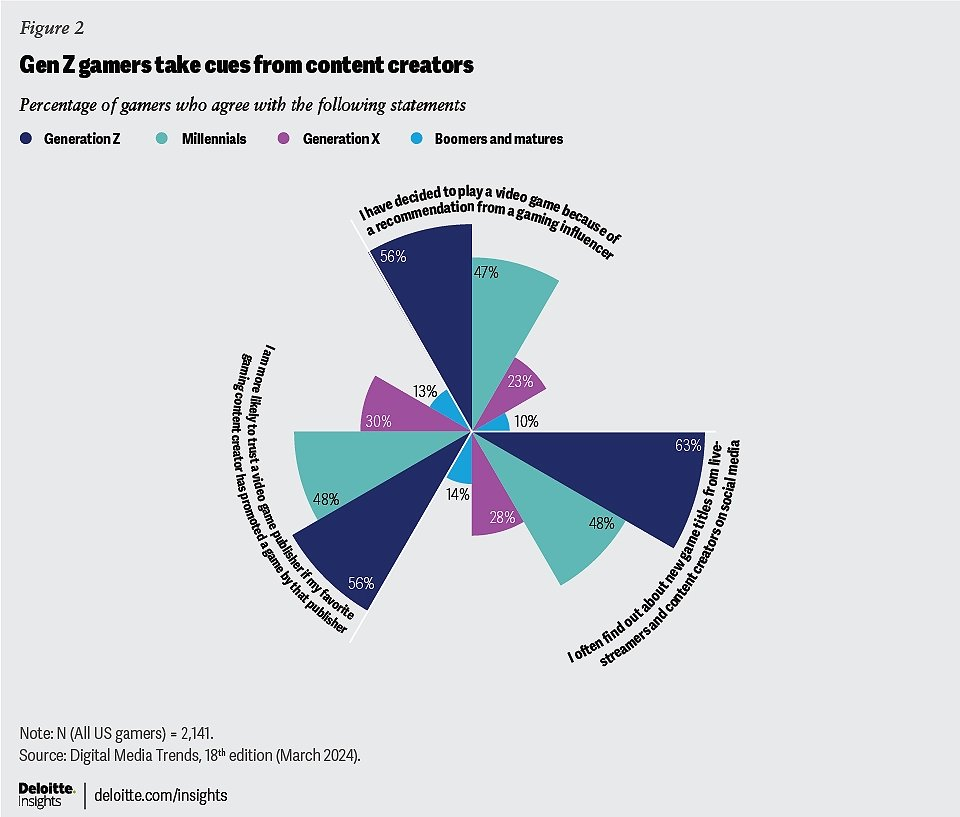

Game streaming shapes how players discover, engage with, and enjoy games today. Almost 50% of Gen Z and millennial gamers discover and decide to play new games based on recommendations from live streamers and content creators.

In gaming, the influence and viewership that streamers wield cannot be overstated. Streaming deepens the relationship between entertainers and viewers through interaction, which creates large, loyal, and monetized communities. Viewers perceive streamers as authentic, and might feel a personal connection, which fosters trust in their opinions and recommendations.

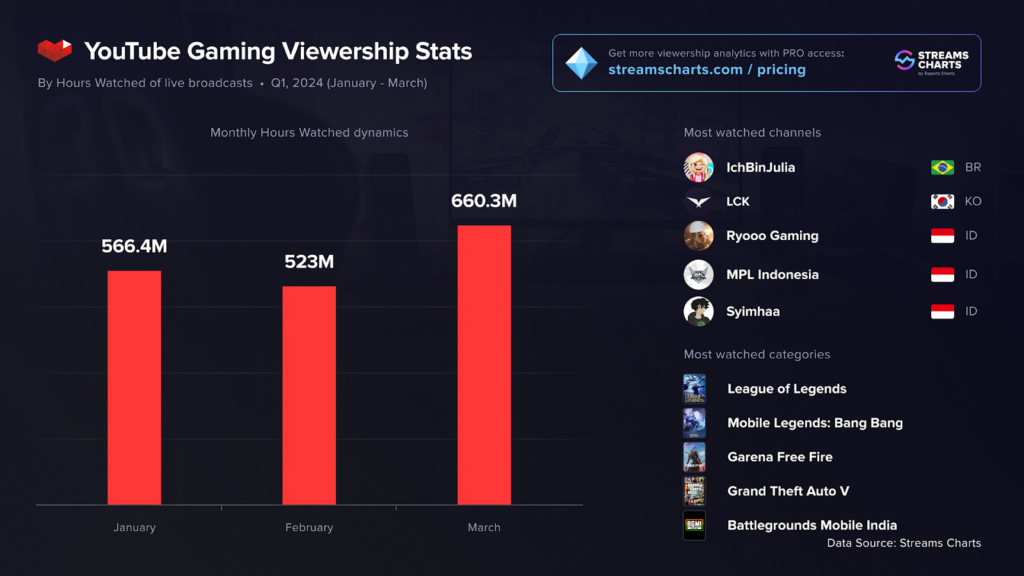

In an era when attention is highly sought after, this unique dynamic has been able to capture the attention of millions. In Q1 2024 alone, viewers consumed 6.4B hours of content every month, with games making up 40% of this slice.

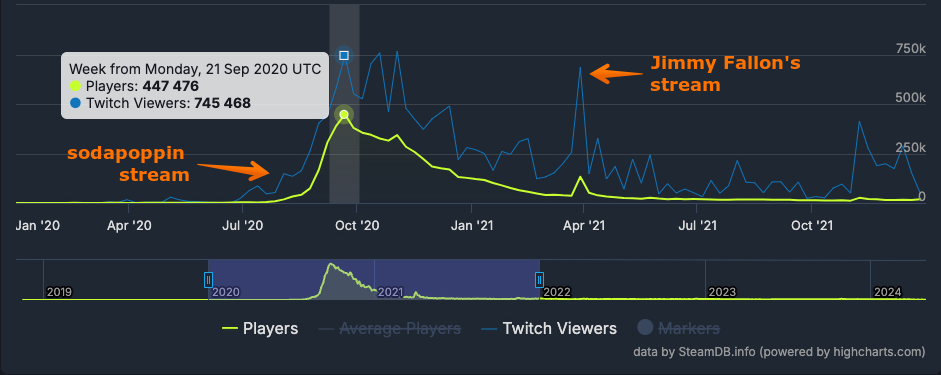

In fact, a game getting picked up by streamers can be a make-or-break moment, propelling even the smallest indie game into hockey stick growth. We saw this with hits like Among Us during the 2020 lockdowns, and with more recent launches such as Balatro and Palworld.

So it is not surprising that a lot of game launches, product sponsorships, and even new tools and platforms are trying to “crack the code” for influencer marketing. But few games achieve staying power after the initial sponsored event with creators.

In addition to creators and audiences, we must also consider all the other actors in the ecosystem — games, developers, sponsors, technologies, and tools.

At the center, connecting and enabling these interactions, are social media and live-streaming platforms such as Twitch.tv and YouTube. A complex network of power dependencies among these actors is shaping the future of games and live streaming.

Twitch and the State of Streaming Platforms

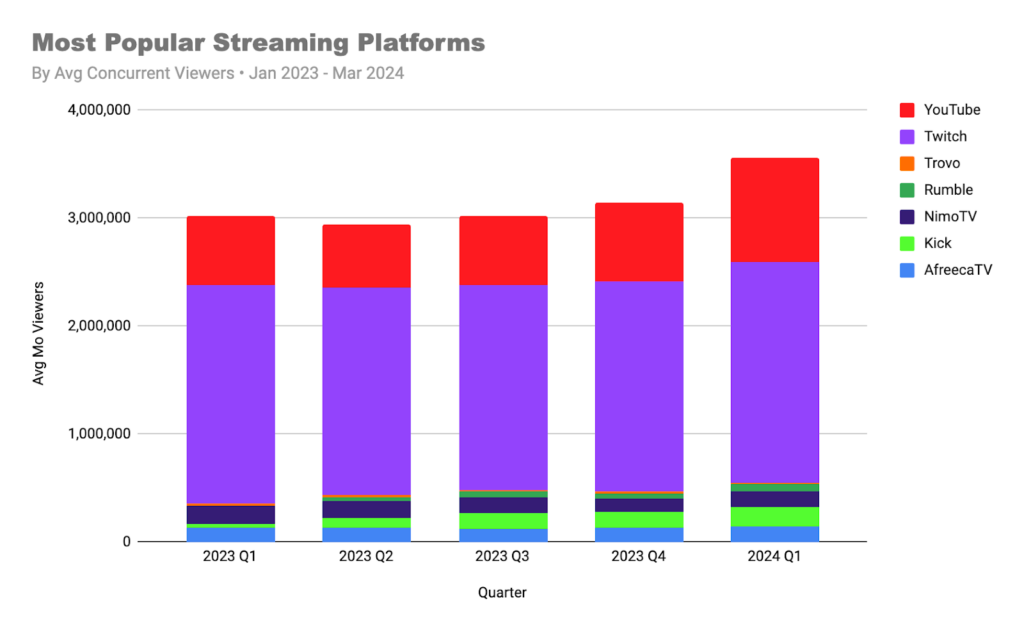

Twitch ontinues to be the dominant platform for game-specific streaming content, capturing 57% (2.5M average concurrent viewers) of overall viewership among all streaming platforms.

Still, other platforms have continued to gain traction. In the past year, YouTube has grown its share from 21% in Q1 2023 to 30% today (1M viewers), and a handful of newcomers and smaller platforms are taking a swing at the space.

Some of these include Kick (190K viewers), Noice (in closed beta), BeamStream (launched in April 2024), and smaller players like Rumble and Trovo. There are a handful of other newcomers too, and we cannot count out TikTok as it makes its way into live streaming.

Twitch’s stronghold in game streaming can be traced back to its origins. On the heels of Blizzard's StarCraft II popularity on the platform, Twitch pivoted to focus on gaming content in 2011. It started by introducing features, like the partner program, to help streamers grow and monetize their audience. By 2014, Twitch had established itself as a powerhouse, and was acquired by Amazon for nearly $1B.

But it was not all smooth sailing for Twitch. With pressure from owner Amazon to reach profitability, it had to navigate a tumultuous 2023. This included several rounds of layoffs, cutting its workforce by 1,000 employees (or about 70%), controversial updates to its revenue split policies (which had to be walked back after a backlash), and pulling out of South Korea due to it being “prohibitively expensive” to run.

With both internal and external pressures, 2024 is shaping up to be an existential year for Twitch. And these pressures are a reflection of the challenges that permeate through the industry.

Challenges

Creator Platforms Struggle to Be Profitable

Twitch is not and has never been profitable. It has benefitted from a decade of “free” money from Amazon to supercharge its growth during the zero interest rate era.

That has come to an end, and the unit economics of running attention marketplaces can get very tricky, very quickly. Twitch, for instance, monetizes primarily from:

- Ad sales: The biggest revenue generator for content on social platforms poses a unique challenge for live content, where an ad popping up in the middle of a stream can be much more annoying to streamers and viewers.

- Subscriptions: With 43% of subscribers from Prime, this yields no directly attributable revenue to Twitch. More broadly, subscriptions and donations are being split or redirected through other platforms like Patreon.

- Revenue share: Platforms receive 30-50% of revenue. But add on all the operating costs for platforms, and any profit margin disappears. It is a key contributing factor to why Mixer and other Twitch competitors ended up shutting down.

Most Streamers See Weak Earnings

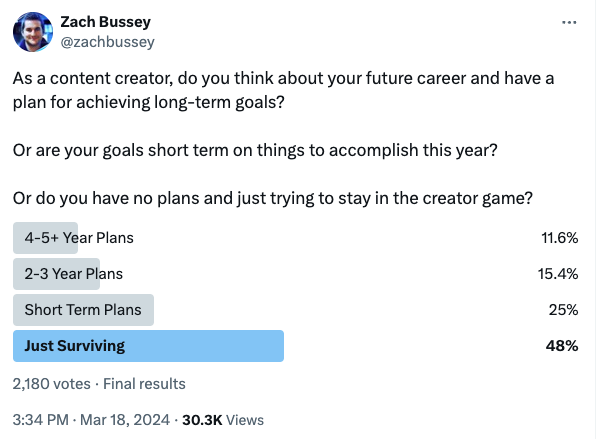

Despite the revenue share programs, the majority of streamers struggle to make ends meet. Last year, leaked earnings reports from Twitch showed that 99% of streamers make less than minimum wage. And last month, Zach Bussey from newsletter Today Off Stream ran a poll where 48% of content creators reported their main goal for the year is to “just survive.”

The harsh reality is that most streamers and content creators barely earn enough to support themselves, let alone being able to turn streaming into a full-time career. This financial precarity comes from oversaturation in the market, high revenue shares and platform fees, and the unpredictable nature of ad revenue and donation-driven monetization.

Content creators also rely on third-party platforms and services that they have no control over, and which can change overnight. Multimillion-dollar exclusivity deals — which are for the most part long gone — are only offered to the top 1% of streamers. This is why streamers look to other avenues for generating revenue, such as sponsored streams from brands and games, donation drives, and merchandise sales, to name a few.

Game developers can tap into the streamers’ audience as a uniquely qualified acquisition channel, but this avenue is largely unexplored. Game companies can leverage streamers as a marketing tool to generate hype and visibility, but the lack of meaningful long-term partnerships and collaborations between developers and streamers hinders the potential for mutual growth and success.

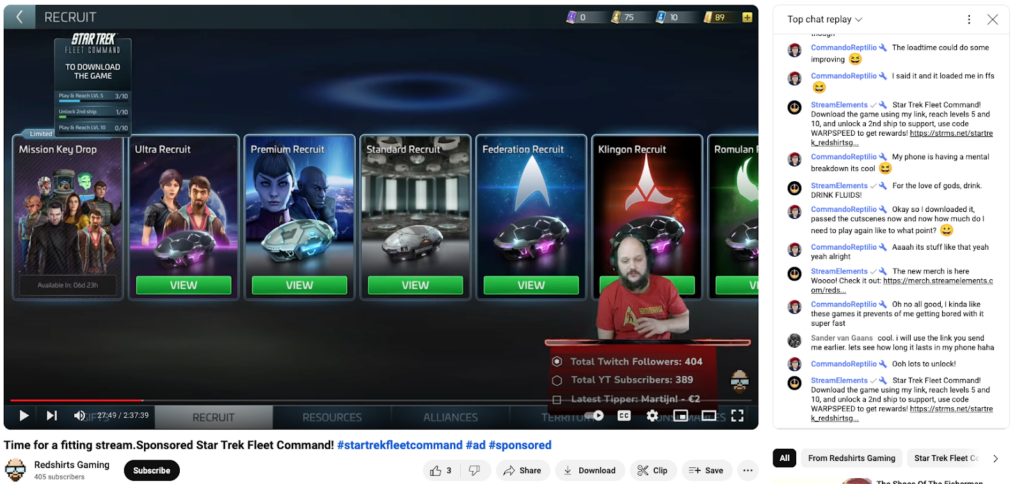

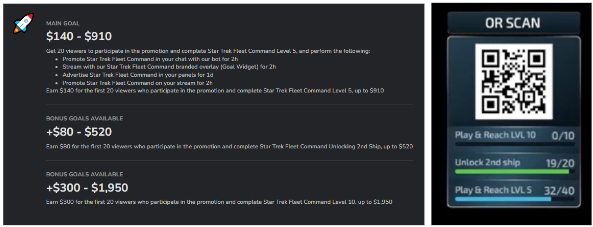

One interesting example of trying to build collaboration is Scopely’s Star Trek Fleet Command, which has been running regular sponsorship campaigns. But looking in from the outside, there is no data that suggests it is a success — neither downloads on data.ai, nor Twitch/YouTube viewership, seem to be significantly affected by these campaigns.

Seeing how streamers and viewers interact with this campaign highlights the challenges this strategy poses.

- Sponsorships do not carry the same influence as unsponsored recommendations. Streamers understand the influence they have, and the value in remaining authentic. Thus it is common practice to clearly call out when it is not an organic recommendation by including #ad #sponsored tags. With these callouts, viewers are less likely to play a game unless their streamers are really into it.

- Applying pressure to convert the audience. To counteract a lack of engagement with sponsored streams, developers give creators goals for their communities to hit and unlock additional monetary rewards for the streamer. While viewers are willing to go the extra mile to support streamers, some creators will not participate in these campaigns as they are reluctant to put that pressure on their audience. Some will even talk about it openly, enticing viewers to support them directly instead of through the game.

- Friction for players to convert. The last point of friction is getting players over any steps required to download the game, especially in today’s cross-platform ecosystem.

Add to these the usual challenges of retention and monetization after user acquisition.

Looking ahead: Creator-Publishers and Other Platforms

So, what will it take for platforms, game streamers, and content creators to thrive in today’s competitive landscape?

First, there is a pressing need for developers of games, platforms, and tools to understand how to solve creators’ needs. These needs can only be discovered by close collaboration and inclusion of creators at the table.

We need innovation around sustainable monetizing solutions, and this will only come through engaging with audiences on a deeper level.

Creator-Publishers

One notable trend is content creators themselves venturing into game development and publishing. They understand the influence they hold over their audience, and seek genuine engagement opportunities that go beyond simple promotional efforts.

Some recent examples include Mad Mushroom, an influencer-owned indie video game publishing company that was announced in 2023 (OTK is one of the largest creator collectives), and Big Mode, another indie publisher, which was founded in 2022 by the popular YouTuber Videogamedunkey. Its mission is to support indie video games “being made with substance, quality, creativity and fun.”

Their involvement is not all that surprising, knowing that content creators already have the power to crown the next runaway hit. If they can continue to do so in a curated way, while supporting indie devs and getting a revenue share, they become their own profitable investment and distribution channels.

Creators as Game Content

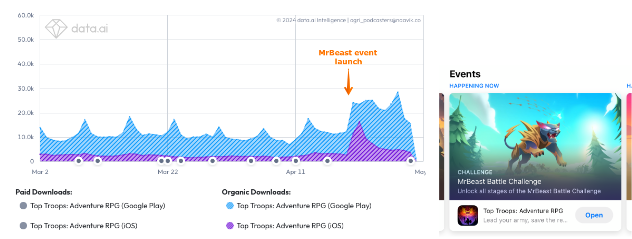

Zynga recently went a layer deeper with creator partnerships in Top Troops by not only doing a sponsorship but releasing a MrBeast event in-game. If they are following a standard revenue share (20-30% for creators) to use MrBeast’s IP, it is easy to see how creators would be highly motivated to promote the game — a win-win scenario.

Looking at data.ai, there is a clear uplift in organic downloads right as the event launched, an early indicator that the partnership is driving value.

While it might not be the best example for a game-to-creator fit, higher relevance matches (similar to how the "Property Brothers" are the main IP in home design) are likely to yield better results for all parties involved.

Existing Platforms

YouTube’s growth has been impressive. Its competitive advantage is two-fold:

- Reaching a global audience via esports events by attracting official accounts broadcasting highly popular games

- Having less pressure on livestream being profitable by supporting it via its very profitable video-on-demand arm.

Another potentially threatening entrant into live streaming is TikTok. While the form factor and user engagement patterns of live streaming seem to be incompatible with TikTok, the platform is constantly pushing the boundaries of content creation and monetization. ABC News Australia recently did a fascinating deep-dive on the growing economy of live streaming on TikTok, where streamers do live face-offs urging viewers to send them gifts to climb up the gift leaderboard.

As Twitch exits specific countries, it also leaves a gap that smaller or niche platforms are quickly seizing. NimoTV saw an increase of almost 30% in hours watched during Q1 2024, a jump caused by the fleeting Twitch ban in Turkey.

Regional platforms can gain initial traction since they cater to localized streamers and audiences with different cultural expectations and needs. While these might be smaller platforms, more of them entering the space will start to encroach on Twitch (and YouTube).

New Platforms

The likes of Kick.com and Noice are also trying to disrupt the status quo. It is notable that previous failures, like Mixer, have not deterred new entrants into the space.

Kick is focused on tackling the revenue problem. Its main attraction is to offer content creators 95% of their subscription earnings. Through this, and deals with big-name streamers such as xQc, it quickly grew from an average of 80K concurrent viewers in May 2023 to over 150K by December. Even though it had an impressive launch, it will be difficult for Kick to take a big market share: its growth has slowed down to about 10% month-over-month and it’ll have to reckon with the high ongoing costs of running a platform.

Noice, on the other hand, is focused on tackling the deeper engagement problem. Currently in closed beta, the platform announced a $20M Series A raise at the end of 2023. We will have to wait and see if it can secure significant market share. It faces a common challenge encountered by late entrants into a two-sided marketplace: the chicken-and-egg dilemma, where streamers seek a larger audience, while viewers gravitate toward platforms with richer content.

Noice will need a much stronger incentive to attract streamers, something similar to Kick’s financial incentives. Additionally, the model Noice is exploring to “play the stream” can easily become a gimmick instead of the true engagement that makes great content.

Twitch (Finally) Redesigning for Today’s Market

Lastly, how is Twitch thinking about the future? If the letter released by Twitch CEO Dan Clancy serves as any indication, it is starting to understand it can no longer keep a closed ecosystem. Twitch has always focused on live content, which helped it focus on developing a specific type of platform and audience — but it also caps its ability to grow. This cap is passed on to streamers and viewers as the platform prioritizes synchronous content — one of the many reasons discoverability is terrible on the platform.

Twitch is finally thinking beyond live by enabling streamers to more easily share clips to YouTube and TikTok. Rather than restricting the sharing of content to competitors, this can become a beneficial loop that boosts discoverability and brings more users back to Twitch. To push discoverability further, the announced overhaul of its home screen borrows from TikTok: Users will be able to quickly jump between bite-sized videos to discover new streamers.

Unfortunately, these changes are focused on growing audiences, and not necessarily monetization. While helpful in moving the needle, they don’t seem to be enough to overcome its biggest challenge: to grow revenue and reach profitability, all while competing with other platforms.

Ultimately, the future of game streaming will hinge on the ability of streamers, platforms, and game developers to collaborate. Only by working together will they adapt and unlock the full potential of the networked ecosystem. They could start by: prioritizing deeper community engagement, unlocking alternative monetization sources for streamers, and partnerships between developers and streamers not only as a marketing channel but as interdependent partners.

A Word from Our Sponsor: RALLYHERE

The Backend Platform Trusted by Over 200 Million Gamers Worldwide

Already trusted by over 200 million gamers worldwide, RallyHere is the Gaming Backend Platform and Service founded by the makers of SMITE, Paladins, and Rogue Company. With over 20 years of experience, our veteran teams have successfully built, launched and grown cross-platform live-service games.

Game developers leverage RallyHere's expertise and tooling, covering matchmaking, cross-platform accounts, server optimization and orchestration, real-time live ops management, player progression, and community engagement, to streamline their development processes, increase speed to market, and maximize their resources.

Want to know how RallyHere can help you with your live service game?

In Other News

💸 Funding & Acquisitions:

- DDM: Gaming investments reached $2.2bn during Q1

- Patriots Division raises $5M for 5v5 action game Shadow War

- Supercell invests in web3 startup GFAL led by King, EA and Activision Blizzard veterans

- Phoenix Games acquires live operations studio PopReach Games India

- Tencent raises its stake in Remedy to 14%

📊 Business & Products:

- Honkai: Star Rail zooms beyond $1 billion on its first anniversary

- The continuing quest to bring Age of Empires to mobile

- LinkedIn launches games on its platform

- Brawl Stars has already earned more in 2024 than the entirety of 2023

- Monopoly Go helps push March sales up 4% | US Monthly Charts

👾 Miscellaneous:

- Unity has finally found John Riccitiello’s successor

- Crunchyroll president Rahul Purini on how anime took over the world

- Partner events are the latest trend in Monopoly GO!, Royal Match and Project Makeover

- AI everywhere: Using neural networks for asset creation, marketing and more

- Dubai wants to be a top 10 games industry hub by 2033

Our Investment Support Services

Over the past few years, we’ve had the privilege of supporting several great investment firms in and around gaming. Our team, which is deeply experienced and uniquely positioned at the cross-section of gaming, technology, and finance, is available to provide market and investment research, due diligence, and advisory support. Here is what one of our clients had to say.

“Having closely worked with Naavik since the firm’s launch in 2019, it’s been an absolute joy to see their growth. At Lightspeed, depth is our center of gravity. The same goes for Naavik. Their success to date is a testament to the team’s uncompromising quality work and thoughtful commentary.”

– Moritz Baier-Lentz, Partner at Lightspeed Gaming

Whether you invest in public markets, venture capital, private equity, or are a business or investment bank facilitating deals, we’d love to help you meet and exceed your investment goals. You can learn more here and reach out below. Also check out our expanded consulting service portfolio here.