tinyBuild is the publisher-developer behind many popular indie games, such as the Hello Neighbor franchise, Graveyard Keeper, and Potion Craft: Alchemist Simulator.

Founded in 2011 by Alex Nichiporchik (CEO) and Tom Brien (former Chief Operating Officer), tinyBuild initially gained recognition with its self-developed game, No Time to Explain. The game was a commercial success, but it left the team burnt out and looking outside of development for their next venture. The company gradually pivoted from development into publishing and, over time, established itself as a prominent indie game publisher.

Its success attracted multiple venture funding rounds, and tinyBuild was eventually listed on the London Stock Exchange in 2021 under the ticker TLBD at a $470M valuation.

After a promising first year of trading, things took a turn for the worse in 2022. Since then, the company’s share price has traded down 98%, and there has been significant management turnover, including the departure of the Chief Operating Officer, Chief Financial Officer, and Chief Commercial Officer. Earlier this year, the company needed a $12M cash infusion from its CEO and Atari to get through 2024.

How tinyBuild Got Here

At the beginning of 2021, tinyBuild was on a tear. It had recently turned an indie game published in 2017, Hello Neighbor, into a franchise that brought close to $50M in cumulative revenue through various spin-off games and multimedia properties.

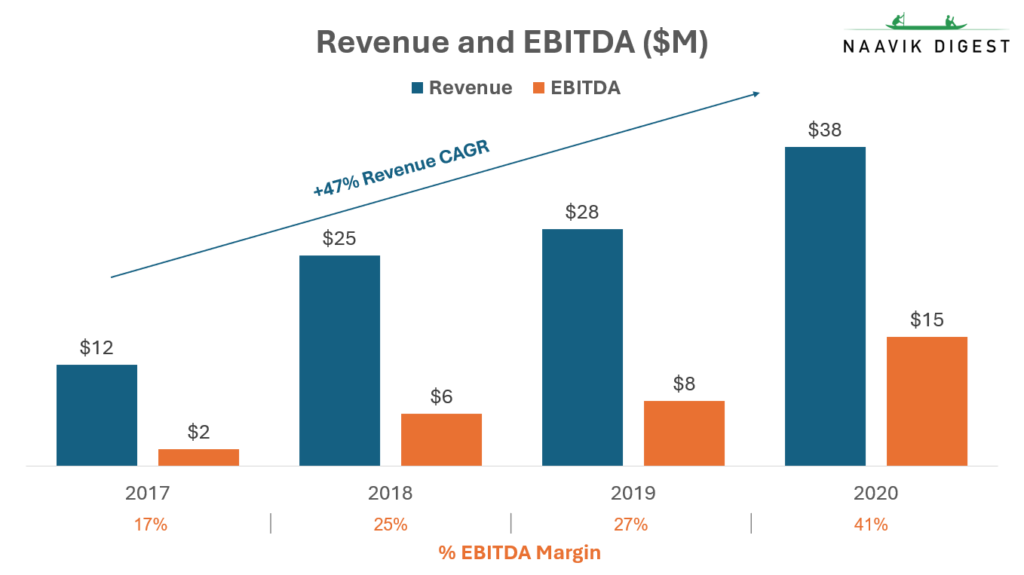

The company also had a string of other successful game launches (Graveyard Keeper, Streets of Rogue, Pathalogic 2) and was growing close to 50% year-over-year since it received its first round of venture funding in 2017.

With the company performing well (partly because of the COVID boom), and the stock market charting new heights in a zero interest rate environment, management decided to go public. tinyBuild launched an IPO on March 9 2021, raising close to $200M, of which roughly $160M went to the founders and investors, and $40M to the company.

Around the same time, the company was also moving "upmarket" from primarily publishing indie games (about 90% of its existing portfolio) to making almost half of its pipeline "AA" games. It also shifted focus to developing games-as-a-service (GaaS) titles that could engage players for “1,000 hours,” which meant pushing into multiplayer.

Finally, the freshly raised capital and publicly traded stock also allowed the company to be much more aggressive on M&A, making seven acquisitions in 2021 alone. The buyouts were of mostly smaller developers (We’re Five Games, Hungry Couch, Doghelm, Animal, and Bad Pixel), but most notably, the firm spent $12.5M (with additional earnouts of up to $19M) to acquire fellow indie publisher Versus Evil and its QA studio Red Cerberus — a deal that eventually came to haunt the company.

Adversity struck in early 2022 with the Russian invasion of Ukraine. tinyBuild had a significant presence in Eastern Europe (its CEO comes from Latvia and has strong ties in the region), with over 80 employees/contractors in Ukraine and another 100 in Russia. Combined, employees in the region made up slightly less than half its 400-person workforce. The company went into emergency response mode, evacuating employees living in the warzone, and securing visas for team members looking to leave both countries.

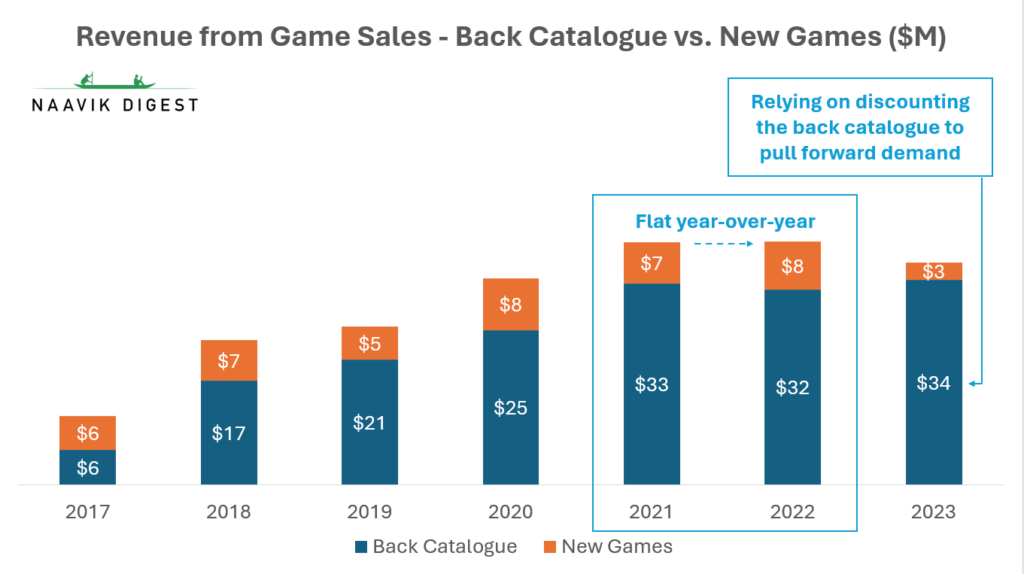

This coincided with flat revenues from game sales, despite the benefit of significant M&A activity, likely driven by the post-COVID hangover in consumer demand and diligence misses on M&A. tinyBuild’s relationship with Versus Evil (its largest acquisition to date) was also starting to sour, and the company took a large write-off in 2022 because Versus Evil was proving to be less profitable than expected. The bad performance was partially masked by significant growth in platform deal revenues (mostly subscription service agreements), which likely stemmed from the launch of Hello Neighbor 2.

2023 was more of the same, with new game sales continuing to disappoint and the company increasingly tapping into discounting its back catalog to attain steady revenue. Based on Steam data, tinyBuild’s top 25 games, on average, went on discount three more times than the prior year and dropped their discount price by approximately 15%. Additionally, the company incurred a $36M impairment charge for development costs it did not expect to recoup and another $12M write-down of assets it had acquired.

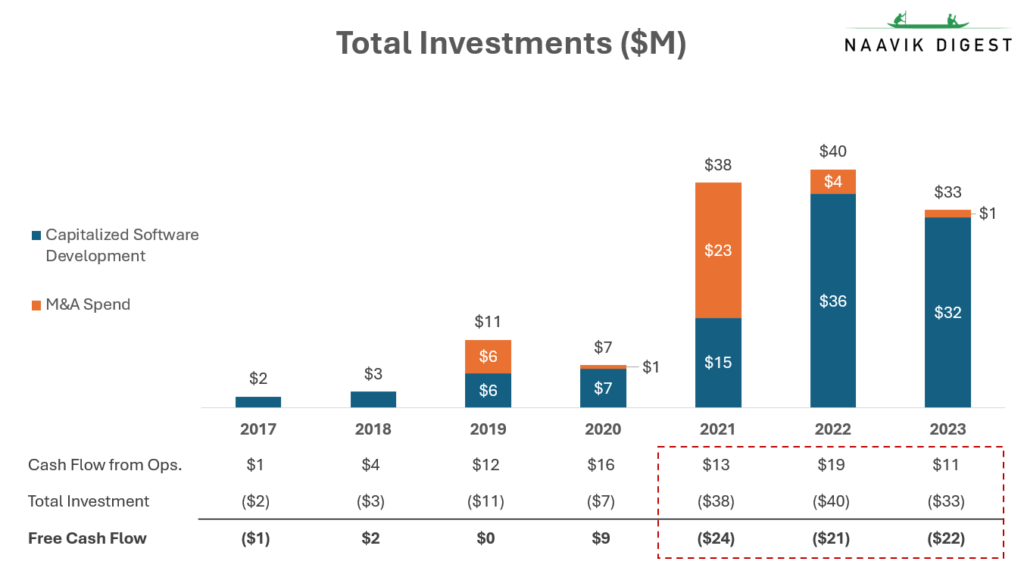

While business performance was soft, management remained optimistic and invested heavily throughout 2022 and 2023, spending north of $30M each year in development costs and M&A, despite operating cash flows averaging less than half that amount. The level of investment was unsustainable and put the company in a precarious position.

This all came to a head in late 2023 when platform deals that were expected to come in at the end of the year fell through. The company was left with only $2.5M in the bank, triggering the need for an emergency cash injection, to which the CEO and Atari contributed $10M and $2M, respectively, to help the company get through 2024. (We suspect Atari came in because it was eyeing some of tinyBuild’s assets — in April, Atari acquired the rights to Totally Reliable Delivery Service.)

2023 was an incredibly disappointing year for tinyBuild. Revenues were down 29% year-over-year, and the company recorded a $7M EBITDA loss. Responding to the poor performance, the market punished shareholders with a 96% drop in tinyBuild’s share price.

What Is Management’s Plan Now?

Well, management isn’t planning on changing its strategy. tinyBuild went through the usual rightsizing that comes with over-investment, shutting down Versus Evil and some of the smaller studios it had acquired (Moon Moose, acquired 2020; Demagic, acquired 2022).

It also paused all M&A activity and underwent a cost reduction program expected to generate $10M in development savings. The cost reduction program still leaves more than $20M in run-rate annual development costs, relative to the $11M in operating cash flows it generated in 2023, implying the company is still in an unsustainable position.

The company continues to push determinedly along its current path of taking a diversified portfolio approach to investing in games, with roughly 50 projects under development. For the games that end up being hits, the goal is to run the Hello Neighbor playbook, and turn the game into a long-lasting franchise through sequels, spinoffs, and multimedia properties — a feat the company has not been able to repeat since Hello Neighbor.

While its overarching strategy makes sense, tinyBuild‘s move toward games with higher development costs and GaaS titles has not yielded better results. Since the beginning of 2022, the company has yet to publish a game that has generated over $2.5M in gross revenue on Steam (estimates from GameDiscoverCo), whereas in the preceding five years, it averaged two games a year reaching this milestone, with much less investment.

The company also doesn’t have many proof points on successfully running the live ops treadmill. This ultimately begs the question of whether the company is drifting from what has historically made it great: finding and backing indie games with low development costs, and helping those games reach the largest audience possible.

So, Where Do We Go from Here?

2024 will be the moment of truth for tinyBuild, as the company will need to deliver hit games that can sustain its current level of investment. As of the end of April, the company has launched four new titles, and the results are mixed with no breakout hits.

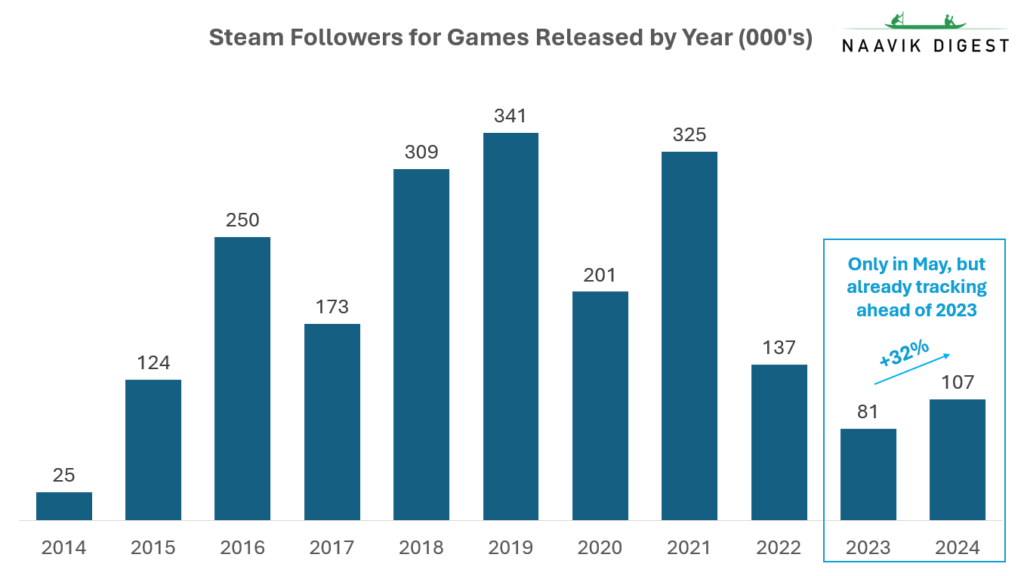

A reason to hold out hope is that the company has many highly anticipated titles in its late ’24 pipeline, including King Makers, which currently sits at No. 36 on the Steam wishlist after its trailer went viral; sequel Streets of Rogue 2; and Level Zero: Extraction, a space-based extraction shooter that is close to entering the top 100 Steam wishlist rankings.

Comparatively, tinyBuild only had one game close to the top 100 last year, I Am Future: Cozy Apocalypse Survival, which peaked at No. 131, and that game was one of its best performers in 2023. Obviously, landing on Steam wishlists isn’t a foolproof indicator, and tinyBuild has had its fair share of flops. A recent example is Broken Roads, which, despite peaking at No. 118 on the Steam wishlist rankings, had an incredibly disappointing launch earlier this year.

Another method to gauge how the company's 2024 releases are performing is by using Steam followers as a proxy. As of the end of April, the company had over 100K followers of its 2024 releases, relative to about 30K followers of its 2023 releases as of the same time last year.

Note that the backend-loaded 2024 release schedule would mean that even if the games end up delivering, the full revenue benefit might not manifest in the company’s 2024 financials.

Another reason to be optimistic about the company is the strong back catalog it has built from years of great content selection. Sales from titles released before the current year have contributed more than $30M in revenue each year since 2021. It’s important to note that these numbers have benefited from M&A, and the company’s inability to deliver new hits in ’22 and ’23 means the back catalog isn’t being replenished at the same rate.

Using reviews and discount data, we approximate that the back catalog has been decaying at roughly 20% each year, and some of the added discounting in ‘23 might have pulled forward demand from future years. Regardless, there’s clear consumer appetite for these older titles, and given they’re generally cheaper and lower fidelity games, there’s no reason to believe they will fall out of style anytime soon.

This stream of revenues from the back catalog will be a critical part of the equation to get the company back on firm footing and provide a floor to the share price as potential profits likely exceed the company’s current market capitalization of $25M.

While the facts above bode well for the company’s share price, there are many lingering questions about the company's direction.

- Since it went public, management’s capital allocation track record has been lackluster. The $60M in write-offs over the past two years amount to almost half of the company’s investments in the three years it's been public, bringing into question whether its business model can scale.

- Management is determined to pursue a strategy that has yet to yield any tangible results, and ongoing investments continue to exceed the underlying profitability of the business.

- The company’s lack of funds today means it can’t invest in games with a longer development horizon, and it is probably missing an excellent opportunity to deploy capital in many displaced and talented teams currently on the market.

- Delays are inevitable, and any significant holdups for games scheduled for launch in 2024 could easily put the company back into a bind.

One final wild card to consider is that if new game sales don’t deliver, and the company’s share price keeps tanking, tinyBuild’s CEO might eventually decide to take the company private. With the CEO already owning 58% of the stock (post the equity injection) and having brought home close to £56M pre-tax on the IPO, buying back the remainder of the company is something that must have crossed his mind.

Conclusion

With the benefit of hindsight, it’s easy to see that the company should have been more conservative with its investments and sold more stock to bolster the balance sheet rather than to pay its founders and investors. It’s probably much harder to make that call in the moment when everything is going up to the right, and the market is eager to provide you with capital.

Unfortunately, the market is incredibly fickle, and some of management’s bad bets have left the company in a challenging position. However, there’s a real chance the company can turn its fortunes by delivering on its 2024 release schedule and continuing to drive sales from its back catalog. Although the market seems to have written off the company, we hold out hope tinyBuild can get back on its feet.

A Word from Our Sponsor: OVERWOLF

Integrate Safe UGC Into Your Game with CurseForge For Studios

Overwolf is an all-in-one platform that lets creators build, share, and monetize in-game apps, mods, and private servers. With over 165,000 creators, and 41M monthly active users, Overwolf supports the world’s most popular AAA titles such as League of Legends, Minecraft, World of Warcraft, and 1,500 other games.

For game developers, Overwolf offers CurseForge For Studios. CurseForge For Studios is a white-label solution that lets game makers and publishers easily integrate mods safely and seamlessly into their games, both existing and new, at zero cost. It’s battle-tested by AAA studios and games, including Maxis (The Sims™ 4), Studio Wildcard (ARK), TakeTwo Interactive (KSP), and others.

CurseForge For Studios offers:

- Cross-Platform Modding: Integrate Overwolf’s open-source SDKs and plugins to let players discover and install mods in-game, across all platforms and storefronts.

- Full Analytics Dashboard: Get a full modding usage dashboard to learn which mods are popular.

- Safe and Secure Moderation: Studios define policies and guidelines on what is permitted, and these are then enforced by Overwolf - with only authorized content being published.

- Creator Relations and Payments: CurseForge supports creators with monthly payments, equity investments, developer contests, and hackathons to get their creative juices flowing, and kickstart content creation for your game.

Content Worth Consuming

Live service, subscriptions and F2P: A new reality for console gaming (gamesindustry.biz): “Over the last five years there's been tremendous change across console gaming driven by the growth in live service games, the increase in free-to-play titles, and the burgeoning influence of multi-game subscription services. This has dramatically altered the competitive landscape on consoles and impacted how game developers and publishers successfully launch new games, get their games noticed, pull in new players and drive engagement. My talk at GDC this year laid out the challenges of today’s market as the industry gets to grips with escalating costs and an era of lower growth, while competing against entrenched games-as-platforms and hundreds of new releases.”

Co-Founder Shelby Moledina's diary: Founding and closing Double Loop Games (Rise and Play Podcast): “It takes courage to build a game company. It takes courage to decide to close a company. It takes double courage to talk about it and share the learnings. In this episode, we follow the journey of Shelby Moledina, co-founder of Double Loop Games, from the aspiring start in 2019 to the difficult decision to close the company in 2023.”

Mastering cozy game design with Spry Fox' CCO Daniel Cook (Deconstructor of Fun): “Recently hitting the milestone of 30 years working in game design, Spry Fox Chief Creative Officer Daniel Cook has long been a leading voice in the game industry. To celebrate his long and distinguished career-spanning games like Realm of the Mad God, Triple Town, Alphabear, and Cozy Grove. MIA host Ethan Levy returns to the mic to talk to Dan about his many lessons and accomplishments. Most importantly, Dan talks about how as a team, Spry Fox found their shared, authentic voice, and how this has led to efficiency in production and success in the marketplace as they consciously chose to specialize in cozy games.”

Satisfying frustration: How to make compelling games that encourage moral reflection (gamedeveloper.com): “Video games have a great potential to support moral development. Playing is a crucial part of learning and developing behavioral patterns. Through play, one can safely test out behaviors and decisions without facing actual consequences. Moreover, a guided form of play, as provided by video games, can lead the player through a set of intentionally designed experiences. These experiences can become unique learning opportunities when they provide players with powers or roles they’d usually not be able to have.”

Sharing a Vision with Paul and Katy Bettner (The Fourth Curtain): “Our guests Paul and Katy Bettner are the Co-CEOs of Playful Games. Paul got his start making Age of Empires and Halo Wars. Together Paul and Katy made the leap into mobile founding NewToy, where Words with Friends became one of the most-played games of all time. They’re now working on Wildcard, a game aiming to fulfill the promise of web3. We talk Alec Baldwin, terrible MySpaces and feelings this week!”

Our Gamification Consulting Services

Today, we’re highlighting our gamification consulting services! Applying game mechanics to all sorts of applications has proven to boost retention, engagement, and revenue — but doing it right can be harder than it seems. More specifically, Naavik offers constructive gamification deconstructions, gamification workshops, and ongoing flexible support. Here is what one of our clients had to say.

“We have been very happy with the support Naavik provided to Sleepagotchi. They have an incredible expert network, with world-class game designers, narrative designers, and UA specialists. The team helps us in developing and stress-testing new game core loops, think deeply about our game constraints, and something that is rare for a consulting partner - care deeply about our mission and vision.”

- Anton Kraminkin, Founder & CEO of Sleepagotchi

If you’d like to learn more, reach out here! Also check out our expanded consulting service portfolio here.