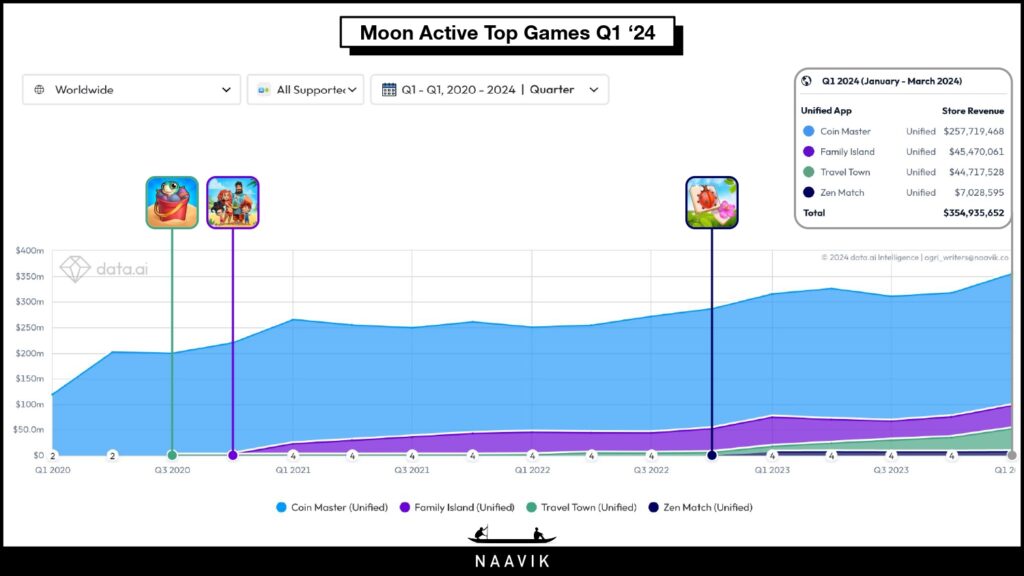

Coin Master developer Moon Active had its best ever revenue quarter in Q1 2024. Of the $355M in Q1 store revenue (as estimated by data.ai), 73% ($258M) was from its flagship game, Coin Master, with the rest from its broader portfolio of acquired casual games.

So let’s take a look at Moon Active’s game portfolio, its casual gaming mastery, and where the company is going next.

The Many Games of Moon Active

Coin Master is a phenomenon, consistently ranking among the top five highest-grossing games globally since the year 2020, with lifetime earnings exceeding $4.17B. The game single-handedly created the "casual casino" genre by going beyond slot mechanics to introduce captivating meta aspects like building and card collection, while also heavily relying on social features, industry leading sales, and offer systems that are echoed across many titles in the casual F2P gaming space.

Recent hits Royal Match and Monopoly Go owe a great deal of their success to Coin Master’s trailblazing path, which has set a high standard for meta, social, offers, and live ops for casual games.

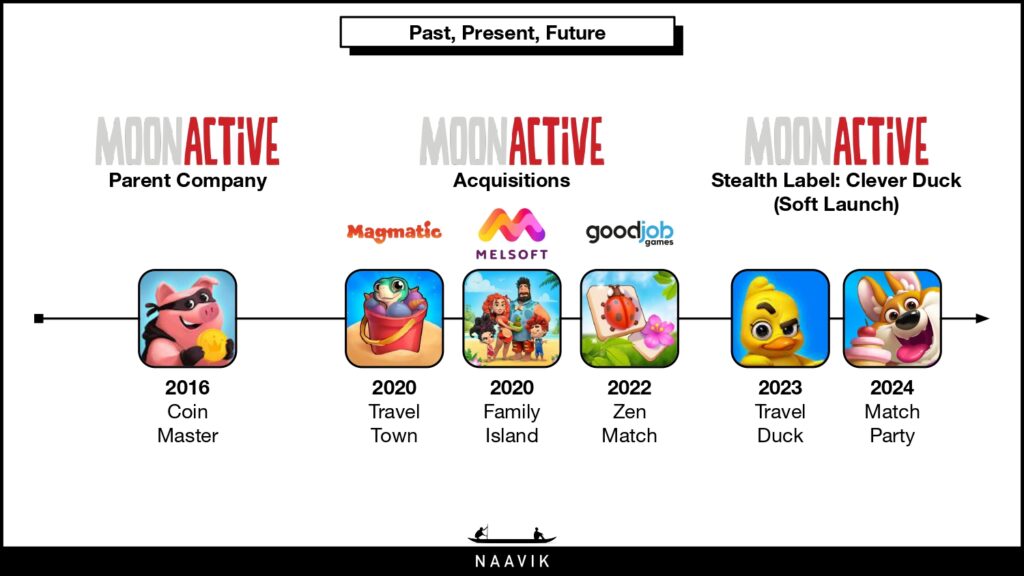

In recent years, Moon Active acquired three casual games (and their teams) to attempt to replicate Coin Master’s success across other genres, and to reduce the risk of relying on a single tentpole title. They are:

- Travel Town, a merge-2 game created by Magmatic Games (co-founded by ex-Wooga product lead Florian Steinhoff, who’s known for this GDC talk on puzzle games).

- Family Island, a farming simulator game by Melsoft Games.

- Zen Match, a tile match puzzle game by GoodJob Games (in this case, Moon Active acquired the game and its core team, not GoodJob Games itself).

Moon Active’s strategic bets appear to have paid off.

Travel Town has risen to become the top-grossing merge game, surpassing well-established rivals like Metacore’s Merge Mansion and Zynga’s Merge Dragons. The merge-2 mechanic at Travel Town's core, which was started by Merge Mansion, surpasses its inspiration in the backend layer of balancing drop rates and progression, making the game board more engaging and casual player-friendly. This core gameplay is then elevated with the addition of Coin Master’s social album collection and trading.

Family Island is the second highest-earning farming simulation game, nestled between the front-runner, Playrix’s Township, and Supercell’s Hay Day. The success of Family Island is largely attributed to the game having the same monetization depth as Klondike Adventures (both are energy-based resource collection and crafting games), while remaining accessible to the wider casual audience. Family Island’s RPD development reached about $6.5 as of Q1 2024, which is nearly twice that of Township and Hay Day’s $3.5.

Zen Match, whose success single-handedly created the tile match subgenre, has been battling its decline due to fierce competition from Spyke’s Tile Busters and Code Dish’s Tile Match. Though Zen Match remains the third-highest earning title in the tile match subgenre, the genre itself seems to have moved on to match-3D games like Triple Match 3D (by Boombox/Miniclip) and the recent Match Factory! (by Peak/Zynga).

The Future Bets of Moon Active

Moon Active is not done with the casual genre yet. After operating and learning from all of these subgenres, the company now has its eyes set on two of the most lucrative casual puzzle subgenres: swipe match-3 and match-3D (which we covered in a previous digest).

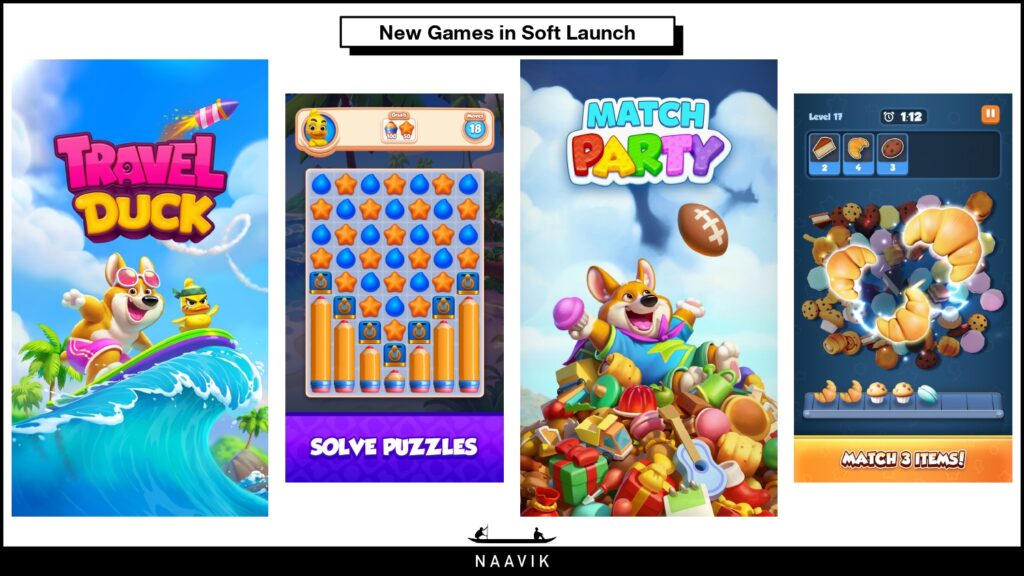

Enter two new soft-launched games from Moon Active’s stealth label, Clever Duck:

- Travel Duck, a Royal Match-like swipe match-3 game.

- Match Party, a Match Factory-like match-3D game.

Unlike Moon Active’s previous titles, which were obtained by acquiring studios or teams, these new games seem to have been built internally by the parent company. While games like Travel Town took almost three years of internal development post-acquisition to adapt Coin Master’s best practices and become the successes they are today, the team may have realized it could be more time and capital efficient to shift focus to developing new games in-house.

Travel Duck is the swipe match-3 iteration of Blast Master, a tap-2 blast puzzler that has been in soft launch since December 2021. Moon Active seems to have killed its blast project in lieu of the match-3 game but kept the meta, events, offers, and live ops structure from puzzle game to puzzle game. Travel Duck appears to be a promising contender, as the game has been soft launched primarily in the UK since August 2023, and the team has now extended testing to the US as of February 2024.

Match Party, on the other hand, just started testing recently. It will be interesting to follow its development as the data starts coming in.

With mastery over several casual titles, the foundation is strong for these new bets to pay off in the near future. Moon Active has experienced steady growth since Coin Master exploded in 2020, even growing 18% in 2023 while the market overall declined. As Moon Active enjoys its current success, its potential for future growth remains even more promising.

A Word from Our Sponsor: NEXUS

Build a Support-a-Creator Program

Explore implementing a game-changing Support-a-Creator program with Nexus, the leading platform for live service PC, console, and mobile video games, designed for building holistic creator programs.

Through Nexus’s Support-a-Creator API, live service publishers can build world-class creator programs that drive significant growth in conversion, ARPPU, retention, and LTV. Nexus has partnered with leading live service publishers like Capcom, Grinding Gear Games, Hi-Rez Studios and Ninja Kiwi to build out their creator programs by managing creator onboarding, payments, analytics, attribution and so much more.

Partner with Nexus and benefit from their expertise while implementing your own Support-a-Creator program.

Content Worth Consuming

Warren Spector says the next logical step for immersive sims is multiplayer (gamedeveloper.com): “Famed creative director Warren Spector still wants to break new game design ground in the world of immersive sims. He and his colleagues at Otherside Entertainment are finally revealing details about the post-System Shock 3 games they've been working on, backed by funding from Aonic Group and its new publishing arm Megabit.”

How creation gaming is revolutionizing educational engagement for Generation Alpha (thecreationgeneration.com): “Platforms such as Roblox and Minecraft are leading a groundbreaking shift in gaming for Generation Alpha, moving beyond simple gameplay in pre-made environments to empower players to build and shape their own digital worlds and stories. This shift marks the rise of "creation gaming," a mode where the act of self-directed building and creativity are central to the gaming experience.”

Mitch Lasky reveals the secret to GTM in games to Justin Kan (Stash's YouTube channel): “Since the mid 1990s, Mitch Lasky has been building and investing in some of the biggest game companies in the world. He was one of the first, if not the first, investor to take game developers seriously as a venture-backable business. He helped build Activision, was CEO of Jamdat (one of the first mobile game studios, which he took public before selling to Electronic Arts for $680M), and was an early investor at Riot Games, helping turn League of Legends from a rough wireframe to the sensation it is today.”

What do Devolver's results tell us about game discovery in 2024? (The GameDiscoverCo): “Late last week, veteran indie publisher Devolver put out its 2023 financial results. And it was a quiet year for the rebels, with revenue down 31% to $92 million, and a statutory net loss of $12.6 million. BTW, some context: before floating on the AIM stock market in London in November 2021, the company bulked up a lot from its historically lean-ish 20 person operating structure, acquiring dev teams Croteam, Firefly, Nerial, Dodge Roll and Artificer, and semi-sister publishing organization Good Shepherd.”

Pricing starter packs: when conversion is king, we may price too low (Deconstructor of Fun): "Starter packs are an essential component of the free-to-play monetization toolbox. The idea is to make players an attractive offer to get them to become paying customers quickly. I have long had a suspicion that starter packs get priced too low in the day-to-day struggle for conversion. Personalization at the starter pack stage is difficult as there is virtually no behavioral data available. So, it’s just too appealing to convert as many players as possible as early as possible – which commonly happens by making them an appealing offer at a low “no-brainer” price point.”

Our Gamification Consulting Services

Today, we’re highlighting our gamification consulting services! Applying game mechanics to all sorts of applications has proven to boost retention, engagement, and revenue — but doing it right can be harder than it seems. More specifically, Naavik offers constructive gamification deconstructions, gamification workshops, and ongoing flexible support. Here is what one of our clients had to say.

“We have been very happy with the support Naavik provided to Sleepagotchi. They have an incredible expert network, with world-class game designers, narrative designers, and UA specialists. The team helps us in developing and stress-testing new game core loops, think deeply about our game constraints, and something that is rare for a consulting partner - care deeply about our mission and vision.”

- Anton Kraminkin, Founder & CEO of Sleepagotchi

If you’d like to learn more, reach out here! Also check out our expanded consulting service portfolio here.