As 2023 came to an end, King, the maker of the popular Candy Crush franchise, soft launched two new Candy titles in the Philippines: Candy Crush 3D, where players race against time to sort and match 3D candies into sets of three, and Candy Crush: Blast!, a tap-to-blast puzzler.

The games are in early testing, with under 5K downloads each and no IAPs implemented. Here, we explore how King is trying to diversify its Candy IP into different puzzle subgenres, and what trends are shaping the future of this genre.

Where is the Puzzle/Match Genre Heading?

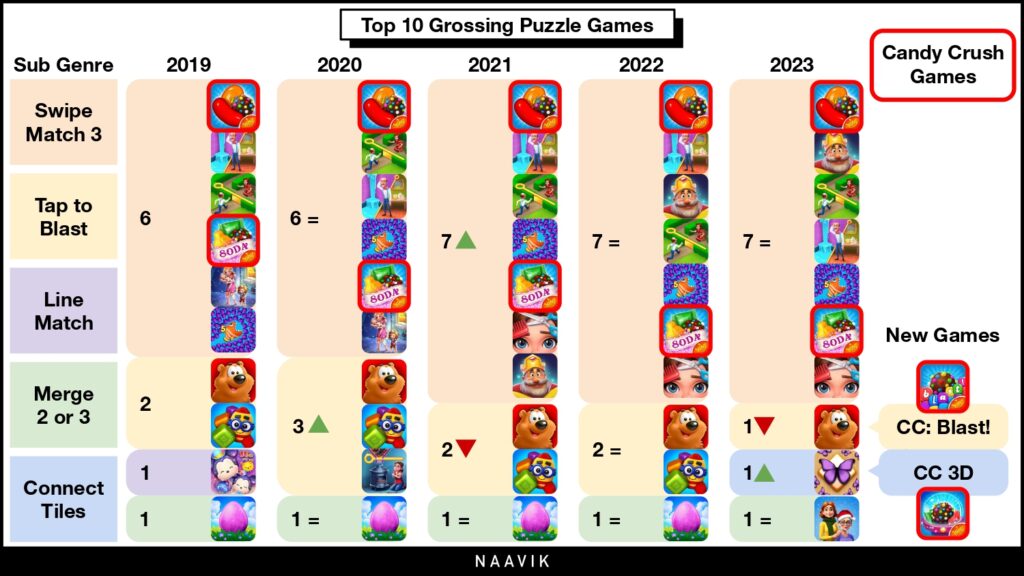

Looking at data.ai’s top 10 grossing puzzle games list, the biggest winners for the past five years appear to be “swipe match-3” and “connect tile” games, both growing by one title. While Magic Tavern/AppLovin’s Matchington Mansion was replaced in this list by the same developer’s newer game Project Makeover, it was Dream Games’ Royal Match and Boombox/Miniclip’s Triple Match 3D that grew their respective categories. This is good news for King’s Candy Crush 3D, as a connect tile subgenre game.

The merge subgenre continues to have one title in the top 10 list, with Zynga’s merge-3 game Merge Dragons replaced by Metacore’s merge-2 title Merge Mansion. The tap-to-blast subgenre, on the other hand, looks to have declined by one title, with both Tactile’s Lily's Garden and Peak/Zynga’s Toy Blast falling behind. This is bad news for Candy Crush Blast, as swipe match-3 and connect tile subgenre titles invade its tap-to-blast space.

An alternate view that leads to the same conclusion is the revenue trend of puzzle subgenres for the past five years. Connect tile has been on a year-over-year growth trend for the past four years, and tap-to-blast has been on a year-over-year declining trend for the past three years.

Before discussing King’s overall strategy with these new Candy Crush games, let’s take a quick look at them individually, alongside their closest competitors.

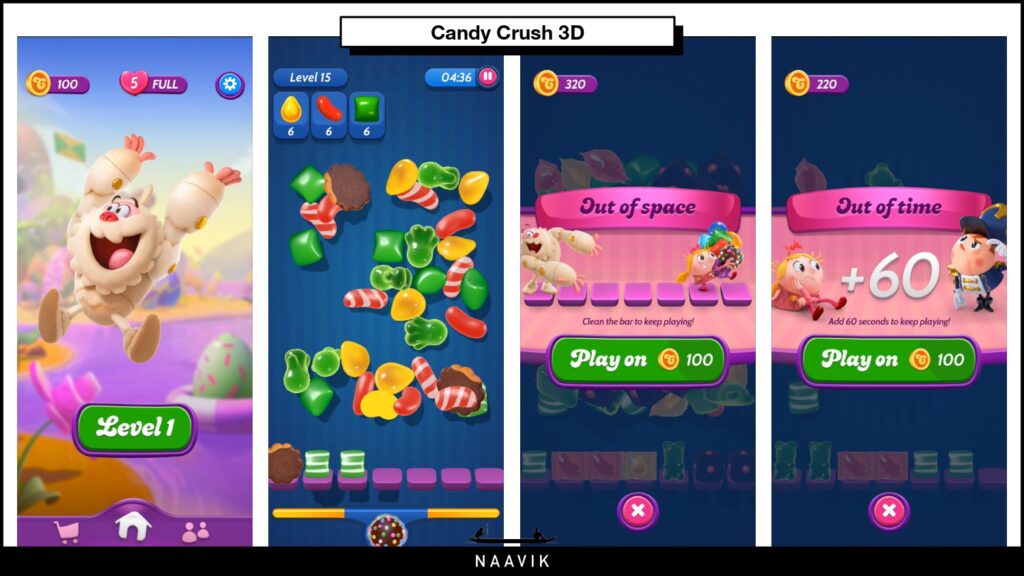

Candy Crush 3D

Gameplay Video

Game Link: Google Play

Puzzle Sub Genre: Connect Tiles

Biggest Competitor 2023: Triple Match 3D (Google Play, App Store) by Boombox (Miniclip/Tencent)

What is it: Candy Crush 3D is similar to the 2022 hit Triple Match 3D, which we covered at length in a previous digest. In Candy Crush 3D, players tap and sort three of the same 3D candies on the game board. Tapping an item adds it to the bar at the bottom of the screen, and once the player has three of the same item there, they are matched and collected, opening the bar for more items. Reaching more than seven items on the bar or running out of the level’s time limit leads to a “continue” popup — an essential part of puzzle game monetization. Check out a previous digest for a more in-depth look at Candy Crush 3D.

Innovation: A timed streak mechanic below the collection bar that rewards players with powerful boosters for making matches faster, and on higher streaks.

Biggest Risk: Does the Candy IP help expand Candy Crush 3D to reach a wider audience than the toy theme of Peak’s new game Match Factory, or the more abstract theme of subgenre leader Triple Match 3D?

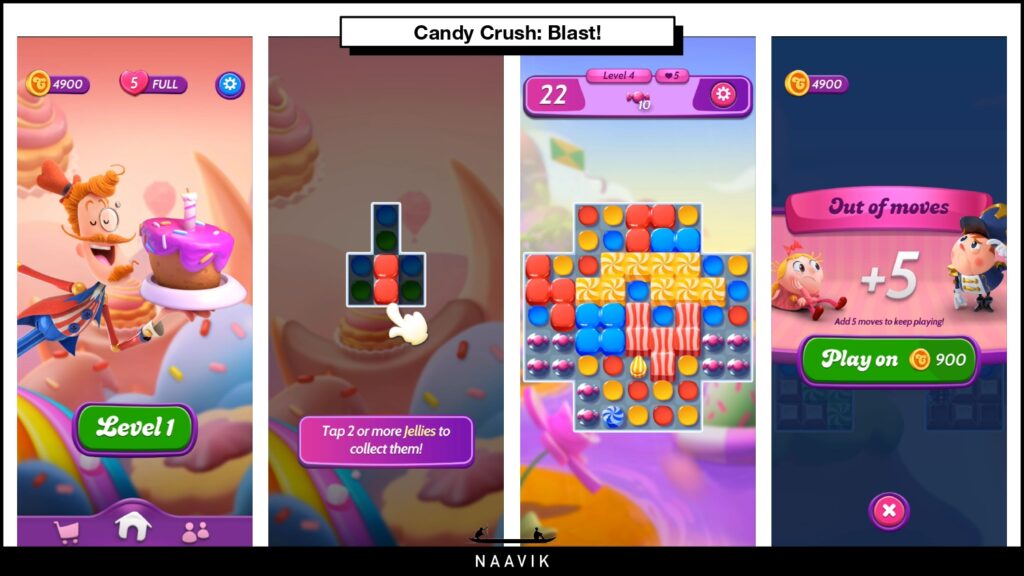

Candy Crush: Blast!

Gameplay Video

Game Link: Google Play

Puzzle Sub Genre: Blast

Biggest Competitor 2023: Toon Blast (Google Play, App Store) by Peak (Zynga/Take Two)

What is it: Candy Crush: Blast! is King’s second foray into tap-to-blast games, a genre owned by Peak’s Toon Blast and Toy Blast. The Candy Crush maker had previously explored this category in the canceled 2018 title Candy Crush Cubes.

With Candy Crush Blast!, King is trying something new in a core-focused direction, bringing all the items from its swipe match-3 game into a new context. This makes the game look and play very differently from all the blast games out there.

Innovation: All the candies and power-ups from Candy Crush Saga have been brought into this blast game with a fresh new look and inventive gameplay.

Biggest Risk: While Blast is different in the moment-to-moment gameplay from everything out there, it also makes the game levels harder to read, power-up rules more difficult to learn, and the game tougher to play overall.

Strategic Expansion or Bust

Looking into other subgenres is a sound strategy for growth in the puzzle space, as well as growth for the Candy Crush IP.

As we saw above, when it comes to subgenre growth, the swipe match-3, merge-2/3 and connect tile are the spaces most likely to continue growing in 2024. According to Dream Games’ co-founder and CEO, Soner Aydemir, the staying power of puzzle games is an inherent quality of the genre being an engaging balance of skill and luck, making it possible to repeat and continue playing forever without getting bored.

Though this holds true for the swipe match-3 subgenre with its increasing market share, it may not hold true for tap-to-blast, highlighted by its declining footprint overall. Fundamentally, the tap-to-blast core gameplay mechanic has not yet proven to have the staying power of swipe match-3 games. This makes it challenging for Candy Crush Blast!, though the team’s exploration of bringing boosters from its swipe match-3 game seems to be an attempt to capture that subgenre’s stickiness.

The challenge of making new, successful tap-to-blast games is also shared by Peak/Zynga’s Star Blast and GoodJobGames’ Wonder Blast, both high production, feature-heavy games built by puzzle genre experts that have been stuck in soft launch for over two years now.

Candy Crush 3D, on the other hand, is entering the exploding connect tile subgenre, driven by core-focused hybridcasual games like Triple Match 3D and Zen Match. It is a young category compared to swipe match-3, and though it’s too early to comment on its staying power, it has certainly grown in market share.

It’s only a matter of time for King to build, globally release, and grow this new Candy Crush title to the heights of — but likely not beyond — its top two swipe match-3 Candy Crush games.

A Word from Our Sponsor: NEXUS

Windwalk Builds Community Software to Enhance Your Relationship With Customers

Windwalk builds digital communities and the technologies necessary to accelerate them.

Windwalk offers a portfolio of services to top gaming companies in addition to the flagship software offering — Harbor. Harbor is an end-to-end community software that empowers community owners to monitor their community’s pulse, gamify the community experience, and collect actionable insights across a growing number of digital channels.

Integrating a game product with Harbor allows community owners to learn how players are interacting with their products and build toward more engaging and rewarding experiences. Combined with Windwalk’s guidance as an industry leader in community management, Harbor is the first step in your product’s community revolution.

In Other News

💸 Funding & Acquisitions:

- Pine Games secures $2.25M for mobile game development in Istanbul

- Harbiz raised $5.4M for fitness professionals platform

- Talofa Games raises $6.3M to build fitness games for good

- Leslie Benzies' Build A Rocket Boy studio raises $110M for "flagship" trio of projects

- Obelisk Studio raises $2M to pivot from codevelopment into own IP

📊 Business & Products:

- Larian will keep Baldur's Gate 3 and other games off subscription services

- The new Ubisoft+ and getting gamers comfortable with not owning their games

- EA is finally launching Plants vs. Zombies 3

- Why Microsoft might be considering Xbox exclusives on PlayStation and Nintendo Switch

- Not everyone bows to the inevitability of subscription models

👾 Miscellaneous:

- Amikaverse debuts on Roblox for hair care fans

- Rocksteady founders have a new, post-Suicide Squad studio

- Tough times for games? Here are five ways that Belka Games has weathered the storm

- Justin Kan’s Stash gives game devs a platform for alternative web shops

- Seven practical steps to becoming a voice actor in games

Our User Acquisition Consulting Services

Today we’re highlighting our product strategy services. This includes market research, live ops strategy, product management, brand marketing and performance marketing. Here’s what one of our clients had to say.

“Naavik elevated our go to market strategy. Their deep understanding of the market and innovative strategies brought our campaigns to a new level, exceeding all our expectations.”

-Kam Punia, Founder & CEO of Pixion Games

If you’d like to learn more, reach out here! Also check out our expanded consulting service portfolio here.