An Update on the Mobile Shooter Market

By Matt Dion, Naavik Contributor

Mobile shooters have had a turbulent year. Since Naavik published its first genre report at the beginning of 2023, the market has undergone a substantial transformation. Though the key players remain the same, the incumbents atop the genre may be faced some challenges.

In just eight months, aggregate store revenues for the mobile shooter genre have plummeted from a high of $296M in January '23 to $210M in August '23 – a decline of nearly 30%. Just a couple of months earlier, June’s $207M total marked the genre’s lowest monthly tally since September of 2019 – one month before the global launch of Call of Duty: Mobile.

On the download front, the genre demonstrated slightly more resilience with 209M downloads in August compared to 218M in January. While these numbers fall well short of all-time highs, they are relatively in line with the last couple years’ performance. Given that downloads have not dramatically changed, what might be causing revenues to drop? We’ll discuss that and much more below.

Before we get started, a quick note: unless otherwise specified, all data and genre classifications used in this piece are courtesy data.ai. All revenue data is exclusive of ad revenue, and does not include data from third-party Android stores in China.

Tencent, and Everyone Else

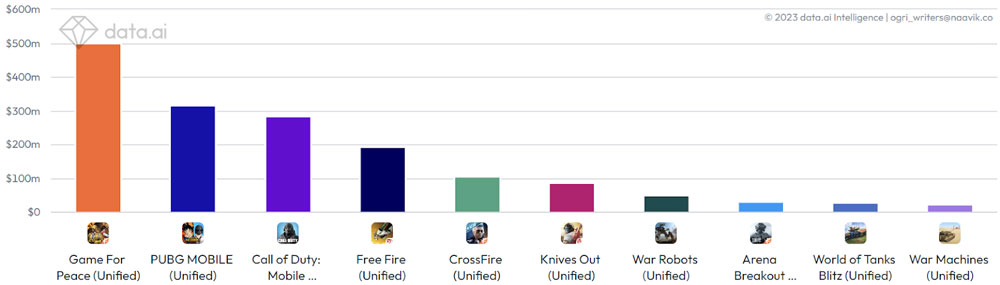

Let’s begin with Tencent. The Chinese publisher dominates the market, operating (either in whole or in part) five of the top ten revenue-generating titles in 2023.

Tencent's Game for Peace (also referred to as Peacekeeper Elite), the genre’s largest moneymaker by a vast margin, saw its revenues collapse from over $100M in January to just $31.8M in August. While other titles like Call of Duty: Mobile and Arena Breakout have seen their revenues trend flat or upward this year (more on this later), the drop-off from Game for Peace has more than offset any gains elsewhere.

Beyond the broader decline in battle royale, it’s been difficult to pin down a specific cause for this massive decline in Game for Peace, perhaps because of a lack of coverage in the English-speaking press. But some outlets (such as the Financial Times) have speculated that Tencent faces domestic regulatory pressure to downsize, which may be impacting their gaming division. From what we can see on data.ai, there does also appear to be an increase in the share of 1 star reviews throughout the year, though it is difficult to attribute such a backslide to these data points alone.

If Game for Peace’s underwhelming August performance were broken out and counted as its own separate title, it would still rank in the top eight globally this year. So yes, a meaningful decline by Tencent’s lofty standards, but a juggernaut nonetheless.

Next there’s PUBG Mobile and Call of Duty: Mobile, two Tencent co-development efforts with Krafton and Activision, respectively. Despite these games’ continued success, both partners have sought to break out of the Tencent co-development relationship in an effort to capture more revenue.

Krafton first attempted this in July 2021 with the launch of Battlegrounds Mobile India (BGMI), and again in November 2021 with PUBG: NEW STATE (since renamed to NEW STATE Mobile). Results for these PUBG extensions have been mixed, as both titles pale in comparison from a revenue perspective (< $10M combined YTD), though BGMI remains extremely popular in India. BGMI is the 14th most downloaded title in the genre this year, despite having its roughly yearlong government ban lifted at the end of May.

Activision, on the other hand, is hoping to see greater success with its breakaway efforts with the release of Call of Duty: Warzone Mobile later this year. This newest mobile iteration of the franchise will feature synchronized battle pass progress and friends lists across Call of Duty: Modern Warfare II and Call of Duty: Warzone. According to the game’s website, it has already passed 35M pre-registrations.

Will this be enough to lure players away from Call of Duty: Mobile and the Tencent live ops machine? Time will tell, but the game will face an uphill battle. The switching costs for players who have already sunk money into CODM and unboxed their favorite cosmetics might prove too great for Warzone Mobile to overcome, at least initially.

Perhaps the long-term appeal of cross-progression will win out in the console-heavy Western markets, but it’s likely that CODM will continue to be a successful product for at least another year or two.

One trend worth keeping an eye on here is the potential for further decoupling from Tencent and other Chinese co-development efforts in the shooter space. Clearly, Activision and Krafton have already begun this process. EA might also be added to this bucket, as Apex Legends Mobile (formally shut down in May of this year) was a Tencent co-development project that, suspiciously enough, has already been cloned for Chinese audiences. Whether the reasons for eschewing Chinese co-dev partnerships are related to greater profits, geopolitical pressures, or simply differences in working style and culture, we may be seeing the pendulum swing back towards in-house development.

Elsewhere in Asia, Tencent rival NetEase continues its impressive run in the mobile shooter space with Knives Out. Despite a significantly smaller player base (< 2M active users) than its peers, Knives Out has maintained a strong position in the genre (sixth highest revenues YTD) through hyper-localization and culturalization to the Japanese market, from which it derives 90+% of its annual revenues. Impressive for a game first launched in 2017.

NetEase also operates in other shooter subgenres, though it has been unable to replicate its previous success. The company has tried its hand at vehicle shooters (Tank Combat; Super Mecha Champions), tactical shooters (Hyper Front, currently the subject of a lawsuit by Riot Games), looter shooters (Badlanders), and even the much ballyhooed extraction shooter space (Lost Light). The company is also rumored to be partnering with Bungie on a Destiny mobile game, though that has yet to be confirmed.

That NetEase would seek out innovation within shooter subgenres should come as little surprise. Of the top five revenue earning games this year, not one was released more recently than 2019. Yet these incumbents have never been more vulnerable to challengers.

Vulnerable Incumbents

We have already discussed the major revenue losses by Game for Peace and the forthcoming launch of Call of Duty: Warzone Mobile as a threat to Call of Duty: Mobile. Genre mainstay Garena Free Fire is also facing disruption – a topic my colleague Mario covered recently for Naavik Digest.

Despite consistently pulling in a massive ~20M monthly downloads throughout 2023, Garena’s parent company, Sea Ltd., has seen its stock tumble amid a host of challenges outside of its gaming endeavors. It has since instituted cost-cutting measures and scaled back user acquisition spend to its lowest level in at least three years (see chart below). If the newly proposed per-install pricing changes from Unity go into effect, Free Fire could be faced with even greater problems.

Free Fire’s struggles may leave the door open for competitors to come in and siphon away users. Free Fire has historically been dominant in markets like India, Southeast Asia, and Latin America, but it still draws upwards of 40% of its monthly revenues from the United States where the aforementioned Call of Duty IP is strongest. Free Fire’s position in India may also be vulnerable, as it has only recently had its government ban lifted.

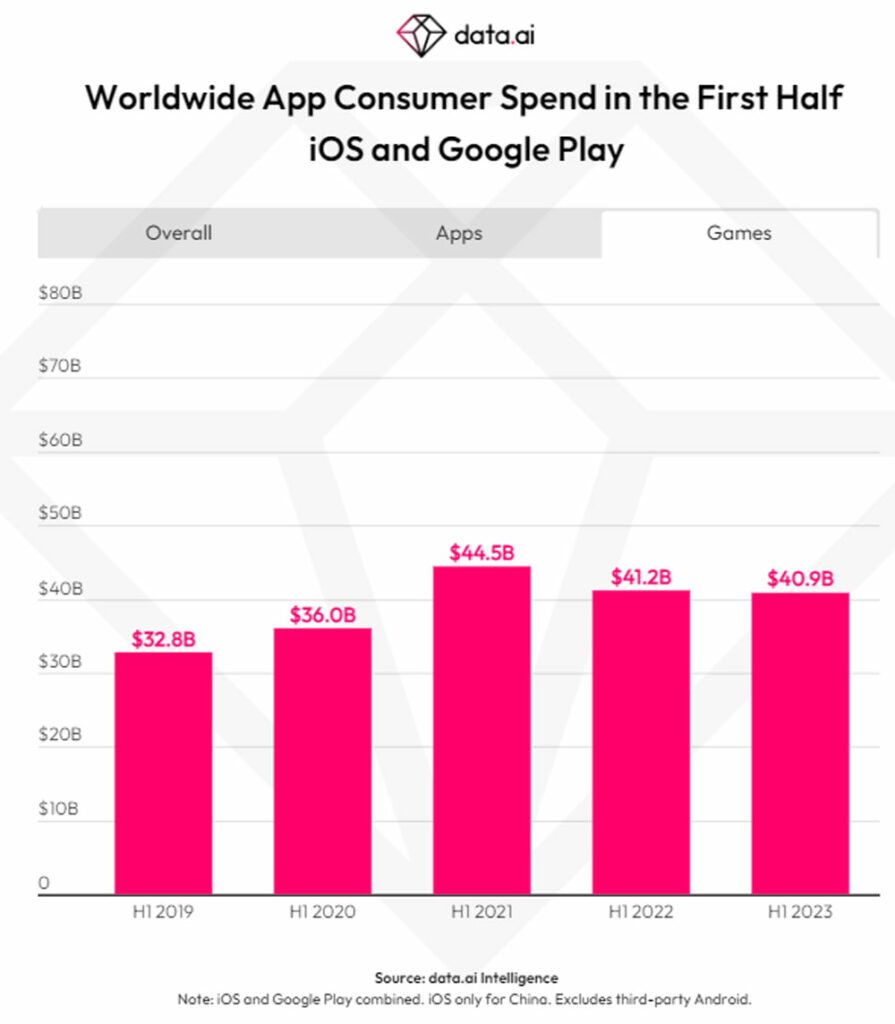

Despite the challenges faced by genre incumbents, prognosticators have been calling for the “next big thing” in mobile shooters (and shooters, generally) for several years now. It’s also worth noting that the mobile gaming market as a whole has taken a step back in H1 2023 after even deeper declines in H2 2022 (see chart below).

Another theory has been that battle royale is a dying genre, and though the vast majority of mobile shooter revenue losses come from this subcategory, monthly downloads have continued to trend upwards for most of 2023. It’s also difficult to properly extricate battle royale from team deathmatch and other subgenres, given that the leading titles all have multiple game modes contained within them.

Whatever the case, publishers remain interested in entering the mobile shooter space. Many developers have tried and failed to break into this lucrative market, including several in 2023 alone.

This year, we saw both EA and Square-Enix exit the mobile shooter genre with a bevy of project cancellations (Apex Legends Mobile and Battlefield Mobile for EA; Final Fantasy VII: The First Soldier and Just Cause Mobile for Square-Enix). Lilith Games’ entry into the shooter space, the much-anticipated Farlight 84, launched in April of this year and performed modestly ($2.8M in revenue on 17.7M downloads YTD).

Perhaps the one green shoot of innovation is the still-unproven extraction shooter subgenre. After being widely touted as the next evolution of shooters (including in this publication), there has been little to show that this hype has translated into meaningful results. The aforementioned Lost Light from NetEase has yet to break $1M in revenue this year and few other examples exist, though one could argue that PUBG Mobile’s recurring Metro Royale mode shares elements with extraction shooters.

The exception to this trend again comes from Tencent, whose extraction shooter Arena Breakout launched worldwide in July after roughly a year of testing in China. The game still draws the vast majority of its revenue from China, but that was still enough to rank it as the eighth-largest money maker among mobile shooters this year at $31.1M.

Krafton also hopes to get in on the extraction shooter craze, as it recently announced a partnership with indie darling Ironmace to bring the fantasy-themed extraction FPS Dark & Darker to mobile.

Beyond extraction shooters, there are still a few major names left on the sidelines. Bungie’s Destiny remains exclusive to PC and console. Ubisoft is preparing to bring its premier shooter IP, Rainbow Six, to mobile and boasts north of 17M pre-registrations. CEO Yves Guillemot has also described it as the company’s “first AAA mobile game.”

Digital Extremes (acquired by Tencent in 2020) is set to bring Warframe to mobile sometime in 2024, and yet another (Tencent affiliated) publisher worth keeping an eye on is Riot Games, which is already in the midst of beta testing Valorant Mobile in China.

With these titles and likely more on the horizon, genre incumbents will have some stiff competition. While Tencent and others have been able to fend off challenges in the past, recent weakness has left them exposed to potential disruption. The question is whether anyone will be able to capitalize on the opportunities, given the scale required to compete.

Given the maturity of the market and the insanely high bar for content, feature sets, and live ops, any potential challengers that do manage to make some noise in the mobile shooter space will likely come from big publishers. I find it unlikely that a startup will be able to compete at this scale, given the high barriers to entry and the massive UA spend required to sustain it.

Large publishers will have further advantages in leveraging existing shooter IPs to reduce acquisition costs (though as we have seen with many of this year’s failed products, that is far from guaranteed). While mobile-first IPs like Knives Out and Free Fire were previously able to rise from obscurity to carve out meaningful footholds in the genre, these teams had the benefit of operating within a still-developing market. Both games launched well before dual-stick shooters were an established format on mobile and have been able to further differentiate by catering their offerings to specific geographic markets. New entrants today will have no such luxury.

Though I am skeptical that any newcomer will be able to compete with Tencent in this space any time soon, there is room for one or more challengers to break into the top ten. Perhaps this will take the form of a crossplay- or cross-progression-compatible game, bootstrapping audiences from other platforms to quickly reach scale? This seems far more likely to me than any sort of design-based innovation, but perhaps Arena Breakout will prove me wrong. My hunch is that many industry observers would place their bets on Valorant Mobile as a candidate for early success, but that again proves that point that any discussion of mobile shooters starts and ends with Tencent.

Where Fun Meets Bitcoin!

ZEBEDEE is a fintech and payments processor with a plug-and-play API plus SDK, enabling developers to easily integrate instant, borderless low-fee payments into various applications using the Bitcoin Lightning Network. Offering transactions with fees of less than one cent, ZEBEDEE already powers over 4,000 developers across a variety of sectors, including gaming, streaming media, and social media, processing 10,000-plus million transactions monthly.

Early adopters have reported impressive results. For instance, Square Enix experienced an 82% increase in ARPDAU for its game Ludo Zenith, Fountain Podcasts doubled its user base after integration, and Fumb Games saw a 1,215% player retention increase for Bitcoin Miner. ZEBEDEE targets the growing demand for borderless transactions, ensuring that digital businesses can effectively engage and monetize a global user base, including the unbanked.

Unity’s Pricing Change, Roblox Updates, iPhone 15 News & Gearbox + Jagex Rumors

By Aaron Bush, Naavik Co-Founder

Unity’s new pricing strategy is backfiring. The engine-maker’s new Runtime Fee, an installs-based pricing structure, blindsided developers and now much of the industry is furious.

- First, some context: Unity’s game engine has never been profitable, and a large sum of users don’t pay anything for the service. The company’s strategy has been to maximize the number of engine users and then upsell the power users through adjacent services. Despite those efforts — not to mention ATT pressures and industry layoffs harming the seat model — Unity has struggled to achieve profitability, and the company’s stock remains over 80% below its highs.

- Enter the new pricing model. Starting in January developers on the Unity Personal or Plus plans will be charged $0.20 for every install after passing 200,000 installs and $200,000 in revenue. On the Pro and Enterprise tiers, the charges are “only” $0.01 per install — after hitting a threshold of 2M installs and $1M in revenue. Notably, the install count resets on a monthly basis, which means developers will be forced back into paying the higher cost tiers each month. Yes, many small developers and games won’t hit the required thresholds, but this dramatically changes the KPI math for most major developers.

- There are several big problems here. Providing fewer than three months’ notice to developers is a slap in the face, and doesn’t give anyone time to adapt. Installs are estimated on a proprietary algorithm that Unity hasn’t explained, which undermines trust. And the pricing model is overly complicated. Even if the math is in some cases more favorable than Unreal’s 5% royalty fee (although in most cases it’s not), and one argues that game engines create more value than others who take 30% fees, this whole pricing change is at minimum poorly executed.

- This is also an ecosystem play. Unity will offer Runtime Fee discounts to developers who also adopt LevelPlay, Unity’s ad mediation solution, which was acquired in the ironSource merger. This is a direct attack on AppLovin and will limit the blow for many developers. Even so, the desired developer ecosystem lock-in is something the development community wants to avoid.

- Unity isn’t backing down (yet) in the face of outrage. Perhaps what the company should’ve done is offer an installs-based pricing model OR a revenue-based model — and then implement the change in a more generous timeframe. In the near-term Unity will see both churn and a higher margin revenue uplift in early 2024. Longer-term, though, it’s an open question just how tarnished the Unity brand is and to what degree that opens the door for Unreal, Godot, and others to swoop in and steal market share. Unity’s days of truly democratizing development are over.

Some highlights from last week’s Roblox Developers Conference:

- Roblox will launch on PlayStation in October. That’s great news in terms of player numbers could enable it to continue aging up. This is on top of recently launching on Meta Quest where Roblox has the potential to be VR’s “killer app.” Roblox also flexed its cross-play muscles by showing users on PlayStation, Quest, and mobile playing together.

- AI is becoming more front and center — for users and developers. On the user side, Roblox’s upcoming Avatar Editor will allow users to construct customized avatars using text prompts and personal images. On the developer side, an upcoming ChatGPT-like feature will help devs more quickly write and debug code, offer advice on how to improve, and more. Expect AI to become embedded so much more in the coming years.

- Roblox will soon enable creators to offer subscriptions, and users will soon be able to video call each other.

- CEO David Baszucki ended with 10 predictions for the next five years. This includes Roblox providing dating experiences, a Roblox development company being worth over $1B, employees having more meetings in Roblox than video, and more.

The iPhone 15 Pro is another great leap for mobile gaming. Or at least that’s what Apple wants us to think.

- Apple unveiled its iPhone 15 models, plus a line-up of AAA console/PC games that will be playable on the new Pro and Pro Max versions. This includes Death Stranding, Resident Evil 4 Remake, and Assassin's Creed Mirage.

- These are not cloud streamed games but native games that play locally. This shouldn’t be shocking, as AAA cross-platform games like Genshin Impact have been playable on mobile for years, but it’s still impressive. What’s getting less attention is the fact that these games will also be playable on Mac, and game purchases will be attributed to one’s Apple ID.

- How much does this matter? We’ll have to see how these games — which will devour hard drive space — actually perform on mobile once available. Also, it’s not as if porting console/PC games to mobile means console/PC players will suddenly play more on mobile (they won’t). It also doesn’t mean mobile players who typically play F2P games will suddenly lean into premium AAA games (they won’t). Interest around the fringes may prop up extra sales, but if anything this news highlights the rising long-term potential for cross-platform gaming more than anything.

Gearbox and Jagex may be up for sale. Any commentary is speculative, so we’ll keep this brief.

- Embracer, formerly a growth-by-acquisition juggernaut, is now dismantling itself to stay afloat. It is reportedly seeking a potential sale for Borderlands developer Gearbox. Embracer purchased Gearbox for $1.3B in 2021; whether it can sell the studio for a similar price is an open question, but the proceeds would likely go toward paying down Embracer’s sizable debt-load.

- Jagex, on the other hand, has been in a game of hot potato for many years, having been owned by Zhongji Holding, Macarthur Fortune Holding, and now the Carlyle Group since 2016. The company is best known for its forever-franchise Runescape, but it also has a small publishing business, has made acquisitions (Pipeworks and Gamepires), and continues to make new games. Most releases haven’t panned out, but the newest project in the works is an open-world survival game set in the Runescape universe. Who knows where Jagex could end up next, but hopefully its forever franchise can find a forever home.

Featured Jobs

- MoneyPlant AI: Founding Engineer (Pune, India)

- Zedge: Mid/Senior UX Designer (Vilnius, Lithuania)

- FunPlus: Lead Game Designer (Barcelona, Spain)

- FunPlus: Senior Game Artist (Barcelona, Spain)

- FunPlus: Senior Game Developer (Barcelona, Spain)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below. We've made the job board free for a limited period, so as to help the industry during this period of layoffs. Every job post garners ~50K impressions over the 45-day time period.