Sea Limited can’t catch a break. The Singaporean tech conglomerate’s recent earnings announcement showcased deceleration among the company’s three major units. The units include Garena, the company’s gaming segment best known for developing and publishing mobile battle royale title Free Fire; Shopee, the ecommerce business and a leading online shopping platform in Southeast Asia, with over 300 million monthly users; and SeaMoney, a digital payments platform within the region with the goal of digitizing financial services for consumers and businesses alike.

Garena, in particular, saw bookings fall for a seventh straight quarter. While broader cost-cutting efforts have made the overall business EBITDA positive for a third consecutive quarter, the renewed focus on profitability may be impacting the growth trajectory of Shopee and SeaMoney. Garena’s decline is noteworthy because the business once comprised the majority of revenues for the group, whereas now it makes up less than one-fifth. Garena and Free Fire subsidized growth for the faster-growing, more ambitious parts of the portfolio, and its decline has presented Sea with a great dilemma.

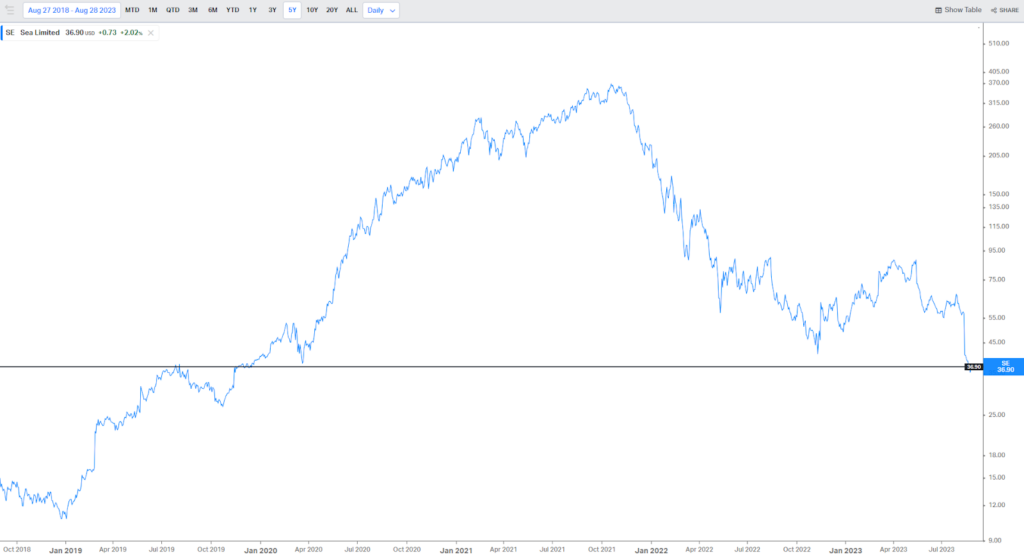

As such, Sea Limited's stock is down a whopping 90% from its 2021 highs, and the business has changed quite meaningfully. Growth has slowed and profits have increased — but why does that matter, and what's next for this previous highflier?

The Big Picture

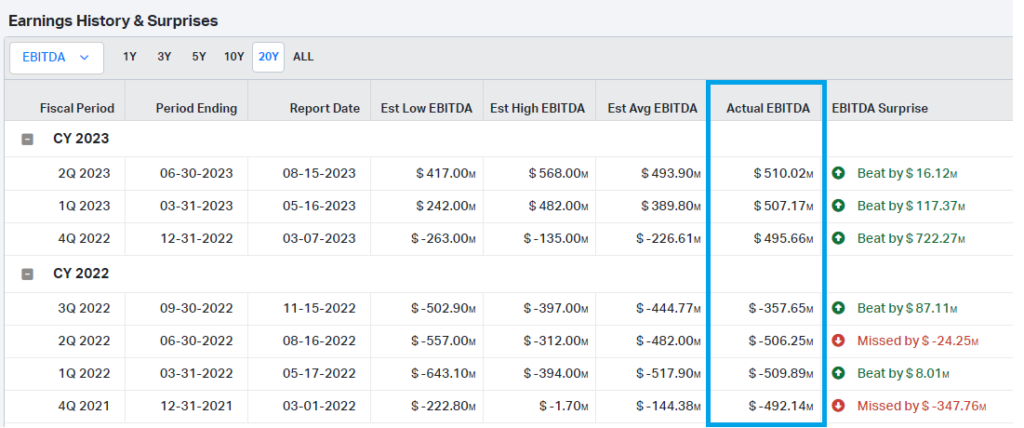

Overall quarterly revenue for the group clocked in at $3.1 billion. An adjusted EBITDA of $510 million beat consensus by $16 million, continuing the profitability trend that started in the final quarter of last year.

Investors initially liked the surprise profits; however, the tune shifted after these most recent results when investors realized the “decisive pivot to focus on efficiency and profitability” only led to a revenue growth of 7%. There was hope Sea could strike a balance of double-digit growth coupled with healthy margins post-pivot, but that hasn’t yet been the case.

The largest culprit is cost-cutting at Shopee, which axed marketing expenses by more than half at a time when emerging competitors like TikTok Shop are accelerating investment in the region. That both sets a cap on growth and potentially cedes market share for Sea. Similarly, R&D costs have also fallen, calling into question how the various units can stay competitive over time. As a result — and also partially due to the impact of China’s economic slowdown — Shopee saw flat sequential growth. SeaMoney has performed marginally better, growing 4% from a quarter prior, as recent layoffs have impacted its ability to serve new users.

Gaming Performance

Let’s dig into the gaming side. Garena’s bookings were $443.1 million, down -4% from the previous quarter and down -38% year-over-year. Much of this is due to the dramatic decline of Free Fire, which was first released in December 2017.

From a downloads standpoint (including all versions of the app), monthly downloads have actually held resilient at roughly 20 million.

The game’s revenue picture looks less friendly, but it’s important to understand the historical context. Free Fire’s net revenue ramped up rapidly following its launch. By May 2018, the game was making $1 million a month in microtransaction sales, and by January 2019, it was netting over $10 million monthly. Since peaking in December 2021 at $68.2 million in revenue, the title has seen a precipitous decline to the ~$20 million range, where it was in 2019.

Clearly, flattened downloads with shrinking revenues mean reduced average player spending. This is happening for a few reasons. For one, the mobile shooter market has grown increasingly competitive. Two, the battle royale genre is also past its peak, as evidenced by Twitch viewership numbers for games such as Fortnite and Warzone. Free Fire was also banned in India (for “national security” purposes), one of its most popular markets, in February 2022. Garena said it would relaunch the game in India this week after a year and a half following the appointment of Indian cricket player Mahendra Singh Dhoni as its brand ambassador and localizing the game for the Indian market with “unique content” that “encourage(s) a safe, healthy and fun gameplay experience.”

Yet many longtime players have expressed dissatisfaction with the current state of the game. The problem of hacking in Free Fire is persistent, the game has become less friendly to low-end devices over time, and play-to-win elements have caused many longtime fans to become disillusioned. You can read more about this in our original Free Fire deconstruction here.

Free Fire isn’t the only culprit behind Garena’s woes. The organization lost the rights to publish League of Legends and Teamfight Tactics in Southeast Asia last November as Riot decided to self-publish its titles in the region starting in January of this year. Garena has published LoL since 2009, and it also ran tournaments in the region. The company did not note how much of an impact the loss of these rights had on revenue, but it’s clear that recent quarters have been affected by factors beyond Free Fire.

In September 2019, Garena also published Call of Duty: Mobile across Southeast Asia. While not a huge revenue contributor, Garena’s version of the game, which is only available on Google Play, netted around $15 million in revenue in 2022. Unfortunately for Garena, Activision Blizzard declared its intent to phase out Call of Duty: Mobile over time (outside of China) in favor of Warzone Mobile. That game has not yet seen a global release, but it does not seem likely Garena will retain any Call of Duty publishing on mobile rights going forward.

Garena also spun out its one major gaming acquisition, Phoenix Labs (the creators of Dauntless, an F2P multiplatform ARPG), earlier this year after an investor-backed management buyout. The Canadian studio was acquired in 2020 for $150 million, a purchase intended to diversify Garena’s gaming portfolio. The acquisition did not have the effect Garena intended, given its single title did not sell as well as hoped, and clearly, the Phoenix Labs team felt suffocated by the larger organization.

Between Free Fire’s free fall, losing publishing partners, and spinning off acquired assets, it’s clear Garena is no longer the highflier it once was.

The Bottom Line

Given its enterprise value of $19.4 billion (down from approximately $200 billion), the company’s valuation is potentially cheap, both relative to other tech companies and the market at large. However, shareholders were spooked by CEO Forrest Li’s comments this quarter that Shopee could go back into negative profitability territory in order to respark revenue growth. The interplay between profits and growth is set to continue, with the whole company’s fate hanging in the balance. Sea's management will need to strategically consider whether to revert to aggressive growth models and risk profitability, or continue on their current path, which is clearly limiting growth potential.

Importantly, Garena’s revenue downturn has not been offset by performance elsewhere within the group. As such, Garena is no longer an outsized contributor to Sea’s business. Instead, it’s a drag on the overall business, and its future is mired in uncertainty. Garena served a larger purpose by subsidizing the rest of the business, but it now appears to be a distant secondary priority, which doesn’t bode well for its turnaround potential.

One potential “solution” is a spinoff or sale, which would turn Sea into a pure play on digital payments and ecommerce. But in this environment, especially given Garena’s negative growth, Sea would struggle to find an entity with $3 billion to $4 billion in capital to buy the operation, and there are only a handful of companies that would even entertain an offer in general. Tencent? Savvy Games Group? It’s tough to tell.

Either way, let’s hope management creates a real plan of action for Garena as soon as possible, because it would be a shame to see a company with so much potential continue to wane due to ongoing company priorities being elsewhere.

This post appeared in the Sunday, September 3rd version of Naavik Digest. If you enjoyed it, please consider forwarding it or sharing the piece with your followers. Also, remember to subscribe to Naavik Digest here.

Sponsored by Lightspeed Venture Partners

Partnering with extraordinary founders in gaming and interactive technology

Lightspeed Venture Partners is a globally leading venture capital firm with over $29 billion in capital under management and more than 500 investments across the U.S., Europe, and Asia. Over the past two decades, the firm has partnered with hundreds of exceptional entrepreneurs and has helped build and scale companies to achieve 190 IPOs and acquisitions.

With its dedicated gaming practice, "Lightspeed Gaming," the firm is investing from over $7 billion in early- and growth-stage capital — by far the largest fund focused on gaming and interactive technology. Lightspeed's team combines deep expertise in gaming interactive technology with a global multistage investment platform and a culture that truly puts founders first.

Selected investments include Epic Games, Snap, and Stability AI — as well as game designers and producers who led the creation of titles like Fortnite, Call of Duty, League of Legends, Wild Rift, Apex Legends, Overwatch, Valorant, StarCraft II, and Warcraft III.

For more information or if you wish to reach out, check out the link below:

#2 Starfield Lands, Subscription Price Creep & CD Projekt’s Next Act

By Nick Statt, Naavik Managing Editor

Starfield Impresses

Reviews for Starfield, Microsoft and Bethesda’s most important first-party exclusive in well over a decade, dropped Thursday morning and were generally very positive, with the game achieving a Metacritic score of 88 and OpenCritic score of 88 after the dust settled.

- The critical reception of Starfield is important because of how much is riding on the title’s success. Bethesda Game Studios hasn’t released a well-received game since 2015’s Fallout 4, and many reviewers are now calling Starfield a return to form for the open world RPG developer.

- For Microsoft, Starfield needed to knock it out of the park. A home run here helps bolster Game Pass’s lacking first-party lineup and also proves that Microsoft’s stewardship over ZeniMax Media properties hasn’t gone awry after the disastrous performance of Arkane’s Redfall.

- Starfield will be an interesting test case for a number of Microsoft’s gaming ecosystem strategies. It may very well become the most-played Xbox first-party game ever, if it manages to amass enough players between console and PC Game Pass, retail sales, and PC downloads on Steam. That, in turn, could drive Game Pass subscription growth and Xbox hardware sales.

- Starfield could be a big seller, if enough players opt to purchase it outright. Although, Microsoft and Bethesda may be hesitant to release sales performance metrics if Game Pass availability does ultimately cannibalize a sizable number of unit sales.

- We’ll have to wait and see what the company decides to announce — a more important indicator might be subscription growth over the next couple of quarters. But given that Starfield has been in the top 10 on the Steam charts for quite some time and now sits comfortably at No. 1 suggests Game Pass cannibalization might not be that big of an issue in this case and more proof that the Xbox ecosystem model is working as designed.

Sony Hikes Subscription Prices

Gaming subscriptions, like most other subscriptions, keep getting pricier — and PlayStation Plus is no exception.

- Sony announced last week that its subscription platform would raise annual plan prices by as much as 35% so that the company can “continue bringing high-quality games and value-added benefits to your PlayStation Plus subscription service.”

- Currently, PlayStation Plus’ three tiers cost $59.99, $99.99, and $119.99. Starting September 6th, those prices go up by between 33% and 35% in the U.S. The increase isn’t as dramatic in Europe or the U.K., where prices are increasing by about 20%.

- Microsoft raised Xbox Game Pass prices earlier this summer and also discontinued its $1 Game Pass Ultimate promotion. But the price hike for Game Pass was a much more modest 10% for the base subscription and about 13% for Ultimate. (The PC-only tier remained unchanged.)

- Sony said its monthly prices for Plus remain the same, so this change might just reflect a normalization of the annual plan prices, after the company originally priced those at a steep discount to aggressively promote the revamp last summer.

- Sony first introduced the new Extra and Premium tiers to PlayStation Plus in June 2022 to better compete with Game Pass, though the company notably does not include first-party games on release as Microsoft does with Game Pass.

- The new pricing may be more economically viable for Sony and its business model, but it certainly makes a price hike this steep sting all the more for consumers. Still, we should expect this move to result in higher profits for Sony due to less churn on annual memberships. Also, this won’t be the last time we see subscription services like this go up in price.

CD Projekt Goes All In on The Witcher

The Cyberpunk 2077 developer said last week that its next chapter is going to be almost entirely focused on The Witcher franchise following the release of this month’s Phantom Liberty expansion.

- CD Projekt CEO Adam Kiciński said on an earnings call last week that over 250 people are currently working on the next Witcher installment, codenamed Polaris. Little is known about the project other than that it's the beginning of a new AAA trilogy the company is planning for the next decade.

- After the release of the Phantom Liberty DLC on September 26th, the company “will transfer a big part” of the roughly 300-person Cyberpunk 2077 team to support Polaris’ continued development.

- CD Projekt also confirmed that Cyberpunk 2077 won’t be receiving another expansion, in part because of the game’s lengthy and, at times, painful development cycle and also because of “technological” considerations with the studio’s transition to Unreal Engine 5. Though we don’t have much insight into how Phantom Liberty will perform, the company did say this past week that it was “happy” with the level of pre-orders, with the expectation that a majority of them would “come in during the final pre-release days.”

- It isn’t the end of the road for Cyberpunk fans. CD Projekt still has codename Orion, a sequel to Cyberpunk 2077. But that game is many years out as CD Projekt turns its attention to Polaris and codename Sirius, another game in The Witcher universe being spearheaded by subsidiary The Molasses Flood. While details are scarce on Sirius, including exactly what type of game it is, CD Projekt rebooted the project back in May, which involved laying off some team members.

Featured Jobs

- Dream Game Studios: Head of Product (Pune, India)

- Dream Game Studios: Head of Marketing (Pune, India)

- Dream Game Studios: Head of Game Production (Pune, India)

- FunPlus: Lead Game Designer (Barcelona, Spain)

- FunPlus: Senior Game Artist (Barcelona, Spain)

- FunPlus: Senior Game Developer (Barcelona, Spain)

- Nexus: Head of Sales (Remote)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below. We've made the job board free for a limited period, so as to help the industry during this period of layoffs. Every job post garners ~50K impressions over the 45-day time period.