It is both surprising and also entirely par for the course in 2023 that TikTok maker ByteDance is reportedly set to shutter its games division, Nuverse.

According to Reuters, the move is expected to impact “hundreds of employees” in a continuation of what has been a brutal year-long trend of industry-wide redundancies. TechCrunch reported that “mass layoffs” have already begun, as of November 27.

What is unexpected is how swiftly ByteDance is making this retreat after several years of aggressive investment in Nuverse and its subsidiaries.

Originally founded in 2019, Nuverse first stepped into the spotlight in early 2021 with a series of big swings. In March of that year, Nuverse acquired Mobile Legends: Bang Bang developer Moonton Technologies. At the time, the Shanghai-based developer was said to be valued at an eye-popping $4B – a figure that has surely dwindled in the ensuing years as the industry has struggled under the weight of uncertain macroeconomic conditions and a frenzy of M&A at inflated prices.

Just a month later, Beijing-based C4 Games was also brought into the fold for an undisclosed price. Known for its China-only Command & Conquer spin-off Red Alert Online, the seasoned developer had seen success in Japan with its mobile idle RPG Houchi Shoujo and was expected to provide additional production capacity for Nuverse’s upcoming projects.

With these acquisitions, ByteDance seemed to be gearing up to take on domestic rivals Tencent and NetEase for dominance in the gaming market, both at home and abroad. Indeed, its gaming teams quickly swelled to more than 3,000 employees, and ByteDance even undertook a major reorganization in 2021, naming Nuverse as one of its core business units alongside TikTok and Douyin, TikTok’s Chinese sister-app.

It then made a splash in Western gaming circles with the May 2022 announcement that it would be publishing US-based developer Second Dinner’s card battler Marvel Snap. It was the first exposure for many in the West to Nuverse, with some outlets even misattributing the firm as one of the game’s developers, rather than its publisher.

In a VentureBeat article from February of this year – ironically titled ‘Marvel Snap is just the start of Nuverse’s plans for mobile gaming domination’ – Nuverse was said to handle “marketing for the game, including user acquisition, branding and everything that’s outward facing,” as well as customer support and other “operational activities.”

Though Marvel Snap has not been Nuverse’s most lucrative game (more on that below), it has certainly been the most prominent. Second Dinner recently moved to reassure fans that the game “will continue to operate and flourish” amid the downsizing.

Reuters reported that Nuverse will seek “ways to divest from titles already launched,” which will presumably include any interest it has in Marvel Snap. Indeed, if recent headlines are any indicator, further divestitures and layoffs are likely forthcoming.

Last month, ByteDance cut“hundreds” of staff from Pico, its VR division (also acquired in 2021), and just a week later was reportedly shopping Moonton around to potential buyers (including “at least one Saudi-based firm”).

So, why is ByteDance suddenly reversing course after investing so heavily into gaming? We’ve hardly even mentioned TikTok, the company’s flagship product and a major player in games marketing and user acquisition. ByteDance also owns Ohayoo, a casual gaming brand that operates games on Douyin. There’s also Danjuan Games (a mobile-only game store) and Pixmain (an “indie game publisher”), among other ventures. Niko Partners has a good roundup of ByteDance’s history in gaming and its various gaming entities, if you’re curious to read more.

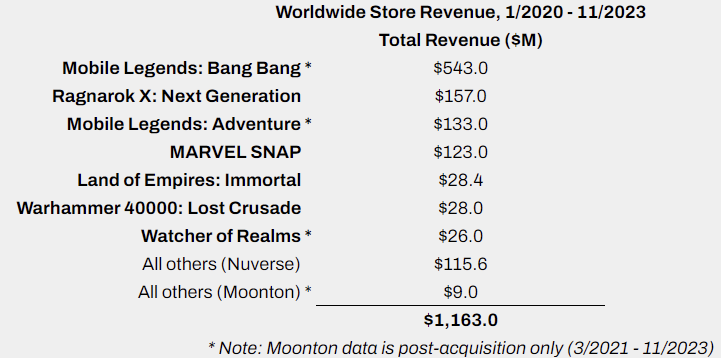

Unfortunately for Nuverse, its games just weren’t bringing in as much revenue as its parent company would have hoped:

According to data.ai, Nuverse’s mobile games have aggregated just north of $1B total revenue over the last three years, with nearly half of that coming from Moonton’s Mobile Legends: Bang Bang. Of its in-house titles, only Ragnarok X: Next Generation and Marvel Snap have crossed the $100M mark. Ragnarok X was first launched in 2020 and appears to be in decline, with revenues and active users both well below previous highs. Marvel Snap may have a brighter future, but it hasn’t yet shown an ability to carry a portfolio of this size. Both games also feature less favorable economics: neither Second Dinner nor Ragnarok X developer Fuchun Technology are owned by Nuverse/ByteDance, and both games share revenue with their respective IP holders.

Even acknowledging that there may be significant Chinese market revenue not factored into this quick calculation, the sum of Nuverse’s successes barely moves the needle for corporate parent ByteDance. The Chinese giant reportedly made $29B in revenue during Q2 of this year alone; Nuverse has barely made a dent in ByteDance’s balance sheet.

The company has said that the moves came as part of a “regular review” of its businesses. While Ohayoo and casual games running on TikTok are not expected to be impacted, ByteDance also reportedly “has no plan to return to the $185B global video games market,” according to Reuters.

It would appear that games publishing is no longer on the table for the foreseeable future, but what of Nuverse’s remaining assets? Well, judging by the reporting on Moonton’s list of suitors, ByteDance’s losses may be the Saudi PIF’s gain. However, if Savvy Games is not the ultimate purchaser, other firms with a presence in China and/or Southeast Asia might also be interested, such as Netmarble or perhaps even Sony. Presumably, ByteDance won’t want Moonton to end up with one of its domestic rivals in Tencent or NetEase, but that sentiment could change. I’m sure that Second Dinner will swiftly find a new partner, too, if it doesn’t opt to bring those publishing support functions in-house.

Still, it’s inevitable that gaming will continue to have a major presence on TikTok, simply because it is so central to the lives of its biggest demographics, Gen Z and Gen Alpha. While game development may be off the table for ByteDance, TikTok and Douyin still play host to games-hungry audiences, making them valuable marketing and user acquisition channels for publishers. Additionally, these platforms are starting to give birth to new game and streaming hybrids, like NPC streaming or multiplayer streaming games. While none of these are big business today, ByteDance’s captive audience, unparalleled insight into user data, and access to the largest gaming markets in the world mean that the company should never truly be counted out of the games industry entirely.

Perhaps this entire saga is another unfortunate case of Big Tech trying to push its way into gaming without truly understanding the market. Or perhaps ByteDance and Nuverse were victims of circumstance, trying to execute an expensive strategy at the market’s peak only to be buffeted by the headwinds of a Chinese economic slowdown, gaming industry with slower growth, and disappointing returns. Whatever the case, though Nuverse may be no more, I don’t think we’ve heard the last from ByteDance in the games industry.

A Word from Our Sponsor: GAMESIGHT

The Growth Engine for the Largest Gaming Brands in the World

At Gamesight, we believe that creativity and data go hand in hand. Our data-driven approach gives you the insights you need to make creative decisions that drive results. Our measurement platform and creator-focused programs are like magic — they help brands grow, make more money, and make players happy all around the world.

Marketing Measurement

With almost a decade of battle-tested experience, Gamesight's attribution platform meets the unique needs of the most successful PC, console, and web3 game developers, including Capcom, Bungie, Netease, and Sky Mavis.

Creator Programs

Gamesight fuels the success of games with thriving creator communities. We ignite the flames of organic content creation through a unified creator program, fostering an engaged community that drives consistent growth and lasting triumph.

End-to-End Campaign Management

Harness the power of data-driven targeted influencer discovery to seamlessly connect your game with the perfect influencers. Say goodbye to guesswork in strategy, execution, optimization, and reporting. Our unmatched expertise has propelled game launches to remarkable success, including titles like Magic The Gathering: Arena, Elden Ring, and Dead by Daylight.

Content Worth Consuming

What needs to happen to make the next big extraction game? (Andrew Chambers Design): “Ever wonder why the extraction genre is exploding right now? So do I, so I got all obsessed about it and dug in.”

Indian Gaming Industry Poised for Strong Growth: Projected to Reach $7.5B by FY28 (Lumikai & Google): “The Indian gaming industry clocked $3.1 Bn in FY23 and is set to hit $7.5 Bn by FY28. The report anticipates that the industry will grow at a CAGR of 20%, driven primarily by growth in-app purchases in casual and midcore games and growing in-game advertising revenues.”

Deloitte unveils global tech, game and entertainment predictions for 2024 (VentureBeat): “Deloitte predicts that Generative AI will reshape multiple industries starting in 2024.[...] Shifting demographics, innovative technologies, and the desire for high-performing IP are driving the evolution of storytelling.”

An Interview with Roblox CEO David Baszucki About Advertising and AI (Stratechery):

“I first talked to Baszucki in February 2022, shortly after the company’s IPO. There we talked about Baszucki’s background and the long journey of building Roblox from its founding in 2005. In this interview we discussed how Roblox’s business has fared since then, including the challenge of being a pandemic stock despite having an underlying business that has continued to grow.”

Game-Changing Storytelling: How To Integrate Narrative Elements in Mobile Games (GameRefinery): “Whether it’s a book, TV show, or movie, most of us have become engrossed in the story of our favorite characters; our eyes glued to the pages or screen, waiting to see what happens next. Narrative design has always been an important part of video game development, but its significance in modern-day games continues to grow as narrative elements play an important role in player engagement and retention.“