Hi Everyone. Welcome back to another edition of Naavik Digest. If you missed last edition, we wrote about 100 Thieves’ evolving revenue strategy through the new game the company pans to develop. Be sure to check it out and share with anybody else who might be interested in reading. With that, let’s dive in!

Roundtable: Game Design Innovation Requires Growing Pains

In this week’s Metacast episode, Nicolas Vereecke, David Amor and Abhimanyu Kumar, join your host Maria Gillies to discuss:

-

EA’s Rumored Sale or Merger

-

Merit Circle DAO Proposal to Remove YGG Seed Investor

-

Is Crypto Gaming Broken? We Don’t Think So

You can find us on YouTube, Spotify, Apple Podcasts, Google Podcasts, YouTube, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: Revisiting the Gaming VC Landscape

Image Credit: Crunchbase

If you’ve been monitoring economic news recently, you will no doubt have noticed a number of doom-and-gloom headlines. As we’ve covered in this space previously, many gaming firms in the public markets have been feeling the pain of a wider economic drawdown spurred by a variety of factors: rising inflation, geopolitical uncertainty, supply chain disruptions, and changing data privacy regulations, among many others. But how are these public signals impacting the gaming venture market?

In a recent letter to founders titled “Economic Downturn”, Y Combinator cautioned that “things don’t look good”. Similarly, Sequoia Capital – authors of the infamous “R.I.P. Good Times” letter in 2008 – alerted its founders of a “crucible moment” for the venture market.

Though both of these entities have some presence in gaming, they would be more accurately described as generalist funds. Further, not all generalist funds have displayed the same bearishness. Andreesen Horowitz, for example, recently announced its new Games Fund One to the tune of $600M (not to mention its massive $4.5B Crypto Fund IV, which may also invest in web3 games).

Given these somewhat mixed signals, it seemed like a good opportunity to revisit a piece we published last August, entitled “The Present & Future State of Gaming Venture Capital”. At the time, gaming VC was on an absolute tear, deploying capital across the industry. A lot has changed in the last nine months, though. Let’s take a look at what’s happened, what predictions we got right, what we got wrong, and what we can glean about the gaming venture capital landscape moving forward.

How We Got Here

Headlining last August’s deep dive into gaming VC was a $155M Series B raised by Turkish casual developer Dream Games, coming hot on the heels of its $50M Series A just months earlier. At the time, the round was emblematic of the white-hot gaming venture capital landscape. A few months later, the company would go on to secure yet another $255M in a Series C round (again led by Index Ventures), at a whopping $2.75B valuation in January 2022 – a time that, in hindsight, came during the earliest days of our current market-wide downturn.

At the time of writing, we attributed the momentum in gaming VC to two primary factors: a confluence of macro investment trends, and a higher likelihood of ventures achieving an exit.

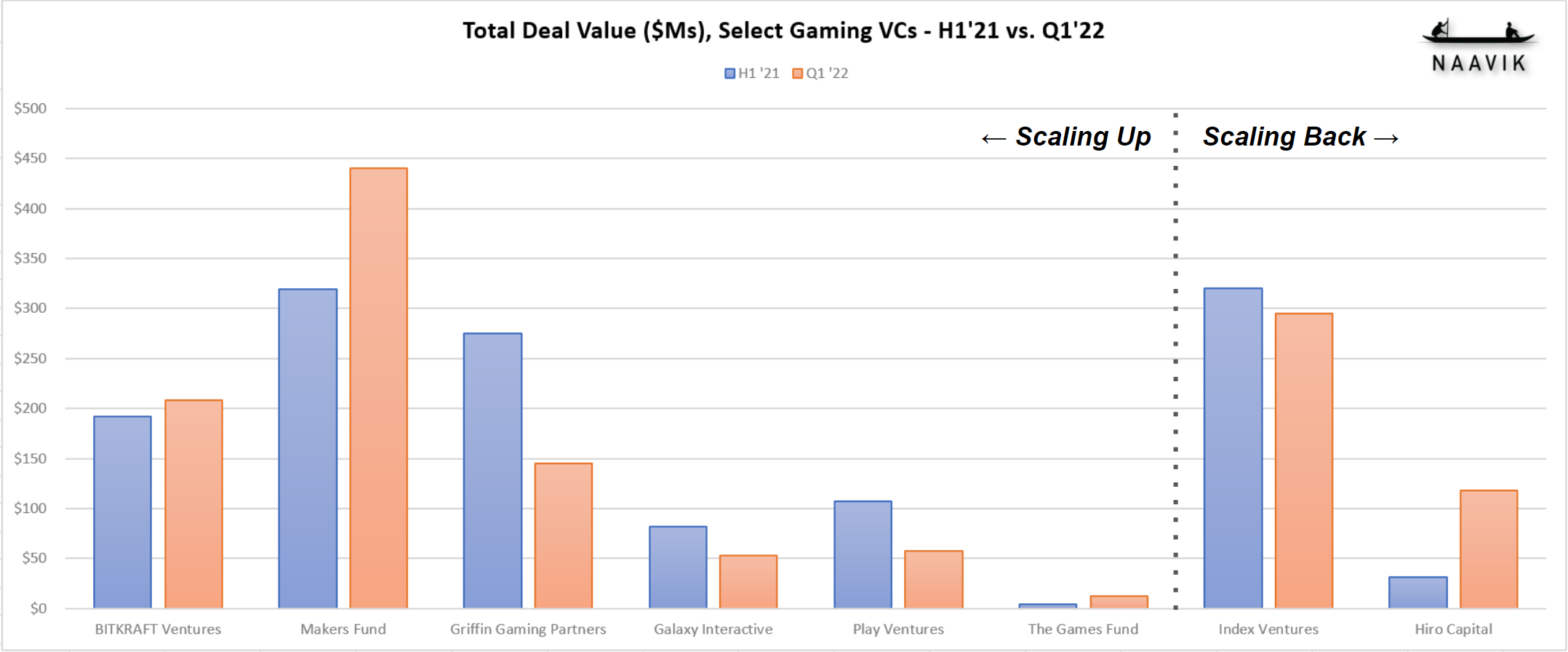

The macro trends identified at the time, such as increasing adoption of web3 technologies, proliferation of “Metaverse” experiences, and growing importance of user-generated content (UGC) have only continued since then – if not accelerated. This is borne out in an examination of the subsequent deal activity across many of the gaming VCs we previously identified as industry leaders:

Source: InvestGame

Leading gaming venture capital firms have already completed more deals at a higher total deal value in the first quarter of 2022 alone than they did in the entirety of H1’21.

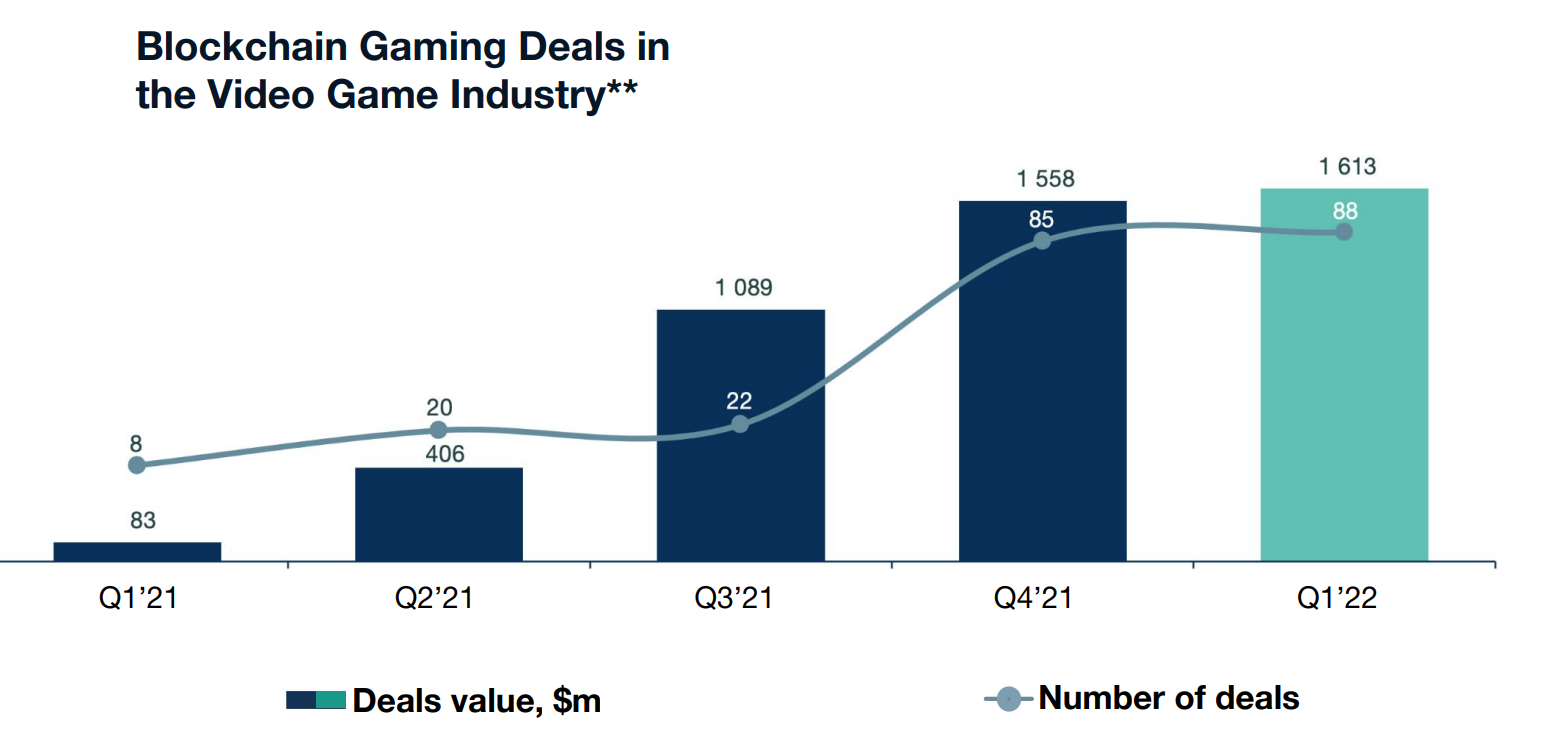

Much of this can be attributed to the continued growth of blockchain gaming investments, though notable rounds for Playable Worlds (cloud gaming), Infinite Canvas (creator economy, UGC), and others represent non-web3 macro trends receiving further attention from gaming VCs.

Source: InvestGame (Q1’22 Gaming Deals Activity Report)

With regards to the second factor driving last year’s momentum – high likelihood of an exit event – the signal is not as clear.

Overall M&A activity has continued at a rapid pace. Total deal flow has held steady, while aggregate deal value showed a 23% quarter-over-quarter decline (according to InvestGame). However, we can expect the recent mega-acquisitions of Activision-Blizzard ($68.7M), Zynga ($12.7B), and Bungie ($3.6B) to spike the overall M&A numbers once again for Q2 ‘22.

Source: InvestGame (Q1’22 Gaming Deals Activity Report)

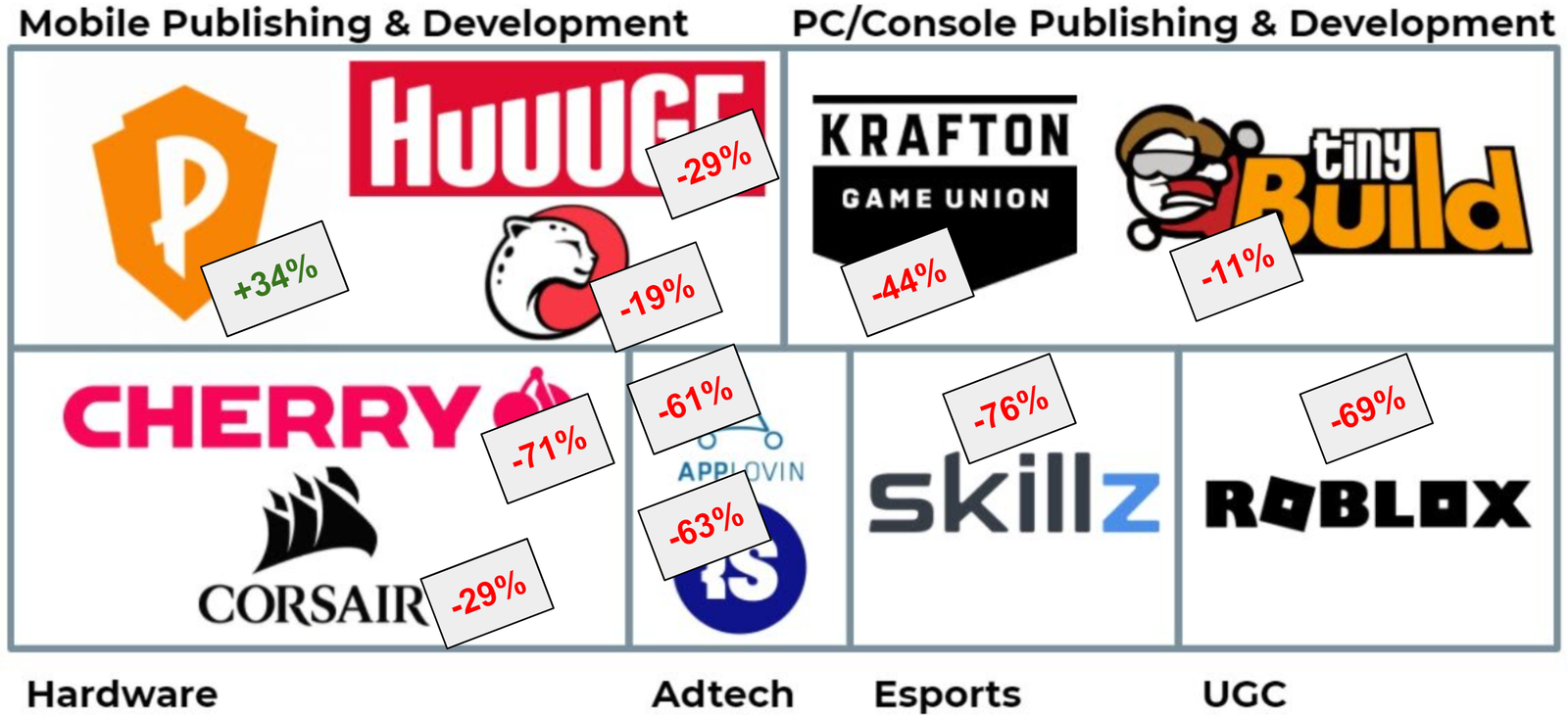

On the IPO front, however, we have seen significant pullback. Many of the firms that had recently entered the public markets at the time of writing, such as Roblox, Skillz, and Playtika, have seen their stock prices take a nosedive:

Source Naavik (All figures YTD at time of writing)

Furthermore, fewer gaming firms have sought to test the waters of the public markets – no doubt given pause by the hostile reception their peers have faced recently. Established companies that might be candidates for an IPO, such as Epic Games or Discord, have instead taken on further private funding.

Source: InvestGame (Q1’22 Gaming Deals Activity Report)

Conclusion

So what do we make of all this? It’s clear that the public markets have been less than receptive to gaming companies, but gaming VCs seem to be operating at full strength despite public bearishness.

One possibility is that we could be observing lagging indicators, and that the true impacts of a market downturn have yet to show up in the data. The analysis in this piece was completed prior to the release of InvestGame’s H1’22 Report, though based on my own informal research of announced deals (both via InvestGame and other media outlets), I expect the numbers for Q2‘22 to continue to reflect an acceleration of gaming venture capital investment.

Another possibility is that gaming is a recession-proof (or at least recession-resistant) industry, and that gaming venture capital investors are not put off by negative perceptions of the public markets. After all, what constitutes “gaming” as an investment category has grown to encompass a number of adjacent areas (web3, “Metaverse”, the Creator Economy, etc.) and it’s entirely possible the secular bullish sentiment is outweighing any overall market tepidness.

Whatever the case, it seems likely based on the data presented above that gaming venture market activity will be increasingly disconnected from performance of the public markets for the immediate future. In the original piece, I predicted that gaming venture capital investment would begin to plateau as more non-endemic investors entered the space. Clearly, I was wrong.

Specialist gaming VCs have largely increased their pace of investment. Perhaps I should have expected this, however, as I wasn’t entirely incorrect about the increased competition for space on founders’ cap tables.

In addition to the aforementioned $600M a16z Games Fund, a number of other generalist funds have entered the space – something Joost van Dreunen recently covered in much greater detail. Solo capitalists continue to join rounds, too – a trend that is particularly prominent in web3 games funding. Strategic investors have also remained a constant in gaming deals.

Perhaps the greatest impact of the public markets on gaming venture capital investment in recent months has been a downstream result of the pressures felt by the largest investors at the top of the market. As tech behemoths like Bytedance, Netflix, and Meta seek to carve out larger footholds in gaming and public market incumbents like Take-Two, Embracer, and Tencent increasingly consolidate small- to mid-sized firms under their umbrellas, the ripple effects force other investors to move elsewhere. Generalists begin to specialize, and specialists niche down even further in response – a prediction we correctly made back in August.

Many gaming VCs have delved deeper into blockchain gaming in an effort to specialize further. BITKRAFT Ventures, Griffin Gaming Partners, and Play Ventures are all examples of gaming VCs that raised new web3-focused funds since the original piece was published.

Our original predictions also foresaw increased activity among region- and demographic-specific venture capital investment. Results here have been mixed, though recent rounds by companies like Superbloom (lifestyle games targeted at women gamers) and Mobile Premier League (India-based mobile esports) indicate that we may see more venture activity in these areas in the future.

I will be interested to see how gaming venture investment activity continues to develop over the remainder of 2022 as lagging public market impacts begin to show up in the data. Warning signs that I’ll be looking out for include layoffs at larger venture-backed companies, a prolonged bear cycle in the crypto markets, and a prioritization of recommitments to existing portfolio companies over deploying capital into new investments.

While I still think that the momentum in gaming venture capital will eventually plateau, I now believe that that time may still be a long ways off. VCs are sitting on huge funds that need to be deployed, and that will take at least a couple years to complete. Perhaps the better question is: when the music does finally stop, will any of these recently venture-backed businesses actually be capable of providing a venture-sized return to investors? (Written by Matt Dion)

#2: Weekly News Highlights

Battle Royale Goes Mobile: After Fortnite was pulled from the App Store, a gaping hole was left in the mobile battle royale genre that games like Free Fire and PUBG capitalized on. Now, with Fortnite back on mobile through an xCloud loophole, the next iteration of companies with solid IP is starting to emerge: Apex Mobile clocked $5M in revenue in its first week and Naraka: Bladepoint plans to launch imminently. The TLDR here is that this is a high margin live services segment, with lots of cross-platform potential given the accessible nature of the games. Let’s see if they can sustain this momentum.

Live Services Games Will be Everywhere: In a recent earnings call, Sony outlined its plan to invest more back into live service games — it expects to have 12 such games by EOY 2025. Given Sony’s and Xbox’s dedicated efforts into subscription, live services will round out the revenue mix across IAPs and digital add-ons, with a second-order effect being that this will strengthen IP cross-platform for the video game giant. Currently, Sony has no live service games, so it will have to develop domain expertise here through acquisition and iteration over the next few years.

Livestreaming Viewership Starts to Decline: StreamElements released the April edition of their State of Streaming report. The largest takeaway: the unprecedented growth of the industry fueled by COVID-19 has finally begun to slow down. Both Facebook and Twitch are facing steep declines from the peaks seen over the last 24 months, but continue to remain high in comparison to early 2020. Both platforms had a respective 118% and 64% spike in viewership as compared to pre-COVID levels. As consumer preferences continue to lean towards IRL experiences like travel and in-person events, we expect the decline to continue steadily for the remainder of the year. The open question, however, is if there are any longer-term implications from the COVID-driven tailwinds streaming has experienced over the last 24 months. There has certainly been an increase in spend across both talent acquisition and product development from all three major platforms; yet, it’s not clear what can retain the consumer attention the space attracted during the pandemic.

Raven Software’s QA Group Establishes USGaming’s First Major Union: Raven Software’s QA team officially voted to establish the first major union in the American gaming industry earlier this week. A subsidiary under Activision Blizzard, the union efforts have faced stiff pushback from the studio’s leadership, including re-orgs and alleged illegal union-busting from the company. Microsoft’s Phil Spencer also went on the record this week to state that his team is planning to recognize the union and their efforts once the pending acquisition of Activision Blizzard is completed in the coming months. It will be interesting to track the impact of this news across various AAA developers in the coming months. This news could be the catalyst for other marginalized or overworked developer teams to establish their own unions.

In Other News…

Funding & Acquisitions:

-

a16z announced a $4.5B crypto fund. Link

-

Kongregate and Immutable X teamed up on a $40M games fund. Link

-

Metaverse App BUD raised $37M. Link

-

Jadu announced a $36M raise for its web3 AR platform. Link

-

MetaKing Studios (makers of Blocklords) raised $15M in seed funding from Makers Fund and BITKRAFT. Link

-

Candivore raised $10M for casual multiplayer games. Link

-

Firestoke announced a $2.2M raise from Hiro Capital. Link

Business:

-

Take Two completed its merger with Zynga. Link

-

Skillz laid off 10% of its workforce. Link

-

Raven Software’s QA group established gaming’s first union. Link

-

Apex Legends Mobile generated $5M in its first week. Link

-

Sony outlines its live service strategy. Link

Culture & Games:

-

A blueprint on Netmarble’s blockchain ecosystem. Link

-

The original Pong had no code. Link

-

The 27 best games on Xbox Game Pass. Link

-

Niantic’s location-based AR. Link

-

A fan-made Gloomhaven spinoff raised $300K in crowdfunding. Link

Miscellaneous Musings:

-

StreamElements’ State of Stream Report. Link

-

When it comes Roblox, Gucci is not playing around. Link

-

Charting the evolution of social, instant games. Link

-

Reality is scarce. Link

Featured Jobs

-

Konvoy Ventures: Investment Analyst (Denver, CO)

-

LILA Games: Game Designer, Systems & Economy (Bangalore, India)

-

OpenBCI: AR/VR Demo Creator - Neurotech (Brooklyn, NY)

-

Lotum: Game Designer (w/m/d) (Germany)

-

Naavik: Content Contributor — Writer (Remote)