Hi Everyone. Naavik is thrilled to announce our new partnership with the World Economic Forum (WEF)! Specifically, we’re excited to collaborate with the WEF as they bring together leading voices from across the private and public sectors to better define the parameters of an economically viable, accessible, open, and inclusive metaverse.

At Naavik, we share this same vision and hope for our digital futures, recognize the importance that the games industry plays in the development of the metaverse, and look forward to helping push forward healthy, productive, and educational dialogue. Over the coming months, our team and network will share their insights with the WEF community, and we’ll also host conversations with WEF representatives on our own channels.

There will be much more to share in the coming months, but for now you can learn more about the WEF’s metaverse initiative here.

With that, let’s give into today’s issue.

Roundtable: Shaping the Metaverse Brick by LEGO Brick

In this week’s Metacast Roundtable episode, David Amor and Matt Dion, join your host Maria Gillies to discuss:

-

Epic & LEGO’s Collaboration

-

Ubisoft’s Ghost Recon NFT experiment

-

Miniclip’s Pivot from Web Browser Games

-

Take-Two’s Public Offering

As always, you can find us on Spotify, Apple Podcasts, Google Podcasts, YouTube, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

Building a Kid-Friendly Corner of the Metaverse

Source: Epic Games

Ten days ago, the LEGO Group and Epic Games announced a partnership “to build a space in the metaverse that’s fun, entertaining, and made for kids and families.” A few days later, it was revealed that Kirkbi, the privately owned company behind The LEGO Group, had invested $1B in Epic Games alongside an additional $1B investment from Sony, valuing the company at $31.5 billion. The size and relevance of these two investors – the owner of the leading toy company and the owner of the leading gaming console – was widely interpreted as a partnership to build a kid-friendly metaverse. The metaverse is an evolution of the internet, not a destination many individuals companies can own separately, so I believe this partnership is more than that. All three companies see embodied digital play and the technology that powers it as core to their purposes and futures. With tech giants like Meta also moving in, a partnership like this enables all three companies to accelerate those ambitions. Let’s explore what it means for each party involved.

Why LEGO partnered with Epic Games

LEGO’s revenues grew from $6.35B to $8.04B from 2020 to 2021, and the company attributes much of this success to a strong digital presence and sales strategy. Importantly, the LEGO IP goes beyond just toys and into licensing. LEGO has experienced significant success with IP: the LEGO Movie franchise grossed over $1 billion worldwide, and the LEGO Star Wars: The Skywalker Saga launch was nearly as big as Elden Ring’s launch. One reason these licensing opportunities are attractive is because licensing IP has close to zero costs. For example, in the case of the LEGO Movie, even a 2% royalty take would have added up to $20M in pure profit. More importantly, though, LEGO saw these movie releases drive consumers to purchase more LEGO products. Movies and games take years to make, however, which can make these marketing moments few and far between. In a more versatile environment like games, creating a global marketing moment can be as creative and simple as an in-game event (like a concert). Furthermore, a digital platform or world (far easier said than done, of course) builds a much larger creative surface area, enables more users to participate, and creates new revenue streams in the process. Who knows what will come of this kid-friendly space in the metaverse, but it’s clear that LEGO wants to stay front-and-center for kids, no matter whether its the physical or digital world. LEGO has made its fair share of video game-related blunders in the past, so it’ll be interesting to watch how it maneuvers this time around.

Why Epic Games partnered with LEGO

There are a few things to point out here:

-

The partnership came with $1B in funding. Epic Games has a lofty long-term vision that requires significant investment. This capital can be used to accelerate investments into wide-ranging tools, infrastructure, and related M&A.

-

It may help Epic Games attract a young audience. Fortnite certainly attracted a large youthful playerbase, and working with LEGO may do the same. It’s a brand kids (and parents) around the world love, and, if the emerging platform is any good, it could easily onboard millions of players. It also gives Epic Games a catalyst to further reinvest in and build around its 2020 acquisition of SuperAwesome (whose tech stack helps teams build and manage kid-friendly digital experiences). Perhaps it’s also a move — alongside its previous investment in Manticore and Fortnite Creative Mode — to better compete with Roblox. That’s a tall task, but the market is potentially big enough for a small handful of winners

-

Epic Games may be searching for a new game / revenue stream to build. Fortnite has always been a testing ground for the Unreal Engine, new creator tools, and innovative in-game experiences. However, maybe Epic Games not only wants to to build a kid-first destination but also a creator-first one. It’s all speculation until more news comes out, which could take some time. Perhaps the push to build something new also has to do with Fortnite’s numbers softening over the last year (partially self-inflicted, of course). A new platform / partnership with LEGO sets Epic Games up for its next big revenue generating opportunity, should Fortnite’s engagement numbers continue to decline.

Why Sony invested (more) in Epic Games

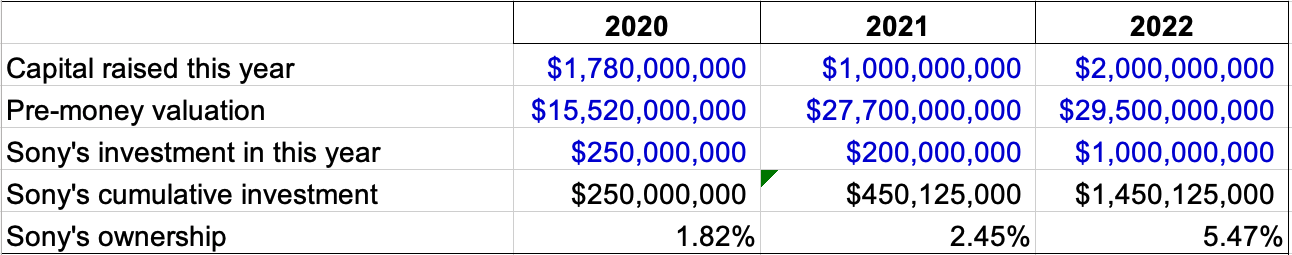

This latest fundraise puts Sony’s ownership in Epic around 5.5% according to my estimate below (a far cry from Tencent’s 40% stake). Not only does Sony clearly believe in Epic — and has for some time — but the company likely aims to build more strategic alignment with them. None of this is surprising, because, if you recall, Sony has already made a handful of investments into others (like Discord), and last year Sony announced that it was setting aside $18B for additional strategic investments. Adding another $1B in investments signals that Sony views Epic as an emerging long-term partner.

Source: Crunchbase

For starters, Sony has its own IP and audience that it can contribute to the LEGO experience, as well as Fortnite — but that’s likely not the #1 driver here. More importantly, other business lines are also likely interested in how they can leverage Epic’s industry-leading real-time 3D creation tool, Unreal Engine 5 (UE5). For example, UE5 can make movie production substantially cheaper and faster for Sony Pictures (15% of revenue last quarter), which has been used to create and render environments in The Lion King and The Mandalorian. If Sony can get discounts on using UE5 in its game development efforts, that’d be a huge win. Sony’s Image & Sensing Solutions business (10% of revenue) could also be interested in evaluating similar capabilities of UE5, perhaps to use as calibration data for their AI sensing solutions. Sony Music (10% of revenue) could be interested in the ways Epic will leverage its newly acquired streaming platform for music licensing in the digital realm. The point here is that most of Sony's businesses have reasons to plug into the portfolio of capabilities that Epic brings to the table across media as a whole, not just gaming.

This deal may also be about VR. As we outlined in our “The State of Virtual Reality,” there is a new hardware battle and Sony’s PSVR headset is a distant contender. Engines like UE5 will play an important role in the future of developing for VR, and Sony likely sees an opportunity to better influence and work with Epic / UE5 developers as they build their next generation of VR experiences. Additionally, PSVR serves to further differentiate Playstation and keep players from switching to Microsoft’s Xbox Game Pass bundle in the future. If all else fails, Sony has a 5% stake in one of the companies most well positioned to help build and influence the future of the metaverse, what Citibank has valued as a $8 to 13 trillion opportunity.

Why Epic Games partnered with Sony

Epic has been on a tear over the last 12+ months buying up technology to support developers for its metaverse ambitions. It bought Capturing Reality (photo-to-3D-model software), ArtStation (a marketplace for digital artists), Sketchfab (3d modeling and marketplace for AR/ VR content), Harmonix (music game developer of Rock Band), and most recently the music platform Bandcamp. As Matthew Ball points out in his primer, Tim Sweeney sees Epic as a benevolent actor on a mission to build a more open metaverse. Part of this means protecting developers against anticompetitive gatekeepers (Apple most notably); part of solving this problem is obviously regulatory change (hence the lawsuits), but another way to do so is by owning more parts of the value chain, building more interoperability into the tech (such as through Epic Online Services), and offering them to developers at compelling prices.

Notably, one area Epic doesn’t own is consumer hardware. Given how expensive VR R&D appears to be (e.g Meta’s $10 billion annual Reality Labs bill) — plus the fact that Epic wouldn’t want to overly compete against everyone it hopes will become a customer — it makes a lot of sense that Epic would prefer to partner on this rather than own it. Furthermore, the additional $1 billion from Sony will enable Epic to continue reinvesting in and acquiring services to bolster its long-term vision.

Zooming out, there’s increasingly a battle for an open vs. closed metaverse. Meta Platforms, with a market cap of over $570B, is the most heavily resourced company with metaverse ambitions, but many people still criticize it for its approach (such as egregiously high take rates). Within this broad metaverse vision, there’s also a huge opportunity to create safe spaces for kids, and it’s a matter of time before someone tries competing more with Roblox. Let’s be clear: there’s room for multiple winners, so it’s not as if Meta or Epic or Roblox or any other company (or crypto project) will “win” the metaverse. They’ll all coexist to varying degrees as the internet becomes more immerse, rewarding, and hopefully open. However, when we zoom in on Epic Games specifically (but also important companies like LEGO and Sony in its orbit), it’s very possible that its ambitions, investments, and partnerships could help lead a new generation of companies to capture a significant slice of the emerging multi-trillion dollar metaverse prize. (Written by David Taylor, Product Manager at EA)

🎮 In Other News…

💸 Funding & Acquisitions:

-

Epic raised $2B at a $31.5B valuation from Sony and KIRKBI. Link

-

Coda Payments raised $690M at a $2.5B valuation for cross-border payments and alternative app stores. Link

-

Infinite Reality acquired RektGlobal for $470M. Link

-

Genies raised $150M at a $1B valuation (we covered a previous raise here). Link

-

Improbable raised $150M at a $1B for its new blockchain pivot. Link

-

Civitas announced a $20M round co-led by Delphi and 3AC for its upcoming, community-based 4x game. Link

-

Goals, an alternative to FIFA on the blockchain, raised a $15M seed round. Link

-

Animoca acquired Eden Games to make more racing games. Link

-

Blast Royale (developed by Naavik contributor, Anil) raised a $5M seed round from Mechanism and Animoca. Link

-

Roblox acquired Hamul for an undisclosed amount. Link

-

Epic Games invested in Aquiris, a Brazilian developer. Link

-

Hasbro bought D&D Beyond, the platform’s leading digital toolset. Link

📊 Business:

-

China ended its gaming approval freeze, granting its first licenses since July 2021. Link

-

Microsoft is building an ad program for Xbox. Link

-

Meta’s Horizon will have a creator tax of 47.5% (a 17.5% fee net of other platform taxes). Link

-

Steam Deck’s first month in numbers. Link

-

VR panel shipments to reach 15.8M units in 2022. Link

🕹️ Culture & Games:

-

Sega teamed up with Gamefam to launch Sonic in Roblox. Link

-

Representing Ramadan in games. Link

-

Niantic’s new game Peridot takes a stab at virtual pets. Link

-

A Club Penguin fan site was recently shut down. Link

👾 Miscellaneous Musings:

-

What happens when twelve thousand game developers converge? Link

-

A thread on why most P2E models don’t work. Link

-

Why GameFi will be bigger than just play-to-earn gaming. Link

🔥 Featured Jobs

-

Immutable: Sr. BD Manager — Gaming (Remote)

-

Immutable: Business Development Manager — Web3 Gaming (Remote)

-

Solana: Gaming Engineer — Blockchain/Web 3.0 (Remote)

-

Naavik: Content Contributor — Writer (Remote)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below.