Hi Everyone. We have a couple interesting team expansion announcements to make today!

-

Thomas Baker: As our newest full-time hire, Thomas comes from Australia and is a highly experienced games industry professional (15+ years). Not only was he the lead designer on EA’s Real Racing 3, but has also taught games and interactivity to university students in the past. About 3 years ago, Thomas agreed to join me (Manyu here) as a part time consultant when Naavik was really in its infancy. He’s stuck around ever since, has become a great friend in the process and it’s nothing less than a milestone and honor to have him join us full-time. As Consulting Partner, he will be taking the reins on our consulting activities going forward, while contributing heavily to Naavik Pro and other parts of the company.

-

Karan Gaikwad: Hailing from India, Karan has significant product management experience having helped build games in companies like Zynga, Mech Mocha, and now Nukebox Studios where he’s Director of Product and building for web3. He recently wrote the Alien Worlds deconstruction (see below) with us and will be plugging in as a Naavik Pro Contributor going forward. We’re stoked to have him with us!

Crypto Corner: How To Design and Scale Blockchain-Powered Game Economies

Robbie Ferguson is a co-founder at Immutable, the builder of the first Layer 2 for NFTs on Ethereum. Immutable has also created the Blockchain Games Gods Unchained and Guild of Guardians. He joins Nico Vereecke today to discuss all things Blockchain Gaming:

-

Why Game Devs should work with Immutable

-

Ethereum Scaling: Zero-Knowledge Rollups

-

What Blockchain brings to games

-

Practical Tips on designing a Blockchain-Powered Game Economy

As always, you can find us on YouTube, Spotify, Apple Podcasts, Google Podcasts, YouTube, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: AppLovin Reports Q2 Earnings

Source: AppLovin

In a smattering of earnings last week, one of the standouts was AppLovin — the stock jumped 20%+ on relatively good earnings and news that the company might split out its two internal businesses.

As a recap, AppLovin has two core revenue drivers: the first is its software business, which enables developers to market and monetize their apps (essentially performance marketing), and the second is its apps business, which is a portfolio of over 200 games.

AppLovin originally built out its studio business to feed more data into its software business. Its portfolio of apps also leverages the software side, giving them a unique ad monetization edge. And while this leads to complaints by other studios that AppLovin uses third party data for their own benefit, the software business improves for everyone because of the overall collected first party data. AppLovin has a rich history of acquisitions like Machine Zone that helps power its first-party data flywheel.

We’ve previously covered AppLovin for its unique nature as a content fortress (the strategy seems to be playing out in spades), but despite its purported moat against IDFA, the company is guiding toward lower topline revenue and reducing marketing expenditure as a result. Perhaps the lower revenue guidance and higher profitability expectations makes the growth narrative a bit different than what the stock is telling us.

Source: Q1’22 Investor Presentation

The business forecasts a ~2x increase in revenue guidance this year for its software business alone. While apps revenue is still projected to be ~2x the revenue of software, the margin profile is completely flipped, with software contributing an adjusted EBITDA margin of 80% — it’s an interesting signal when the business itself starts splitting out these two segments separately.

As we can see from the chart below, management expects the software business to quickly catch up with apps revenue in 2023, warranting a deeper investigation in how to better operate the business.

Source: 10-Q; FY2023 app revenue is a rough estimate but illustrates the growth of software revenue.†

“For the last several quarters, we've talked about how the apps business is not as strategic as it once was. With the continued scaling of our software platform, we've proven that the two businesses can operate independently from one another. More directly, given the success of our software platform, we will no longer require games as a cost center. This means we will be exploring how to structure our apps business so that it is run more efficiently as its stand-alone business unit. This exploration may result in operational changes and possibly plan to sell or spin-off some of the studios. Among them are nearly 20 very capable games videos, their founders and their teams, we will operate the studios with a more profitable spend on user acquisition, which we already started to do in late Q1. Traditionally, we were willing to spend more on new users, valuing the scale, audience and data as the justification.”

It begs the question — why is AppLovin considering splitting its business? After all, the combination of the two types of businesses is what drove the competitive advantages that management had touted for so long. Why break that up, and why now? It boils down to a few reasons:

-

Should AppLovin continue to hold portfolio companies, some potential clients might view this as anticompetitive and might not want to use AppLovin services for their own because their data would go directly into making AppLovin (or other competitor) titles better. Some might perceive a portfolio of studios as a conflict of interest, and so vis-à-vis increasing its client base, AppLovin may want to offload any brand challenges (this isn’t to say they can’t just operate it as separate businesses). Perhaps they’re already seeing this impact growth in tangible ways.

-

There have been increasing diminishing returns to the ingesting more first-party data from its portfolio of game studios (we’ll dive deeper into this below).

-

The games industry has increasingly run into obstacles (e.g IDFA headwinds) but there have also been a record number of M&A transactions in games these past few months — it might be a good time from a multiples & diminishing returns perspective to sell game studio assets.

-

The margin profile of its software business line is clearly much better than its apps portfolio. It makes sense to reinvest where there’s higher growth potential and healthier bottom line unit economics. To be clear, they might also just be less interested in the mobile gaming industry from a reinvestment standpoint vs. necessarily a profitability perspective.

-

And lastly, given new roadmaps around NFTs, OEMs, and Connected TV, it’s worth mentioning that AppLovin may want their business to hinge less around games. Expanding their purview into other areas and disassociating focus from games is important for industry perception.

The other big question on my mind is “why now?” — why does this timing make sense in context of this announcement? Firstly, although AppLovin is affected by IDFA, it still has a competitive advantage through its first-party data. Secondly, its acquisition of MoPub has officially come online with 90% of publishers having transitioned to AppLovin MAX (ad monetization platform, optimizing ad inventory through bidding) and a now 700M MAU reach. During the acquisition we wrote:

“This independence is one of the selling points for MoPub — many publishers that don’t want to use the services of their competitors use MoPub instead. As a result, MoPub gained access to a variety of unique user database and became one of the largest data sources, which now supplies such ads companies as Liftoff and Moloco. Combine this with AppLovin’s existing data from its AppLovin MAX ads monetization platform and its LionStudios hypercasual division — and we get the company that knows almost everything there is to know about ad monetization. Notably, with the acquisition, AppLovin has even more knowledge about the ads market, and increases the volume of its data chest.”

With the integration of MoPub into MAX, AppLovin’s machine learning tools (AXON) to match users with the most relevant ads, and Adjust, which helps marketers find the right audiences, AppLovin has all the puzzle pieces in place to become the top-tier ad mediation platform. It has the first party data from 1) its portfolio and 2) its clients and the tools to be able to efficiently organize a series of third-party ad requests. And as it continues to onboard more clients, its portfolio — which initially helped train its model — is no longer needed as much as a cost center.

So, what’s next for AppLovin? One path is to sell the assets, providing cash to invest into their other business. The other path is to better split the business, either as separate business units under one roof or as a second entity that could get sold or spun out."To be fair, they have incredible breadth in the game business but top of mind for them will be to prioritize securing enterprise clients across all app types (they should have leverage here given reliance on ads and the difficulty of IDFA) and to offload key cost centers (app portfolio) in order to reinvest back into new software segments. They recently acquired Wurl to expand out into Connected TV, but ad monetization in OEM and Blockchain are also top of mind as next steps.

A few things are for certain — AppLovin has built an incredible flywheel that through machine learning can continue to operate across many segments, the company has a deep history of success in acquisitions (Adjust, MoPub, games studios, etc.) that they’ll likely leverage to expedite new segments, and they have best-in-class software margins to continually reinvest back into the business. I expect this will be a slower roll into a (still) highly competitive and consolidated market. AppLovin has been quite resilient and silently building, and the separation of games and software presents a crossroads where the strategy moving forward isn’t quite as clearcut as it may have been (ingesting data for the flywheel). This will be an exciting one to watch. (Written by Fawzi Itani)

#2: Alien Worlds Game Deconstruction (Preview)

Source: Alien Worlds

Alien Worlds is blockchain-based economy simulation game running on Ethereum, WAX, and BSC. It launched in late 2020 and is a poster child for the early blockchain games.

Alien Worlds is published by DACOCO.io, which is based out of Switzerland and is one of the pioneers in the blockchain space. Its founding members are Michael Yeates, Rob Allen, and Sarojini Mckenna. The team’s earliest work dates back to 2018 when they designed and initiated eosDAC, the viral airdrop and tokenized DAC block producer. A DAC (Decentralized Autonomous Corporation) is a company managed by a group of people self-governing and functioning autonomously and guided by smart contracts. This structure is important in the context of this deconstruct, because one can see its guiding principles in many of the decisions made by the team. Its belief in community, fairness, decentralization, and ownership has been the lens to make decisions like going multi-chain, storing assets on IPFS (Decentralized File Storage), along with many others. Although it has 11 investors, the only on-record funding is seen to be from its ICO for $2M during March 2021.

The game’s lore revolves around the Federation, which in 2055 discovered cryptic messages from aliens while mining for bitcoin. This led to the discovery of a wormhole that let humans travel to exoplanets in the far corners of the galaxy. The main objective of the game is to mine the rare on-chain currency Trillium (TLM) from the 7 different planets. Planets within this metaverse are DAOs that receive daily TLM from the central metaverse smart contracts. Players, or as they are called in the game, Explorers, engage through mining, acquiring and renting land, voting for Planetary governance to impact TLM and NFT payouts, among other strategic actions.

The Core Loop of Alien Worlds is very straightforward. On close observation, the entire gameplay revolves around players' need to equip themselves with powerful tools. All players get a basic avatar and tool by default. They then have to choose the Planet and Land that they wish to mine as different types of land have different mining potential. The outcome is also based on the tools that the players bring in to mine. After the mining process is completed, players get rewarded with TLM and may also get NFTs. The TLM can then be used to Shine (upgrade) the Tools or Stake — both of which are ways to get more TLM.

As a game (if it can be called that), Alien Worlds is not fun in the traditional sense of the word. This limits its potential to keep real players engaged in the long-term.

The two main metrics to look at are the Users and the Transaction Volume. Here, when we look at users, these are unique wallets and are prone to bots. So this number needs to be taken with a pinch of salt. The transaction volume is a good indicator of the economic activity in the game.

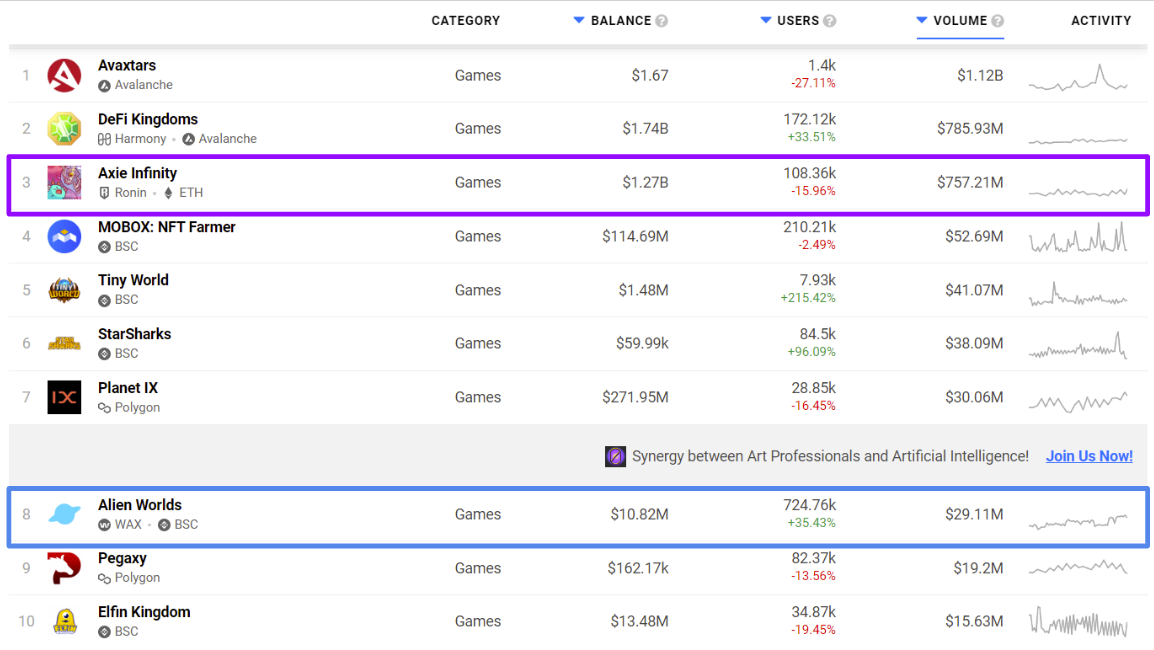

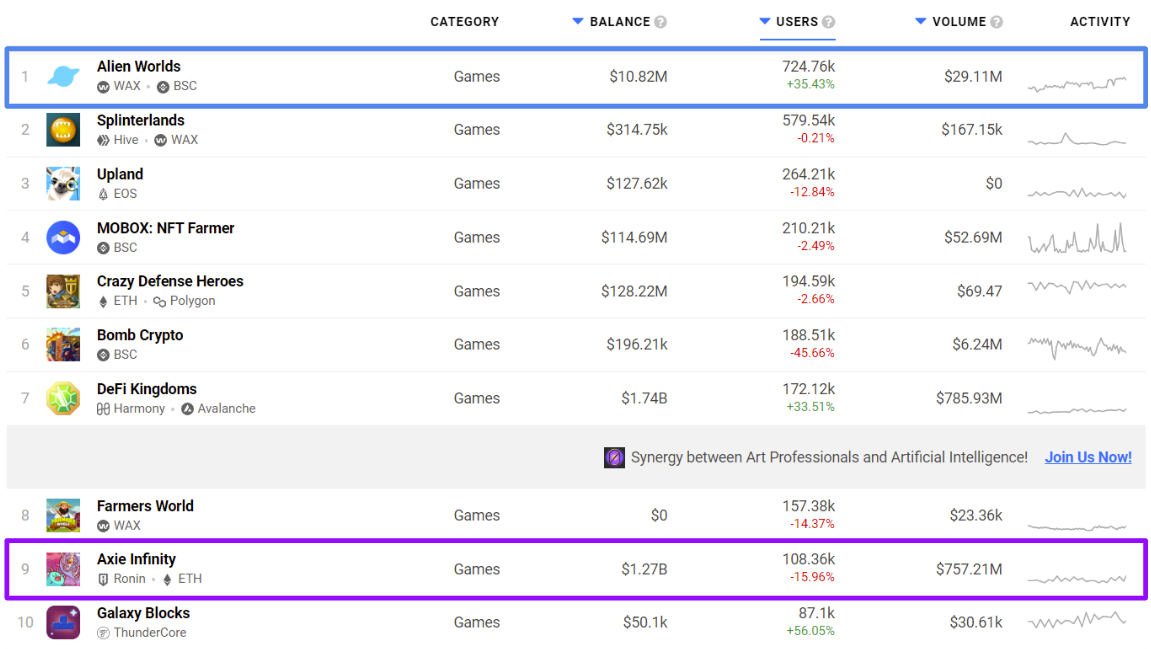

Source: DappRadar; Games by Volume; 30 Days; 10th April 2022 Source: DappRadar; Games by Users; 30 Days; 10th April 2022

As of the time of writing, Alien Worlds has the most MAWs (Monthly Active Wallets) at 724K. In the past, this #1 rank of Alien Worlds has moved from time-to-time but it has stayed in the Top 10. There has always been stiff competition from Splinterlands when it comes to MAW. However, when it comes to 30 day Transaction Volume, Alien Worlds stands at Rank 8 with $29M.

There is an interesting juxtaposition to be made to Axie Infinity, which has MAWs of 108K and monthly Transaction Volume of $757M. This means that even with a 7x lesser wallet base compared to Alien Worlds, Axie Infinity has a 26x larger volume. This has primarily to do with the fact that players can start Alien Worlds without a heavy initial investment. It’s also the reason why it has a much healthier userbase.

Axie Infinity has a Transaction Volume/User that is 174x as compared to Alien Worlds. What remains to be seen is if the Alien Worlds economy is sustainable.

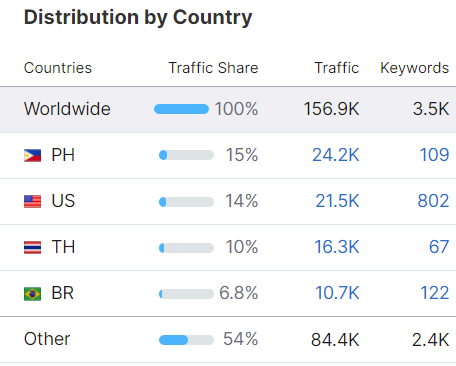

Alien Worlds Website Visitors. Source: Semrush

Though it is difficult to accurately understand the location of players, a quick look at the website visitors can be indicative of the geographic distribution of the player base. Compared to some of the top games right now that are very popular in the East, Alien World’s popularity is comparatively spread out.

-

Hypothesis 1: Since, as a game, Alien Worlds is not as fun to play compared to some of these other games, the players in the East (primarily Philippines) have not migrated to it. This also makes it less suitable for the Guild/Scholar model which has gained traction in South East Asia.

-

Hypothesis 2: The simple gameplay makes Alien Worlds very bot-able. A large number of bots means that people anywhere in the world can engage and earn out of the game leading to a large spread of users across different geographies.

This leads us to the 3 main questions that we want to ask for Alien Worlds:

-

How does the money flow through Alien Worlds’ economy, and is it fundamentally sustainable?

-

What is the role of bots in this economy?

-

What updates will (or should) the game implement in the future?

Let’s dive in…

This research essay was originally posted on Naavik Pro - the #1 research portal for blockchain and F2P games! We serve both investors and developers with our premium research. Make us your remote games research department today!

Content Worth Consuming

Designing A Sustainable Game Economy (Lyceum.gg): "In previous blog posts, we have mainly focused on various challenges web3 game economies have experienced thus far. In this post, we are shifting to highlighting some of the more sustainable design elements used by existing NFT games and what they mean for each economy. Games frequently mentioned in the examples here, such as Splinterlands and Gods Unchained, are some of the longest-running NFT games and serve as proof that these designs can have a meaningful impact when it comes to sustainability. Note that the design elements covered here are not the only sustainable ones currently being leveraged and we continue to see new, creative elements introduced at a rapid pace.” Link

The Lost Ark Has Found Its Way (GameBakery): "When we talk about MMO, many may relegate this game category to “old-school” or “niche.” This genre is getting marginalized in the West. Only MMO like World of Warcraft and Final Fantasy 14 are still generally recognized by western gamers. While gamers are waiting for a new and high quality MMO title, Lost Ark finally lands in the Western Gaming market after its initial launch in Korea 3 years ago. With the powerful marketing of Amazon, active user numbers have been in a leading position since the game’s launch on 11 Feb. According to reports and Steam Charts, registered users of Lost Ark reached 20 million and DAU steadily maintained at 500K while its peak is 1.2 million (as of 18 Mar). Amazon Games has finally made its name after the tough launch of New World. In this article, we are going to explore this topic: Does Lost Ark help MMORPG in the western market enter a new age?” Link

Netease Looks to Expand Globally (Bloomberg): “Jenova Chen needed money to put his latest game out in China. It was 2016, right after Tencent Holdings Ltd. made a splash by taking over Clash of Clans studio Supercell Oy, and Chen was counting on the newly acquisitive internet giant. But when Tencent passed, calling his novel mix of stylized designs and free-play too risky, it was the smaller NetEase Inc. that swooped in. Founder William Ding flew all the way to San Francisco and spent hours with Chen to seal the deal, unheard-of back then for the reclusive Chinese billionaire.” Link

Why in-app personalization, not probabilistic attribution, is the future of post-ATT advertising (MobileDevMemo): “To my mind, probabilistic attribution at the level of the channel, much less at the level of the campaign, is impractical to impossible using in-app behavioral signals. And if fingerprinting is policed, that activity will not be possible using device parameters, either. That leaves advertisers with one tactic for improving funnel conversion and thus the efficiency of advertising spend: in-app personalization.” Link

Featured Jobs

-

Konvoy Ventures: Investment Analyst (Denver, CO)

-

LILA Games: Game Designer, Systems & Economy (Bangalore, India)

-

OpenBCI: AR/VR Demo Creator - Neurotech (Brooklyn, NY)

-

Immutable: Sr. BD Manager — Gaming (Remote)

-

Immutable: Business Development Manager — Web3 Gaming (Remote)

-

Solana: Gaming Engineer — Blockchain/Web 3.0 (Remote)

-

Naavik: Content Contributor — Writer (Remote)