Hi Everyone. Last edition, we wrote about how AppLovin might split its two business units and examined the reasons behind such a decision. If you’re enjoying Naavik Digest, we’d love it if you shared it with a friend or two — we try to make it one of the best emails you get each week, and hope you’re enjoying it.

Roundtable: Luna Crashed and the Bear Woke Up

In this Metacast episode, Anton Gorodetsky, Nicolas Vereecke and Aaron Bush, join your host Maria Gillies to discuss:

-

Luna/UST Crash

-

Bear Markets

-

InvestGame’s Q1 2022 Report

You can find us on YouTube, Spotify, Apple Podcasts, Google Podcasts, YouTube, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: Yuga Labs and the Future of the Yugaverse

Source: NFT News

We are now at an interesting point of time where NFTs actually have a narratable history. Some of the first NFTs ever made were a series of PFPs (Profile Picture Projects), which were images designed to be used as avatars for social media accounts. Among the first in the subgenre were the 24x24 pixel CryptoPunks, which were algorithmically created in 2017. Though before the explosion of NFTs in 2021, creators and developers rarely stuck around to build utilities around their collections or projects. Instead, they typically cashed in on a particular NFT craze and then immediately set their sights on the next lucrative opportunity. That was until Yuga Labs came into the picture.

The more I researched this company, the more it fascinated me. Exactly two months ago, Miami-based Yuga Labs raised a monster $450M seed round at an even more monstrous $4B valuation. Yes, it was a shocking highly seed round led by none other than a16z — amongst other VCs, such as Animoca Brands, LionTree, Sound Ventures, Thrive Capital, FTX and MoonPay, who were all eager to back a major player in the NFT craze.

How did Yuga Labs manage such a stupendous raise and valuation? Well, it likely comes off the back of Bored Ape Yacht Club (BAYC) — the widely known PFP collection and largest NFT project to date. It currently trades at a floor price of ~$185,000 and is owned by a large swath of globally renowned celebrities. Not to mention, BAYC is just one of the many top PFP projects now owned by Yuga Labs, including Mutant Apes Yacht Club (MAYC), CryptoPunks and Meebits.

Source: DappRadar

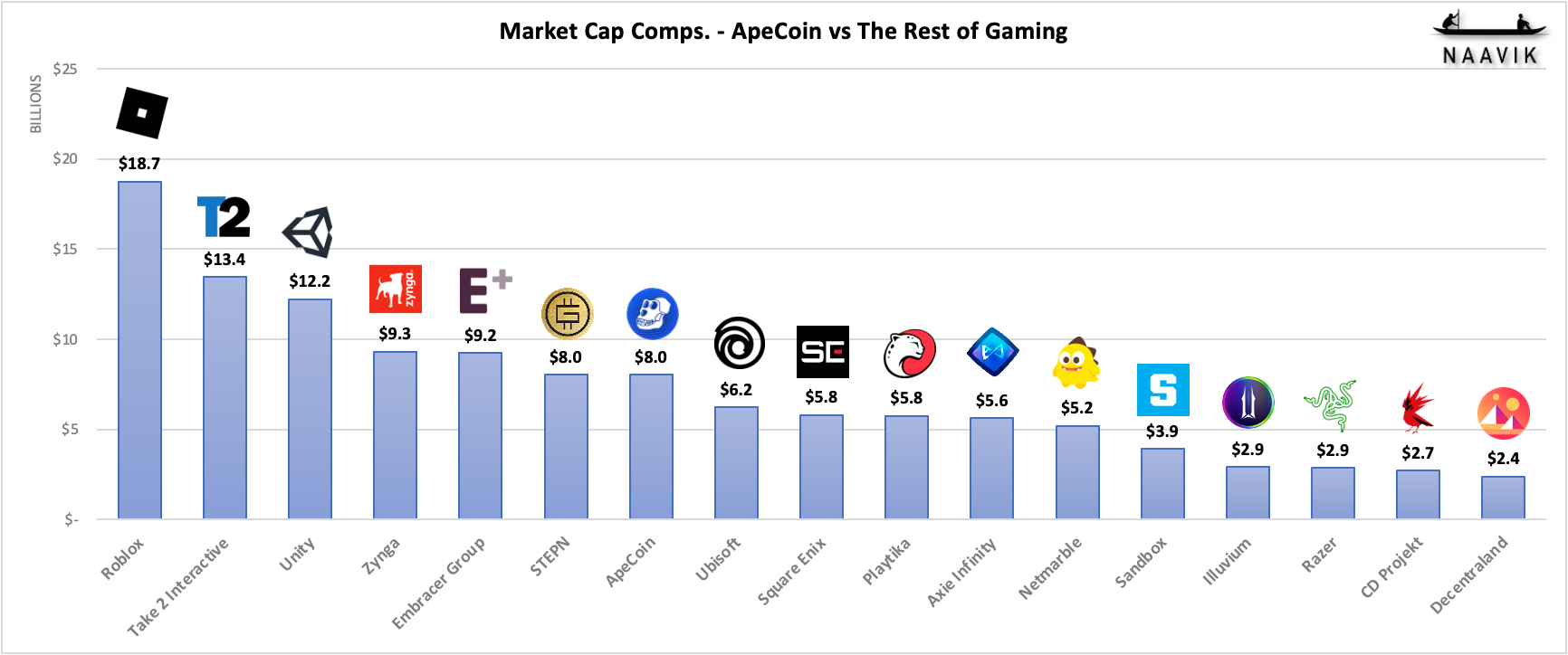

These PFP projects are just the tip of the iceberg though. Yuga Labs is also relatively fresh off the launch of ApeCoin — a token that will serve as the financial fabric of the upcoming APE ecosystem. ApeCoin’s fully diluted market cap currently stands at $8B! Just to put that impressive number in context, it is almost half of Roblox’s, two-thirds of Unity’s, slightly higher than Zynga’s and way ahead of Axie Infinity, The Sandbox and Decentraland.

Source: Naavik

Further, Yuga Labs is looking to build all this momentum into its own version of the metaverse called “Otherside”, which promises to be a massively multiplayer UGC-enabled gaming experience that integrates avatars from a number of other NFT projects (through a proprietary SDK) and allows players to play as any Web3 persona they wish.

See you on the Otherside in April. Powered by @apecoin pic.twitter.com/1cnSk1CjXS

— Yuga Labs (@yugalabs) March 19, 2022

If those eye-popping statistics and visuals have piqued your interest, let me tell you that I’m right there with you. The company’s $4B seed stage valuation, ApeCoin’s pre-product/utility $8B market cap and their upcoming Otherside metaverse play all drove my curiosity to take a deep and critical look at a business that has never built a game before. My hope was come out the other side (no pun intended) with a judgement on the gap between investor/market expectations and reality here.

Armed with many unanswered questions, I set off writing what was meant to be a 1,000 word essay, which has now turned into 7,000 words. In this deep dive, I take a look at Yuga Labs’ beginnings, recap their grand vision and mission, evaluate how they’re performing at this very nascent stage, speculate on their future and conclude with a take on all the above. But first, let’s start with some company history.

Buckle up! The hype train is about to leave the station.

#2: Weekly News Highlights

Source: a16z

Tencent reported sluggish Q1 gaming results. Total games revenue was 43.6RMB ($6.5B), which represented 32% of the company’s total Q1 sales and was essentially flat compared to last year. Domestic games represented 75% of total game sales, but this revenue decreased 1% year-over-year, which is unsurprising given the glacial pace of game approvals, post-COVID normalizations, and heavy minor protections that limit both time and money spent. Newer launches like League of Legends: Wild Rift and Fight of The Golden Spatula helped provide new revenue, but they couldn’t make up for reduced revenue seen elsewhere in games like Call of Duty Mobile and Moonlight Blade Mobile. On the International side (25% of games revenue), results were a bit better (+4% year-over-year); games like Riot’s Valorant and Supercell’s Clash of Clans drove growth while others like PUBG Mobile experienced normalized post-COVID spending. Tencent will clearly remain an incredibly important industry player, but government-forced limitations will hold back the team’s full potential and cause the company (alongside other leading Chinese firms) to further prioritize international expansion.

Andreessen Horowitz (a16z) launched Game Fund One. A16z has long invested in the games industry, but this new $600M fund is the firm’s recommitment to supporting the next generation of builders. This continues the firm’s long-term strategy of splitting investment categories across its holistic firm. The fund will invest across three main themes: 1) game studios, 2) games x consumer (like social apps), and 3) infrastructure. It also launches with strong backing, including notable investors such as David Baszucki (founder of Roblox), Jason Citron (founder of Discord), Mark Pincus (founder of Zynga), and much more.

Ubisoft+ is headed to PlayStation. Ubisoft’s subscription service will soon become accessible on PlayStation, and, perhaps more notably, part of the service (Ubisoft+ Classics) will actually be embedded into the higher PlayStation Plus tiers. This means games like Assassin’s Creed Valhalla, Watchdogs, and For Honor will be available to PlayStation subscribers. This is somewhat similar to when EA Play became embedded into Xbox Game Pass. The vast majority of publisher-specific subscription services are simply too niche to see great scale, so seeing additional partnerships and consolidation across leading subscriptions services makes good sense.

Embracer Group reported fourth quarter results. If you take a quick look at Embracer’s numbers, two metrics leap off the page. First, the company generated 117% year-over-year revenue growth, which is clearly driven by acquisitions. For example, over the past fiscal year, Embracer acquired several companies like Asmodee (board games), Dark Horse (comics), Gearbox (Borderlands), and the recently divested Square Enix assets. The other standout number is -34% organic growth; Valheim is a notable reason for the decline, but (paired with cash flows) this is the top metric to watch in order to judge Embracer’s ability to create real sustainable value via M&A. Management says they’re not worried, and we’ll have to see how the pipeline of 223 projects (25+ of which are AAA) move the needle going forward. Changing market dynamics (including a stock price that’s down 35% from its highs) may also affect how management views M&A, but it’s unlikely that Embracer will stop being aggressive anytime soon.

Metatheory raised a $24M Series A. Started by Twitch co-founder Kevin Lin, this company’s is on vision is to build strong story-driven IP franchises using web3 tools. The team is starting with games first, but the (lofty) goal is to move multi-platform and pursue transmedia. The first sci-fi franchise, Dustbreakers, is already live. The first 10,000 Genesis Dustbreaker NFTs sold out in December, the team has now launched its second F2P minigame, and a full play-and-earn game is scheduled to launch in Q4. The bold vision is to build the experience so that community-driven decision will impact the story across evolving (and future) NFTs, games, animations, comics, and more. There’s clearly a lot of work left to do. Coincidentally, Lin is now the second Twitch co-founder to found a blockchain gaming business; the other, Justin Kan, recently launched Fractal, a new NFT marketplace for games.

In Other News…

Funding & Acquisitions:

-

a16z launched a $600M games fund. Link

-

N3twork Studios raised a $46M round to build blockchain games. Link

-

MetaTheory raised $24M to build out transmedia franchises. Link

-

Azra games announcer a $15M round led by a16z to build combat RPGs. Link

-

Eric Seufert launched a $10M fund to invest in mobile ad and gaming startups. Link

-

Istanbul-based Hyperlab raised a seed round. Link

Business:

-

EA is reportedly looking for exit opportunities. Link

-

Improbably sold Midwinter Entertainment to focus on metaverse initiatives. Link

-

100 Thieves is building a game. Link

Culture & Games:

-

Eve Online will launch browser-based play called Eve Anywhere. Link

-

Fall Guys is going F2P and cross-platform. Link

-

MiHoYo teased an upcoming beta for its newest game, an urban RPG. Link

Miscellaneous Musings:

-

Mr. Autofire — the best shooter you’ve (probably) never played. Link

-

How SF musicians are turning to video games. Link

-

A look at Arrivant’s project unveil: Eluune. Link

-

A new, fan-created Pokemon game. Link

Featured Jobs

-

Konvoy Ventures: Investment Analyst (Denver, CO)

-

LILA Games: Game Designer, Systems & Economy (Bangalore, India)

-

OpenBCI: AR/VR Demo Creator - Neurotech (Brooklyn, NY)

-

Lotum: Game Designer (w/m/d) (Germany)

-

Naavik: Content Contributor — Writer (Remote)