This deep dive was written by Abhimanyu Kumar. Special thanks to Aaron Bush and Fawzi Itani for the valuable feedback and edits.

We are now at an interesting point of time where NFTs actually have a narratable history. Some of the first NFTs ever made were a series of PFPs (Profile Picture Projects), which were images designed to be used as avatars for social media accounts. Among the first in the subgenre were the 24x24 pixel CryptoPunks, which were algorithmically created in 2017. Though before the explosion of NFTs in 2021, creators and developers rarely stuck around to build utilities around their collections or projects. Instead, they typically cashed in on a particular NFT craze and then immediately set their sights on the next lucrative opportunity. That was until Yuga Labs came into the picture.

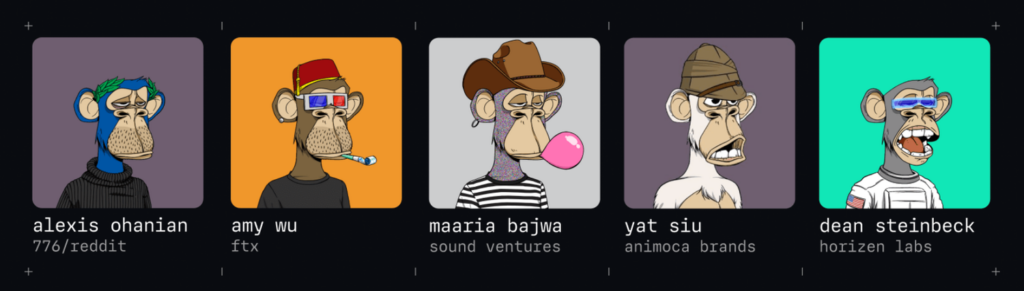

The more I researched this company, the more it fascinated me. Exactly two months ago, Miami-based Yuga Labs raised a monster $450M seed round at an even more monstrous $4B valuation. Yes, it was a shocking highly seed round led by none other than a16z — amongst other VCs, such as Animoca Brands, LionTree, Sound Ventures, Thrive Capital, FTX and MoonPay, who were all eager to back a major player in the NFT craze.

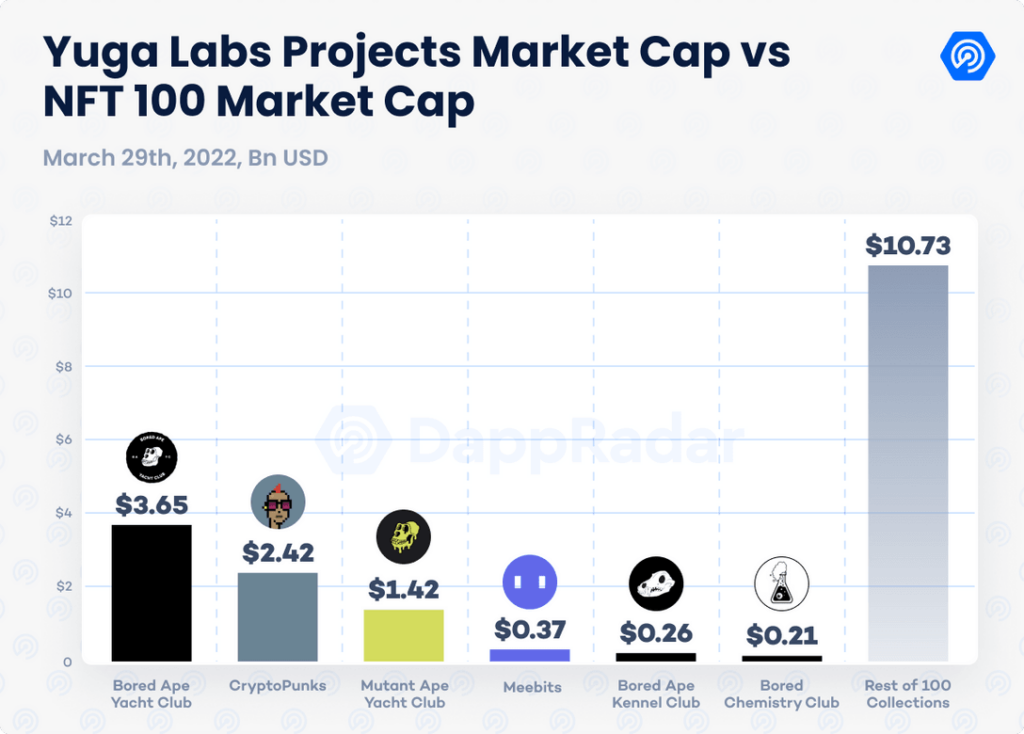

How did Yuga Labs manage such a stupendous raise and valuation? Well, it likely comes off the back of Bored Ape Yacht Club (BAYC) — the widely known PFP collection and largest NFT project to date. It currently trades at a floor price of ~$185,000 and is owned by a large swath of globally renowned celebrities. Not to mention, BAYC is just one of the many top PFP projects now owned by Yuga Labs, including Mutant Apes Yacht Club (MAYC), CryptoPunks and Meebits.

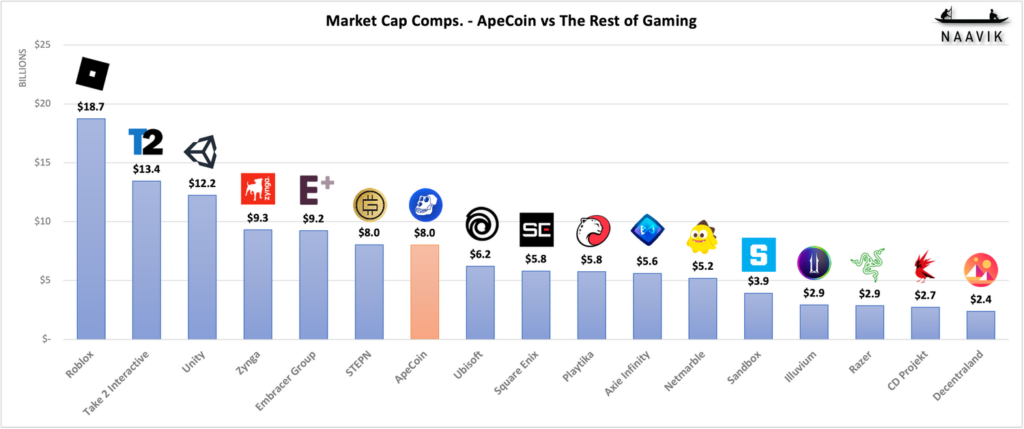

These PFP projects are just the tip of the iceberg though. Yuga Labs is also relatively fresh off the launch of ApeCoin — a token that will serve as the financial fabric of the upcoming APE ecosystem. ApeCoin’s fully diluted market cap currently stands at $8B! Just to put that impressive number in context, it is almost half of Roblox’s, two-thirds of Unity’s, slightly higher than Zynga’s and way ahead of Axie Infinity, The Sandbox and Decentraland.

Further, Yuga Labs is looking to build all this momentum into its own version of the metaverse called “Otherside”, which promises to be a massively multiplayer UGC-enabled gaming experience that integrates avatars from a number of other NFT projects (through a proprietary SDK) and allows players to play as any Web3 persona they wish.

They’ve already made the first steps towards realizing the Otherside with launching their first land plots sales at the start of May 2022. Yuga Labs sold 55,000 blocks of land at a mint price of $6,100 each. Not only did that result in ~$330M in additional revenue for the company, but also it was the largest NFT mint to date that also crashed Ethereum!

If those eye-popping statistics and visuals have piqued your interest, let me tell you that I’m right there with you. The company’s $4B seed stage valuation, ApeCoin’s pre-product/utility $8B market cap and their upcoming Otherside metaverse play all drove my curiosity to take a deep and critical look at a business that has never built a game before. My hope was come out the other side (no pun intended) with a judgement on the gap between investor/market expectations and reality here.

Armed with many unanswered questions, I set off writing what was meant to be a 1,000 word essay, which has now turned into 7,000 words. In this deep dive, I take a look at Yuga Labs’ beginnings, recap their grand vision and mission, evaluate how they’re performing at this very nascent stage, speculate on their future and conclude with a take on all the above. But first, let’s start with some company history.

Buckle up! The hype train is about to leave the station.

Where did Yuga Labs Come From?

The name of the company, Yuga, comes from the main antagonist of The Legend of Zelda: A Link Between Worlds. This is because one of Yuga’s special powers is to convert both himself and others into paintings! It’s quite a fitting name, to say the least, for a company that had its beginnings in the world of PFP NFTs — they’re behind the $3B+ market cap BAYC collection, as previously mentioned.

How did the company come to be? Yuga Labs was founded by four real-life friends from very diverse backgrounds (Jewish, Cuban, Turkish, Pakistani): Gargamel, Gordon Goner, EmperorTomatoKetchup, and NoSass — all pseudonyms, of course . More recently, we’ve gotten to know that Gargamel and Gordon Goner are Greg Solano and Wylie Aronow. And as Yuga Labs puts it in their wonderful writeup — “everything stemmed from this sentence”.

While many believe that BAYC’s inspiration was Larva Labs’ CryptoPunks (~$2B market cap), it was actually The Hashmasks art project that served as the true artistic inspiration. The founders were always interested in crypto, and it was The Hashmasks project that made them realise that “the technical aspects of the NFT project were not the point,” and there was a broader cultural revolution brewing that would not only take the world by storm, but also be a significant opportunity to capitalise on.

As the founding team learned more about NFTs, they realised that this technology was an opportunity to create art, tell a story in a new medium, irrefutably prove that a piece of digital artwork is authentic, and use that artwork as a membership card for an exclusive club. They were dead set on bridging the gap between culture and web3, and Yuga Labs’ uphill climb started in February 2021 with the following conversation between Gargamel and EmperorTomatoKetchup:

The fire had been sparked.

From Modest Origins to the Largest NFT Project

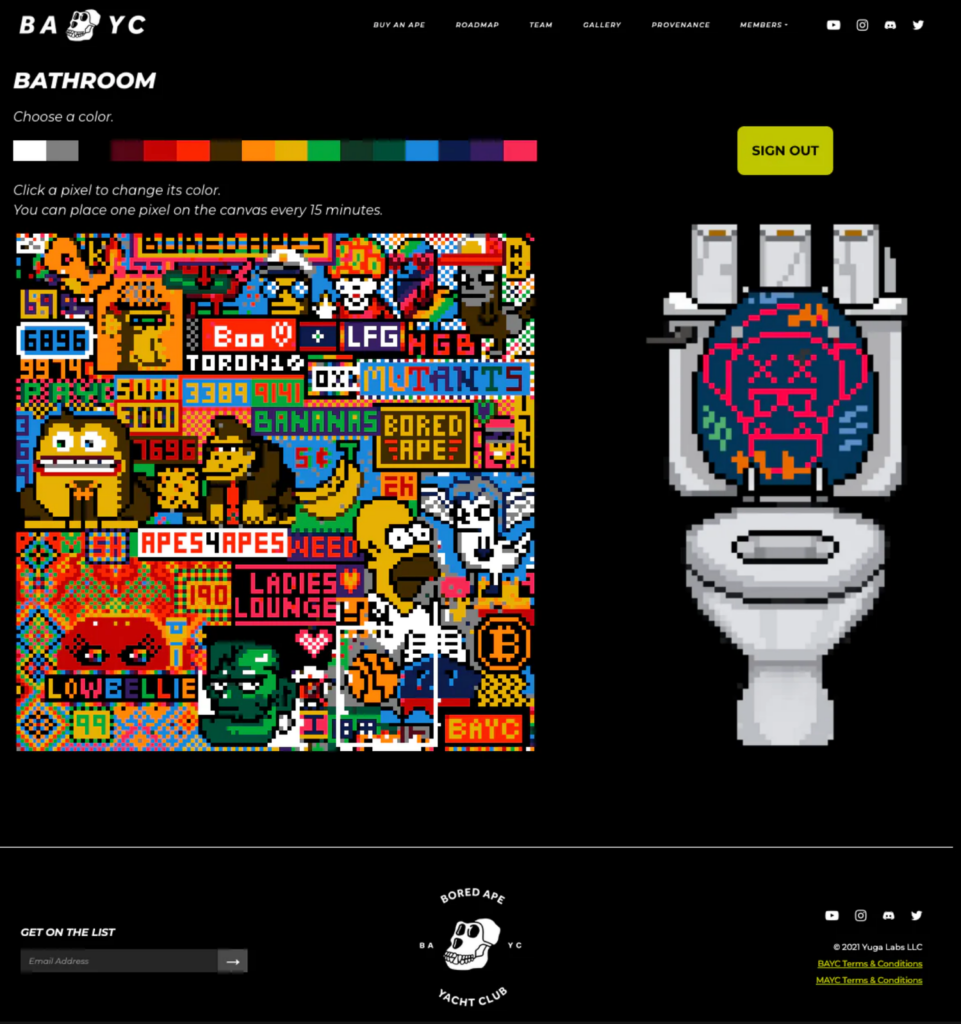

Originally, the BAYC project was a collaborative art piece that everyone in the community would be able to build and grow together. There was a single canvas and multiple people were allowed to change one canvas pixel to a color of their choice once every 15 minutes.

The founding team told Nicole Muniz (currently hired as CEO) about the idea, and she laughed it off by saying — “But everyone is just going to draw penises!”. But in hindsight, one can see how callous that statement really was. The simple idea of a collaborative art project ended up transforming into a picture that showcased a yacht club’s toilet stall in a future swampy version of Miami that was inhabited by a bunch of bored apes. In a nutshell, last year’s collaborative art project is today’s BAYC lore.

Since then, much has happened. Here is a timeline of how the BAYC universe rapidly expanded over the last year and where we are today:

- Q1 2021:

- Early February: The seed for doing a PFP NFT project is planted

- Until April: Yuga Labs works with a team of freelance illustrators to create what we know today as BAYC

- Q2 2021:

- April 23: BAYC launches a week-long pre-sale with a 0.08 ETH (~$200 at the time) cost to mint, resulting in a total of ~500 apes being minted

- May 1: The remaining ~9.5K apes mint in one day, resulting in the collection selling out and BAYC becoming the most used smart contract on Ethereum

- June 18: Bay Area Kennel Club (BAKC) joins the BAYC family, where each BAYC owner gets a companion dog NFT and all proceeds are donated to animal charities

- Q3 2021:

- August 8: The grand opening of the BAYC Riverboat Casino in Decentraland occurs

- August 21: Yuga Labs collaborates with The Hundreds on a collection of t-shirts, hoodies and rugs

- August 28: Mutant Ape Yacht Club (MAYC) establishes itself, and each BAYC owner receives a serum that can be used to mutate their BAYC into a MAYC, resulting in minting 10,000 additional MAYC NFTs (currently at ~$1.5B market cap)

- September 9: Sotheby’s hosts the “Ape in!” auction of 101 Boring Apes (~$25M in value) and 101 BAKC Dogs (~$1.8M in value)

- September 13: Yuga Labs collaborates with RTFKT, where the winner of an interactive treasure hunt is rewarded with 10 ETH, a BAYC, a BAKC and RTFKT shoes

- Q4 2021:

- October 12: Yuga Labs signs Guy Osreay (U2 and Madonna talent manager)

- October 31 to November 6: The first APE FEST, a week-long event for free members, commences with exclusive Halloween yacht parties, art galleries and limited-edition merchandise pop-ups, among other perks

- November 12: Timbaland announces partnership with Yuga Labs to create Ape-In Productions, an entertainment company that’ll focus on turning various BAYC characters into metaverse music artists

- December 13: Yuga Labs partners with Animoca Brands to create a BAYC-based game

- December 17: Yuga Labs partners with Adidas

- Q1 2022:

- January 12: Guy Osreay signs World of Women NFT collection (currently ~$174M market cap)

- February 7: Yuga Labs founders hire a leadership team — CEO (Nicole Muniz), COO (Jasmin Shoemaker) and CCO (Patrick Ehrlund)

- March 11: Yuga Labs acquires CryptoPunks and Meebits

- March 17: ApeCoin starts trading

- March 19: Yuga Labs teases its metaverse play — “Otherside” (you’ll notice the original BAYC lore in the first scene)

- March 23: Yuga Labs raises a $450M seed round at a $4B valuation with participation from a16z, Animoca Brands, FTX and others

- April 30 : Otherside NFT land sale is launched, rakes in ~$320M, and crashes Ethereum!

What a ride! Truly impressive.

Going back to Yuga Labs’ original mission around merging art, identity, ownership, utility, interoperability and culture to push the crypto/NFT space forward, the plan always was to sell art and allow the owners of the art to use it as a key to an exclusive club of sorts. Looking at the timeline above, it’s quite clear to me that Yuga Labs has stayed true to their mission. The inception and expansion of the Ape’s family tree (BAYC, BAKC, MAYC) continues to be the “selling art” step, while milestones like providing BAYC owners with access to special merchandise, BAYC mutation serum to mint MAYCs, tickets to the APE FEST, ApeCoin airdrops etc. are the “exclusive club” benefits.

And as we will see in the next section, this is just the beginning.

Where is Yuga Labs Headed?

With all the above context set, I want to hit on the huge vision that Yuga Labs has for its future. After all, this is the vision they need to deliver on so as to fully justify the massive $450M seed round and attached $4B valuation — not to mention future rounds they will be raising and potentially higher valuations. From their leaked pitch deck:

If you’d like to hear it from the CEO, watch this video:

While the pitch deck is quite cryptic and sparse on details, I’d probably bucket the above bullets and the rest of the plans laid out in the deck into five categories that attempt to encapsulate the future Yuga Labs is building towards:

- Club Immersion: This would cover introducing and delivering new forms of real and virtual world utility (aka limited access) to Yuga Labs’ NFT holders, which include many big celebrities from all walks of life such as Serena Williams, Justin Bieber, Snoop Dogg etc.

- IP Expansion: This includes further expanding the BAYC universe (BAKC, MAYC), acquiring other universes (such as CryptoPunks, Meebits, World of Women) and building entirely new universes to further expand Yuga Labs’ audience and reach. This will all be used to fuel the next point.

- Metaverse Creation: This would include leveraging their various partnerships (Animoca Brands and Improbable in particular) to break into gaming with their UGC-enabled metaverse play, Otherside — the financial fabric of which will be ApeCoin and other auxiliary revenue drivers (land sales, secondary market transactions, UGC marketplace transaction fees etc.).

- Lifestyle Brand Evolution: With BAYC already in mainstream culture, this would include further permeating everyday life through other fitting verticals (such as fashion and entertainment) to keep the IPs cultural relevance (and hype) pretty high, while creating ancillary revenue streams, such as merchandizing, content, etc.

- Vertical Integration: While this point is not explicitly mentioned in their pitch deck, I feel Yuga Labs will eventually pursue vertical integration, so as to capture more steps of the value chain internally. This might involve following in the footsteps of companies like Sky Mavis or Epic Games to eventually transform the PFP-focussed organization into a highly technology enabled self-reinforcing ecosystem.

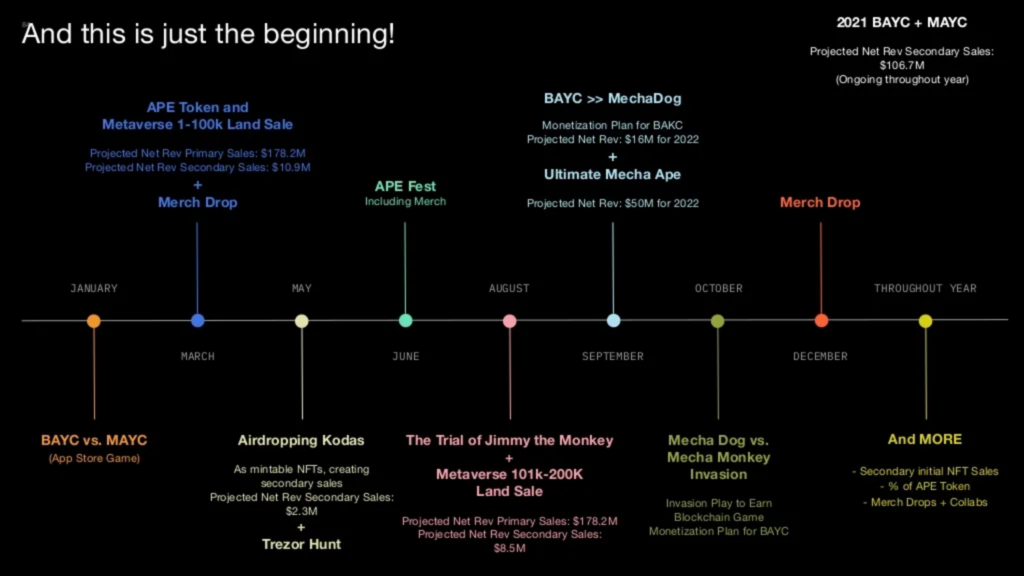

Here is what the above multi-year vision looks like in terms of a more immediate 2022 roadmap:

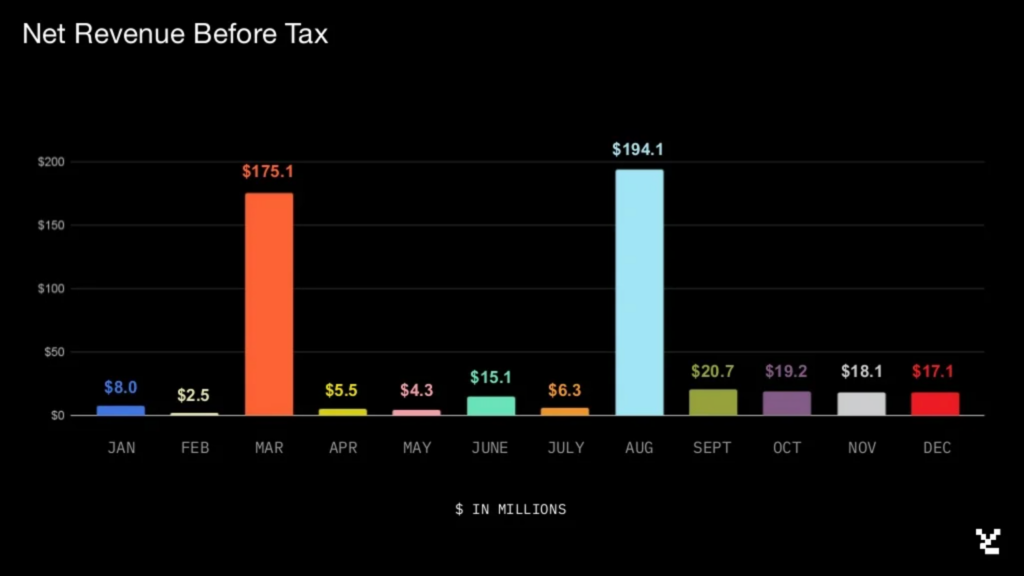

And what the above roadmap becomes in terms of expected revenue over 2022 looks like this (I will be evaluating how they are tracking towards this in the next section):

In many ways, Yuga Labs is blazing a trail for how humble (and successful) PFP projects can not only evolve their vision and goals over time, but also become widely known crypto/digital-native brands in their own right. That said, the above roadmap is packed with a bunch of NFT sales, two land sales and a playable blockchain game just five months away. Given the very tall order, the key question is if they can deliver on the roadmap and revenue goals. We’ll start with evaluating the latter.

How is Yuga Labs Currently Faring?

It’s hard to say that all the plans laid out above are not exciting. But to ground this analysis in reality, an evaluation of how Yuga Labs is performing towards their 2022 revenue goal of ~$540M is quite necessary. To do that, let’s take a look at some key aspects of the business:

- Primary + secondary market sales for PFP projects

- Land sales for the Otherside

- ApeCoin and its ecosystem

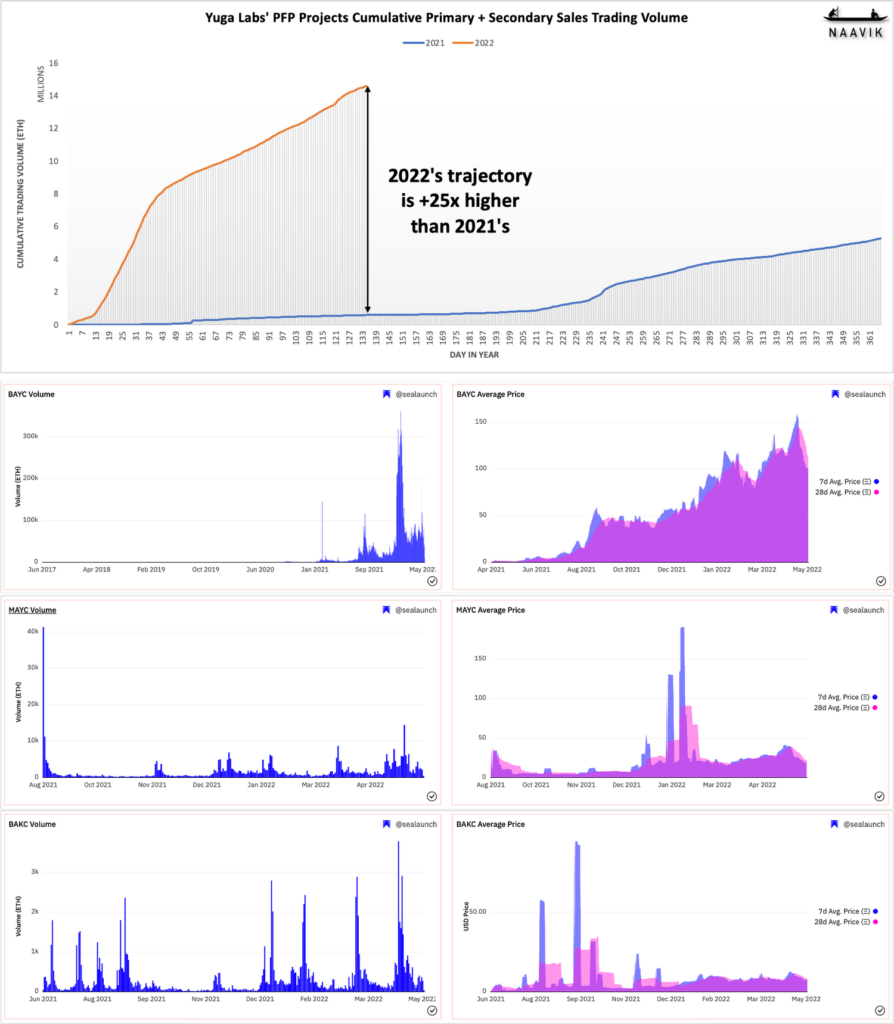

#1: Primary + Secondary Market Sales for PFP Projects

On the surface, this is probably Yuga Labs’ healthiest revenue layer with 2022’s PFP trading volume trending 25x higher than that of 2021’s. The two key drivers include:

- BAYC, MAYC and BAKC floor prices are generally at a higher baseline in 2022 vs 2021.

- BAYC, MAYC and BAKC trading volumes are generally at a higher baseline in 2022 vs 2021.

While the general increase in baseline metrics is quite understandable given the hype around arguably the most premier blue-chip PFP projects in the space, it should also keep in mind that one successful year does not mean the trend will continue forever. This can be seen in how the average prices for both MAYC and BAKC specifically are well below their highs during January 2022 and September 2021, respectively.

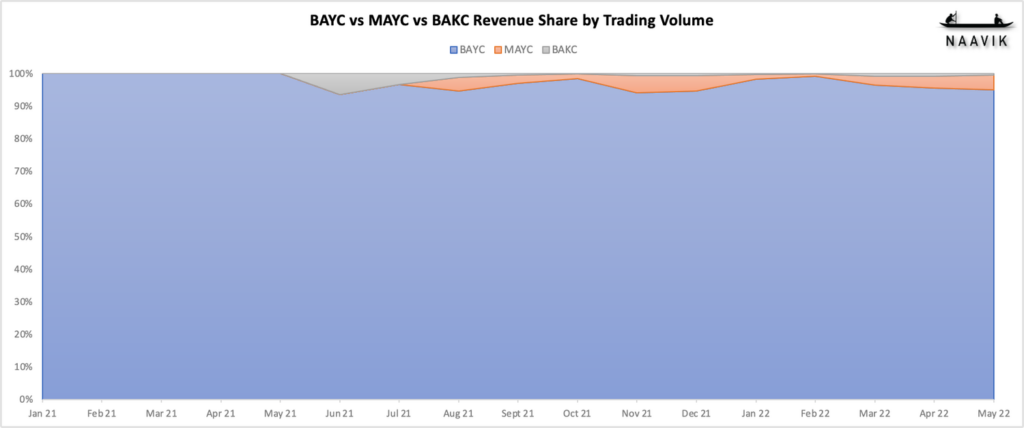

Further, it is also important to note that BAYC makes up for >90% of the sales volume, which means this revenue line is highly concentrated. Considering PFP project revenues contribute to ~25% of the overall $540M revenue goal, Yuga Labs is clearly heavily dependent on just one of their many PFP projects to make that happen.

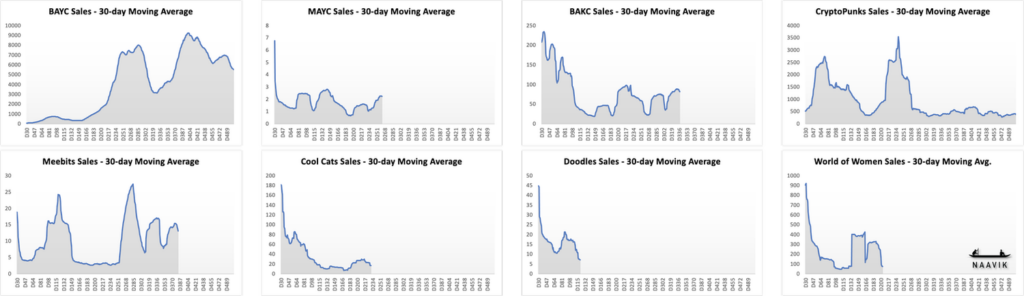

All that said and zooming out a bit, BAYC, MAYC and BAKC are actually one of the most healthy PFP projects out there because all three are seeing increasing trading volumes and floor prices. A PFP project experiencing such business metric behavior would indicate a healthy balance of owners either transferring or holding NFT ownership due to ongoing hype and promised future utility. In other words, Yuga Labs is doing a great job with keeping the enthusiasm going around these PFP projects and creating ongoing revenues through the process.

The above point is especially important to note because many other famous PFP projects, such as CryptoPunks, Meebits, Cool Cats, Doodles or World of Women, are not following similar trends and thereby not sustaining ongoing revenues similarly. They’re facing either:

- Dropping trading volume and increasing floor price, which would indicate owners increasingly holding their NFTs while the price continues to rise due to ongoing hype or promised future utility → Cool Cats and Doodles seem to fall in this category

- Dropping trading volume and dropping floor price, which would indicate owners simply losing held NFT value while the price continues to drop due to a decreasing number of interested buying parties available or not exciting enough plans for future NFT utility → CryptoPunks, Meebits and World of Women seem to fall in this category

Given all the above data context, it is absolutely fair to question the longevity of a PFP project driven revenue layer. Since hype cannot go on forever, longevity is mostly driven by NFT utility. And that is why owning the BAYC, MAYC and BAKC PFPs play a key role in gaining access to whatever Yuga Labs is building in the future. In a way, the upward trending baseline metrics of these PFP projects is a testament to Yuga Labs’ mission about allowing the owners of the art to use it as a key to an exclusive club of sorts. Yuga Labs is well on its way to blowing through its PFP projects revenue goal for 2022 and the increased utility of these NFTs is just starting to take shape.

#2: Land Sales for the Otherside

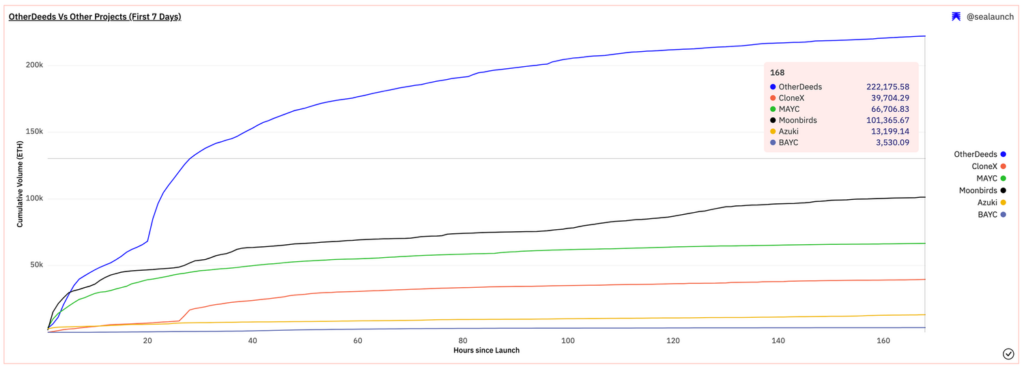

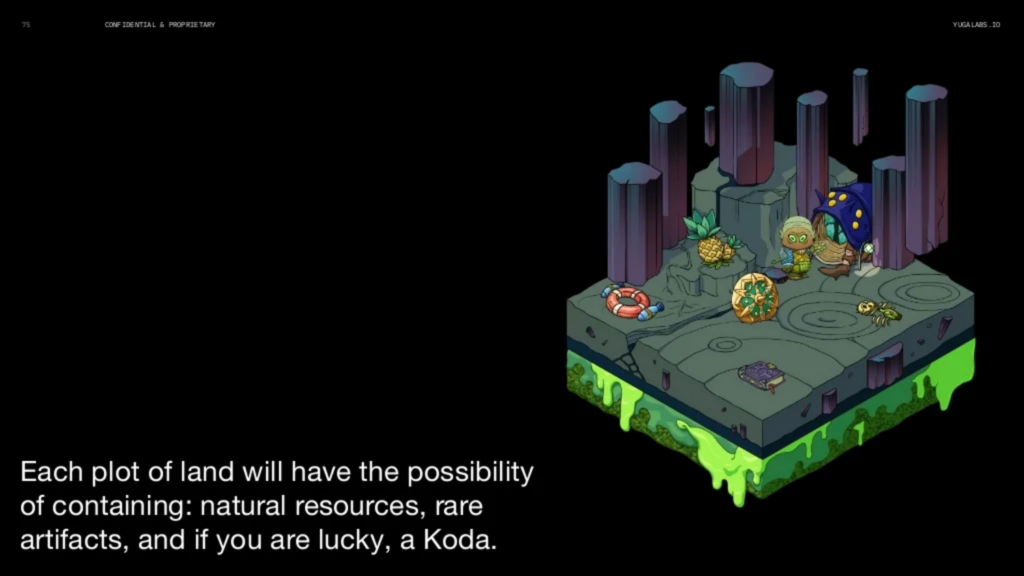

As previously mentioned, Otherside is Yuga Labs’ upcoming UGC-enabled metaverse play. While I will get into some more specific product details later, what’s important to know now is that this metaverse will be made up of different land plots (similar to The Sandbox), on top of which the various UGC experiences can live. Each of the land plots are called “Otherdeeds”, have special properties of their own, and were sold as portions of the eventual Otherside experience. Most importantly, these land sales are expected to contribute to ~70% of Yuga Labs’ $540M annual revenue goal.

As a quick primer on how the land sales work:

- There will be a total of 200K land plots

- The genesis drop, which happened on April 30 2022, sold 100K of those plots. The second drop (scheduled for August 2022) will sell the remaining 100K plots.

- Both sales are structured similarly:

- 10% will be set aside for BAYC holders

- 20% will be set aside for MAYC holders

- 15% will be set aside for the Otherside development team

- 55% will be available for sale with ApeCoin for all others interested

- In terms of revenue projections:

- Projected primary sales revenue is at ~$180M, while secondary sales revenue is at ~$11M

- Projected primary sales revenue is at ~$180M, while secondary sales revenue is at ~$8.5M

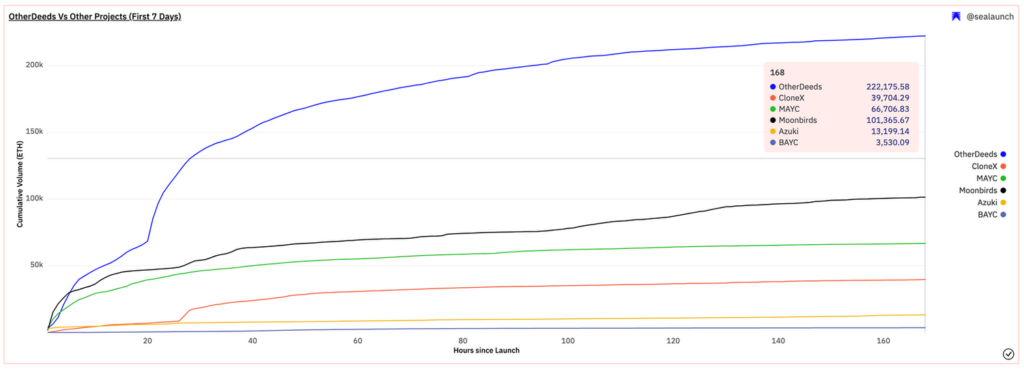

In terms of the first land sale’s performance, the ~$175M goal was far exceeded with Yuga Labs raising an additional ~$330M ($6,100 mint price * 55,000 land plots) through the Otherdeed mint — making it possibly the largest mint of an NFT project to date. To put that in context, OpenSea set a new daily trading volume record on Ethereum on mint day.

Further, the secondary market trading volume is just above $900M as of May 21st, 2022. Assuming BAYC’s take rate of 2.5% on secondary market sales for Otherdeeds, it would result in an additional $22.5M in revenue for Yuga Labs. Simply put, Otherdeed’s primary and secondary sales performance is hype-driven scarcity-based economics at its finest with Yuga Labs blowing past its first land sale mint revenue goals by almost a factor of 2! That already brings them to ~65% of their 2022 revenue goal.

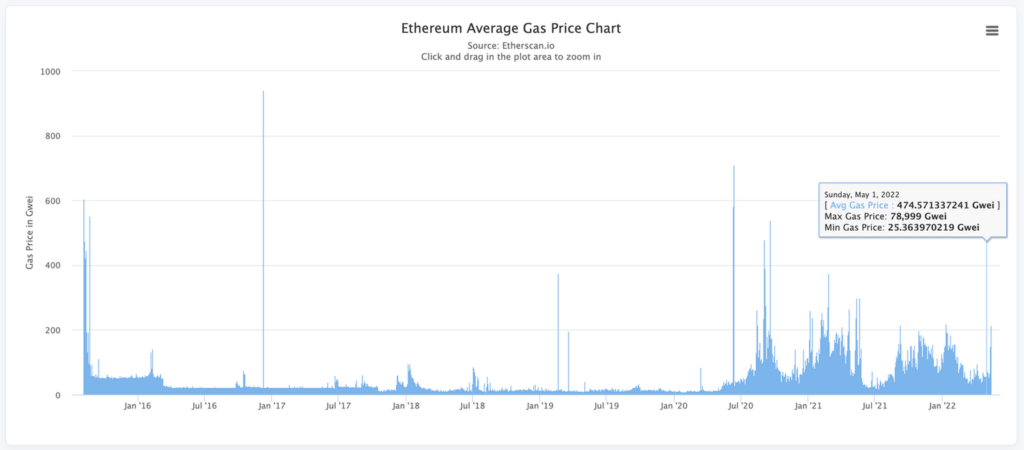

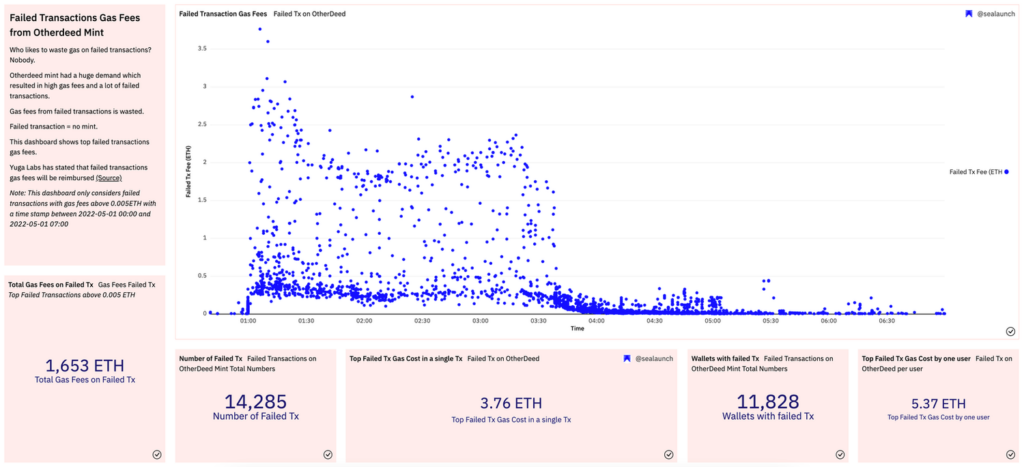

That said, the execution of the land sale was not as impressive, as it was accompanied by a host of technical issues and buyer complaints. On the technical side, the massive demand for Otherdeeds created a two-fold problem for the Ethereum-based sale. First, the steep rise in the volume of transactions led to a spike in the price of Ethereum gas fees, requiring people to spend around 2 ETH (approximately $6,000) in fees to mint, which was pretty much the mint price ($6,100) of a land plot. That resulted in more than $157M in ETH being burned in gas during the mint, temporarily driving transaction fees on the Ethereum blockchain to one of the top 10 spikes since 2015!

Second, many of the participants in the sale, not only missed out on the minting, but also lost ~1.7K ETH in the process due to the bottleneck in demand. In other words, of the $157M total gas fees paid, ~$4.7M (or ~3%) were essentially lost in failed transactions.

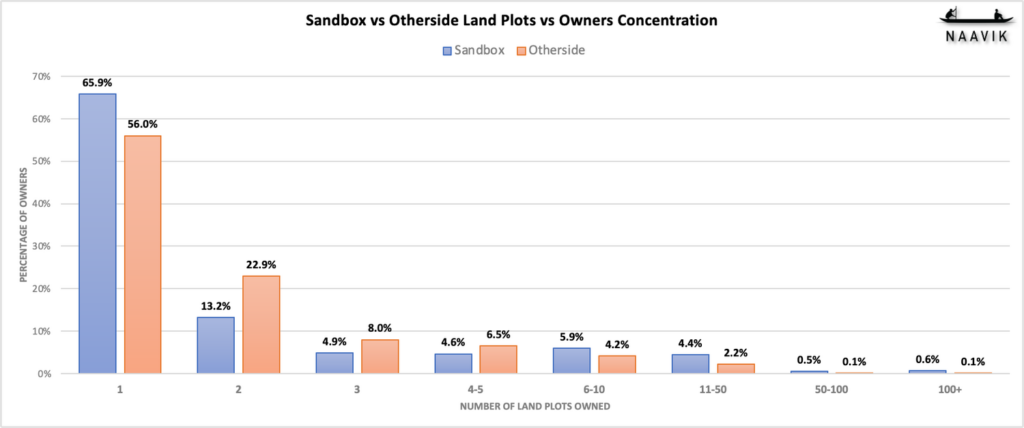

On the buyer complaints side and slightly related to people missing out on the sale, land ownership in the Otherside is a little more concentrated than the same in The Sandbox. For example, 65.9% of The Sandbox land owners own one plot of land, while it is 56% for the Otherside. Simply put, broader buyer access to the exclusive club just got more exclusive.

Also, some grumbling occurred amongst buyers about the “quality of land” that was offered to the public. According to CryptoFinally, it seems like the really good plots were being kept by insiders like existing BAYC/MAYC holders, while others were charged.

i wanted to participate in yuga, but one of the more fked up parts of otherdeed: non BAYCs who want to get involved paid for far shttier land, BAYCS got the only land worthwhile. yuga doesn't seem to show interest in decentralization outside the existing core group. priced out.— CryptoFinally (@CryptoFinally) May 2, 2022

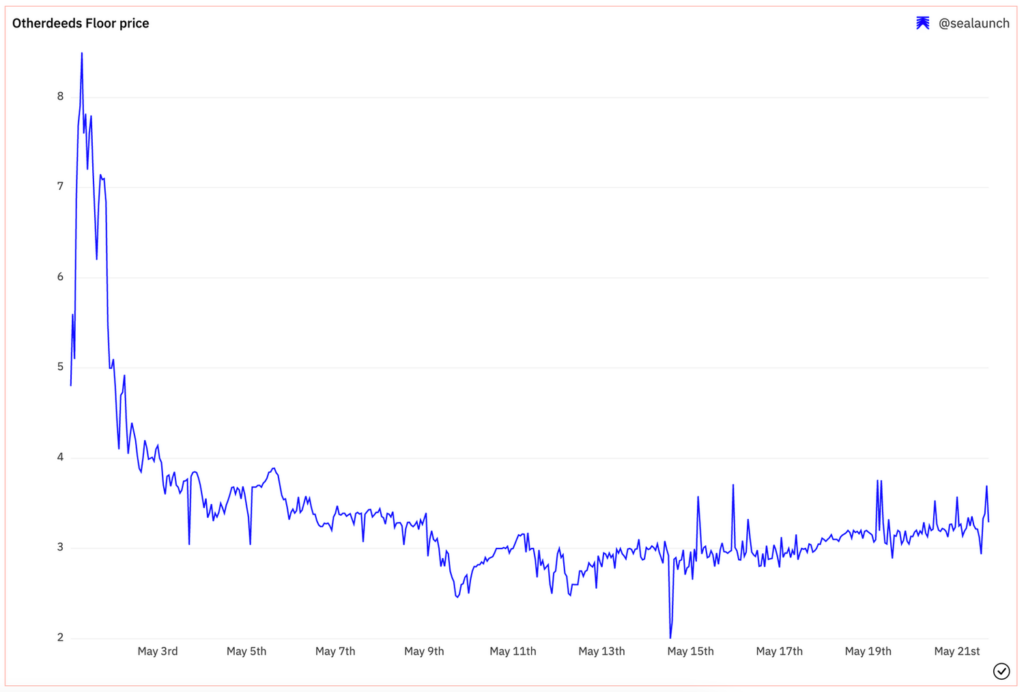

Since the first land mint, Yuga Labs has apologised for causing the Ethereum outage, refunded only 5% of the lost ETH, and announced that it is now “abundantly clear” to them that they need their own chain going forward (think Sky Mavis’ Ronin). The floor price of Otherdeeds is now at half of its original mint price (305 $APE or $6,100) and sluggishly trending upwards. It’s probably too early to say whether this is good or bad, since we are going through a crypto bear market and the Otherdeed market might just be resetting an exorbidantly high mint price. But the floor price is generally a good indicator of broader owner sentiment — especially when the value of the land being owned is defined by its virtual map location, property make up and future earning potential. And currently, it seems like early owners are okay with selling their Otherdeeds at a -50% loss and that’s not ideal.

All things considered, almost every issue in this botched land sale could have been foreseen. In other words, the way Yuga Labs handled this land sale does speak volumes to their execution abilities on their supposed home turf. And that in turn raises my eyebrows just a bit about how they’re going to handle building out the Otherside, especially when they’ve never built a game before.

#3: ApeCoin and its Ecosystem

As Yuga Labs puts it — “ApeCoin is an ERC-20 governance and utility token used within the APE ecosystem to empower a decentralized community building at the forefront of web3.” It launched on March 17, 2022 and has a total supply of 1 billion tokens, which will be fully in circulation over the next 4 years and is currently allocated in the following fashion:

As mentioned before, ApeCoin is designed to be the financial fabric running through the APE ecosystem, within which all of Yuga Labs’ projects (BAYC, MAYC, BAKC, Otherside etc.) and other 3rd party projects using ApeCoin live. To ensure ApeCoin’s ideal usage, there are two entities that manage and utilise ApeCoin:

#1 The APE Foundation: This functions as the base layer on which ApeCoin holders in the ApeCoin DAO (discussed next) can build, and its goal is to steward the growth and development of the APE ecosystem in a fair and inclusive way.

- It is tasked with inspecting the decisions of the ApeCoin DAO, and is responsible for day-to-day administration, bookkeeping, project management, and other tasks.

- It utilizes the Ecosystem Fund, which is controlled by a multisig wallet, to pay its expenses as directed by the ApeCoin DAO and provides an infrastructure for ApeCoin holders to collaborate through open and permissionless governance processes.

- The Foundation consists of a highly qualified and impressive administrative board (see below), which exists solely to oversee the decisions of the ApeCoin DAO, as well as a third party project management team in charge of ensuring ApeCoin DAO decisions are implemented. The initial Board will serve 6 months, after which DAO members will vote annually to keep existing or appoint new Board members. Board members can also be spontaneously removed if the DAO members vote in majority for it.

#2 The ApeCoin DAO: This functions as the decentralised governance layer of the APE system. It functions like any other DAO and is open to all ApeCoin holders. ApeCoin DAO members can make decisions regarding Ecosystem Fund allocations, governance rules, projects, partnerships, and beyond. Even though a DAO is a great way to give every ApeCoin holder a vote on important decisions, the reality is that today a DAO cannot sign a lease or hire people or make merch or whatever the community decides to do on its own. This is also why The APE Foundation exists as a legal entity to ensure that the DAO community’s ideas and decisions have the support they need to become a reality.

And finally, there are currently four key utilities for ApeCoin:

- Governance: Allowing ApeCoin holders to participate in ApeCoin DAO activities.

- Unification of Spend: Giving all its APE ecosystem participants a shared currency to trade value.

- Access: Providing access to certain parts of the ecosystem that are otherwise unavailable, such as exclusive games, merch, events, and services.

- Incentivization: Acting as a tool for third-party developers to participate in the APE ecosystem by incorporating APE into services, games, and other projects.

All the above can essentially be captured in the following APE ecosystem diagram:

Since its launch — and with 29% of its total supply in circulation as of this writing — ApeCoin’s market cap hasn’t significantly moved from where it started — currently at ~$2.3B. There was significant market cap appreciation just before the Otherside land sale occurred (since the land plots had to be purchased with ApeCoin), but it has since returned to its March launch levels.

Since there is not much one can do with ApeCoin at the moment, one way to interpret the above data is that there is no significant need felt by the broader market currently to buy or transact with ApeCoin. Even if that were true, ApeCoin is currently outperforming the entirety of blockchain gaming with a market cap rivalling those of Decentraland, The Sandbox and Axie Infinity.

Further, it is simply mind-boggling that ApeCoin’s fully diluted market cap currently sits at $8B! To put that in context, the fully diluted market cap of ApeCoin (a simple token with minimal utility) is currently higher than Ubisoft (~$6.2B), Square Enix (~$5.8B), Playtika (~$5.8B), Netmarble (~$5.2B) and CD Projekt (~$2.7B).

In my eyes, ApeCoin’s current valuation is simply too high for a token/project ecosystem that has nothing much to show for except a leaked pitch deck, hype-driven profile pictures, one successful land sale and the promise of a metaverse experience bar none. Simply put, all this underscores just how much of ApeCoin’s current value is heavily driven by speculation versus any tangible execution.

All in all, I’m quite confident that Yuga Labs will have no problem meeting, and possibly beating, its (potentially tactically conservative) 2022 revenue goals. And they will continue to use the hype they’ve built around their efforts to make that happen. But, the eye popping numbers above also showcase a pretty significant gap between market expectations and reality. The bar is really really high for Yuga Labs and it is but obvious that there is so much left to prove for them. The road ahead is going to be a long one.

Looking Ahead for Yuga Labs

Given what we know now, my key questions about the company’s future are threefold:

- Will The Otherside live up to its expectations?

- Will the “exclusive club” strategy hurt Yuga Labs longer term?

- What is the future of ApeCoin?

#1: Will the Otherside Live Up to its Expectations?

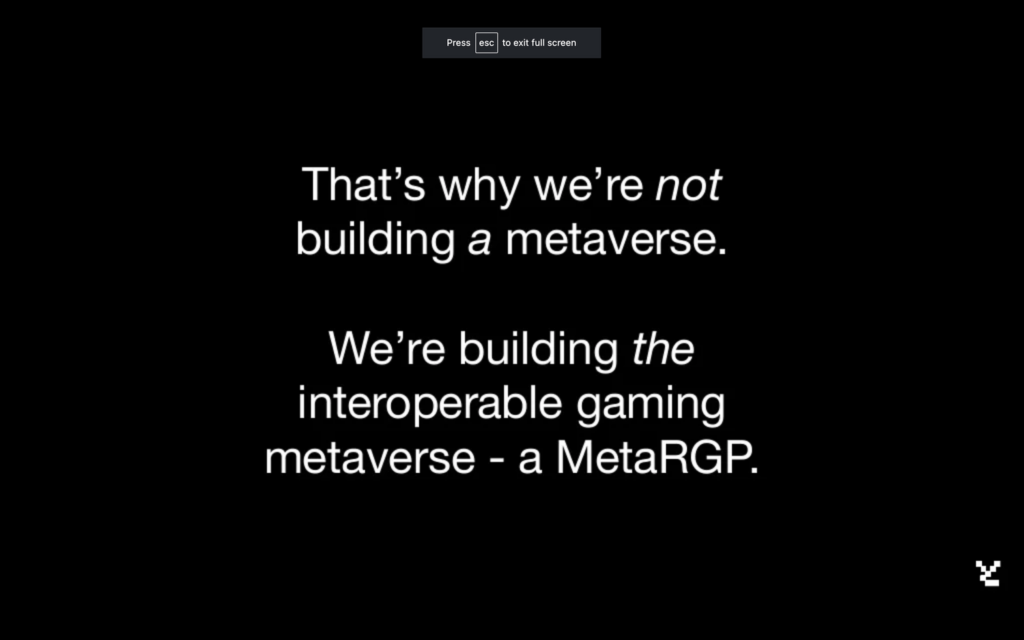

While details about the Otherside continue to remain scant, the above pictured vision can be broken out into some key facets as told by Yuga Labs -

- The MetaRPG will start with land sales, where each plot of land sold will correspond to real land in the game.

- Players will be able to convert their owned NFTs into in-game characters through a proprietary SDK, thereby allowing them to play as any Web3 persona (aka different PFPs) they want.

- It will be a massively live multiplayer experience, which looks and feels amazing!

- The economy will be on-chain with a robust primary and secondary sales market.

Further, and since Yuga Labs has partnered with Improbable to help build this interoperable gaming metaverse out, we can get some more insight from Improbable’s official announcement about the partnership:

“Yuga Labs and Improbable are partnering to make Otherside where the impossible happens. With the power of Improbable’s M² technology, 10,000+ players will be able to interact simultaneously in a single place, connect with natural voice chat (even in crowds of thousands), experience rich, immersive gameplay supported by AI and physics, and move between metaverses. Otherside players will break through barriers in scale, bandwidth and rendering as they create new types of gameplay and social possibilities…

If you like building your own stuff, you can do that too. Yuga Labs will offer an SDK that will allow creators to make things for the Otherside as well as sell them in the game’s marketplace – not just characters, but also outfits, tools, structures and even games.”

Finally, there is the Otherside hype trailer:

Based on all that and Otherside’s website, there are three key takeaways for me. First, it seems like the Otherside is going to be a Sandbox and/or Roblox and/or Minecraft competitor. Talk about being an underdog.

Second, Improbable isn’t a game studio through and through. They’ve rarely published their own games and mostly focussed on building out game engine compatible technology that can be licensed to actual game studios to build their games on — for example, Mediatonic built Fall Guys using Improbable’s SpatialOS technology. While this might indicate Yuga Labs’ mentioned SDK being built in the safe hands of Improbable, it raises a red flag for me around both teams being relatively inexperienced with building and shipping full fledged gaming products at the scale Yuga Labs is hoping for. Further, neither team seems to be amply experienced with designing and balancing on-chain token economies with live trading marketplaces. But maybe Animoca Brands will play a heavy role in both those areas eventually and help balance things out. It remains to be seen.

Third, players being able to convert owned NFTs and play as any Web3 persona in a massively multiplayer experience sounds like the beginnings of a potentially broader brand goals vs product vision mismatch. Playing as a Web3 persona requires the player to own a Web3 NFT, such as BAYC, MAYC, BAKC, CryptoPunks etc.. Not only are any of those NFT examples available in limited quantity, but they’re also extremely expensive. How does a company create a massively multiplayer experience if the entry tickets are choked in supply and additionally are extremely expensive to purchase? More on this in the next section.

All that said, competing against the likes of Roblox or Minecraft (or even Sandbox’s 350K MAUs) is not child’s play. Not only is it going to require massive audience expansion from Yuga Labs’ side, but also a host of other discovery, curatory, security and administrative services that existing UGC-experience incumbents have taken years to build and perfect will need to set up. Overall, I continue to remain skeptical, but it is still very early in Yuga Labs’ journey to make any concrete conclusions. In fact, their tech demo video looks pretty impressive, but Yuga Labs is no stranger to generating hype successfully either!

#2: Will the “Exclusive Club” Strategy Hurt Yuga Labs Longer-term?

The first step to answering this question is measuring Yuga Labs’ current audience reach. Here is what the current holder count for their various owned entities looks like:

- BAYC holders - 6.5K

- MAYC holders - 5.5K

- BAKC holders - 12.5K

- Otherdeed holders - 34.3K

- ApeCoin holders - 72.8K

Assuming every holder as unique (even though there is a 30% overlap between BAYC/MAYC/BAKC holders), Yuga Labs’ current acquired audience totals up to a mere 131,600! Needless to say, this a far cry from typical audience scale averages that usually justify a $4B company valuation.

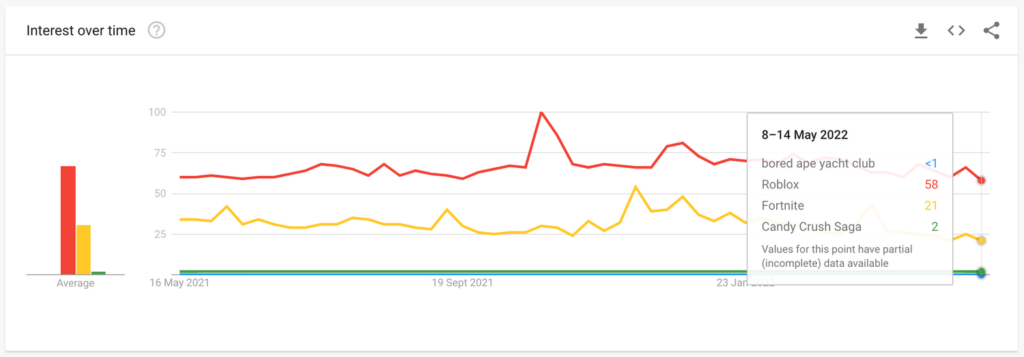

That said, there is a difference between how many people ARE IN the ecosystem versus how many KNOW ABOUT the ecosystem. Using Google Trends as our measure (US market, last 12 months) and Roblox, Fortnite and Candy Crush Saga as the comps, it is also clear that not as many as I would’ve hoped for either know about or are interested in knowing about BAYC, for example.

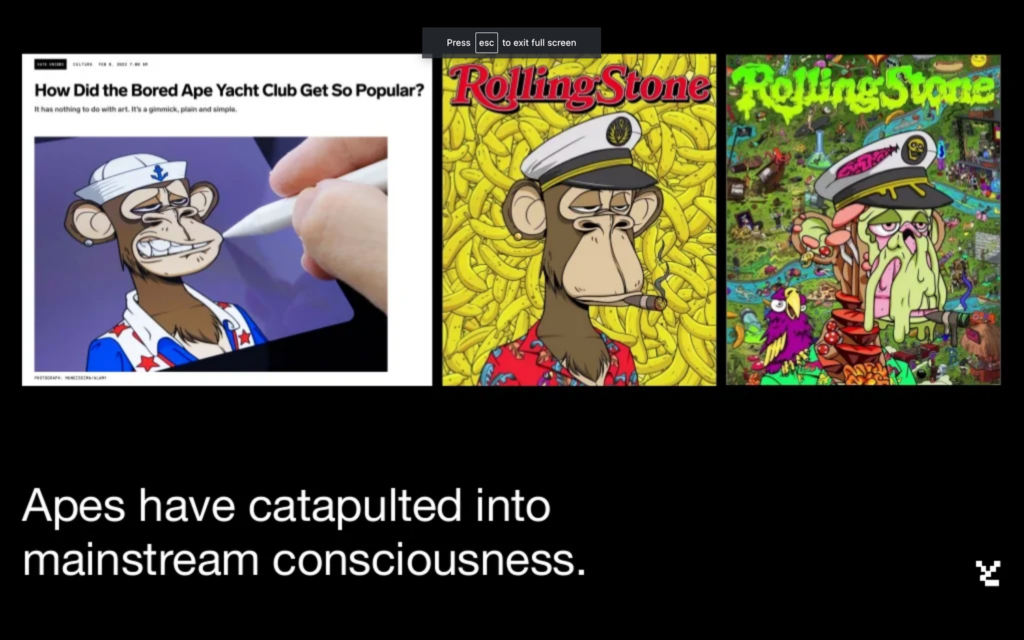

The tiny audience reach can be further seen in the download numbers of Yuga Labs’ first mobile game launch — Mutants vs Apes. Unfortunately, it only garnered a total of ~11K installs over its week of store availability. While it would be fair to say that Yuga Labs did not invest much into marketing the game’s availability and/or it was mostly marketed to BAYC/MAYC holders, 11K downloads for a brand that Yuga Labs claims to have “catapulted into mainstream consciousness” is criminally low.

Based on all the above, I’d critically question how mainstream Yuga Labs’ brands really even are, even though crypto Twitter might be singing a different tune. More broadly though, the lack of mainstream consciousness showcased above surfaces two critical issues.

First — The downside of every “exclusive club” strategy is that club members’ retention is initially built on a foundation that starts with scarcity, leading to hype, reinforcing scarcity, generating more hype and so on. This virtuous cycle can be significantly monetised when done right, but the foundation is fundamentally fragile. If nothing changes, not only does this foundation have a short half-life, but also the switching costs between different scarcity-driven hype trends is quite low - especially when your core audience consists of so many money-rich celebrities who want to stay on the bleeding edge of cultural trends to stay relevant (and potentially profit massively while doing so).

Don’t get me wrong — if scarcity did not exist in the real world, businesses won’t exist. And hype would not be able to be used as an effective business fire starter. But hype is not a long-term business strategy. The Web3 world mitigates this risk by building valuable and long-term utility in and around their hype-driven entities, and this is a core reason why Yuga Labs is going after the metaverse opportunity with the Otherside. But there arises the next issue.

Second — While BAYC might have decently high brand recognition (although not as big as the mega-brands), there’s a huge difference between mainstream recognition and mainstream participation. Mainstream recognition is what creates value around status (NFTs). Mainstream participation is what creates value around scaled activity (fungible tokens). Herein lies a potential brand goals versus product vision mismatch for Yuga Labs.

A core brand goal of Yuga Labs’ mission is to deliver on an exclusive club experience, while the larger product vision with the Otherside is to build a massively adopted metaverse experience. But can the two really coexist? If they prioritize the small/exclusive group, it doesn’t make sense to build entertainment products that usually need scale to be sustainable and justify the high cost of production to make something high quality. If they prioritize the large/mainstream group, then making something more sustainable and high quality is possible, but only at the expense of diluting down what makes the so-called exclusive group feel extra special and highly valued.

Said differently, even if the brand recognition is high, creating experiences that serve millions is just so fundamentally different from creating experiences that serve thousands. While I’m sure this line of thought has also occurred to Yuga Labs, their plans currently sound like they’re trying to have their cake and eat it too, wherein they’re confident about cracking the coexistence of exclusivity with mass adoption conundrum. That said, maybe this is why a key utility of ApeCoin is to provide “access” (to the masses?), but even that has a purchase barrier.

#3: What is the Future of ApeCoin and the APE Ecosystem?

As previously mentioned, ApeCoin currently stands at a fully diluted market cap of $8B — two-thirds of Unity’s and half of Roblox’s. As my friend and co-founder, Aaron, puts it - “APE’s value really is backed by nothing but hope at this point, nothing fundamental.” And like my other friend and colleague, Lars, previously analyzed with The Sandbox, the APE ecosystem is being priced as if it has already won big, when in fact it’s only getting started and it’s going to be a tougher road than many true believers might think. In short, the gap between expectations and reality is huge.

It might be too early to talk about the how ApeCoin and the broader APE ecosystem bridges that gap, but I believe most of it will come down to ApeCoin’s long-term intra-ecosystem utility, or in other words, how the Otherside enables ApeCoin’s utility longer term. Yuga Labs might also try to push ApeCoin utility through all the previously mentioned and mostly real world “exclusive club” benefits for ApeCoin holders, but this method will likely be a minor driver.

Currently, all we know is that ApeCoin will be the currency that powers the Otherside app store like marketplace. This can mean many things, but at the minimum ApeCoin (or some conversion of it) will be used to buy/sell virtual items on the Otherside marketplace. Therefore, there is again significant pressure for Yuga Labs to:

- Increase their audience to ensure a lively marketplace with tons of tradable items being bought and sold, which brings up the brand goals versus product mismatch topic

- Create a highly accessible and fully featured UGC SDK to allow this audience to successfully create virtual items they are proud of, which is a pretty significant undertaking in itself

- Provide a well rounded and well serviced UGC game experience, with an optimally balanced on-chain token economy that drives the demand-supply curve for these tradable virtual items in a highly profitable fashion for all stakeholders, which is.. well.. you know what I’m going to say

The other way Yuga Labs’ hopes for ApeCoin to accrue value is through inter-ecosystem utility, or in other words, third-party developers using ApeCoin to fuel their games too. This is currently being tested by Animoca Brands and through their previously F2P, now P2E game “Benji Bananas”. From Animoca Brands’ official announcement: “PRIMATE is the core of the play-to-earn system being added to Benji Bananas. Players will be able to earn PRIMATE Tokens by playing the game while holding a Benji Bananas Membership Pass NFT. PRIMATE Tokens will be swappable for ApeCoin, as well as fungible tokens in the Animoca Brands ecosystem including REVV, TOWER, GMEE, QUIDD and PROS.”

There are few potential upsides of this strategy:

- Players can play a variety of games outside of the Otherside experience to earn ApeCoin (through a token swap). That reduces the pressure on the Otherside to host all definitions of fun gaming experiences within its UGC experience.

- Players of other games will be primed about ApeCoin, and therefore it doubles up as an indirect user acquisition channel for the Otherside.

- Players can move their owned assets/earnings between games, and cut their losses. For example, if one ever gets bored of playing Benji Bananas, they could choose to swap their PRIMATE tokens into ApeCoin tokens and start playing the Otherside instead.

While this idea is not novel (since token swaps are not novel), it is good to see Yuga Labs thinking about increasing the footprint of ApeCoin in such a way. That said, the big downside of this idea is that players will only swap their other game tokens to ApeCoin when it is worth it, which will mostly be driven by how the Otherside enables ApeCoin’s value. Therefore, it still comes down Yuga Labs being able to ensure a healthy and massively adopted open economy, and a robust value accrual model to ApeCoin contained within the Otherside.

Finally, it is worth noting that not all parts of the ecosystem may win evenly. Yuga Labs’ value, which currently hinges on NFT sales, might be better positioned than that of the APE ecosystem’s for instance, which hinges on scaled participation in wide ranging experiences that don’t exist yet.

Closing Thoughts

What Yuga Labs wants to build is ambitious to say the least. In many ways, it feels like the holy grail of every buzzword Web3 promises us — exclusivity, community, utility, ownership, interoperability, provenance, metaverse… I can go on. At the same time, there are many big open question marks -

- Can Yuga Labs deliver (at quality) on their highly ambitious 2022 roadmap?

- Until the Otherside releases, can they increase the longevity of their currently primary revenue line (NFT sales)?

- How quickly can they migrate to a new chain that doesn’t have the scalability constraints of Ethereum that puts their next land sale at risk?

- Do they have the right game development partners to help build out the Otherside in the best possible fashion?

- Are they flying too close to the sun given the currently huge gap between expectations and reality with regards to what the APE ecosystem promises to be?

- Are they currently facing a brand goals vs product mismatch, and if not, how will they make extreme exclusivity coexist with mass adoption within a single product/ecosystem?

If I was to recommend one takeaway for game developers from this article, it would be this - Web3’s game development and operating model is one that is easy to generate hype in, but those promises made to players will eventually need to be kept and so one should tread carefully. While I do applaud the high goals Yuga Labs has set for itself, ideas are a dime a dozen (especially in Web3’s current climate) and execution is what ultimately separates lofty dreams from reality. It is one thing to successfully launch and (supposedly) permeate mainstream culture with a NFT PFP project. Building an honestly fun game with a long-term sustainable, open on-chain token economy, interoperable NFTs, and an open world experience powered by a full-fledged UGC creation SDK is an entirely different thing.