Last week, Disney announced it had bought a $1.5B stake in Epic Games, and that the two companies will develop a Disney universe within Fortnite.

CEO Bob Iger says it's Disney's "biggest entry ever into the world of games." Considering the $1.5B investment, he is technically correct – however, the Disney game business has existed for over 30 years.

Disney’s On-and-Off Relationship With Games

Disney is notorious for its back-and-forth between internal development and licensing business models. Iger may or may not have done the math, but the company’s cumulative investment in games must run into the double-digit billions.

Disney's game business started as Walt Disney Computer Software in 1988. Its early successes include licensed console games such as DuckTales (1989). Later, Disney got its in-house animators to contribute to platformers like Aladdin (1992) and Lion King (1994).

In the mid-2000s, Disney got into internal game development and went on an acquisition spree from 2005–2007, buying up, among others, Propaganda Games (known for modern Turok games), Avalanche Software (developer of toys-to-life series Disney Infinity), Black Rock Studio (known for MotoGP), Junction Point Studios (dropped its internal game to work on Epic Mickey) and New Horizon (Club Penguin).

Disney dabbled in everything from AAA action platformers to casual mobile games; it even operated multiple virtual worlds. It also invested heavily in its toys-to-life dream Disney Infinity, which never turned a profit.

By 2016, what then was Disney Interactive Studios had been dissolved, all developers were laid off, and Disney had reverted to the licensing-only model. (Happily, Avalanche was reestablished under Warner Bros. in 2017, redeeming itself by developing one of the biggest games of 2023, Hogwarts Legacy.)

The Predictable Collaboration

Disney's statement on Epic is ripe with buzzwords from "entertainment universe" to "interoperating," but concrete details on the collaboration are scarce. It did hint at a Disneyland-esque digital experience, though.

One can only assume the product will follow in Lego Fortnite’s footsteps: a game within a game, like Fortnite Festival (a rhythm game from Rock Band creator Harmonix) and Rocket Racing (a racing game from Rocket League maker Psyonix).

Depending on whom you ask, Lego Fortnite is either yet another Lego crossover game or a taste of things to come in Epic’s pursuit of a walled-garden metaverse. Lego has also invested in Epic, announcing a partnership and a $2B investment from Lego-affiliated KIRKBI and Sony in April 2022. Lego Fortnite was released 20 months later, in December 2023.

The Disney-Epic partnership is a no-brainer collaboration: Epic gets more premium content in Fortnite, and Disney can write "metaverse" on investor slides without engaging again in risky and costly development. (Disney laid off its metaverse division last year.)

Why the Investment Matters

According to The Information, Disney’s investment was made at a $22.5B valuation, giving the entertainment conglomerate a 9% stake in Epic. In April 2022, Epic was valued at $31.5B, marking a 29% valuation drop since then.

It's a significant enough stake to consider Epic married to Disney, and it's unlikely that a single Disney Fortnite game will be the last we see of this partnership. It’s also worth considering Epic's role in challenging Apple and Google's platform duopoly now that the fight is silently supported by Sony and Disney, both with their own mobile ambitions.

Finally, Epic’s platform play with Fortnite and Unreal Editor for Fortnite (UEFN) is now supported by the Disney, Sony, and Lego IPs - a claim that one of Epic’s closest competitors, Roblox, cannot make.

A Word from Our Sponsor: RALLYHERE

Backend Platform Trusted by Over 200 Million Gamers Worldwide

Already trusted by over 200 million gamers worldwide, RallyHere is the Gaming Backend Platform and Service founded by the makers of SMITE, Paladins, and Rogue Company. With over 20 years of experience, our veteran teams have successfully built, launched and grown cross-platform live-service games.

Game developers leverage RallyHere's expertise and tooling, covering matchmaking, cross-platform accounts, server optimization and orchestration, real-time live ops management, player progression, and community engagement, to streamline their development processes, increase speed to market, and maximize their resources.

Want to know how RallyHere can help you with your live service game?

Game of the Week: Command & Conquer: Legions

By Jordan Phang, Naavik Consulting Partner

- Developer: YoRha Studios

- Publisher: Level Infinite

- Platform: Mobile

- Status: Soft launch (Philippines, France, Canada, Australia, Mexico, Spain, New Zealand, Singapore, Luxembourg)

- Genre: 4X

- Gameplay: Link

What Is It?

Legions is a 4X game that uses EA’s Command & Conquer IP, but make no mistake, it is an odd fit: It looks and sounds like the C&C game at first, but it quickly reveals its mobile 4X core.

Legions is a good mobile 4X game with three fully fleshed-out "minigames" in its skirmish modes:

- Mech Fury: A Vampire Survivors clone with multiple mechs to choose from and upgrade.

- Global Conquest: Real-time tactical battles, kind of like the non-base building missions in the C&C games of old.

- Core Battlefield: PVP team battles with rankings.

There are references to characters from the C&C IP, like Kane, but it does not feel like a C&C game. Where are the over-the-top storylines, campy characters, and the so-serious-it's-funny vibes?

Instead, Legions feels sterile and by-the-numbers. For example, the officers (troop commanders) look like generic "cool" heroes you might find in a shooter like Apex Legends or Valorant.

How Is It Doing?

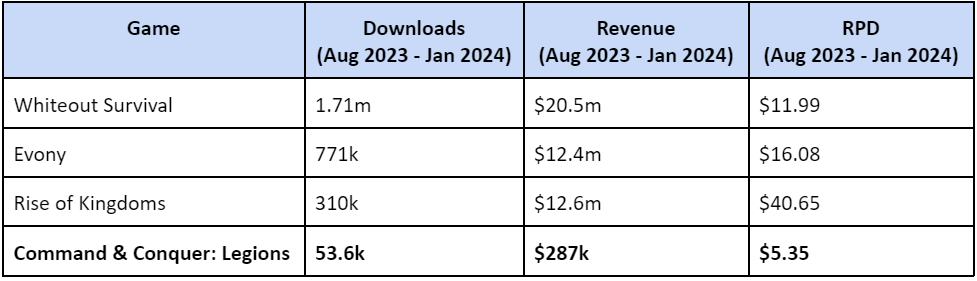

It’s still in soft launch, so take the metrics with a pinch of salt. Still, the table below shows downloads, revenue, and RPD from August 2023 to January 2024 for the four Tier 1 countries in its soft launch list (Australia, France, Canada, and Singapore). We can see it is significantly underperforming against its rivals.

Given the CPIs for 4X are some of the highest in the industry, the game has an uphill battle to global launch.

Does the IP Help or Hinder?

As we’ve seen with Monopoly Go and Marvel Snap, games that respectfully integrate the IP and can keep the flavor of what made those IPs popular in the first place can see great success.

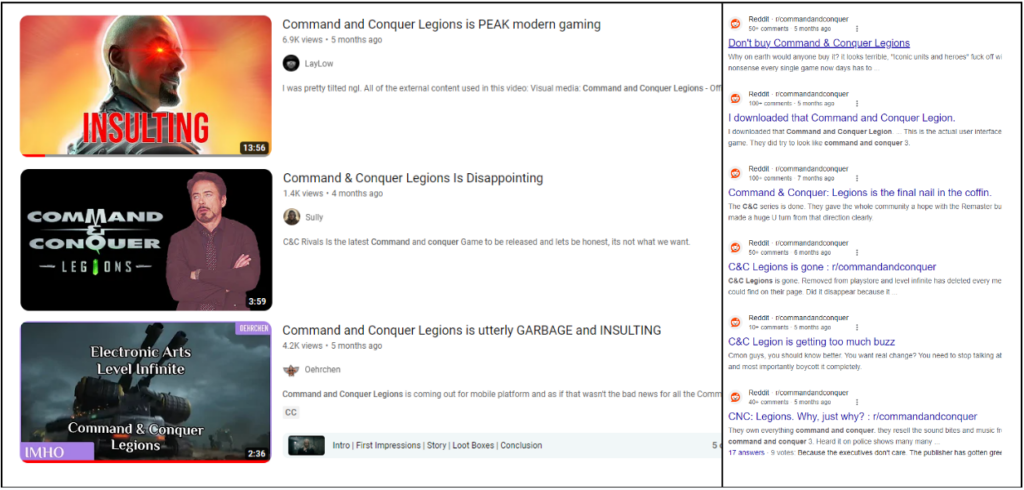

However, this isn’t one of those. It’s a skin-deep paint-over that can be seen a mile away. In this interview, the CEO of YoRha Studios Sidney Tang says the developer’s goal is to maintain the original feel of the IP. Unfortunately, players don’t agree.

The huge mismatch with audience expectations has even spread to its marketing materials, with the post below on X (formerly Twitter), highlighting the importance of acquiring speedups (a standard monetization lever for the genre).

That failure to capture the essence of the IP, along with some tone-deaf marketing to a pay-to-win-adverse Western audience, means that this may be another failed C&C mobile game after 2018’s disastrous Command & Conquer: Rivals.

Our Investment Support Services

Over the past few years, we’ve had the privilege of supporting several great investment firms in and around gaming. Our team, which is deeply experienced and uniquely positioned at the cross-section of gaming, technology, and finance, is available to provide market and investment research, due diligence, and advisory support. Here is what one of our clients had to say.

“The gaming industry's complexity, marked by its diverse audiences, products, platforms, and business models, requires relevant and current insights. Naavik's research has been instrumental for our team, keeping us up-to-date on various trends and developments across the entire vast playing field.”

- Juha Lindell, Director of Platform at Play Ventures

If you’d like to learn more, reach out here! Also check out our expanded consulting service portfolio here.