Hi Everyone. If you missed last edition, we examined the divergent approaches and attitudes of Minecraft and Square Enix toward NFTs. Check it out and let us know what you think.

This Week on The Metacast

Drawing The Ethical Line For Misleading Ads — Anthony Pecorella, David Amor and Tim Mannveille, join Maria Gillies to discuss:

-

Web Forums vs Discord Social Hubs: Are web forums a thing of the past?

-

Misleading Ads: Should misleading UA ads be incentivized?

-

Polygon Announces zkEVM: What does the new tech bring to blockchain game development?

-

UK Government Loot Boxes Self-Regulation: Can the games industry self-regulate?

You can find us on YouTube, Spotify, Apple Podcasts, Google Podcasts, YouTube, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: Speed Bumps In the Console Market

Source: The Verge

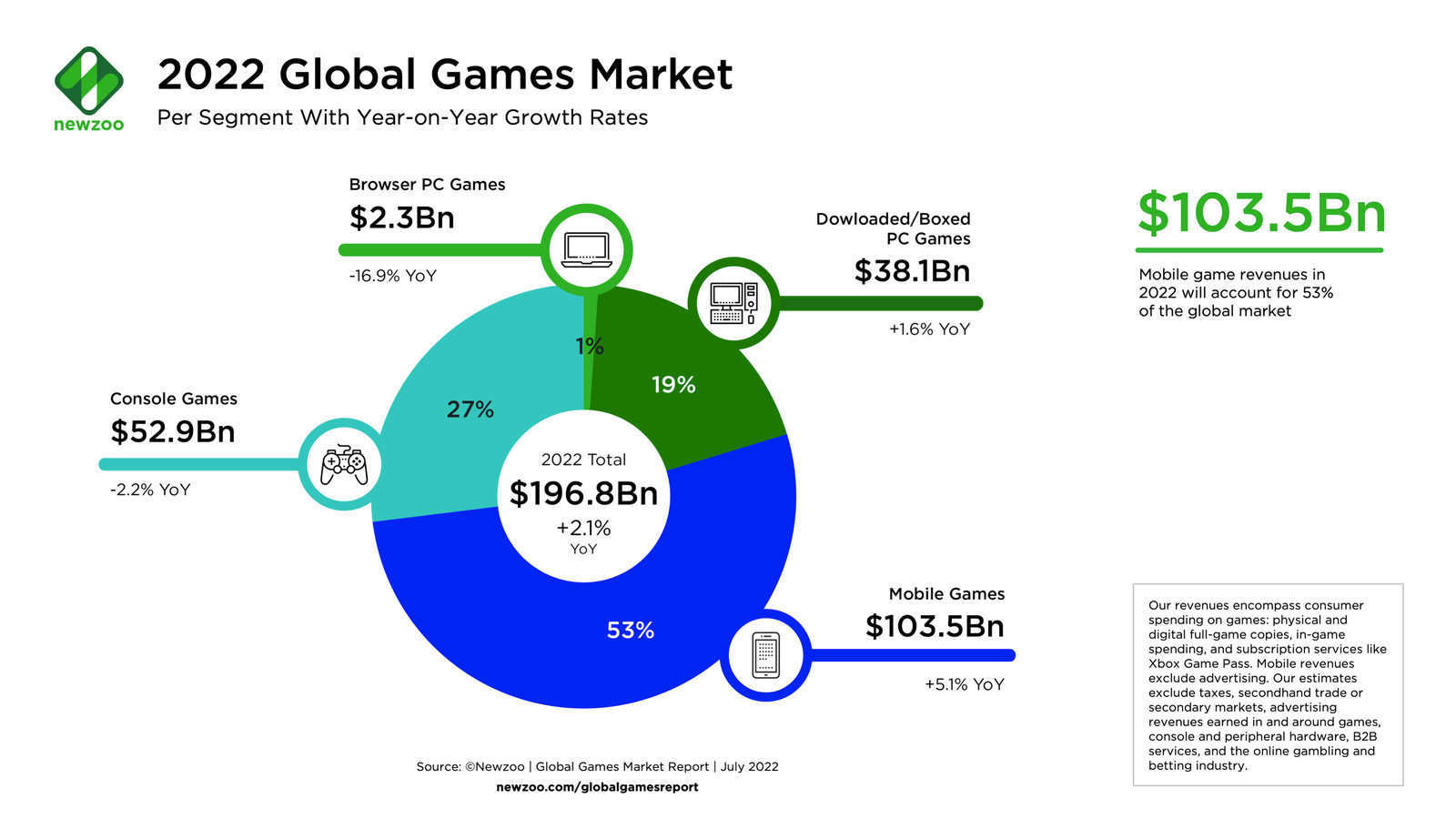

In Newzoo’s latest global games market forecast for 2022, the team predicted that even though the overall market will slightly grow this year, console gaming is the weakest corner and will see a slight decline. You can see this in the image below.

Source: Newzoo

Xbox and Playstation, whose parent companies recently reported earnings, point to similar trends. But before diving into specifics, it’s important to acknowledge the obvious.

For one, much of the industry is seeing tough engagement comps as post-COVID normalization plays out globally. Second, there’s been a dearth of blockbuster releases in recent months — also partially due to COVID-induced delays. For example, according to NPD data, did you know that Elden Ring has been the top selling US console/PC game every month since it released in February (except when it briefly dipped to #2 in April)? Yes, Elden Ring is incredible, but it’s also a sign of fewer competing hits. And, third, there continues to be supply constraints on new consoles (namely chips), which invariably weakens overall demand for games.

Xbox’s results in Microsoft’s recent Q4 earnings release back up this view. Xbox hardware and content / service sales declined 11% and 6% year-over-year, respectively, pushing Microsoft’s gaming revenue as a whole down 7%. The team saw decreased engagement, which naturally led to weaker monetization (in first and third party games) — despite growth in Xbox Game Pass. It also recently pushed its two main 2022 first party releases — Starfield and Redfall — to 2023.

Perhaps the best segue to PlayStation is to actually mention that — despite it being clear that the PS5 will win this console generation in terms of units sold — “next-gen” Xbox consoles have actually outsold the PS5 in North America for three quarters in a row. Sure, Game Pass helps, but in reality this shows just how supply constrained PS5s have been. Last quarter, Sony’s management felt optimistic and raised its forecast of 2022 PS5 sales to 18M (it sold 11.5M in 2021); however, this quarter it only sold 2.4M units (compared to 2.3M this quarter last year), so the company has its work cut out for it if it hopes to still meet that target. Additionally, and similar to Xbox, PlayStation saw quarterly “Game & Network Services” revenue dip 2% year-over-year — also caused by decreased first and third party sales (lower than any quarter in fiscal 2021) and a mild sequential dip in PlayStation Plus subscribers. Management is slightly lowering PlayStation’s 2022 sales forecasts as a result.

This all sounds negative, but there are two silver linings.

First, Xbox’s and PlayStation’s long-term strategies remain unchanged. Xbox continues to build towards a Game Pass-centric future, has more studios than ever making first party games, and is waiting for regulatory approval on the mega-Activision Blizzard deal. And PlayStation also continues to heavily invest — organically and via M&A (most recently Bungie) — in more first party content than ever, while adding new tiers to its own subscription model (which hopefully we’ll learn more about the early results later this year). Sony is also heavily invested in gaming-related partners like Epic Games and Discord, and is pursuing transmedia opportunities across its business.

Second, much of this decline is driven by lacking supply, not lacking demand. If consoles could be manufactured faster and AAA games released faster, I believe these results wouldn’t be as bad. There is a case for optimism. Not only are there signs that chip shortages may ease by the holidays, but, macroeconomic weakness or not, there’s unwaveringly strong demand for next-gen consoles and incredible AAA games. If anything, previous recessions should prove the point that the console market can perform well even in hard times. The rebound from these weak results is coming.

When it comes to Xbox, PlayStation, and the broader console market, we may see tough comps as supply races to catch up to demand (for perhaps another quarter); however, the long-term upward trajectory is clear. Demand will drive growth, and both companies’ strategies will serve them well in the coming years. PlayStation’s playbook to do more of what it’s done in the past remains the most obvious, but even Xbox with Game Pass is poised to do well, especially as (and if!) AAA releases continue to trickle onto the service. Don’t overlook the forest for the trees. (Written by Aaron Bush)

#2: Weekly News Roundup

Source: Capcom

Capcom Earnings: Given tough comps from last year, Capcom missed earnings and reported a 48% decline in net sales ($184M). That being said, there are bright spots: the Monster Hunter franchise continues to sell well, with the newest expansion Sunbreak surpassing 2.5M units; in a move to expand their IP, the Resident Evil live action series started streaming on Netflix; and, Capcom has other major IP like Mega Man, Devil May Cry, and Street Fighter. As we mentioned in the PlayStation / Xbox blurb above, the story of AAA publishers will be one of supply — the strategy moving forward for Capcom will be to launch new games and experiences around its IP. I had previously written: “Capcom is entering the next quarter from a position of strength and growth, having demonstrated that its IP is resilient and able to expand. There are rumors of a Resident Evil 4 remake and a new Street Fighter in the works, but more so, Capcom has an increased focus on bringing this IP across mediums.” They’ll be able to execute on this with time, but in the meantime, short-term earnings will continue to take a hit.

Google and Apple Continue To Make Serious Moves In Ads: Starting September 30th, 2022, Google will ban interstitial ads to have a better ads experience. From a Techcrunch article: “In-game ads can be annoying and Google wants to improve on that. This policy will prohibit any full-screen ads that are not closable after 15 seconds. Opt-in ads, like the kind that provide in-game rewards when watched, can exceed these time limits. The company is prohibiting full-screen interstitial ads that appear before the app’s loading screen, when you start a level or during the gameplay, too.” In addition to this news, Apple is rumored to be updating search ads, helping developers promote their content on the App Store. The takeaways here are very much around the fact that platforms hold the power for more superior consumer experiences and advertising — games developers are left to adapt to these changes, be it from IDFA or otherwise. The changes pose fresh challenges for game developers to solve for, and we’ll discuss the challenges and opportunities in more depth in this week's Naavik Pro issue.”

🎮In Other News…

💸Funding & Acquisitions:

-

Players’ Lounge raised $10.5M for prize-based gaming in a round led by GGP. Link

-

Mighty Bear Games raised $10M through a token sale. Link

-

Magicave announced a $6.4M raise led by BITKRAFT and Fabric to build the next generation of digital toys. Link

📊Business:

-

Axie Infinity’s CEO apparently moved tokens before the reveal of the hack, according to Bloomberg. Link

-

“Google announced new Play Store policies around intrusive ads, impersonation and more”. Link

-

It’s rumored that Apple will also launch new App Store ads. Link

-

A metaverse consortium for web3 launched (reminiscent of the metaverse standards forum). Link

-

Meta will increase the price of the Meta Quest 2 by $100. Link

-

FTC sues to block Meta’s acquisition of the VR company, Within. Link

-

Top Switch eShop games for the first half of 2022. Link

🕹Culture & Games:

-

India blocked BGMI from the Play Store. Link

-

PlayStation and Backbone teamed up on an officially licensed controller. Link

-

Roblox removed its “oof” sounds from the avatar shop. Link

-

Star Wars Knights of the Republic has been delayed. Link

👾Miscellaneous Musings:

-

One third of CoD Mobile players also play Candy Crush Saga. Link

-

Newzoo’s global games market report. Link

-

If indie games are underreported, mobile games must be invisible. Link

🔥Featured Jobs

-

Discord: Manager, Strategic Revenue Finance (San Francisco, CA)

-

Hidden Leaf Games: Product Manager (Remote)

-

Naavik: Content Contributor (Remote)

-

Naavik: Games Industry Consultant (Remote)