Hi Everyone. If you missed last edition, we shared a mini deep-dive on Roblox studios’ unit economics, examining if they are viable venture-scale models. Check it out and let us know what you think!

This Week on The Metacast

BreederDAO: The Factory of the Metaverse — On this week’s Crypto Corner, BreederDAO Cofounder and CEO Renz Chong joins Nico Vereecke for a no-nonsense discussion about Play-to-Earn/Play-and-earn, inter-game arbitrage, NFT-based Breeding Ponzi’s and the future of the Web3 Metaverse.

You can find us on YouTube, Spotify, Apple Podcasts, Google Podcasts, YouTube, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: Two Divergent Approaches to Blockchain Gaming

Source(s): Mobidictum | WaPo

In what may be a preview of divergent industry-wide movements to come, Square-Enix and Microsoft both made headlines last week by sharing updates on their respective approaches to web3 and blockchain gaming.

Square-Enix continued its strategic pivot toward web3 with its announcement that it would release a collection of NFTs to celebrate the 25th anniversary of Final Fantasy VII. Beginning in 2023, the company will release a series of physical trading card packs that each come with a redemption code for a digital NFT trading card. Later in the year, it will follow that up by releasing a physical figurine of Cloud Strife (the protagonist of Final Fantasy VII) that comes with an NFT certificate of authenticity (as well as a 3D replica NFT, if you buy the “Digital Plus Edition”).

The company is no stranger to web3 at this point, having made clear its intent to explore blockchain integrations in President Yosuke Matsuda’s New Year’s Letter to shareholders. Other recent moves include an investment announced just last week in blockchain payments company Zebedee, as well as prior investments in The Sandbox and the introduction of its Dungeon Siege franchise to The Sandbox.

This particular integration represents, in my opinion, a cautious step in the direction of “decentralized gaming”, as Matsuda-san puts it, rather than a definitive plan of action. Certificates of authenticity and 3D replicas are much closer to digital facsimiles of Square-Enix’s existing merchandise business than they are to, say, play-to-earn gaming. While the NFT trading cards may eventually turn into a larger game (Triple Triad, anyone?), the company has largely left their options open with this latest announcement.

This circumspection is understandable given the importance of the Final Fantasy franchise to Square-Enix. More ambitious undertakings, such as those that might appeal to the “play-to-contribute” UGC audience (also referenced in the New Year’s Letter), are left for the lesser-known franchises to figure out. The aforementioned Dungeon Siege collaboration with Sandbox is a perfect example of this.

Powering Square-Enix's announced moves is a partnership with Enjin and its Efinity product. Billed as a “scalable, decentralized, cross-chain network designed to bring NFTs to everyone”, Efinity will host the forthcoming Final Fantasy collectibles. This is not Square-Enix’s first collaboration with Enjin either, having previously worked with the company on website hosting for Final Fantasy XIV guilds.

Beyond Square-Enix, Enjin has a variety of other gaming projects operating within its ecosystem. Most notable among these is a partnership with Microsoft on its Azure Heroes digital badge rewards program. This initiative, designed to “inspire developers to learn, coach, and build on Azure and promote healthy, inclusive communities”, was used as recently as February to promote a series of limited edition Minecraft NFTs celebrating women and girls in science.

This, of course, is made all the more ironic by the aforementioned announcement from Microsoft.

Despite its previous foray into web3, Microsoft and Mojang have recently changed course, announcing a ban on the use of NFTs and blockchain technology within Minecraft. The companies stated in a blog post that “NFTs are not inclusive of all our community and create a scenario of the haves and the have-nots.”

This comes as especially bad news to the variety of NFT projects already building on top of Minecraft, such as NFT Worlds, a project that has generated upwards of $75 million in total transaction volume. Following the announcement, the floor price of NFT Worlds plummeted more than 50%. The team behind NFT Worlds have since announced their intention to pivot, should attempts at dialogue with Microsoft prove fruitless.

One can’t help but wonder what might have changed between February and last week to prompt this decision by Microsoft. Perhaps the initial experiments with Enjin performed poorly, or maybe Microsoft is responding to the loud anti-crypto backlash among gamers?

To be fair, Mojang and Microsoft have a prerogative to protect and shape the third-party ecosystem around Minecraft as they see fit. Minecraft is not a trustless protocol, and Microsoft did not seek out integrations with NFT Worlds and other Minecraft-based projects. The company had to respond to these external forces. It should also be noted that Minecraft hasn’t shut the door on web3 entirely, stating that it will “be paying close attention to how blockchain technology evolves over time”.

Whatever the case, these two approaches to web3 (Square-Enix’s embrace and Microsoft’s pivot away) may be indicative of an industry-wide fracturing to come. I suspect that we will continue to hear more stories like these coming from large publishers.

Blockchain gaming represents a classic Innovator’s Dilemma for most incumbents, with far more downside than upside in the short term. This is especially true for firms like Activision-Blizzard, Take-Two, and EA that are already under the microscope from players and regulators alike for their monetization practices. Anti-blockchain sentiment will only make this transition more difficult for these publishers.

On the other hand, it has largely been the Asian publishers (with the exception of those in China, where cryptocurrencies are banned) that have embraced web3 experimentation early. Netmarble, Nexon, Krafton, NCSoft, and (most prominently) Animoca Brands are among the many Asia-based publishers joining Square-Enix in making large investments in blockchain gaming. Even venerable Nintendo has expressed interest in exploring the Metaverse, and rival Sony has invested billions into Epic Games (one of the few Western gaming giants to not turn its nose up at web3).

Should blockchain gaming eventually take hold among gamers at large, I believe that it will be these Asian publishers that reap the early rewards. We have seen previously during the evolution of mobile free-to-play gaming that Asian developers have been ahead of the curve in adopting novel monetization mechanics. Gacha systems, VIP programs, and other monetization features that Western audiences might perceive as overly aggressive have been (and continue to be) the norm among Asian mobile games. Given the popularity of web3 in places like South Korea, the Philippines, Singapore, Vietnam, and Thailand (among other Asian markets), I see no reason to believe this trend won’t continue.

As a result, Western companies will again be late to the party, eventually opting to acquire talented web3 studios rather than organically develop internal capabilities. Upstart Western firms with AAA pedigrees, such as Mythical Games, Dapper Labs, or Forte, may be among the first to get snatched up as incumbents try to catch up. This is all speculation, of course…but in a recessionary macro environment, can any publisher afford to miss the next wave of innovation? (Written by Matt Dion)

#2: Apex Legends Mobile: Fighting the Competition

Source: Apex Legends Mobile

This is the introduction to a full game deconstruction of Apex Legends Mobile, written by Niek Tuerlings. Check out Naavik Pro to request a demo, read the full write-up, and access our entire research library.

Having been acquired by Electronic Arts in December 2017, the new subsidiary, Respawn Entertainment, probably pitched Apex Legends to management shortly after, which must have sounded something like “Battle Royale featuring Overwatch-esque heroes.” Apparently after some convincing, they agreed to go forward with the development of the game for PC and console.

Years later, all respectable Battle Royale games have been ported to or developed for mobile, and EA is among the last to join the party by releasing Apex Legends Mobile (ALM). It’s not a port featuring cross-play with PC and console like Fortnite but a dedicated experience for smartphones, similar to its direct competitors.

First, let’s set some things straight. Throughout this article we’ll be comparing Apex Legends Mobile (ALM) with some or all of these competitors: Call of Duty Mobile (CoDM), PUBG Mobile (PUBGM) and Garena Free Fire (GFF), depending on the relevance of the comparison.

Here’s a quick overview on who’s behind each of these games:

ALM was developed by Tencent’s Lightspeed & Quantum Studios, which also developed PUBGM in 4 months back in 2018. Therefore, any link or comparison to PUBGM’s gameplay is logical and will therefore be less of a focus throughout this piece. The difference is that PUBGM was published by Tencent as well, while ALM has been published by Electronic Arts and was co-developed “under supervision” of Respawn Entertainment.

Additionally — and this is a messy story — CoDM was also developed by a Tencent Subsidiary, TiMi (one of the biggest mobile development studios in the world, with over $10B reported revenue in 2020), which in early 2018 also released a (very different) version of PUBG as well. Tencent is very much prone to having its subsidiaries compete hard for the same audience, and ALM and CoDM are no exception.

For a more thorough deep dive on what motivates players when it comes to Battle Royale gameplay, read all about Garena Free Fire in our deconstruction from March.

Back to ALM. The fact that the game is made by a highly experienced team like LS&Q has kept ALM free from UX issues that other competitors like Final Fantasy: The First Soldier suffer from. The resulting smooth experience has allowed ALM to compete with the biggest hits of the present day.

So How Is That Going?

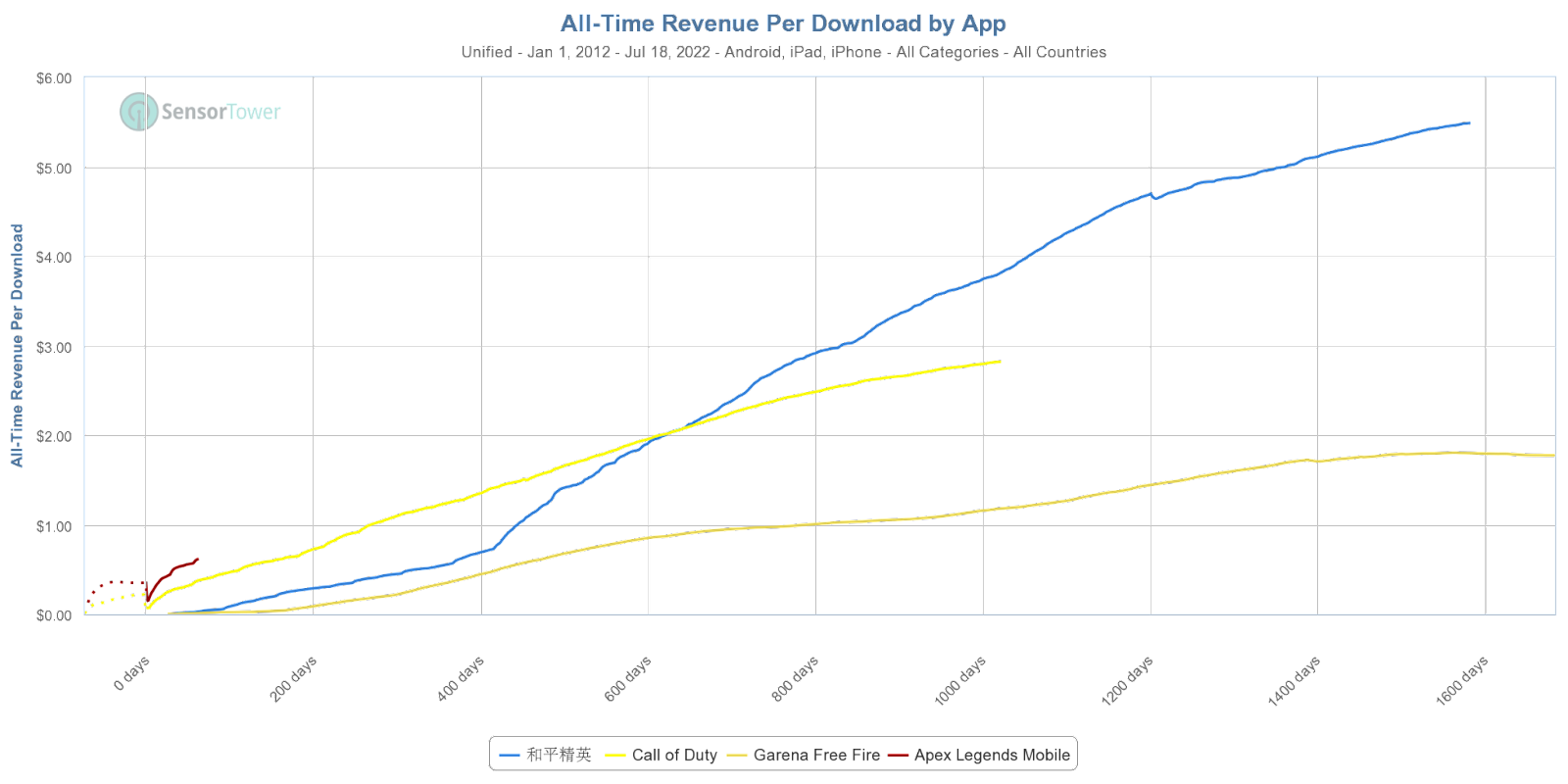

Well, as mentioned in June, the game had a pretty good launch, grossing $4.8M in its first week. Fueled by its golden cohort of 5.5M players that installed the week after launch, the Revenue Per Download floats around $1. When comparing this with Call of Duty: Mobile, it actually floats at the same level in terms of monetization potential right after launch. The other two (older) competitors had a different launch strategy (and target markets) and only reached this mark more than a year after their launches.

RPD curve relative to launch date for ALM and its three biggest competitors.

In terms of revenue, there’s no reason to be alarmed yet. Compared with CoDM, the game seems to be able to monetize just fine for a game its age. The issue is that Activision’s prodigy didn't have its monetization even close to finalized at launch, but it managed to improve over time. Presuming ALM can follow a similar improvement curve is a bold statement, as the game’s feature set and live-ops calendar look quite complete already.

More alarming trends can be seen in terms of downloads, where ALM is simply in a lower league than its competitors. First of all, Call of Duty has been one of the biggest IPs in gaming for years now. This became clear in September 2019 when it smashed all records by having 1.3% of Earth’s population download its mobile version within a week after its launch. The U.S. market has been accounting for about 45% of its revenue ever since.

Next, PUBG is huge in China, where it alone rakes in about $90M per month. This feat makes PUBG the most lucrative mobile shooter worldwide, with a 4-5x margin from the others. Garena Free Fire is a strange yet fierce competitor as it has been serving the world’s less privileged smartphone owners. This is also not something Apex Legends is aiming to compete with when looking at its download size, device requirements, and the amount of player reviews that litter its store page at the moment complaining about bad performance on lower-end devices.

Worldwide downloads per week for ALM’s competitors over the last 2.5 years.

(Note that CoDM’s Dec ‘20 peak is not its global- but just its China launch)

When looking at regional opportunities, ALM’s biggest market in terms of downloads is the US, but this is where CoDM reigns as well. Interestingly, the US is not ALM’s most lucrative region. 42% of ALM’s lifetime revenue comes from Japan, and it has managed to do this with less than a third of the downloads compared to the US. While the (all-time) RPD over there is a meager $0.75, in Japan it has hit a very comfortable $3.70!

Thematically, one wouldn’t be crazy to predict that the Japanese audience most likely has more affinity with the more fantastically themed world of ALM than the more realistic army setting CoDM provides, and since the Japanese are notorious for their royal spending (CoDM’s all-time RPD has recently reached $10), EA would be smart to not let this market go unnoticed.

Additionally, the game hasn’t seen the light in China yet either, which must be quite high on EA’s agenda, even though it took CoDM 15 months to get its game green-lit there. It’s difficult to say if or when this would happen for ALM, as foreign games are mostly being ignored in terms of approval. At this point, even Tencent and NetEase have not been seeing any approvals for quite some time.

And then there’s India, Asia’s fastest growing market. A renamed version of PUBG was released in India after it was banned from the stores for a year, and GFF is currently locked in the same situation. While ALM is downloadable as usual in India right now, it’s not performing much at all. EA’s new shooter gained better traction in other countries like Taiwan and Thailand, albeit only a minor fraction compared to the US and Japan revenue.

Daily Revenue for ALM per country since its launch.

Generally speaking, ALM’s downloads are rapidly decreasing and have even dipped under GFF over the last two weeks. Safe to say, this is not a good sign when your game is only two months old. Which is why we currently foresee Apex Legends facing trouble holding its own in the already crowded mobile shooter market. But maybe things can go differently?

In this piece we’ll:

-

Deconstruct its game modes, systems, cosmetic options, and experience

-

Compare how the game relates to Apex Legends on PC and console

-

Compare how ALM differentiates itself from its competitors

-

Suggest ways how EA can try and increase ALM’s success

Content Worth Consuming

Game Developer Report (Game7): “To unite and empower builders, players, and pioneers, we need to first determine the challenges collectively faced today. Rather than relying on our own assumptions, we interviewed building web3 games. This report is a summary of our primary findings and takeaways organized into actionable items. In order to address these findings, we strive to create a Web3 Game Developer Ecosystem that provides a positive, supportive, and inclusive environment to collaborate and share what is learned.” Link

The Future of Crypto Gaming (Delphi Digital): "It’s no secret by now that most gamers hate crypto. We’ve witnessed heavy community backlash around announcements such as Ubisoft Quartz and even more recently with Dr DisRespect’s Midnight Society. Video game commentators such as Asmongold, Josh Strife Hayes, and many more continue to hound the sector—often with good reason. Perhaps you’re surprised to hear a crypto-native company admit this, but we understand where the sentiment comes from and believe there are grounds for it. As a team of gamers and some of the earliest supporters of blockchain games, the dismissal of a space we care for so much caught us off guard. Initially, we assumed it was a case of people not understanding the benefits that crypto could bring to gaming. In time we’ve listened, debated, and listened some more. After much discussion, we believe there is a lot of validity to many of the critiques surfaced. Not just towards crypto gaming, but more broadly the evolution of the game industry’s core monetization practices over time. In this post, we’ll share our insights and an evolved thesis they helped formulate. We’ll provide historical context for where we find ourselves in the games industry, share some reflections on crypto’s entrance into the arena, and frame several models for where we think crypto belongs in games. In particular, we will explore a new model called PlayFi, developed by Brooks Brown and the team at NOR. We strongly recommend watching our inaugural Disruptor’s Episode with him. We built our thesis upon many of these principles, adding in some modifications based on our experience.” Link

Epic Games Is At The Center Of The Metaverse: A Look at Their Assets (RE3W): “There are many public reports covering the history, formation, and foundation of Epic Games as one of the most important web2 gaming and 3D technology companies on earth. What seems to be lacking in many reports is the understanding of how Epic Games is currently the most important metaverse company by default and how its assets work together as a metaverse tooling ecosystem. While their video game and 3D engine technology, Unreal Engine, is not decentralized or open source, the company has been more open to providing developers a variety of toolsets and distribution services at fair rates and terms.“ Link

How Big Fish Games is Focusing On Its Core Business of Casual Games (VentureBeat): “It’s been eight weeks since Larry Plotnick left his job as Amazon’s Prime Gaming boss and became the president of Big Fish Games, a top 20 competitor in the $16 billion casual games market. And now he has a handle on how the company plans to double down on casual games as it enters its 20th year in free-to-play mobile games. In the new job, Plotnick will manage teams that have created recent successes such as EverMerge and Gummy Drop.” Link

🔥 Featured Jobs

-

Soba Studios: Crypto Games Analyst Intern (Remote)

-

Lotum: Game Designer (w/m/d) (Germany)

-

Discord: Manager, Strategic Revenue Finance (San Francisco, CA)

-

Hidden Leaf Games: Product Manager (Remote)

-

Naavik: Content Contributor (Remote)

-

Naavik: Games Industry Consultant (Remote)