Hi Everyone. If you missed the last edition, we covered the future of the hypercasual genre and showcased a Naavik Pro deconstruction of Crypto Unicorns. We also released our exclusive interview with legendary gaming icon Raph Koster. Make sure to check those out!

This Week on The Metacast

National Game Engines Could Shape The World: In this Metacast episode, Matt Dion and Tammy Levy, join your Maria Gillies to discuss:

- Benefits and Challenges of Player Polls: How does player polling affect Old School RuneScape? Based on NME’s article.

- Russia’s National Game Engine: How could national game engines shape the world?

- Unity x ironSource Merger: How does the merger benefit both companies?

You can find us on YouTube, Spotify, Apple Podcasts, Google Podcasts, YouTube, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: Roblox Developer Unit Economics

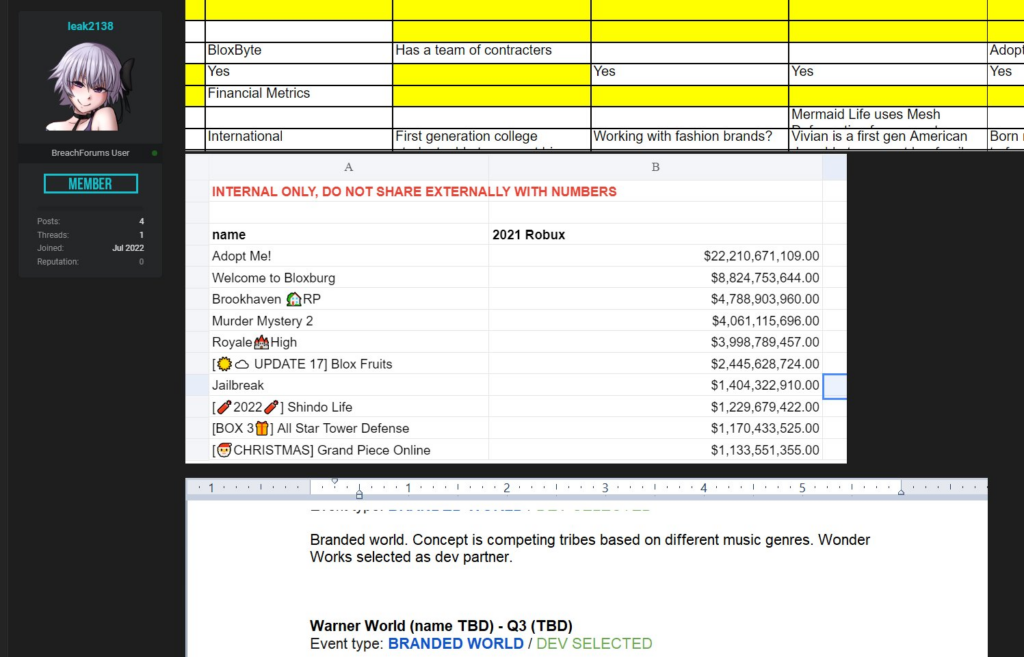

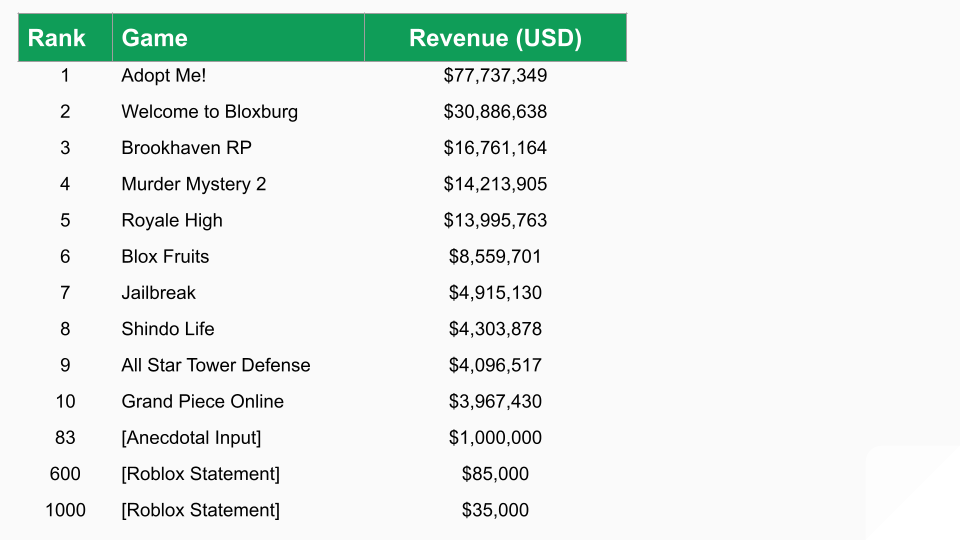

Earlier this week someone released internal documents taken from Roblox. One of the documents, shown below, disclosed how much revenue the top 10 Roblox games brought in last year. Although leaks such as this are easily faked, Roblox acknowledged the leak and the numbers appeared consistent with CEO Dave Bazucki’s comments in last year’s Investor Day, when he stated that one team was “approaching someday soon $100 million.”

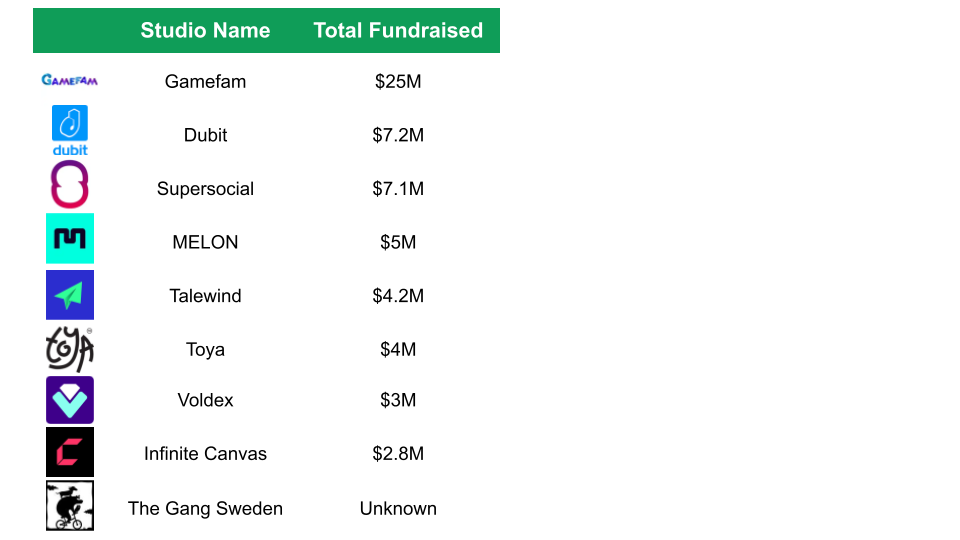

With the sudden emergence of VC-backed companies building games on Roblox, I’ve been wanting to better understand the unit economics to see if they can deliver venture scale returns. After all, the small teams that create these experiences are in stark contrast to the hundred-person studios launching AAA mobile games and the total addressable market appears to be limited to a fraction of Roblox’s revenue. This is the first time we’ve had this clear of a picture as to what the top Roblox developers are making so I was eager to dive in.

Over the last few weeks I interviewed several Roblox studios to understand their costs and get a sense of how they define success for their business. While the studio heads I spoke to were incredibly generous in sharing their perspective, they were understandably hesitant to share the exact details of their business and key metrics for their games on Roblox. With the recent leak, however, I was able to break down the unit economics of game development on Roblox and analyze why Roblox studios might make sense as venture-backable startups. Let’s get into it.

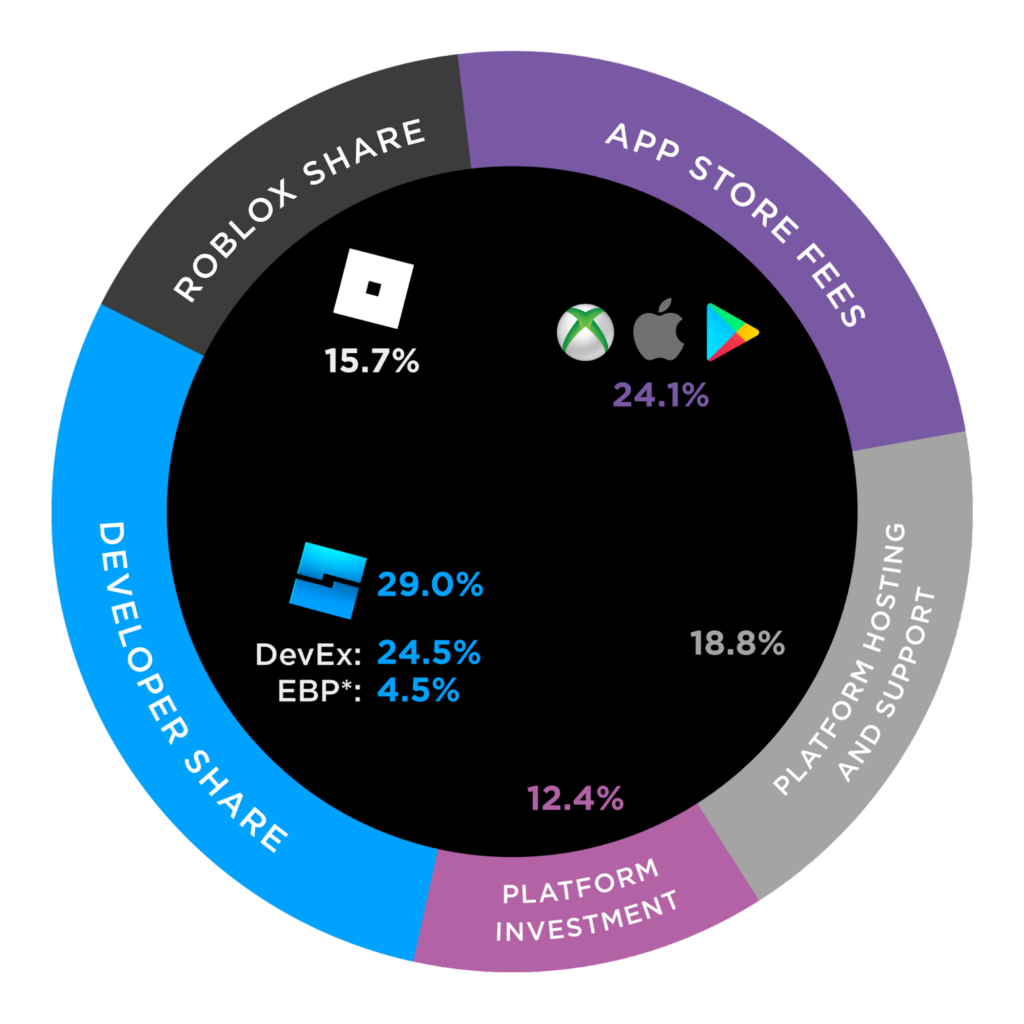

Cost of Development on Roblox

Infrastructure costs are extremely low on Roblox as hosting and platform fees are free and provided by Roblox. Furthermore, developers do not need to write native code to reach users across hardware platforms (i.e. Xbox, PC, iOS and Android). This is in large part how Roblox justifies its 72% share of the revenue made in a game. As a result, personnel is the only cost of development that most Roblox developers I spoke to think about. Roblox developers pay competitive wages to their programmers given the high demand, while artists and audio designers are paid slightly less.

As far as how many people it takes to develop a game, it varies based on the complexity and polish of the game. One game team I spoke with had 12 full-time employees and were releasing games at a clip of four games every six months. While I used this information to form my estimate, it is important to state how different one studio can be from the next. For example, Uplift Games, the creators of the biggest Roblox game ever, Adopt Me!, has over 50 employees and only one, five-year-old game.

Estimated cost of development: $120,000 per game

Marketing Cost on Roblox

There are 1,000 or so games displayed on the Roblox Discover page at any given time. Considering that there are over 30 million experiences on Roblox (and a marketplace strategy for the platform), advertising becomes a critical part of any game’s success. One developer estimated that the cost associated with getting a game the necessary traction was about half of the total cost of launching a game and increasing due to heightened competition. While user acquisition (UA) on the platform is quite cheap, game teams quickly reach a ceiling of being able to reach new players given the limitations of Roblox’s advertising solutions. Roblox could improve by offering a wider range of UA opportunities, given they often end up losing the vast majority of marketing spend to YouTube (albeit free advertising for Roblox, too). Getting a top YouTuber to promote a Roblox game runs on average $20,000 per promotion, according to a developer I spoke with. Developers will engage YouTubers to release promotional content at different points in a game’s life cycle, especially if there is a big live service announcement.

Developers adjust marketing spend depending on the traction of a game so there is no definitive amount of marketing spend required. For the purposes of our unit economic analysis, I was told that $60,000, or about three Youtuber promotions across the lifetime of a game, was a reasonable estimate.

Total estimated marketing cost: $25,000 - $120,000 per game

Revenue per game on Roblox

Although the games themselves are quite different from mobile/F2P games, the monetization tactics are similar. Games are free to play and monetize with in-game purchases or game passes that unlock vanity items, progression boosts or access to restricted areas of an experience. Given that there is a separate Roblox item store that allows users to purchase vanity items that can be taken across experiences, it’s fairly rare that a game will be successful on vanity alone. As a result, pay-to-play, pay-to-win or progression boost mechanics are the most reliable sources of revenue. Alternatively, games can make revenue with engagement-based payouts calculated on the number of Roblox “premium subscribers” they attract which, according to Roblox is roughly 15% of total payouts to developers.

While the vast majority of individuals who develop on Roblox make nothing, studios are betting that they can hack game growth in order to cover the cost of development and drive meaningful returns for stakeholders. The recent leak of information, plus other statements that Roblox has made on developer earnings, allows us to extrapolate what games can expect to make based on how successful they are.

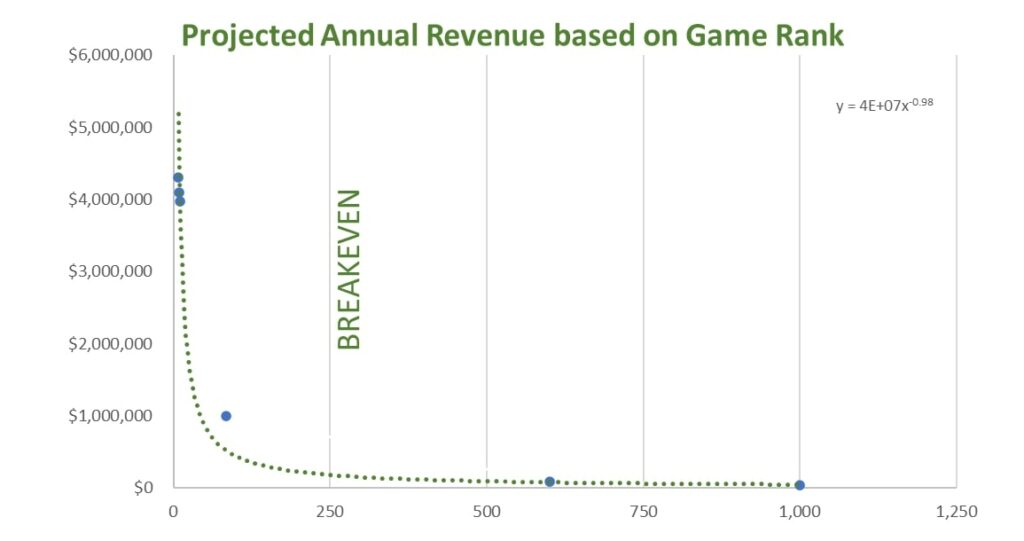

With these data points, I created a line of best fit to estimate the projected revenue by game rank. Given the estimate that it costs a professional Roblox studio $120,000 to get a game to launch, and at least another $60,000 to promote a game across its lifespan, I project that a breakeven of $180,000 in revenue can be achieved as a top-250 game (see image).

Notes on this analysis:

- The green line represents the line of best fit, while the blue dots are our real world data points.

- Given their stratification, I’ve omitted the top seven Roblox games, for ease of viewing.

- Most developers who build a successful game focus on monetizing that game rather than building additional experiences, which is why I’ve taken the liberty of assuming that the revenue made by a top 600th developer is equivalent to that of a top 600 game.

How achievable is a top-250 game?

It’s hard to say whether launching a top-250 game is a repeatable task for VC-funded studios entering the space given that success on Roblox is more art than science today. The remarkable creativity and drive of indie developers on the platform combined with the sheer volume of them would suggest that it’s not easily repeatable. Larger studios I spoke with have their sights set on the top 10, but this appears highly ambitious as the average age for the top 10 Roblox games in 2021 was roughly four and half years old. Breaking the top 10 is thus quite rare on Roblox. Making it even more difficult is the fact that while Roblox boasted an average of 45.5 million daily active users in 2021, only 678,000 of daily users are paying users according to their most recent 10-K.

An alternative option that some studios are pursuing is to partner with, or contract for, big brands looking to set up experiences in Roblox, some of which I’ve discussed previously. I was unable to get terms for any completed deals, but one developer I spoke with shared that the brands they had been approached by had offered $150k per experience without revenue sharing, which would yield a 16% net margin as a business based on estimates above.

Summary of Findings:

- Cost to build a Roblox game: $120,000

- Cost to market a Roblox game: $60,000

- Game rank needed to achieve breakeven: top-250

- Average age of top 10 Roblox game: 4.5 years

- Cumulative market share of top 10 Roblox games: 33%

- Brands willingness-to-pay for a Roblox branded experience: $150k

Roblox studios (and their investors) are betting on the future

Making any money is challenging on Roblox, and yet even a successful launch does not spell “venture-style returns”. However, there is still reasons to believe in the success of Roblox studios for a few reasons:

Roblox Growth — Roblox’s $563 million developer payouts might be a fairly small total addressable market today, but this number grew by 52% from 2020 to 2021. It’s not unreasonable to think that development on Roblox alone could be a $1.5 billion dollar market by 2025.

- Short path to profitability — A Roblox game only takes 6-9 months to build and if it’s done right can yield much needed cash flow for early stage businesses. Additionally, well funded studios have much deeper pockets than your average indie developer. This gives them a significant advantage to ensure that they get the traction needed to turn a well-made game into a hit. This makes investor fear of “being too early” more palatable while these investments yield valuable learnings on the state of the metaverse and the future of media in the short term.

- Early mover advantage — Although low barriers to entry means more competition, many developers I spoke to were emboldened by the learning curve required to design a Roblox-style game (spoiler: they’re not like mobile/F2P games). The difficulty to break into the Top 10 is an opportunity just as much as it is a challenge. If this trend continues, being an early mover in this space could yield outsized returns as the metaverse market and Roblox-native users mature.

- Industry growth and metaverse diversification — Citibank has valued virtual worlds as a $8 to 13 trillion opportunity by 2030. Meta is spending $10 billion annually to build out theirs, while Epic raised $2 billion and partnered with LEGO and Sony to build a more kid-friendly product. Additionally, Tim Sweeney revealed Unreal Engine 5 tools would come to Fortnite Creative later this year and professionalized studios are forming in anticipation of this fact. Many of the studios that are building on Roblox today intend to bring their expertise to other platforms in order to expand their TAM beyond Roblox and mitigate the risk associated with being on any single platform.

- A launchpad for new IP — Roblox reaches 55 million users per day and have an ambitious goal to reach 1 billion monthly active users (roughly 4x their current MAUs). While only the top 1000 developers make $35,000 or more. A game that only makes $35,000 in a year could still achieve 35,000,000 visits. We know that play is one of the best ways to grow love for an IP, so it’s not inconceivable that we will see Roblox-native IPs grow beyond Roblox to not just another metaverse but other mediums entirely. To this end, Gamefam for example launched a toy-line in Walmart last week and has previously reported a video series in the works for its Twilight Daycare IP.

The best time to start developing on Roblox was six years ago…

The unit economics paint a low-risk, low-reward picture today. However, the metaverse landscape is evolving rapidly. The studios that have launched in the last few years to compete with Roblox-native developers (the current market leaders) are betting that their organizational sophistication will enable them to scale the Roblox game ranks over time. Additionally, this sophistication will hopefully position them to take advantage of new innovations that Roblox and other metaverse companies bring to market in pursuit of higher fidelity game experiences. Meanwhile, more brands (both gaming and non-gaming) as well as musicians and artists are increasingly exploring the low-cost, easily scalable, and monetizable nature of Roblox. Each will require studios who are digitally-fluent to build these experiences for them.

Better monetization and advertising tools are reportedly on the horizon, and this is likely to draw additional competitors to the space. At the same time, the Roblox accelerator program will continue to act as a launchpad for developers looking to make a splash in this burgeoning space. I expect that this will raise the bar for what a successful Roblox game looks like and force further consolidation – or collaboration – amongst Roblox developers. As a representative from Roblox stated succinctly, “At certain points in our growth, it probably didn’t make sense to have a 50-person studio, but today it does.” (Written by David Taylor)

#2: Weekly News Roundup

Ubisoft Earnings: Earnings season is back in full force, with Ubisoft being one of the first to report. Net Bookings were $277M, of which the company’s back catalog accounted for 91%. For Ubisoft, Rainbow Six Siege and Assassin’s Creed were the top revenue drivers, with mobile accounting for ~12% of total bookings. As will be the case with many gaming companies over the next few months, the focus will be on pushing out new titles (Ubisoft has 20+ in development including F2P and AAA), and about stabilizing top-line in a potentially recessionary environment. Ubisoft also announced a strategic mobile partner and the delay of several titles, including a game based on the Avatar film series. We'll be tracking these announcement and their impact on the company in the coming months .

Corsair Earnings: Demand for PCs and related accessories has been showing signs of near-term contraction, and Corsair is a clear example. Corsair Gaming reported preliminary Q2 net revenue $284M vs. an expected $349M. While consumer cash holdings are at all time highs, this part of the gaming industry was accelerated due to the pandemic and we’re seeing a pullback in consumer spending on gaming gear. That said, the company is optimistic about an influx of higher end GPUs that might catalyze a new wave of custom-built PCs.

Jagex Acquires Pipeworks Studios: As a reminder, Jagex was acquired by Carlyle investment group in 2021, with the intention of leveraging the publisher as an acquisition vehicle for other studios. Pipeworks and Jagex have been around for a while, but both companies have recently shown resiliency and adaptability around new business models — Jagex with a robust LiveOps / membership strategy and Pipeworks with a co-development strategy in burgeoning trends and player experiences like cloud gaming. Through this acquisition, Jagex will bring its experience to creating long-lasting games to Pipeworks’ IP, and expand its footprint more concertedly in North America.

Wild Rift Crosses $500M in lifetime: We published a full research essay on Wild Rift in Naavik Pro a few weeks back, but this is interesting news in part for the geographical breakdown. The TLDR here is that the game hasn’t performed as well in Western markets as it does in China, despite the presence of Honor of Kings which has grossed $10B+ in lifetime revenue. 72.2% of player spending is in China. And as a result, spending is skewed toward the App Store because Google Play is unavailable in China (outside of China, Google Play accounts for 57% of spending).

🎮 In Other News…

💸Funding & Acquisitions:

- Earnings: Corsair | Ubisoft | Stillfront

- Klang raised a $41M Series C led by Animoca Brands and Kingsway Capital. Link

- Zebedee announced a $35M round to build a bitcoin-payments system for games. Link

- Jagex acquired Pipeworks Studios. Link

- PlayStation acquired tournament platform Repeat.gg. Link

- Xset announced a $15M Series A. Link

- Nekcom raised $8M from Galaxy Interactive. Link

- AGMI Studios raised a round led by YGG, BITKRAFT, and Delphi. Link

📊Business:

- Wild Rift crossed $500M in gross revenue. Link

- Discord partnered with Xbox Live to make a streamlined audio experience. Link

- Some Apple Arcade games are leaving the service, and no longer have platform exclusivity. Link

- $107B in M&A deals were closed in H1 2022, according to Drake Star. Link

🕹 Culture & Games:

- Minecraft announced its position on web3, banning NFTs. Link

- Square Enix partnered with Enjin to launch NFTs in Final Fantasy. Link

- Diablo Immortal is nearing its launch in China following the delay. Link

👾Miscellaneous Musings:

- What the EU Digital Market Acts means for game developers. Link

- Coinbase Ventures on the blockchain gaming opportunity. Link

- Reflecting on Atari’s 50 year legacy. Link

- Post-game, that’s wen token. Link

🔥Featured Jobs

- Soba Studios: Crypto Games Analyst Intern (Remote)

- Lotum: Game Designer (w/m/d) (Germany)

- Discord: Manager, Strategic Revenue Finance (San Francisco, CA)

- Hidden Leaf Games: Product Manager (Remote)

- Naavik: Content Contributor (Remote)

- Naavik: Games Industry Consultant (Remote)