Executive Summary

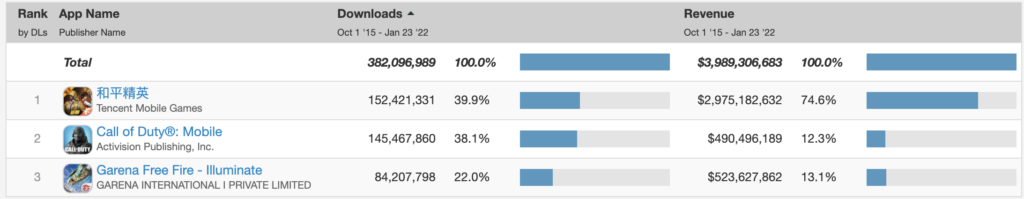

- Garena’s Free Fire is the most downloaded battle royale game in the world, largely thanks to massive uptake in non-Western regions.

- Singaporean company Sea Limited owns Garena, alongside Shopee (e-commerce), and SeaMoney (eWallet); the success of each company feeds the success of the others.

- Garena started as an online gaming platform in 2008, giving it valuable expertise in network optimization, localized content and community development, which the team capitalized on when developing Free Fire.

- The core of Free Fire’s success is the genius of battle royale as a gameplay format, which features a huge degree of player agency, massive replayability, intoxicating tension and high stakes survival gameplay, and a large player count (meaning different players can have different definitions of “win”).

- Free Fire stands apart from the competition with exceptional technical and gameplay accessibility; a versatile, mass market-friendly aesthetic; diverse and deep monetization methods, including selling temporary cosmetics and power; monetized private servers and UGC; and very polished, hyperlocal live ops.

- Short matches, touch-friendly controls, and low device performance requirements have enabled the game to capture a huge audience, some of whom have never played online games before.

- An “anything goes” art style and game world give the game broad appeal, making for varied cosmetics, live ops, and IP tie-in opportunities.

- The power that players purchase is diluted by the fact that it has a limited and unreliable influence over the outcome of any given match. This arguably puts the selling of power in the “goldilocks” zone, reducing the sense of pay-to-win.

- Players of other battle royale games – which don’t sell power and where item ownership is typically permanent – seem unlikely to warm to Free Fire’s approach.

- Relentless and deep live ops keep the game fresh, and region-specific development teams enable Garena to cater to the cultural preferences of each audience, but prioritizing constant reinvention seems to be causing technical issues, resulting in churn.

- The recent ban of Free Fire in India (mid-February 2022) uproots a large part of the operations Garena has been planning in the near future: India was targeted as the fastest growing mobile games market and one of the few regions where Free Fire revenue has been steadily growing.

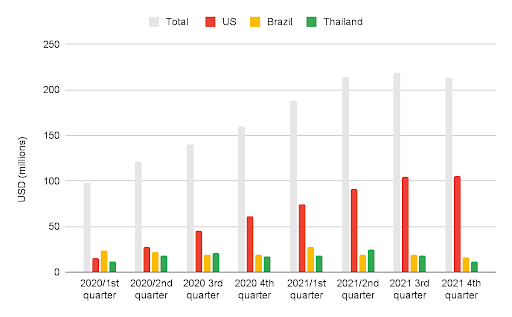

- In the United States, Garena rose to an unexpected success especially given that no strong focus has been aimed in that direction – in the last quarter, half of the total revenue was coming from the US, with 1.5% of total audience being placed there – that is a risky position to be in for a company that specializes in targeting regions and combining revenue from many different areas

- Coupled with declining engagement in the SouthEast Asia (SEA) region (specifically Thailand and Indonesia) plus the India ban, Garena’s growth will slow (unless it creates / acquires new hits).

- Free Fire MAX is an “Ultra HD” sister app targeted at high-tier devices, with identical gameplay and shared matchmaking pools, progression, economy and live ops. On balance it seems to be a marketing exercise aimed at capturing a Tier 1 audience.

Introduction

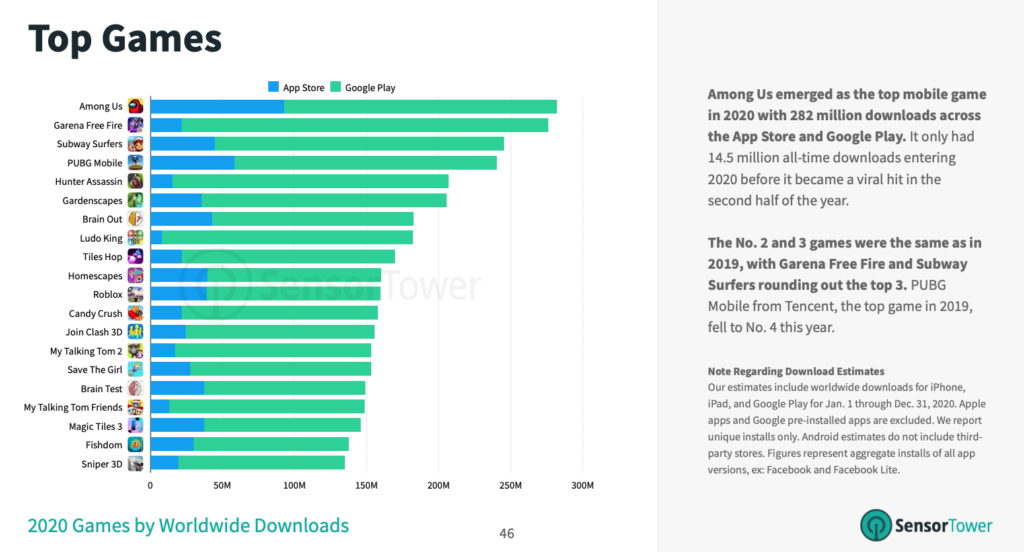

Last December, Free Fire, the battle royale game that is still relatively unknown in the West, reached a huge milestone: 1 billion downloads, making it the most downloaded Battle Royale game ever and placing it ahead of PUBG Mobile.

While that is definitely a noteworthy achievement, Free Fire has been breaking records left and right since it launched in September 2017:

In 2021, it was the most downloaded game (fourth in 2018, close second behind PUBG in 2019 and 2020; and finally hitting the first position last year).

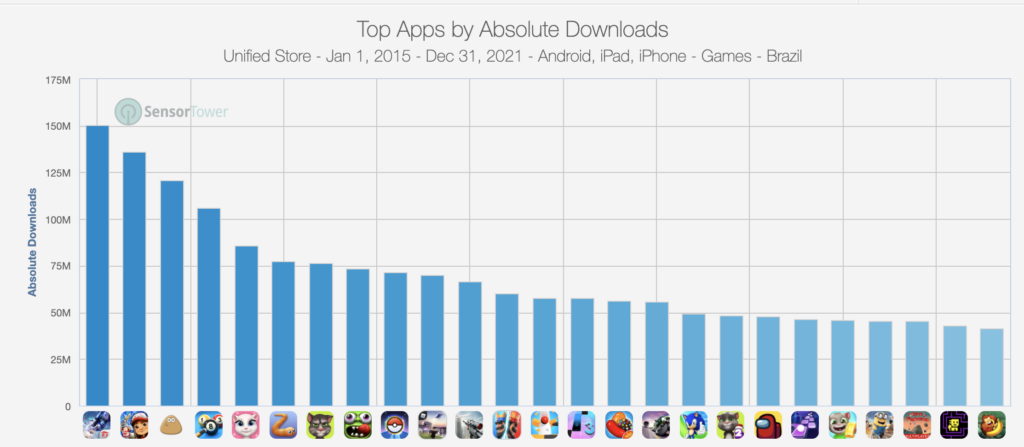

- In Brazil, a country notoriously known as a no-spender market, it broke records from the start, beating the second best, Clash Royale, by more than 4x.

- Free Fire cemented the first position regarding revenue in the Indian market after PUBG was removed from the Indian stores September 2020, and until the recent ban, showed a strong upwards trend in one of the fastest growing markets of the world.

- In May 2020, Free Fire beat a record set by Fortnite when it came to the most players online at the same time.

- Free Fire was the most watched battle royale game of 2021 (1.08 billions hours watched), slightly edging out Fortnite. Related, since December 2020, Free Fire is the second most watched game on YouTube, after Minecraft.

As we know, the battle royale world is full of big names and stories: Fortnite disappeared from both the App Store and Google Play store after issues with direct payments in the game. India banned PUBG for digital sovereignty reasons with a bang (and returning with a slightly smaller bang and green blood this summer) – a fate that just hit Garena mid-February!

What sets Free Fire – and its developer, Garena – apart is how it breaks a long standing axiom that to be a successful developer, you need to be successful in the West. As we’ll cover in detail in this report, Free Fire rose up in countries like Brazil, Mexico, Indonesia, Thailand, India… and only way later grew in popularity in the United States.

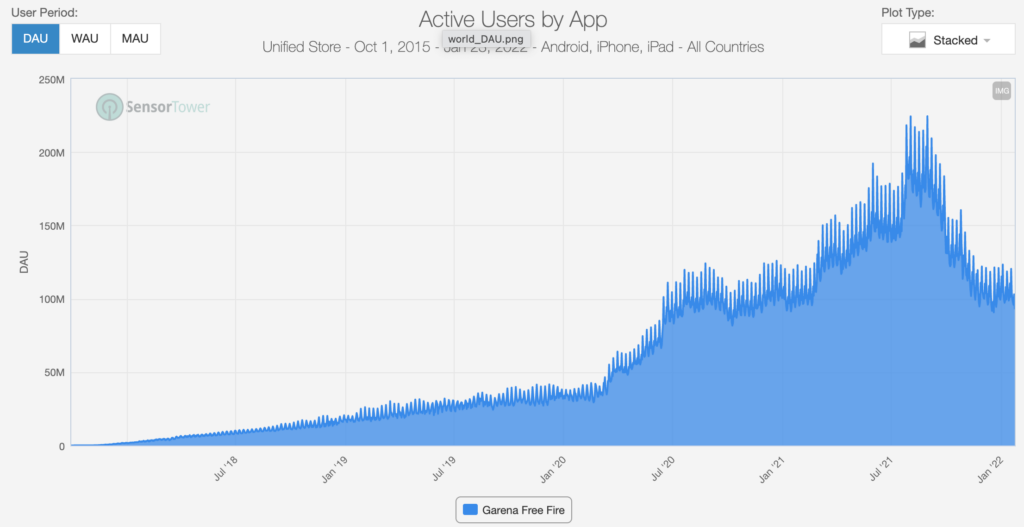

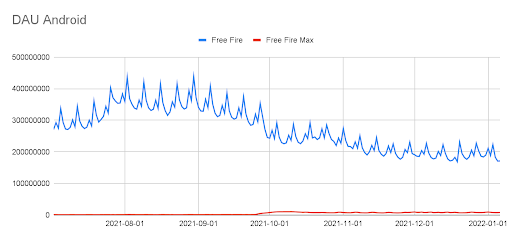

Notably, after such a meteoric rise, daily active users (DAUs) have been steadily dropping since August 2021 – and the decline is occurring across regions. For a company that relies on the profits from its gaming business to fuel reinvestments into its other major ambitions (e-commerce, payments, etc.), this is concerning.

In this essay, we will look into:

How did Garena build up the game to this point? What core design elements of the game led to it becoming so successful across regions?

- What are the regional stories – namely SouthEast Asia (SEA), Latin America, India, and the US – and why do they matter?

- How does Free Fire and Garena fit into the larger Sea Limited (parent company) ecosystem?

- Why has Free Fire been losing users and revenue in recent months? Why has it fallen so precipitously from the peak… and was it actually the peak?

- Why did Garena launch an HD version of the game, Free Fire Max, last fall? Plus, what else should we expect from Free Fire going forward?

The Story of Garena and Sea Limited

Free Fire is developed by Garena and a Vietnamese studio called 111dots. Garena itself is a part of a Sea Limited, a Singapore-based tech giant with grand and broad ambitions. We’ll dig deeper into Garena, plus Sea Limited’s past and future – and what it all has to do with Free Fire. Off to the broader context!

Garena: The Platform

Garena’s first product was a gaming platform (under the same name) that connected players across SEA over the last two decades. Starting as a distributor of LAN games such as Counter Strike, Starcraft, and Call of Duty 4, Garena struck a deal with Riot Games around 2010. From the games operated back then, only League of Legends remains, and Garena won’t get publishing rights to Riot’s new games (Riot is building its own team in Singapore). That said, Garena still operates Call of Duty: Mobile and Arena of Valor in certain regions.

This platform originally offered three main user-facing functions: chat, a clan system, and leagues. This is all notable but perhaps the most important advantage was the knowledge Garena gained regarding network optimization, a critical skill that contributed to the success of Free Fire.

Understanding what players needed (a community, a way to communicate, a shared goal) in these early days of massive multiplayer gameplay speaks to founder and CEO, Forrest Li’s visionary qualities.

Another smaller yet noteworthy moment from the early days was the creation of the Thai server alongside the localization of League of Legends in 2012. The team also created a special ‘Muay Thai’ skin for the in-game champion Lee Sin. As we’ll dig into more, bringing local flavors into games is one of the biggest strengths that Garena possesses and utilizes heavily in Free Fire.

After helping bring League of Legends and Arena of Valor to new regions, Garena landed and deepened a partnership with Tencent, which granted publishing rights in Indonesia, Taiwan, Thailand, the Philippines, Malaysia, and Singapore. This partnership allowed Garena to grow its own knowledge and operations that would be later transferred to its own development.

Free Fire Development

Garena’s first internal studio was established in 2014 with the goal of acquiring talent in Southeast Asia and China to build its own games. After a couple years of battle royale gaining popularity via mods on PC games, Free Fire was launched on mobile in September 2017. For context, Fortnite came out at the same time, and PUBG appeared on mobile in early 2018.

The world’s top developers had been eyeing the genre for a while, but each took a different approach. Epic released Fortnite on PC and console first, porting to mobile in the following year. Bluehole, the Korean developer of PUBG, followed a similar path – first coming out with an early access version on Xbox, then releasing the mobile (and F2P) version of the game in February 2018. Both of these games, the biggest Free Fire competitors, were intended for high-performing devices and have dominated the App Store since.

Garena took a different path.

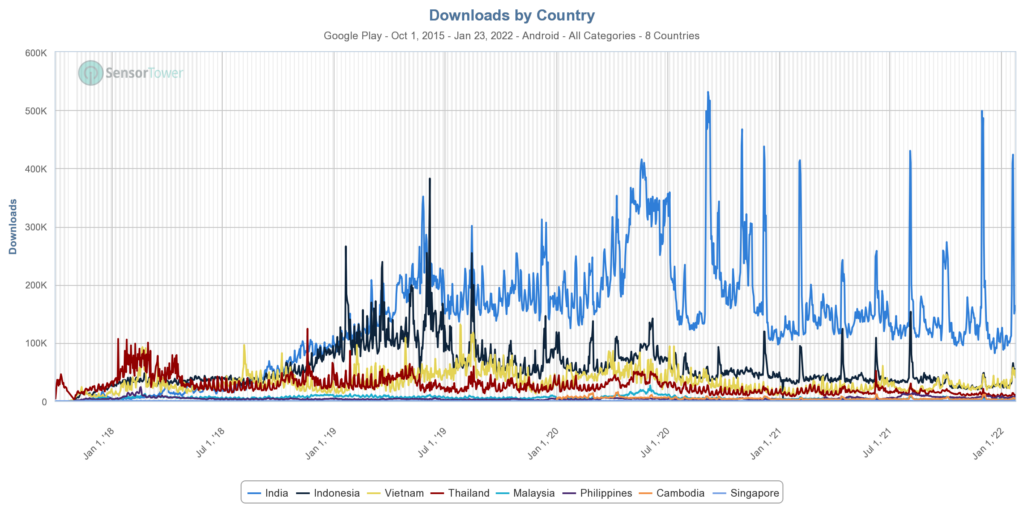

While Epic and Bluehole were developing for clear, existing audiences (console/PC), Garena bet on the rise and ubiquity of ever-improving smartphones. It also took aim at specific regions; both LATAM and SEA, the two largest markets for Free Fire, were Garena’s target regions from the beginning. The team put effort into developing a game that would run on devices on which their competitors’ games wouldn’t, both in terms of data stream and the actual size of the game. Fortnite wasn’t even released on Android in its first two years.

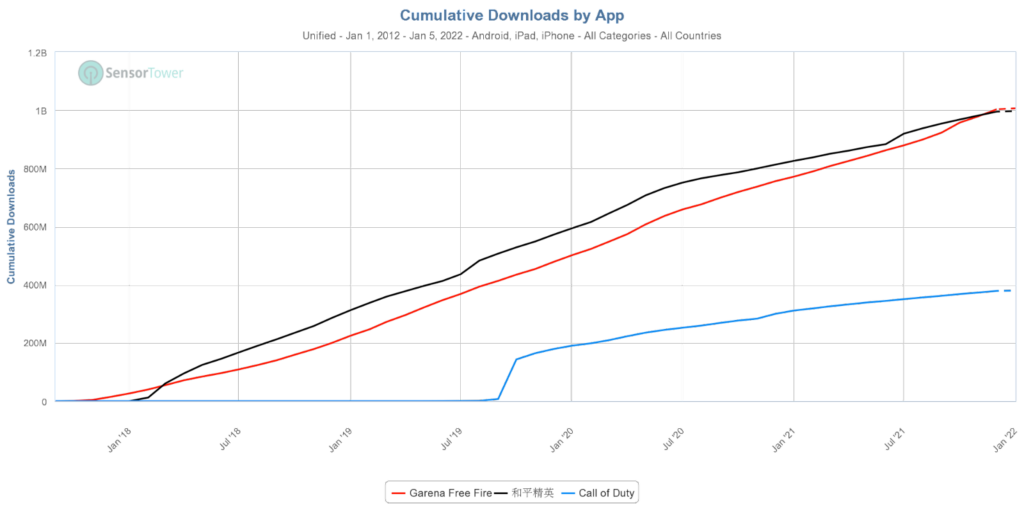

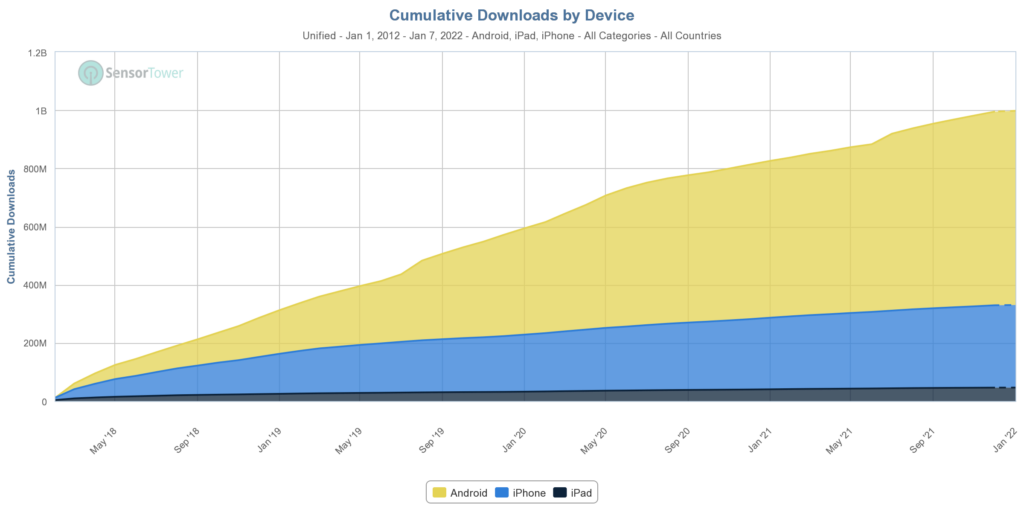

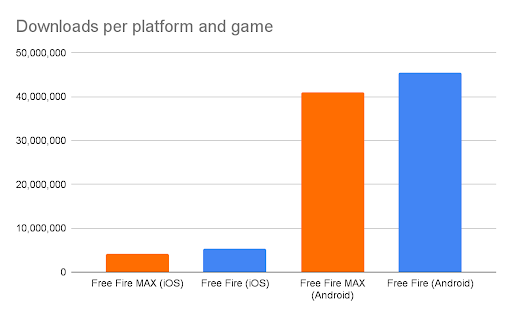

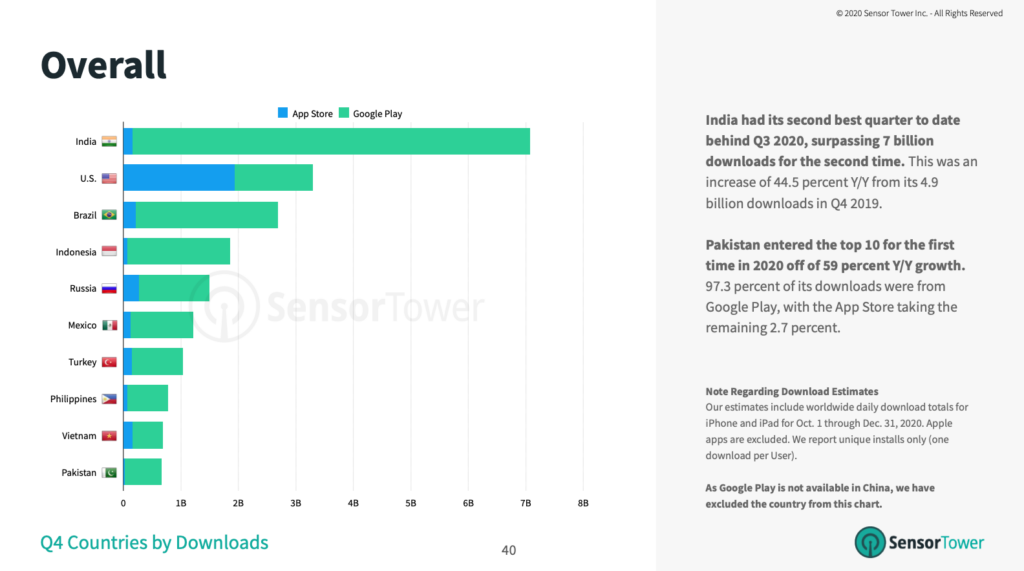

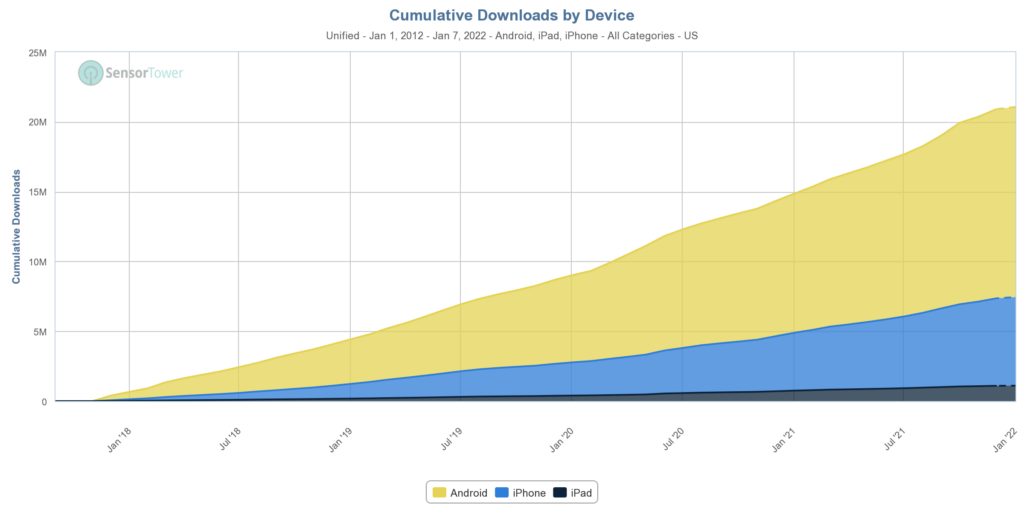

As you can see in the charts below, Free Fire and PUBG have both recently hit 1 billion cumulative downloads, although Free Fire’s audience leans much more Android-centric.

Free Fire’s cumulative downloads:

PUBG’s cumulative downloads:

This Android leaning bent – a reflection of the markets Garena targeted – led to Free Fire generating less cumulative revenue compared to PUBG, but its region-specific growth is still a remarkable feat.

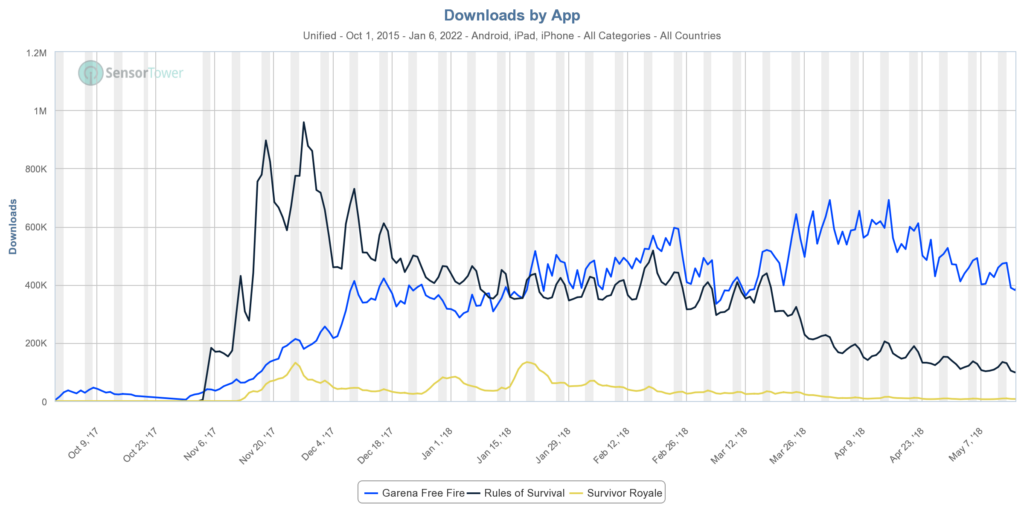

Garena also wasn’t alone: other mobile-only battle royale games were released around the same time (Survivor Royale, Rules of Survival), but even the initially far more successful Rules of Survival didn’t stand the test of time.

The Big Picture: Sea Ltd.

Let’s zoom out and focus on the parent company for a moment. Sea Limited is a Singapore-based tech company with three main businesses: Garena (video game), Shopee (e-commerce), and SeaMoney (digital payments).

Given that Shopee (founded in 2015) and SeaMoney (founded in 2014) predate the launch of Free Fire, it’s pretty clear that founder and CEO, Forrest Li, was thinking about expanding Sea Limited beyond games for quite some time. It’s not hard to see why – SEA was a rapidly developing region, many of the same digital trends that made gaming popular led to growth in other large industries, and other companies (like Tencent) had previously shown what’s possible. Of course, scaling multiple aggressive business units is a tall task, so it took time for all the pieces to fall into place.

Before Free Fire, Sea Limited was dependent on licensed games, which provided the company limited upside. After Free Fire started becoming enormously successful, however, everything changed. Most notably, the profits from Garena have been used to subsidize the rapid expansion (and market share leadership) of Shopee. For example, based on a recent earnings release, the Digital Entertainment Adjusted EBITDA was positive $715.1 million, while the e-commerce Adjusted EBITDA was negative $683.8 million. These numbers will ebb and flow – and the e-commerce unit should eventually turn profitable – but the role Garena plays to support the entire ecosystem is quite evident. Even though the company’s stock has been whacked (along with the rest of growth/tech recently), the fact that Sea Limited’s been able to build a $60B+ business out of gaming and e-commerce is still impressive – and the story is far from over.

The company's ambitions are still extremely high. Not only is it hoping to deepen its penetration in SEA (through traditional e-commerce but also through new avenues like ride sharing, hotel bookings, food delivery etc.), but it's beginning to target new markets for e-commerce (already including France, Poland, Spain, India, and Argentina). It may not succeed in all new ventures and in all new territories, but what do these new ventures all require? Capital! Therefore, the business may raise more money, but it also means the profitable parts of the business (games) still play an important role in fueling growth.

If Free Fire is waning – which we’ll dissect much more below – it may spark further revenue deceleration and put pressure on the company’s ability to internally reinvest at the same high levels. Any serious decline will likely lead to Garena pursuing new opportunities beyond Free Fire within gaming. We’ll dig into what that could look like later on in the essay, but given management's ambition and the financing role Free Fire and gaming play in Sea Limited's broader ecosystem, it's unlikely they'll sit still for long.

Before we dig into how the game is performing in different parts of the world and what the team can do to reaccelerate, let's first dig into the design of the game itself, what's unique about it, and how these characteristics led to tremendous global growth in the first place.

Game Design Deconstruction

Free Fire’s incredible success is the result of numerous factors, many of which stem from the underlying game design. Here we’ll deconstruct what makes this title such a potent competitor in a crowded field, starting with the battle royale mode that forms the core of the experience, before moving on to what sets Free Fire apart.

Battle Royale - The Heart of a Champion

The battle royale subgenre is enormously compelling for a wide variety of reasons, and since this game mode is central to Free Fire – along with PUBG, Fortnite and many others – let’s explore what makes it so dominant.

At a high level, battle royale’s success can be attributed to the following elements of the game design:

- High degree of player agency due to the large map and drop-in mechanic

- High replayability thanks to various randomized elements

- Intoxicating tension and high stakes “survival” gameplay

- Large player count means different players have different definitions of “win”

We’ll explore each of these in turn.

The first interesting decision the player makes when starting a battle royale match is when to exit the spawn vehicle and which location to parachute into. This choice will determine how the rest of the match plays out, since dropping into a high risk/high reward area – one with lots of good loot, and which will therefore be heavily populated – means they will almost immediately be engaged in conflict, whereas choosing to play it safe and drop somewhere relatively remote with low traffic will give them time to gear up and proceed more covertly.

Different players will make different choices depending on their preferred playstyles. In some cases, the same player might make a different choice based on how they’re feeling, what their goal is for the match, or how much time they have available to play. An aggressive player whose train is arriving in 5 minutes will drop into a heavily contested area, whereas a less confrontational player might spend 15 minutes skirting the edge of the map, avoiding firefights and playing it safe, hoping the competition will wipe each other out so they can swoop in at the last second and claim the final kill. In this way the genre is well-suited to many different play circumstances and player types.

Furthermore, the fact that the spawn vehicle starts its path across the map from a different randomized location each round means the entire set of drop-in possibilities the player can choose from also differs from round to round.

When playing as a group, this drop-in decision gives players something to discuss and debate, creating immediate tension and excitement, as well as an opportunity for a skilled team to coordinate and strategize from the outset.

Once the player has hit the ground, the interesting choices and variety keep coming. Since battle royale maps are always quite large, there’s a very good chance the player will have started this round in a different location to the last. Of course, some players will have played so much that every nook and cranny of the map is familiar, but even their sense of excitement and desire to explore will be guaranteed by another essential ingredient in the battle royale recipe: randomized loot.

Every location has a chance of spawning something common and mediocre, something very rare and powerful, or nothing at all. This ensures that no matter how well players may know the map, they never know exactly what they’ll find. A knowledgeable player can rig the odds in their favor by going to the likely spots, rewarding them for their investment and expertise, but nothing is guaranteed: a noob might get lucky and a pro might be cursed by the gods of random, and so every match feels at least a little bit fresh.

As the player explores, hunting for the next piece of loot to increase their chances of survival in the next encounter, the sheer size of the map means that they might not see another player for an extended period of time (or they might be right around the corner). The tension created by sporadic encounters ensures players are always on edge, and since they can’t predict when or where they’ll cross paths, or how many other players they’ll cross paths with, the sense of anticipation is intense and intoxicating.

This tension is massively amplified by the fact that – in most implementations of the battle royale ruleset – once the player is dead, they’re out of the match. Everything you’ve collected up until that point will be lost, and it’s back to the spawn vehicle to try your luck again. This gives everything a weighty sense of finality, since every moment, every encounter, and every gunshot could be your last. Some battle royales mess with this rule, giving players the ability to respawn their teammates or re-enter the match, but it’s always a high stakes endeavor.

The real sugar in the royale recipe – the thing that forces players into inevitable conflict and ultimately guarantees that every match ends with a nail-biting showdown – is the shrinking circle. If you’re outside the circle, you’re taking damage, and a constantly ticking timer indicates when the circle will shrink even further.

This ingenious dynamic channels all surviving players into an ever-smaller portion of the map, steadily ramping up the likelihood of conflict into a nerve wracking finale.

The circle’s location changes from round to round, further adding to the set of randomized elements that make battle royale so eminently replayable. One match might end in a dense urban environment with lots of verticality, while the next concludes on a sparsely forested hillside. Players can’t know exactly which situation they need to prepare for, and nor can they position themselves in the ideal defensible location, since an unlucky circle switch might leave them bleeding health while running across dangerous open ground, adding to the tension and uniqueness of each round.

The icing on the RNG cake is map events – high value loot drops, carpet bombing, player-spotting drones – which force players to tactically reevaluate, creating even further intensity and variety, even when there aren’t other players around.

In many ways battle royale is the roguelike of online shooters, since the starting conditions are different each time, the player’s power and survivability are partially governed by chance, and the stakes are high because death means the end of a run. It’s a brilliant blend of two seemingly disparate genres that makes for a powerful procedural war story generator that can lead to players remembering specific rounds for months or even years afterwards.

Part of the genius of the subgenre is that a large player count – typically 100, or 50 in the case of Free Fire – means that actually outright winning a round is extremely unlikely for the vast majority of competitors. Intuitively this seems like it would be discouraging, but in practice it allows players to tell themselves wildly different stories of success based on their expectations. If a noob drops into a dangerous area and survives for longer than 2 minutes by hiding in a cupboard, they’re winning; if a middling player lives for 10 minutes, gets 2 kills and is then sniped from across the map, they’re winning; if an experienced player makes it to the final circle but gets caught in the crossfire and only takes 3rd place, they still bested almost everyone else in the round, and so they’re winning.

Additionally, the fact that the outcome of a round isn’t determined by how many kills you got but by whether or not you survived means that a player could be stealthy and still do well. In fact, depending on the goals in the battle pass, the player doesn’t even have to fire a shot in order to feel like they’ve nailed it, because success might be “Travel x distance on foot,” “Play for x minutes,” or “Eat x mushrooms”.

In short, the massive scale and survival-based nature of the competition means that definitions of “win” or “lose” are highly fluid and down to the individual player, which is fantastic for ensuring they feel competent - a fundamental psychological need.

This massive scale – large amounts of players dropping into a large playspace – can even facilitate satisfying player experiences for different types of player or sizes of group. You can drop solo, in a duo, or as part of a squad and still have a good time. This is great for developers because the same content and ruleset works for everyone, and players get a lot of choice and versatility in how they engage.

The many ingredients of battle royale’s recipe for success make for one of the most flexible, compelling, and replayable game designs in history, as evidenced by its meteoric rise and sustained appeal. But what is it about Free Fire’s implementation that’s so special? Let’s dig in.

Free Fire - Maximum Accessibility

Free Fire messes with the formula in a number of critical ways that make it more accessible to an even wider audience than the already very popular competition. For the most part, the changes focus on adapting the gameplay format to acknowledge the everyday reality of the mobile devices that billions of prospective players have in their pockets.

Starting with match duration, a combination of 50 players per round and a notably rapid shrinking circle of death mean that games are over within 10-15 minutes, which is much more manageable than PUBG’s 20-30 minutes, given the often opportunistic or fleeting nature of mobile play.

The lower player count means the map doesn’t need to be so huge, which means the device performance requirements are lighter and the map assets don’t take as long to download, nor take up as much space on the device. A bonus side effect is that the development team can produce new maps more quickly. It also seems likely that a lower player count would make for lower network performance requirements, enabling players on slower or more lossy connections to participate more fully.

Also keeping the round duration short is the striking prevalence of decent loot, ensuring players will gear up relatively quickly. This near guarantees competitors feel equipped to engage in conflict and avoids a scenario where a player – through sheer bad luck – reaches the end of a round without finding something solid to defend themselves with.

Free Fire has also done its part to lower the barriers to entry by incorporating very generous auto-aim, meaning that – along with guns that have very little recoil and virtually no bullet drop – the core gunplay requires much less skill than its competitors. Not only that, but Free Fire takes Fortnite’s complex building mechanics (which involve collecting materials, switching to build mode and placing walls, floors, ceilings, and stairs) and distills them down to placing “Gloo walls.” This is a much simpler and more accessible way to get most of the benefit (the ability to alter the flow of battle and reflexively put a defensive barrier between you and your opponents) while doing away with most of the dexterity required.

If Free Fire ever goes cross-platform and enables competition between mobile and console/PC, these simplifications to the control scheme will put all players on a more even footing, which is definitely in its favor.

Finally – and not unlike its rivals – Free Fire has the player compete against relatively unskilled bots early on in their time with the game. This is standard practice for the genre, but Garena seems to have struck a reasonably good balance, with AI that presents as a semi-believable opponent without being so dangerous that the player’s sense of competence is threatened.

Overall, this emphasis on accessibility has enabled Free Fire to capture an even larger audience than the formidable genre incumbents. Technical accessibility enabled Free Fire to take root in previously untouched regions where low-tier devices and relatively slow or unreliable networks are the norm, and smart gameplay tweaks have made it even more at home on the mobile devices it’s native to.

The launch of PUBG Mobile Lite in August 2019 – with “matches lasting 10 minutes or less” and low technical requirements – is a strong validation of this approach. Further vindication of prioritizing accessibility is the addition of a new “Extreme” battle royale mode to the freshly launched PUBG New State, where the player count is capped at 64, rounds will be 20 minutes long, players will start with gear, and loot will be more plentiful. These deviations from the PUBG norm could almost certainly be attributed to the abundance of playtime that Garena’s formula tweaks have attracted.

So now we have a clear picture of why battle royale’s core game design is so potent as a player experience, and how Free Fire has taken that potential and broadened its appeal for a truly global mass market audience. But we need to zoom out much further to get a complete picture of Free Fire’s dominance, specifically regarding how it gets all those massively engaged players to open their wallets.

Threading The Needle

By far the most common way to make money in a F2P battle royale is to sell cosmetics. Fortnite forged this path in spectacular fashion back in 2017, popularizing a visual customization-based business model in the West, and simultaneously pioneering a whole new way to monetize and engage players with the advent of the battle pass.

Battle royale is an excellent vehicle for cosmetics, because the pre-match squad lobby in the front-end gives players a chance to do intimate social comparison with their friends, subconsciously telling themselves a story about how cool they look, or gazing upon their squadmates with envy.

Similarly, Free Fire’s match warmup lobby dumps a huge number of players into the same space for a short period. In the lobby, all players do is tensely interact with soon-to-be opponents – trying to look impressive or interesting while being quietly intimidated by their skins and gear – and potentially showing off by emoting with their friends.

Importantly, a default third-person camera perspective ensures players are reminded of their avatars’ appearances at all times. Even spectating the player who killed you puts their cosmetics in the limelight because you can’t respawn, so you have plenty of time to begrudgingly take in the details of their getup before exiting to the frontend for another go.

Free Fire is able to deliver on the potential of this model better than most thanks to an artful choice of aesthetic that makes for a playful style and relatively wholesome world flavor, straddling the line between Fortnite, PUBG, and Call of Duty (COD). It’s not exactly “Saturday morning cartoons” for kids, nor is it “everyday realism” or “hardcore military” for adults; it splits the difference and ends up with very broad appeal.

There’s a lack of a definitive theme that enables Free Fire to include a wide variety of skins, visual styles, and IP tie-ins – even various knock-off versions of pop culture icons (fake John Wick, Agent 47, etc.) – without seeming incongruous or alienating the audience. To be fair, PUBG Mobile and COD Mobile completely abandoned their IP roots long ago by incorporating all sorts of fanciful and outlandish cosmetics, and it clearly hasn’t killed their player bases, but Free Fire’s choice to start with an “anything goes” aesthetic is nonetheless very wise.

Aggressive Monetization Design

Heavily gamified spending is also characteristic of battle royale, most notably COD Mobile with its Lucky Draw system that’s effectively gambling for highly desirable cosmetics and resources.

Free Fire takes this to an extreme with a wide variety of mechanisms and minigames, including:

- spend-specific progression systems that give players more exclusive rewards the more they spend in any given day

- chance-based spending minigames that allow players to “rig the odds” in their favor, or where the player’s chance of winning the grand prize gets progressively better the more they pull the lever

- spending prompts an immediate follow-up spend offer for something at a significant discount

All of this is hardly unusual, and such methods could be layered into a competing title – or indeed almost any title, if it’s willing to be associated with pseudo-gambling – without much difficulty.

So what exactly does Free Fire do that no-one else dares to…?

Power Profits

For many developers and players of battle royale games, fairness is sacrosanct. The story goes that every time a player drops into the map, they should have the same chances of winning as any other. The victor should be determined by that intoxicating blend of skill and luck detailed above, not by some pre-existing form of power that they bring with them into the match.

Many hailed the true genius of Fortnite as being that it had found a way to make good money without resorting to selling power, which – as illustrated by many free-to-play games – tends to be ultimately unsustainable and leads to messy problems like inflation and power creep. Here was a game business model that could print money forever, as long as quality cosmetics could be produced at an adequate rate, and as long as the gameplay itself was kept entertaining and varied enough that players wanted to keep buying and showing off cool gear. Almost every competitor is cast in the same mold, but Free Fire isn’t just another competitor.

While Fortnite was blowing up in the West, Free Fire was exploding everywhere else at almost exactly the same time, as explored elsewhere in this report. In fact, a month before Fortnite launched on mobile and into the stratosphere, Free Fire rocketed down a very different path: it began selling power.

Garena’s title has a lot of interesting monetization elements that other battle royale games don’t, most of which are fairly blatantly pay-to-win, including:

- Playable characters and pets, with level progression and upgradeable skills

- Gun variants, many of which are better than the base model

- “Evo guns”, with their own stat-affecting progression

- Consumables, which players choose and take with them into the match

We’ll explore each of these in turn.

Characters

Free Fire’s 40+ characters each have their own distinct appearance, name, backstory, and flavorsome idle animation that plays in the front-end. Critically, each one also has its own level progression and associated active or passive skill that increases in effectiveness as leveling up occurs.

Each character has 3 additional skill slots, which you have to pay to unlock. With a slot unlocked you can then equip another owned character’s skill at the related upgrade level. Any reasonably serious player would have a minimum of 4 characters at max level, and then they’d have the skills of those 4 characters equipped on one.

Players can directly purchase characters from the Store or hope to acquire one in the course of regular play. It’s worth noting that the player’s starting character does not have any skills or skill slots, and the most convenient method of acquiring a premium character is to convert and buy hard currency, which immediately bundles one in.

Interestingly, up until April 2021, leveling a character required players to spend soft currency – as well as grinding for character-specific “Memory Fragments” – but Garena removed the currency requirement, suggesting that players were either vocally frustrated by the price or were failing to engage with the system as much as Garena would like. The change had no appreciable impact on KPIs, for better or worse, so perhaps it was simply a calculated PR move to come across as generous to the player base, having A/B tested the change to ensure it wouldn’t have a negative effect on metrics.

The character and skill system is fairly obviously pay-to-win, with the gap between a character with no skills and a fully stacked premium character being quite significant. For example, the character below has narrowly applicable but nonetheless significant buffs to armor durability, movement speed, armor penetration, and accuracy, with no debuffs.

That said, the system is pretty loose. Many characters can be directly purchased for soft currency, the player can level characters just by grinding, and they only ever need to unlock the 3 additional skill slots on a single character in order to max out the power potential of the system. Unlike most games with a character collection component, nothing in Free Fire requires or even encourages use of or investment in any specific character.

So why would players pursue ownership of many characters, or a newly added one? A few possible reasons: 1) because the new character’s ability is more powerful than anything else they own (power creep), 2) for the sake of having a complete set (collection compulsion), or 3) because they have a particular affinity for the character based on appearance or reputation (hedonic appeal).

Overall, it feels like a system that has developed very organically, as well as with significant inefficiencies, with only modest investment required from the player in order to reach close to the power ceiling. Perhaps that’s ultimately in the game’s long-term interests, since a more tightly designed system would demand even more spend from the player, whereas the current one encourages all players to spend only a moderate amount. It seems safe to assume the deepest spend is occurring elsewhere.

Pets

Pets, like characters, have their own level progression, with premium pets also having a gameplay-affecting upgradeable skill. The player can equip one pet at a time.

Since pet skills seem to have only marginal utility and only a handful of upgrade levels – with the rest of the unlockable benefits being purely cosmetic – it seems likely that pets mostly function as cute vanity items. Notably, PUBG Mobile has similar “companions” but without any skills or abilities.

Pets are also utilized in specific temporary game modes, including the Among Us clone Pet Rumble and Fall Guys clone Pet Mania, which is a clever way of strongly encouraging players to invest in what are otherwise basically animated accessories.

Gun Variants

Like many other gun games, Free Fire features a wide variety of weapons, as well as many cosmetic variants of each. Unlike almost any other successful gun game, Free Fire’s variants also have statistical differences from the base versions, and in most cases the differences mean that the variant is more powerful. COD Mobile has occasionally featured buffed gun variants, but they tend to be the reward for reaching the final Tier of a battle pass. They also tend to be much maligned by the community.

Since Free Fire has more than 45 weapon types and the loot is randomized, players are required to collect a huge number of variants in order to maximize their chances of actually finding and utilizing one of the buffed weapons from their collections. As discussed in detail later, this level of spend is massively compounded by the fact that most variants are temporary.

Evo Guns

Distinct from gun variants, there are a handful of “Evo” guns that players can collect that have their own progression. These are spectacular variants of existing weapons that the player can level up. Higher levels of Evo guns have custom muzzle flashes and kill effects, along with, of course, higher stats (increased buffs and reduced debuffs).

In order to acquire an Evo gun, the player has to be playing at the right time, during the right season of live ops. In this sense, Evo guns are like mini-seasons that players likely look forward to. It also seems likely that players use ownership of a particular Evo gun as a yardstick of another player’s veterancy and level of investment in the game, in the same way that hardcore battle pass players know exactly which cosmetic items were available during which seasons. Furthermore, players must earn Evo guns by spending in a chance-based minigame, ensuring acquisition is not straightforward.

Although COD Mobile has had guns with progression-based zero sum mods for years, and PUBG Mobile has a similar system that allows players to level up specific weapons to upgrade their appearance, neither is brazenly selling power like Free Fire.

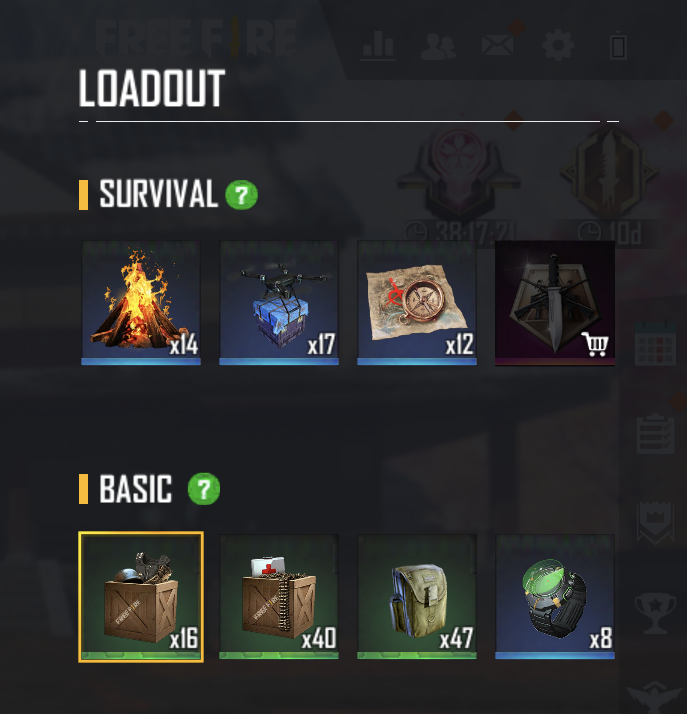

Consumables

Players can collect and utilize consumables with different effects. Some are active from the start of the match, while others must be manually activated. Since these aren’t exactly scarce, it’s hard to see them as much more than just a strategic pre-match loadout choice, but they’re nonetheless a piece of the overall pay-to-win puzzle.

Notably, consumables are disabled in some modes, such as Clash Squad, but all the other forms of power described above are still allowed.

Watered Down Power

Although there are many different sources of power available to the player, the benefits of that power are diluted by a number of factors.

Most character skills only trigger in specific circumstances; they’re not consistently in effect or useful. Meanwhile, just because you have a powerful gun variant active in your Vault doesn’t mean you’ll actually find it during a match, since there are more than 45 gun types and loot is randomized.

Even if you do manage to find one of the weapons that you have a variant equipped for, the circumstances that you encounter other players in vary wildly. Sometimes you’ll be at short range, sometimes long range, sometimes it’ll be a 1v1 encounter, and sometimes there’ll be 4 squads converging on one location. Therefore, it can be hard to say for certain that you won or lost a fight because of the gear involved.

In order for players to absolutely maximize their chances of winning each round, they would need:

- 4 characters at max level, with all 3 of their currently selected character’s skill slots purchased/unlocked and the 3 additional maxed out characters’ skills equipped

- A pet with an ability at max level

- Over 45 gun variants or Evo Guns equipped, to cover all of the possible weapons that might be found when looting

- Their preferred consumables in stock and equipped

Even if the player were to have access to all of the above, the outcome of any given encounter or match is so chaotic that spending a lot doesn’t ensure they’ll dominate. Skill, chance, and circumstance are all significant factors.

In many ways Free Fire has created the ideal scenario to sell power, because the degree to which it affects the outcome is in the goldilocks zone: the benefit of spending is “just right,” since buying power might increase your chances of winning, but it’s not so influential that the game feels consistently and fundamentally unfair or corrupt.

This scenario – where the player can spend on things but not reliably have access to them – is quite rare, and it’s inherent in the core game design of battle royale. If another F2P game can recreate this pay-to-have-a-chance-of-finding-something-that-can-help-you-win dynamic, it might stand to profit enormously. CCGs, roguelikes, and games featuring randomly spawning power-ups are all likely candidates here.

Perhaps it’s this unreliable benefit of power that makes the pay-to-win aspects of the game palatable for players. Or maybe – for Free Fire players – buying power just feels normal…?

Baked-in Pay-To-Win

Given Free Fire’s rampant popularity in regions where mobile gaming is still relatively young, for many of its players it’s likely to be the first and only battle royale game they’ve played. If that’s the case, the fact that it sells power would be uncontroversial because the player base’s frame of reference and expectations for the genre would include the selling of power by default.

In some ways, Free Fire has cornered the market on selling power because none of the other genre incumbents would dare try to introduce it for fear of player revolt.

Free Fire is doing what few other F2P games do: successfully selling both cosmetics and power. Typically it's all power, all cosmetics, or lots of power and some cosmetics on the side, but here both appear to be very significant sources of revenue.

But that’s not the only interesting monetization trick up its sleeve.

Temporary Value

When a player spends in Free Fire, it’s completely normal for them to receive something cool or powerful - temporarily. The vast majority of prestigious cosmetics and gun variants can be earned in 24h, 3d, and 7d versions, with a ~3% chance of any given loot box or spending minigame awarding an item permanently. Once the real-time limit has run out, the item simply disappears from the player’s inventory.

This isn’t unique to Free Fire. The practice of awarding exciting items temporarily was popularized by Korean game developers a while ago, while PUBG Mobile has had them for years, and even PUBG on PC has dabbled now and then. However, in Free Fire, temporary ownership isn’t the exception – it’s pretty much the rule.

In some ways this is a clever alternative to the standard randomized rewards practice of giving players stuff they don’t care about most of the time, with the hope that they’ll receive something awesome. In Free Fire, the player is basically guaranteed at least temporary access to something desirable, with the chance of permanent access. Another benefit to this system is that players can be given awesome things for a relatively modest sum; they just don’t get to keep them. For some players that’s probably preferable to being given something unremarkable permanently.

This approach has the interesting effect of compelling the player to engage more heavily with the game while they’re in temporary possession of the awesome thing in order to make the most of it, with the possible downside that players might not want to spend unless they intend to play a lot in the short-term. The result is that Free Fire players might save up and spend a lot shortly before a big session. Generally speaking, anything that discourages a player from spending right now is considered weak monetization design.

Another con of temporary ownership is that players aren’t steadily building up a large collection of items they can grow attached to and therefore want to invest in further. The sunk cost is just as great, but the implicit loyalty and stickiness it generates is dulled because the player has much less to show for it.

A further side effect of temporary cosmetics and flashy gun variants is that you can return to the game and sometimes your character looks strikingly different. Without something fancy equipped, you feel “naked” and you’re compelled to put something new on (prompting you to browse your inventory) or try to acquire something fresh.

All that aside, what does it take for a player to maximize their chances of winning? If you combine the 45+ gun types with temporary ownership, the amount of spend required for a player to reliably happen across a buffed gun is truly immense. Presumably – as with selling of power – the prevalence of temporary ownership is fine and dandy for the audience because, for many of Free Fire’s players, this game set the precedent and the standard. However, it seems doubtful that players who are used to permanent ownership of their items will find Free Fire’s approach appealing.

Free Fire has one last wildcard to play in the monetisation game: UGC and private servers.

Privatized Fun

Free Fire players can spend a “ticket” to create their own private room, choosing from a bunch of different game modes and customizing numerous gameplay parameters (jump height, max HP, etc). Monetized custom servers are present in other titles – notably PUBG Mobile – but with the release of Free Fire MAX, Garena has upped the UGC game with “Craftland,” enabling players to not only host their own matches but design their own maps.

Since Fortnite and its Creative mode have been absent from mobile since mid-2020, this is something of a resurrection for UGC in a mobile shooter. It’s also potentially a real boon for Garena, as building an intuitive on-device map editor is a major technical and UI/UX undertaking, and most competitors seem unlikely to do the same.

The combination of having to spend in order to host a private room with the existence of player-designed maps is a step in the direction of harnessing player creativity as one of the flywheels in Free Fire’s monetization engine. However, it seems unlikely to really take off, since players have to pay every time they want to make their creation available for others to check out. Arguably Garena designed the monetization strategy in a way that seems likely to severely harm the uptake of Craftland, which will in turn reduce demand for private room tickets – a negative feedback loop that could ruin the whole ecosystem.

So, is all this selling of power, temporary items, and UGC sustainable? Will Free Fire’s player base be exposed to other battle royale games that are more fair or generous and desert it in droves? Are we already seeing that happen in some regions?

Before we can answer those questions, we need to take in how Garena keeps the game fresh and exciting for its enormous audience.

Hyperactive Live Ops

Battle royale games are well-known for keeping their hungry players fed with a steady stream of new game modes, maps, weapons, vehicles, gadgets, and cosmetics, often wrapped up in cohesively themed and slickly marketed packages. Free Fire is no exception, and Garena arguably does all this better and faster than anyone else, with some of the most polished, diverse, and deep live ops in the business. Each exquisitely executed season and battle pass has its own in-game intro video and menu scene, along with very high quality cosmetics, some of which also have their own intro animations.

Within a season, Garena will roll out multiple very involved and strongly themed sets of live events on a tight calendar. Some of these events manifest as a remarkably complex temporary game-within-a-game, such as a boardgame where the player rolls dice and moves along a path, or a mini town builder/tycoon game with its own intricate set of currencies, timers, and progression requirements. Each mini-metagame has a custom UI, theme, setting, storyline, and ruleset.

These are just some of the walled garden economies that players are frequently invited to participate in, where tokens earned from engaging with one type of live event or another can be spent in a specific themed shop that features exclusive items.

On the level of regular gameplay, Garena keeps its playlist fresh and rotating through with new game modes and maps, with the most ambitious and noteworthy additions being knock-offs of other ultra-popular online multiplayer titles, such as Pet Rumble (Among Us) and Pet Mania (Fall Guys). This is a clever way to capitalize on proven gameplay formats floating around in the zeitgeist that players already understand, while keeping players within the Free Fire universe (dare we say turning the game into a micro-metaverse - a “microverse”).

These particular modes are markedly more social and less violent than the regular play, which is a step in the direction of making the game a place to simply “hang out,” capitalizing on the digital macro trend that emerged during the pandemic. These modes also utilize pets as the playable character, which allows the player to get more out of their existing assets and encourages them to invest in an otherwise secondary collection.

Furthermore, making these novelty modes available in the live public schedule and then migrating them to the monetized private servers system potentially results in lots of players being exposed to these experiences and then later spending to have those experiences again once they’re out of rotation. Regardless of whether this was calculated or developed organically, it’s a smart side hustle that further engages and monetizes players.

As is the industry standard, Free Fire’s live ops tie into various seasonal cultural events, such as Christmas, Chinese New Year, and Carnival. As has been written about extensively elsewhere, Garena’s execution of these events is noteworthy for being particularly region- and audience-specific in order to maximize the chances that they’ll be relevant, evocative, and engaging. These “hyperlocalized” live ops are facilitated by mini-development teams on the ground in each major region, which also enables the company to run in-person esports events and tournaments to foster grassroots communities.

The game also incorporates numerous IP tie-ins (e.g., Free Fire x Venom, Free Fire x Money Heist), some of which also have their own metagame systems; they’re not just cosmetics, they’re actual gameplay. Similar to Fortnite, the playful aesthetic and theme of the game overall make for a broad canvas to paint on, ensuring almost nothing is incompatible as a licensed live event.

Also not unlike Fortnite, Free Fire has played host to in-game concerts by pop stars, such as DJ Alok, a hugely successful Brazilian artist. As it’s wont to do, Free Fire shows even greater ambition, taking the interesting further step of having its own virtual band, which is something of an inversion: instead of taking mainstream pop culture and bringing it into the virtual world, Free Fire is generating its own culture and exporting it to the “real world.” Garena already produces massive amounts of promotional video material for Free Fire, including live action short films, so perhaps it will continue down this path and commission a TV series, in the same vein as Fortnite, PUBG, and League of Legends.

In short, the sheer volume, variety, and quality of Free Fire’s live ops is so great that the game feels genuinely different from one week to the next, not just because of the standard levers being pulled (time-limited metagoals, cosmetics, game types, and maps) but because the rules and modes of engaging with the game are also frequently changing in a surprising and delightful way. It’s relentless, incredibly compelling, and very profitable fan service.

However, surely all that furious activity takes a toll, on both players and the game?

Free Fire’s continual evolution and reinvention is so demanding that players are having to re-learn the rules of the game from week-to-week and month-to-month. Sure, they don’t have to engage with the new stuff, but if they want to make the most of the exclusive cosmetics, gun variants, and other rewards, then they need to grapple with the metagame systems that allow them to access it. It’s impossible to say for certain, but it seems likely that the high level of investment required to make the most of Free Fire’s live ops is causing some players to lose interest and churn out.

Perhaps more importantly, and backed by significantly more evidence, is the theory that constant, complex additions to the game are sucking a dangerous amount of Garena’s development resources, leaving fundamental technical issues to fester. The high prevalence of player complaints about performance issues, critical bugs, and hacking – in some cases correlating with a marked drop in DAU – indicate that the tech debts are piling up. It doesn’t matter how fresh the gameplay is if players simply can't play the game, or they're worried they'll lose their progress. This is a somewhat ironic problem for Free Fire to have since it established dominance in the first place thanks to its unrivaled technical accessibility.

Arguably Garena has risked flying too close to the sun, and it needs to return to a focus on the fundamentals if it wants to keep doing such good business in the long-term. The last – and in some ways most confusing – element of the big picture is Garena’s dual-app strategy.

Tiered Up To MAX

In late 2021, Garena launched Free Fire MAX, “designed exclusively to deliver [a] premium gameplay experience in a Battle Royale” with “Ultra HD resolutions and breathtaking effects.” Whereas Free Fire is intended to cater to the low-tier masses, MAX’s enhanced visuals are targeted at players with more high-end devices.

Unlike the fragmented mess of region-specific SKUs that constitute the mobile PUBG universe (encompassing 6 different titles), Free Fire and Free Fire MAX are essentially the same game, with identical gameplay and content, along with shared matchmaking pools, progression, and economy states. The player can seamlessly switch between apps, profiles, and devices and maintain access to the same stuff, as well as playing with friends regardless of which version of the game they’re on. The only functional difference between the two is availability of the map editor, Craftland, which requires a more powerful device.

This appears to be a masterstroke on Garena’s part, since it’s taking the benefits of a huge, established player base and layering on an HD experience, potentially appealing to a part of the market that had previously disregarded the game on the basis of appearance. However, the dual-app approach does beg the simple yet important question: why? Why split the game out into two separate pieces of software? Why not just have the game detect the capabilities of the device it’s being played on and use that to determine which assets to download and display, and which visual effects and features to enable?

Unless there’s something intrinsically limiting about how the game has been engineered, the dual-app approach simply doesn’t seem technically necessary, and in fact the work involved in maintaining the various links between the two is probably much greater than would be required if they were to build the HD functionality into a single-app solution.

Given this, MAX seems likely to be nothing more than a marketing ploy – an attempt at appealing directly to a largely untapped Tier 1 audience by launching a whole new version of the game, tailored to their “premium” devices.

What about performance?

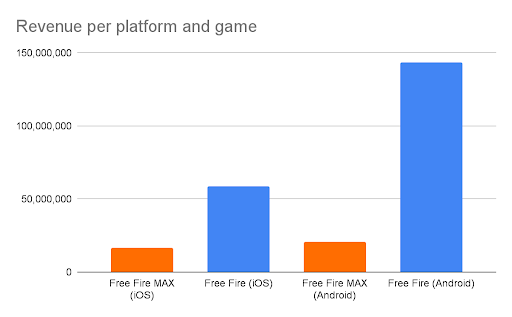

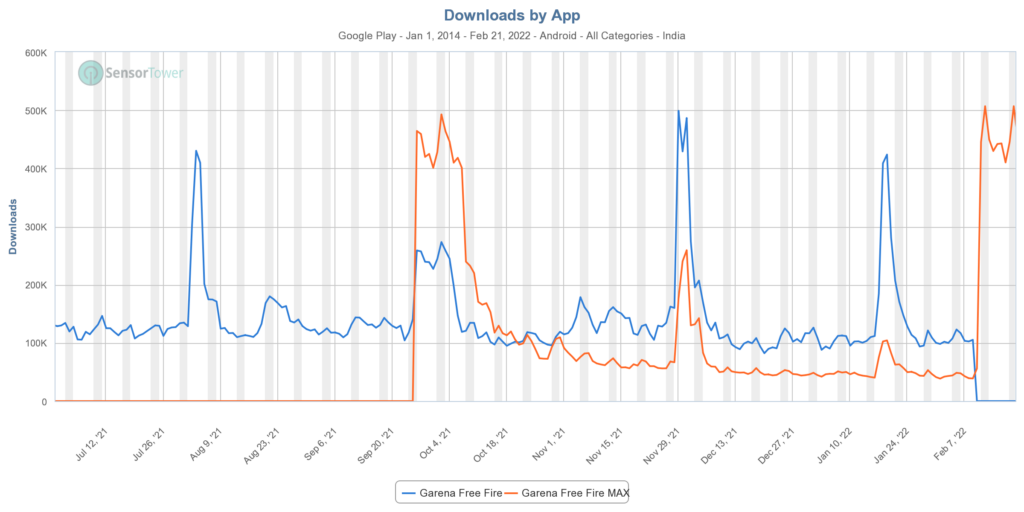

MAX has been out globally since last September. If we look at the last quarter of 2021, in terms of downloads, on both platforms, MAX has been breathing down Free Fire’s neck. Nowadays, the average daily # downloads in the App Store is around 20k, and on Google Play it’s about 10 times more.

However, regarding revenue, MAX doesn’t lift off the ground nearly as high as the original version; unsurprisingly, the ratio is lower on Android.

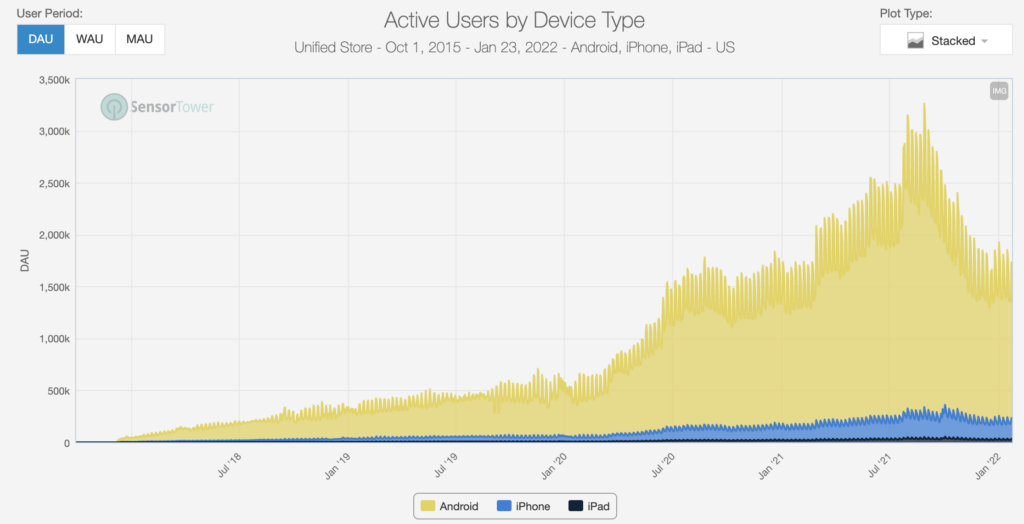

Average DAU on Android is 4 million, and on iOS it’s 260,000. The original version has a 10x bigger audience on iOS, and on Android this difference is almost 25x! Also, it doesn’t go without notice that the release of MAX coincides with an immediate drop in the DAUs of the original game – and one that isn’t offset by the new players joining MAX:

We can speculate about whether players left to try the new version and never came back to either, or felt that Garena’s focus is shifting, or that the gameplay changed too much with the shared matchmaking. Technical reasons also cannot be excluded; for a significant part of the audience, the game has become heavier and heavier for a while.

The difference in ARPDAU on iOS is $0.37 (MAX) to $0.29 (normal); and for Android $0.04 (MAX) to $0.01 (normal). As of the time of writing, on neither platform is the player loss from the base app balanced out by a gain in MAX.

Can we consider MAX a success?

Not really – or at least not yet. The shiny new version doesn’t match up either to the original or to the competition. If Garena hoped to steal a substantial piece of the iOS pie, it hasn’t happened. If there is an audience interested in the HD version of Free Fire, it isn’t finding it, and the original keeps outperforming MAX significantly.

However, it’s hard to believe that Garena would take on such an endeavor without a purpose in mind. A likely scenario is that Garena needed to learn about the development of an HD game, and translating the original into MAX was the cheapest solution. In that case, the real value is the data and technological knowledge. These learnings will very likely be utilized in the next product, or in adapting MAX to a PC/console release, possibly with the same crossplay and shared progression featured in MAX on mobile.

What Led to Free Fire’s Popularity

That’s a thorough examination of Free Fire’s design, but which of those elements contributed to Free Fire’s incredible rise in popularity?

#1 Mobile-First Development

Back in 2016/17, most battle royales were still mainly on PC/console. While not the only company aiming for mobile, the many competitors failed in doing what Garena did right. For instance, Rules of Survival offers maps for 300 simultaneous players, which is hardly the optimization a mobile-first approach requires. Releasing only on mobile and adjusting the content to mobile sessions has been the decision that set Free Fire apart from the competition.

#2 Heavy Optimisation for Low End Devices

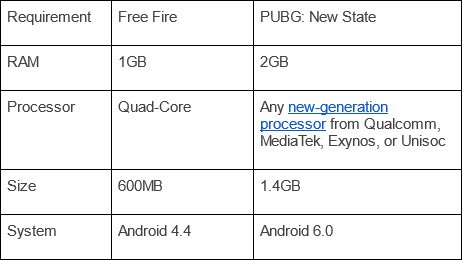

First, the device requirements allow for way simpler devices to run the game, which was a major differentiation for several developing regions. Simply compare the requirements of Free Fire and PUBG: New State (which is mobile-first and perhaps a direct reaction to Free Fire’s dominance on low-tier devices) to see what we mean:

Second, data streamlining: an internet speed of about 1-2 MB per second can deliver a decent gaming experience in Free Fire. In comparison, PUBG and Fortnite require at least 3 Mbps. The game also doesn’t download content without the player expecting it.

Last but not least, design decisions like lowering the amount of players in one map and making the map smaller may have been a part of the plan to make the sessions shorter and more mobile-friendly, but they also allow for easier streaming.

#3 Laser-Precise Content Localization

Garena intimately knows and further explores the needs and desires of the players in vastly different cultures. This started back when Garena localized League of Legends for Thailand, but the team – with hubs in Brazil, Mexico, Vietnam, Thailand, Indonesia, India, Morocco, and Turkey – has done quite a bit with Free fire too. When Free Fire entered India, it introduced a game character, Jai, which was inspired by Bollywood megastar Hrithik Roshan. Another example would be Garena’s inclusion of Indonesian actor Joe Taslim as a brand ambassador of Free Free, with Garena creating a new in-game character, Jota. Of course, that’s just scratching the surface.

#4 Esports Organization Experience

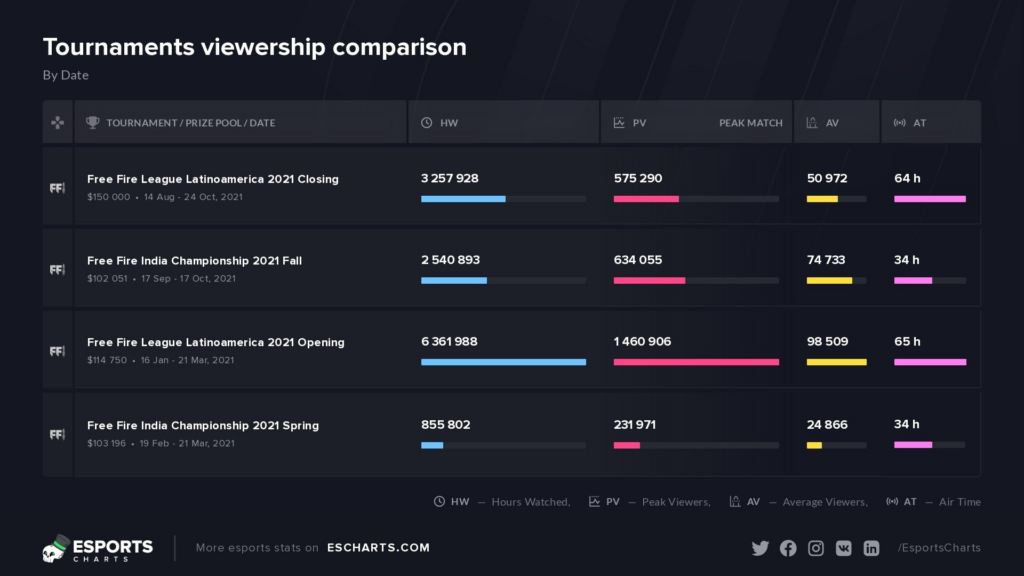

Garena organizes global and local esports tournaments and makes sure everyone feels included. For example, in the Free Fire World Series 2021, even when Indian teams could not participate due travel restrictions, they still received a piece of the rewards, with a follow up tournament enabling remote participation of Indian and Nepalese teams.

Garena not only organizes the Free Fire tournaments but also makes sure they are a spectacle. It seems to pay off given the game’s enormous popularity on YouTube.

#5 Using Its Platform for Distribution

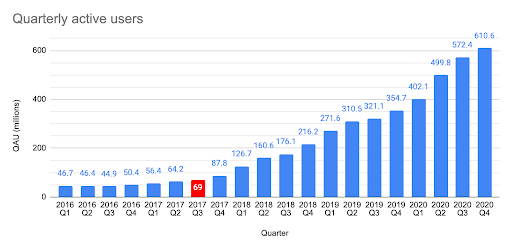

Advertising Free Fire within the Garena platform in SEA definitely helped offset acquisition costs in SEA that other studios would’ve faced. When Free Fire launched, Garena already had 69 million quarterly active users. Of course, much of this was PC players, but it still provided an early competitive advantage.

What’s flawed?

Before moving on, let’s also take a quick note at some weak elements of the game. Of course, some are more important than others.

- The P2W and temporary ownership aspects are probably gradually churning players out due to a sense of greed/unfairness, and it will likely harm the game’s ability to expand to regions where other (less P2W) battle royales are already popular.

- Technical performance seems to be steadily declining, which is a major issue given that the game’s original success can be partially attributed to excellent performance on a wide variety of devices.

The character meta seems weak:

- There’s nothing in the game’s core structure that requires the player to collect/use/level a wide variety of characters.

- In the long-term, power creep seems inevitable since releasing more powerful characters seems like the only way to get players to keep spending on them.

- This will probably prove difficult to solve because the solution would involve a restructuring of the core game / progression.

- The menu and game features are very abruptly introduced; there’s room to improve the first time user experience (FTUE) and ease players in.

- Like a lot of live service games, players are absolutely bombarded with pop-ups, offers, and live event notifications. It can get tiring.

Before moving on to what Garena can do to set Free Fire up for future success, it’s critical to note that the game’s metrics, audiences, and operations vary widely by region. Therefore, in order to be smart about why deceleration has occurred and how to possibly reaccelerate from here, we first must understand the region-by-region stories. Let’s dig into that next.

The Regional Stories

Very few games have region-to-region stories as different as we see with Free Fire. Sure, it can be partly ascribed to Garena’s specific local efforts, but it’s also a fascinating case study of how different cultures respond to rapid changes in the game, the markets, and geopolitical factors.

Before diving into the details of the specific regions, let’s study some higher level observations.

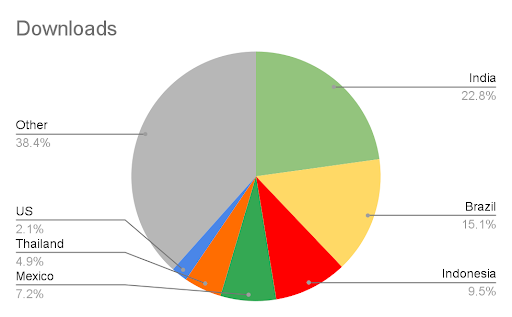

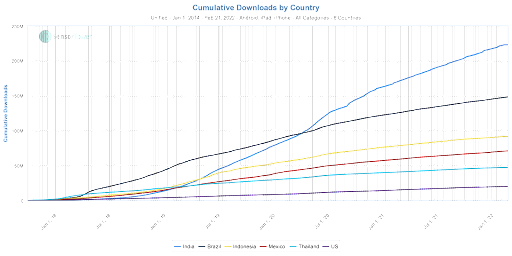

First, take a look at cumulative downloads broken down by region:

As we can see, India has captured the most downloads (followed by Brazil), the US only represents 2.1% of downloads, and Indonesia, Mexico and Thailand round out the top five. Here’s another view:

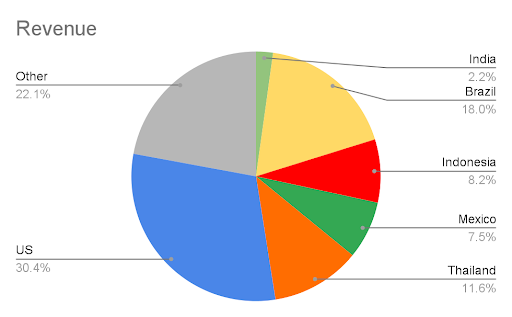

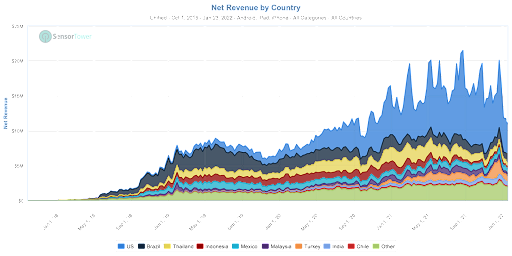

However, when we look at the total revenue, India and the United States act in reverse. India’s total revenue represents only 2.2% of the total, while the US accounts for nearly a third. Brazil comes second with 18%, and Thailand, Indonesia, and Mexico round out this top five.

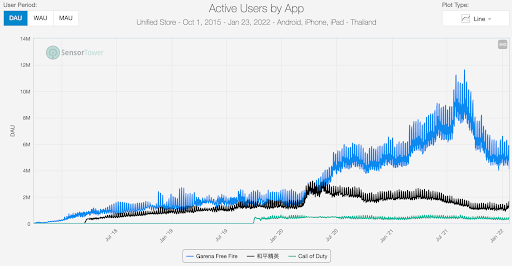

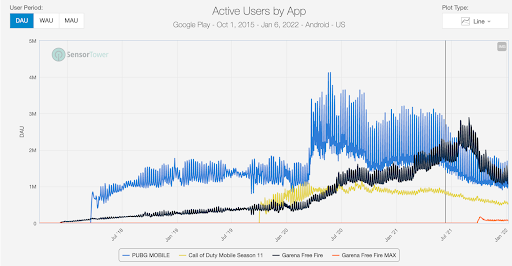

Another high level observation is that COVID was (unsurprisingly) a major driver of growth:Another high level observation is that COVID was (unsurprisingly) a major driver of growth:

As we see in the data, PUBG also experienced a steep increase in DAUs at the start of the first lockdown, but it’s Free Fire that kept the upward trend for a substantially longer period. However, that trend is not sustainable; in August 2021 users peaked, and since then 35% of MAUs (or 155 million players) left the game. Players leaving the game is always a worrying trend. Couple that with a worldwide revenue chart:

The perhaps unexpected success in the US is obviously a positive; if it weren’t for the US, revenue would be the same as mid-2019. However, it still could cause a headache for Garena. After all, it’s not its natural habitat, and it’s the result of a tiny minority of players contributing outsized revenue.

Next, we’ll cover the four big regions – SEA, India, Brazil, and the US – to better understand the local stories and better be able to make predictions about Free Fire’s future.

SEA: What Happened?

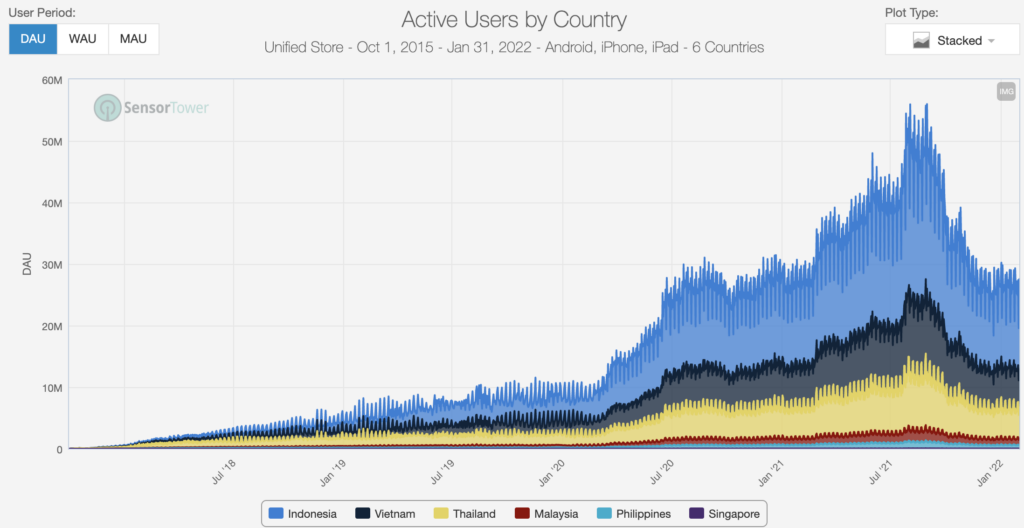

The SEA region has always been one of Garena’s primary focuses, given it is where the company is based and where the team first started operating its publishing platform. As we covered above, Garena’s top two SEA countries are Thailand and Indonesia, so let’s look one layer deeper into the regional data.

DAU-wise, the numbers generally echo the worldwide trend; after the August peak, DAU dropped and stabilized:

What is just as, if not more, worrying is the overall regional revenue:

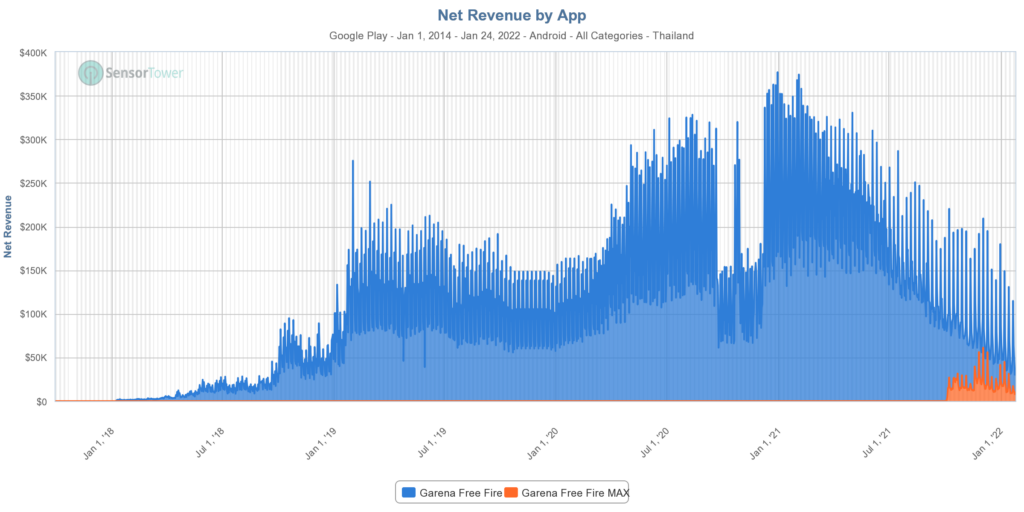

Let’s take a brief look country by country. First, Thailand, which once held a strong third position in worldwide revenue, is experiencing a worrying trend:

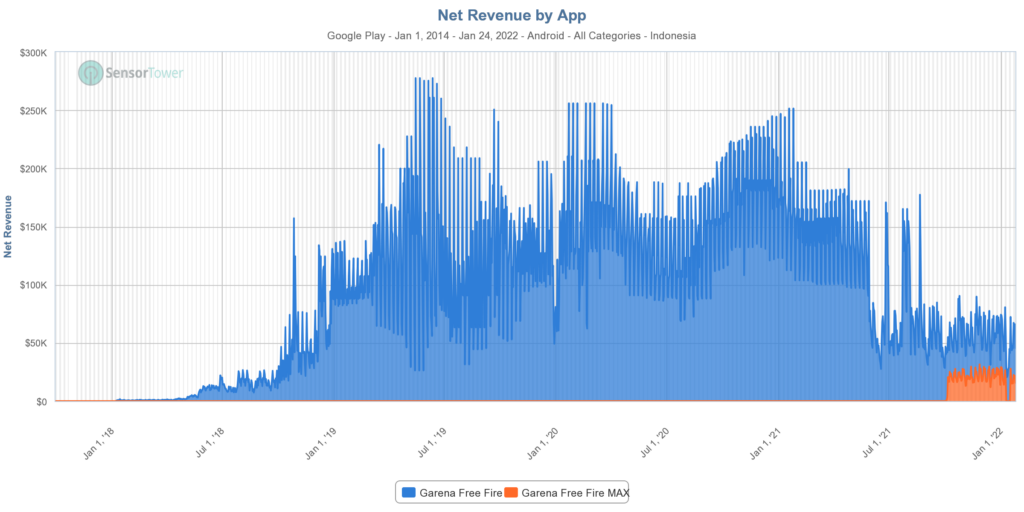

Indonesia, another major market, is also declining. Peculiarly, players abruptly reduced their monetization despite DAUs holding relatively steady (and only on Android) in mid-2021, never to truly recover:

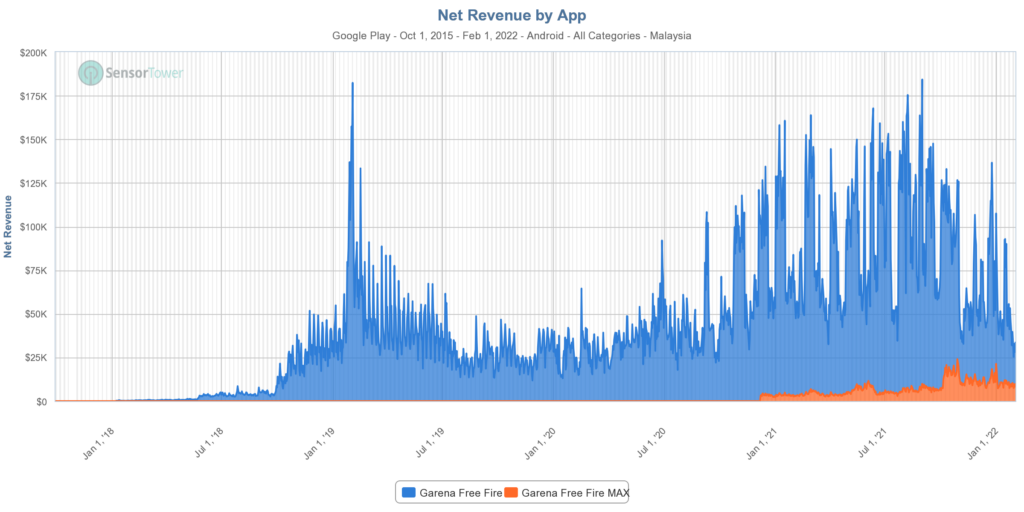

Malaysia, Free Fire’s third biggest revenue-generating country in SEA, contributes ~4% of Free Fire’s total revenue. It hasn’t experienced as clear of a downswing as the other countries, but it doesn’t appear to be growing either:

We have looked extensively at this sudden revenue drop across SEA that happened early June of 2021:

- If it was a technical problem, the DAU would reflect it.

- If it was a reversible change in the game, it would have probably been reversed.

- If it was a societal or economic factor, it would not be as abrupt.

- No lockdown was enforced – or lifted – then.

- It could theoretically be a reporting problem, but that is rather unlikely.

So the only plausible explanation is that something happened in the game that for whatever reason wasn’t possible or desirable to be reversed – at least if we don’t believe that any sort of external change could have caused such a change.

In any case, Indonesian Android payers spend a half of what they used to, and Thai players across platforms spend almost a quarter compared to their peak. Malaysia, while stable so far, isn’t able to make up for the overall trend in SEA.

The question is how did Garena let this happen, and why is it losing audience in its own backyard? For instance, in Indonesia the growth of mobile game usage was +26% between 2020 and 2021, and such growth brings new games to the market that chip away at Garena’s audience. Rising competition, combined with pushes for local development and Garena’s greedy monetization tactics, makes the result less surprising than it may seem at first glance.

India: A New Hope… Crushed

It is definitely crushing for Garena that Free Fire was among the 53 apps banned in India on February 14th, 2022. Both versions on the App Store and the base game on Google Play are no longer available for download, making Free Fire MAX on Google Play Garena’s last app standing.

The reasons for the ban are not completely clear: India already banned many Chinese apps back in 2020, and once again the ban is aimed at China on “national security threats” ground. As we know, Garena is based in Singapore (though Li is originally from China), but given the company’s ties to Tencent, it’s possible that user data was being sent to China. It’s likely that between the company’s ties to Tencent and public calls for banning in relation to tragic stories of teenage suicides, Free Fire was an easy geopolitical target.

Let’s look into India as a market. As we said, Free Fire MAX is still available on Google Play, so whatever strategy Garena was plotting, it’s not completely off the table.

The Rise of India’s Gaming Market

To align yourself with what’s been happening in India, we recommend Naavik’s interview with Salone Sehgal, general partner at Lumikai (India’s first gaming & interactive media fund). Some high level impressive data:

- India has 1.3B inhabitants and 560 million internet users, which is quickly rising.

- 100 million users paid for games in 2021; this number will triple over the next 5 years.

- 50% of new mid/hard gamers pay between $7 to $14 per month.

The number of potential Indian players that can still discover the game is high, and we expect Garena to do all it can to get Free Fire unbanned. India has 1.3B inhabitants, 560 million internet users (second largest market after China).

Part of Free Fire’s success before the ban was the simple fact that it ran on $100 phones. Indian interest in esports is also growing; the absolute numbers may still be small, but the audience tripled in size between the latest spring and fall tournaments. Expect it to continue growing at a rapid pace.

Free Fire in India

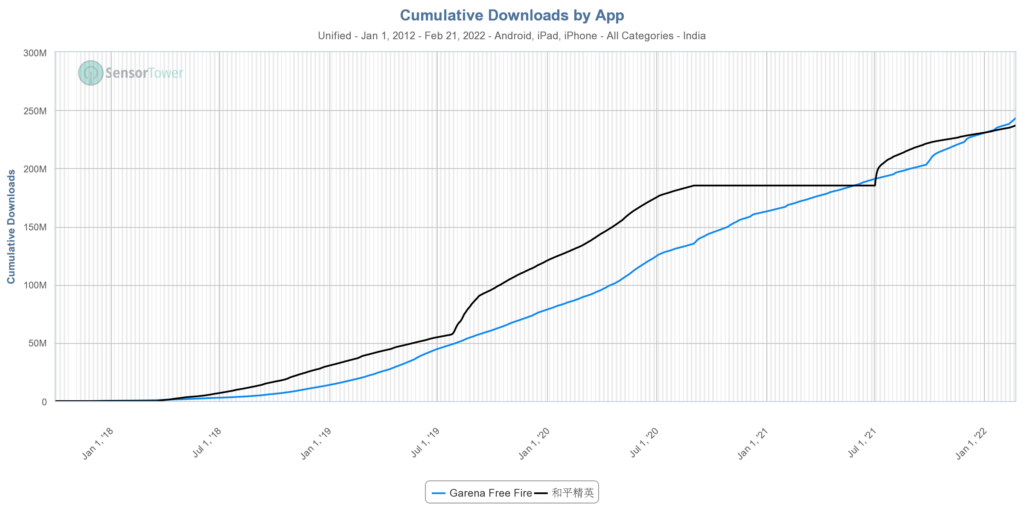

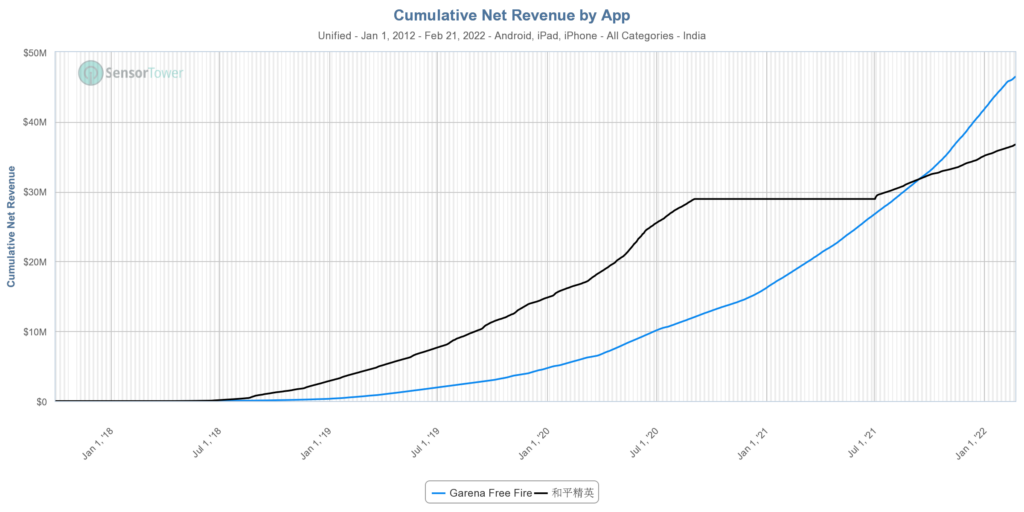

Indian players increasingly flocked to Free Fire after PUBG Mobile got banned in September 2020. As you can see below, Free Fire is still beating PUBG Mobile in terms of downloads. The fact that MAX remains available on Google Play is responsible for the recent numbers being quite stable:

In cumulative revenue, Free Fire has been catching up and passing PUBG – but the impact of the ban is already showing in the latest data:

Until the ban, Free Fire’s revenue in India was growing swiftly (though still small on a relative scale). The ban, of course, had terrible timing, because not only did it hit the country with the highest growth prospects, but it occurred right as other key regions started waning. As we can see, before the ban, Garena turned its user acquisition focus and operations to India more than to the countries in the SEA region:

After the ban, we see that Indian players turned to MAX:

Revenue from MAX almost makes up for the loss – with two caveats. First, the absolute numbers are far from satisfying. Second, the Sword of Damocles still hangs over MAX. It’s unclear why this version of the game sidestepped the ban and whether it’ll be banned shortly.

It’s unclear what will happen next: PUBG Mobile managed to return to the Indian market when they removed gore, under a new name (Battlegrounds Mobile India). Garena will almost definitely work to have the same kind of comeback. Whether the team will succeed is a different story. India has been pushing for digital decolonization, which puts a greater emphasis on local development teams and games. In other words, there’s quite a bit of geopolitical complexity. Of course, if Free Fire doesn’t come back to app stores, it stands to reason that eventually MAX would be removed as well.

Brazil: Becoming A Phenomenon

As Free Fire’s biggest market in LATAM, Brazil (along with LATAM in general) has been in Garena’s sights from the start. All the points listed as why Garena succeeded worldwide do obviously apply here, but two of them hit particularly strong in Brazilian context:

- Free Fire aims for low-end mobile devices;

- Free Fire has a strong focus on esports and localized social experiences;

Let’s look at the numbers. First, Free Fire is the most downloaded game in Brazil:

Second, Free Fire is also, by an impressive margin, the highest grossing game in Brazil:

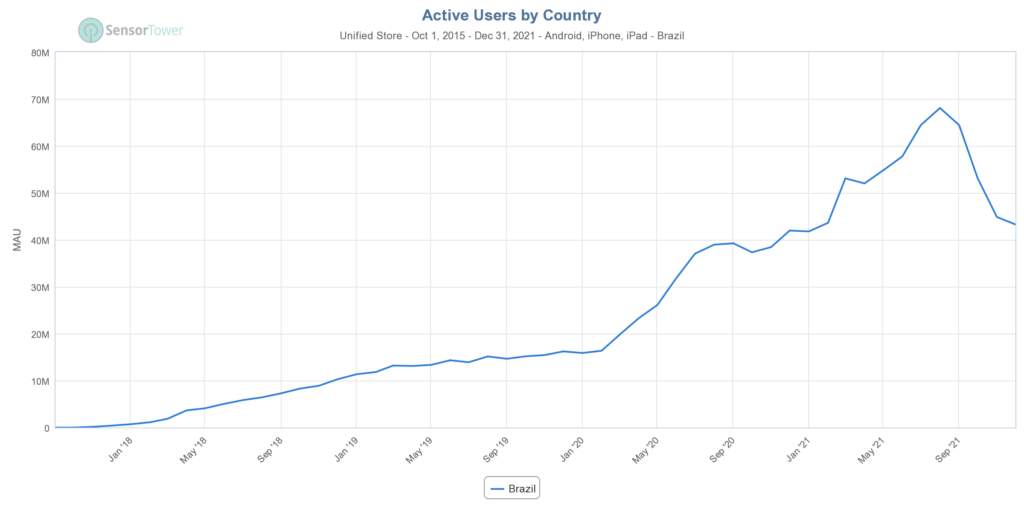

Third, MAU growth in Brazil has been strong until recently:

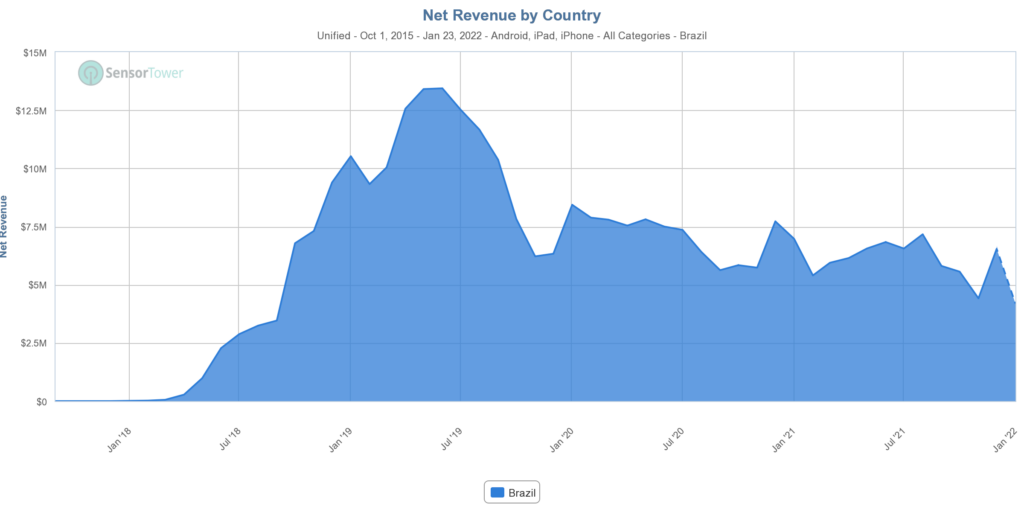

And fourth, revenue peaked in 2019 but is holding relatively steady (just slightly declining) over the past couple years:

The two last charts are very interesting, because revenue was the highest before the COVID-related increase in DAU happened. What happened in the game in 2018 and 2019?

The rise

In 2018, Free Fire became a phenomenon and spread in Brazil like wildfire. Even if you had a premium phone, there was now an option to play with your friends who did not. The speed and intensity of the adoption spoke to how underserved the Brazilian market was when it came to approachable competitive games. Influencers (like Nobru, LOUD Babi, and El Gato) grew overnight from ten thousands to millions of followers. At that point, the majority of the top 10 videos on YouTube in Brazil were Free Fire videos.

Free Fire in Brazil took the old dream of becoming a soccer star and leaving the favela, and turned it into a dream of becoming an influencer. In a survey by the Data Favela Institute, Garena's title was cited as a favorite by 96% of respondents. Among participants aged up to 15 years, this rate reached 100%. Simply no other game was remembered.

In 2019, Free Fire continued to be immensely popular. Just as in the previous year, it was the most downloaded and highest revenue generating game in Brazil. The same year, the National Free Fire Association (NFA) was founded. Unlike the Garena-organized single league tournaments, the NFA attracted viewers for a longer haul, as the audience loves to watch the players develop over time. Among many youth, following the Free Fire leagues equaled what soccer meant for previous generations.

The Peak and Approaching Fall

Even though Free Fire maintains its position in Brazil as the most downloaded game, as well as the game that generated the most revenue over the last four years, Free Fire’s revenue seems to have peaked in the region. The bigger trend is that while DAU kept increasing all the way up until last August, revenue was going down disproportionately.

In 2020, the influx of new players kept steady but didn’t get significantly boosted by COVID. We can assume that by this time most players that could have been exposed to Free Fire and converted already were. Growing internet access can account for some new players, but it is unlikely that the virality of 2018 would ever repeat itself. Brazil’s socioeconomic situation also plays a significant role; Brazil’s GDP has been weak, and most people would feel the impact.

However, Garena itself isn’t guilt-free. The game first gained traction in Brazil before the gun attributes were introduced, and adding a P2W aspect in a region with lower buying power that's sensitive to unfairness was never going to be warmly accepted. A recent example of Garena trying to squeeze as much as possible out of players was the Festa de Verão, a mid-January event in Brazil where players “could” win up to 10k of diamonds. Over the week, the game accumulated 600k negative comments, with every fifth one-star review mentioning the event directly. Miscommunication, terrible odds at finding the right token, and tricking influencers into promoting the event all heavily backfired.

Garena placed a bet on success in Brazil from the beginning, and it more than paid off. Free Fire is still big in Brazil and will likely remain so for a while. The decreasing DAU doesn’t seem to impact revenue, meaning that the players that are indeed leaving were likely not heavily paying in the first place. It’s possible that the players who can’t afford to pay up for the P2W aspects are losing interest and churning out.

Can Garena stage a comeback in Brazil and return to the numbers experienced in 2019 when the game was peaking?

Brazilian culture is incredibly viral, and it’s likely that a similar success could be achieved with the right game and the right sensitivity for this specific audience’s need. For Garena, the risk is that the audience will get tired of the P2W mechanics and grindiness, and also, for the influencers, no amount of highly innovative live-ops will keep the game interesting forever. It’s unlikely the numbers would return to the 2019 peak simply because almost everyone who could have seen and tried the game already did (150 million downloads in a country with 212 million people).

The United States: Android Middle Class

Making Free Fire succeed in the United States hasn’t been Garena’s top priority. In fact, the first opportunity to watch Free Fire esports in English only started in 2021, and US-based DAUs only started accelerating in March 2020 alongside the pandemic. Until then, Free Fire has silently been living in the shadows of its more successful battle royale competitors.

Or has it?

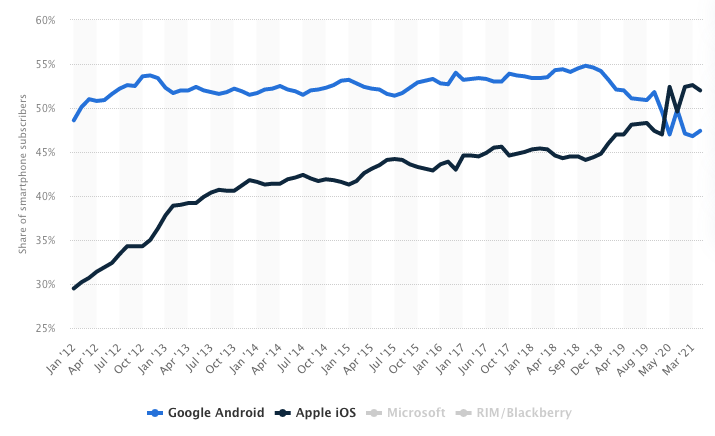

The download per platform chart is only mildly interesting. Sure, the ratio of Android to iOS devices is unusually high (for Call of Duty: Mobile and PUBG Mobile, iOS is the dominant platform):

The truly intriguing reality shows when we look at DAUs. Whereas PUBG Mobile’s iOS users represent 63% of its total audience, and whereas Call of Duty Mobile’s population is more or less evenly split, for Free Fire, the chart looks like this:

That’s an incredible number. Even in the US, Free Fire is dominated by Android, which is the opposite of what most would guess and what most games see. Here’s another statistic:

In the US, the iPhone has over 50% market share. In this iOS audience, if they play a battle royale game on their phones, it’s 10 times more likely to be PUBG Mobile than Free Fire. The other half – Android users, especially those with lower-end devices – is underserved.

This mass of Android low-end device users picked up Free Fire simply becausethere wasn’t anything else. It would be shortsighted to believe that just because these are low-end devices, their owners are not willing to spend money. As a reminder, players in the United States make up only 2.1% of Free Fire’s total downloads but account for 30.4% of the total accumulated revenue. At this very moment, almost half of the Free Fire monthly revenue comes from the US. This puts Garena into an interesting position – the big market they haven’t prioritized is suddenly holding outsized influence on Garena’s profitability.

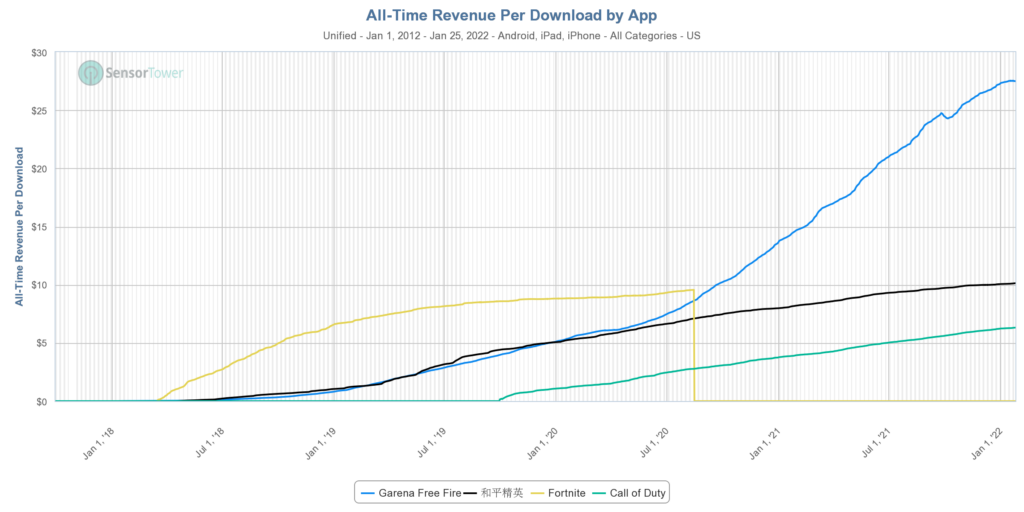

Also, Garena in the US has an incredible revenue per download (RPD): Given that installs are stable, we can assume that whatever marketing Garena is doing, it works great for the existing audience.

For now, Free Fire is sitting in a good spot in the US – perhaps even too good as it will be tough to further grow the market or monetize much better, given the market is already performing so well.