Big thanks to David Taylor for spearheading this essay — and to our OGRI partners for making it possible! To explore working with Naavik and David on your UGC games consulting needs, please contact us here. We'd love to chat.

It was a massive year for user-generated content (“UGC”) games in 2023. New platforms launched, developer payout pools grew, platform capabilities expanded, and new games made by indie developers pushed the boundaries of what is possible in their respective platforms. If UGC games seemed like a trend at the start of the year, the number of momentous events across the year makes it seem more like a movement as the year came to a close.

- Epic Games caught the attention of the entire games industry with its announcement at Game Developers Conference (“GDC”), where it committed 40% of Fortnite’s net revenue, an estimated $1B, to an engagement pool for Fortnite creators. In the end, developers will likely bring in only 20-25% of that engagement pool after Epic takes its share of the pool, but it was a major influx of capital into the burgeoning UGC segment of the gaming industry.

- Meanwhile, Roblox made great strides in providing more capabilities to creators across analytics, advertising, and monetization, all while continuing to grow at roughly 20% year-over-year in bookings, player growth, and developer payouts.

- Generative AI became a key talking point for Roblox and Rec Room. Similarly, several startups that struggled to accelerate the flywheel of creators, UGC games, and players looked to AI to solve their cold-start problem.

- The Mediatonic team introduced new tools in Fall Guys Creative Construction that put obstacle course creation in the hands of the players. According to the Fall Guys Twitter, players created 230,000 levels in 48 hours, showcasing that the creation process can be a strong engagement lever for players. Meanwhile, NetEase’s Eggy Party, continued to grow its user base overseas by leaning on UGC minigames, and a new competitor from Tencent, Fun Party, jumped into the UGC-enabled party game fray.

- In August, Rockstar acquired FiveM, the server provider for most Grand Theft Auto V (“GTA V”) UGC, and also where the majority of GTA V engagement takes place. With 190 million copies of GTA V sold, GTA VI has the potential to be the next big UGC games platform if the Rockstar+FiveM combination is up for the task.

- Major game studios including Maxis, Studio Wildcard, and Blue Isle Studios partnered with Overwolf to integrate CurseForge as a platform to elevate community-created modding experiences for new and existing games. Studio Wildcard’s ARK: Survival Ascended, a remake of ARK: Survival Evolved, focused on leveling up graphics and modding capabilities, leaving the storytelling to its large following of UGC creators. LEAP by Blue Isle focused on integrating UGC from day one with an extensive UGC offering, including private servers, diverse official maps, and modes, and a robust content roadmap. Since partnering, mods for Maxis’ The Sims 4™ have reached 500 million downloads, while ARK: Survival Ascended mods have reached over 50 million downloads.

It’s not all rays of sunshine in the UGC games space this year, however.

On Sept. 1, Media Molecule, the Sony-owned developer of Dreams, announced it would end its servicing of the UGC games platform that was launched in February of 2020. Dreams was Sony’s opportunity to own its corner of the metaverse and the expectations leading up to its launch were high. However, Sony never made significant investment into marketing or developer payouts, and the platform only managed to gain a small and passionate creator community. If anything, the decommissioning of Dreams goes to show the resource intensity required to get a UGC games platform launched. As Epic is discovering with Fortnite, it is a long road, requiring heavy investment in development tools, publishing platforms, and community payouts. Not everyone, Sony included, has the stomach or budget for it.

Being a platform in the UGC games space comes with many challenges, but the rewards are tremendous. In this article, we will cover the biggest moments of 2023 for the two biggest UGC games platforms, Fortnite and Roblox. We will also take a look at the world of live-service UGC, as well as modding for platforms that could rival Roblox and Fortnite in the future. Lastly, we will break down creator earnings and what it means for those looking to build the next UGC game breakthrough.

The State of Roblox

We think of Roblox mostly as a gaming platform. But it’s important to remember that Roblox thinks of itself as a social network, and that games just happen to be the way that its current audience prefers to socialize. Roblox has set their sights on the goal of becoming a billion-user platform. As it stands today, Roblox has roughly 70 million DAUs, making it larger than Playstation and Xbox combined, but if it can sustain its current annual growth rate of 20%, it would still be a 15-year endeavor.

To sustain growth and achieve user numbers like Facebook and Instagram, Roblox will need to grow beyond gaming and become a primary form of communication across all age demographics. To that end, Roblox founder and CEO Dave Baszucki has started referring to Roblox as a “utility company” along with the introduction of Roblox Connect, which allows avatars to meet up in virtual environments but also features facial recognition and animation. Roblox also introduced age 17+ experiences for mature audiences this year to further entice older demographics to the platform. The hope is that if they can create a social ecosystem of content and communication catered to all ages, Roblox will become a part of every connected individual’s everyday activities.

Roblox will not become the next Instagram or Facebook overnight, but it is important to keep in mind that its ambitions extend beyond gaming as we look at the numerous strategic initiatives it executed over the last year.

Improvements to the Platform

This year, we saw Roblox execute several initiatives that moved the needle financially and the long-term viability of the platform and the creator ecosystem it enables:

- Geographic Expansion

- Platform Expansion

- New Creator Tools

- Enhanced Monetization

- Discovery Optimization

Let’s tackle these one at a time.

Geographic Expansion

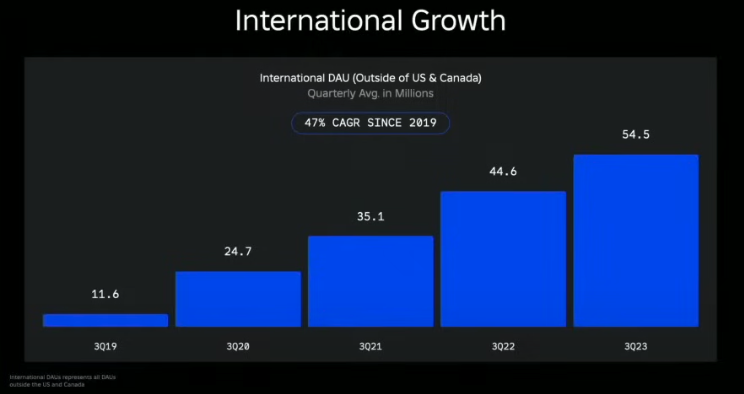

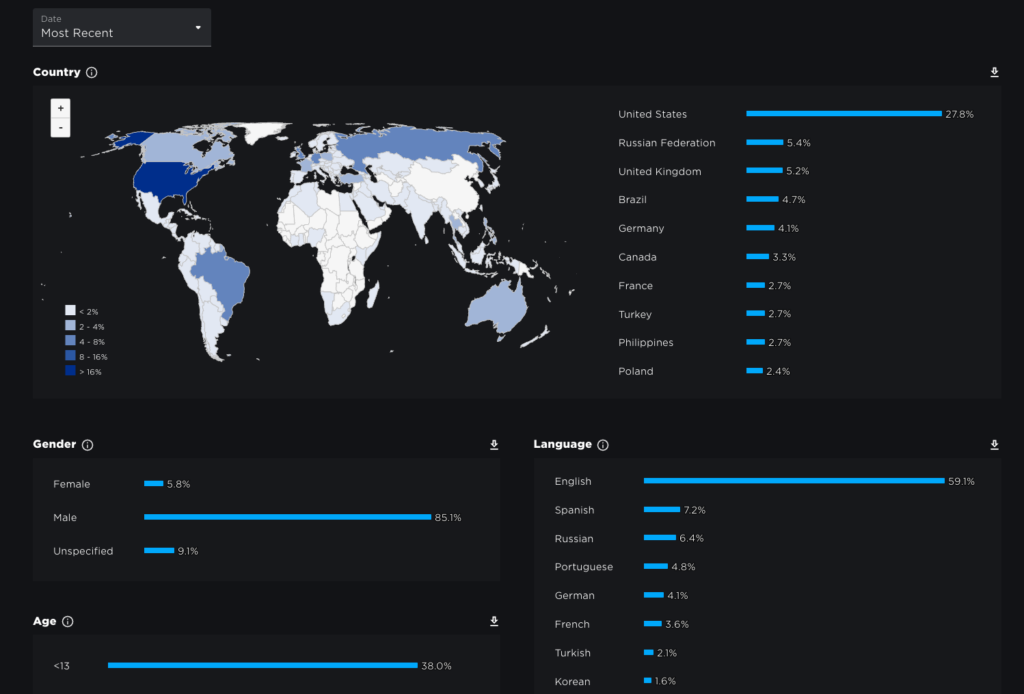

Roblox’s primary growth drivers for 2023 were driven by global expansion, notably in Japan, Germany, Brazil, and India. International growth since 2019 has been increasing at a compound annual growth rate (“CAGR”) of 47%. While these geographies are currently less profitable than the U.S., Roblox pointed out in its Nov. 15 Investor Day that monetization per player is increasing globally.

Like all growth, it will slow as the company reaches market saturation, but for now, there appears to be a green field for Roblox to continue to grow internationally.

Platform Expansion

This year, Roblox arrived on Meta Quest and PlayStation. The latter in particular saw 15 million downloads within the first few weeks. I personally was a beneficiary of free Meta Quest Pros given out to every attendee of the Roblox Developer Conference (“RDC”) — a smart partnership between Roblox and Meta that could nudge creators to develop more first-person immersive experiences suitable for the Meta Quest. (It could also clear out some Meta Quest Pro Inventory that was going to be rendered obsolete by the Meta Quest 3 and the potential discontinuation of the Pro line, but hey, I’ll take it.)

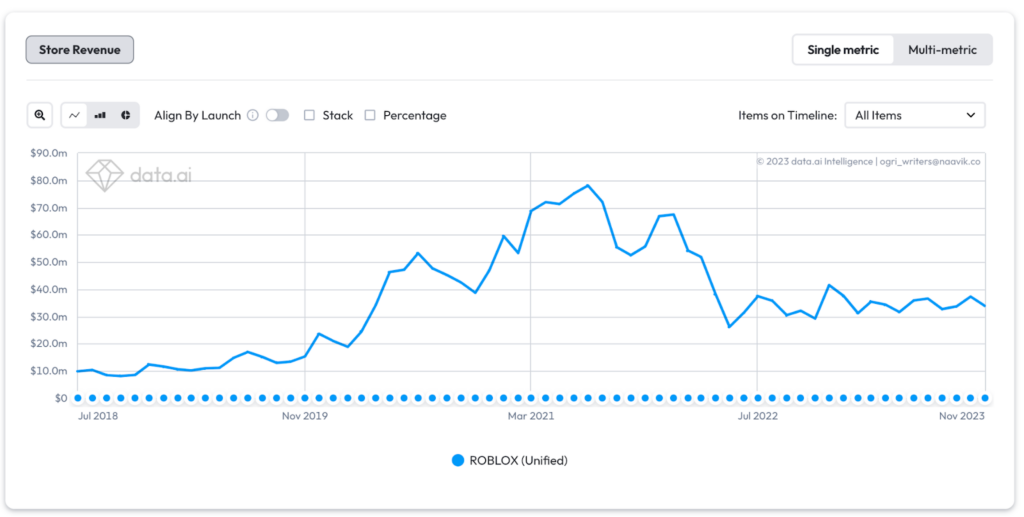

Both of these initiatives are critically important as they represent new sources of revenue for Roblox and critical frontiers for Roblox to maintain its 20% YoY revenue growth. As the graph below shows, mobile revenue in the U.S. has not rebounded from COVID highs, so Roblox is more dependent on higher monetizing platforms like consoles, PC, and most importantly, gift cards to maintain their revenue growth.

Monetization Expansion

Roblox saw its bookings and revenue beating estimates by a considerable margin, sending the company’s stock soaring by 16% in the fourth quarter of 2023. There were two monetization initiatives that likely contributed to this outperformance:

- Roblox adjusted the discovery algorithm to favor games that monetize better.

- It also enabled all creators to produce limited items. These are digital collectibles (like NFTs) created and sold in the Roblox marketplace. Giving these limited items away for free, referred to as “Free UGC” by the Roblox community, became a popular incentive to bring players to experiences, but oversaturation of limited items has reduced the effectiveness of free UGC as an acquisition lever, and likely the willingness for creators to spend time minting” them.

Some initiatives that are on the horizon, but haven’t yet delivered major revenue uplift, include:

- Subscriptions for experiences.

- Several advertising features were also introduced to help developers monetize. Now, developers can drag and drop ad units into their experiences and make money off the number of “teleports” in the case of immersive ad portals, or “impressions” in the case of video ads. While paid teleporting was already a tool offered on the platform, Roblox’s Ads Manager makes it far more accessible to developers to integrate, track, and be compensated for those teleports.

- Any bookings increases are likely further out as the developer community and the players they serve become better acquainted with these products before they can scale.

Further, average monthly payers have been growing at a 45% CAGR since 2019, reaching 14.7 million in the third quarter of 2023, in large part due to the stickiness of the Roblox Premium subscription strategy. Additional advertising features are on deck to further grow revenue per user, like in-game commerce, which we’ll discuss in the Branded Experiences section.

Toolset Expansion

Roblox also took steps in building out its creator toolset. Generative AI was one notable addition intended to make it so that anyone could be a creator. Meanwhile, Roblox invested in added analytics capabilities equipping developers with deeper insights about their game and allowing them to become more sophisticated operators. Both these features have major implications for creators:

Generative AI tools - Roblox announced early in 2023 it would be introducing generative AI tools to make game creation easier for developers. Then, in September, at RDC, the company invited developers to opt in to sharing their anonymized Luau script data to train their AI model. Roblox said in the announcement that “[developers’] script data will be added to a data set made available to third parties to train their AI chat tools to be better at suggesting Luau code, giving back to Luau developers everywhere.” It’s worth noting that there was no discussion by the company on how AI could make developers’ hard-earned skills less valuable.

If Roblox is successful in its vision of making “every user a creator,” the coding skills of developers could eventually be obsolete and Roblox development commoditized. This is all to say that creators who invested years of their childhood and early careers into developing for this platform might have disadvantaged themselves if they opted in to sharing their code base to train Roblox’s AI development co-pilot.

Analytics Capabilities - Data is power, and in this case, Roblox delivered in 2023.

Over the past year, improvements included:

- See your audience segmentation by geography, language, age and gender.

- See how your experience is performing relative to similar experiences on the platform.

- Added important monetization analytics features, such as revenue by product type, so creators know which items are resonating best with their audience.

- An error report counting the number of times different errors occur in the experience, allowing developers to easily optimize their experience and identify persistent and pervasive bugs faster.

These new analytics features will allow creators to better understand the audience they are developing for, empowering them to make smarter updates, and ultimately better games.

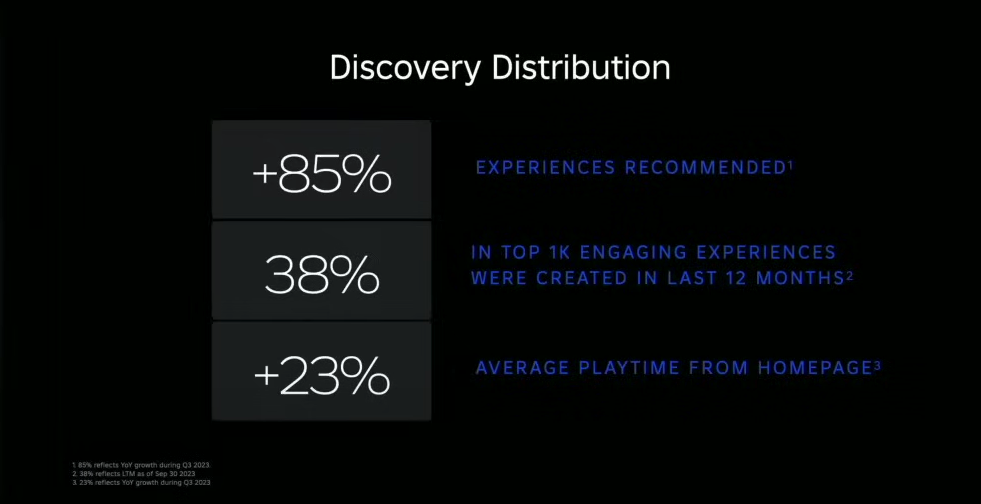

Discovery Optimization

To keep a steady flow of new developers and new content, Roblox needed to demonstrate that new games could be successful, too. When I reported on Roblox back in 2022, the average age of a top 10 experience was 4.5 years. Today, the average age is under four, and three of those experiences are less than a year old.

To achieve this, Roblox increased the number of experiences being recommended in discovery by 85%. As a result, by the end of September, 38% of the top 1,000 experiences were created in the last 12 months. It’s likely that the emphasis on monetization also helped push players to new experiences since new games would get recommended as a result of the change.

As saturated as the market might feel with 5.6 million individuals developing experiences on the platform, the data above suggests that it is becoming easier for new developers to be successful through Roblox’s increased distribution of payouts.

Developer Payouts

The two most important factors game developers consider when choosing a platform are whether they can make the games they want and whether they can earn enough money making them. In terms of the second factor, Roblox continues to increase the number of creators who can make Roblox development a full-time job, or even a venture-backed company.

The top 10 developers on Roblox are, on average, making $27 million per year, a 1.5 times increase since 2020, with the top creator just shy of $100 million. Additionally, there are almost 100 creators making over $1 million on the platform, a 2.2 times increase since 2020.

Given that developer payouts for the whole platform increased by almost 2.5 times over the timespan shown, it appears Roblox has managed to reduce the concentration of developer payouts, spreading more to less popular creators beyond the top 100. This is critical because it allows for there to be more creators in the ecosystem who are able to sustain a livelihood, while incentivizing emerging talent to onboard. It also benefits Roblox because it makes the company less dependent on any single piece of content. For example, if the platform’s top game, Blox Fruits, were to spawn a lawsuit alleging it infringed on the One Piece IP, Roblox could weather a shutdown of the game without losing the tens of millions of players who play the game every day.

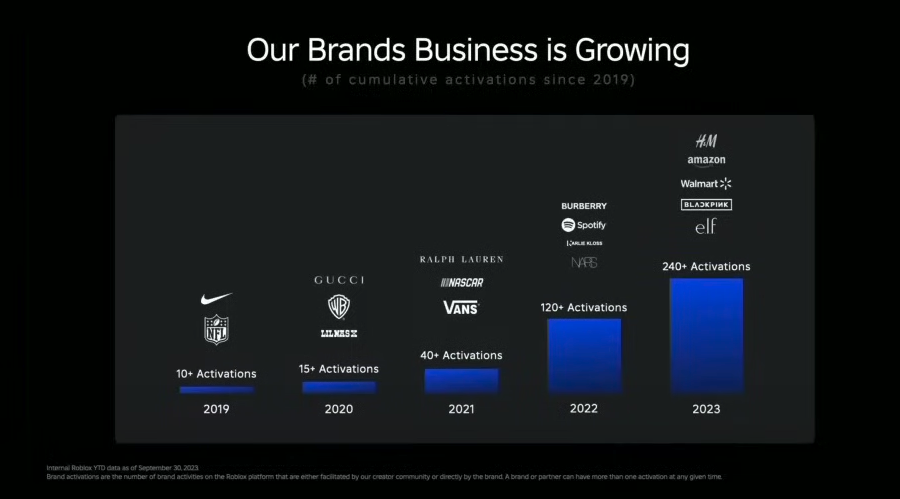

Branded Experiences

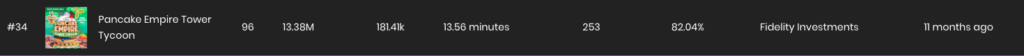

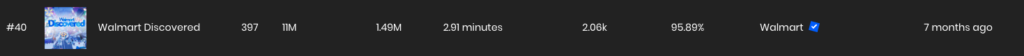

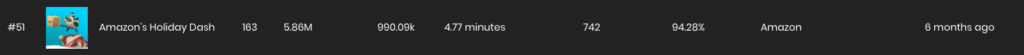

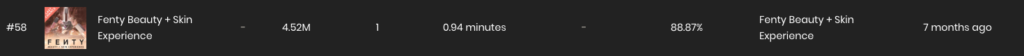

The number of branded experiences on Roblox doubled in 2023, demonstrating continued interest from brands in metaverse-like platforms. However, whether those branded experiences were successful is another story. A look at the top-performing non-entertainment brands pictured below shows that across the board, non-entertainment brands struggled to drive significant engagement on the platform.

This is not a new phenomenon. The brand experience with the most visits all-time is Vans World with over 105 million visits occurring over a 2-year period. On average, Vans World has 700 concurrent players in it, which for a branded experience is extremely high, but compared to the platform as a whole, would be around the 1,000th most engaged experience in a given year.

As a result of the high cost of launching an experience like this — between $300k-$500k just to develop, not including operating costs — brands are turning to already highly-trafficked experiences like Livetopia (a popular roleplaying game) to do brand activations. While Livetopia charges a high price for brand placements within the game, it is a more reliable source of impressions for brands, and they still net out to be cheaper than a standalone brand experience.

All that said, in-game commerce capabilities (e-commerce but in-game) is expected to be added to Roblox in 2025, and I suspect this will change the game for brands. Players will be able to walk into an in-game store, try on a digital item, and then purchase the physical version. This has the potential to change a $0.50 purchase into a $50 purchase. Roblox will have to effectively navigate app store fees and physical items having a marginal cost and distribution cost, but this is the experience that brands creating Roblox experiences have been missing.

- Roblox’s algorithm favors high monetizing experiences - The average revenue per daily active user (ARPDAU) on a game is around half-a-cent on Roblox today. Most branded games struggle to achieve even that. But if Gucci, for example, can sell a real-life t-shirt rather than a virtual one to every thousandth player, their ARPDAU would be 60 cents, putting them 120x above the current average. That will likely push the discovery algorithm far more in a branded experience’s favor.

- Attribution will finally be possible on the platform - Today, there is no way to tell if the branded experience actually leads to an uplift in sales. Without attribution, it's hard for brand managers and marketers to justify the high costs of developing and maintaining a branded Roblox experience. With in-game commerce, brands will finally be able to see purchase conversion and thus be able to measure return on development cost and marketing spend, justifying further investment.

- It gives players a reason to visit a branded experience in the first place - Branded Roblox games are not improving on what already exists, so players don’t have reasons to visit them without expensive incentives such as free limited cosmetic items. Immersive shopping experiences, meanwhile, have the potential to be more interactive and fun than walking through a mall. If that's the case, players (that is, shoppers) will come.

According to Christina Wootton, Roblox's chief partnerships officer, Gen Z represents $360B in spending power, and 84% of Gen Zers say that once they try on an item on their avatar, they are likely to purchase it. This makes having a standalone branded experience a must-have for any brand. While brands will have to wait until 2025 to get access to this new feature, they should ensure they are making plans for when this feature does eventually roll out.

Summary

In sum, the Roblox platform continues to make incredible progress on building out its platform capabilities. The remarkable thing about Roblox is its ability to continue to add new features that give players more reasons to be on the platform. Roblox Connect and mature experiences will draw in an older audience and give more people more reasons to use Roblox on a daily basis. Meanwhile, advertising and in-game commerce continue to represent untapped potential for Roblox as it seeks out new ways to monetize its rapidly growing user base of 70 million daily active users. At the same time, they’ve put more power in the hands of their creators with generative AI tools and better analytics capabilities, enabling them to make better, more relevant, experiences for players. 2024 is shaping up to be a very exciting year as creators and players start to adopt these new capabilities, unlocking Roblox’s latent potential as a viral content-enabled social platform.

The State of Fortnite Creative

Epic Games’ UEFN (Unreal Engine for Fortnite) and Creator Economy 2.0 announcement at GDC in March will stand as a milestone that reshaped the landscape of the UGC gaming space.

As an extension of the wildly popular game, Fortnite Battle Royale, Fortnite Creative offers a sandbox-like platform in which players can design, build, and share their own unique Fortnite games. The introduction of UEFN took this a step further, providing a toolkit powered by Unreal Engine, a new scripting language, Verse, and the ability to import 3-D assets into any Fortnite Creative map to help creators produce games with much more diverse visuals than previously possible. Just as important as UEFN, Creator Economy 2.0 promised much higher payouts to creators. Most importantly, it sent the world a message that Roblox was no longer the only major UGC Games platform in town.

While Fortnite is now competing directly with Roblox, it is also important to note their distinct approaches. While Roblox offers only a development and publishing platform, Fortnite continued to create first-party content, which competed with creator-made games for engagement and a cut of the roughly $1B pool of engagement-based payouts. Over the past year, Fortnite reached 100 million MAUs to close out the year, up from 70 million back in March. That 43% increase was largely due to Fortnite OG’s huge success, and the Big Bang Event that followed, along with LEGO Fortnite. That’s important to note because Fortnite Creative’s success to date has been largely driven by the success of the Fortnite Battle Royale live service, and we see no signs of that changing in 2024.

Fortnite’s Big Bang Event

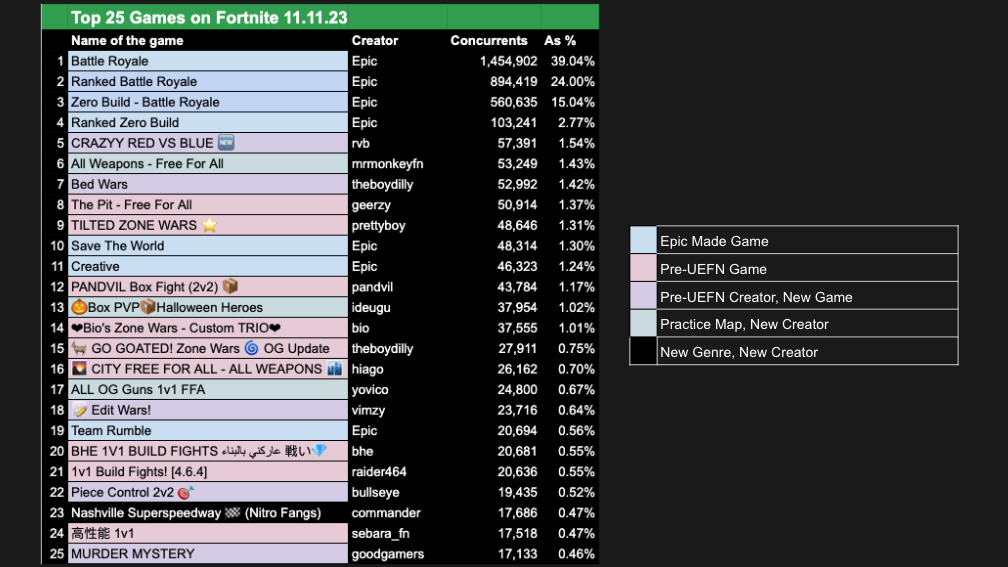

This year, Epic had its own cold-start problem in that the publisher wanted creators to build experiences for a new audience, but creators won't build experiences for audiences that don't exist on the platform yet. That’s why we see so few new genres showing up in the top 25 experiences: The existing audience isn’t interested, and creators want to build things the audience will enjoy.

Epic’s Big Bang Event, which followed on the heels of Fortnite OG, an update that brought back the original Fortnite map, broke records by bringing in 100 million players in November. Many lapsed players also flooded back to experience the Fortnite they had played years ago. It was the perfect moment to let players know what would be coming next: LEGO Fortnite (a survival game that rivals Minecraft), Rocket Racing (a racing game based off the Rocket League IP), and Fortnite Festival (a low-end Guitar Hero experience).

This was a great demonstration of how UGC games platforms achieve increased operating leverage as they accumulate more content (i.e. more players, less cost). Players might come for LEGO Fortnite, but if they don't like it or want to do something new, they find other things to play within Epic's ecosystem.

Furthermore, Epic gets to bundle its marketing of LEGO Fortnite with Rocket Racing and Fortnite Festival. Day 2 of the Big Bang Event, when both Lego Fortnite and Rocket Racing were out, there were 420k people watching live streams of Fortnite at peak watch hours, sustaining more than 200k viewers later into the day.

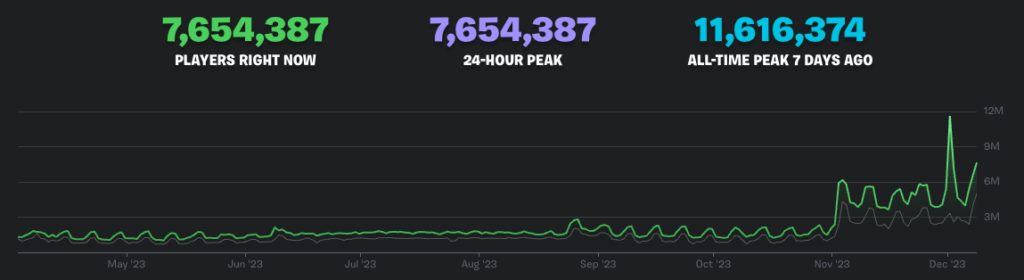

The hope is that a massive event in which three new first-party games are launched in quick succession will bring in a host of new players. And it certainly did so given the Big Bang event hit 11.6 million concurrent players, and it shattered streaming records with 7.3 million peak concurrent viewers. In fact, at the time of the event, over 50% of Twitch viewers were watching Fortnite. A look at Epic’s concurrent player charts over the last year suggests Fortnite is reaching new heights.

The question that remains to be answered is whether players who are clearly engaged in these first-party games will trickle down into UGC games.

Takeaways from Fortnite OG and Big Bang Event

Fortnite’s Big Bang Event was equally important as a prototypical move in the UGC games playbook. One way to solve the cold-start program for a UGC games platform is to create first-party content that will attract an audience. We have seen Rec Room, Manticore Games, Spatial, and Fortnite all deploy this strategy to varying degrees of success. What each platform is attempting to do is provide compelling content that acquires players, with the hope that they will retain players through the available UGC.

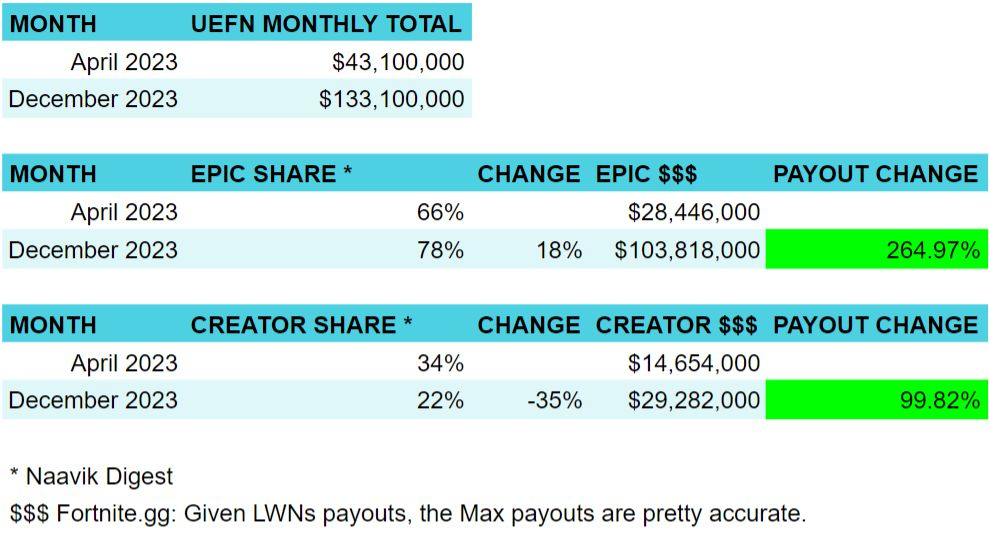

Epic’s big first-party moves at the end of the year presented a great opportunity to understand what drives engagement for the platform and whether the creator ecosystem was truly benefiting from this first-party content. To that end, Patrick Moran, COO and co-founder of Look North World, was generous enough to share the projected payouts for his UEFN studio. While engagement in creative maps decreased by 35%, payouts actually doubled.

This is an important finding as it proves that for now, offering first-party experiences benefits creators in terms of total payouts.

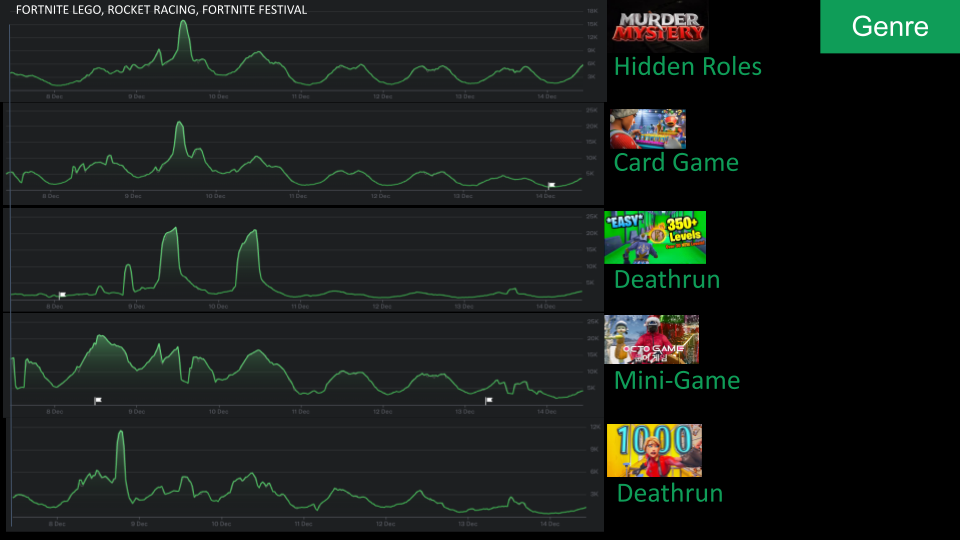

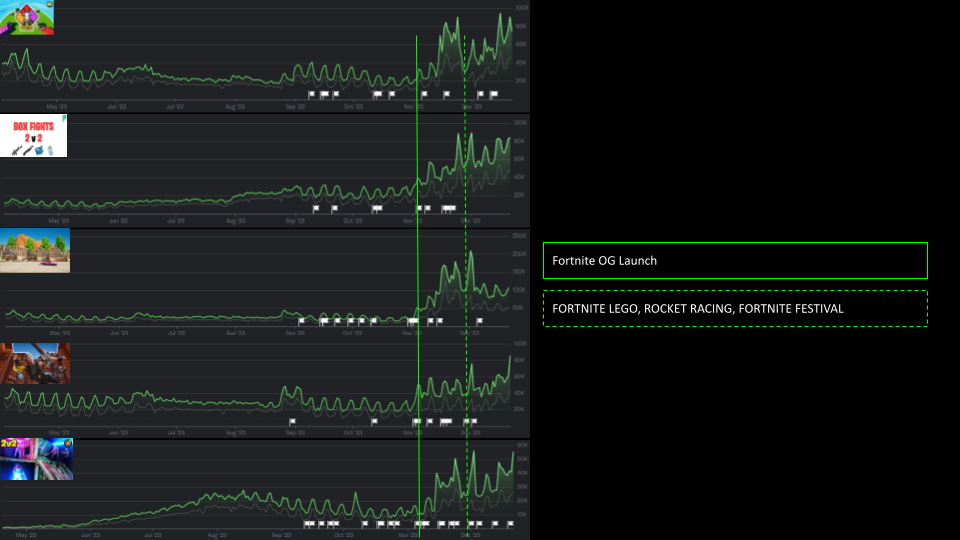

In the ideal scenario, in addition to increased payouts, we would start to see some of those LEGO Fortnite, Rocket Racing, and Festival players start to trickle into more nascent UGC genres, incentivizing creators to build innovative new experiences. Upon examining the top five games shown below, which exclude practice maps, it becomes evident that these events did not noticeably influence their engagement. The brief increase in popularity they experienced is probably due to their advantageous positioning in the game discovery window for a limited period.

Practice maps, on the other hand, did benefit. When there was a big moment in Fortnite Battle Royale, like Fortnite OG, the top Fortnite Creative games (which are practice maps) show large influxes of players. With the LEGO Fortnite launch, there was a decrease in engagement, followed by a resurgence beyond the previous high, suggesting that Fortnite players engage with new content but then quickly gravitate toward Battle Royale and the associated practice maps.

So what does this all add up to? At the moment, Fortnite Battle Royale continues to be too sticky, so it and the associated practice maps are drawing in the majority of additional engagement that the platform receives when first-party games launch. While this still benefits creators in the short term given the increase in total revenue, ultimately, Epic Games wants to see premium-level content created by independent creators. That is going to take some time given that the toolset Epic has provided to date does not enable creators to make premium games like LEGO Fortnite, Rocket Racing, and Festival.

Fortnite Creative’s Long Road Ahead

We knew at launch that the UEFN toolset left a lot to be desired. If there is cause for concern about the future of Fortnite Creative, it would be because the tools are still not quite there yet.

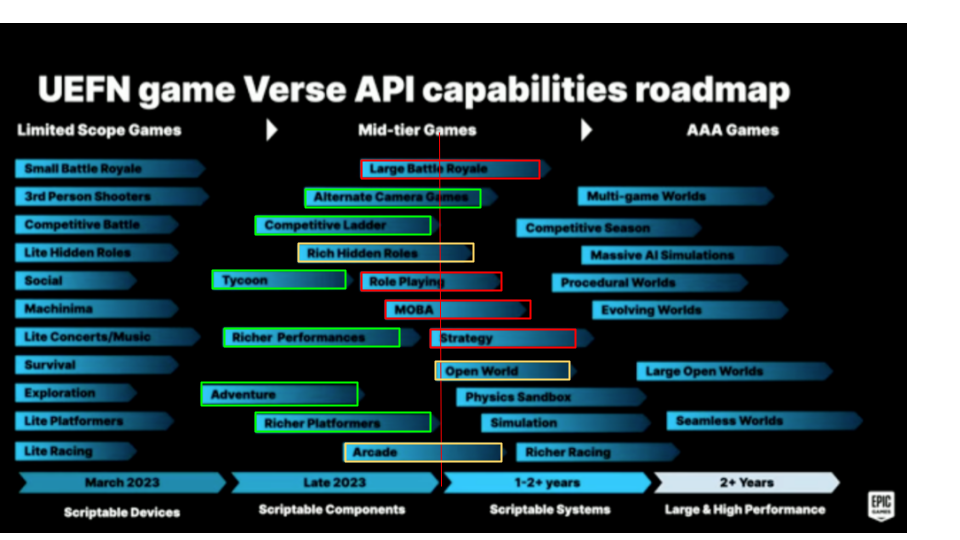

Fortunately, a glance at Epic’s publicly available roadmap shows there are features that will make a big difference planned in the near future including:

- Persistence API that will allow a wider range of player data to be captured.

- Scene Graph APIs enabling customizable and destructible game assets as well as dynamic game environments.

- Custom UI and HUD devices that unlock novel UX design.

- Custom NPCs, which allow the creation of NPCs with distinct logic.

- Analytics to track how frequently players interact with different elements of the game.

These high-value features will have a major impact, but turning a game into a platform is not easy, and can lead to developers waiting longer than expected for much needed features. With that said, when we look at its execution from the original UEFN roadmap, Epic has delivered on most of what the company said it would back at the 2023 GDC announcement:

I’ve tagged the different types of games based on the degree to which they’re now possible on the platform. Red means not achieved, yellow means achieved in a limited sense, and green means achieved. (Source: State of Unreal, 2023)

While the achievement of many of these items is fairly open for interpretation, it does demonstrate that Epic has made significant progress on its roadmap in the last year as everything in green was not possible when they launched. (If you’re interested, this video shows a few good examples of what’s now possible.)

Lastly, Epic announced that it would enable Fortnite creators to integrate with LEGO Fortnite, Rocket Racing, and Festival, further broadening the range of creation that is possible on Fortnite Creative.

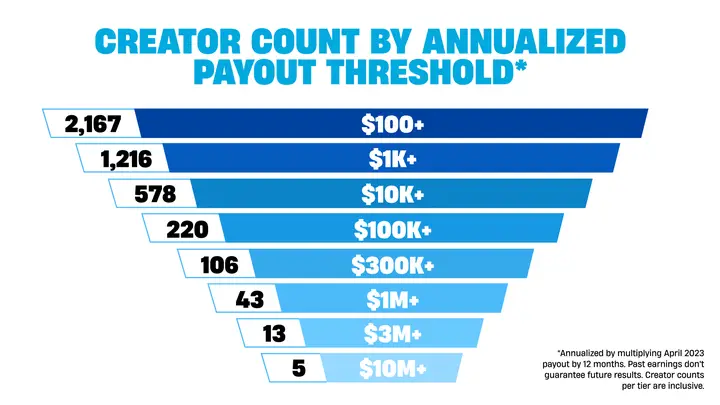

Fortnite Creative Developer Payouts

At Unreal Fest in October, Epic announced that it had paid out $120M after six months to Fortnite developers, meaning it’s on track to pay $240M to developers in Creator Economy 2.0’s first 12 months. Shortly after that, Epic said it would be adding an additional criteria for payouts based on whether players spent money a week before or after playing a given map. This meant the company would be paying creators less since most purchases take place at the beginning of a new season, when engagement is more concentrated in Epic-owned maps.

This also demonstrates an important point that I’ve talked about previously: UGC games platforms dictate how much money their developers receive for their games and can change monetization policies (not to mention discovery algorithms) at any time. Therefore, UGC games studios are always at risk of losing significant chunks of their revenue at a moment's notice. Part of the reason Epic has obfuscated exactly how it pays creators is to find the right balance between payouts to creators and covering their own costs. According to Tim Sweeney, Epic’s layoff of 16% of its workforce was needed because “creator content with significant revenue sharing … is a lower margin business than we had when Fortnite Battle Royale took off.” Effectively, Epic laid off a portion of its workforce for payouts to its creator community. But this just proves that when times are tight for the platform owner, the belt will tighten on the creator side as well.

In conclusion, Epic Games' platform strategy with Fortnite, particularly the introduction of UEFN and Creator Economy 2.0, represents a significant evolution in the UGC gaming world. While the Big Bang Event and the launch of first-party experiences like LEGO Fortnite and Rocket Racing have drawn new players and set streaming records, the long-term benefit of these events and the ability for creator content to keep players engaged remains uncertain and will take years to play out. It is fascinating to note that this platform strategy actually precedes Fortnite Battle Royale’s unprecedented success as Donald Mustard, the creator of Fortnite, who recently left Epic, revealed on X last week.

The State of Live-Service UGC

Live-service UGC has increasingly become an area of interest for game teams far and wide. It allows players to edit and modify levels in the game with an easy-to-use toolset. Fall Guys’ Creative Construction, displayed below is a great example of this.

The game provides easy drag and drop tools so that players can create their own obstacle courses. To further illustrate the distinction, games on platforms like Roblox are fully contained experiences that often operate their own live service and have nothing to do with one another. In contrast, Fall Guys Creative Construction is simply adding new content to the same game and narrative.

Live service UGC is not new. For example, I logged many hours in the Starcraft Campaign Editor as an adolescent. However, it’s increasingly proving itself as a must-have feature for three reasons:

- Reduces the cost of operating a live service: Players create content that other players can engage with so the developer does not need to create as much content to keep the content engine running.

- Deepens engagement for a cohort of players: The players who are interested in creating increase their engagement significantly as the creation process takes considerable time.

- Brand integrity and moderation: While Roblox has had its own set of struggles ensuring that players are not exposed to inappropriate UGC, live-service UGC constraints reduce the range of inappropriate content that can be created, making moderation far easier.

Party Game UGC Heats Up: Fall Guys, Eggy Party, and Fun Party

Fall Guys was ironically following one of its mobile copycats when it launched Creative Construction this year. Eggy Party from NetEase launched with a “Workshop” mode, which is becoming increasingly popular as the game itself takes the world by storm. Eggy Party announced that in addition to exceeding 100 million MAUs in August, it had also exceeded 100 million UGC maps created and 10 million creators. Unlike most live-service UGC predecessors, these UGC tools are exclusively delivered on mobile and have significantly deepened their functionality over the past year, likely as a result of the high engagement in the tools, if not the resulting content. A glance at the “Popular” tab on the discovery pages range from 1-4 million visits, suggesting an individual game does not achieve widespread adoption.

Taking note of NetEase’s success, Tencent has now jumped in the ring with Fun Party, and a commitment of over $140 million to a creator ecosystem over an undisclosed period of time. The news of the game sent NetEase’ stock plummeting, suggesting that investors don’t believe there can be only one king of the mobile party genre with deep live-service UGC capabilities.

Other Live Service UGC

Party games are a perfect fit for UGC content as players expect to move quickly from one game to the next, but there are two other games where live-service UGC also made a splash.

Overwatch 2 Workshop mode made a comeback earlier this year after being removed due to concerns around moderation. As a side note, Overwatch 2’s popular workshop mode, Genji Ball was copied by a developer on Roblox, and quickly became one of the biggest games on the platform.

LEGO Fortnite, which bore a striking resemblance to UGC-driven game Minecraft, invested in tools allowing players to construct their own LEGO Fortnite maps and share them with friends via a “world seed,” a unique numerical identifier.

While we don’t have access to engagement numbers for most live-service UGC, the continued investment from game teams that use these tools suggests they are having the desired effect in terms of sustaining player engagement. As such, I expect to see more game teams offering easy-to-use customization tools for new game modes and maps in 2024.

The State of Modding

Modding, the editing of a game's code base to alter the game experience, dates back to the origins of gaming. Since then, accessibility has seen significant advancements for both gamers and developers. Challenges like game stability, security, and ensuring compatibility with future updates continue to present obstacles, but players and creators now benefit from the emergence of various platforms such as CurseForge, Steam Workshop, Mod DB, mod.io, and Nexus Mods, simplifying the search and installation of mods. APIs have been increasingly introduced to make cross-platform functionality much easier and enable moderation capabilities. In 2023, we saw several major franchises invest in modding capabilities, many in partnership with Overwolf.

GTA Online Mods/RP

The GTA franchise made a big splash with a trailer for its next entry, GTA VI, that was viewed 90 million times in 24 hours and broke several records on YouTube. What many people forget is that on PC, there are regularly more people playing UGC than the base game itself. Unlike Roblox and Fortnite, which provide a platform for players to access a wide range of UGC games, GTA UGC is enabled by a separate entity called FiveM, which was almost banned by Rockstar, the developer of GTA, until the company realized that the popularity of FiveM servers were driving unit sales.

The primary driver of the GTA modding scene is role-playing servers enabled by FiveM, where players immerse themselves in detailed simulations of everyday life, adopting various roles and engaging in everyday activities within a virtual economy. There are frequently over 200,000 concurrent players engaging in these experiences across thousands of independently hosted servers. The popularity of these experiences are in part a function of regularly getting play from top streamers, a testament to the depth of simulation, the high-fidelity graphics, and the commitment from other players to play their role (police officer, tow truck driver, bank teller, etc). Interestingly, popularity across servers is fairly evenly distributed. The top server makes up less than 1% of the total player base at any given time, whereas Roblox and Fortnite’s top developers make up over 10% of engagement in their respective platforms' UGC content. This is likely a function of the non-scalable nature of dedicated servers, but also the fact that each server represents a community of players who have gotten to know and trust each other through roleplaying. After all, a key element of the roleplaying experience is each player’s commitment to playing their role (e.g. if a police officer breaks character, the immersion is broken for everyone else involved). It’s important to note that these servers represent vital parts of a player's social life and thus are highly monetizable, with servers bringing in $10K-$100K per month depending on the size of the server, according to one server owner I spoke with. That is astronomically high for a UGC game when you consider that even the biggest servers have only 1,000 concurrent players at any given time. (Typically, a game on Roblox with 1,000 concurrent players will bring in around $5,000 per month.)

The popularity of roleplaying servers peaked during the pandemic but remains strong today, and can be expected to take a leading role in the development of GTA VI as FiveM was acquired by Rockstar this year. The acquisition is likely in an effort to address a real concern that the franchise has: how to migrate players from their GTA V roleplaying communities to GTA VI. By acquiring FiveM, Rockstar has more control over how that migration occurs. That is not the only benefit, of course. The acquisition of FiveM is a signal that Rockstar wants to build off the work that FiveM has already done, rather than to try and make a better version of it themselves. As we have seen with Fortnite Creative, building a creator ecosystem takes significant time and capital investment so this acquisition gives Rockstar a much needed headstart.

The Sims

The Sims announced a major partnership with Overwolf toward the end of 2022, so 2023 was when we saw that partnership start to flourish. Since integrating with CurseForge, The Sims 4 mods have reached over 500 million downloads.

Project Rene, also known as The Sims 5, is expected to launch as early as 2025. It will be interesting to see whether the Maxis team makes UGC core to the game, and what tools they put into the hands of players versus outsource to Overwolf.

Ark Survival Ascended

An example of this is Studio Wildcard’s partnership with Overwolf to bring cross-platform modding to ARK: Survival Ascended (“ASA”) through the CurseForge platform. The ASA launch has introduced an industry-first cross-platform modding experience, allowing established game developers to bring their original content and IP to ARK’s fanbase through premium mods. This launch signified a paradigm shift in how game developers approach UGC.

According to Jeremy Stieglitz, co-founder of Studio Wildcard, “ASA enables that original ARK experience to thrive in next-gen quality with continued developer support as well as the exciting growth from UGC creators.” Along with the cross-platform modding capabilities enabled by Overwolf’s CurseForge platform, Wildcard and Overwolf are offering $350,000 in awards for the most creative cross-platform mods. While that’s a drop in the bucket of the payouts across Minecraft, Fortnite, and Roblox, it does go to show that the broader industry is looking for ways to extend the life of games through UGC and is willing to pay communities for their creativity.

Premium mod-enabled games such as ASA will allow game studios to experiment with less development time and lower risk than creating an entirely new game. It will be interesting to see if any games follow suit in 2024.

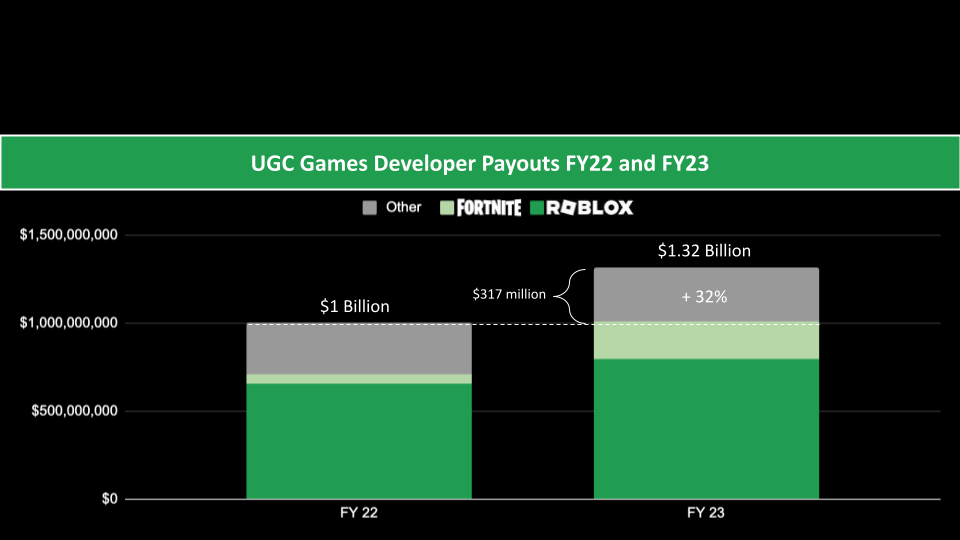

Developer Payouts Growth

As we look back at the significant advancements that each UGC game platform made in 2023, it is important to take stock of the creators who put hundreds of hours into making compelling content for these platforms and their earnings. 2023 marked a dramatic growth in developer payouts, primarily driven by Fortnite’s launch of Creator Economy 2.0 and Roblox’s continued year-over-year growth. Overall developer payouts increased 32%, from $999.5M to $1.32B, marking another consecutive year of substantial growth for the industry.

Fortnite showed the biggest growth by percentage, increasing payouts by over 300% YoY and contributing to just under half of the industry's overall growth with $150 million in developer payouts. Meanwhile, creators across Overwolf’s entities (Overwolf, CurseForge, and Tebex), which include Minecraft Java, GTA V, The Sims 4, Ark Survival and several more, grew by 25.6% and contributed $40 million to industry growth. Roblox, the biggest individual contributor to overall payouts (estimated at $730 million in total), grew by 18% YoY, contributing $111 million.

A common question for those looking to enter the UGC games space as a professional creator, it might be helpful to look at which platform has the best probability of success. According to Fortnite.GG, there have been maps created under over 12,500 accounts since the website began tracking performance at the beginning of April. One thing to note is that the more prolific creators often have multiple accounts, so the number of actual creators is less than that.

That likely comes as a surprise as it means that on average, a Fortnite creator makes almost $20,000 per year. When you compare that to Roblox’s 5.6 million developers making an average of $142.86 per year, there appears to be a lot more room to make a living on the Fortnite platform compared to Roblox and Overwolf’s partners, which include The Sims 4, GTA V, Ark Survival and Minecraft Java as the most notable contributors.

| Platform | Annual Developer Earnings | # of Developers | Payouts per developer |

| Fortnite | $250,000,000 | 12,500 | $20,000.00 |

| Overwolf | $201,000,000 | 165,000 | $1218.18 |

| Roblox | $735,000,000 | 5,600,000 | $142.86 |

While the respective age of the platforms is certainly one contributing factor to the disparity in number of creators between Roblox and Fortnite, the primary reason is that Roblox has always had creation as its core focus. For example, every new player is given their own experience in which to create by default. Having worked on several Roblox games myself, players would always get very excited when I would hop into the game, illustrating that Roblox developers are idolized by the broader community. Fortnite, on the other hand, has mostly been a Battle Royale game that had a few passionate players that wanted to create their own spin-offs of Battle Royale. The introduction of Creator Economy 2.0 on March 23 increased creator payouts by 5 times overnight, but the number of creators has still not caught up. That is likely a result of creation still being a nascent part of the broader Fortnite culture.

In summary, if you want to make a living developing UGC games, Fortnite may be the platform to try in 2024.

Conclusion

It is clear that UGC Games is the future of gaming and that these tools will be a consideration in most major game launches going forward. Whether that takes the shape of a full-on UGC games platform, live-service UGC, or modding tools will vary on a case-by-case basis, and the investment each studio or publisher is comfortable with.

However, the introduction of a new UGC platform is not without its challenges. As evidenced by the shuttering of Dreams and Fortnite Creative’s long road ahead, establishing a successful UGC platform is fraught with complexity and demands substantial investment. Yet, the promise of UGC games remains compelling, driven by a community of creators and players eager to shape and share their own experiences, and the flywheel that emerges when the right balance of creator tools, payouts, and player growth is struck.

As we look to the future, the question is not just about how large the UGC games market will grow, but also about the nature of its evolution. Will it continue to expand within the boundaries of established gaming platforms, or will it transcend these to give rise to entirely new forms of interactive and social experiences like Roblox Connect? What we know for certain is that the Roblox generation of players and creators expect to be able to take a game or platform they love and make their own mark. For that reason, expect to see UGC games continue their evolution as an integral part of gaming culture, offering limitless possibilities for creativity, engagement, and innovation in 2024.

Did you know that Naavik provides consulting support to teams in and around UGC gaming — ranging from design, live ops, market research, investor support, and more? If interested in exploring how Naavik, and David Taylor, can help your business, please contact us here.