Hi Everyone. Welcome to 2022's penultimate issue of Naavik Digest! We know it’s been a tough time with layoffs / finding jobs, so we’ve been reflecting on how we can continue to support the industry in this regard, while also spreading some holiday cheer.

So, today, we’re opening up our job board for free! If you’re a recruiter / founder / manager, click the button below to post as many roles as you’d like and have them featured in the newsletter. Every job post garners ~50K impressions over the 45-day newsletter featuring period and results in 1-10 applications depending on the company and role.

We’re doing this for a limited period of time, so don’t miss out on recruiting from our insanely qualified reader base. And if you’re a job seeker, we hope this helps you land the right job in the new year.

End-of-Year Learnings & 2023 Industry Predictions

What’s the funding environment going into 2023? Can mobile be conquered by studios with short runways? We dive into the latest game business news with Aaron Bush, Anil Das-Gupta, Joakim Achrén, and your host Maria Gillies.

You can find us on Spotify, Apple Podcasts, Google Podcasts, YouTube, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: The 2022 UGC Games Playbook

2022 was a rollercoaster year for UGC games. Roblox shed 72% of its market capitalization despite demonstrating continued user growth. Fortnite Creative mode set the foundations to become the future of Fortnite. And creators reaped the benefits of large cap gaming companies like Electronic Arts continuing to invest in the UGC trend, such as creators making a reported $160M over a trailing 12-month period from Overwolf’s mod-platform alone. All of this excitement is why I decided to do a series of deep dives into the top UGC game platforms including Roblox, Fortnite Creative, Rec Room, and Core. As I studied these platforms several themes emerged — a UGC Games Playbook that can be summarized as follows:

- Competing for Creators/Developers

- Adding New Creator Tools

- Funding Tentpole Content

- Enabling Brand to Fund Growth

- Platform Expansion

Let’s jump into each of these.

1) Competing for Creators/Developers

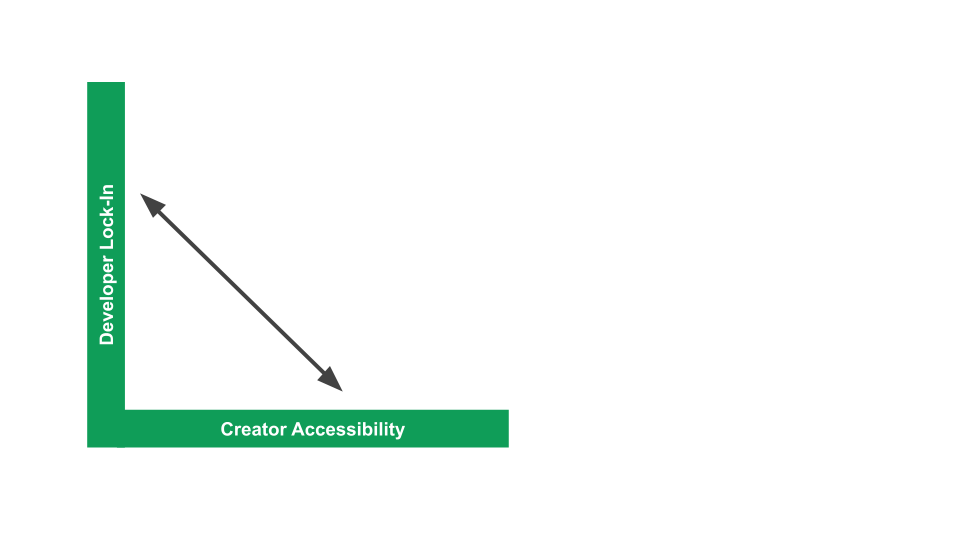

Unlike photo and video UGC platforms like Instagram and TikTok, only a fraction of the players on UGC game platforms actually create content. For example, of Roblox’s over four billion accounts (see UserID), only 9.5 million accounts have created experiences. For this reason, the competition to attract players who are actually interested in creating content is fierce. Ease of creation is a strategic decision that platforms have to make: if the creation is easy, then anyone can get started, but creators can easily switch to a different platform. Whereas if creation requires technical skills — like on Roblox — developers will be far less likely to leave as it requires learning a whole new skill set.

Reflections from 2022:

Manticore Games uses the Lua programming language (the same as Roblox), hoping to attract developers as they age out of Roblox. Manticore Games followed up on these tactics with the introduction of blockchain wallet compatibility in order to attract web3 developers who might be looking to create more use cases around their NFTs. Another example is Fortnite’s decision to introduce its own coding language for Fortnite Creative (called Verse). This was in-part born out of a desire to simplify C++, the coding language of Unreal Engine, and make it “learnable for first time developers”.

Expert Prediction for 2023:

“Making an analogy with web3 terms, we could say game1 is single player games, game2 is online — all of the sudden I can play with friends — and game3 is the transition from playing with my friends to actually creating content for myself and for my friends as we play together and potentially make a living.” — Uri Marchand, CEO, Overwolf

2) Adding New Creator Tools

Games that start off as purely drag-and-drop enable anyone to jump in and become a creator. There is still a learning curve, but it’s much shorter. However, the challenge with purely drag-and-drop tools, is that it can be quite laborious to create large environments as well as creating new functions. As platforms encourage their players to create new experiences that push the boundaries of what’s possible on the platform, in order to keep players engaged, they need to introduce new tools and ask their creators to upskill in the process. Adding additional tools also has a competitive advantage as it increases lock-in by giving existing creators a new tool to learn, without compromising accessibility.

Reflections from 2022:

Rec Room announced their partnership with Unity. When released, this will make it possible to create and polish assets and environments in Blender or animate them in Maya before porting them to Rec Room. These are some of the most laborious aspects of UGC game creation and should unlock the ability to create better looking and more expansive games within Rec Room. Meanwhile, Fortnite planned to integrate Fortnite Creative with Unreal Engine by December, but it was delayed until the new year. (Side note: I got excited when Epic announced this week that they would be demoing the new integration, but after watching the stream for an hour, Tim Sweeney announced they were having technical difficulties and would not be able to show it until next year).

Expert Prediction for 2023:

“Looking forward, we expect UGC to be the next iteration of live-ops as developers open up creation tools and IP to their users” — Jackson Vaughn, Managing Director, Konvoy Ventures

3) Funding Tentpole Content

A tentpole game is one that is sufficient to attract a large audience, independent of whether there are other games that players want to play. Fortnite’s move from a Battle Royale focused game and the most-played game ever to a UGC-driven platform demonstrates how a single game can become a UGC platform, even when UGC wasn’t the original intent. UGC game platforms on the other hand, have a cold start problem, which is why they invest in creating their own games. These games demonstrate what’s possible on the platform, but more importantly, give the 95%+ of players who are only there to play games something fun to do while the creator base grows to a critical mass.

Reflections from 2022:

To this end, Roblox added an additional $10M to their annual Game Fund, bringing the total for 2022 to $35M. While Roblox is not building the tentpole games themselves, they are funding games that they think have potential to be hits on the platform with $500k investments apiece. Meanwhile, Rec Room launched a new original game called Showdown, which was reportedly buggy, but nonetheless has been played 3.6M times since its release in August. And, Manticore Games hired several game designers as they look to build tentpole game(s) on their platform, Core.

Expert prediction for 2023:

Games will become metaverses before metaverses become games. The best metaverses will be MMO games, focusing on quality gameplay and social player experience. — Frederic Descamps, CEO, Manticore Games

4. Enabling Brands to Fund Growth

Over the last year, brands have taken a growing interest in the metaverse. Initially, this may have just been about signaling innovation to shareholders, but gaming has emerged as one of the best ways to get consumers engaged with a brand. I gave the comparison on a recent podcast that a 30-second Super Bowl ad costs a brand 5 cents per viewer, whereas launching a branded Roblox game can be 1.5 cents per 10 minute gameplay session. It’s no wonder that brands are now flocking to the top UGC platforms given that they can increase engagement with their branded content for a fraction of the price.

Reflections from 2022:

Fortnite and Roblox both benefited greatly from off-platform brands funding development in pursuit of the valuable younger demographics present on these platforms. Even smaller platforms such as Rec Room, The Sandbox, and Mythical Games got in on the action. These activations are important sources of revenue for developers on these platforms and it helps reduce the cost associated with incentivizing developers to create. Without these brand activations, I’m not sure the unit economics for venture-backed UGC studios would work. Fortunately, UGC platforms are a key part of many brands’ transmedia playbook and they have been rewarded with significant increases in brand recognition by executing it.

Expert Prediction for 2023:

“People crave a sense of belonging and brands have the power to create and nurture communities around their brand story. In 2023, brands will continue to play an instrumental role not only in helping to popularize the metaverse, but more importantly, creating virtual experiences that enchant communities in ways not done before.” — Yonatan Raz-Fridman, CEO, Supersocial

5. Platform Expansion

One sure way to grow a user base is to have the offering on as many platforms as possible. Obviously that comes with a cost (Ben Thompson estimates that going multiplatform increases costs by 25-40%). As such, companies must be prudent about how many and which platforms to launch on before they have demonstrated consumer interest. For example, Rec Room started with a focus on VR before adding mobile, which added an additional five million monthly active users over a 2-year period.

Reflections from 2022:

To this end, Rec Room launched a new standalone PC Client, which was expected to significantly increase the player base by making it easier to jump into games and priming players to keep coming back with an icon on their computer. Meanwhile, Manticore planned to launch on mobile this summer, but there is still no Core app to speak of at the end of the year. It’s not entirely surprising as launching on mobile requires a complete redesign of the UI in order to accommodate a small touch screen. Either way, mobile has been a significant source of players for both Rec Room and Roblox, and we can assume Core will get a similar boost once it does come online. Manticore’s transition into Web3 can also be viewed as a platform expansion, as they look to reach users that have aligned themselves with blockchain technology.

Expert prediction for 2023:

The breakout blockchain games won't talk about blockchain. The winning games will be great games first, which happen to be using blockchain as an enabling technology for their open economies instead. — Frederic Descamps, CEO, Manticore Games

Signing off

As we wrap up a year of UGC analysis and reporting, I’d like to say thank you to everyone who was willing to be interviewed for our UGC pieces. From content creators to platform developers, it was a delight to dive into the different approaches that each UGC platform takes and to witness the creative energy that these platforms unlock for players. UGC is going to be an increasingly significant part of our daily lives so we are excited to be able to share the latest strategy and innovations from the industry. As we look to the future, I thought I’d leave you with a list of the most recent fundraises in the UGC space. As you can see, the competition will be heating up as we head into 2023:

- Infinite Reality is expected to raise $1.85B through a SPAC

- Yahaha raised $40 million for its Unity-based low-code platform

- BUD raised $37.5 million for it’s drag-and-drop UGC metaverse.

- Soba raised $13.5 million for its no-code platform aimed at creators and influencers

- Rusk raised $9.5 million to build a UGC-led social gaming platform

- MixMob raised $7 million for its Web3 UGC gaming platform

- Cubzh raised $3 million for more accessible UGC gaming

- The Mirror raised $2.3 million for its next-gen UGC platform

(Written by David Taylor)

#2: Weekly News Roundup

Apple To Allow Sideloading?: Bloomberg reported that a second big Apple change is on the horizon, with Apple allowing people to download apps to an Apple device without necessarily needing to go through the App Store (importantly, the 30% tax still applies). We wrote last week about the company’s pricing changes would affect how people thought about consumer and player experiences within games, but these platform-level changes bring their own consideration set: cloud gaming (Xbox Game Pass) and games marketplaces (Epic Games Store, Netflix) can now live on Apple devices when they previously couldn’t. We’re reminded of TapTap, which allowed Android users download games directly but only served as a community hub for iOS users. Should Apple need to comply with the EU’s Digital Market Act in the future, the third-party apps might actually yield a scenario in which Apple can’t monetize off of external apps (or at least alternative payment methods).

Brawl Stars To Remove Loot Boxes: One of Supercell’s evergreen games is getting loot boxes removed. This follows the recent legislation in Belgium, The Netherlands, (and potentially) Australia among growing criticism of the exploitative nature of these business model. All this means that Brawl Stars, which has generated $1.25B+ in lifetime revenue, is moving to direct monetization. While this will benefit new and returning players (they can easily catch up to advanced players), it does raise questions as to the long-term engagement of players and what Supercell will do to solve for that on the monetization front (trophies, currency system, etc?). It’s curious what will happen next with this game because Supercell is taking a huge leap of faith with core IP that could change how F2P thinks about monetization and engagement loops moving forward. Could this be in preparation of something else like a cross-platform launch?

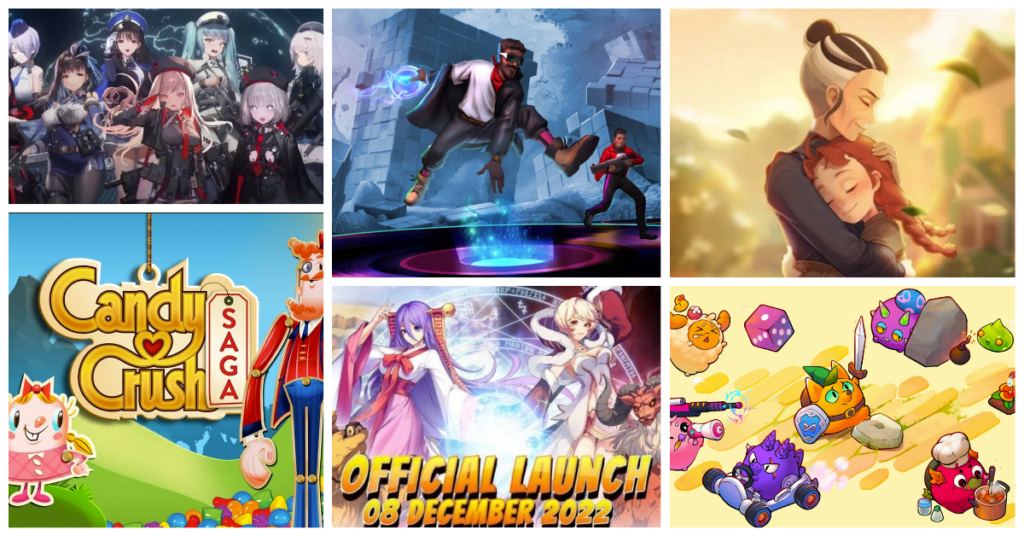

Data.ai’s Top Breakout Games: Lastly, our data partner Data.ai released a recap on 2022’s in-app purchase trends. In total, consumers spent $129B on in-app purchases across all apps, of which 65% can be attributed to iOS. On the games front, there were a few breakout hits in terms of downloads (see chart above), but it was games with strong existing IP that saw the most success.

🎮In Other News…

💸Funding & Acquisitions:

- Jagex acquired Gamepires. Link

- Futureverse rolled-up eight web3 companies into an open metaverse concept. Link

- Javi Game raised $3M in a round led by Play Ventures. Link

- Lost Native raised from Private Division (congrats, Becky!). Link

📊Business:

- Data.ai’s year-end reports shows $129B in 2022 in-app spending. Link

- Apple is preparing to allow third-party App Stores. Link

- Supercell will remove Loot Boxes from Brawl Stars. Link

🕹Culture & Games:

- Riot Games is live with Game Pass. Link

- God of War is getting a live-action TV series. Link

- Playdate is getting a webstore. Link

👾Miscellaneous Musings:

- Survey data on Japanese elementary / middle school gaming habits. Link

- A deep dive into Universal Paperclips. Link

- GameRefinery’s November round-up. Link

This Week In Naavik Pro

Looking for more great games industry analysis? Check out Naavik Pro!

This past week the Naavik Pro team published:

- A new game radar on three upcoming blockchain titles: Guild of Guardians, Phantom Galaxies, and Illuvium

- A deconstruction on Puzzles & Survival - the 4x title that has found success in a post-IDFA world

- A F2P market update covering Appsflyer’s new retention report, and the shutdown for Boom Beach Frontlines

- Analysis on Fenix Games’ recent $150M raise and the economy reveal for Big Time

Next up, we’re deconstructing Arknights and Marvel Snap, writing an esay on Candy Crush’s 10-year journey, releasing new blockchain market update, and writing a research essay on the Myria ecosystem!

If interested in learning more or signing up, request a demo below.

🔥Featured Jobs

- Griffin Gaming Partners: VC Analyst (Santa Monica, California)

- Bungie: MBA Product Management Intern (Remote — US)

- CD PROJEKT RED: Junior Processing Specialist (Warsaw Poland, Remote)

- Stillfront: SVP Operations Management & Processes (Stockholm, Remote — Europe)

- Naavik: Content Contributor (Remote)

- Naavik: Games Industry Consultant (Remote)