Blade Ball is the latest breakthrough hit on Roblox. It was developed by Y1ddy and Chunchbunch, two amateur developers in their early twenties who started exploring the concept in January this year, but only began serious development in June. With the use of open-source assets and a game category invented by others long before them, they developed and launched what is currently the third most popular Roblox game in a matter of months (intro video here).

Blade Ball’s meteoric rise teaches us a great deal about how to be successful on Roblox, the importance of social media in game distribution, and the meaning of IP on UGC game platforms. So without further ado, let’s dive into Blade Ball.

The Origin of Blade Ball

Blade Ball is the culmination of a long line of UGC games starting with Team Fortress 2’s Pyro Dodgeball. That was in itself the product of several evolutions of a mod in which players play as the Pyro; both teams of Pyros use their compression blast ability to reflect the rockets and bombs back at the other team.

One variant of this game emerged as Speed Dodgeball, which was recreated in the next evolution of the game, Genji Dodgeball. Genji Dodgeball was a Workshop mini-game in Overwatch 1 and 2, and while Genji Dodgeball eventually had a competitive league, it remained rather niche.

As it turns out, Blade Ball was not even the first of its kind on Roblox. Deflect has virtually the same gameplay mechanics, but has maintained a modest following of around 500 concurrent players since its launch in January.

This long history of niche success demonstrates an interest across multiple player bases, but the lack of awareness in the mainstream after numerous launches makes Blade Ball’s success somewhat unexpected.

The Rise of Blade Ball

The two developers experienced steady growth through word-of-mouth, the Roblox algorithm, and the ads that every game must run in order to train Roblox’s discovery algorithm. An individual investor had provided the $1,500 in advertising funds that got the game the traction it needed. By the first week of September, the game had around 9,500 concurrent players, and creators Y1ddy and Chunchbunch were struggling to squash all the bugs that players were finding. That led to an initial 75% “like” ratio, much lower than their “like” ratio of 95% today.

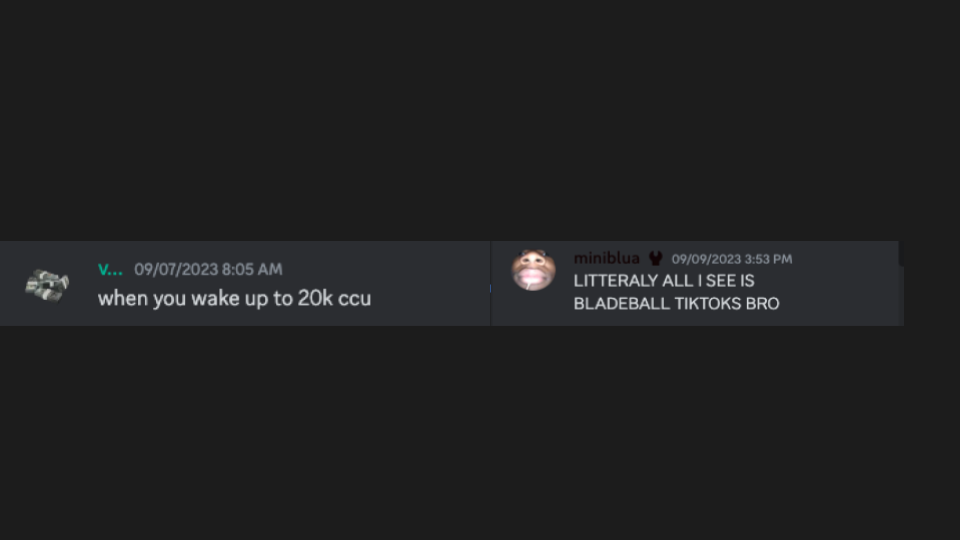

However, on September 7th, everything changed.

The game became a huge hit for content creators, particularly on TikTok. Nifty particle effects, 15-second duels, and the rhythmic nature of the game were nicely complemented by TikTok's offering of heavy-hitting electronic music clips to create engaging short-form content. Concurrent players exploded from 15K on September 6th to over 100K on September 9th.

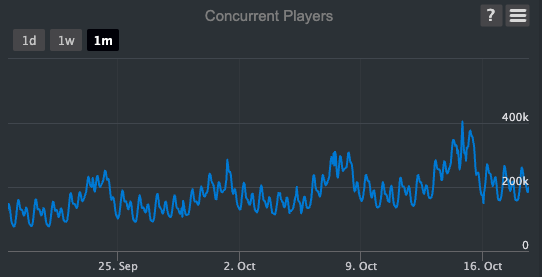

At the time of writing, TikTok videos with “#bladeball” tags have been viewed 850M times, and viewership has accelerated from there; there have been 350M new views since I posted about it two weeks ago. Similarly, Blade Ball continues to grow its player base and platform share of Roblox with peak concurrents reaching over 418K, or 7% of the platform share, according to RoMonitor Stats.

Breakthroughs like this do not happen often, as the average age of a top 10 Roblox game is four and a half years. Blade Ball has almost three times the player base of Roblox mainstay Adopt Me! and relative to the AAA gaming world, Blade Ball’s concurrent players are well ahead of Baldur’s Gate 3, the third most popular game on Steam, according to SteamDB.

While the early spike was certainly driven by TikTok, Roblox’s algorithm has done much of the heavy lifting as well. Given that most Roblox studios live and die by the Roblox algorithm, let’s explore Blade Ball’s success there as well.

Discovery on Roblox

According to Roblox’s documentation, to help acquisition through algorithmic discovery, creators must focus on engagement, retention, and monetization.

Engagement

Roblox says developers should focus on the Average Session Time metric, but Blade Ball leaves a lot to be desired in this regard. For example, when you spawn in, there is already a game going on, so you immediately have to wait a minute or two before you can join in. Once in the game, it’s all about figuring out the timing of when to deflect the ball and avoid being knocked out. This can be quite difficult when the ping is inconsistent due to the location of the game server changing.

Roblox also does not do a great job of consistently placing players in servers that are geographically close to where they are, leading to highly variable player experiences. After being knocked out, a player needs to wait for the round to end before they can try again. To learn timings, a player needs to play several rounds, and that can take a while given the wait times between games.

There are numerous points of friction that would lead a typical Roblox player to churn from the game. The game’s middling average session length of roughly 10 minutes, according to Rollimons, reflects this. On the flip side, the initial difficulty can translate into a stickier game if players are willing to power through.

Retention

Roblox also highlights D1 and D7 retention as key metrics for success. Blade Ball’s presence on TikTok serves as a constant reminder for players to hop back into the game – every third video on my feed is Blade Ball after researching this article.

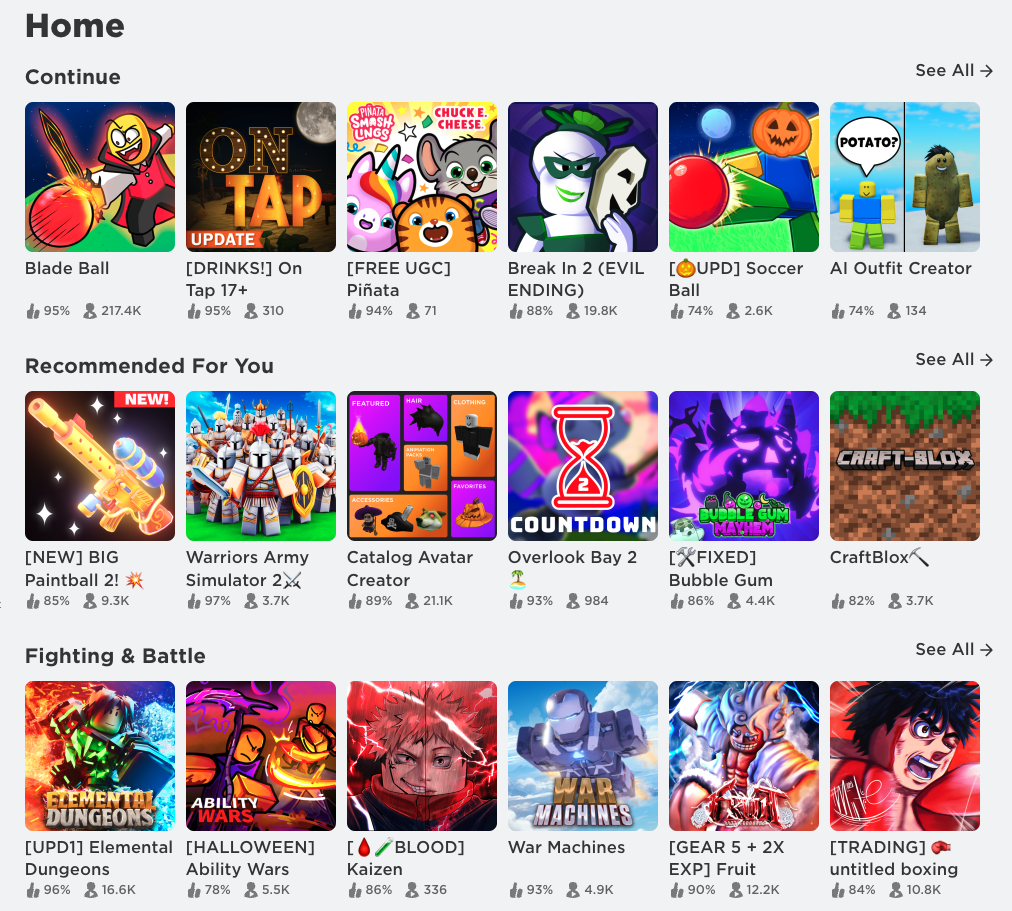

Additionally, the fact that the game is multiplayer helps make every session feel unique, while the confined rules of engagement allow players to viscerally experience their progress. The simplicity of the game means players can hop in for a couple rounds of Blade Ball intermittently throughout the day without much cognitive load. This keeps Blade Ball at the top of the screen in the “Continue” section (see below), which dramatically increases the likelihood that players will return.

Y1ddy and Chunchbunch have also been delivering weekly updates that include new limited items with custom animations and effects, new abilities, and new maps. This trains players to come back every week, especially on the weekends, to engage with the new content.

Blade Ball’s Discord also boasts a membership of over 500K, giving the team a direct line to the player base to inform them of updates, events, and tournaments. It also gives players a place to connect on all things Blade Ball.

Monetization

Competitive games like Blade Ball shine on Roblox because the player community is far more amenable to pay-to-win mechanics and loot boxes.

Abilities, pictured above, are what give players an edge in the game. Abilities can be acquired either through currency or by spinning a wheel, which also ultimately requires currency. This is reflected in the fact that 90% of revenue comes from money purchases and premium case rolls (loot boxes for cosmetics that are paid for in Robux, Roblox’s premium currency), according to Y1ddy.

The only way to acquire currency (aside from paying for it) is by knocking players out. Players get seven coins per knockout, and some simple math shows that on average, players would achieve one knockout every two games. The first ability costs around 300 coins, which means most players need to play over 80 games before they get their first ability.

In other words, progression is painfully slow, and if a player’s friends are playing Blade Ball, they need to spend some money or a lot of time to keep up. This arms race has resulted in what is likely a very high conversion rate and average revenue per user: above 0.5% and an ARPDAU of 10 Robux is considered high on Roblox. Roblox, which is under pressure from investors to reduce its losses, is looking to games such as this to improve its outlook, and will reward them accordingly in Discovery.

Other than hitting the metrics necessary to show up in Roblox’s algorithm, there is off-platform marketing. The Blade Ball team has even resorted to giving people cash rewards for videos that get the most views.

The team is firing on all cylinders to ensure it sustains this massive audience. Time will tell if they can hold players’ attention with an engaging live service and TikTok content. They will also need to fend off the numerous copycats that have emerged to compete across Roblox as well as Fortnite.

No Intellectual Property for UGC Games

It’s been six weeks since Blade Ball blew up, and though it remains to be seen whether it can continue to deliver meme-worthy content on TikTok, it is up 20% week-over-week. Introducing new game modes will be critical, not just to keep existing players engaged, but also to ensure a similar game isn’t created that is able to capture a portion of the existing player base. For example, one Roblox copycat called Soccer Ball has emerged over the last couple of weeks and reached 5,500 concurrent players last Saturday. Another called Anime Ball has also garnered several thousand concurrents.

Over on Fortnite Creative Mode, a different team created “Blade Ball Fortnite” three weeks ago, and it has seen sustained engagement with support from Fortnite streamers. However, for now there is no real threat of players migrating to Blade Ball on Fortnite from Roblox due to the lack of community features available for Fortnite creators. The Unreal Editor is also still a work in progress – until this week there was no way to save player data.

While no copycat is likely to share the spotlight with Blade Ball, the unfolding of iteration after iteration of the same game is what makes UGC games so interesting. Having a good idea doesn’t matter: The only way to stay in the lead is to continually innovate through iteration. If you don’t, someone will take your game and become the next worldwide sensation in a matter of months.

A Word from Our Sponsor: Overwolf

Integrate safe UGC into your game with CurseForge For Studios

Overwolf is an all-in-one platform that lets creators build, share, and monetize in-game apps, mods, and private servers. With over 165,000 creators, and 38M monthly active users, Overwolf supports the world’s most popular AAA titles such as League of Legends, Minecraft, World of Warcraft, and 1,500 other games.

For game developers, Overwolf offers CurseForge For Studios. CurseForge For Studios is a white-label solution that lets game makers and publishers easily integrate mods safely and seamlessly into their games, both existing and new, at zero cost. It’s battle-tested by AAA studios and games, including Maxis (The Sims™ 4), Studio Wildcard (ARK), TakeTwo Interactive (KSP), and others.

CurseForge For Studios offers:

- Cross-Platform Modding: Integrate Overwolf’s open-source SDKs and plugins to let players discover and install mods in-game, across all platforms and storefronts.

- Full Analytics Dashboard: Get a full modding usage dashboard to learn which mods are popular.

- Safe and Secure Moderation: Studios define policies and guidelines on what is permitted, and these are then enforced by Overwolf - with only authorized content being published.

- Creator Relations and Payments: CurseForge supports creators with monthly payments, equity investments, developer contests, and hackathons to get their creative juices flowing, and kickstart content creation for your game.

Gaming Market Update: October 14th - October 20th

By Mario Stefanidis, CFA, Naavik Contributor

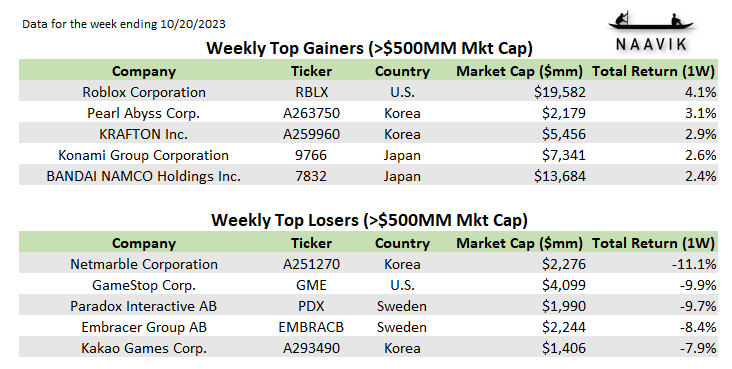

- For the week ending October 20th, 2023: The average return for gaming companies tracked by Naavik with a market capitalization exceeding $500M was -2.7%. The S&P 500 returned -2.4% and the Nasdaq-100 returned -2.9%. Full access to the Naavik Gaming Company universe is available here.

- Paradox Interactive (STO: PDX) declined after a lukewarm reaction to the release of Cities: Skylines 2. Its newest published title and the second installment in the Cities: Skylines franchise was labeled by some reviewers as an incremental upgrade to the first game. There were performance problems as well, forcing developer Colossal Order to raise the minimum and recommended specs for the PC version. In a post-launch FAQ, Colossal Order stated it knew there were issues but chose to release the game regardless. The game’s mods will also only be distributed through Paradox Mods, and Steam Workshop will not be supported. This is a departure from the first game which heavily relied on Steam’s modding community.

Notable Venture Financing Deals

- Utah-based Noodle Cat Games closed a $12M Series A round, having also previously raised $4.1M in seed funding last November. This latest round was led by London’s Hiro Capital, with contributions from Makers Fund, Krafton, and Sony Innovation Fund. The studio’s core team consists of veterans from Epic, EA, and BioWare, who have credits on games like Fortnite, Star Wars: The Old Republic, and Infinity Blade. Noodle Cat is preparing to develop its debut, a multiplayer action RPG with physics-based combat. CEO David Hunt has publicly described the game industry as “broken” and ripe for disruption through an “effective development environment that leads to better business and individual outcomes.” The studio’s debut game is slated for a 2024 reveal, and the studio's immediate agenda is team expansion.

- Forge, a web3 platform that rewards gamers for their achievements, raised $11M in seed funding. The concept for Forge was developed within GGWP, a gaming startup founded in 2020 which uses AI to counteract gaming toxicity. The round was led by Makers Fund, BITKRAFT, and Animoca Brands. Previous backers from GGWP, like Griffin Gaming Partners, Riot Games, and Sony Innovation Fund, have also invested in Forge. The startup’s leadership team includes Dennis “Thresh” Fong, Crunchyroll's Kun Gao, and Cyence’s George Ng.

The Forge platform allows gamers to link their gaming and social accounts, consolidating their achievements across various games. Based on their gaming history, players are rewarded with exclusive content, in-game currency, and even early access to specific games. Developers can also offer engagement quests to players. The platform’s Season Pass enables gamers to earn points and unlock exclusive content, with added opportunities to win weekly bonuses, such as gift cards and gaming PCs. Forge has collaborated with multiple web3 games for its launch week, such as Genopets, Mojo Melee, and Pixelmon. New games will be introduced weekly during the beta period.

- Zeedz.io raised a $1M seed round to fund its “play-for-purpose” mobile game Zeedz. Notably, funding was raised from all five panelists of the German spin-off of Dragons’ Den, Die Höhle der Löwen, which also spawned Shark Tank in the U.S. Zeedz.io's mission is to deliver gameplay experiences that entertain while reaching tangible climate goals. In Zeedz, players tackle carbon emissions by collecting and nurturing plant-themed creatures known as Zeedles. Players plant Zeedles on a real-world map, intertwining the game experience with current environmental circumstances.

- Quest Portal, an Icelandic startup, raised a $7.6M seed round to enhance its online tabletop role-playing game (TTRPG) platform. The platform is aimed at simplifying the TTRPG experience for newcomers, particularly those that want to become a Dungeon Master. Quest Portal offers a free tier and a Pro subscription, with the latter including an AI-powered assistant for rule clarifications, idea generation, NPC creation, and more.

- Upland extended its Series A funding round to raise an additional $7M for its blockchain-based virtual real estate game. Upland is one of the top web3 apps, with over 3M registered users on the EOS blockchain and around 300K virtual property owners. Users on the platform can engage in games developed by third parties, trade assets minted by creators, acquire virtual assets like branded items, and interact in 3D settings.

- Copresence, a Swiss digital avatar generation platform, raised $6M in seed funding. The money will be used to expedite growth, further develop its technology for creating photorealistic 3D avatars using only a smartphone, and expand its team based in Zurich. Copresence's platform is compatible with large 3D engines, including Unity and Unreal. It allows users and developers to create high-quality 3D avatars quickly, inserting them in gaming, VR/AR/XR, and video conferencing applications.

Notable Strategic Investments

- GameSquare, the esports company backed by Dallas Cowboys owner Jerry Jones, has acquired FaZe Clan for up to $18.5M in an all-stock deal. This acquisition comes a little over a year after FaZe’s $725M SPAC deal, as the company has suffered heavy losses every quarter. GameSquare will offer FaZe shareholders roughly 0.14 shares for each of their FaZe shares, with major investors of GameSquare offering to buy up to $10M in a private placement if required. Upon finalizing the deal, GameSquare shareholders will own 55% of the combined company.

FaZe founders will assume executive roles in the consolidated company. Richard “FaZe Banks” Bengtson is slated to be CEO, Thomas “FaZe Temperrr” Oliveira will be appointed as president, and Yousef “FaZe Apex” Abdelfattah is set to be COO. Former FaZe CEO Lee Trink was deposed in September as a result of the extremely poor performance of the stock, which declined over 97% from its SPAC price of $10.

The deal is a stark reminder of the current financial state of esports companies and teams, which have been faced with closures, layoffs, and restructuring attempts all year. In May 2022, Forbes claimed FaZe was worth $400M, and was the fourth most valuable team behind TSM, 100 Thieves, and Team Liquid. These valuations were never “real,” but instead were a product of unrealistic private market valuations resulting from impossible growth estimates.

- Krafton invested $14.8M in South Korean mobile app marketplace One Store, a joint venture between domestic telecoms companies SK Telecom and KT Corp established in 2016. The funding is earmarked for the international expansion of the app store, whose goal is to counteract the dominance of tech giants like Apple and Google in Western markets. One Store has benefitted from a South Korean crackdown on Google as the search giant has been fined over alleged anticompetitive activity. Korea’s Fair Trade Commission said earlier this year that Google asked NCSoft and Netmarble to exclusively release new games on the Play Store in return for free promotion. An insider from Krafton revealed that a goal of the 2023 investment is to gain insights into international gaming markets. Additionally, One Store is considering another bid for an initial public offering, following a retraction in 2022.

- Supercell-backed game studio Metacore has acquired Finnish animation and illustration studio Piñata for an undisclosed amount. Since the 2020 release of Metacore’s hit mobile game Merge Mansion, the two firms have enjoyed a close working relationship, and Metacore CEO Mika Tammenkoski stated that the acquisition will boost their entertainment offerings, extending beyond games to marketing and community engagement. We’ll cover this acquisition more in Thursday’s issue.

- Mobile publisher Azur Games has acquired the game portfolio of U.S. hypercasual mobile games publisher Tastypill. Tastypill’s portfolio includes games like Cart Crash, Claw Builder, and Crash Tower, and boasts over 1B downloads. As part of the deal, Azur Games will gain the intellectual property rights and assets for these titles. However, the agreement doesn't encompass the acquisition of Tastypill as a company. Tastypill intends to remain independent and will pivot toward developing games in the casual genre.