It has been an exciting couple of weeks for Epic with its ‘Fortnite OG’ update, which brought players back to the game’s beginnings. It was a smart nostalgia play that broke records with 44.7M players in a single day. Just before the new season, Epic raised the cost of V-Bucks and modified the formula for how engagement-based payouts are shared with the Fortnite creator community, tilting it more in Epic’s favor and making Fortnite OG’s launch even more lucrative.

It was a much needed win for Epic, which is still reeling from laying off 16% of its workforce and the retirement of Donald Mustard, one of the lead creatives behind Fortnite. According to Tim Sweeney, the layoffs were needed because “creator content with significant revenue sharing… is a lower margin business than we had when Fortnite Battle Royale took off.” He was referring to the generous commitment Epic made back in March to carve out 40% of its Fortnite revenue as part of an engagement pool it would share with creators of Fortnite Creative mode. Epic called this Creator Economy 2.0, and announced at Unreal Fest that it has paid out $120M after six months.

We are almost nine months into Epic’s UEFN and Creator Economy 2.0 experiment, and with so much riding on Fortnite Creative 2.0, let’s take stock of whether Epic is on track.

Is Epic Achieving its Objectives with Creator Economy 2.0?

Epic has stated its objectives for UEFN and Creator Economy 2.0 in various interviews. In essence, the progression from Battle Royale game to UGC game platform has three main benefits:

- Grow the user base with content that appeals to a more diverse audience:Aside from the success of Fortnite OG, the game’s user base has been steady for the last few years. As Epic thinks about growth opportunities beyond Battle Royale, it is easy to look at Roblox and see that a more diverse content offering could mean more players for the platform. Fortnite is 74% male, while Roblox is 51%. Sixty-four percent of Fortnite players fall within the 18-24 age group, whereas Roblox spans from under nine to 25-plus. It’s clear that Fortnite has opportunities for growth, if it can expand its audience to other demographics.

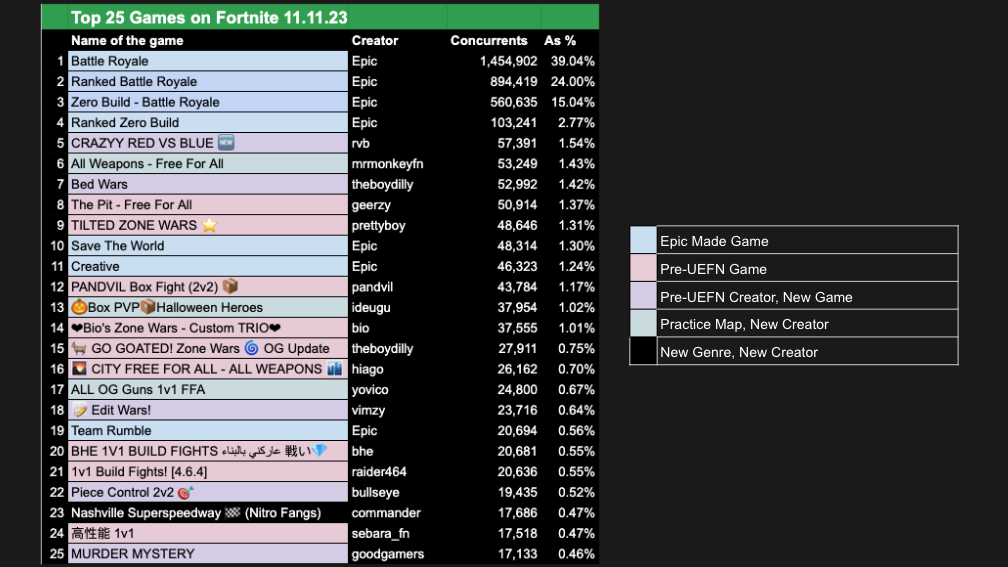

Has it been successful so far? When we look at the Top 25 games on the platform from last week, seven of them are made by Epic and eleven of them are games that were already on the platform when UEFN/Creator Economy 2.0 was released. As for the remaining seven from new creators: six are copycats of previously existing practice maps, leaving one game, Nashville Superspeedway in 23rd spot, as the only one that represents an entirely new game in the top 25 today.

Although there have been no sustained breakthroughs so far, Tim Sweeney noted in his statement on layoffs that “Fortnite is starting to grow again, [and] the growth is driven primarily by creator content” – a sign that Epic is still bullish on building out the ecosystem.

- Take pressure off of the live service team: Fortnite engagement ebbs and flows with how each new content update is received, putting pressure on the live service team to deliver something that players will love each season.

Platforms like Roblox, though, do not have to worry as much about the success of any single game update – because if any one game slips there are still hundreds more.

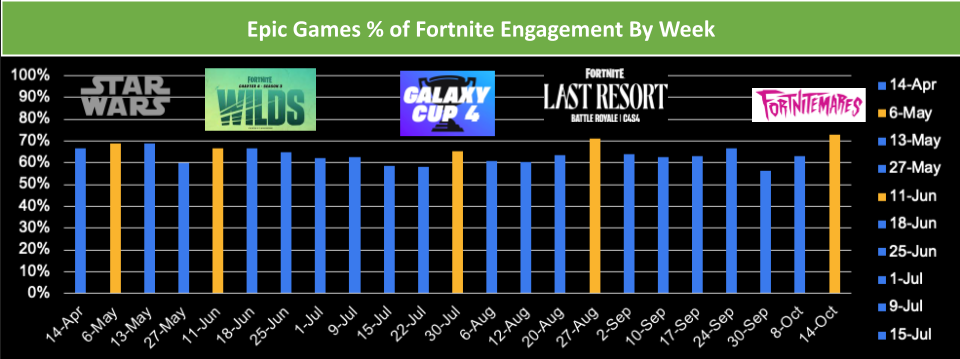

Has it been successful so far? There’s some evidence to suggest Fortnite Creative mode is taking pressure off of the Battle Royale live service. For one, Epic claims that 40% of engagement is in Creative Mode, though according to my data, it’s closer to 36%.

There are some important caveats to that: if the engagement is really around practice maps, then the game is still dependent on a strong live service to make sure players have a reason to practice. Additionally, many Fortnite Creative modes allow players to ‘AFK’ and passively gain XP towards their Battle Pass. This is a phenomenon explicitly encouraged in Roblox and likely a contributing factor to some of its claims around the platform’s astronomical engagement time.

With that said, I do see evidence that engagement in creative maps increases as a season drags on. This suggests that players do gravitate towards creative maps as they run out of fresh content on Battle Royale – a sign that Fortnite Creative is achieving the desired effect.

- Bring in more professional developers to the ecosystem, including Unreal Engine developers: Epic only takes 5% of revenue from developers that use Unreal Engine 5 (UE5), and that is only after they have earned over $1M in revenue. The rest of that revenue goes to publishing, marketing, and development costs, all of which are mostly taken care of on UEFN. That makes it a win-win for Epic and developers: Epic captures 85% of the net revenue generated in Fortnite, and developers can immediately reach a massive audience with no marketing cost, and potentially make more money than they would with an indie game.

Has it been successful so far? We don’t have any way to track how many professional developers have tried their hand in UEFN. The most notable studios I’ve come across are the esports organization 100 Thieves, which recently spun out its development studio, and Bungie founder Alex Seropian’s Look North World. While the games these studios have built bring professional polish and design to the platform, none have landed a major success yet. Meanwhile, established UGC game studios like Gamefam and Voldex have had slightly more success through purchasing and operating existing games, bringing in a little over $1M in annualized revenue from the games they now own within Fortnite Creative.

As we saw from the Top 25 games chart above, it doesn’t pay to be innovative, yet. This needs to change for professional developers to be willing to roll up their sleeves, learn ‘Verse’, the new scripting language that was a surprising departure from UE5’s blueprints, and try their hand at building in UEFN.

Epic May Have Jumped the Gun on Economy 2.0

I’ve heard rumblings that Tim Sweeney is not pleased with the number of new developers that have entered the space, and I can understand why. Sacrificing $200-300M per year to the creator economy would ideally come with a larger ROI than what we’ve seen to date. For context, Call of Duty and GTA VI reportedly cost over $250M to make, and even more to market, but these games are developed over multiple years. In effect, Economy 2.0 should be creating the value of an additional major franchise each year. Epic recognized this in a recent Forbes article, where Sax Person, EVP of the Fortnite Ecosystem, stated: “We have no illusion that we could build first-party games to get us to the size that we really want to grow to. What we are focused on is building systems that scale to 100 million, 200 million, 500 million people and provide the economic incentive for people to participate on that platform.”

Fortnite wants to eventually have games by indie developers that are bigger than Battle Royale, in the same way that Roblox has some of the largest player bases in the world with Blox Fruits, Brookhaven RP, and Blade Ball. However, when I’ve spoken to creators, the biggest hang up is the limitation of UEFN’s functionality. I reported on this previously: “The biggest limitation in the UEFN toolset today is the inability to store player data. When a player leaves a game, their data is lost forever and progression beyond a single play session is limited to hacky workarounds. Another limitation is not being able to make original items(you’re stuck with slurp juice if you want to recharge shields).”

While save functionality was introduced last month, developers reported a high degree of bugginess and they are still forced to ask people to post their scores on X (formerly Twitter) or via a Google Spreadsheet so they can be manually added to a leaderboard. Fortunately, a glance at Epic’s publicly available roadmap shows there are features that will make a big difference planned in the near future including:

- Camera and Control Modes that allow for top-down and isometric games to be developed.

- Scene Graph APIs which enable customizable and destructible game assets as well as dynamic game environments.

- Custom UI and HUD Devices that unlock novel UX design.

- Custom NPCs which allow the creation of NPCs with distinct logic.

These high value features will have a major impact, but turning a game into a platform is not easy and Epic’s timelines surrounding Fortnite Creative 2.0 have been dubious at best. That puts existing studios producing professional quality games in an uncertain spot as they wait for these tools to come online.

Reflecting on the Big Creator Economy 2.0 Announcement

Now that we’re nine months into Creator Economy 2.0, we can look at the money that’s been spent and ask: ‘Was such a significant increase in creator payouts the best use of Epic’s capital?’

It’s possible Epic could have been better served investing that money to hire more Epic developers and build out the UEFN toolset faster, but adding more developers doesn’t always lead to more efficiency.

Epic may have been better off making a commitment to increase the engagement pool over a three-year period – that would have sent a signal to developers that this was a platform worth investing in, enabling Epic to work with creators to build out the feature set. It may have also prevented Epic from simply increasing payouts to its existing creator base five-fold without getting the improvement in content or engagement it was hoping for.

There’s no question that building out a UGC game ecosystem that rivals Roblox takes time (Roblox development started back in 2003). However, that long road ahead necessitates Epic’s prudence in managing capital efficiently. It is worth considering if gradually increasing payouts over time as more UEFN features come online could be a better foot forward for Epic in the long-term. Misfire or not, Epic is committed to building this ecosystem, and that’s a strong signal to send to those building in Fortnite Creative.

A Word from Our Sponsor: OVERWOLF

Integrate Safe UGC Into Your Game with CurseForge For Studios

Overwolf is an all-in-one platform that lets creators build, share, and monetize in-game apps, mods, and private servers. With over 165,000 creators, and 38M monthly active users, Overwolf supports the world’s most popular AAA titles such as League of Legends, Minecraft, World of Warcraft, and 1,500 other games.

For game developers, Overwolf offers CurseForge For Studios. CurseForge For Studios is a white-label solution that lets game makers and publishers easily integrate mods safely and seamlessly into their games, both existing and new, at zero cost. It’s battle-tested by AAA studios and games, including Maxis (The Sims™ 4), Studio Wildcard (ARK), Take-Two Interactive (KSP), and others.

CurseForge For Studios offers:

- Cross-Platform Modding: Integrate Overwolf’s open-source SDKs and plugins to let players discover and install mods in-game, across all platforms and storefronts.

- Full Analytics Dashboard: Get a full modding usage dashboard to learn which mods are popular.

- Safe and Secure Moderation: Studios define policies and guidelines on what is permitted, and these are then enforced by Overwolf – with only authorized content being published.

- Creator Relations and Payments: CurseForge supports creators with monthly payments, equity investments, developer contests, and hackathons to get their creative juices flowing, and kickstart content creation for your game.

Content Worth Consuming

Global Gaming Deals Activity Report Q1-Q3’23 (InvestGame): “InvestGame’s team is pleased to present our Global Gaming Deals Activity Report for Q1-Q3’23. This report analyzed a significant shift in the gaming industry’s investment landscape, characterized by reduced dealmaking activity and a challenging environment for early- and late-stage investments.”

The State of Web3 Gaming (Game7): “This report provides a comprehensive and first-time glance of key ecosystem metrics based on rigorous primary research methods, aiming to give a bird's eye view of the Web3 gaming space from 2018 until today."

Insights from Xsolla Funding’s VP on Slowdowns, Self-Publishing and Smart Funding (Premortem): “In his working life Justin Berenbaum, VP Strategic Planning at Xsolla & GM Xsolla Funding Club, has read thousands of pitch decks and seen thousands more pitches in person. He has helped numerous developers close deals and accumulated a ton of invaluable experience in the world of game publishing and funding. “I am super lucky in the role that I have. I get to travel the world and help indie game developers succeed.”

GamerGPT: What to Consider When Considering Generative AI in Gaming (GameDeveloper): “We briefly cover how AI tech and law intersect with generative AI in video games, starting with a survey of issues related to the right of publicity, intellectual property (“IP”), and privacy.”

Internet Spaceships Are Serious Business (Game Economist Cast): “It's finally here...the EVE episode. The crew speaks to one of the world's first Game Economist, Dr.Gudmundsson, who helped manage and advise on one of gaming's most durable and well-known game economies...ever. We cover the origin of E.V.E. (a simulation!?), his biggest wins at CCP, the role of game economists, and if crypto has a future.”