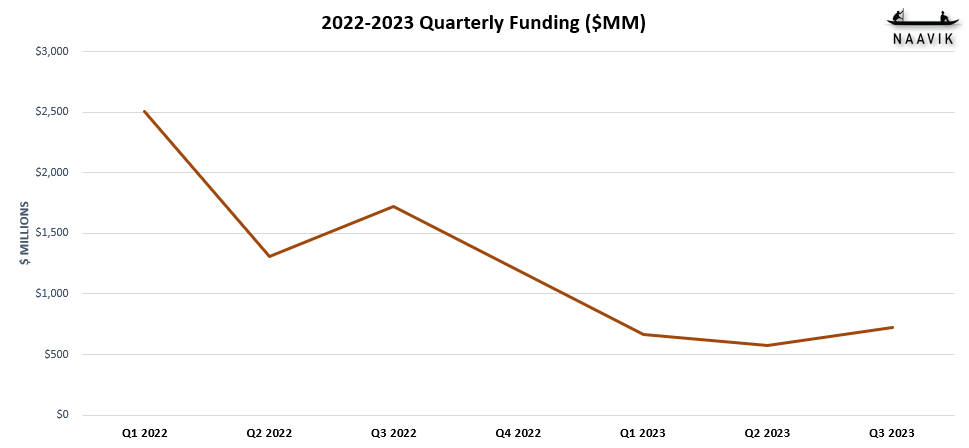

This quarterly web3 report emerges in the middle of the crypto winter that began in early 2022. There are still a number of first generation web3 games hanging on with a mix of bots and die-hards, but there have been very few impactful game releases for some time. We’ve also seen a pull-back in venture funding, and many ambitious games are still expectedly taking a long time to see the light of day.

It’s been a quieter time, but the widespread and global building continues. There’s been a strong focus on iterative improvements across infrastructure, onboarding, tokenomics, and mobile policy. Issues like transaction speed and cost are being addressed by a number of games using improved zero-knowledge technology or game-focused blockchains. Also, a variety of wallet solutions are being built out to ease onboarding and custodianship for the next wave of adopters.

As the market has cooled down in the west, there has been a transition of enthusiasm for web3 gaming in the east. South Korea is increasing development despite a ban on playing web3 games locally, and Japan has also begun embracing web3 gaming with even the government supporting NFTs and heavy hitters like Square Enix, Sega, and Konami all dipping their toes in.

Other big publishers are testing on the fringes, too. Despite Ubisoft taking some hits for its failed Quartz NFT attempt, the company remains experimental, including with its first web3 game, Champions Tactics. Zynga’s foray into web3 gaming via its multi-game project Sugartown is also making progress. Yuga Labs, meanwhile, has been pushing forward past its initial effort, Dookey Dash, to launch two small games using its NFTs, HV-MTL Forge and Legends of the Mara.

Progress was also made on the mobile front. Google finally revealed a more welcoming NFT policy and Apple made it (mostly) clear where it stands on the topic. This led to one moderate web3 hit on both platforms, NFL Rivals (by Mythical Games).

Also, combined with new self-publishing capabilities, Epic Games Store is set to become a leading destination for desktop web3 games, helping bypass the clunkiness of downloading and updating games from websites or custom launchers. There is still a lot of potential for the integration of web3 features like wallets, marketplaces, and more that Epic Games could pursue. We’re also keeping an eye on Hyperplay, which is building a different distribution platform with growing web3 features (like bridging the gap between wallets) from day one.

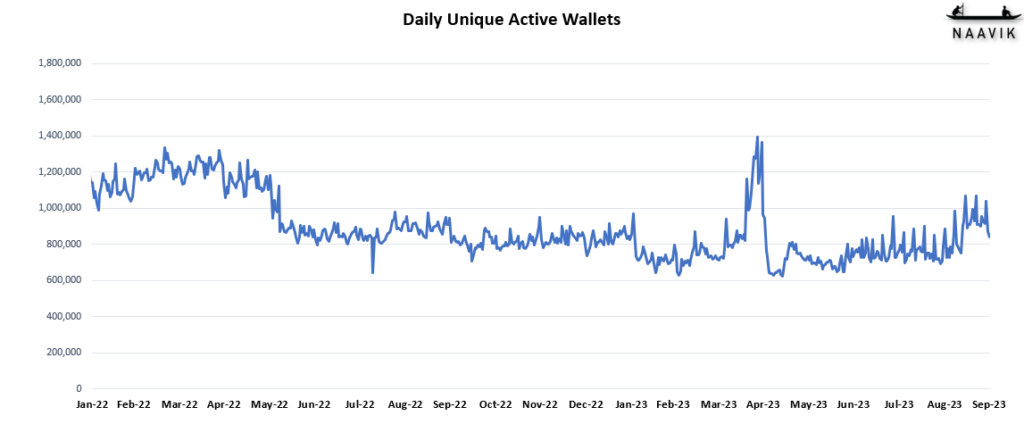

In terms of quarterly metrics, Unique Active Wallets (UAWs) have surprisingly maintained relative stability over the past two quarters - mostly running between 700-800K per month, according to DappRadar. This consistency likely results from a blend of bots and committed users, with the balance tilting towards the former. However, games that once led UAW activity, such as Alien Worlds, now give way to casual mobile games and late play-to-earn ecosystems. Newer games are exhibiting a much lower level of contract interaction (and therefore UAW metrics) as a separation grows between fully on-chain concepts and “web2.5 games,” which are largely traditional games with optional web3 aspects. This has a tendency to solidify the presence of longtime favorites in the top 20 monthly UAW games until there are more universal ways to track activity.

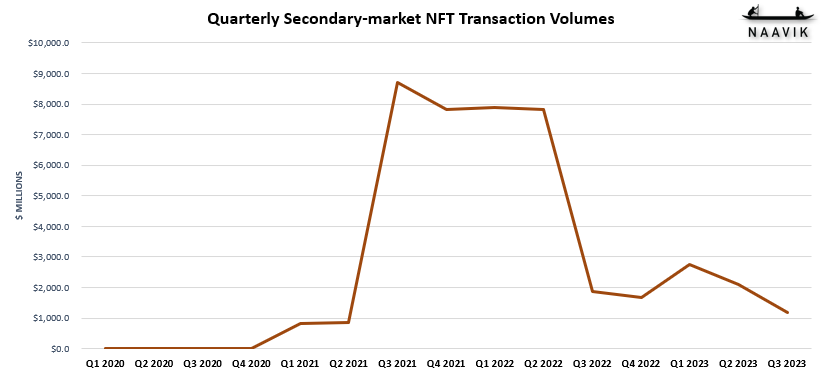

Secondary market activity for NFTs has also continued to decline. With the broader NFT and play-to-earn bubble long since popped, plus players waiting for fun games that are worth trading around, there’s little reason to see volume rebound in the short-term. Consequently, games built around affordable, enjoyable to collect, and frequently traded NFTs, like trading cards, now dominate transaction volumes, albeit at a limited scale. This quarter also accentuated the gap: NFTs from games like Digidaigaku and Yuga Labs Otherside, which leaned heavily on speculation, witnessed sharp declines in both price and volume. The challenge of ensuring royalties has further discouraged developers from promoting high-volume trading until there is a stronger solution, especially after OpenSea’s flip-flopping on the matter.

While we may not have reached the market nadir this quarter, the end might be in sight. Game business models are evolving alongside enhanced tokenomics and platform policies. Game developers are starting to rightly question what parts of web3 make sense for games and how best to implement them, especially around tokens.

It’s also worth noting that a tighter funding environment means we’re likely to (sadly!) see several teams run out of cash and need to shut down; others will need to run more lean to extend their burn rates. Of course, there still are several investors in this space. It’s just that expectations have risen as broader interest has waned – all part of the hype cycle. In short, patience is still needed, mostly as we wait for the number of higher quality games to release over 2024 and 2025. We’ll keep you posted, but for now let’s dive into the details – game updates, company updates, metric trends, and funding announcements for the latest quarter.

Notable Game Updates

NFL Rivals

Released in Q2, NFL Rivals only really kicked off heading into Q3, coinciding with the NFL season's start. This semi-casual American football game centers on acquiring and upgrading players, which can optionally be NFTs, for brisk football matches against AI. Mythical Games collaborated with Apple and Google, ensuring the game's web3 components met both companies' standards. Apple even spotlighted it, contributing to its growth on the platform. Crucially, the game's design prioritizes the web2 business model, paving the way for a secondary market.

Its NFL foundation makes the game predominantly US-centric and seasonal, which could restrict its expansion but guarantees a dedicated audience. Data from data.ai reveals about 2.5M downloads by Q3's end and over 1M active players. While its IAP revenue for Q3 is approximately $1.3M, Mythical Games also draws a significant yet undisclosed royalty from NFT trades on its platform, accounting for roughly 15% of its revenue (that would be around $200K for Q3) according to an interview with Naavik. For context here is a chart with a few other mobile games that have optional web3 elements.

NFL Rivals compares very well to any of the games not developed in South Korea, and beats all of them in the US. NFL Rivals makes very little outside of the US, especially compared to the Mir series (WeMade) and Ni No Kuni: Cross Worlds (Netmarble).

However, those three games are also much more complex RPGs with a better variety of monetization methods and content. Unfortunately we don’t have good data across all these games for secondary markets to accurately compare how NFL Rivals may be faring there.

As a final note NFL Rivals compares favorably in terms of active users with only Ni No Kuni beating it on Android, and it beats all of them on iOS, suggesting it could be doing a much better job of monetizing the active player base in-game. We recommend checking out our recent digest on Mythical Games for more.

Parallel

Established in 2021, Parallel, an Ethereum-based sci-fi trading card game (TCG), has often been overlooked because of its gradual momentum. Contrary to many flash-in-the-pan games, Parallel saw its record month for secondary market volume in August this year with $1.4M, surpassing its previous best of $1.2M in January 2022. Part of the reason for the slow growth is the lack of details on the actual game until later in 2022 and no playable Alpha until this year. The early sales were based on the appeal of the art and theme combined with typical web3 design that included benefits for early NFT purchasers.

The game distinguishes itself through its futuristic world-building and high quality art. Cards were steadily released, peaking in January, supplemented by digital comics to retain holder interest. A Closed Alpha release in Q1 spurred trading volume beginning in March as Alpha testers shared more about the gameplay. Momentum accelerated in Q3 based on huge jumps in secondary market volume, marked by a Closed Beta launch on July 31st and the promotion of the impending ‘Planetfall’ expansion set's art.

This quarter the dev team also held a ‘play to earn’ avatar contest and opened beta friend referrals. It also announced an Unreal Engine 5 game, Colony, at Token2049 in September. This new title will incorporate NFTs, the $PRIME token, and some AI innovations. The game remains in beta, now embarking on its third battle pass season. While the game is playable, it still seems to lack UI/UX polish. The sci-fi theme is a double-edged sword as it provides a nice alternative to all the fantasy themed TCGs like Gods Unchained, Cross the Ages and Splinterlands, but sci-fi generally has a smaller audience in TCGs. The game does have a few unique mechanics but overall isn’t drastically different from Gods Unchained and we don’t expect it to get anywhere near the metrics we’ve seen for that game, especially as it’s still unreleased to the public.

Wreck League

Most games in web3 spend a lot of time building up hype, community and FOMO behavior to drive excitement upon release. Wreck League, on the other hand, waited until the game was done to even announce it, and quickly pushed allowlists and early NFT sales.

Wreck League is a 1v1 robot fighting game for PC and mobile that uses a card system similar to Clash Royale for more casual gameplay. The game comes from Animoca Brands subsidiary nWay, which built it on top of a previous mobile game that used the Mighty Morphin Power Rangers IP. The gameplay and systems have important differences from the Power Rangers game and the robots players use are built from parts that can be swapped around. They can also optionally be NFTs. This system of body parts becoming cards during gameplay is similar to Axie Infinity, but with just a single robot instead of a team.

The game’s release opened with a short time window allowlist to buy blind boosters of NFTs that could be used to build a mech. There was also a special promotion for owners of Yuga Labs NFTs like Bored Ape Yacht Club to get special legendary Yuga Labs edition parts. After initial sales, the secondary market attained $3.8M in volume in August, but that dropped dramatically down to just $201K in September. The sharp downturn could have a few causes such as most of the initial buyers just looking to flip for profit, general lack of interest in the game after seeing it, and the inability to freely play other players outside of tournament entries.

One of the biggest concerns with Wreck League is that the Power Rangers mobile game it is based on was not successful, according to revenue and active users data from data.ai. Robots are always a hard sell due to a lack of specific personalities and characters to latch onto, and if the Power Rangers game failed with an actual popular IP attached that doesn’t bode well for Wreck League. Having body parts swappable is fun but adds to potential for disinterest from viewers and even confusion while playing against opponents.

The gameplay itself is fun, but may lack the depth necessary to carry it long-term without strong progression systems and live ops. There is a patent pending system coming for NFT owners to create IAP copies of their mechs to sell for a profit-sharing system, which could be interesting if the game manages to get traction.

At the moment it still seems to be in a very early access-like stage with the mobile version only on Android through a downloadable apk file, and not on the store. The game has some potential as it does already have some polish and is actually playable (at least against bots in practice mode). But we should have a better idea on its viability once it hits a broader release.

Notable Company Updates

Sky Mavis

Axie Infinity’s rapid rise ushered in the NFT game craze, but its just-as-quick plummet became a cautionary tale for many. Developer Sky Mavis has persevered, and Axie Infinity was relaunched as Axie Infinity: Origins (the original now termed “classic”) in April 2022. The player base is smaller, but remains dedicated. Sky Mavis, using funds from Axie's peak, has focused on fulfilling past commitments like Land and broadening the Axie and Ronin blockchain ecosystems. While not everything succeeded initially, the past two quarters have shown progress.

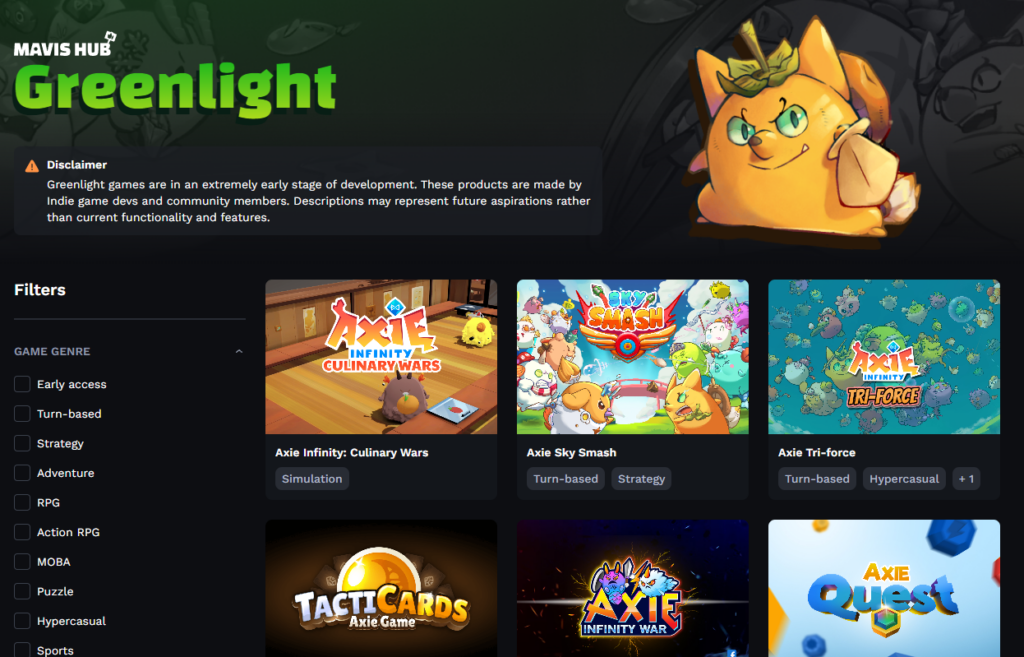

Sky Mavis introduced upgrades to the Axies themselves with NFT leveling using earnable per Axie XP (called AXP). It is also increasing support for third party Axie games by expanding its builders program into the new Mavis Hub: Greenlight, which launched with two games, Mini Tri-Force and Culinary Wars.

The Mavis Hub: Greenlight project is similar to Steam’s Greenlight system, but for third party Axie-based games that are at least in the beta stage. It serves as a helpful way to filter out some of the low quality attempts, but of course this only works so long as there’s an incentive to develop games for someone else’s IP in the first place. That incentive is usually AXS tokens which are still continually going down in price, reducing the motivation for anyone but superfans who will mostly make very amateur projects.

Sky Mavis also continued building on both its land-focused games Homeland and Raylights. There’s also a new social experience in development for Axie owners called Project T, which is designed to increase the bond between Axies, their owners and the community.

On the Ronin blockchain front, Sky Mavis is negotiating with unreleased games to move to Ronin, such as Wild Forest, to join the five existing third party games The Machines Arena, Tribesters, Bowled, Battle Bears Heroes, and newest addition Pixels. The strategy is to transform the isolated Axie environment on the Ronin sidechain into a vibrant community, backed by funding and a loyal player base. It has also struck promotional partnerships, like bringing NFT project CyberKongz's Genkai collection to Ronin.

It’s a risky strategy to try and bring a bunch of smaller games over to the network that suffered one of the biggest hacks, rather than consider moving over to a more populated blockchain. The quality, genre and platforms of these games is a mixed bag and this counts on either these games bringing users to the network or Axie players getting interested in them enough to stay within.

The pivot also comes a bit late after Polygon and Immutable already fought over most of the more desirable games, but Sky Mavis has been pretty aggressive in trying to secure deals with newer games in development. The big question is what Sky Mavis really brings to the table for these games outside of money, a dwindling user base with a generic Ethereum sidechain, and a lack of long-term game development experience.

Sky Mavis still faces challenges securing a sustainable future. Yet, Axie Infinity maintains a declining but decent secondary market volume, ranging between $1.3M-$1.7M monthly. Building both a brand and a network in the present market is daunting, but they have financial cushioning to continue pushing.

Gala Games

Gala Games set up a pretty ambitious slate of games as a publisher for its own blockchain that continues to grow and even includes film and music. Fully released games so far include Town Star, Spider Tanks, Grit, and PokerGo Play. There’s also the two games it is revamping from acquired mobile developer Ember Entertainment, Meow Match and Dragon Strike. Its efforts in establishing a game portfolio and ecosystem have been mixed but progressive. Gala has adjusted its economic design, launched a blockchain, adapted mobile games to web3, and released games with varying levels of success.

Its first release, city builder Town Star, had potential but faced economic hitches with its play-to-earn tokenomics design. After ditching its own token and overhauling its economy to use the Gala token in May, this quarter it rebranded as Common Ground World as part of a partnership with Gala Films eco-documentary Common Ground.

Spider Tanks, a deathmatch tank arena game, progresses with regular updates including new tank parts, arenas and events as well as economic tweaks. Unfortunately with the game being on an isolated Gala network we don’t have any accurate metrics outside of the price of the game token SILK, which has been declining steadily for some time. The gameplay is decent, but realistically without pushing the game to mobile or at least Epic Games Store it’s unlikely to have a long life span.

Grit, an old west themed battle royale game on Epic Games Store, unfortunately lost its player base from both lack of a network effect and technical issues. The game had a lot of potential to be an interesting twist on the genre, but a botched release with no bots or attempts to fill the player base combined with immediate tokenomics problems made it basically dead on arrival.

Gala Games introduced Champions Arena this quarter, which holds promise as a turn-based RPG not requiring a large player base. The big downside is launching into a very crowded genre and it shows with the game only being able to pull in 3-4K players according to data.ai.

Additionally, after acquiring mobile developer Ember Entertainment, Gala added NFT support to existing games Dragon Strike and Meow Match with the promise of future play-to-earn aspects for the Gala token. It’s hard to gauge if this has had much impact on the games, but Meow Match seemed to drop a large number of players, especially on iOS, in early August. Dragon Strike has managed to grow its player base, although not its revenue.

Gala Games continues its momentum with promising early releases like Last Expedition (a PvPvE extraction FPS) and Superior (a coop roguelite third person shooter), and eight games in the pipeline, including Legacy – a business sim helmed by the infamous Peter Molyneux.

So far Gala Games has failed to launch any hits and going in so many directions at once may be sapping its ability to put its weight behind those with real potential. Adding in the film and music areas is further dividing the resources of the company. It’s uncertain how resources have been allocated, but three low performing game launches isn’t a great start.

This quarter also revealed internal conflicts with co-founders Eric Schiermeyer and Wright Thurston suing each other. The lawsuit itself is between the two individuals, but it’s tangled up in Gala business, especially the token. Both are essentially accusing the other of some form of misuse of the tokens and NFTs. There is some possibility that the Gala token v2 upgrade is related to the suit, along with Coinbase delisting the token. Containment of further impact to Gala will probably depend on any evidence of wrongdoing that sheds a bad light on the business going forward, as the business itself isn’t part of the suit.

Recent policy changes have created opportunities for web3 games on Google Play, which now allows NFT transactions without focusing on capturing a cut of NFT revenue. However, due to the potential real-world value of NFTs, purchases with random values (like loot boxes) are considered gambling. There are potential solutions such as converting to an NFT after an item comes out of the loot box or selling the loot box outside of the game.

Another update allows advertising games containing NFTs unless they are linked to gambling. However, games involving cryptocurrencies are still restricted, likely because of potential for illegal activities.

These policy shifts could be impactful for both developers and Google given the importance of advertising to Google's core business. They've paved a much simpler path for games with optional web3 elements on Android.

This is significant for the future of web3 game adoption, but game developers must still reconcile these changes with Apple's policies when releasing on both platforms. It’s unclear if there are any games taking advantage of this recent policy change yet outside of Mythical Games (NFL Rivals and Nitro Nation: World Tour), but there are games with mobile versions in development such as Wreck League and Mighty Action Heroes that will definitely factor this in. There are also tools like Stardust and Ready.gg that could be leveraged to quickly add web3 support to a game now that the policy is clearer.

Zynga

Zynga finally revealed its debut web3 venture Sugartown, which has been in development for 18 months and is described as a transmedia IP and platform for games and community building. Despite all the hype, there was very little revealed initially besides a trailer featuring the IP’s central characters.

A number of experienced web3 staffers were hired to help the entire project target web3 natives. It started with a Discord community and coaxing engagement to get onto allow-lists for the first NFT mint of ‘Oras’ without revealing what these NFTs would even be for.

Zynga ran an ‘NGMI Alpha Event’ which involved staking the Ora NFTs for $SUGAR and a procedurally generated side scrolling game called NGMI that let players use their Ora NFTs as the playable character.

The thing that makes this worth paying attention to is Zynga’s involvement. Historically it is one of the companies that profited most from new platforms (Facebook) and monetization models (free-to-play) so the biggest question is what the ZW3 team has up its sleeve for turning this experiment into a functioning business model. Interviews with the team have given the impression that it’s still feeling out the space in that regard and F2P monetization isn’t off the table, nor are royalty models.

The team has at least stated that it’s just focused on a web3 audience for now. The team is also taking a very live ops oriented approach so at the very least it intends to manage this as an ongoing experiment to potentially inform future projects.

The tricky part will be maintaining interest amid current web3 market conditions, although that does at least mean reduced competition. Initial secondary market volume for the Ora NFTs in September was about $2.5M and as some of the initial hype diminishes it looks to finish October under $1M. We definitely look forward to seeing some better gameplay out of Zynga than a rudimentary 2D side scroller.

Unique Active Wallets

- According to DappRadar, Unique Active Wallets (UAWs) have seen erratic growth from their recent slump. However, a detailed examination of individual games and their numbers highlights the challenges of gauging web3 game activity by solely tracking smart contract transactions. As web3 games shift from browser-based or downloadable versions to platforms like iOS, Android, and Steam, we might expect more comprehensive data from sources like data.ai.

- Older on-chain games such as Alien Worlds and Splinterlands, which once dominated the charts, have experienced notable declines. Overall, the UAW for the top game each month has been trending downward, with new leading games seldom holding the top spot for more than a month, as this chart depicts:

- We anticipate further decline in mainstays such as Alien Worlds, Splinterlands, Upland, Farmers World and Axie Infinity in the next quarter. They are all unlikely to expand the user base and any reasons to continue playing are diminishing outside of a very core audience and poorly managed bots. As interest and profit falls, game developers also start losing incentive to continue developing and it becomes a death spiral. Splinterlands has already begun significant downsizing and reorganizing projects into subsidiaries.

- As a reminder, UAWs are not a perfect indicator of users. A user can have more than one wallet – potentially overestimating actual user activity. Conversely, a user can play a game but not transact with a blockchain over a period of time, potentially underestimating actual user activity. Bots are also common across many games due to the ability to earn and will also show up in UAW numbers.

Top Games by Unique Active Wallets

- Solitaire Blitz, a P2E mobile Solitaire game, performed strongly this quarter, particularly considering its initial appearance on the charts was in June 2022 and its subsequent dip out of the top 10 in 2023 for newer "Blitz" series games. However, this success seems fleeting. Daily UAWs surged at the start of September, jumping from an average of 800-1,200 in the prior quarter to a sudden 40,000. While it's challenging to determine the spike's exact cause, data.ai indicates a surge in iOS-specific downloads during this time, hinting at a potential increased ad expenditure or an Apple feature. The game's daily UAW have landed at a respectable 8,000 average in early October. We'll monitor how both this game and Joyride Games' entire Blitz series perform in Q4.

- Sweat Economy has risen in the charts over the past few months, partially due to the project’s US launch. However, it should be noted that Sweat Economy is less a game and more a gamified approach to walking/running, linked to a Sweat Coin token. It mirrors a previous project, Stepn, that initiated the "move-to-earn" trend. In these kinds of projects the price of the token is generally unsustainable since few are willing to pay others to walk or run outside, leading to a bubble then crash of price and motivation. Some, like the Sweat Wallet program, collaborate with sponsors and offer providers to maintain benefits in exchange for customer exposure. Due to its financial nature, Sweat Economy currently has significant presence in the top UAWs, driven by numerous contract interactions.

- Farmers World, a farming game on the WAX blockchain, experienced a significant and questionable surge in contract interactions beginning in August. Despite being seemingly abandoned by its developers in early 2022 and largely overrun by bots, it's unclear how this relates to the jump from its typical mid-100K monthly UAWs to almost 1M by Q3's end. Interestingly, some unusual X (formerly Twitter) spam promoted the game in early August. It's conceivable that the game's abandonment left exploitable flaws, potentially leading to mass abuse. The trend into Q4 may offer more insight into the cause, but overall it's fair to say the game has been essentially dead for some time. It does at least show the useful persistence of the blockchain although we aren’t optimistic that WAX is a forever kind of blockchain.

- Alien Worlds, a sci-fi, timer-based mining game on WAX, is showing its age despite adding features like the third-party-developed Battledome. While it has introduced alternate game modes and fresh NFT types, the game predominantly focuses on mining the token, Trillium (TLM). A dedicated core audience may remain, but many players are believed to be bots. The price of TLM saw a sharp drop in mid-June that may have resulted in a significant daily UAW decrease from late August to September, with even some bot operators dropping out. We anticipate the game's decline to persist next quarter.

- Gameta (Hippo Dash), PlayEmber, Iskra, and Tevaera are all at the forefront of the rise in web3 game ecosystems centered on hyper/hybridcasual gameplay. Typically, these games interface with blockchains only for NFT verification and occasional payouts, and the bulk of the contract interactions often stem from ecosystem NFTs and tokens rather than the games. These ecosystems usually employ variations of play-to-earn models but spread the token economy across various games, reward programs and NFT investments. With user acquisition becoming pricier, offering tokens and NFTs usable across several games is a strategic move to boost retention without directly compensating players. Retention obviously isn't endless as evidenced by Hippo Dash's recent slump but its retention is still outperforming many generic mobile endless runners.

- Iskra, despite dwindling interest, launched two games this quarter: Clashmon: Ignition and Norma in Metaland. Unfortunately, Norma in Metaland, hasn't yet attracted even 100 active users based on data.ai statistics. These quick turnaround hyper and hybridcasual games are mostly exploiting a gap in the market between the first generation of web3 games and the much higher quality games that can take years to produce. Many of these are also play-to-earn, even if most of the earning is just driven by ecosystem rewards rather than cash. We expect these types of platforms to continue growing for some time as the wait for high quality games continues and players look for unsustainable play-to-earn ecosystems to bounce between even as the good games trickle out. In the medium to long term, however, most of these will fail.

Transaction Volume

- NFT secondary market volume plummeted 44% to $1.19B in Q3 compared to Q2, marking its lowest since the NFT surge in mid-2021. Naturally, not all of this activity relates to game assets, but even within gaming most NFTs faltered because of lackluster gameplay or utility.

- As web3 gaming evolves, NFTs will likely be marketed as "digital collectibles" available for optional “marketplace trading”, avoiding some of the NFT stigma. In the near term, game developers should prioritize direct game sales and in-app purchases over hyped-up NFTs and challenging royalty structures. This focus will probably further reduce transaction volume, given that games have primary revenue avenues, unlike art projects primarily banking on speculative trading royalties.

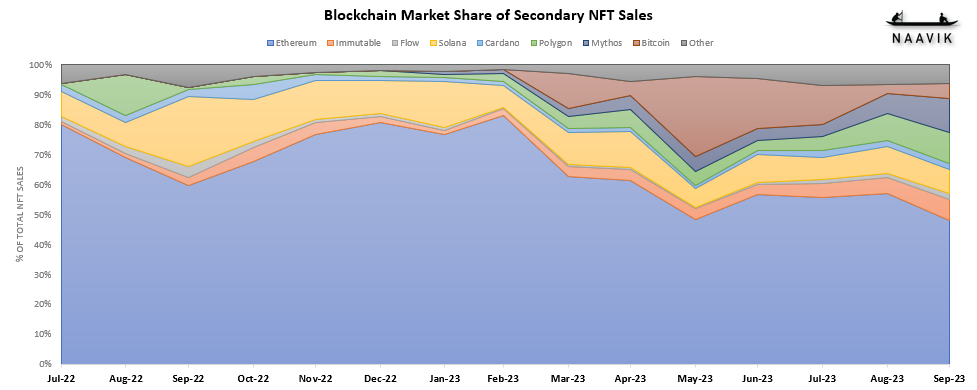

- Ethereum, representing 50-60% of the overall volume for much of 2023, witnessed an 85% quarter-over-quarter drop in secondary market NFT volumes. It's the primary hub for many NFTs, especially non-gaming ones, but it’s also the costliest to operate. Games have been migrating to faster and cheaper Layer 2 and sidechain networks or just building them like Ronin and Immutable. Game NFT assets meant for gameplay shouldn't be exorbitantly priced, making them unsuitable for Ethereum's gas fees and slow speed.

- Although 2022 and early 2023 saw the rise of various alternative blockchains with Layer 2’s and rollups like Polygon, Immutable, and Arbitrum or new Layer 1’s like Solano and Flow, many of those in the Other category have mostly faded by late 2023. The shift to other networks, including Ethereum's Layer 2 solutions and standalone Layer 1 alternatives, diverts volume from Ethereum. The market share of secondary transaction volume on Ethereum decreased from 73% in Q1 to 55% in Q2, then to 54% this quarter. This downward trend is expected to persist as games, originally on Ethereum, shift to more efficient networks. Ethereum also has no business development due to its decentralized nature and other networks often have had funding and support to convince game developers to switch, giving even more reason for new games to launch elsewhere.

- Despite ImmutableX (IMX) witnessing a 15% quarter-over-quarter decline in secondary market volume, it remains a steadily growing Layer 2 solution, encroaching on Ethereum's dominance. The platform primarily focuses on gaming, even with few fully released titles. Currently, the majority of its trading volume stems from the 2021 trading card game, Gods Unchained, which catalyzed IMX’s inception. ImmutableX’s gas-free trading environment has been a big benefit to maintaining high volume with cheap NFTs like trading cards, even with protocol enforced royalty payments. One thing that has held back some games from joining the network however is the lack of smart contract support, forcing game developers to work with IMX’s shifting tech more directly. To address this issue Immutable partnered with Polygon to use its new zkEVM blockchain tech for a second Immutable blockchain, Immutable zkEVM. This has allowed Immutable to regain MetalCore back into its upcoming games after it had previously gone over to Polygon. Between its two blockchains (once zkEVM launches that is), there is a slate of highly anticipated titles that should hit in 2024 and boost trading volume such as Immutable’s next two games Guild of Guardians and Shardbound (zkEVM) and the long awaited Illuvium. Guild of Guardians has been going through some growing pains, but the same team that helped revamp Gods Unchained has been on top of trying to steer the game forward. While it's taken a while for Immutable to expand to more live games, the improving tech (like its recent Immutable Passport) and partnerships with promising looking games should keep this one of the more relevant blockchains to watch for the future of web3 gaming.

- Unlike Immutable, Polygon targets a broader ecosystem beyond games, but it too experienced a 15% quarter-over-quarter decline in volume. This quarter, Ryan Wyatt, the head of Polygon Labs, departed, and combined with statements made by COO Sandeep Nailwal about Polygon being an “infrastructure company”, this hints at a shift in focus. The partnership with Immutable to provide the technology for the Immutable zkEVM network also suggests that Polygon may see infrastructure for games as more of an opportunity than the games themselves. Notable titles launching on Polygon seem to have slowed down with some games migrating to other chains like Arbitrum (Pirate Nation, Skyborne Genesis, Mighty Action Heroes) and ImmutableX/zkEVM (MetalCore), and on the plus side at least one game, Champions Ascension, migrating to a Polygon Supernet from Ethereum. Polygon managed to successfully launch its new zkEVM chain in Q1 with a promise of cheaper transactions, but it has yet to prove it out on live games which could hinder growth. As games that haven’t launched yet consider the options available, developers have expressed concerns about Polygon’s PoS system struggling to scale and potential high transaction costs on the zkEVM chain as it settles to Ethereum. But there is some interest in Supernets - Nexon announced that MapleStory Universe will use the tech. We forecast a continued decline in Polygon's transaction volume for gaming alongside Ethereum next quarter, with neither zkEVM nor Supernets expected to make a significant impact just yet.

- Flow continues to face challenges as a blockchain, yet its transaction volume rose by 31% quarter-over-quarter, nearly matching Q2 figures after three consecutive quarters of decline. Notably, the surge isn't largely due to games. Its sports ‘moment’ video trading cards, NBA Top Shot and NFL All Day, dominate the network's usage. Volume decreased noticeably after both sports concluded their seasons in late Q1/early Q2. However, as the NFL season progresses and the NBA season approaches, volumes indicate renewed interest. Seasonal influxes and substantial investment have sustained Flow for the moment. Nevertheless, Dapper Labs has made its third round of layoffs this quarter, anticipating challenges ahead given the limited projects being built on the network. At this point there’s little to indicate that the Crypto Kitties creator will turn things around and become a significant player.

- Solana's lack of compelling games persisted in Q3, leading to a sharp 51% quarter-over-quarter drop in NFT trading volume, following a 40% decrease in Q2. Major titles like Star Atlas remain far from launch, while existing games such as Mini Nations: Royale and ev.io find growth challenging. Despite these setbacks, because Solana still boasts cheaper and faster NFT art project trading, the network’s volume surpasses Immutable and occasionally Polygon. We foresee a further decline for Solana in Q4.

- Mythos, a recent entrant, saw a significant increase in Q2 volume, followed by a 16% drop this quarter. All three games on its network come from Mythos developer Mythical Games: Blankos Block Party, NFL Rivals, and Nitro Nation: World Tour. Mythical Games plans to launch more titles but derives most of its revenue from in-app purchases, with secondary market royalties contributing just 15% to its game revenue according to CEO John Linden.

- Bitcoin made waves at Q1's end by integrating NFTs via the Ordinals tech. Despite a surge in Q2 activity, there was a 74% drop this quarter as enthusiasm waned. While some interest in the pioneer network will persist, we forecast an additional drop in Q4.

- The "Other" category, encompassing Binance, Arbitrum, Ronin, WAX, Panini, Avalanche, Tezos, and Algorand, experienced a 21% decline quarter-over-quarter. Most of these platforms are in this category due to diminished relevance. As the market narrows, we foresee continued declines, despite Arbitrum and Ronin (Sky Mavis) enhancing their networks this quarter.

- Overall we anticipate that most blockchains will continue declining in Q4.

- As a reminder, Cryptoslam only accounts for NFT volumes in the secondary market. It also only includes data on the following blockchains: Ethereum, Solana, Avalanche, Ronin, Flow, WAX, Polygon, Panini, BNB, Cardano, Arbitrum, Mythos, Bitcoin, Immutable and a handful of very small others.

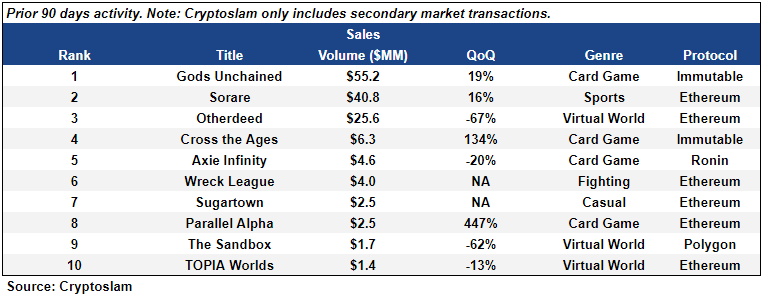

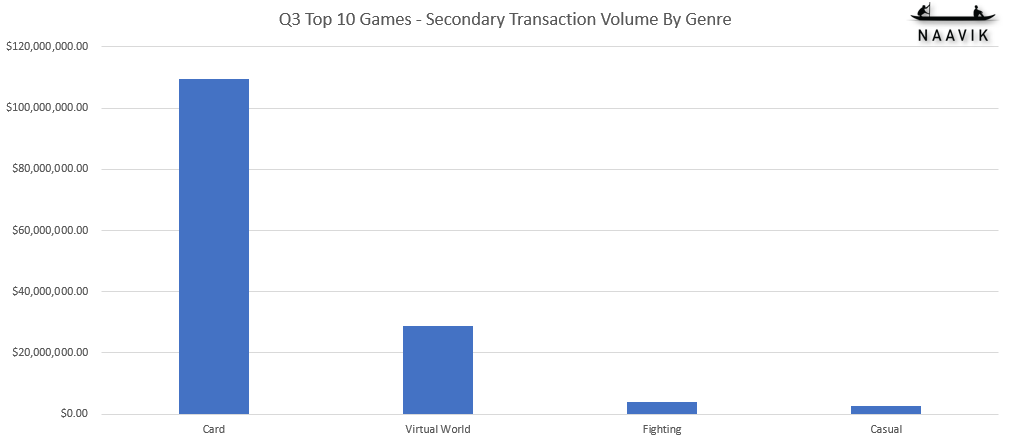

Top Games by NFT Transaction Volume

- While the secondary market volume decreased, many top games persisted, with varying degrees of success. Trade volume is predominantly driven by intuitive NFT assets like cards and land. There was a 50/50 split between those that did better than Q2 and those that didn’t, although some of those that did better were by a pretty large percentage. Two of the games, Wreck League and Sugartown, also didn’t exist in Q2 with both of them seemingly coming out of nowhere in Q3. Looking at the genre distribution it wasn’t just that card based games were the most common, they also took up a massive share of the secondary trade volume as Virtual Worlds continued struggling to maintain relevance.

- Gods Unchained saw a 19% increase compared to Q2, but it's worth noting that June boasted the game's record secondary market transaction volume at $23.1M, with April and May being a bit low in comparison. The game launched on the Epic Games Store in late June, and this was complemented by the debut of the Chaos Constructed game mode in July, the introduction of an in-game market in August, and the Sealed game mode in September. With the game's next expansion slated for mid-October, the upcoming quarter promises potential growth. The absence of a gas fee on ImmutableX bolsters card trading, especially given the average card's low price. While Immutable imposes an 8% royalty fee — translating to an estimated $4.4M from trades this quarter — payments likely spanned several tokens, including USDC, ETH, IMX, and game tokens like GODS. Thanks to revitalization efforts led by Chris Clay and the Immutable team, Gods Unchained is managing to grow despite its age and the difficulty of maintaining success in a competitive genre. Nevertheless, Immutable's revenue from Gods Unchained isn't solely from secondary market royalties; they also profit from card pack sales of each new set just like a physical TCG, with prices starting at roughly $2.

- Sorare continues to profit from its tradable seasonal fantasy sports cards, which span three sports: Football (Soccer), MLB (Baseball), and NBA (Basketball). While the recent additions of MLB and NBA took time to gain traction, Football has performed well for Sorare, boasting $1M+ in monthly secondary transaction volume since September 2020. This quarter's volume hasn't reached its previous peak but shows improvement from a $35.1M Q2. While the game's success might not last indefinitely, it will likely maintain decent performance unless they face government regulation or a competitor captures significant market share.

- The Otherdeed entry in the top 10 combines various NFT types that Yuga Labs developed for its Otherside ecosystem. This includes Otherdeed Land, Otherdeed Expanded Land, HV-MTL Mech, Koda characters, and Otherside Vessels NFTs. While Yuga Labs was initially successful in expanding its Bored Ape Yacht Club NFTs into cultural relevance, transaction volumes, including BAYC, have trended downward for some time. The extent of Yuga's revenue from royalties remains uncertain, especially with older NFTs not enforcing them. If they are crucial to paying for business operations it could hinder its Otherside plans by reducing ability to scale up development and manage multiple NFT projects. The company is definitely not doing as well as it would like as indicated by restructuring and layoffs in early October that mostly affected US staff. Nevertheless its creative uses of NFTs and small game events continue to be aped by others for now.

- Cross the Ages, another TCG, also benefits from zero gas fees on Immutable. The game is available to play on PC and both mobile app stores, and the gameplay is different from typical TCGs as the player battles around a grid system. This could help it stand out, but could also limit broad appeal as it is difficult to get used to for TCG veterans. Despite robust secondary market volume, especially in August, the mobile game's player count seems low, per data.ai. The usual secondary market volume hovers around $1M, with the $4.4M in August being an exception. A consistent $3M per quarter would still rank it within Q4's top 10 if trends persist. Trading card games are a tricky genre for player retention and with the game being niche both in player demographic and gameplay, it could be a struggle for growth and retention in the medium term.

- Wreck League and Sugartown emerged this quarter with substantial initial volume. Sugartown hasn't launched its NFT game yet but has garnered attention as Zynga’s first major web3 initiative. Its activities so far have focused more on gamified Discord and Twitter engagements. However, the market's patience for extended web3 projects, as seen with Limit Break's Digidaigaku, might be waning. Wreck League on the other hand actually has a playable game, but one that is clearly built on a poorly performing mobile Mighty Morphin Power Rangers fighting game. Its debut in August saw nearly $4M in secondary volume due to its surprise allowlist, blind box approach, and Yuga Labs collaborations. However, the volume plummeted to $200K in September, suggesting that Animoca Brands’ subsidiary, nWay, has its work cut out in Q4. The game does have potential from a gameplay standpoint but user acquisition might severely limit its ability to be successful with web3 gamers being such a small audience right now.

Fundraising Events

- Game funding saw a surprising increase in Q3, reaching $228M – a 41% rise from Q2's $162M.

- Leading up to its $54M raise, Futureverse has rolled up 11 companies with a mix of AI tech, web3 protocols and payment systems, game developers and content studios. The overall goal for the company is to build up what it considers the metaverse, which it sees as a combination decentralized infrastructure of blockchains, digital collectibles, AI content generation tools, with a focus on interoperability within the ecosystem. It is building ‘The Root Network’, a Layer 1 and Layer 2 blockchain with baked in support for digital items, multi-token gas support, and a suite of open protocols, tools, and frameworks combined with proprietary AI systems. The focus for the company seems to be around making things as open and interoperable as possible through infrastructure and tooling, with only a vague sense of what that will entail. It’s a pretty ambitious goal helped by gathering expertise through acquisitions, which is risky if the real brains don’t stick around. This funding round was focused on helping to scale the project with the talent it has acquired. The company has at least tried to show off its AI tech in games with a FIFA related ‘AI League’ football mobile game, and AI-powered boxing game Muhammad Ali – The Next Legends. The blockchain isn’t live yet, but testing of that network with some live apps will help determine if the funding is well spent.

- Mocaverse offers what it is also calling a “metaverse” (or Mocaverse in this case) but without defining much of what that will be just yet. So far it seems entirely focused on a limited quantity membership NFT collection based on all the companies it owns, invests in, and partners with. The $20M investment in a project centered on community and a focus on 8,888 non-transferable NFTs definitely seems audacious given today's market.

- Animoca Brands so far has a track record of significant fund raising and investments over recent years, but many of those projects aren’t doing great, especially the Revv motorsports concept. Projects like this that talk about community, creators and an open metaverse but don’t provide any concrete details are worrying, especially after so many of them have been complete flops. We remain very skeptical of the project without a lot more details. Unfortunately knowing how these projects go we may not really get all that in Q4.

- The $33M backing for Proof of Play is ambitious. The mission? Crafting "forever" on-chain games. While such games have potential longevity, they're a double bet on blockchain endurance and player adoption. The company’s first game, Pirate Nation, showcases its capability, but it has also grappled with migrating blockchains due to Polygon's high fees. The company intends to use the funding to help it tackle the hard problems around scaling, building out more features and open sourcing elements to embrace its on-chain ethos. There’s been a growing interest in on-chain games over the last two years, but the technology has a way to go before being player-friendly enough to attract a large audience. Nevertheless there is room to grow this niche space. There’s more on this in our recent interview with CEO and former Farmville developer Amit Mahajan.

- Xterio, with its recent $15M raise on top of last year's $40M, aims to expand its game ecosystem as both a game developer and publisher. While Xterio has established a good variety of partnerships, the majority of its 23 games are still in the works, with only seven currently available. All of the 23 games currently listed are developed by third parties, but Xterio is the publisher for three of them: Overworld, Age of Dino, and TTT. The games span a variety of genres like MMO, MOBA, party games, 4X strategy, farming, and more. Almost all of the games, with only three exceptions, are targeting mobile with some having desktop as an option. Ultimately Xterio is trying to build a platform ecosystem focused on easy on-boarding and asset exchange through a semi-custodial wallet and infrastructure for interoperability. As with many of these platforms the advantage for developers is access to tech, some support and hopefully players, but it’s clearly not exclusive as Blocklords is listed on Xterio and Epic Games Store. In many ways Xterio is reminiscent of flash game portals/publishers like Kongretate, but centered more around assets than games and chat. It’s unclear how Xterio plans to make money from the public documentation, but it intends to have a marketplace and seems to be slowly launching its $XTER token on Binance.

- Lastly, Mahjong Meta's $12M raise is somewhat unexpected, and a large amount for a game you wouldn’t typically associate with web3. Mahjong Meta has broader ambitions than a typical digital Mahjong game, with an esports focus and what it refers to as an “on-chain theme park”. The most likely interpretation of the theme park aspect would be mini-games and social functions, but the current version shows nothing indicating that. The platform is looking to appeal to a broad audience with high quality graphics rather than more traditional art, along with web3 integration via an NFT pet that uses AI to help make the game more casual friendly. A pet battle mode also exists to allow for the AI to play against each other with the use of collectible ‘strategy cards’ that shape the decisions. There is definitely an audience for Mahjong games, but seemingly bolted on AI, NFT, and even metaverse aspects don’t inspire confidence that the game warrants the funding received. However, a May beta test boasted 15,000 players, so there’s potential – though long-term player retention will be the ultimate determinant.

What We're Watching Next

Despite the recent downturn, there are several promising developments on the horizon. Web2.5 game designs like NFL Rivals aren’t perfect, but they demonstrate a viable business model. Plus, with mobile platforms clarifying their rules (and Google, in particular, being more friendly to these games), there is opportunity opening up on mobile for web3 to add new forms of revenue. It’s also worth keeping an eye on the potential growth of web3 gaming in Asia, which may indicate trends that eventually hit the rest of the world.

Despite funding and excitement being at a low point, several high profile web3 titles are still in the works, including shooters like Shrapnel, MetalCore, Off the Grid, and Deadrop. Shrapnel and Deadrop are both introducing more early access play in Q4, but they aren’t likely to be complete until 2024 if not 2025.

It's realistic to expect some delays in AAA game releases, but we anticipate more playable alphas and betas soon. RPG BigTime has begun its pre-season and should hopefully have some impact on Q4. Champions Ascension, an MMORPG with PvP combat, has also opened up a pre-alpha with rewards and a much more public alpha on Epic Games Store is coming in November. Illuvium, an open-world creature collector-battler, is scheduled to have a number of public betas in Q4. Phantom Galaxies, an open-world mech based space sim, will be launching early access in November.

We also await more clarity on heavily-funded, yet ambiguous projects like The Otherside and Digidaigaku, hopefully by next quarter. Yuga Labs’ recent restructuring with a refocus on The Otherside increases the chance of the team delivering, but the most realistic expectation is a “third trip” test in Q4. Digidaigaku, on the other hand, has revealed nothing about Limit Break’s actual game, and with the NFTs dropping off the radar, there is greater pressure on the company to deliver something. We get the impression that the heavy cooling of the market has motivated Limit Break to make, at the very least, some minor tweaks or pivots.

Blockchains such as Immutable zkEVM are gearing up for launch alongside the already launched Polygon zkEVM, and newcomers like Sui and Oasys are beginning to showcase games. It will take some time to get games going on these platforms, but all of them have dedicated significant capital to convincing and supporting games coming to those blockchains. Oasys will be an especially interesting one to watch due to it being the future blockchain of choice for many South Korean and Japanese developers, as well as Ubisoft. We anticipate a continued push for announcements of new games on these blockchains to maintain interest into at least the next quarter.

Next year, we expect to see significantly more fully released projects. Some of these will be PC-based, but many will be on mobile due to the shorter development time required. We also anticipate a lot more web2.5 and web3 games taking advantage of Epic Games Store as a way to be part of a legitimized platform with potential discovery, but the battle for distribution is only heating up and should get more interesting once big, better games get off the ground.

All in all, the market turnaround is a waiting game, and the wait isn’t over. The good news is that ambitious builders are still out there, and progress on interesting games and innovative technologies are happening every day. Where exactly web3 gaming goes in the future remains an open question, but as long as talented designers, developers, and entrepreneurs are making progress, we’re optimistic that value will eventually be unlocked – and there will be a lot of fun to be had.

Naavik has helped 250+ games teams with game & economy design, market research, user acquisition, due diligence, and more – including around web3. If interested in how Naavik can help your team, make sure to learn more and get in touch.