Hi Everyone. Welcome to another issue of Naavik Digest! If you missed our last one, be sure to check out our dive into the creator code revenue model. This issue, we’re discussing the age-old rivalry between Microsoft and Sony in the context of Xbox’s regulatory issues and PlayStation’s hardware success.

Microsoft Acquires Speedbumps / Apple’s Legal Victory / Ballooning Game Costs

In this episode, we discuss Microsoft's acquisition challenges, Apple's win against Epic, and the impact of record-breaking successes of The Super Mario Bros. Movie and miHoYo's latest mobile game. We also explore how Mythical's newest mobile game is expanding the audience for web3 and the effect of ever-expanding game development costs on the industry. Join us for all the latest games business news with Aaron Bush, Anil Das-Gupta, Jonathan Anastas, and host Devin Becker.

You can find us on YouTube, Spotify, Apple Podcasts, Google Podcasts, YouTube, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: PlayStation Can’t Be Caught

Written by: Nick Statt, Naavik Managing Editor

Not since the launch of current-gen devices in 2020 has the ever-widening gap between Microsoft and Sony’s console businesses been so apparent. While Sony enjoys record hardware sales, acquires new studios, and continues planning an ambitious live service roadmap, Microsoft has been sent scrambling by a nearly deal-killing regulatory blow in the U.K., declining Xbox hardware sales, and arguably its most botched major first-party release to date with Arkane’s disastrous and bug-filled Redfall.

For the past couple of years, Microsoft has made a strong showing of trying to keep pace with Sony and capitalize on its rival’s supply chain issues to bridge the gap between Xbox and PlayStation. That’s coincided with solid growth in its gaming division, including record Xbox sales last spring, and a clear vision from Xbox chief Phil Spencer on what the company’s key growth areas are: cross-platform, mobile, subscriptions, and cloud.

But a great deal of Microsoft’s strategy so far has been banking on the Activision Blizzard deal going through, which would help the company both gain a strong foothold in mobile via King and build out a robust pipeline of first-party AAA releases to drive retention and further growth for Xbox Game Pass. Virtually all of that has come crashing down in the last week, and it’s getting very difficult to deny that Sony’s lead from the PS4 generation is repeating again this era — and that it may be insurmountable.

“It's just not true that if we go off and build great games, all of a sudden you're going to see console share shift in some dramatic way. We lost the worst generation to lose in the Xbox One generation, where everybody built their digital library of games,” Xbox chief Phil Spencer said in a candid interview on an episode of the Kinda Funny Xcast published Friday. "This idea that if we just focused more on great games on our console, that somehow we're going to win the console race, I think doesn't relate to the reality of most people."

Beyond the shallow console race and fanboy debates that tend to populate conversation around this topic, the strength of Xbox is important for the industry at large because of Microsoft’s ambitions around many of the areas its competitors would rather not invest and compete in. If Xbox continues to struggle, we may not see subscription or cloud gaming expand as aggressively, and both developers and consumers will find themselves more beholden to the business models of Sony (and to a lesser extent Nintendo). Less competition in the console space will mean less pressure to compete on hardware and software pricing and less innovation; after all, Sony’s PlayStation Plus Extra and Premium tiers were a direct response to Game Pass.

So let’s go through the three major areas PlayStation continues to lead Xbox and why they’re making it increasingly difficult for Microsoft to compete.

Hardware

It was always a matter of when, not if, Sony would solve its supply chain issues and start producing enough PS5 units to meet demand. And with its last quarterly earnings report, we’ve gotten our first real glimpse at the staggering success of the PS5 and what we should expect going forward.

Not only did Sony surpass its FY2022 target with 19 million units shipped (versus 18 million forecast) — a 66% year-over-year increase — but at 6.3 million quarterly shipments (a 215% year-over-year increase) it sold twice as many PS5s from January to March of this year than the PS4 sales record. The company has now set an ambitious target of 25 million units shipped to retailers for the current fiscal year.

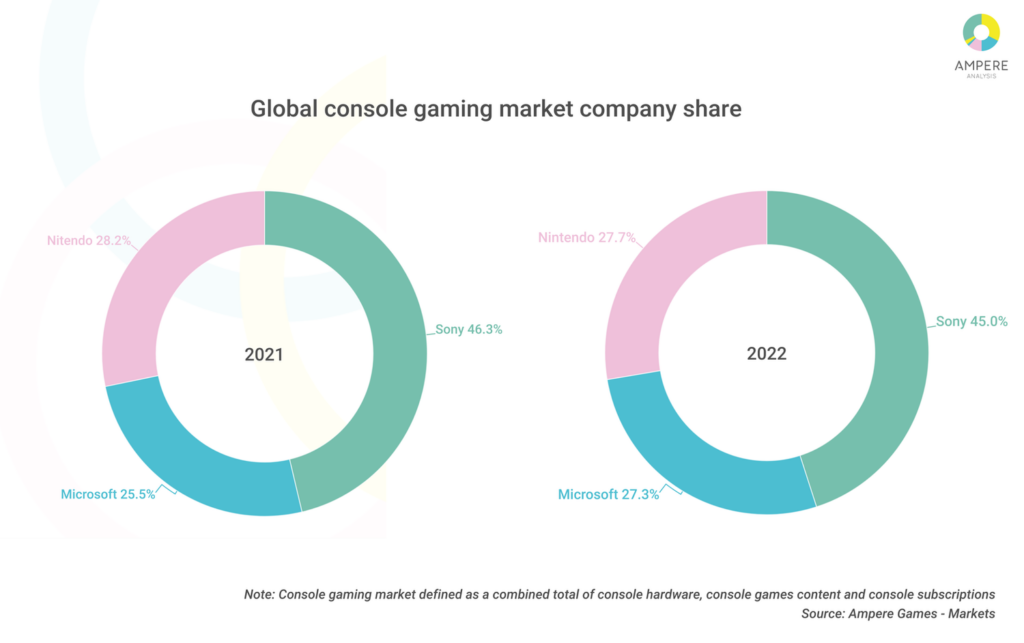

Microsoft hasn’t disclosed sales figures for its Xbox Series consoles, but Xbox hardware sales for the same time period were down 30%. (In fairness to Microsoft, Nintendo experienced a 21% year-over-year decline in hardware sales in its last fiscal quarter ended December 31st, 2022, though Nintendo has yet to report its latest quarterly earnings). Industry estimates put the sales ratio of the two device hardware lines at roughly 3:2, and Ampere Analysis estimated in February that the Xbox Series line had sold roughly 18.5 million units to date (compared to PlayStation’s roughly 32 million at the time).

Of course, Microsoft is less focused these days on console sales because of its cross-platform and subscription strategy. Unlike Sony, Microsoft publishes all of its first-party games on both Xbox and Windows simultaneously and also into Game Pass upon launch, so it stands to reason that fewer consumers may feel the need to pony up for an Xbox if they already have a PC. That’s proven to be a bit of a double-edged sword for Microsoft, which has struggled to articulate to consumers why exactly they should purchase an Xbox if it is not technically the only platform to play its exclusive games.

Furthermore, hardware sales do matter if only to help drive Game Pass growth and software sales, and although Xbox is fairing better than it did in the Xbox One generation, Sony is on track to repeat its 2:1 sales lead if the situation worsens for Xbox.

First-Party Releases

Sony’s first-party strategy became the envy of the industry during the PS4 era and for good reason. The company developed multiple exclusive releases that sold north of 10 million units each, and three — God of War, Horizon Zero Dawn, and Marvel’s Spider-Man — that sold more than 20 million units.

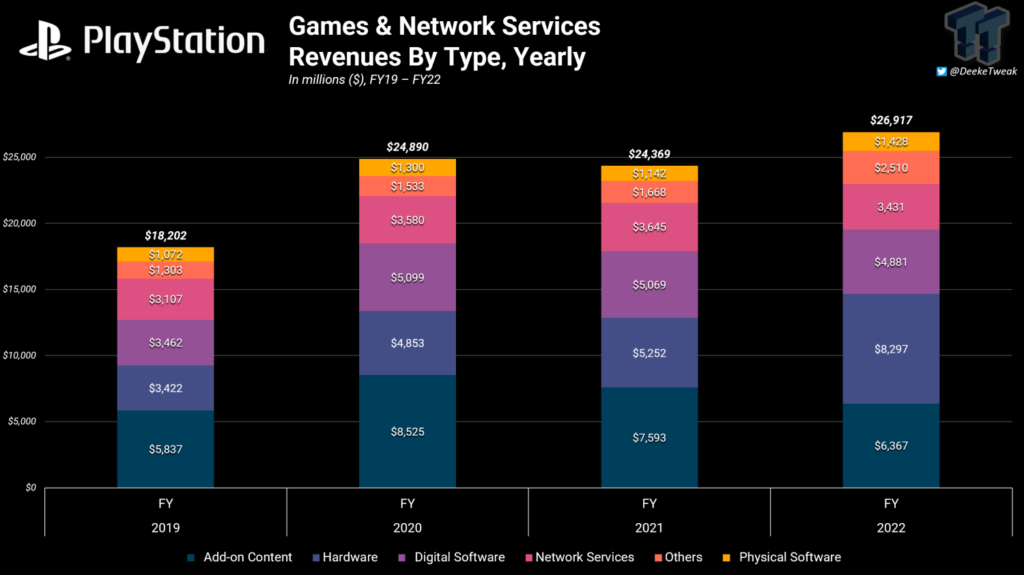

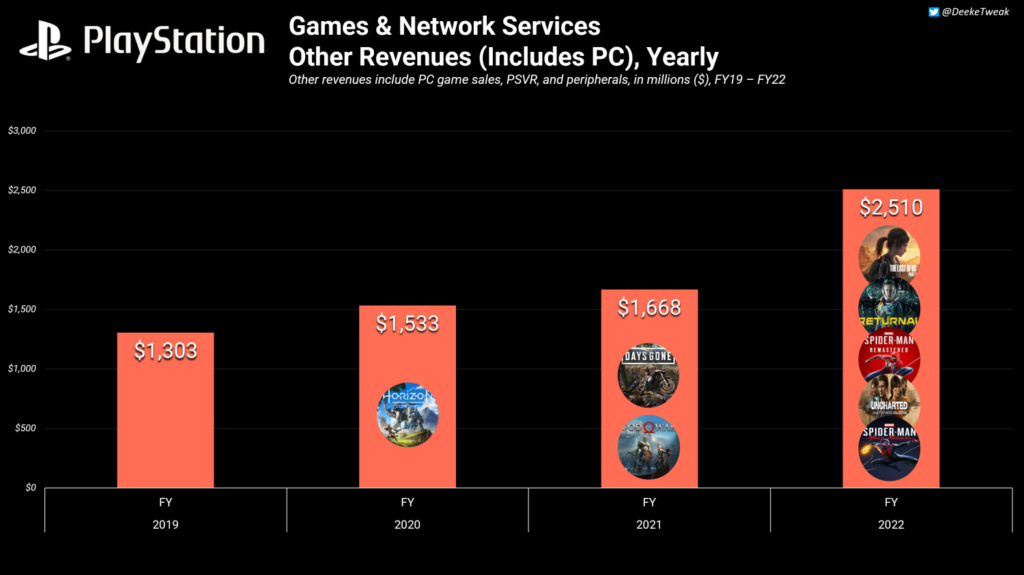

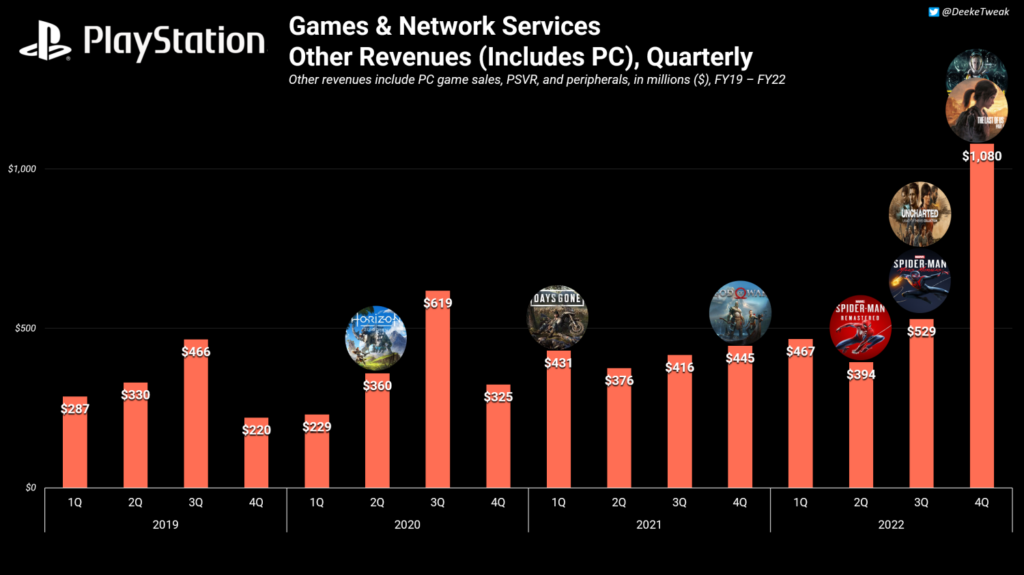

The company is repeating this strategy with the PS5, while at the same time accelerating its development of PC ports to generate additional revenue. Unlike Microsoft, Sony chooses not to release PC versions of its games at launch and instead carefully dictates a window of time after which sales of a PC port likely outweigh console-only sales. In FY2022, Sony released more than twice as many PC ports as it did the year before, for a total of five that included three remasters (The Last of Us Part I, Uncharted: Legacy of Thieves, Spider-Man Remastered).

Naturally, this has helped Sony expand its “Other Revenues” segment in the Gaming & Network Services division to an all-time high of $2.5 billion for FY2022. This has created a lucrative flywheel for Sony in which it develops first-party releases for the PS5, maximizes sales during the first year to two years of release, and then ports the game to PC at full price. This extends the shelf life of its games without having to resort to aggressive discounting.

Microsoft doesn’t get to enjoy this same cycle for Xbox first-party releases, instead focusing on using a mix of licensed indies and other third-party releases in combination with its first-party games to drive Game Pass adoption. The problem, however, is when there is little to look forward to and when the new titles that do release end up disappointing like Arkane’s Redfall.

Redfall, released this week to abysmal reviews, was an attempt at injecting Arkane’s beloved supernatural immersive sim design with live service, shooter, and multiplayer elements. The result has been a disaster. The game has a 62 Metacritic score with a 2.7 user rating, making it one of the lowest-rated games on the platform. Nearly every critic who’s reviewed the game has lambasted it for lackluster gameplay, atrocious enemy AI, and its hodgepodge of clashing features.

“I’m upset with myself,” Spencer admitted on Friday’s Kinda Funny appearance when asked about Redfall. “The critical response was not what we wanted,” he said, adding that “the team didn’t hit their own internal goals when it launched.”

For Microsoft, Redfall is emblematic of much deeper, structural issues with how it’s handling its first-party studios and their output. Purchasing Bethesda parent ZeniMax Media for $7.5 billion followed by Activision Blizzard for nearly $70 billion is part of a strategy to increase both the frequency and the quality of new games coming to Xbox and Game Pass.

But so far, besides the bright spot that was Tango Gameworks’ Hi-Fi Rush in January and the benefits of Bethesda’s backlog on Game Pass, all Microsoft has gotten out of the Bethesda acquisition was a PS5 exclusive (Deathloop), a twice-delayed Starfield, and now Arkane’s worst-ever reviewed game to date.

“I think we need to improve on engaging in games that are midway through production when they become part of Xbox," Spencer said of Xbox’s studio management approach. "I do think there's a different expectation for a game and even a team when you've been third-party and all of a sudden you become part of first-party… We didn't do a good job early on in engaging with Arkane Austin to help them understand what it meant to be part of Xbox and part of first-party, and use some of our internal resources to help them move along that journey even faster."

Game Pipeline

Microsoft has been struggling to find a first-party hit since the launch of the Xbox Series consoles. Back in early 2022, the company revealed that Halo Infinite and Forza Horizon 5 logged 20 million and 18 million players, respectively, over the course of a few months after release, showing off the power of Game Pass and its subscription-first model.

Yet Microsoft didn’t release a major AAA first-party release in 2022, while Halo Infinite’s live service ambitions sputtered and then fell completely flat. The drought became dire in May of last year, when the company announced it would delay Bethesda’s Starfield and Redfall into 2023. (Starfield would be delayed a second time and is now slated to release this fall.)

Spencer didn’t mince words when answering broader questions about Redfall’s failure and the overall Xbox strategy on an episode of the Kinda Funny Xcast published Friday. "We're not in the business of out-consoling Sony or out-consoling Nintendo," Spencer said. "There isn't really a great solution or win for us.” He went on to say, “And I know that will upset a ton of people, but the truth of the matter is, when you're third place in the console marketplace and the top two players are as strong as they are and have in certain cases a very discrete focus on doing deals and other things that kind of make being Xbox hard for us as a team — that's on us, not on anybody else.”

With Redfall a flop, virtually the entire Xbox ecosystem strategy is riding on a successful Starfield launch, putting immense pressure on the team at Bethesda to deliver a system-selling, Game Pass-justifying first-party hit. Still, even Spencer doesn’t sound too optimistic that a homerun will materially change the overall ecosystem issues at play. “There is no world where Starfield is an 11 out of 10 and people are selling their PS5s. That's not going to happen,” he said.

Sony faces none of these pressures. In contrast to Microsoft’s strategy, which has involved spending generously to scoop up established studios, Sony spent many years cultivating talent and nurturing smaller developers into powerhouses like Naughty Dog and Santa Monica Studio.

Lately, it’s been acquiring strategic talent across the industry with the intention of beefing up its live service portfolio, including Jade Raymond’s Haven, Destiny maker Bungie, and just last month Firewalk Studios, a company of former Bungie developers building a new AAA live service game. Sony also enjoys a close relationship with fellow Japanese publishers like Kojima Productions and Square Enix, ensuring timed exclusivity on releases like Final Fantasy XVI, Final Fantasy VII Remake, Forspoken, and Death’s Stranding.

Looking ahead, PlayStation fans have much to look forward to, from Insomniac’s Spider-Man 2 and Wolverine to scores of new projects in the works at its nearly two dozen internal studios. For Microsoft, the road ahead is much more existential, raising some hard questions for the Xbox ecosystem. With its Activision deal in jeopardy, its first major first-party release a dud, and its pipeline looking weaker than ever, Microsoft’s vision for gaming is looking shakier than ever before. Catching PlayStation this generation feels like a pipe dream. More pressing for the Xbox business is how it locks in new studios and levels up the quality and quantity of its first-party output.

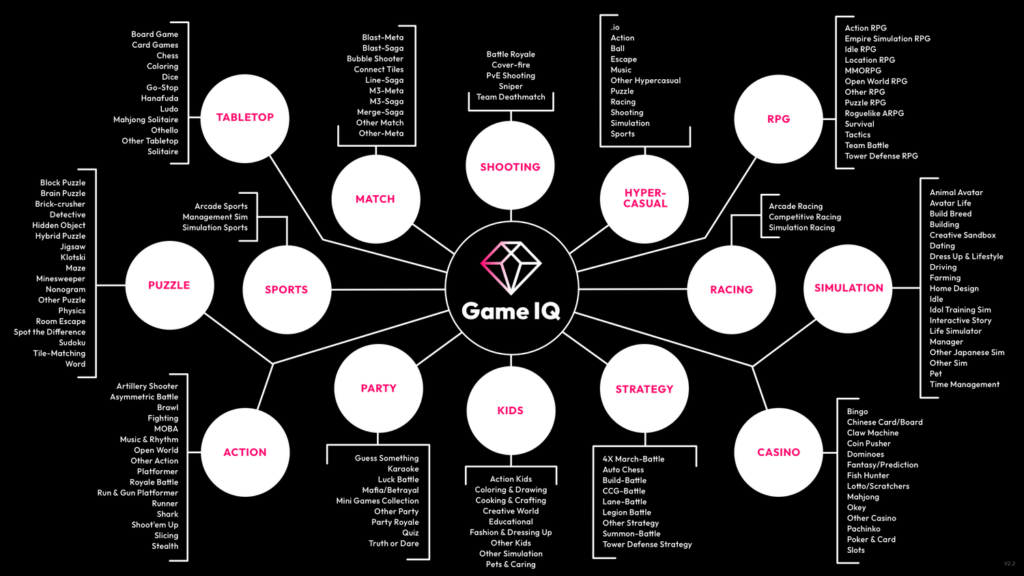

GameIQ Solves The Industry's Toughest Challenges

Game IQ is a market and competitive intelligence tool for mobile gaming that allows publishers to identify hidden growth opportunities, tie features to performance KPIs, and help you make difficult roadmap decisions. With hundreds of thousands of gaming apps in the app stores and thousands of new mobile games released each month, data.ai (formerly App Annie) is looking at a huge number of games to be classified. On top of this, the high granularity of our taxonomy structure makes it quite time-consuming to manually figure out into which category each game should fit.

How can we cover the vast majority of gaming apps in global markets accurately, efficiently, and in a scalable manner?

Game publishers and strategists today are facing various key challenges:

• Determining what features will provide lift

• Making roadmap decisions based on accurately modeled expected outcomes

• Discovering how competitors lifted performance through feature releases

• Benchmarking performance against competitors

• Confidently focusing on the highest potential genre for a new game release

With the enhancements we’ve made to data.ai Game IQ including Feature Tagging, Genre Summary, and Tag Trends, you can now effectively solve these challenges.

#2: Stillfront’s Efficiency, Mario’s Blockbuster & Yet Another Cloud Gaming Deal

Microsoft strikes another cloud gaming deal. Last week we wrote about how the U.K.’s Competition and Markets Authority (CMA) is blocking Microsoft’s Activision Blizzard deal based on antitrust concerns regarding the region’s cloud gaming market, and how that rationale is completely absurd. In an attempt to satisfy other global regulators and change the CMA’s mind, Microsoft continues to strike long-term deals with other cloud gaming platforms. This week, Microsoft announced a 10-year deal with Spain-based Nware in which it will bring Activision and Xbox games to this new platform. This is the same deal the company also struck with Ubitus, Boosteroid, Nvidia, Nintendo, and even U.K. cellphone carrier EE. In short, bringing the company’s games to as many cloud gaming platforms as possible should be more than enough in concessions to ease concerns about antitrust in the U.K.’s borderline non-existent cloud gaming market, but we now expect the legal battle to draw out for several more months.

Stillfront reported its Q1 results. In short, the company reported 5% revenue growth and 15% growth in adjusted EBITDAC (EBITDA less capitalized product development). If you look deeper, though, you’ll see that the company reported -5% organic growth (meaning that most revenue growth was M&A driven), axed eight active games while only adding one, and saw free cash flow fall due to working capital changes. While some of that is disappointing, there’s a few other points to be optimistic about. For example, several key franchises continue to perform well (like BitLife and Albion Online), the diversified portfolio of 71 active titles enables flexibility in where the user acquisition budget flows, and the company continues to generate high margins on its collection of studios and games (24% adjusted EBITDAC in Q1). What’s more, while the company’s M&A machine has slowed down, management appears to have doubled down on efficiency — such as setting higher ROI targets for new games and setting frameworks in place to better measure cross-company synergies. From the outside it’s hard to say what’s next on the M&A or organic growth front, but management’s renewed focus on efficiency is bound to lead to wiser investments and stronger profitability in the future.

The age of financial fitness continues. This week, two more notable games company layoffs were announced. For one, Phoenix Labs, the company behind Dauntless that recently regained its independence after spinning out of Sea Limited’s Garena, laid off 9% of its staff as the team refocuses on fewer projects. And second, Unity laid off 600 more employees (8% of its workforce) in what is its third and largest round of layoffs in less than a year. As growth slows, recession fears loom, capital becomes tighter, companies refocus on profitability, and AI tools start to show signs of efficiency boosts, we expect belt-tightening across the industry to continue throughout 2023.

The Super Mario Bros. Movie surpasses $1B at the box office. This milestone was reached after approximately a month of showing at theaters, and it’s the first movie of 2023 to cross that major threshold. We’ve talked before about how we’re in an age of higher quality video game adaptions that’s only poised to accelerate, but given this enormous success it’s hard not to think that Nintendo and Illumination are thinking about a sequel — or how other Nintendo IP could be adapted to the big screen. Could the Nintendo Cinematic Universe (or even the Sony Cinematic Universe, etc.) be on the horizon? We suspect it’s more likely than not, and it’ll pocket publishers with the biggest and best IPs more high margin licensing revenues in the future.

In Other News…

💸 Funding & Acquisitions:

- Mobile gaming studio Cosmic Lounge raised $4.4M in a seed round. Link

- Japanese AR/VR studio CharacterBank raised $2.5M in a Series A. Link

- Icelandic game developer Vitar Games secured $550K in its first round of funding. Link

📊 Business:

- Unity conducted Its third and largest round of layoffs in a year. Link

- Phoenix Labs laid off 9% of its staff. Link

- Hogwarts Legacy passed $1B in sales with more than 15M copies sold. Link

- Sony reduced its investment budget to allocate more cash for PlayStation gaming. Link

🕹 Culture & Games:

- Marvel’s Midnight Suns Switch version canceled. Link

- Gran Turismo’s first trailer makes it seem like the movie hates gamers. Link

- Pokémon Go monthly earnings reportedly plummeted to their lowest in five years. Link

- The Super Mario Bros. Movie surpassed $1 billion globally. Link

👾 Miscellaneous Musings:

- The Publisher's lie. Link

- AI offers new tools for making games, but devs worry about their jobs. Link

- Phil Spencer: "We're not in the business of out-consoling Sony.” Link

🔥Featured Jobs

- Astra Fund: Operations & Finance Manager (Remote)

- Backbone: Product Manager (Remote)

- Carry1st: Head of Growth, Games (Remote)

- Immutable: Economy Designer (Sydney, Australia; Remote)

- MY.GAMES: Production Director (Remote)

- Voldex: Product Manager (Remote)

- Voldex: Game Designer (Remote)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below. We've made the job board free for a limited period, so as to help the industry during this period of layoffs. Every job post garners ~50K impressions over the 45-day time period.