Hi Everyone. Welcome to another issue of Naavik Digest! If you missed our last one, be sure to check out our analysis on the state of esports in light of Riot Games’ defense of the industry. This issue, we have a thorough timeline of the Activision Blizzard acquisition saga and dive into where the deal goes from here after the CMA’s surprise decision to block the merger.

#1: Where Does the Microsoft-Activision Deal Go From Here?

Written by: Nick Statt, Managing Editor

Microsoft’s Activision Blizzard deal is teetering on the edge. On Wednesday, the U.K.’s Competition and Markets Authority (CMA) shocked the industry by blocking the deal on the grounds it would harm competition in the U.K. cloud gaming market — not the console gaming angle that attracted a majority of the public sparring and regulatory debate. This major setback came as a surprise because earlier reporting suggested the CMA was on a path to approval. Regardless, the decision brought the large, looming question that’s been haunting these negotiations into full focus: what if the merger fails?

The deal isn’t totally dead yet. The European Commission is set to announce its verdict on May 22nd, after which the final holdout will be the U.S. Federal Trade Commission (FTC), which sued Microsoft to block the deal back in December. Microsoft said it is already working closely with Activision Blizzard leadership on preparing an appeal to the CMA’s decision, and there is now some speculation swirling on how the acquisition might still go through with further remedies for the U.K. market.

But it’s been nearly a year and a half since this mega-merger was first announced and subsequently kicked off arguably the fiercest regulatory battle the gaming industry has ever seen. We here at Naavik have been following the saga closely, but perhaps you have not. In that event, we thought now would be a good opportunity to recap the deal’s biggest story beats so far and also highlight the major revelations from the 3 million documents and more than 2,100 emails that have been produced for regulators as part of the investigation process. We’ll also offer some insight into what might happen next, and who stands to benefit and lose if the deal does indeed fall apart. Let’s jump in.

The Activision Deal Timeline So Far

January 18th, 2022 — Microsoft announced its deal to acquire Activision Blizzard for a record-breaking $68.7 billion. The deal, the largest in game industry history, was the result of a tumultuous period for Activision Blizzard, which was dealing with ongoing sexual harassment lawsuits, severe executive turnover, and numerous game delays. The company’s hurting stock price put a target on management and spurred CEO Bobby Kotick and Microsoft Gaming CEO Phil Spencer to enter into merger talks in December 2022. The deal was announced a month later with a target closing date of July 18th, 2023.

April 1st, 2022 — The first rumblings of regulatory action started in the U.S. with a letter to the FTC from four U.S. senators. Among the group was Sen. Bernie Sanders and Sen. Elizabeth Warren, who said they were “deeply concerned about consolidation in the tech industry and its impact on workers.”

June 13th, 2022 — Microsoft signed a labor neutrality agreement with the Communications Workers of America. One wrinkle in the Activision deal was how Microsoft would handle the game publisher’s growing unionization movement. Yet Microsoft President Brad Smith said Microsoft would stay neutral on any labor organizing efforts within its own company and Activision Blizzard, too.

August 1st, 2022 — The first of many regulatory documents was made public in Brazil, and sparks began to fly. This is where Sony first began expressing concern over Call of Duty becoming an Xbox exclusive.

- In the documents, Sony told regulators CoD could influence players’ choice of console and claimed it would be nearly impossible to develop a rival shooter series.

- Microsoft responded by accusing Sony of being “resentful of having to compete with Microsoft’s subscription service” and said the PlayStation maker was railing “against the introduction of new monetization models capable of challenging its business model.”

- Later that month, Microsoft told Brazil regulators that Sony regularly paid for blocking rights'' to keep games off Game Pass.

- Another regulatory filing from Microsoft said Sony’s last console outsold the Xbox two to one, confirming the rumored disparity between the two platforms.

September 1st, 2022 — The CMA hinted at its opposition in its first public statement on the deal and ordered a Phase 2 investigation. On the same day as a blog post from Spencer revealing Microsoft would put Call of Duty and Blizzard games on Game Pass, the CMA formally raised competition concerns over the deal. The regulator said in a press release that the deal may “harm rivals” ensuring a more in-depth regulatory investigation would be highly likely.

- The Phase 2 investigation began on September 15th after Microsoft failed to address the CMA’s concerns within the tight five-day window.

September 2nd, 2022 — Microsoft committed to keeping Call of Duty on PlayStation for “several more years.” In a statement to The Verge, Spencer said Microsoft had offered a contract extension to Sony back when the deal was announced to “guarantee Call of Duty on PlayStation, with feature and content parity, for at least several more years beyond the current Sony contract.”

- A week later, Sony released a statement from PlayStation CEO Jim Ryan to Gamesindustry.biz calling Microsoft’s offer “"inadequate on many levels,” indicating that CoD was fast becoming a major bargaining chip in ongoing negotiations.

October 6th, 2022: Brazil becomes the second market to formally approve the deal after Saudi Arabia.

October 12th, 2022 — Microsoft hit back at the CMA’s characterization of the game market. As part of the launch of its Phase 2 investigation, the CMA detailed its concerns with more specific examples, listing the harm the deal may pose to subscription and cloud gaming services as high on its list of potential anticompetitive effects.

- In response, Microsoft accused the CMA of relying on “self-serving statements by Sony.”

- Microsoft also began trying to convince regulators that it had no incentive to remove CoD from PlayStation because it would “alienate” the series’ fans and "tarnish both the Call of Duty and Xbox brands.”

November 8th, 2022 — The EU opened an “in-depth investigation” into the deal. The European Commission gave itself a March 23rd, 2023 deadline to make a decision on the merger and said in a statement it was concerned Microsoft “may foreclose access to Activision Blizzard’s console and PC video games.”

November 11th, 2022 — Microsoft offered Sony a 10-year deal to keep CoD on PlayStation. Microsoft upped the ante by roughly tripling the length of time it was willing to commit to keeping CoD on its rival’s platform.

November 23rd, 2022: Sony wrote a letter to the CMA saying the deal could threaten its business. This is where Sony arguably made its most desperate pleas against the deal.

- Sony said it risks “losing significant revenues" if Microsoft owns franchises like CoD and Overwatch. It also said the deal would harm indie developers and also bolster Game Pass to the detriment of competing services.

- Sony also made the argument here that losing the microtransaction revenue it enjoys from a franchise like CoD would "severely diminish SIE’s ability and incentive to invest in future hardware innovation and gaming technologies,” and also said that the console generation after the PS5 would be “extremely vulnerable to consumer switching and subsequent degradation in its competitiveness."

December 7th, 2022 — Microsoft said it agreed to a 10-year CoD deal with Nintendo. The agreement, designed to help persuade regulators against the notion that Microsoft would keep CoD off rival platforms, promised Nintendo Switch and future Nintendo hardware owners at least a decade of CoD access.

- Microsoft also made a commitment to Valve to support CoD on Steam for an equal amount of time, but Valve CEO Gabe Newell said such a commitment ”wasn’t necessary” because he trusts Microsoft.

December 8th, 2022 — The FTC sued Microsoft to block the deal. The agency said at the time that the acquisition would “enable Microsoft to suppress competitors to its Xbox gaming consoles and its rapidly growing subscription content and cloud-gaming business.” A trial date was set for August 2nd, 2023.

December 23rd, 2022 — Microsoft mounted a defense against the FTC’s lawsuit. In a public statement, the company began its offensive against the agency by accusing it of using flawed logic in its assessment of the game market.

- "The acquisition of a single game by the third-place console manufacturer cannot upend a highly competitive industry, particularly so when the manufacturer has made clear it will not withhold the game," Microsoft said at the time.

- Microsoft also said its past actions regarding exclusivity of Bethesda games like Starfield and Redfall were irrelevant to the Activision deal because those games are “designed to be played primarily alone or in small groups.”

January 23rd, 2023 — Microsoft subpoenaed Sony in the U.S. as part of its FTC defense. The move threatened to reveal the inner workings of Sony’s game development and publishing practices as far back as 2012, including sensitive details regarding platform exclusivity.

- After numerous legal back-and-forths, a judge ruled on March 3rd that Microsoft could in fact request and include this data as part of its case, but it was restricted to information from 2019 onward.

February 8th, 2023 — The CMA floated the possibility of Microsoft selling off CoD. In its provisional findings published that month, the regulator said it believed the deal could harm gamers and suggested potential structural remedies that included selling off the CoD business

- The CMA also said Microsoft’s 60-70% share of the nascent cloud gaming market could “alter the future of gaming, especially so if it becomes a destination for CoD and other major Activision Blizzard franchises.

- Microsoft President Smith responded on February 22nd by saying the company doesn’t see a “viable path” forward for the deal if CoD is required to be spun out from Activision.

February 21st, 2023 — Microsoft formally signed its Nintendo cloud deal and added Nvidia. The company made a public showing in Brussels of its signing the formal agreement to bring CoD games to Nintendo hardware and also announced a new deal to bring all of Xbox’s PC games (including Activision Blizzard’s) to Nvidia’s GeForce Now cloud platform.

- Microsoft signed a third cloud gaming deal with Boosteroid the following month, and that same week signed a fourth deal with Ubitus.

March 2nd, 2023 — A report from Reuters indicated the EU was likely to approve the deal. The report cited Microsoft’s new cloud deals with Nintendo and Nvidia as helping assuage the concerns of EU regulators.

- On March 17th, the EU extended its deadline to rule on the acquisition from April 25th to May 22nd after Microsoft reportedly submitted remedies that might satisfy regulators and get the deal cleared.

March 24th, 2023 — The CMA does a surprise U-turn on the deal. The authority shocked Sony when it said new evidence meant it no longer believed the deal would result in a “substantial lessening of competition” in the console market or that Microsoft would withhold from or degrade Call of Duty on rival platforms.

- Part of the new evidence apparently convinced the CMA that making CoD exclusive to Xbox devices would be "significantly loss-making under any plausible scenario" for Microsoft. Yet the CMA did also say at the time it was still concerned about the deal’s implications on the cloud gaming market.

- Sony responded two weeks later by calling the reversal “surprising, unprecedented, and irrational.”

March 28th, 2023 — Japan approved the deal. The country’s regulatory body said the merger would be "unlikely to result in substantially restraining competition in any particular fields of trade."

April 17th, 2023 — South Africa became the latest country to approve the deal. The total list of approved markets at the time included Brazil, Chile, Japan, Saudi Arabia, Serbia, and South Africa.

April 26th, 2023 — The CMA blocked the deal on the grounds it may harm competition in the nascent U.K. cloud gaming market.

Breaking Down the CMA’s Decision

The CMA’s decision to block the deal is consistent with its determination back in March that Microsoft acquiring Activision Blizzard is not likely to harm competition in the console market. But the regulator made a rather shocking leap in determining that the nascent cloud gaming market, which was an estimated $2.4 billion in 2022 and accounted for less than 1.5% of global gaming revenues, was a substantial enough consideration to block the whole deal.

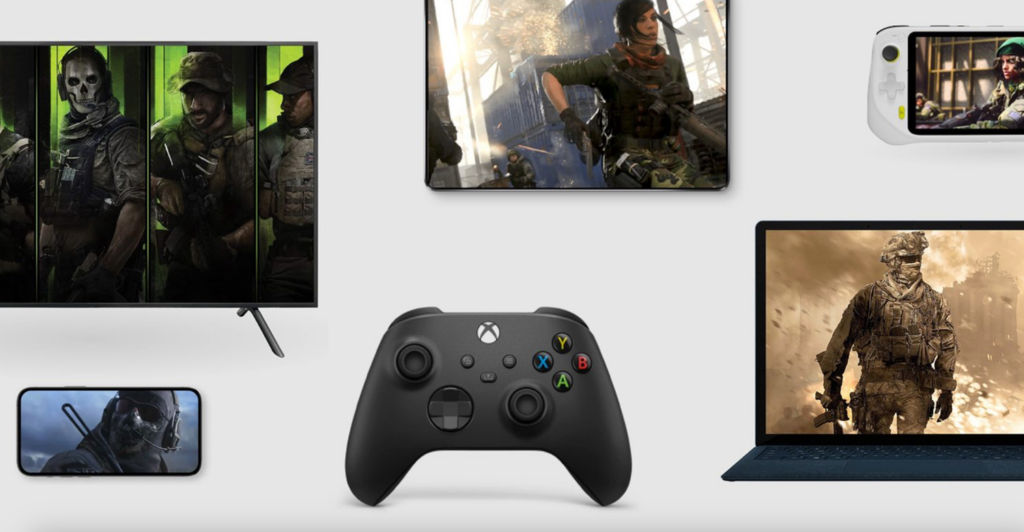

Effectively, the CMA sees Microsoft’s majority share of the cloud gaming market and unique technological advantages (Azure, Game Pass, Windows, etc.) as a means by which it could monopolize a future in which cloud is more dominant. To the CMA’s credit, the market might grow into a major pillar of the industry in five or 10 years’ time; NewZoo forecasts cloud gaming revenues tripling by 2025, and the more optimistic view from Fortune Business Insight sees it growing into a $41 billion business by 2029. The CMA explained its reasoning by saying Microsoft’s remedies simply didn’t go far enough because they still advantaged Microsoft as the owner of Windows and Game Pass, and that adding Activision’s library might encourage the company to raise prices down the line.

Still, industry analysts were baffled by the decision, Bloomberg reported on Wednesday, because it seemed to conflate Microsoft’s use of cloud gaming as a complement to Game Pass with the standalone models of the failed Google Stadia and the struggling Luna. “I think they’re rather misinformed on what the cloud gaming market is,” NYU professor and gaming newsletter writer Joost van Dreunen told the publication. “They’re conflating cloud gaming with the revenue model. Then they’re looking at it as a distinct technology and a market in another sense.”

The CMA’s decision also runs counter to an expert submission from Joost Rietveld, an associate professor of strategy and entrepreneurship at the UCL School of Management. Rietveld argued in a filing to the regulator published earlier this month that cloud gaming is not in fact a distinct market. He rather convincingly laid out a framework for understanding cloud gaming as a distribution method with four types: feature, platform, complement, and input. In this context, Game Pass is the product and cloud streaming is a complement, making it far from the primary reason why customers pay for Microsoft’s subscription platform.

"Consumers’ willingness-to-pay for standalone cloud gaming services apparently is low and this is perhaps the strongest indication that cloud gaming should not be considered a distinct market,” he wrote. “Cloud streaming is a potentially promising distribution method that will very likely continue to be used and relied upon to various extents by different companies with different offerings aimed at a diverse set of customers that can be both end users and business-to-business customers. It behooves the CMA — and other agencies — to view it as such.” The CMA disagreed in the end, and now Microsoft is left scrambling to figure out whether there’s a path forward for the deal in the U.K. and one that might still allow it to keep investing in cloud gaming and Game Pass.

This betrays either a fundamental misunderstanding of the current cloud gaming market or a desperate desire on behalf of U.K. regulators to block the deal by any means necessary. Having already exhausted its options of doing so by way of characterizing the deal as anticompetitive for the console gaming market, the CMA has decided a theoretical future scenario in which Microsoft is dominant in cloud gaming and cloud gaming itself is a much more pivotal (and distinct) market than it is today is worth tanking the entire deal. This level of outsized political influence on the global gaming industry seems incongruent with the size of the U.K. market and also unnaturally aggressive to a company that’s been by and large cooperative with the regulatory process and its competitors.

What’s Next, and Who Stands to Win or Lose?

The future of the acquisition does look much bleaker after today, especially considering a majority of appeals to the U.K.’s Competition Appeal Tribunal have historically failed. But Wedbush Securities analyst Michael Pachter told VGC there is a potential path forward if Microsoft is able to convince the CMA that an appropriate remedy would be a fixed price for Game Pass in the U.K., or a concession that involves keeping Activision titles off the subscription platform in that particular market.

Still, given the original July 2023 deadline to close the deal, any potential appeals process will most likely drag further deliberation well into Q3 or Q4 2023 while also ensnaring Microsoft in a court battle with the FTC starting in August. All in all, it’s likely the deal, if it lives, may not close until 2024. If the deal doesn’t go through, Microsoft will owe Activision Blizzard $3 billion in fees.

If the deal fails, the longer-term implications are substantial. Let’s take a look at who stands to benefit in that situation, and who stands to lose.

Winners if the Activision Deal Fails:

- Sony is far and away the winner if the deal goes down in flames, because as the console market leader it will remain in a dominant position in the market with continued access to one of the most lucrative franchises in the industry.

- The success of CoD on PlayStation generates significant store commissions, licensing fees, and a recurring microtransaction revenue share for Sony. And without pressure from Microsoft on subscriptions and cloud, Sony is free to invest in those parts of its business at its leisure.

- If Microsoft is unable to purchase its way to a stronger pipeline of content, Sony also has more time to catch up with the rest of the industry on live service, cross-platform, and mobile gaming, three other complementary and vital areas it has severely neglected until only recently.

- Government regulators, especially in the U.S. and Europe, would see a blocked deal as a major win after years of failed intervention in Big Tech’s growth and the gaming industry’s increasing consolidation push.

Losers if the Activision Deal Fails:

- Far and away the biggest loser if the deal implodes would be Microsoft because the company is in desperate need of a more robust internal studio pipeline to help reinvigorate Game Pass, bolster Xbox sales (which took a major hit last quarter), and help supercharge its subscription, cloud, and mobile ambitions. It’s also spent almost two years trying to get this deal passed, and that’s time (and money) it could have spent moving forward with smaller, more focused M&A activity.

- Game Pass customers are also losers in a blocked merger because it will mean a far less attractive subscription offering from Microsoft without Activision’s titles. Game Pass has been suffering from a lack of AAA titles due to continued game delays, a factor that may be dragging on growth.

- The last update on its performance was a confirmed 25 million monthly subscribers nearly 18 months ago. A Game Pass without CoD or Diablo looks much weaker.

- Activision Blizzard is also at risk here. The company’s leadership, especially Kotick, have been banking on the acquisition to save the company’s share price and alleviate concerns about its toxic workplace culture and dysfunctional game studios. The company’s financial performance of late has been more promising, but a tanked deal might only hurt its share price in the short term and net it $3 billion in extra funds to mount further turnaround efforts.

- Other cloud gaming providers are also hoping the deal goes through. Boosteroid, which signed a cloud deal with Microsoft, said it was disappointed by and disagreed with the CMA’s decision on Wednesday and that it’s hoping for a “quick resolution.” Nvidia also released a statement saying it sees the deal “as a benefit to cloud gaming” and that it’s hoping for a positive resolution.

- The CWA has already expressed its support for the deal, and in the event it doesn’t happen, the media labor union is left with a more antagonist Activision Blizzard instead of the much more labor-friendly Microsoft with which the CWA has a unique neutrality agreement.

Of course, we’ll know more come May 22nd when the European Commission issues its ruling on the deal. But for now, Microsoft was dealt a devastating blow and now finds itself backed into a corner as it hopes for a miracle that might turn the Xbox business around.

#2: New Games, Hardware Struggles & Evolving Dealmaking

Games, games, games! Over the next few weeks, your gaming backlog is destined to grow. This week already saw the launches of notable games like Star Wars Jedi: Survivor, Honkai Star Rail, Dead Island 2, and The Last Case of Benedict Fox. But over the next few weeks, we’ll see several more highly anticipated AAA games fight for your attention, especially if you’re privy to console/PC: Redfall (May 2nd), The Legend of Zelda: Tears of the Kingdom (May 12th), Street Fighter 6 (June 2nd), Diablo IV (June 6th), Final Fantasy 16 (June 22nd), and much more. Plus, in the process, we’ll learn more about the impact of these games on their respective businesses, strategies, and next steps.

Xbox’s Q3 results outperform but still show a need for change. In short, Xbox’s total gaming revenue for the quarter fell by 4%. Content and services saw growth of 3%, which is ahead of expectations but a bit surprising given the dearth of first party releases. That said, hardware sales fell a whopping 30% (while, in contrast, PlayStation hardware sales is growing exponentially). We’ve covered this several times so don’t need to beat a dead horse, but at the end of the day a gaming ecosystem’s success boils down to the quality and output of its games. So as long as Xbox is slow to release “must-play” games, it will continue to lose market share. This puts this week’s news about the CMA blocking the Activision Blizzard merger even more into perspective.

Activision quietly maintains its growth streak. On the other side of the M&A table, Activision Blizzard continues to experience rebounding growth. In its recently released Q1 results, net bookings grew 25% and operating income grew 70% (both year-over-year). As CEO Bobby Kotick states, “Every one of our key intellectual properties continues to grow year-over-year, with Call of Duty once again a key driver of growth.” Mobile is also a strong point (driven by King / Candy Crush as always), with mobile net bookings growing double-digits year-over-year. What’s next? Diablo IV will be the next new game to drive growth, a new China publishing partner should get announced, and we’ll keep tabs on the company’s evolving mobile strategy, especially given the upcoming launch of Call of Duty: Warzone Mobile and the reduced focus on Call of Duty Mobile. Of course, the M&A battle will likely continue for the rest of 2023; as noted in the piece above, if the deal falls through it’ll hurt Activision Blizzar’s share price in the short-term, but the company will have abundant IP and resources to build around in the years ahead.

Tencent eyes Europe for dealmaking. One trend we’ve covered several times is how major Chinese publishers like Tencent are looking to expand beyond China, which is held back due to heightened regulatory restrictions. Over the past several months, Tencent’s global gaming dealmaking has certainly slowed, but according to new reporting from the Financial Times, it might soon accelerate again. This time around, the company is reportedly setting its sights on Europe (given higher geopolitical tensions in the US). Tencent has abundant resources to reinvest — into full M&A, partial ownership, or even kickstarting more global studios — but it likely won’t be alone, as NetEase will be scouring the globe for opportunities too. This also comes at a time when new M&A competitors like Saudi Arabia’s Savvy Games Group are entering the fray (despite others like Embracer becoming less active), so it will be fascinating to see the dealmaking landscape evolve over the next couple years.

In Other News

💸 Funding & Acquisitions:

- TreesPlease Games unveiled LongLeaf Valley and $8M funding. Link

- Virtual reality game studio Vinci Games raised $5.1M. Link

- Web3 gaming platform Gameta raised $5M from Binance Labs and others. Link

📊 Business:

- Microsoft’s Activision Blizzard acquisition was blocked by U.K. regulators. Link

- Microsoft and cloud gaming platform Nware signed a 10-year agreement. Link

- Sega of America workers want to unionize. Link

- NetEase announced development outfit Anchor Point Studios. Link

- Sony shipped a record-breaking 6.3M PS5 units in Q4 F2022. Link

🕹 Culture & Games:

- FromSoftware’s ArmoredCore VI Fires of Rubicon will launch August 25th. Link

- Nintendo is heading back to Gamescom for the first time since 2019. Link

- TikTok is turning into gaming’s discovery engine. Link

👾 Miscellaneous Musings:

- The mobile games moving away from gacha. Link

- Hypercasual's not dead… but it is slowing down. Link

- Top 10 highest-grossing mobile games of all time. Link

🔥Featured Jobs

- Astra Fund: Operations & Finance Manager (Remote)

- Backbone: Product Manager (Remote)

- Carry1st: Head of Growth, Games (Remote)

- Immutable: Economy Designer (Sydney, Australia; Remote)

- MY.GAMES: Production Director (Remote)

- Voldex: Product Manager (Remote)

- Voldex: Game Designer (Remote)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below. We've made the job board free for a limited period, so as to help the industry during this period of layoffs. Every job post garners ~50K impressions over the 45-day time period.