Hi Everyone. Welcome to another issue of Naavik Digest! If you missed our last one, be sure to check out our timeline of the Microsoft-Activision deal and our analysis on where the acquisition saga is headed next. This issue, we look into the new wave of creator-led studios and projects that are successfully leveraging fan relationships and unique revenue sharing models.

Naavik Gaming Podcast: Best of 2023

The Naavik Gaming Podcast is still on break, but we’ve gone back through our 2023 archives to pull out some of the best interview episodes to feature in this week’s issue. As always, you can find us here on Naavik’s website or over on YouTube, Spotify, Apple Podcast, and Google Podcast.

- Interoperability, Game Ecosystems, and Web3: Interoperability between game ecosystems and economies has been held up as a possibility that is opened up by decentralized protocols, blockchain technologies and web3, but until now, it has mostly been a pipedream rather than a reality. But now two web3 companies — metaverse avatar developer Ready Player Me and open-world shooter developer Faraway Games — have partnered up to deliver on the promise of interoperable game worlds. Host Niko Vuori chats with Alex Paley, Founder & CEO of Faraway Games, and Timmu Toke, Founder & CEO of Ready Player Me, about interoperability, closed versus open game ecosystems, and the promise of web3. Link

- Sky Mavis, Delegated Proof of Stake and Building on Ronin: Sky Mavis, the developers behind the OG web3 game Axie Infinity with $1.3 billion in lifetime revenue, have been busy beefing up the security of their Ronin blockchain and opening it up to third-party game developers. On March 30th, 2023, Sky Mavis announced the Ronin blockchain’s upgrade to Delegated Proof of Stake (DPoS) and unveiled the genesis batch of game studios that will be building and launching games on Ronin: Directive Games, Tribes, Bali Games, and Bowled.io. Host Niko Vuori chats with Kathleen Osgood, Director of Business Development at Sky Mavis, about what this means for Sky Mavis, Axie Infinity, and third-party game developers looking to build on Ronin. Link

- Using AI to Build Smarter NPCs: NPCs in games are notoriously goofy. They walk into walls, they repeat themselves over and over again, and they run out of cover in the middle of a gunfight. At their best, they kind of just blend into the surroundings and the player barely notices that they’re there. At their worst, NPCs can actually ruin the gameplay experience. But what if we could use the latest developments in machine learning to give NPCs more intelligence and real personalities? Could NPCs and how they behave become a core part of the game, even a reason to play and replay a game? Kylan Gibbs, co-founder and Chief Product Officer of Inworld.ai, is trying to do just that, and joins host Niko Vuori to discuss how, and why now. Link

- The New York Times Games Strategy: The New York Times is one of the world’s most recognized and respected newspapers, and has been in circulation since 1851. With almost 10 million subscribers (of which 8.6 million are digital-only), the Times has a huge audience and an even larger cultural impact. But the Gray Lady isn’t content to just rest on her laurels and focus on news — other verticals in which the Times operates are product reviews (The Wirecutter), sports (through their 2022 acquisition of The Athletic), cooking and, of course, games. In addition to their seven home-grown casual titles, the Times of course famously acquired viral sensation Wordle for “seven figures” in early 2022. To talk more about the Times’ games strategy, host Niko Vuori talks with Jonathan Knight, Head of Games at The New York Times. Link

#1: Digging Into Creator Revenue Attribution

Written by: Fawzi Itani, Naavik Business Lead (In Partnership with Nexus)

You may have noticed a rising new trend in recent months: a plethora of game creators announcing their direct involvement in either newly founded game studios or freshly minted game projects. Alexandra Botez teased a chess-related video game studio. Streamers Timthetatman, CouRageJD, Ninja, Nickmercs, and SypherPK also announced last week that they’re all teaming up for Project V, an upcoming battle royale built on Fortnite Creative by SuperJoy Studios. (SuperJoy is a Fortnite game development studio founded by SypherPK, aka Ali Hassan.)

We’ve previously covered 100 Thieves’ upcoming game, as well as Dr DisRespect and developer Midnight Society’s upcoming web3 extraction shooter Deadrop. Back in March, Shroud became the latest mega-popular streamer to jump into game development with an open world survival title in partnership with British studio Splash Damage. It’s no secret that other creators like Mr. Beast or creator collectives like MSCHF have developed their own games from time to time and will continue to launch new gaming experiences.

The studio and creator model is thriving for a few reasons:

- Creators can widen top of funnel

- Creators can lower cost of go-to-market (at least for launch and perhaps around live service updates)

- Creators know other creators who can help market the game

- Creators are looking for new ways to diversify their income

- Creators are uniquely positioned to start and keep the player engagement flywheel turning

- Creators can re-engage churned players and can encourage increased player spending

I was curious to dig into this topic now because there are so many examples of game studios that have attributed their game’s success through the marketing boost and buzz that comes from organic creator interest. Among Us, Fall Guys, Sea of Thieves, and Escape From Tarkov all come to mind, To dig into the data, I partnered with my friends at Nexus — a creator infrastructure service empowering developers to launch their own support-a-creator programs — to dive into the empirical data on what boost creators actually give to games.

While many developers have made an effort to formulate a creator strategy — whether that be organic outreach to influencers or paid campaigns — very few publishers have the bandwidth or expertise to build fully fleshed-out holistic creator programs. Arguably the most success creator programs in the industry are those for Fortnite, Call of Duty, and Supercell titles. For instance, Ninja drove an estimated $100M-plus in sales alone during the peak Fortnite era, with 5% attributed back to him. In other cases, it’s rumored that Asmongold drove nine figures of revenue just by playing FFXIV so much that Square Enix sold out of digital copies and instituted a wait list to purchase the game. (None of this revenue Asmongold saw himself.)

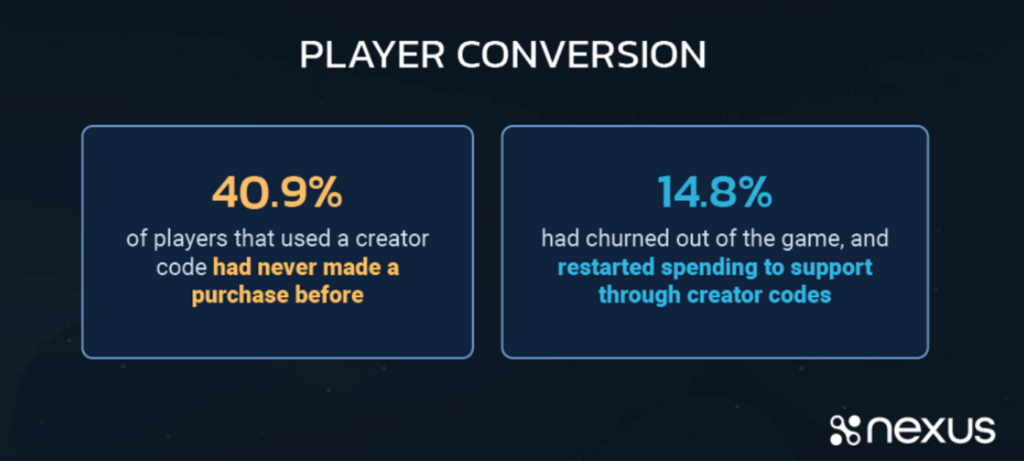

Each of the programs above has seen enormous success, and according to data from Nexus, 40% of all players who used a creator code had never made an in-game purchase before. The incentive to support their favorite content creators and the specific and intentional call to action from those content creators helped players make the leap. Nexus’ data also shows that even after paying the creator’s cut (and their platform fee), players that interact with a creator program have nearly 2x the LTV of the average paying player.

I often cite OfflineTV or DreamSMP has two of my favorite examples of creator collectives that have led to outsized success within their games of choice. Indeed, for a live service game to be a longterm success, developers need to both create top-tier gameplay that supports a sustainable cosmetics-based economy as well as find an audience large enough to bring said economy to life. Though reaching this audience is half the battle — turning them into purchasers has nearly always been the challenge — most free-to-play games see a sub-5% conversion rate from free to paying player.

The Nexus study also found that players went on to spend a 17.1% more when using a creator code than their counterparts. It’s also worth mentioning that creator programs have been gateways to more robust UGC revenue sharing systems. We can point to the rise of Roblox, and now Fortnite’s UEFN and Creative 2.0 as examples.

Content creators have the unique ability to transform regular game updates into engaging content on a consistent basis. Their personality mixed with their unique perspective on the game and steady drip of content encourages sustained player engagement. Nexus shared that while the session time between players using a creator’s code compared to the general player population is nearly equal, the former plays twice as many sessions.

That steady drip of creator-made content also has a sizable impact on retention. Again, nearly twice as many players using creator codes stick around at every measured date, from d7 to d180. To be fair, not every creator is destined for success. To name one small example, Magnus Carlsen’s chess studio was acquired by Chess.com and presumably didn’t reach large enough scale; so, perhaps it will be Botez’s studio that will crack the distribution audience with her more engaged streaming fan base.

As I mentioned in my piece “Distribution is Everything,” I believe that creator-led strategies in and around gaming will continue to proliferate in a big way. As cost of acquisition rises and targeting the right consumer becomes more difficult, not having a holistic creator program integrated into your game's overall design philosophy could significantly impact and reduce the desire for creators to play and make content around your game.

I believe it will become more habitual for creators to monetize through commerce — for example, this can take the form of revenue attributed to a creator through creator codes or founding their own studios versus necessarily being paid to play a game on launch day. And a creator’s audience will, over time, become more inclined to support them through in-game purchasing. I also believe it will be less likely that a creator will work with your title if you don’t have a creator program. This sort of meta-game is one where the early winners are the big winners.

#2: Goddess of Victory: Nikke — Attempt at World Domination

This piece is a preview of a game deconstruction written by Niek Tuerlings for Naavik Pro.

NSFW Warning. Please be advised that for the first time in the history of Naavik Pro deconstructions, some of the imagery and hyperlinks below are of a highly suggestive, sexual nature.

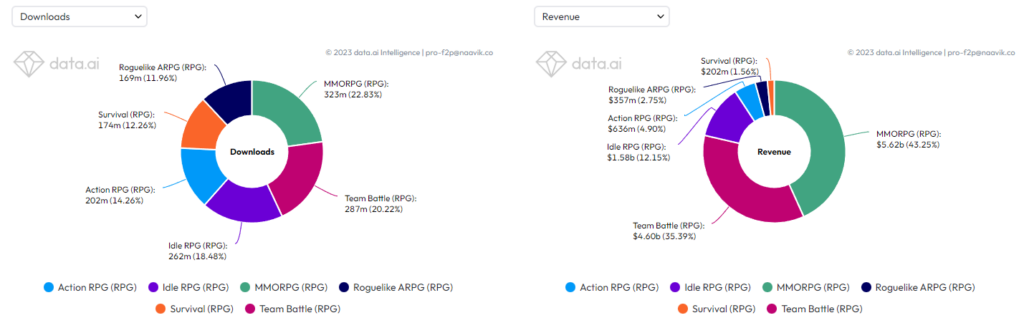

When looking at last year’s data, Team Battlers are the second largest subgenre (after MMOs) in the RPG category. More than 20% of downloads and 35% of revenue can be attributed to games that require players to create and manage their favorite teams of fighters and send them off to battle. But even within the subgenre, there is a lot of nuance and variation. As the Team Battler categorization groups games with a specific metagame, their core games can be wildly different.

Additionally, choice of theme in this category generally shows strong variation as well. This article will focus on a new title that has broken records over the past six months with its unique combination of core gameplay and theme choice.

Nikke: Goddess of Victory, developed by Shift Up and published by Level Infinite and Tencent, is the full title of this controversial, yet highly successful game. Many of our (largely male) readers might have seen ads fly by showing anime ladies in their underwear shooting robots from behind cover.

While these creatives initially and most likely have been greeted with a massive eye roll, after a couple of repetitions it does make one wonder if this blatant sexualization of the female form works in this context. While we at Naavik don’t condone sexualizing women as a strategy to optimize for user acquisition (UA), it’s important to keep reporting about these developments and trying to contextualize the success of game’s that rely on these unique formulas.

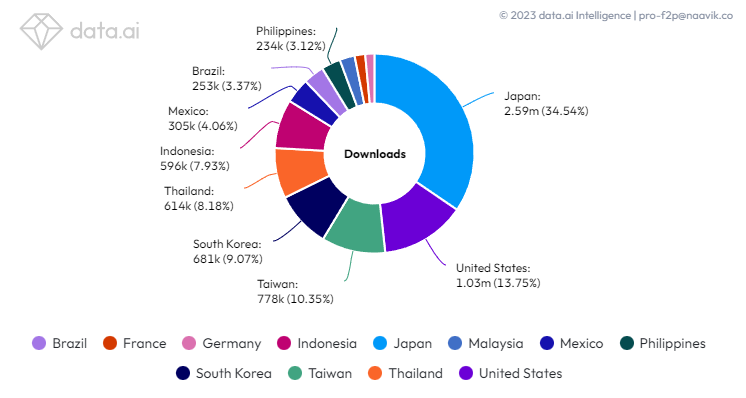

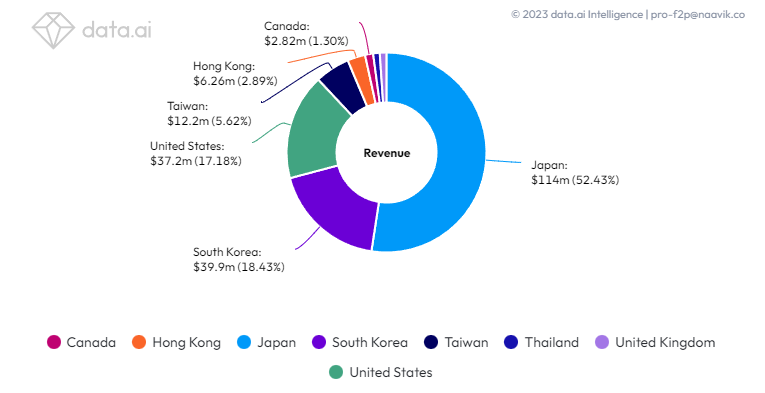

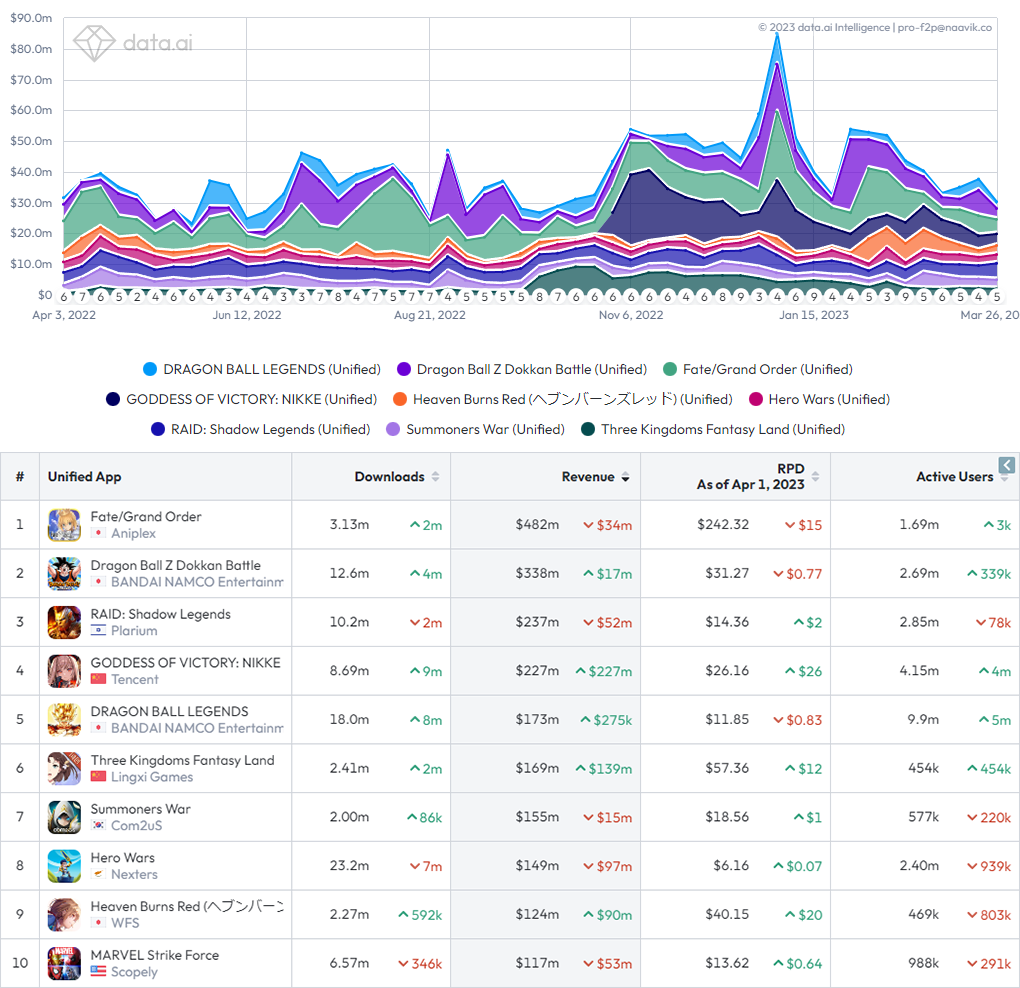

Next to noting that Nikke’s RPD on iOS has plateaued at around $32 since the start of the year, the image below should be able to answer this question quite clearly. Nikke recently passed 25 million downloads and has grossed more than $220 million to date.

What’s remarkable about Nikke’s case is its relatively worldwide appeal. Whereas games with similar themes usually don’t reach much further than Japan, Korea, and the occasional weeb elsewhere around the world, more than 57% of Nikke’s downloads and 30% of its revenue come from other countries.

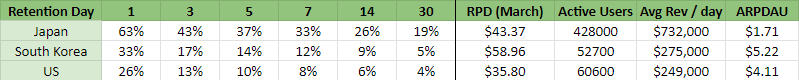

What’s interesting is that, according to data.ai, retention numbers in the West look abominable, but the game still monetizes very well. Unsurprisingly, Nikke seems to be a niche in the U.S. and South Korea, but the few players who like it seem eager to spend at substantial levels. In Japan it’s more the other way around, where downloads are 10x the other two countries (skewing ARPDAU downwards) with equally strong RPD. Please note that in the table below, the first week of Nikke’s existence is excluded to not have the Japanese market’s initial spike in downloads influence the ARPDAU even further.

We’ll discuss the various reasons why Nikke is performing this way throughout this deconstruction. But the biggest prerequisite is top-of-the-line localization — including English dubbing for the game’s long and countless campaign dialogues — that has pushed Nikke to become the world’s top-grossing Team Battler over the last six months. That’s right: from its launch, Nikke has been outperforming Fate/Grand Order and Dragon Ball Z Dokkan Battle, both of which have been the all-time top performers in the Team Battler genre.

It’s been a great six months for Team Battler fans: in addition to Nikke, other games in the subgenre like Three Kingdoms, Heaven Burns Red and Blue Archive have all been strong climbers, but only the last of that group was released in the West.

Now, spoiler alert! Throughout this deconstruction, we’ll discover that Nikke’s core gameplay actually doesn’t have such a big impact on the game experience because of its highly restrictive damage calculations and minimal agency. For that reason, the game could actually also be categorized as an Idle RPG, which makes it very similar to games like Attack on Time, which released last year but failed to make a splash.

When looking at other games with the common theme of waifu collecting, most of them are Team Battlers too, but perhaps the most relevant comparison is Honkai Impact 3. This miHoYo game also performed relatively well in the West, but it offers a very different core gameplay experience with its free-movement Action RPG controls.

So it seems that with Nikke, Tencent has clearly found another huge, gaping hole in the market to capitalize on and then managed to advertise its product in the West well enough to make it a global hit. The question remains for how long the game can extend its tail. Can Nikke keep its momentum and continue Westernizing the waifu-collecting phenomenon?

To be able to predict this better, we’ll dive deep into the aforementioned hole by covering the following topics:

- More on the game’s UA vis-à-vis the appeal it has managed to achieve

- A breakdown of the game’s unique core gameplay, and how much of it is actually real!

- The three facets of Nikke’s meta that take care of the game progression

- A short section on the game’s social and live-ops features

- An analysis of its monetization approach

- Our take on the future and the potential revolution Nikke has started

Content Worth Consuming

Nintendo: The Console Wars (Acquired): “In the 1980’s, Nintendo was on top of the world, with the NES achieving over 90% market share of home video games globally. So how did they fall all the way down to ~10% in just a few short console generations? And how did they then build themselves back up (and down and up again) to the top of the world again? Spoiler: it all hinged on one very small, yet very large and durable platform… the Game Boy. Fire up your favorite portable entertainment device and tune in for the epic story of Nintendo’s fall from grace and journey back to the top — capped off by our robust discussion of where they go from here, and whether this 130+ year old company may still (!) be misunderstood and mis-valued.” Link

PlayStation: Our live-service games will target different genres, release schedules and audiences. (Gamesindustry.biz): "We understand the competitive environment that is out there, and the time investment from players that live services offer. And we want to deliver the highest quality games… There is a risk that we talk about 'live service' in generic terms — as if it is a single genre, or even a single business model. PlayStation Studios are making a variety of games that could be referred to as 'live services', targeting different genres, different release schedules, and at different scales. We are also creating games for different audiences, and I take confidence from our track record in creating worlds and stories that PlayStation fans love." Link

The Mobile Games Moving Away From Gacha (GameRefinery): “That’s why it was such a surprise when Brawl Stars and Mario Kart: World Tour removed gacha mechanics in recent updates and to see Marvel Snap neglect the mechanic entirely in favor of other monetization methods. With this starting to look like a broader trend, more mobile games are likely to follow, but the question remains: why now? Below we take a deeper dive into the challenges facing gachas across the industry and look at the mobile games that have since adopted a new monetization strategy.” Link

Electronic Arts: FIFA, The Sims, Madden and More (Business Breakdowns): This is Matt Reustle and today we are breaking down the iconic video game publisher, Electronic Arts. EA’s corporate history dates back to the 1980s and the business has evolved with all of the industry shifts in the decades since. To break down EA, I am joined by the author of The10thMan blog. We cover the role of a publisher in the video game ecosystem, the history and dynamics behind crown jewels like FIFA and Madden, and what the growth in mobile and new forms of monetization mean to a business like EA. Please enjoy this breakdown of EA. Link

🔥Featured Jobs

- Astra Fund: Operations & Finance Manager (Remote)

- Backbone: Product Manager (Remote)

- Carry1st: Head of Growth, Games (Remote)

- Immutable: Economy Designer (Sydney, Australia; Remote)

- MY.GAMES: Production Director (Remote)

- Voldex: Product Manager (Remote)

- Voldex: Game Designer (Remote)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below. We've made the job board free for a limited period, so as to help the industry during this period of layoffs. Every job post garners ~50K impressions over the 45-day time period.