Hi Everyone. Welcome back to another edition of Naavik Digest. If you missed last edition, we shared an overview on Yuga Labs and their vision for the Yugaverse. Be sure to check it out and share with anybody else who might be interested in reading. With that, let’s dive in!

Crypto Corner: Blockchain Gaming in a Crypto Bear Market

In this week’s Crypto Corner Sebastian Park and Ryan Foo join your host Nico Vereecke to discuss:

-

Blockchain Gaming in a Crypto Bear Market

-

If We Expect too Much out of Blockchain Games (more reading here)

-

Common Errors in Assessing Probabilities for Success in Entrepreneurship

You can find us on YouTube, Spotify, Apple Podcasts, Google Podcasts, YouTube, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: 100 Thieves and Creator-Driven Gaming

Source: Esports.gg

When I wrote about FaZe Clan’s SPAC announcement last fall I was skeptical of the company’s chances for success in public markets. My greatest critiques centered around scalability – the resources needed to grow a content-driven business model were large and the margins didn’t meet the $1B valuation of the company. Since, FaZe has still yet to go public, and the company has amended its S-4 to note higher than expected costs for programming and executive hires, impacting their bottom line and missing projections from their first filing. Sufficient to say, profitability at scale continues to be the largest barrier to success for late-stage, content-driven gaming businesses like FaZe.

Despite FaZe’s struggles, I have conviction that one of these content businesses will eventually build the right mix to solve the profitability problem. It comes down to finding the right high-margin business to better monetize the reach these companies command. That’s why it caught my attention last week when 100 Thieves announced it plans to develop its own video game, a play at diversifying revenue for the content business and a refreshingly unique initial stab at higher margin business lines.

In the announcement video, Nadeshot and COO/President John Robinson paint a vision of a game built with input from the company’s “community, creators and owners.” Affectionately dubbed Project X, the duo shared that they’ve already brought on Zynga/TellTale/Mythic Games alum Pete Hawley to serve as the company’s Chief Product Officer and lead the charge on the title’s development.100 Thieves has always excelled at building a brand across different revenue drivers – so, why couldn’t they be well-positioned to build a game and fix the problems faced by FaZe and others? Let’s explore further.

The success of the game hinges on the ability to give its development team the time, resources, and staff needed to get something fully baked into the market. Project X is no exception. A look under the hood at 100 Thieves’ financials reveals a stable and diverse business. In an interview with Joe Pompliano last fall, COO John Robinson said that the company's revenue is an even 33/33/33 percentage split between their existing content, apparel, and esports businesses (that being said, the costs for these businesses are likely not equally shared). Contrast that to FaZe’s 76/18/8 revenue mix across the same categories, and this begins to paint a picture of a durable business that isn’t overly reliant on one part of the company.

Add that to the organization’s recent addition of Highground, a gaming hardware brand acquired last fall, and the revenue mix into DTC continues to deepen – 100 Thieves has excelled in physical products and branding, and has cash in the bank from these ventures to reinvest elsewhere. The question is if they can now bring this elsewhere, and if the team’s expertise is truly durable enough to sustain long development cycles.

The team’s management also seems to be operating the business with a long-term time horizon in mind, building for “decades, rather than months.” Simply put – from the outside looking in it seems as though the company has the financing and flexibility to invest in building out this studio. Success in this category is a natural segue for its creators (which already promote other games) and allows the company to reach its next milestones.

That doesn’t mean that the organization has hedged all its risks, though. Long-time fans will remember FaZe’s own gaming debacle back in 2016, in which the team gathered over $20,000 on the promise of launching their own FPS title. The game was ultimately scrapped mid-production and never saw the light of day, with FaZe’s announcement for the game being removed from YouTube. The difference between FaZe’s downfall and 100 Thieves’s latest bet are noteworthy (the team used an understaffed, less experienced third party studio rather than building their own in-house as 100T is), but the end result still serves as a precautionary tale of what's to come if the organization can’t execute correctly.

That being said, while 100 Thieves has some of the best expertise in building personal images for their creators, establishing a brand around IP is a different muscle to flex. Success cases like Dream SMP & Minecraft, or Offline TV and Rust show that creators can supercharge go-to-market efforts once they have something to promote, but the game needs to come to fruition before that can happen, and that's anything but a given. Luckily, creator-driven models for games are abundant and 100 Thieves can tap into this inspiration.

There’s also the expectations of the team’s fans, which are some of the most dedicated and vocal in the space. As I noted in my analysis of Dr. Disrespect’s own gaming studio last summer, phrases like “creator and community driven development” come with the added scrutiny of vocal detractors. Mix this with Hawley’s own history of delaying titles in favor of quality over speed, and it’s not hard to imagine a world two to four years from now with no news or launch date for the game and public pressure mounting. There is a lot that hinges on execution.

Long-term, I am still optimistic about content-based gaming businesses finding a way to overcome margin and profitability issues. Ultimately, value in this space accrues to building a strong brand and a horizontal product play across their fans. 100 Thieves creators and their engaged fans should help tackle that.

The gaming creator space is one of my favorites across the entire industry, and I am personally a big believer in the journey 100 Thieves has created to take viewers from casual fans on YouTube to monetizable audiences via merchandise, content, and (eventually) in-game purchases. While game development comes with a lot of questions, I’ll be watching this one closely. (Written by Max Lowenthal)

#2: Royal Match Performs Regally Well

Source: Royal Match

This is the introduction to a full game deconstruction that publishes in Naavik Pro tomorrow (written by Niek Tuerlings). Click on the button below to join Naavik Pro, read the rest, and enjoy new games industry research each week.

The puzzle game category has experienced double-digit year-over-year revenue growth for years now — 34% in 2018, 17% in 2019, 29% in 2020, and 16% in 2021. In January of this year, mobile marketing agency Udonis wrote this as part of its Puzzle Games Report:

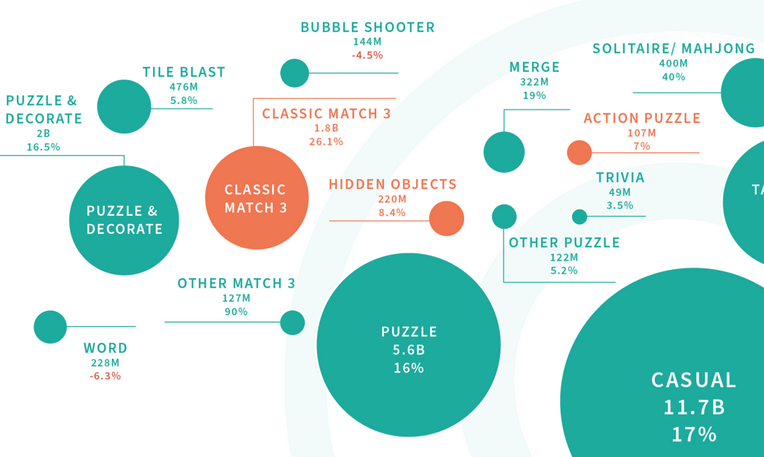

The state of mobile puzzle games. | Source: Udonis

The matching games subgenre includes eon-old titans like Candy Crush Saga, Homescapes, and Fishdom, which all have seen near-continuous revenue growth in recent years. These games terrorize the waters in the bloodiest ocean of the casual game space, while only a very select few manage to not get eaten alive.

Casual puzzle market growth in 2021. | Source: Deconstructor of Fun

Every year, growth in the puzzle games category can be attributed to only a handful of huge successes. For the rest of the contenders, it’s a hard-knock life. When looking at Classic Match-3 and Puzzle & Decorate (which is predominantly match-3 as well), only two new games during the last 5 years have managed to safeguard a spot in today’s top-10 (based on revenue). The first one was Magic Tavern’s Project Makeover. Most recently, Royal Match, Dream Games' regally themed smash hit, was added to this exclusive list. The rest of the spots are still taken by aforementioned oldies.

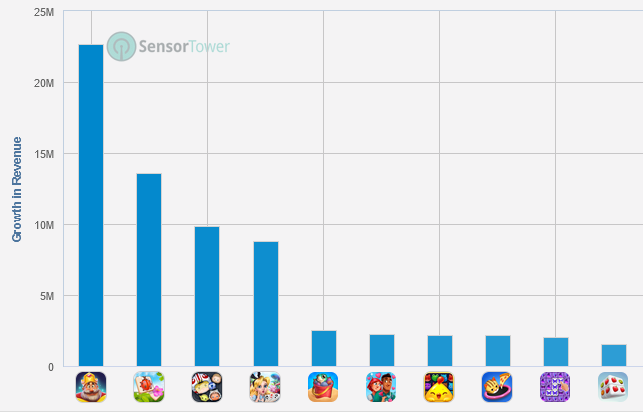

To better understand the success of a game like Royal Match, simply glance at last year’s absolute growth in revenue compared to other top match-3 games. As you can see in the graph below, Project Makeover, Candy Crush Saga, and Royal Match were the three biggest growing match-3 games in terms of revenue. Impressively, especially compared to the others, all Royal Match revenue in 2021 came from new players as the game only officially released in February. For context, Project Makeover had already acquired ~20M players in 2020.

YoY Revenue Growth for the top-12 match-3 games in 2021. Worldwide, both platforms. Source: Sensor Tower

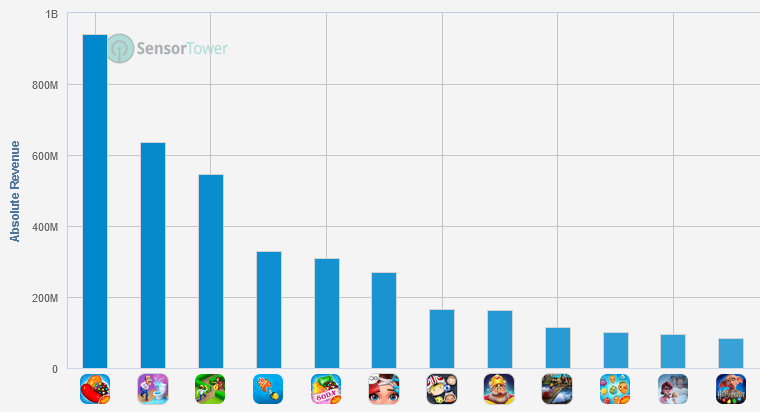

This makes Royal Match the 8th most lucrative match-3 game in the world in 2021 based on absolute revenue:

Absolute Revenue for the top-12 match-3 games in 2021. Worldwide, both platforms. Source: Sensor Tower

Want to hear another impressive Royal Match stat? Out of the top 10 list of 2021’s revenue growers, Royal Match is the only remaining grower in 2022. Literally all other competitors from 2021’s leaderboard are in decline, including Project Makeover, the fastest grower of 2021. New competitors in terms of revenue growth are classified as “other” — more hybrid-casual successes like Zen Match (which is #2 in the revenue growth chart below) and Cube Master (which is #10 below).

Revenue Growth for the top-10 match-3 games in 2022 YTD. Worldwide, both platforms. Source: Sensor Tower

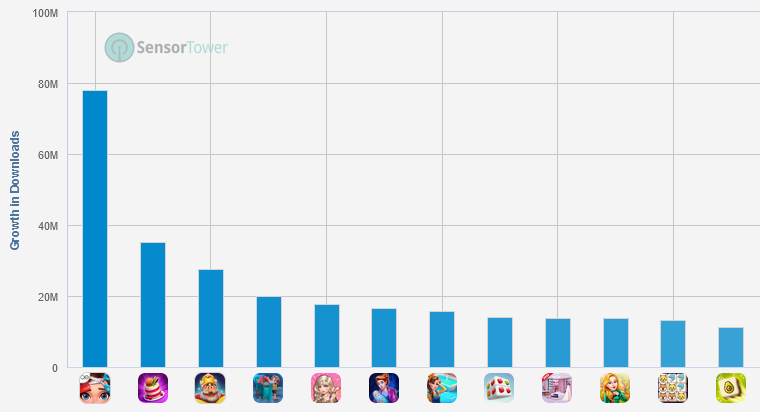

From the perspective of downloads, Royal Match acquired a huge number of new players (nearly 30M) in 2021. It was only bested by Project Makeover —which had an insane year in terms of UA— and Tile Master.

YoY Downloads Growth for the top-12 match-3 games in 2021. Worldwide, both platforms. Source: Sensor Tower

Regardless of growth in 2021, it’s important to note that the games from the days of yore still topped the charts in terms of absolute downloads throughout the year.

Absolute Downloads for the top-12 match-3 games in 2021. Worldwide, both platforms. Source: Sensor Tower

For 2022 year-to-date, Royal Match downloads have actually plateaued. However, the fact that the game doubled its Revenue Per Download compared to last year helps justify its #1 spot in the 2022 revenue growth chart above.

There’s a lot to dig into here. Why was Royal Match able to grow when most competitors couldn’t, including other more recent hits like Homescapes? How was it able to find a wedge into the match 3 market and chip market share away from the category titans? We’ll explore all of this below, but let’s first start by understanding the team behind the game; after all, this level of success is no accident.

The Dream Team

In 2019, Turkey-based Dream Games was founded by 5 ex-Peak Games employees. Undoubtedly inspired and seasoned by the success of their old company’s hits — Toon Blast, Toy Blast, and to a lesser degree their match-3 switcher Lost Jewels — they set out to create their own success. The ambitious quintet consisted of Soner Aydemir as CEO, Hakan Sağlam as CTO, İkbal Namlı as Head of Software Engineering, Eren Şengül as Product Director, and Serdar Yilmaz as Art Director.

Maybe the most striking aspect of this ensemble at the time was their confidence in regards to the casual puzzle market and its saturation. Many CEOs in the space would have argued that trying to penetrate this shark tank of a market segment by making yet another match-3 game with a renovation meta would be suicide, especially as a newly founded company. However, the founders had a couple of tricks up their sleeves that helped convince Makers Fund and Balderton Capital to board the Dream train as early investors. A short financial timeline:

-

In November 2019, to fund its initial inception, the team of founders — together with a handful of trusted employees — raised a $7.5M round of seed funding.

-

In March 2021, coinciding with Royal Match’s global launch, the startup secured a $50M round of Series A funding. It was the largest Series A in Turkey’s startup history.

-

Only 3.5 months later, at the end of June, the company secured another whopping $155M in Series B funding.

-

In January of this year, the a $255 Series C was secured.

This staggering turn of events has led the company to be valued at $2.75B, only 2.5 years after its founding date. With less than 80 employees at the time of its Series C, Dream Games surpassed Supercell as the games company with the highest valuation per employee with every employee being worth about $34M in market cap. It’s arguably an unfair comparison given the difference in both companies’ life cycles, their cash flows, and the amount of games they produce, but it’s a very impressive feat nonetheless.

At the time of the Series B, it became clear that Dream Games aimed to take a game to the highest levels of perfection before releasing it, not unlike other immensely ambitious companies like Supercell. Outside of games, Pixar has been mentioned as an inspiration. In Pixar’s case, the team heavily focused on fine-tuning its famous story spine and testing it until it was perfect. Because of the rigidity that was required throughout the process, the length of a Pixar project could take up to 3 years to complete.

Pixar’s Story Spine. | Source: Khan Academy

The same laser-focus can be seen in the way Dream Games operates. As CEO Aydemir said when raising the Series B last year, “When Pixar started, it was very low frequency, a movie every 2-3 years, but eventually the rate increased. And it will be similar for us. This year we need to focus on Royal Match but if we can find a way to create other games, we will.” With an intense focus on perfectionism and an urge to design elegantly, the team grabbed the match-3 bull by its horns and started making changes that increased the player’s quality of life in ways never seen before.

Finding the Right Wedge

Even though the biggest match-3 competitors are typically occupied with adding complexity to their games (in terms of meta), the team behind Royal Match went the other way and obsessed over simplicity. As a result, Dream Games scooped up millions of players that play games mostly to feel accomplished and skillful by trying to solve puzzles.

This approach holds similarities to what King has been doing with its Candy Crush titles for more than a decade — a heavy focus on the puzzles with a very minimal meta layer around it, which creates a very slight dose of long-term progression. However, whereas King refrained from innovating on its meta games, Dream Games took away all possible friction the most puzzle-hungry players felt when trying other heavy-hitters like Homescapes and Lily’s Garden: no written narrative and no customization when decorating.

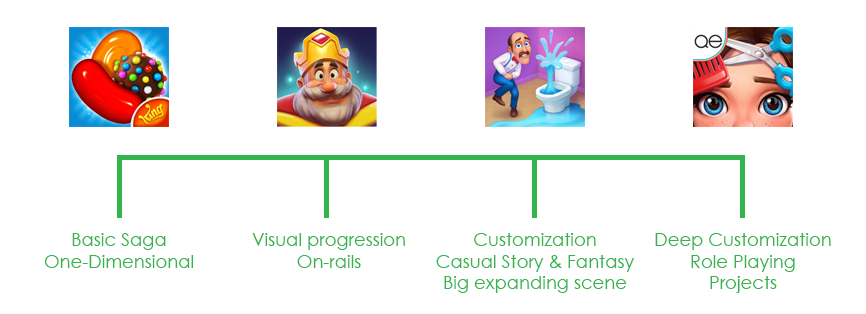

Scaling Meta Game Complexity across 4 top-grossing titles. Source: Naavik

In a way, Royal Match does what hybrid-casual developers have been trying to do for some years now, albeit in a more high-fidelity landscape: wedge right in between the old-fashioned, one-dimensional, core-focused games and the deep casual games with rich metas. This approach has found an audience to cater to that doesn’t want to get bored soon and search for a new game but also isn’t looking for a deep game with too many bells and whistles. This means that Royal Match, since day 1, has attempted to capture the classic match-3 players, as opposed to Puzzle & Decorate aficionados.

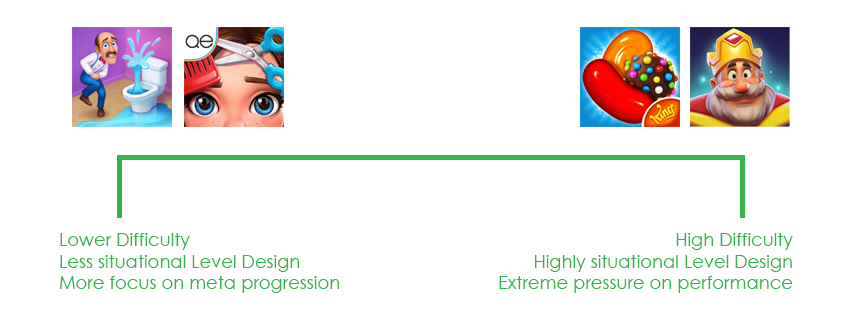

Because the focus is more on the core game experience, more attention has to be put on things like fluidity of the puzzle board, color & power-up balancing, power-up combinations, transparent modifiers, and overall level design. When zooming in on the levels of the game, it becomes clear quite quickly that Royal Match has gone full force towards loss-aversion mechanics. Its levels are extremely well-tweaked towards the creation of near-misses that create pressure on players to spend some currency on extra moves or force them to activate those in-game boosters.

Scaling Core Game Pressure across 4 top-grossing titles.

Additionally, Royal Match’s levels are designed for easy use of power-ups the player might have acquired in the numerous events of the game’s well-oiled machine that is its live-ops calendar.

In this essay, in order to deconstruct the exact way in which Royal Match was able to achieve the above success, we’ll dig into the following topics:

-

An analysis of Royal Match’s core game design

-

A look at the game’s highly lucrative live-ops strategy and how different features improved the game’s performance

-

Why the game’s marketing strategies work so well

-

Where Royal Match has room to improve and where we think (and advise) the team will focus next

Let’s dive in!

This research essay was originally posted on Naavik Pro - the #1 research portal for blockchain and F2P games! We serve both investors and developers with our premium research. Make us your remote games research department today!

Content Worth Consuming

Crypto Unicorns: How to Play & Crypto Analysis (Nat Eliason): "So one of my strong theses with Crypto Gaming has been that the games which will succeed will be the ones where a base set of IP and crypto assets can be used in a variety of games. Instead of trying to manufacture a hit on the first try, create a strong set of NFTs and tokens and then use them in a collection of games so you get more attempts to build a hit using those assets. Crypto Unicorns is a newly launched game taking exactly this strategy. They have two sets of NFTs: Unicorns and Land, with which they’re building a variety of games over the next year. And they have two fungible tokens to go with them: RBW (Crypto Unicorns Rainbow) the fixed-supply governance token, and UNIM (Unicorn Milk) the infinite-supply in-game currency.” Link

Elden Ring (Bayjinger): “To write about Elden Ring feels almost as daunting as it is to finish it. My first play-through clocked in at around 135 hours, which is the longest of any FromSoftware game I’ve played, and really, any game I remember ever finishing. And so for a few days after that play-through, I sat around thinking about writing, and instead started a second fresh play-through (as opposed to the NG+ route)… In terms of my credentials as a fan of FromSoftware’s works, I’m somewhat of a halfway convert. I’ve finished Bloodborne (2015), which was my introduction, and Sekiro (2019); I played Dark Souls III (2016) for maybe 20-30 hours, but never finished it; and I’ve dabbled 10-20 hours in Dark Souls (remastered) and maybe 10 hours in Demon’s Souls (PS5 remake). Suffice to say, I understand the Soulsborne formula, but I’m not a master of its earlier iterations.” Link

State of Crypto Report (a16z): “A lot has changed in the state of crypto since we started investing in the area nearly a decade ago. This report is the first of what will be an annual overview of trends in the crypto industry, shared through the a16z crypto vantage point of both tracking data and across the countless entrepreneurs and builders we meet. It’s for anyone who seeks to understand the evolution of the internet, and where we are on the journey towards a decentralized, community-owned-and-operated alternative to the centralized tech platforms of web2 – especially as it touches creators and other builders.” Link

Reggie Fils-Aime on Diversity and Memeablilty (Gi.biz): “Following the launch of his memoir, Disrupting The Game, we talk to him about his experiences at Nintendo and as one of the industry's few prominent Black gaming executives. He also shares his thoughts on the industry's ongoing diversity issues in general, as well as thoughts on the future of games, including the use of cloud technology and how Nintendo can follow up on the success of the Switch.“ Link

Featured Jobs

-

Konvoy Ventures: Investment Analyst (Denver, CO)

-

LILA Games: Game Designer, Systems & Economy (Bangalore, India)

-

OpenBCI: AR/VR Demo Creator - Neurotech (Brooklyn, NY)

-

Lotum: Game Designer (w/m/d) (Germany)

-

Naavik: Content Contributor — Writer (Remote)