With the simultaneous revelations that Microsoft will bring some Xbox titles to PlayStation, and Sony’s surprise hit Helldivers II, it appears the previous rules of console exclusivity have been shattered.

Though this trend had been slowly developing for years, the recent profound changes herald a new era for competition in gaming, and it requires a new perspective on the relationship and tensions between platforms, services, and content.

As the business logic behind exclusivity changes, it points to a future where the role of content in the market is substantially different. With uncertain growth prospects, heightened financial pressure, and a prevalence of live service titles, console gaming’s platform owners have responded by accelerating the breakdown of content exclusivity, a shift which will ricochet across the industry, from mobile app stores to cloud gaming, and more.

Exclusivity Has Been Declining for Years

Last week, the dam broke for both Microsoft and Sony. Four first-party Xbox titles, Sea of Thieves, Grounded, Pentiment, and Hi-Fi Rush will be published on Sony and Nintendo consoles, while PlayStation’s Helldivers II has seen massive success with Sony’s first simultaneous release on PC and PS5.

The breakdown of rigidly defined, tightly held exclusives has been years in the making. Through its acquisition of Mojang Studios in 2009, Microsoft assumed publishing duties for Minecraft across all consoles, mobile, Windows, Mac, and a long list of esoteric platforms, and has since continued to bring the game to competitive ecosystems.

Starfield and nearly all other Xbox-published games retail through Steam as well as the Microsoft Store on PC. PlayStation’s PC releases now generate $300M annually, and its baseball game MLB The Show is also published on Xbox (thanks in part to a licensing requirement from Major League Baseball). From nearly any angle, content exclusivity on PlayStation and Xbox has been steadily eroding for years.

Why Is Total Exclusivity Increasingly Illogical?

While jealously guarded exclusive games made strategic sense previously, today the business benefit of this tactic is increasingly questionable for three key reasons.

1. Platform and services revenue has stalled, leaving content as the best lever for growth.

Gaming has not seen meaningful, real growth for years now. The market has only grown 1.7% per year in inflation-adjusted terms since 2019. Additionally, the current console generation is reaching maturity, and additional device sales will slow, according to Sony’s most recent investor update.

Slower growth in console sales affects the growth rate of platform revenue (the 30% share of third-party transactions), which is a function of not just the size of a platform’s user base, but also the popularity of third-party titles among that user base.

On top of the slowing growth in users, 2024 is not anticipated to have many blockbuster game releases, doubly limiting expected platform revenue. Grand Theft Auto VI will doubtlessly change that in 2025, but Xbox’s small market share means Sony and Steam will disproportionately reap the benefits of what will no doubt be the highest-grossing entertainment product ever.

Nintendo, as ever, marches to the beat of its own drum, with highly differentiated hardware and a heavy focus on exclusive content of the highest quality.

Services revenue from subscriptions like Game Pass and PlayStation Plus is expected to slow since, in their current form, they are largely tied to device ownership and platform usage. PlayStation Plus has a very limited PC offering and is thus largely confined to consoles, which, again, are expected to see declining sales. Xbox, meanwhile, has tried to bring Game Pass to other platforms (such as mobile and smart TVs) as a means of compensating for its poor console market share, but has been met with rather limited success outside of PC, in particular due to restrictions imposed by Apple. Therefore, growth in services for both platforms is likely to stagnate, even with the addition of Activision Blizzard games to Game Pass.

The console market is maturing, and neither Sony nor Microsoft see meaningful growth from device sales, platform revenue, or subscription services. So the primary remaining growth opportunity within their control is content monetization.

Content is best monetized when it is as widely available as possible, not kept within a confined ecosystem. Thus, both companies are unbundling their content from their platforms and services in order to better monetize it directly.

2. Exclusivity hinders the profitability and revenue upside of content.

There has always been a tension between exclusivity — which can drive hardware, platform, and services revenue — and maximizing the business opportunity in content alone. Ed Fries, former Microsoft VP in the early days of Xbox, recalls saying to his bosses that the best way to increase content revenue would be to bring Halo to PlayStation — a nonstarter back in 2001, but something that may be on the table today.

Today, this tension is heightened by the spiraling costs of AAA game development, where even the most successful titles struggle to provide a return on their investment — a phenomenon that is especially exacerbated when sales are limited to a single platform.

Insomniac’s Marvel's Spider-Man 2 cost over $300M to create (nearly three times as much as its predecessor), and despite being the fastest-selling first-party PlayStation game to date, its profitability was far from guaranteed given the anxiety-inducing cost of development. While it certainly helped push some hardware sales (and some incremental platform and services revenue), the financial risk of such high-budget content is always higher when its availability is limited to a given ecosystem.

This effect is especially true for Xbox, which has about half of the install base of PlayStation this generation. As a result, it is effectively twice as hard for an Xbox game of a similar budget to break even as it would be for a PlayStation title.

So if Sony is feeling pressured to pursue off-platform content releases to reach profitability, Microsoft must be doubly concerned. During its tussle with the CMA regarding the Activision Blizzard acquisition, it stated directly that keeping Call of Duty off of PlayStation would simply be unprofitable.

Sony president and PlayStation chairman Hiroki Totoki recently spoke of his desire to increase profitability by expanding PlayStation’s off-platform releases: “So if you have strong first-party content, not only with our console but also other platforms like computers, a first party can be grown with multiplatform — and that can help operating profit to improve.”

Even outside of mega-budget exclusives, the upside for smaller games stuck within a confined ecosystem (especially, again, an ecosystem with by far the smallest user base) is severely capped. Microsoft has argued that Game Pass actually drives sales of the same titles on other platforms, but this can only happen to third-party games that are actually available on those other platforms. (Palworld’s presence on both Game Pass and Steam is a recent example.) First-party Game Pass titles like Pentiment are not premier enough to drive Game Pass or device adoption, and Xbox’s user base is too small for a significant amount of revenue from purchases. Like other Xbox games, it is available on Steam (where it has made an estimated $3M), but without a presence on the Switch or PlayStation, it already reached most of its potential.

It is this logic of maximizing content revenue, and ensuring its increasingly risky profitability, that led to the status quo of first-party platform release and a PC release — but only once the revenue potential on the console had been largely assured. This a classic windowing strategy, where the monetization potential of content is maximized while minimizing the benefit it has to the substitute platform (PC) through timed delay, preventing rival platforms from benefiting.

But as development costs have risen, and companies have begun optimizing for profitability and efficiency in recent years, this logic has eroded further to allow simultaneous PC release (Helldivers II) and release on rival platforms (Xbox’s four upcoming PlayStation/Switch titles).

Sony is in an interesting position where it has stated it does not have any blockbuster content releasing until 2025 — therefore it may be especially incentivized to maximize the potential of the first-party content it does have available for release, which means putting more titles on PC sooner rather than later. The stunning success of Helldivers II surely seems like both good luck and an important lesson to PlayStation, given the upcoming first-party content drought and unrelenting pressure for profitability.

3. Live service games rely on network effects, which are weakened by exclusivity.

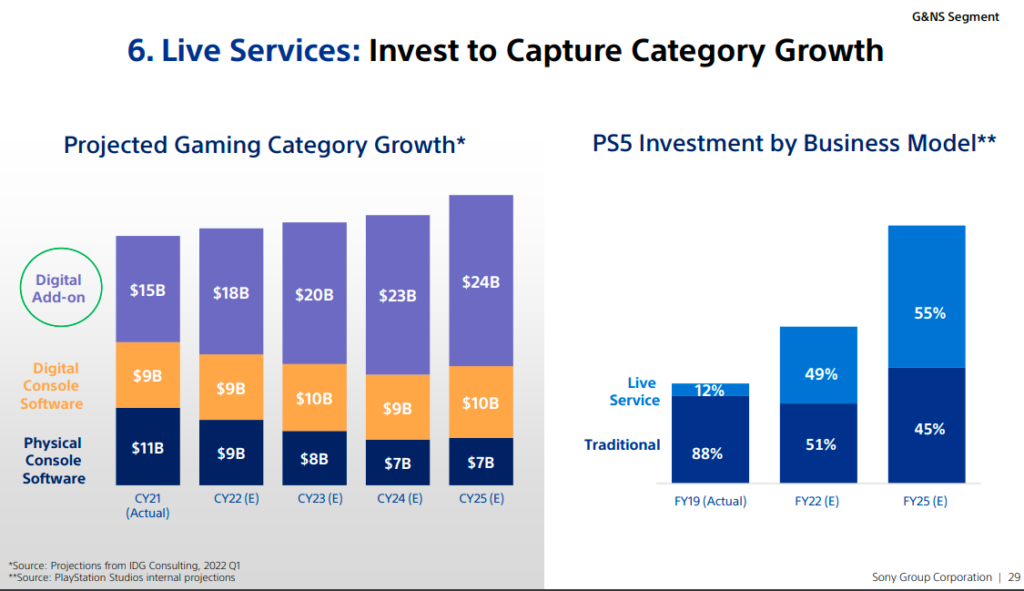

Exclusivity is especially limiting to live-service games, an ever more critical part of the industry.

During the Xbox business update, Phil Spencer emphasized that “community-driven” titles made particular sense to expand off-platform. This is due to the critical network effects in these games, as the value of the experience increases as more players engage with the platform.

A larger player base leads to enhanced matchmaking, more vibrant communities, and increased opportunities for social interactions and content sharing. On the flipside, a small user base is what inevitably kills service-based games — it makes little sense to keep them contained within one platform, especially if that platform has the lowest market share.

Sony’s decision to release Helldivers II simultaneously on PC and PlayStation — a first for the company, instead of the typical PC release one year after console — was certainly informed by this logic as well, and so is the company’s intent to bring Bungie’s forthcoming live service shooter Marathon to Xbox and PC with full cross-play.

PlayStation’s intent to prioritize service-based first-party games — though it has since reduced its ambitions somewhat — directly aligns with its plans to dramatically increase its off-platform publishing business. In 2022, PlayStation revealed its expectations to launch half of its new titles on PC and mobile by 2025. For all the talk of Microsoft becoming a third-party publisher, it may be Sony that eventually has the bigger off-platform content business.

The Next Era: Mobile and Cross-platform Services

Content exclusivity is a concept that has defined platform competition for decades, yet after years of gradual change, it’s suddenly transforming faster than ever — a phenomenon that lays bare how the industry’s core structure has been shifting.

For Xbox, as Phil Spencer said, a change in publishing tactics is not a change in the overall strategy, as Microsoft still intends to prioritize making the Xbox ecosystem accessible on “every screen”. Somehow, Xbox must also balance trying to succeed as a hardware platform, a goal that by nature somewhat conflicts with its vision for an omnipresent services and content business. Selling consoles holds back the potential of that vision, and at some point, Xbox will have to make a clear strategic choice unless it wants to continue muddling along behind its rivals.

Sony’s strategy is an altogether different one given its dominant market share, even as it also expands its off-platform publishing. At its scale, it does not need to prioritize reaching more screens as Xbox does, and instead can realize incremental revenue (and improve content profitability) without weakening its position by releasing more content on select other platforms at strategically chosen times.

The impact of these competitive dynamics will only increase as the console market continues to grow more slowly through the rest of this generation, meaning Xbox will likely continue to put more content on other platforms, and Sony will seek more growth from PC publishing, until new hardware (somewhat) resets the landscape.

The changing nature of exclusivity currently being defined on consoles will have an impact across gaming and the broader worlds of entertainment and technology. Microsoft’s long-awaited “gamer-first” mobile app store, which, like Game Pass, is also at the mercy of iOS, is positioned to wield exclusive content as a competitive tactic against dominant incumbents.

Just as Call of Duty would be unprofitable to remove from PlayStation, Candy Crush or Diablo Immortal won’t abandon the App Store or Google Play. At the same time, it seems likely that some games, maybe even future titles from the same developers, could be accessed only through Microsoft’s mobile storefronts. And within the PC ecosystem, Epic Game Store’s exclusive strategy continues to accelerate as a means to battle Steam.

While exclusivity in both these cases refers to content being restricted to a platform, services like Game Pass and Netflix Games are establishing themselves as cross-platform subscriptions; meaning “exclusive” can now also signify that content is available on several platforms, but accessible only through a single multiplatform service. This evolution brings the potential for yet more change to a model not dissimilar from that of television or SVOD (subscription video on demand), where content producers license out their shows to different competing services over time.

It is not so hard to imagine a similar future in gaming, where a title may debut on PlayStation and Steam for a $70 purchase, then become exclusive to a cross-platform, cloud-based Game Pass for three months, then a flash sale only on Epic Games Store, then move to Netflix’s subscription, and finally to PlayStation Plus, to full maximize its revenue on each service before migrating to the next one. Meanwhile, the publisher is also simultaneously creating promo games of the same IP on complementary platforms like Roblox and Fortnite.

This is a very different model of “exclusivity” than what exists in gaming today, yet it could be one of a number of ways the concept evolves over time. As the boundaries of traditional console exclusivity crumble, new opportunities open up, and core tensions within companies and across the industry can be seen; the importance of great content to any strategy has rarely been clearer.

A Word from Our Sponsor: CLEVERTAP

Revolutionize Gaming with CleverTap Gaming's Live Ops Capabilities

With cutting-edge technology and advanced analytics, CleverTap Gaming empowers gaming studios to create personalized and immersive experiences for their players. Maximize user engagement, retention, and monetization through real-time player segmentation, targeted messaging, and dynamic in-game events. Stay ahead of the competition by delivering tailored experiences, optimizing player journeys, and driving long-term player loyalty.

No one knows this better than Greg Lin, the director of live operations tools and platform at Big Fish Games, who has been using CleverTap Gaming (formerly Leanplum) to power Live Ops for the past decade — at two different gaming studios. Learn his strategies for maximizing Live Ops campaigns.

Game of the Week - Helldivers 2: The New Go-to Shooter?

Written by Jordan Phang, Naavik Consulting Partner

Developer: Arrowhead Game Studios

Publisher: Sony Interactive Entertainment

Platform: PlayStation 5, PC

Status: Launched 8th February 2024

Genre: Co-op Shooter

Gameplay: Link

What Is It?

Like its predecessor, Helldivers II is a co-op shooter in the vein of Left 4 Dead and Deep Rock Galactic, but clearly inspired by Starship Troopers.

Unlike the first game, Helldivers II is played in third person, and to great effect – the camera angles really help immerse you in the action whether you’re mowing down smaller Terminids or taking down a huge Bile Titan.

The gunplay is excellent, and weapons all feel weighty, chunky, and extremely satisfying.

How Is It Doing?

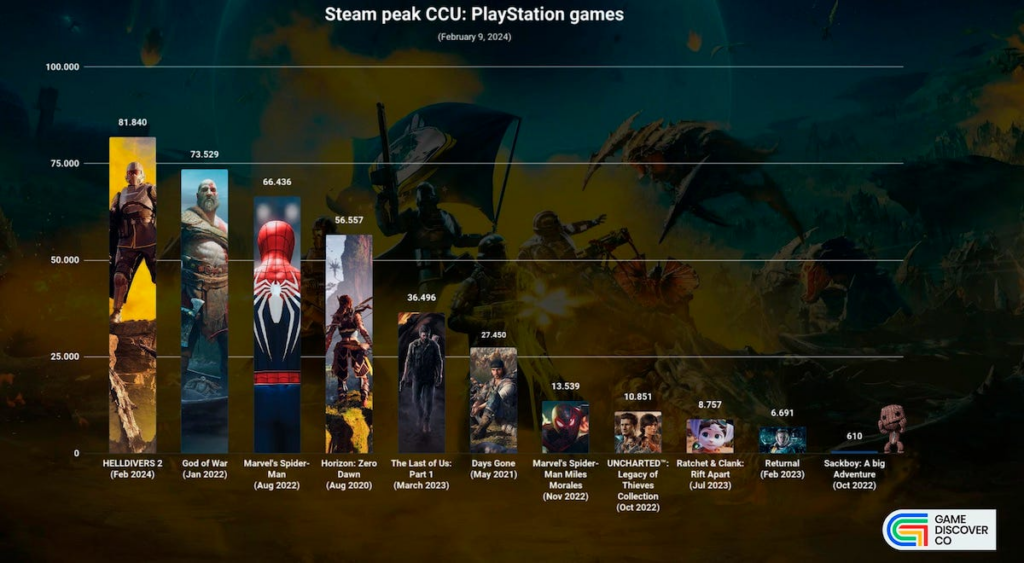

In a word, fantastic. According to VGInsights, it’s the third best selling action game for the year, selling 2.9M units ($93.6M in revenue) in the two weeks since release, and has peaked at an average CCU of 300k as of the 19th of February.

It’s also currently the best-selling PS5 game in the US, no mean feat against titles like Call of Duty and Madden.

The success of the game came as a surprise to the team, and as a result it has struggled to keep up with demand. Players are reporting multiple server-related issues such as mission payouts failing, being kicked out to their ships, or logged out. It’s even spawned a meme:

Helldivers II has also captured mindshare across consumer media, social media, Twitch, Youtube, and more. The virality is partly driven by very meme-able situations in game, like this player getting their own grenade bounced back at them by a Terminid.

The combination of a great game and viral sharing has meant that Helldivers II has eclipsed the launch performance of other big action titles like The Finals, Armored Core, BattleBit Remastered, and even Lethal Company.

Will It Last?

It’s still very early days for Helldivers II, but its sales are still going strong (on PC at least).

The big question is whether it can keep these players and continue to grow. As we’ve seen in other titles that burned bright but ultimately declined, this isn’t easy. While Helldivers II is a “premium” game sold for $40, it also has microtransactions (mainly to buy the Battle Pass or cosmetics). Player consensus is thus far pretty positive on the microtransactions, as you’re able to earn Super Credits (the hard currency) just by playing the game. While having a Battle Pass doesn’t automatically make Helldivers II a GaaS title, Arrowhead Games released a total of 14 DLCs for Helldivers I. Suffice to say, we can expect lots more content over the coming months for Helldivers II. If they are just weapon and gear releases like the DLCs in Helldivers I, players will tire of the formula, and we’ll likely see player counts drop pretty soon. To ensure players keep coming back for more, they’ll need updates with full-fledged content that will freshen things up.

Our Product Consulting Services

Today we’re highlighting our product strategy services. This includes market research, live ops strategy, product management, brand marketing and performance marketing. Here’s what one of our clients had to say.

“We have been very happy with the support Naavik provided to Sleepagotchi. They have an incredible expert network, with world-class game designers, narrative designers, and UA specialists. The team helps us in developing and stress-testing new game core loops, think deeply about our game constraints, and something that is rare for a consulting partner - care deeply about our mission and vision.”

- Anton Kraminkin, Founder & CEO of Sleepagotchi

If you’d like to learn more, reach out here! Also check out our expanded consulting service portfolio here.