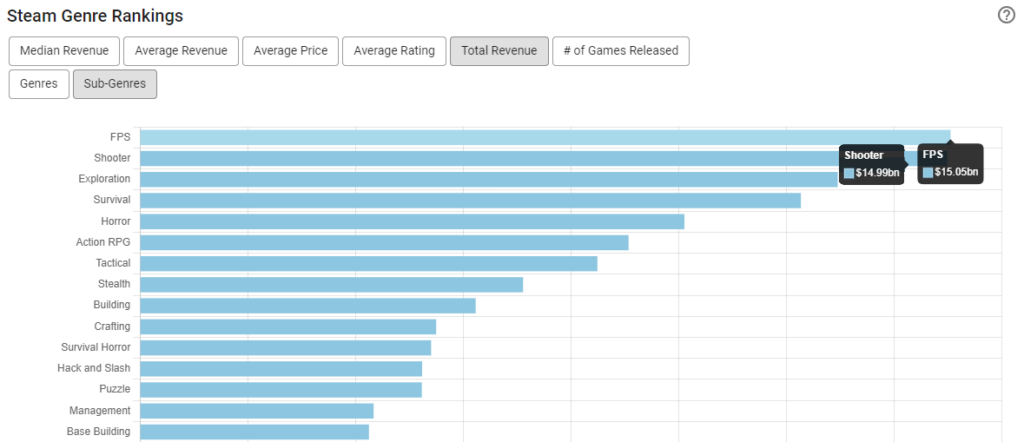

First-person shooters and PCs are like ducks in water – the genre is one of the most important for the platform, and according to VGInsights, FPSes ($15.05B) and Shooters ($14.99B) are the top two genres by lifetime revenue on Steam.

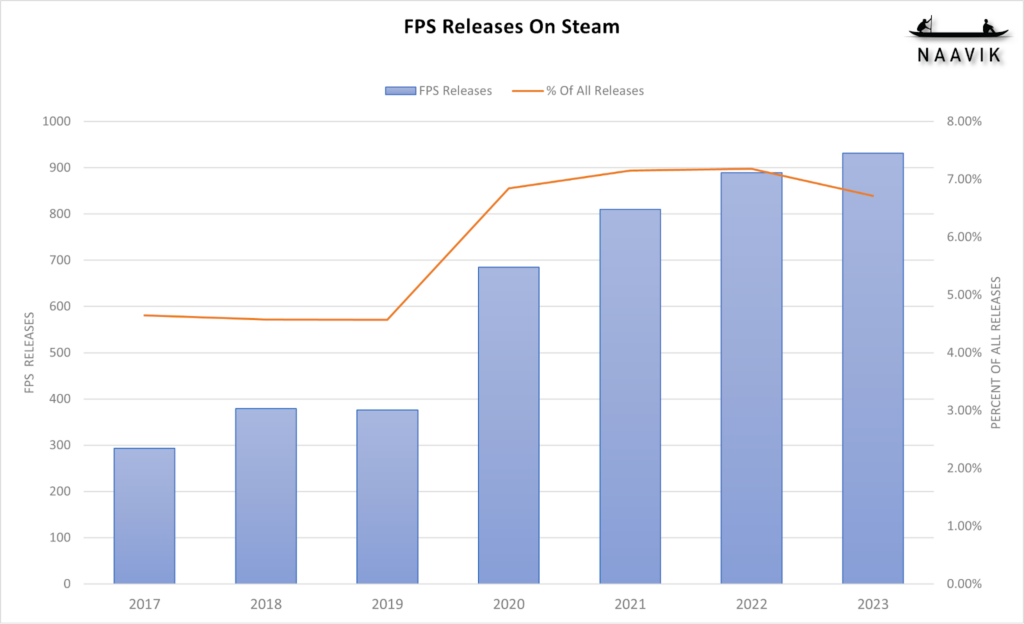

They have also become more popular among developers, with FPS games seeing a bump in total releases from 2020 as well as making up a greater share of all releases.

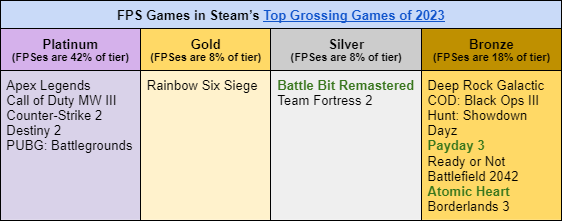

Looking at Steam’s Best of 2023page, which ranks the top 99 games based on gross revenue, we found that FPSes make up 17% of all the games on that list. The games are segmented into four tiers by gross revenue ranking:

- 1-12: Platinum

- 24-13: Gold

- 50-25: Silver

- 99-51: Bronze

The Platinum tier is heavily skewed toward FPSes, making up 42% of the games on the list. Games that are highlighted green in the table below are those that were launched in 2023.

To put some context to the revenue numbers for these tiers, let’s take Deep Rock Galactic in the Bronze Tier, for which we can get its actual units sold (2.57M). Taking into account that the price fluctuatedbetween $9.89 and $29.99, we estimate it had a 2023 revenue of about $40.8M. Not bad at all for a team of 32.

At the other end of the spectrum, Call of Duty: Modern Warfare III hit $1B in revenue in just 16 days after its launch on November 16, 2023.

Over on the Epic Games Store, FPSes make up 14% of the top sellers there. While Epic doesn’t reveal sales figures, Dead Island 2 sold over 1M units in three days, and 2M units as of May 2023. Plotting these numbers into a log curve gets us total sales of around 2.8M units by the end of 2023. The game was a timed Epic Games Store exclusive, so if we base the PC/Console sales split on the Metacritic user review ratios (66% console, 34% PC), we get 952K PC sales or approximately $57M in PC revenue (based on a $60 per unit cost).

So far, so good. But dig into it a little more, and you’ll see that in both tables, there are a total of only six new FPS releases — the bulk of the success, 80%, is from older titles.

To put that another way, 931 FPSes were released on Steam in 2023, so the new FPS successes make up only 0.3% of that cohort. It’s extremely difficult to stand out.

Even for those that do standout, games like BattleBit Remastered and The Finals, which got a ton of hype and a surge of players, struggle to reach the same heights as juggernauts like Counter-Strike 2 (not to mention Fortnite).

Even if they do manage to reach a significant audience, they are unable to retain the players long term. For example, The Finals had the highest launch CCUs of the three new releases, at a daily average peak of almost 180K, but that is now around the 37K mark. (Still respectable, but that’s an around 80% drop in players in less than two months.)

The top tier of FPS gaming is incredibly difficult to break into due to the performance of the incumbents. Unless you can bring something new to the formula (BattleBit’s massive 254-player games, or The Finals’ total destruction), you aren’t giving players a compelling alternative. Even then, games may break through to reach a good initial audience, but aren’t able to keep those players around.

But hold on! What about Extraction Shooters, the “future of Battle Royale”? The genre pioneered by Escape From Tarkov evolves the Battle Royale experience to something fresh and has been heralded as the next big thing for some time now (something we predicted as well).

Well, these games are nowhere to be found. Hunt: Showdown is the only one on either list, and it’s from 2018 (Early Access). It’s not that extraction shooters aren’t being released; it’s just that they haven’t performed.

- The Cycle: Frontier has been sunset.

- Marauders was a middling success that peaked at a daily average CCU of ~10k and is now in the hundreds on Steam.

- Vigor hasn’t been a huge hit and wasn’t behind Bohemia Interactive’s third-most successful financial year in 2020 (instead that came from Arma 3 and Dayz).

- Scavengers was released in 2021 and shut down a year later.

- Hyenas was canceled.

- HAWKED looked dead on arrival

- The Hunt: Showdown is an exception here, and has been successful for Crytek, with an estimated $132.1M in lifetime revenue, according to VGInsights.

These failures haven’t discouraged publishers and developers though, and there are many Extraction Shooters coming soon:

- Shrapnel: early access in 2024

- Deaddrop: speculated to be released in Q3 2024

- Project Black Budget: coming in H2 2024

- Marathon: delayed till 2025 due to layoffs at Bungie

- The Division: Heartland: speculated to be released sometime in 2024

- Exoborne: no release date

- Arc Raiders: releasing sometime in 2024

Will any of these games be the next coming of battle royale? There’s every chance, but I think that, like auto chess games, extraction shooters may be too challenging for the mass market.

The high stakes and tension that make extraction shooters exciting can also be very frustrating, and too slow-paced for less hardcore shooter fans. Is the answer to simplify it to its essence? The challenge there is the fine balance between simplifying it enough for a more casual audience without losing what makes extraction shooters special in the first place.

So it’s no wonder this emerging genre leaves behind a trail of failures. Will we see an extraction shooter hit in 2024? I don’t think so. And if one does, it’ll need to be something pretty special.

Is there no hope for other FPSes? I think for FPS success, a new release needs some sort of genre-mashing — perhaps like a certain Pokémon-inspired game that blew up recently. Gone are the days where slick gunplay is enough to carry a game; there needs to be an interesting metalayer above the core shooting gameplay.

A Word from Our Sponsor: LIGHTSPEED

Partnering with Extraordinary Founders in Gaming and Interactive Technology

Lightspeed Venture Partners is a globally leading venture capital firm with over $29 billion under management and more than 500 investments across the U.S., Europe, and Asia. Over the past two decades, the firm has partnered with hundreds of exceptional entrepreneurs and has helped build and scale companies to achieve 190+ IPOs and acquisitions.

With its dedicated gaming practice, "Lightspeed Gaming," the firm invests from an over $6.5 billion pool of early and growth-stage capital — by far the largest set of funds with a dedicated gaming practice. Lightspeed's team combines deep expertise in gaming interactive technology with a global multistage investment platform and a culture that truly puts founders first.

Selected investments include Epic Games, Inworld AI, and The Believer Company — as well as game designers and producers who led the creation of titles like Fortnite, Call of Duty, League of Legends, Wild Rift, Apex Legends, Overwatch, Valorant, StarCraft II, and Warcraft III.

For more information or if you wish to reach out, check out the link below:

In Other News

💸 Funding & Acquisitions:

- Helsinki studio Order of Meta raises $3.3M

- Roro raises $1.6M for 3D digital dollhouse game

- Mountaintop raises $30M in Series A funding

- Pixelmon raises $8M as it seeks redemption for its ambitious Web3 games

- Oculus co-founder's new studio Mountaintop attracts $5.5M in investment

📊 Business & Products:

- Activision Blizzard added $2B in revenue to Xbox’s Q2 growth

- Genshin Impact Summons $5B in Mobile Consumer Spending Faster Than Any Previous Game

- Konami raises forecasts as profits rise 53% to $427M

- Palworld is biggest third-party Xbox Game Pass launch

- All the biggest news and trailers from PlayStation’s 2024 State of Play

👾 Miscellaneous:

- Report: 95% of studios are working on or aim to release a live service game

- Seven reasons to be hopeful about the future of the video games industry

- Scottish Government backs new National Games Strategy

- Switch 2: all the news and rumors on Nintendo’s next console

- Xsolla issues State of Play report winter 2024 edition

Our Gamification Consulting Services

Today, we’re highlighting our gamification consulting services! Applying game mechanics to all sorts of applications has proven to boost retention, engagement, and revenue — but doing it right can be harder than it seems. More specifically, Naavik offers constructive gamification deconstructions, gamification workshops, and ongoing flexible support. Here is what one of our clients had to say.

“We have been very happy with the support Naavik provided to Sleepagotchi. They have an incredible expert network, with world-class game designers, narrative designers, and UA specialists. The team helps us in developing and stress-testing new game core loops, think deeply about our game constraints, and something that is rare for a consulting partner - care deeply about our mission and vision.”

- Anton Kraminkin, Founder & CEO of Sleepagotchi

If you’d like to learn more, reach out here! Also check out our expanded consulting service portfolio here.