Executive Summary

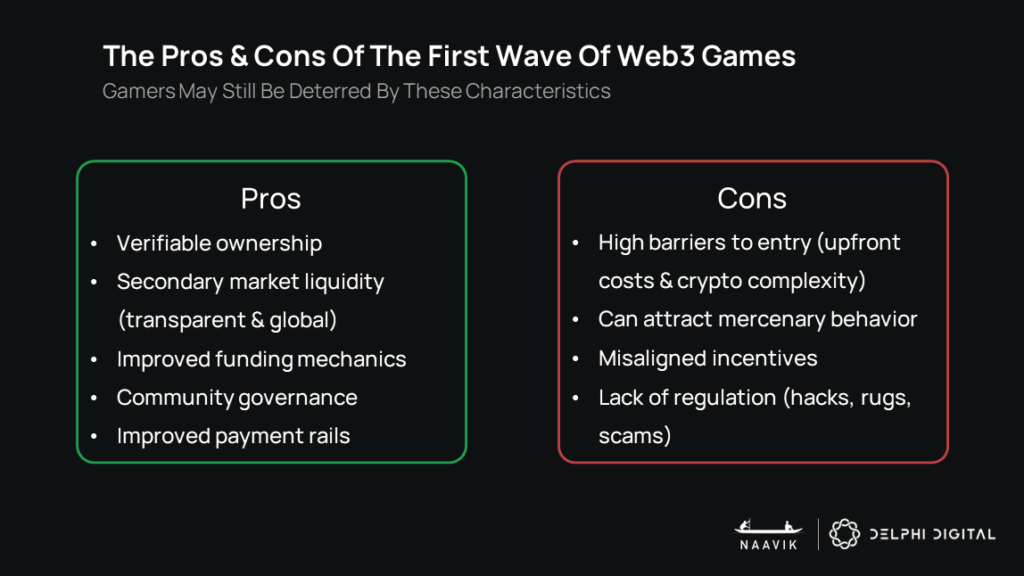

- Web3 gaming – an ever-changing term simply defined as video games with varying levels of embedded blockchain-based mechanics and economies – initially got off on the wrong foot. A widespread focus on player earnings (manifesting itself in the term play-to-earn) took precedence over fun and sustainability, which led to a financial bubble and a wild ride through the hype cycle. Now, with bad actors and unsustainable models largely purged from the system, we’re entering “The Great Reset” – a time in which builders and investors can refocus on what matters most: good games and long-term sustainability empowered by crypto technology.

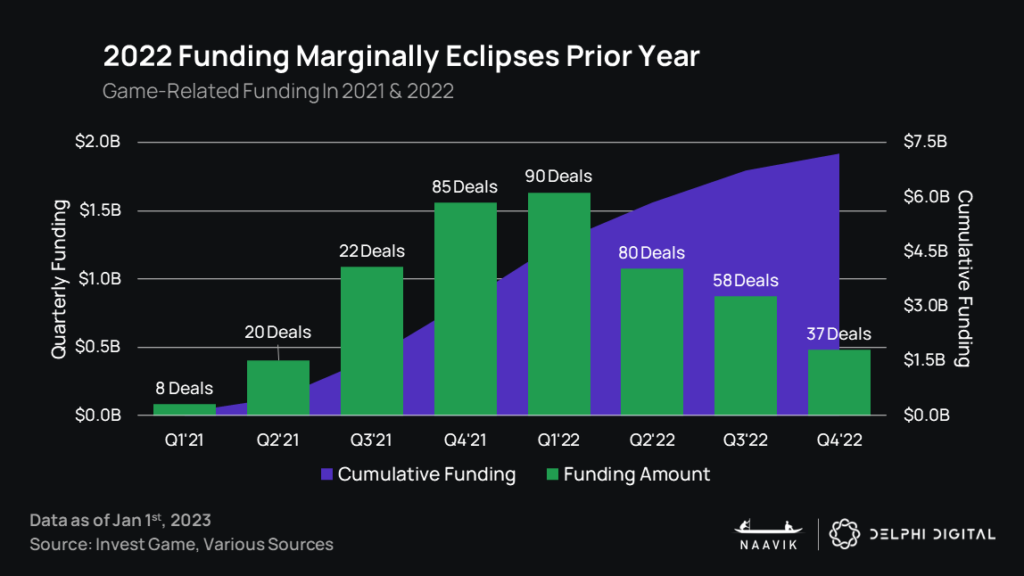

- After a turbocharged 2021, investment in web3 gaming companies grew slightly from 2021 to 2022. That said, funding levels diminished in the back half of 2022. In 2023, interest appears to be waning as the market for token launches has collapsed (driven by crypto industry blow-ups), investor rigor increases as FOMO dissipates, and everyone waits for further evidence of what successful web3 gaming will look like.

- The current state of web3 games leaves much to be desired. Most hits so far were short-lived off the back of models that proved to be unsustainable and are lacking in gameplay. Fortunately, there’s a new wave of building ongoing. 2023 might not be the year in which breakout web3 games take the industry to the next level, but the quantity and quality of building is far improved.

- Over the past couple of years, hype around land-based virtual worlds – as part of the broader NFT and metaverse fervor – was enormous. Enthusiasm (and price) has since plummeted from their highs, and leading land-based virtual world platforms like Decentraland or The Sandbox still have to prove that they can attain and retain exponentially higher user activity. We question the current economic models and their ability to compete with other non-land-based virtual world platforms, at least in the near-term, but we’ll learn more as The Sandbox in particular fully opens to creators later this year.

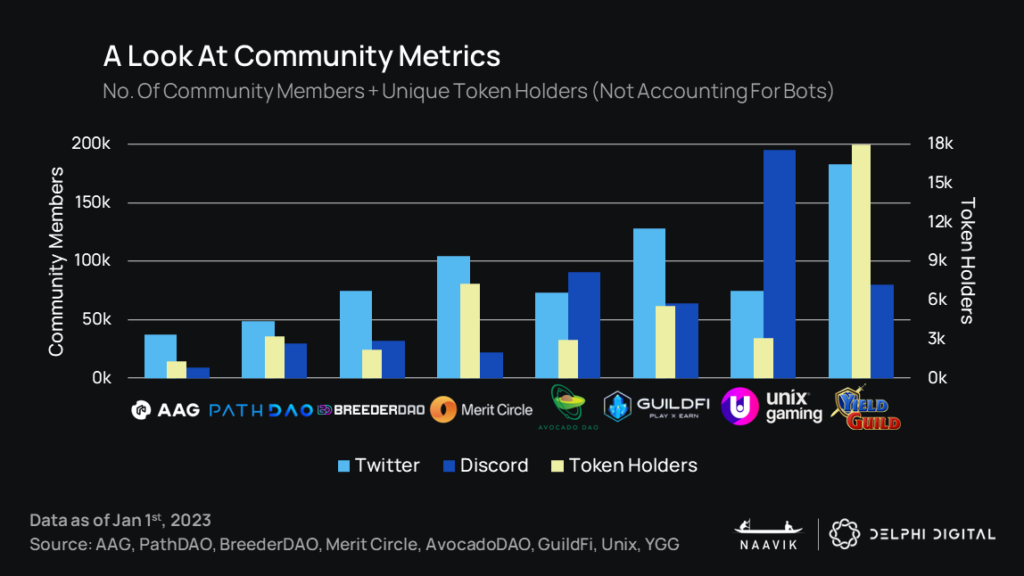

- As play-to-earn games proved unsustainable and collapsed, so have the guilds that built their businesses leveraging these games. As a result, most guilds are going out of business, and a few are hunting for ways to pivot – either building tools, leaning into esports, or finding other ways to leverage their large communities. Guilds as they existed before no longer need to exist, but we’re curious about how (and how well) the largest guilds will try to adapt in the new year.

- Infrastructure progress has mostly been a bright spot, and there’s more to look forward to. Whereas web3 games are largely back to square one, infrastructure developments – from blockchains, Layer 2s, player wallets, and developer tools – have made steady progress and should continue to. Hacks and poor UX are examples of where there’s more work to be done, but web3 games continue to be better technically supported than anytime prior.

- There is still a tremendous amount of regulatory confusion regarding crypto at large, which naturally affects crypto-infused gaming. Irregular enforcement is commonplace, which is not ideal, and it’s hard to say exactly what 2023 will bring. Similarly, when it comes to platform rules, it’s been hit and miss; in 2023, we expect more ongoing tension with Apple’s App Store, more launches on the Epic Games Store, and a continued emphasis on browser-based gameplay.

- In 2023, we’re excited to watch new games launch, new game design and economy models be experimented on, more companies of all sizes get involved, increasing collaborations across the industry, improved tooling/interfaces for developers and players, and of course all the unexpected events to come.

Introduction

Most gamers have always viewed web3 gaming with skepticism, and 2022 — with its major hacks, frauds, and FOMO-driven bubble popping — certainly didn’t help. The lowlights of the year have felt embarrassing to many in the space, and one could argue that the Wild West nature of crypto has actually done more harm than good so far. After all, despite reaching tremendous multi-tens-of-billion dollar heights a year ago, those gains have since fizzled away and unfortunately were never sustainable to begin with. At the same time, the space has made tremendous steps forward in scalability, game design innovation, talent flows, community, and more. While a skeptic might argue that it’s more or less back to square one, many teams continue to march forward and are making quiet progress.

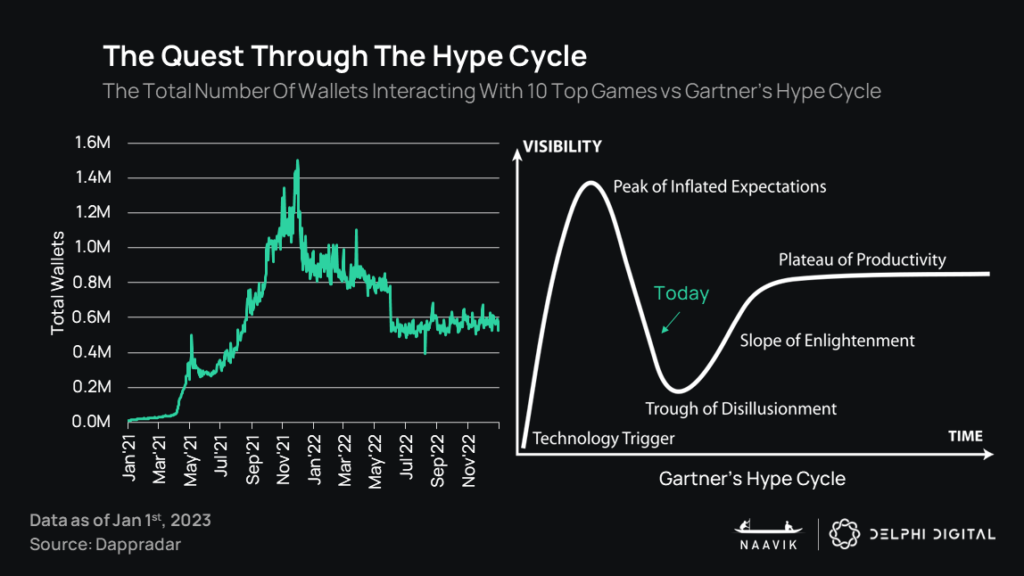

The story of web3 gaming feels new — and in many ways is — but its foundational narrative is a story as old as time. Like most emerging technologies throughout history, it rolls through the hype cycle and experiences growing pains (sometimes big ones) on its way to maturity — whatever that ultimately looks like. Of course, “maturity” is never guaranteed, and the time it takes to roll through an entire cycle varies, but it’s a useful model for understanding volatile, nascent markets.

It might feel obvious where we are in the cycle today (sentiment and expectations have plummeted), but before we stake our flag in the ground on where we’re going next, let’s take a short trip down memory lane.

The genesis of web3 gaming, the “technology trigger,” began with CryptoKitties in late-2017 (amidst the heights of the previous crypto bubble). CryptoKitties was a special because it was the first widely recognized NFT project to be minted using Ethereum’s ERC-721 token standard, but more practically it was the first time many people realized that scarce digital assets with some type of utility (like breeding and composability) could be a thing. Naturally, though, the project hit too early. Even if there was more to do with the assets, Ethereum’s network couldn’t handle the throughput. Scalability was still a distant dream, and the project’s hype fizzled away. Nevertheless, CryptoKitties played a key role in inspiring developers to think bigger about how this technology might permeate gaming more broadly.

The next milestone, Sky Mavis’ launch of Axie Infinity — a true web3 game in which teams of NFT monsters battle against each other for financial rewards — took place in 2018 to small reception. The team’s original mission was to “introduce the magic of blockchain technology to billions of players,” while “believing in a future where work and play become one… [and] in empowering players and giving them economic opportunities.”

The game began to skyrocket once Ronin, Sky Mavis’ sidechain, launched in early 2021. Spurred by financial incentives under the term “play-to-earn” (P2E), growth was exorbitant — especially in developing markets like Southeast Asia where many players treated the game as a job (the mania also coincided with COVID, which prevented work for many). By the end of the year, the game’s governance token, AXS, was worth over $40B (fully diluted), larger than all but the very biggest publicly traded games companies.

This financial success created enormous ripple effects. Dozens of play-to-earn copycats rapidly took off, dreams of games-driven universal basic income abounded, fundraising from both institutions and retail investors skyrocketed, countless guilds (who buy and rent in-game assets to players for a cut of the proceeds) became all the rage, digital land was viewed as the next great asset, and valuations across the entire digital asset landscape were higher than ever. FOMO dominated the market, and the rapid explosion of activity led many to sacrifice investment discipline as they chased the next big hit. If that doesn’t shout “peak of inflated expectations” nothing ever will. Of course, it wasn’t all negative. Even if the peaks were unsustainable, it turbocharged developer interest, put web3 gaming on the map, and led to the funding of many teams who still aim to create great games and innovate in new ways.

Unsurprisingly, and as we all know, this mania has largely come to an end. 2022 was the year play-to-earn died — or at least, more specifically, the era in which the primary driver of play is earnings.

Delphi covered the fundamental growth of the ecosystem early on, and Naavik chronicled the Axie Infinity story — as well as a report on why the initial model was unsustainable — here and here. To simplify the top takeaway: when most players aim to financially extract more value from a game than they put in or create, that lasts only as long as new players enter and put new money into the system. Even though the team had good intentions of helping people, because of a breeding-driven business model, revenue (and therefore valuations) were propped up by the pace of user growth more so than the total player count and spending (like most games). This, of course, wasn’t unique to Axie Infinity — STEPN, Pegaxy, Town Star, DeFi Kingdoms, and dozens of other “games” have similarly faced unsustainable economy-driven death spirals in 2022.

Notably, the economic fallout didn’t only affect the assets of pure play-to-earn games. The guilds around them have also been falling apart and pivoting (as we’ll discuss more below), virtual real estate (in worlds like The Sandbox and Decentraland) have plummeted, and hacks (like of the Ronin Bridge), frauds (like FTX), and platform crackdowns (like Apple’s latest App Store policies) only make the broader situation more challenging. Despite progress that’s being made in many corners of the industry, it's not surprising to see a generally bearish sentiment.

Daily unique active wallets (UAWs), a rough proxy for active users who interact with the blockchain elements of games, are well below their highs and show no current signs of growth.

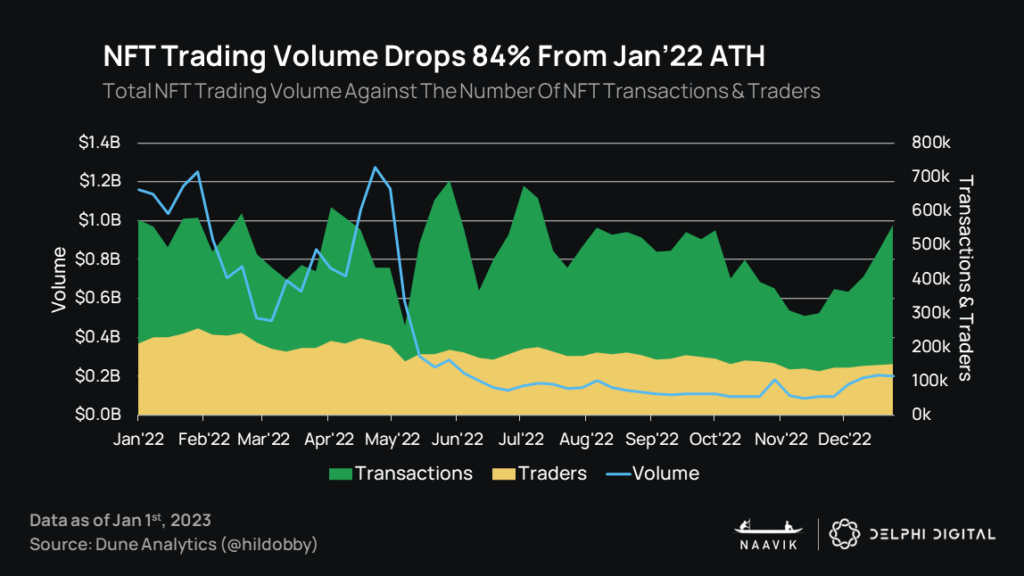

Secondary market NFT transaction volumes, which display actual economic activity across various blockchains, are similarly in the doldrums.

Welcome to the “trough of disillusionment.” The gap between hype and reality has largely closed — with many dreams having fallen much faster than progress could rise — and everyone in the blockchain ecosystem, including those who are doing interesting and compelling work, feels the pain. If reading this piece so far feels overly negative, well that’s because that’s what the market currently reflects! After all, the entire ecosystem went through enormous hype all for there to be more hacks, rug-pulls, and hate from mainstream gamers than truly great games to play (so far). This makes it harder to raise money, recruit top talent, build trust with consumers, and know what rules and regulations to prepare for.

So what’s next? Will the web3 games industry face a quiet death, or will it find its way out of the Wild West and enter the “slope of enlightenment”? And if the industry is to claw its way out of the darkness, what “enlightenments” — new games, business models, infrastructure capabilities, and more — will make that happen?

We can’t answer those questions with complete certainty, but we’ll take a shot. What we do know, however, is that if 2022 marked the year play-to-earn as a model died, then 2023 will be the year web3 gaming dramatically resets. Call it “The Great Reset,” if you will.

It may or may not be the year in which new games catapult the industry to new heights, but it should be the year of going back to the basics (and hopefully leaving the term “play-to-earn” in the past). The industry must renew its focus, reprioritize what matters most (fun, sustainable, and scalable games), and (re)establish new and old best practices. It won’t be perfect, it will take time to work through, there will be both ongoing innovations and obstacles, and many teams won’t survive, but it’s truly going to be the great reset that sets the foundation for the industry’s next (and likely superior) era.

Any reset will also be driven by the combined efforts of strong leaders and companies across the entire industry; it must be willed into existence. Fortunately, tremendous talent has entered the space, many smart companies are well funded, and many promising games are in the pipeline. Even if the details on what’s next are fuzzy, there’s plenty of reason to be excited about the long-term road ahead as many excellent teams relentlessly experiment with crypto technologies in and around games.

Several industry leaders (many of which we quote throughout this report) seem to roughly agree with our general thesis. For example, Dean Takahashi, the legendary and prolific GamesBeat reporter, puts it quite simply. He tells us:

“The time for raising money and building companies on hype is over. With the economic downturn and the crypto winter, it’s time to focus on building real products. The talent has been moving into the space from traditional gaming, based on the promise of successful past disruptions like free-to-play games. Now it’s time for blockchain gaming to move on to delivering real products. We’ll see fewer new startups and more consolidation, but those who have been focused on development should be able to launch their products into the market. Gamers will be skeptical, and so those games need to be fun first and deliver on promises. Once we cross that bridge, the market will begin to grow. But the quality bar will only get higher, and if the products are successful then the road to the metaverse will be open. I expect this process will begin in 2023, but it could take many years to fulfill.”

Ronen, a core contributor for Game7, also thinks similarly:

“The original promise of blockchain games was to help us create more equitable and fair game economies that were inclusive and collectively owned by players and developers. But the contagion following the collapse of 2022, led by incompetent 'heroes', created a crisis of credibility in blockchain technology and its promise. Despite that, blockchain gaming presents creative and economic opportunities, and the past cycle only represents its initial attempt to prove it.

It's clear now that we must rebuild the foundations and revamp education by which we will build sustainable economies and the infrastructure to support them. In the coming years, we will see successful web3 native studios create the next wave of blockchain games that are fun with a community-first approach, where players and developers collectively define their desired experience.

For web3 gaming to reach mainstream adoption, we must address accessibility and usability. Gamers don't want to pay outrageous prices for an item or wait for a node validator to process a transaction before getting their seasonal cosmetic item. In a bear market, the best products are built, and I anticipate tremendous advancement in infrastructure across L2s, Zero Knowledge technology, wallet UX, and innovation in crypto native economic game loops that genuinely highlight the promise of the technology.”

Sebastien Borget, the co-founder and COO of The Sandbox, also echoes these thoughts. He tells us:

“2022 brought a great wave of experimentation among blockchain games and some took off while others already disappeared. An excessive focus of the primitives of play-to-earn hasn’t proven to be sustainable in the long term by over-emphasizing tokenomics than actual gameplay, but the industry is ready to move over. We’ve seen it before – from arcade machines, consoles to mobile phones that simplistic gameplays prevailed initially and were sufficient to attract early adopters.

Over the mid-term, increased sophistication of game mechanics, core loops, and retention systems became needed to keep users and establish top grossing studios. It is expected that 2023 will bring more varied & rich gameplays from studios having accomplished fund raisings throughout 2022. Attracting players to create their wallet might still remain a challenge of both UX, tech and education in 2023, but once users get their wallet and own NFTs they are more likely to engage over a long time.

The Blockchain Game Alliance 2022 Members Survey still indicates that 68.9% of the 347 individual industry professionals considered “true digital assets ownership by players” as the primary appeal for using blockchain, and 89% of respondents see themselves continuing to work within one year in the industry, which shows confidence in the future. The combination of user-generated content, socialization, gaming mechanics, story telling, brands/IP and token-based incentives – where users are true stakeholders of the future of the platform they spend time into – offers great potential. And 2023 might be that year as platforms like The Sandbox or Otherside will be opening to the public.”

Why do we still lean excited, and what does a great reset even mean in practice? And where should we even look to spot the most needed innovations and changes? That’s what we’ll dig into today. This report explores:

- 2022’s most notable milestones and what they mean for the industry

- Examinations of the most important sub-trends, such as the latest with new games, guilds, infrastructure, virtual worlds, policies, and more.

- Our big open questions with thoughts on where the industry goes from here

- Further statements from other industry leaders like Robbie Ferguson, Ryan Wyatt, Nicolas Julia, and Amy Madison.

2022: Timeline of Key Events

January: Mythical Games Acquires Polystream

Mythical Games – which is creating blockchain-based games like Blankos Block Party as well as a full-service blockchain economy platform for developers – acquired Polystream, a UK-based company that developed real-time 3D streaming technology. The move was significant for several reasons. First, Polystream’s solution enables developers to stream interactive content from the cloud at scale, bypassing the need for high-tech rigs and heavy gaming clients — a strong prerequisite if virtual worlds are to move beyond PC and ultimately reach billions of users. Second, this was the second case of a web3 studio acquiring Web2-born technology through M&A, just a few days after Forte had acquired N3TWORK, with plans to integrate it into its end-to-end blockchain infrastructure. It’s notable that both companies had raised large rounds of funding in the past, namely a $150M Series C round for Mythical Games and a whopping $725M Series B for Forte.

February: The Rise of Asian Publishers + Oasys

February saw the launch of Oasys, a new EVM-compatible, multi-layered blockchain that many leading Japanese publishers have rallied around. The project’s founding team is notably composed of leaders from prominent gaming and blockchain companies (including Yield Guild Games, BANDAI NAMCO Research, Sega, and others), while its broader network includes companies such as Ubisoft, GREE, and Konami. Oasys’ gaming-focused characteristics include a natively multi-layered architecture, a flexible token design system, and “anti-scam” features. The network’s numerous partnerships with (mostly) leading Japanese publishers could signal the rise of a regional blockchain ecosystem. The Japanese government is actively taking a very pro-crypto stance, so we’re excited to monitor developments in this space.

March: The “X-to-Earn” Frenzy

Following in the footsteps of play-to-earn games, a number of companies started applying the “X-to-Earn” model to various use cases. Underlying this trend was the idea that introducing crypto-native incentives to common activities through token rewards could boost engagement and encourage lasting habits. For example, Zenbase offered users rewards for meditating; Proof of Learn came to market with “learn-to-earn” protocol; and STEPN, a “web3 lifestyle app,” made the rounds with a GPS-enabled, “move-to-earn” mobile app. Some of these apps (most notably, STEPN) gained rapid traction as the hope of quick gains drew users in and sent the apps’ token soaring in typical ponzinomic fashion. However, reality caught up with even the hottest names out there, sending these tokens back to their lows — along with other “X-to-earn” games. All in all, the trend proved to be yet another fleeting narrative and a further reminder that a model in which most users expect to profit is fundamentally unsustainable.

April: Sky Mavis’ Ecosystem Plans

One of Sky Mavis’ goals has been to use Axie Infinity’s IP, the Ronin side-chain, the Katana DEX, and the Mavis Hub launcher as the foundation for an entire ecosystem. The Builders Program, announced in April, aims to “strengthen [the] community’s ability to create gaming experiences and tools” through financial, operational, and technological support. The Axie Creator Program, unveiled in June, supports contributors in the Axie ecosystem across all skills (from artists to developers to competitive players). In November, Sky Mavis formally invited third-party studios to make the most of its infrastructure, before laying out Axie Core, its broader vision “for all Axie gaming experiences.” Despite big plans, skepticism is warranted. Anecdotally, Sky Mavis appears to have a decently long runway, but with a dwindling player base and waning cultural relevance, the team is fighting against the clock to salvage its once hot property.

May: The Ronin Hack

In May, hackers breached the Ronin Network, Sky Mavis’ Ethereum-based side-chain that powers its game, Axie Infinity. Attackers exploited the network for 173,600 Ether and 25.5M USDC, the equivalent of $625M at the time. The hackers were able to forge a withdrawal signature after getting control of five of Ronin’s nine nodes, a small validator set that “made it much easier to compromise the network.” Sky Mavis was hard hit and had to raise an emergency $150M round that, combined with Sky Mavis’s balance sheet funds, “will be used to ensure that all users affected by the Ronin Validator Hack will be reimbursed.” When Sky Mavis started reimbursing users in June, the dwindling price of ETH put the total reimbursement amount at around $216.5M. After the attack, which was later attributed to North Korea’s Lazarus Group, the team pledged to bolster its security protocols, first increasing the number of nodes on its network to 11 “with the long-term goal of having over 100.” By and large, the hack evidenced the difficulty of building proprietary infrastructure and the security trade-offs made by the Sky Mavis team in trying to expedite decentralization.

June: Illuvium Sells $72M of Virtual Land Despite Bleak Market

AAA-focused Illuvium managed to sell nearly 20,000 digital land plots (out of a total of 100,000 in the future) through a Dutch auction — a somewhat reassuring signal for web3 gaming at large, considering the past few months had seen multiple hacks and the far-reaching collapse of Terra. Tier 1-5 land is “connected to the earning side of the Illuvium economy,” as it will generate Fuel that can later be sold for ETH. According to the developer, leveraging Immutable’s L2 infrastructure “drove a 60% reduction in gas fees, with users paying approximately $20 per transaction on average.” In March 2021, Illuvium had already distinguished itself technically by partnering with Balancer on the launch of its native token $ILV via a Liquidity Bootstrapping Pool that came to a close with $90M in traded volume, the largest Balancer pool ever. We’d like to see this as a sign that developers can and indeed should extend UX considerations beyond the confines of their games.

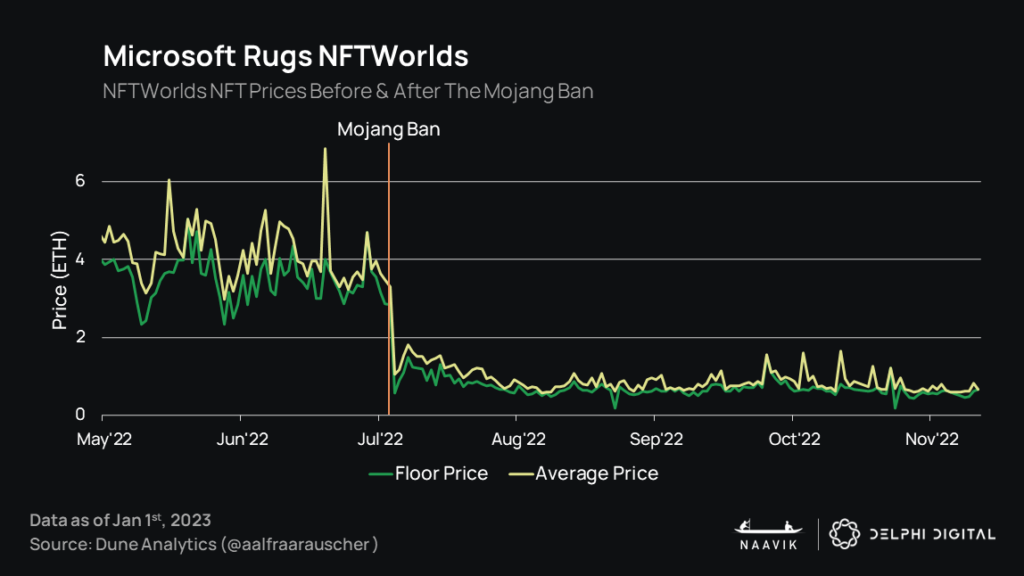

July: Mojang Bans NFTs in Minecraft

Microsoft-owned developer Mojang formally banned the use of NFTs in Minecraft, stating that the technology “creates digital ownership based on scarcity and exclusion, which does not align with Minecraft values of creative inclusion and playing together.” In particular, Mojang pointed out “the speculative pricing and investment mentality around NFTs” that encourage profiteering at the expense of fun. The announcement came after several companies, most notably NFT Worlds, started offering Minecraft assets such as skins, worlds, and mods as NFTs. Mojang’s hard stance comes in contrast with that of Roblox, which in September revealed that in-game items would soon be able to support limited supply enforced via a “scarcity contract.”

July: Former Terra Projects Migrate to L2

The sudden collapse of Terra forced dozens of projects, including gaming projects, to urgently look for new homes. On Ethereum, Polygon was quick to launch a “relatively uncapped multimillion dollar fund” in May to support those teams in their migration. According to Polygon Studios CEO Ryan Watt, over 48 projects had migrated to Polygon by July, including horse-racing game Derby Stars and the GameSwift ecosystem (formerly known as StarTerra), which debuted on Polygon Supernets in August. ImmutableX also benefited, welcoming multiple gaming projects. Both ecosystems kept up the momentum throughout the year with business development wins both inside and outside of gaming, including partnerships with established Web2 brands.

July: Yuga Labs Launches Otherside

Yuga Labs, the creators of Bored Ape Yacht Club (BAYC), launched Otherside, a virtual world set to become a hub for BAYC and other NFT communities. Developed in partnership with infrastructure company Improbable and Animoca Brands, the venue is being built with large-scale experiences in mind: Otherside’s first demo in July welcomed 4,500 concurrent participants while allowing full physics effects. In March, the debut of Otherdeeds — a collection of NFTs that serve as deeds to digital plots of land in Otherside — generated over $560M in sales in less than 24 hours, clogging the Ethereum network and causing an intense gas war. Though it’s early days, Otherside is a good example of what the most ambitious and well-capitalized NFT brands are now willing to take on. Of course, executing on this vision will be challenging, and it’s fair to be skeptical of whether investing so much into virtual worlds that prioritize scarcity over abundance is a workable path to scale.

August: Limit Break and the Start of “Free-to-Own”

Limit Break, the web3 gaming company launched by an ex-Machine Zone (MZ) team, drew considerable attention this year. In August, the company (led by industry veteran Gabe Leydon) debuted DigiDaigaku, a series of 2,022 anime-styled NFTs that could be minted for free by early supporters. That same month, the team raised $200M in funding at a whopping $1.8B valuation. DigiDaigaku’s “free-to-own” model has been hailed by some as a landmark move for the space, as it enables developers to better align incentives and encourage participation from early believers. The model, though, is not without its critics who suggest it’s not as revolutionary as claimed but rather a marketing tactic. The truth is likely somewhere in the middle, and with big ambitions and ample funding, the Limit Break team seems intent on bringing web3 gaming to the masses.

September: The Epic Games Store Supports its First web3 Game

In September, Epic Games listed its first web3 game on the Epic Games Store: Mythical Games’ Blankos Block Party, a 3D party game that the studio says has amassed over 1M users. Like Epic Games’ own title Fortnite, Blankos leans heavily on avatar skins and accessories, an obvious use case for NFTs. The Epic Games Store’s pipeline of blockchain games also includes Gala Games’ western-themed battle royale title, Grit, which was originally set to debut first. Epic’s willingness to support early web3 gaming projects puts it in sharp contrast with its competitor Valve, which in December 2021 announced a blanket ban on NFT-powered games on its own platform, Steam.

October: Apple’s Limiting NFT Policies

Apple made it clear that it will tax NFT-related transactions just like any other in-app purchases. The company’s updated guidelines gave developers a formal greenlight on enabling the minting, listing, buying, and selling of NFTs but made those transactions subject to the App Store’s usual take rate of 30%. Developers also aren’t allowed to create “buttons, external links, or other calls to action” that might circumvent the App Store’s payment rails, or to accept crypto payments. The announcement came after multiple industry leaders (from Meta to Starbucks to Nike) have started leveraging NFTs for their own use cases. Apple’s renewed stance drew backlash from crypto proponents, who saw the move as a striking example of monopolistic rent-seeking and another reason why Apple’s antitrust leanings need to be regulated away.

November: FTX Blows Up

After a liquidity crunch, FTX was exposed as a fraud that, most notably, illegally tapped into customer deposits to fund its sprawling ambitions. Not only is this an enormous setback for the entire crypto industry in terms of maintaining consumer trust, but we’ve now seen trickle-down effects across the industry, including gaming. For starters, the company was involved in numerous web3 gaming projects, through both FTX Ventures and Alameda Research. The company also owned a large stake in the Solana network, which got stress-tested as FTX sold significant amounts of tokens. In addition, many companies (including gaming teams) held part or all of their funds on FTX at the time of its bankruptcy. Losing a significant chunk of their liquid assets dramatically shortens runway for these teams, adding pressure in an already tense funding and macro environment.

December: The NFT Royalty Battle

The debate over royalties support on NFT marketplaces evolved into a battle over NFT standards and control. After originally moving towards not supporting royalty payments for creators, both Magic Eden and OpenSea were forced to backpedal in response to community backlash. Both players ended up pushing for their own standard (Magic Eden’s Open Creator Protocol and OpenSea’s Operator Filter Registry, respectively) as a way to enforce royalties for willing brand new collections — leaving backward compatibility for existing projects out of the picture. Metaplex, the developer of the NFT standard on Solana, was dragged into a public spat when Magic Eden accused it of governing the standard for its own benefit. The (ongoing) argument is proof that the whole debate about control and decentralization is still far from settled. One of the selling points of NFTs is that their owners, not the creators, get to decide what to do with them. At the same time, making royalties optional understandably casts doubts on web3’s ability to foster a fairer compensation model for creators. Even though much of the debate has focused on NFT art, it directly affects games looking to use secondary transactions as one of their revenue models.

Next, let’s break the market down into a few different components – funding, live games, guilds infrastructure, and rulings/regulations – to discuss how the industry evolved over 2022 and where it could go next.

The State of Web3 Gaming’s Market & Funding Environment

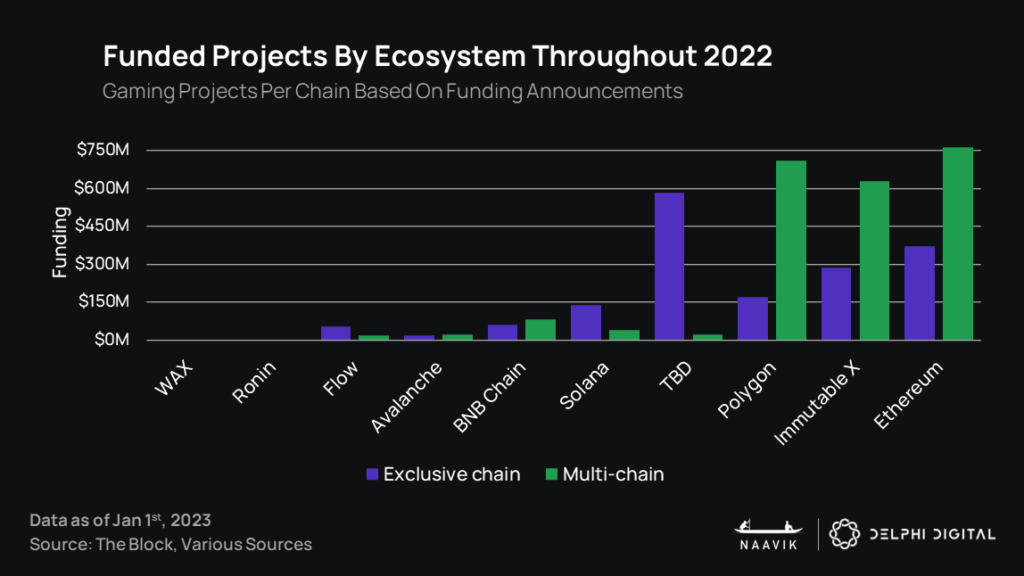

As previously mentioned, the increased hype and speculative growth caused by the first-generation of blockchain games led to an influx of talent as well as both institutional and retail investment. By early 2022, over 50% of all crypto deals were gaming-related, following a total of $3.6B raised by gaming projects in 2021. This figure was marginally surpassed in 2022 with ~$3.7B raised as illustrated in the graph below, although the number of deals continued to decline throughout the year.

That being said, we are encouraged by the quality of talent moving into the industry, and there have been a number of exciting projects that were able to raise the funding needed to deliver the next generation of blockchain games. Even though they may not be as repeatable in today’s market environment, we also saw a number of standout capital raises, namely Limit Break’s $200M raise at a $1.8B valuation, Sky Mavis’ securing $150M following the infamous Ronin Bridge hack, and Animoca Brands' $185.3M raise at a $6B valuation (they went on to make five large gaming deals throughout the year worth $54.2M).

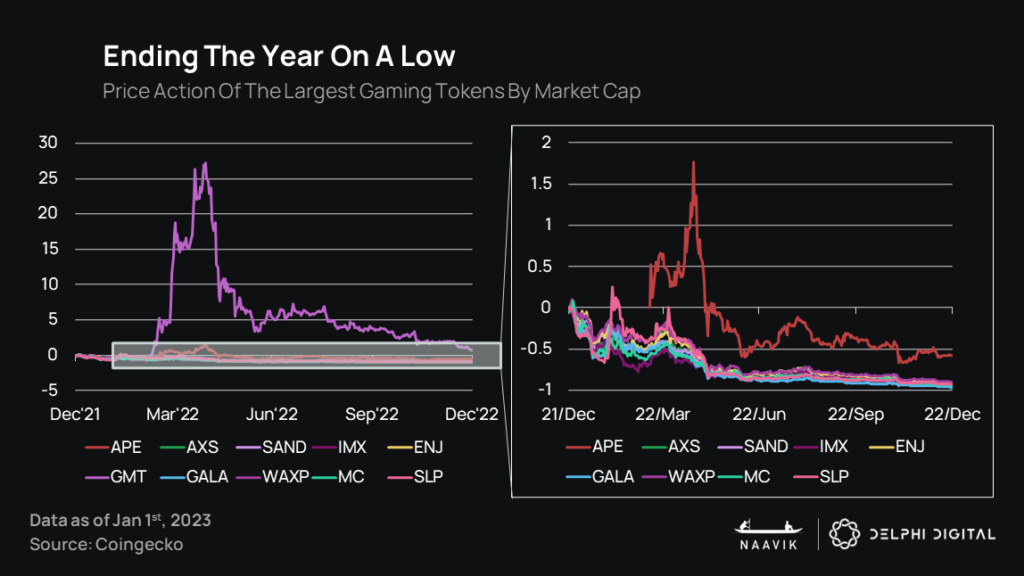

Since the start of the year, the top 10 web3 gaming tokens by market cap have fallen by an average of 97%. This is partly due to the overall decline in interest from retail investors; however, as we alluded to earlier, the primary factor is the inability of the first generation of web3 games to maintain sustainable in-game economies and active player bases.

The drop-off in on-chain wallet interactions and transactions for gaming projects is an indicator of disinterest in the current selection of web3 games. As in-game profits declined and these games failed to be truly fun, players simply left. Some of these players – especially those who viewed playing more as an income-producing job – were bound to leave anyway, but, in short, old games fell off faster than new and improved games could get off the ground. This is not shocking, because great games take time to build, but the collapse of users still hurts.

All that said, the number of web3 games that have come out of stealth mode continues to grow rapidly, and many blockchain ecosystems are still benefiting from this rise.

Is Consolidation Coming?

Despite an active funding environment this time last year, the numerous hacks, frauds, broken token economies, and plummeting prices have inevitably cast a shadow over the industry. Though some firms are still actively supporting the space with substantial capital — such as BITKRAFT and Framework, which have raised significant funds — the overall funding environment is getting tighter. More rigorous investment diligence is raising the bar for getting funded, especially for large rounds. There are still plenty of rockstar teams out there, but many web3 gaming projects that might have raised funding in a less demanding market may now struggle to raise money for the foreseeable future.

As such, fewer new companies will get off the ground, and others without sufficient runway may struggle to survive, which could decelerate the talent flows from established studios. Slowing talent flows isn’t to be celebrated, but at the same time it also creates an environment in which charlatans and grifters are less likely to succeed, which is important for moving out of the Wild West stage the industry is currently in. This environment – while grim – also should enable the most capable and well-capitalized teams to outlast the depths of the winter, out-execute the competition, and ultimately stand out in the market. And as these top companies scale, it increases the odds that we’ll see a new type of consolidation in the space commence.

Traditionally, active consolidation is often a sign of a healthy market – large, ambitious, and (usually) cash-generating companies unlock new growth avenues while the upstarts have more exit opportunities, incentivizing even more entrepreneurship. In the games industry, that means that if a young company has a successful game or tool on its hands, there’s often a bigger buyer willing to scoop it up and add it into its portfolio.

Web3 is naturally different. Even if the industry were thriving, there are new considerations. How does M&A make sense when value is captured more in tokens than in equity? And how would it work when many teams aim to decentralize governance over time? In short, the current world of web3 is structurally less inclined towards consolidation. Plus, we have to face the fact that acquirers in the games industry typically only want to buy companies with successful products – an area in which web3 gaming is still sorely lacking.

For now, this question is mostly moot. Consolidation is more likely to happen once successful products exist that are worth consolidating. It’s not hard to imagine web2 and web3 game development tools merging together, for example, or major publishers buying their way into web3 via successful studios (like they did with mobile). Even though web3 has some differences, success is what will drive consolidation, and that will simply take time to play out.

The State of Web3 Games

Let’s now take a look at a few gaming projects that experienced the highs of 2021 and are now redefining what they think it takes to survive in 2022 and beyond. There are many games that we could point our attention toward, but for the sake of brevity let’s center on a handful of games that most defined the narrative for this year: Axie Infinity, Sorare, STEPN, and land-based virtual world platforms like The Sandbox and Decentraland.

If you are to take any one lesson from this section it should be: video games in which the dominant incentive is the profit motive will always fail. We’ll dig into each game to explain why that is, as well as one game that is bucking the trend and found a sustainable model.

Axie Infinity

We would be remiss to not touch upon the game that has arguably onboarded the most users into web3 gaming. In late 2021, Axie attracted mainstream attention by providing underserved communities with a source of additional income during a global pandemic.

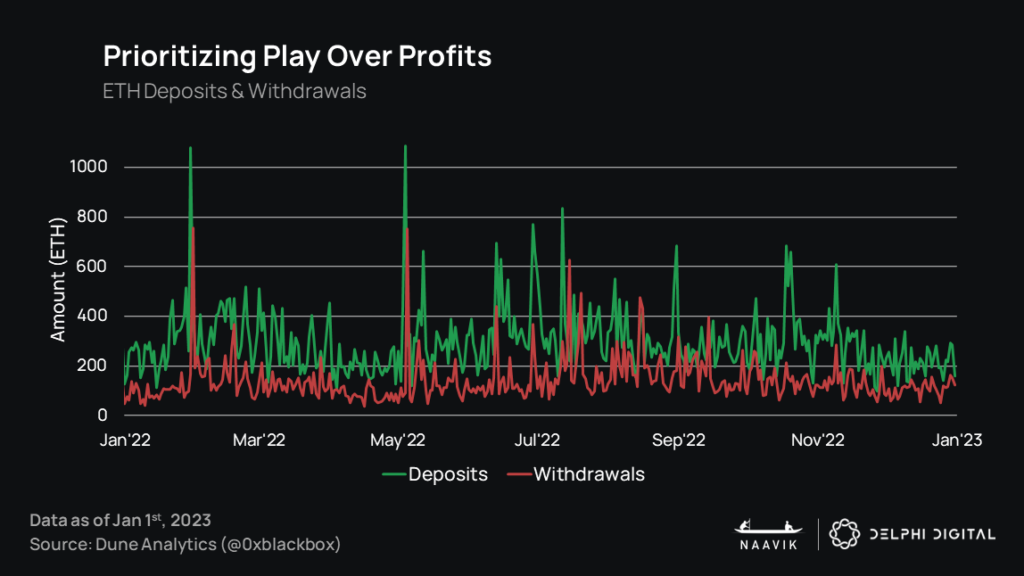

There was a time when Axie Infinity was the most-used blockchain application, generating more fees than both Ethereum and Bitcoin combined. Sky Mavis’ proprietary sidechain, Ronin, processed 15% of all NFT volume, representing more than all scaling solutions combined. However, the project hit those metrics based on the premise that players could earn a meaningful real-world income. Players were prioritizing profits, web3 gaming guilds were created to industrialize economic activities (more on this later in the report), and the in-game economy was reliant on a constant instream of new users.

The combination of inflated asset prices, the beginnings of a market crash, rapid token inflation, rebalancing efforts that reduced in-game earnings, and an increasingly negative sentiment towards P2E gaming slowed the number of new users entering the game. Since the peaks seen in November 2021, asset prices have subsequently entered into a downward spiral and Axie Infinity’s daily active users (DAU) has been on the decline as earnings took a back seat as the leading retention incentive.

Since the start of the year, daily volume has decreased by 97%, NFT holder count has dropped by roughly 30%, and the number of daily unique active wallets interacting with the game's on-chain elements has fallen by 92%.

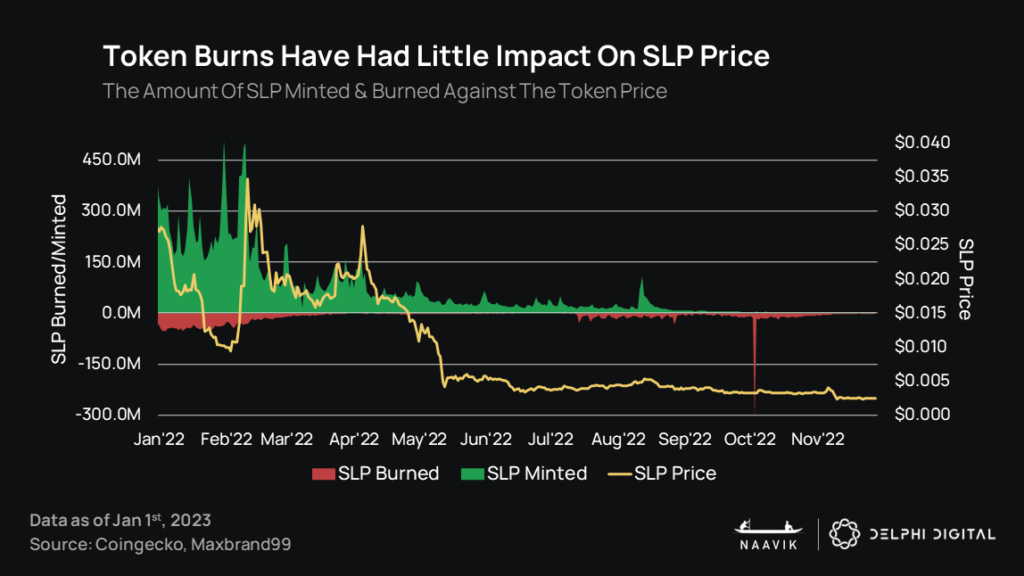

In a bid to re-engage its user base and attract real players, the game is in a state of transformation. Throughout 2022, the Sky Mavis team has implemented more than 20 updates for Axie Infinity/Origins. The vast majority of these were centered around gameplay balancing, but it was also nice to see a number of deflationary sinks introduced, along with increased token fees (for crafting Runes and Charms) and adjusted token rewards. Several updates include breeding fees tripling, an increase in marketplace fees, a rebalance of economic faucets, and new game modes such as Axie Origins (which leans into free-to-play). That said, we’re yet to see evidence in the data of this having the desired effect. Despite these efforts and the project burning more than 14B SLP tokens in the process, SLP prices are still down as much as 99% from their all-time highs. AXS, the governance token, and the Axie NFTs themselves are fairing similarly.

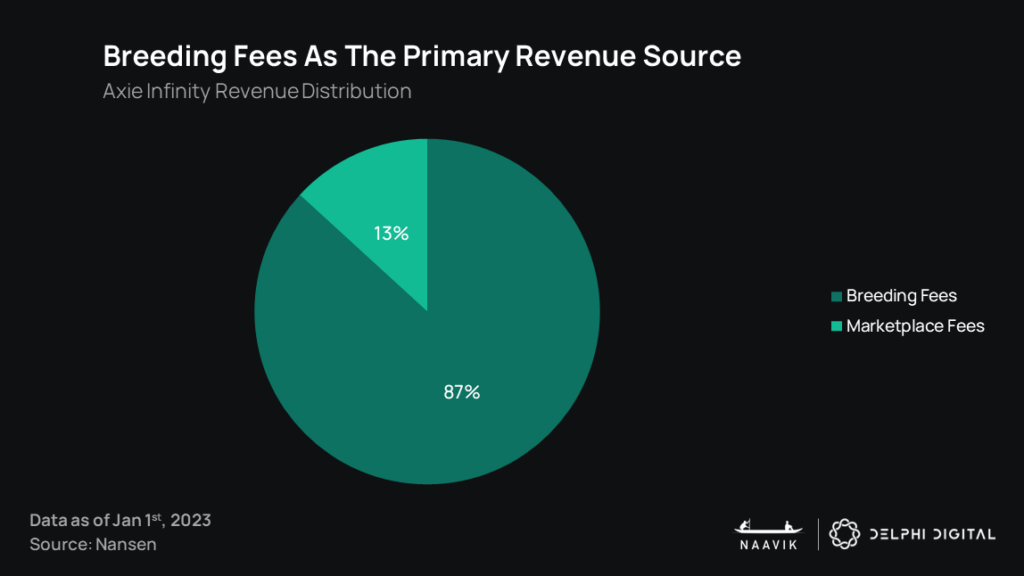

The game’s revenue is mostly made up from NFT breeding fees, a mechanic that ultimately leads to further asset inflation (so pricing deflation). Furthermore, some balancing efforts have adversely impacted the capital-constrained players, who are more sensitive to increased breeding fees and changes made to what is required of a highly competitive team of Axies.

The recent launch of Axie Origins, which lowers the barrier of entry for new players, and efforts to build out the ecosystem with new experiences from third-party developers are both theoretically steps in the right direction, if well executed. However, it’s not a panacea; Origin in particular exists to broaden the game’s top of the funnel (remember: onboarding new users to buy Axies is what helps keep prices up), but since the underlying economy is still P2E-focused, it wasn’t a major step forward in terms of sustainability. Furthermore, the builders program has yet to generate high quality experiences or have a notable impact on user acquisition and retention. While we applaud the team’s innovative spirit, steady stream of updates, and efforts to turn the ship around, Sky Mavis will need to either revamp its strategy or find other means of fully kickstarting its ecosystem again if it hopes to make a comeback. It must fully abandon its P2E roots and instead build a winning community based on having an increasingly fun game. We’ll be rooting them on in 2023.

Sorare

Sorare, a leading free-to-play web3-based fantasy sports game that started with soccer, garnered a lot of attention in late 2021 after its large $680M Series B. The project has partnered with sports stars Serena Williams, Lionel Messi, Zinedine Zidane, among others, and confirmed partnerships with new prominent sports leagues. The number of partnered soccer clubs reached 250 by July, and there are currently more than 10,000 athletes available as NFT cards.

Nicolas Julia, co-founder and CEO of Sorare, frames up the situation well:

“After an exuberant 2021, many expected a cool-down in 2022. It's been a tough year for communities operating in the web3 space, from exchanges to creators and games. Within the non-fungible landscape, this year clearly showed the importance of building NFTs that can provide access, social capital or utility. At Sorare, since day one, our thesis has been that non-fungible technology is a paradigm shift for the gaming industry. It's now possible to give back powers to the gamers by giving the ownership of the items they buy in-game. They are free to own, play, trade and use gaming assets backed by non fungible technology such as Sorare cards as they wish. In 2022, we've kept growing despite these difficult market conditions. We launched two US Sports with the NBA and MLB, grew our trading volume and user base. Tough times are for builders and we'll keep being focused on building a product that will help educate passionate sport and gaming fans to the benefits of truly owning gaming items.”

Naturally, Sorare’s successful start was not enough to immunize them from the 2022 market crash, with floor prices for their in-game assets dropping as much as 90% since January. However, according to Cryptoslam, the project has remained in the top ten traded NFT collections (based on sales volume and the number of transactions within a 30 day period) month after month the entire year. This is notable – despite Sorare garnering relatively less mainstream attention than some of the other projects mentioned in this report, the game represents a more sustainable model for blockchain-based games.

This is because the game eschews a complex token economy and instead centers around a simple NFT-based one. Simply put, Sorare regularly sells new athlete NFT cards each month and gives back part of the proceeds as rewards in the game’s weekly tournaments. The game has net-inflows (you can see this clearly in the chart below), which is profitable for the business. Plus, players understand that not everyone can profit, and there’s potential future upside if Sorare ever decides to institute royalties or charge players for transaction fees.

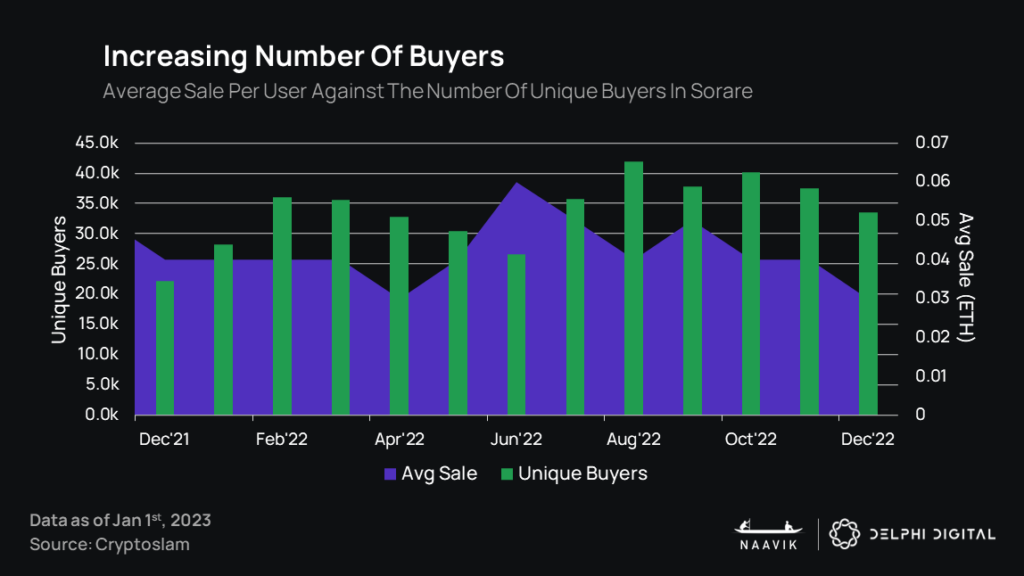

Despite a fall in NFT floor prices, user engagement is higher than it was in December 2021. The team reports that Sorare’s first-party marketplace saw a total of 2M transactions as of March and the average number of transfers per user is just under 50. Unique buyers have increased 51% YoY, and monthly average sales have remained relatively stable throughout the year.

Sorare has also steadily rolled out updates and improvements to the user experience, which helped facilitate the positive metrics listed above. For starters, the official Sorare app launched on both iOS and Android devices (hitting 500k downloads), and users can purchase in-game assets (NFTs) with fiat using payment processors such as Moonpay. It also helps that these users skew toward more developed, higher income regions (versus the developing, lower income regions that most P2E games reach). Furthermore, marketplace updates, such as the new counteroffers and price history features, have made it easier for users to assess and trade assets, and Sorare has done a great job of empowering its community to build new features. New social features, such as private leagues and the “Play with Friends” competitive leaderboards, also are nice touches. According to data.ai, app retention admittedly doesn’t look great versus industry benchmarks – so there’s more to improve on from a mobile lens to maximize that growth channel – but it still is a standout success for a web3 game these days.

With its impressive list of prominent sports figures and organizations, and many more planned for the coming year, Sorare is well positioned to not only weather the storm but to come out the other end with an even more compelling product. What’s left is to see if they can continue to improve the user experience, further abstract the complicated blockchain elements, maintain their competitive advantages, and successfully reach a wider (non-web3) audience.

STEPN

By mid-2022, the hype behind the P2E craze was starting to die down as in-game earnings for games like Axie Infinity began to fall. However, as we highlighted in the Key Events section above, when many games should have been focusing their efforts on developing fun and engaging game loops to attract and retain users, we instead saw a rise in the number of projects transitioning to the “X-to-Earn” movement.

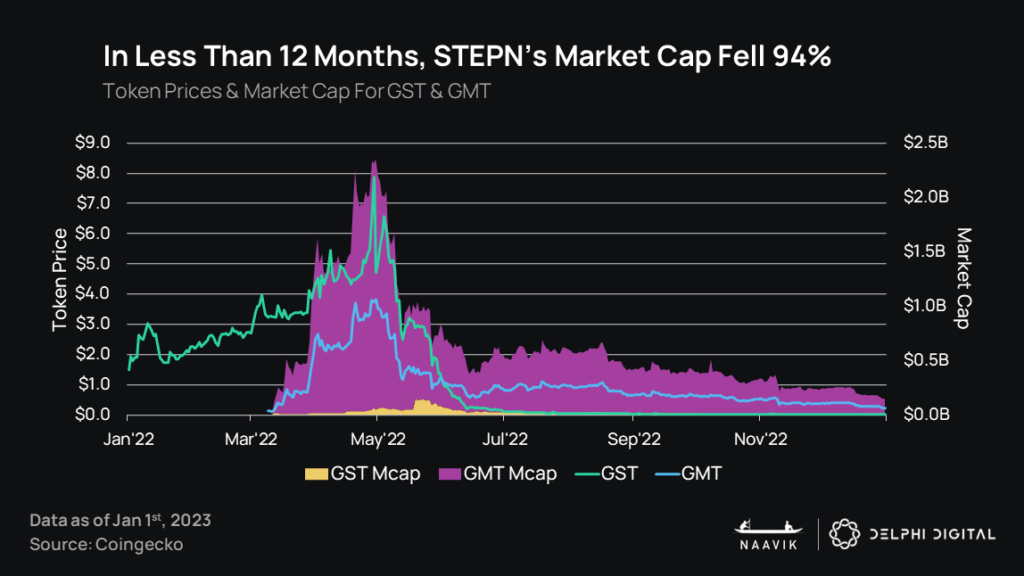

One project in particular that took full advantage of this new trend was STEPN, a casual mobile fitness app that financially rewarded users for going outside and taking a short walk. On March 30th, the trading volume for GMT surpassed that of BTC and ETH, and the app had a self-reported 2.3M monthly active users. By late April, the project’s two tokens, GST (in-game utility token) and GMT (governance token), had increased in price by roughly 400% and 2,600%, respectively. And at its peak, STEPN was facilitating $200M of daily trading volume across 300K+ transactions, making roughly $1.4M in fees.

The premise was simple: users were required to purchase Sneaker NFTs that would convert their physical steps into digital currency (GST), which could then be cash-out or reinvested to increase token yields via a number of inflationary sinks. Additionally, users could breed their sneakers to mint more NFTs, increasing their net token earnings or selling them on to other users.

Sure, this product promoted an active and healthy lifestyle; however, it was really just smoke and mirrors for a completely unsustainable model. Imagine: Players buy scarce Sneaker NFTs in order to start exercising and earning; the yield is lucrative, which inspires more people to join. Sneaker prices go up as demand exceeds supply, and GMT/GST grow in value because they’re burnt when new sneakers are minted and are more in demand when users want to buy sneakers. Also, since upgraded sneakers increase yield, players are also motivated to sink tokens in order to achieve those upgrades, which leads to sinks in the short-term but more tokens released over time.

So where’s the problem? Well, if you squint closely, you’ll notice that the underlying engine behind the value creation here perfectly correlates with the pace of new user additions (not even the number of total users). And the same ponzinomic model that accelerates wealth creation on the way up creates a similarly powerful death spiral on the way down. After all, if new player growth slows (which based on the law of large numbers is inevitable), then so does the demand for new sneakers; if sneakers are in less demand, then sneaker prices fall and fewer tokens are burned; this leads to more tokens being minted than burned, creates a higher circulating token supply, and ultimately leads to lower token prices; then, if token prices are lower, then the yield naturally fall, and if the yield falls, then there’s less reason to buy sneakers, which keeps the feedback loop rolling all the way to zero.

Hence, complete value destruction. GST and GMT have since fallen ~100% and 93%, respectively, from their all-time highs.

It’s a reminder that there’s no such thing as a free lunch, and if you don’t know where high yield comes from, then you as a user are the yield. And that simply cannot last.

Sadly, the narrative of move-to-earn was just a reskin of previous models already proven unsustainable. Hopefully, at this point teams have learned their lesson and we won’t see similar models gain traction in the future.

If the above three case studies have taught us anything, it is that sustaining a game made up predominantly of net-earners is impossible. This is not to say earning never has a role, but game economies must be designed for net-inflows; rewards are ideally given to those who create outsized value for the ecosystem, or they’re given to a minority of players who standout above the rest in some way. Every game is different, but ultimately developers should strive toward making games with fun-driven incentives that encourage users to delay their “return on investment” in favor of enjoyment.

Land-Based Virtual Worlds

The “metaverse” – often oversimplified down to immersive, land-based virtual worlds – became one of the most hyped sectors in late 2021, with estimates of virtual real estate becoming a multi-trillion industry by 2030. This led to a number of impressively large funding rounds as well as Meta committing $10B to metaverse developments. Investors subsequently sank over $120B into virtual world-related projects in the first half of 2022, more than double the amount raised in 2021.

The metaverse hype train dramatically impacted the highly speculative crypto market, with the total digital land market cap (excluding fungible tokens) across the two largest projects – The Sandbox and Decentraland – reaching $1.2B in November 2021. Virtual land NFTs reached an average price of $18k by January 2022, the Otherside land mint by Yuga Labs caused network-wide Ethereum congestion and average gas fees of $5,000, and total secondary trading volume for virtual land NFTs hit almost $2B by May.

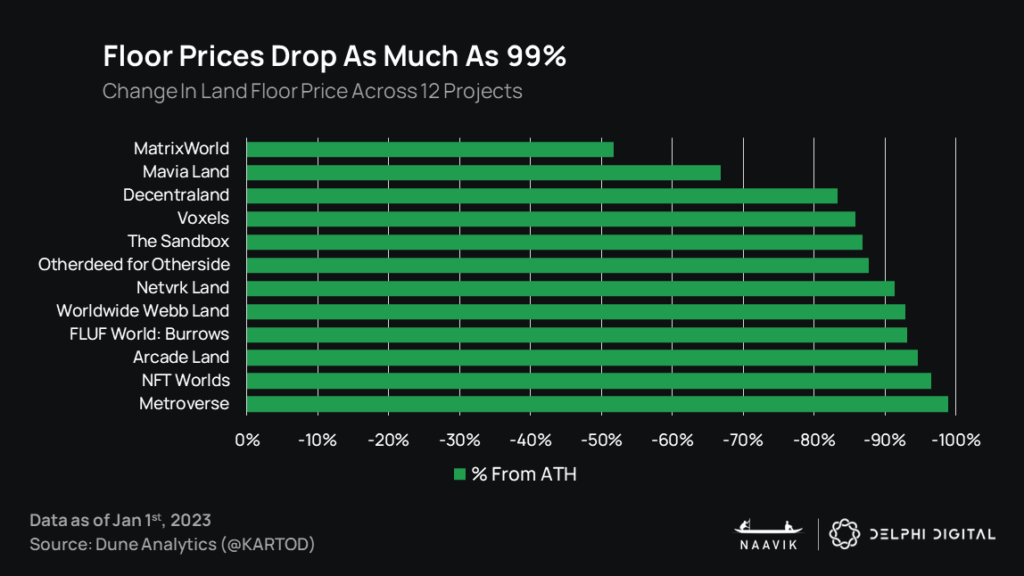

However, there was little in the way of real value to justify these bloated valuations, so it didn’t take long before this speculative bubble popped. Since the start of the year, trading volume is down 77% and NFT floor prices across the most popular virtual land projects have dropped as much as 99%.

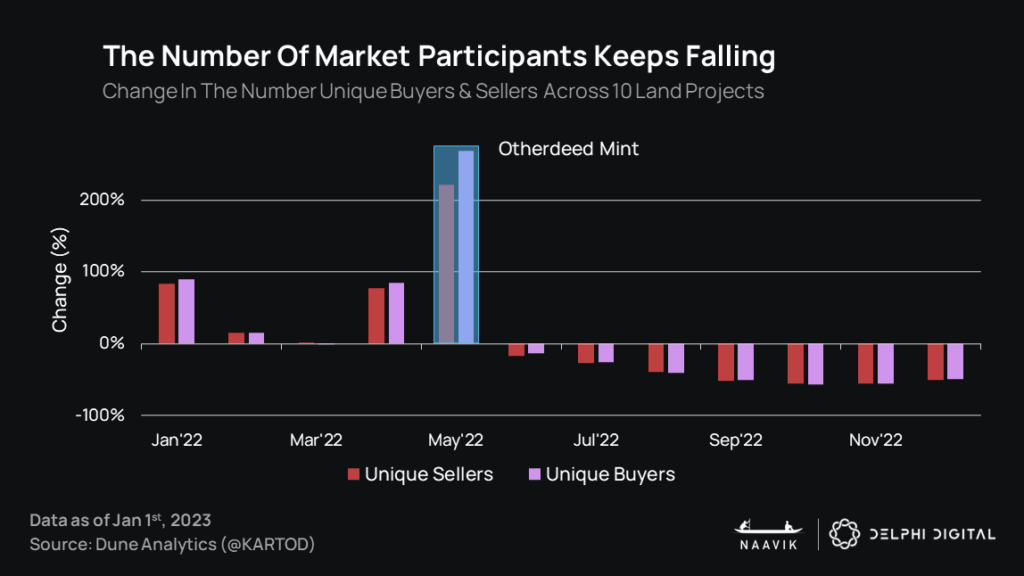

Additionally, the number of unique trades has decreased by 98%, and the number of unique sellers and buyers has been in steady decline since the Otherside mint in May.

It may be true that less-than-optimal market conditions compounded the dramatic fall in these metrics. However, a more glaring issue is the lack of active recurring users within web3 metaverse projects. The Sandbox team has reported that there were 350k total active users during Alpha Season 2 event, which launched in March. Based on The Sandbox’s most recent statement, this number increased to only 360k users in Alpha Season 3, which had almost three times as many experiences available to players. Decentraland keeps these figures closer to its chest but has supposedly only reached between 300k and 600k MAU.

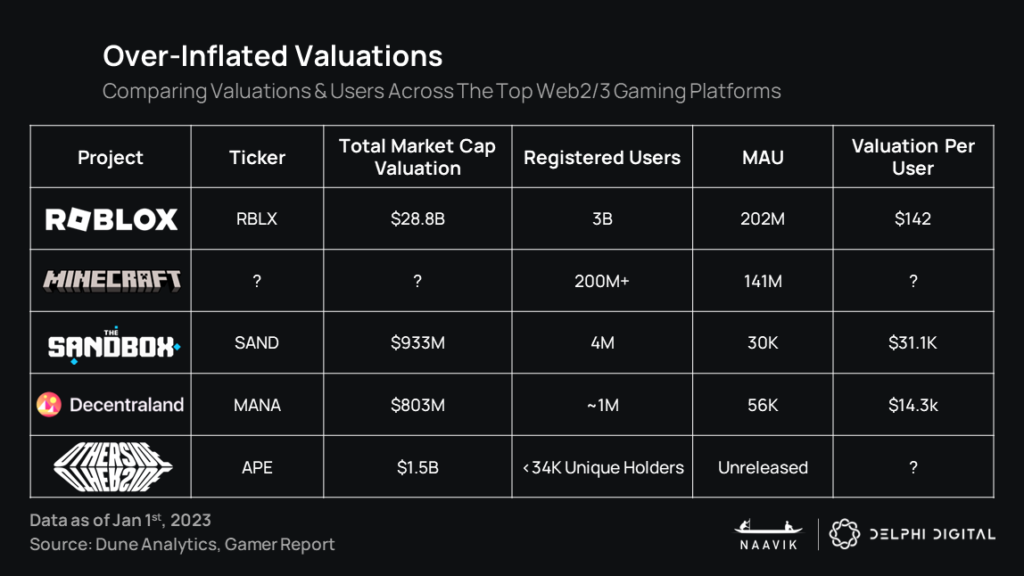

It is important to put things into perspective. There is still an evident disconnect between market valuations and active users when compared to the Web2 competition – the issue being that many of the most notable web3 projects have been valued as if they were already successful (especially at the highs of last year). Although their monetization models may differ, there is limited data to suggest that the average revenue per user (ARPU) will be dramatically or sustainably higher than the Web2 alternatives. Even though the total combined land market cap for DCL, TSB, and OTH has fallen by 71% since January, the valuation per user for top competing web3 virtual worlds is still as much as roughly 200 times higher than Roblox’s.

It is still early days for Otherside, which conducted a successful mint and one-day beta event earlier in the year. Phase one of the project will be an 11-part narrative-driven game available only to landholders. Phase two of the project will seemingly rely upon the community to create new experiences that may or may not be available to the wider public.

Decentraland estimates their DAU to be around 8,000 as of October, but the number of concurrent users only exceeds ~500. In reality, Decentraland largely feels like a half-built and empty town, and there is very little to do in the Decentraland virtual world apart from playing poker and hanging out with friends. Furthermore, similar games, such as VRChat, have 100 times the DAU and roughly the same market valuation.

The Sandbox has managed to secure a number of high-profile partnerships in 2022, with more than 20 being announced in the second half of the year. Partners include notoriously crypto-friendly personalities like Paris Hilton and Snoop Dogg, prominent IP such as Ubisoft’s Rabbids and The Smurfs, and global brands from HSBC to Gucci. Each such activation typically came with its own set of exclusive NFTs, a good way to gauge, and monetize, community engagement. However, these collaborations have not proven to generate much upside.

Interestingly, these collaborations have yet to create much upside – perhaps because the platform is still in beta – but it still gives some skeptics pause. Part of the reason for skepticism is simple. There simply isn’t yet enough great content to attract new users and consume players’ time. But the “why” behind that is more telling. Some of it has to do with lacking network effects and more primitive design tools, but the land-based model is the bigger issue and may be more problematic than many first thought.

Land creates a few complications. Most importantly, if land is required to create or host experiences, then the landowners become middlemen between creators and players. Not only does this greatly increase barriers to creation in general (Roblox, for comparison, allows anyone to create for free), but landowners can set terms with creators and have ultimate control of what exists on their land. This is not creator friendly, adds friction to the experience, and it will cause the best creators to go to other platforms where they don’t have to deal with often money-hungry middlemen (who are looking to break even and profit on what they paid for land). If not well managed, land can also lead to broader economic issues or downturns within a game. For example, landowners can have different incentives from other participants, and if they have voting power can hold the entire economy back if progress means lower land prices. Landowners can also choose not to build on their land, which resorts to empty or half-built spaces that hold the economy back further (a land value tax, discussed at Naavik here, is a potential solution in order to incentivize economic activity); this is a prominent issue in Decentraland. And in The Sandbox, what users can build can only be as large as the land itself, which is a silly way to hold creators back when in digital worlds space can be made infinite.

In short, not only do virtual landowners in most cases so far capture more value than they create (in fact, many exist to only capture value and not create), but they are a wedge between users and creators. And when landowners are given too much influence, it pushes creators away, which is the exact opposite of what you'd want to see happen, because great creators are ultimately what attract users. Platforms paying early creators can only go so far – and honestly should be done more to kickstart these ecosystems – but it won’t matter in the long-run unless the policies around land dramatically change, which would likely infuriate landholders in the process. Healthy economies instead lower barriers to creation, reward the creators themselves for creating outsized value (not any sort of middlemen), make land less location dependent (therefore reducing the variance in prices between lots), and ensure that land isn’t the only way to get access to needed materials for play.

Similar to our assessment of the early web3 games, most early virtual land based products likely won’t be the ones to succeed unless they make major changes. Decentraland may not be a long-term winner since it doesn’t have a centralized guiding force for change, and its platform is already seeing heavily reduced engagement. The Sandbox has more potential for greater change given its run by Animoca Brands – not to mention the fact that it opens up to the public more this year – but we’ve yet to see them take actions that lower the influence of landholders and dramatically lower barriers to entry for creators. And there’s much more to learn about Otherside, but it too will have to ensure it doesn’t overly cater to those with specific and scarce assets if it also wishes to be more mainstream.

It’s also worth saying that web3 land-based games don’t need to all be UGC, which has been the early trend. Many early movers who combined land with UGC may stay in the doldrums, but other emerging players who can learn and improve from these examples – such as Illuvium, which includes land but isn’t UGC and has a smarter economy design – have real chances to level up the status quo. It’ll take a bit more time to see who the winners will ultimately be, but we’re optimistic that newer entrants will begin to launch more attractive games with better models over the next couple of years. They might not light the world on fire in terms of metaverse dreams and trade at billion dollar market caps, but they’ll have better odds of finding real success with real users.

The State of Guilds

The rise of P2E brought with it an increased demand for in-game NFT assets that opened up the ability for players to earn additional streams of income from P2E games. Taking full advantage of this demand, several web3 gaming guilds rose up to industrialize activities around in-game economies by supplying scholars with assets and taking a cut of the profits. The early entrants profited handsomely and raised large amounts of funding in their efforts to onboard underserved communities that relied on in-game earnings during a global pandemic.

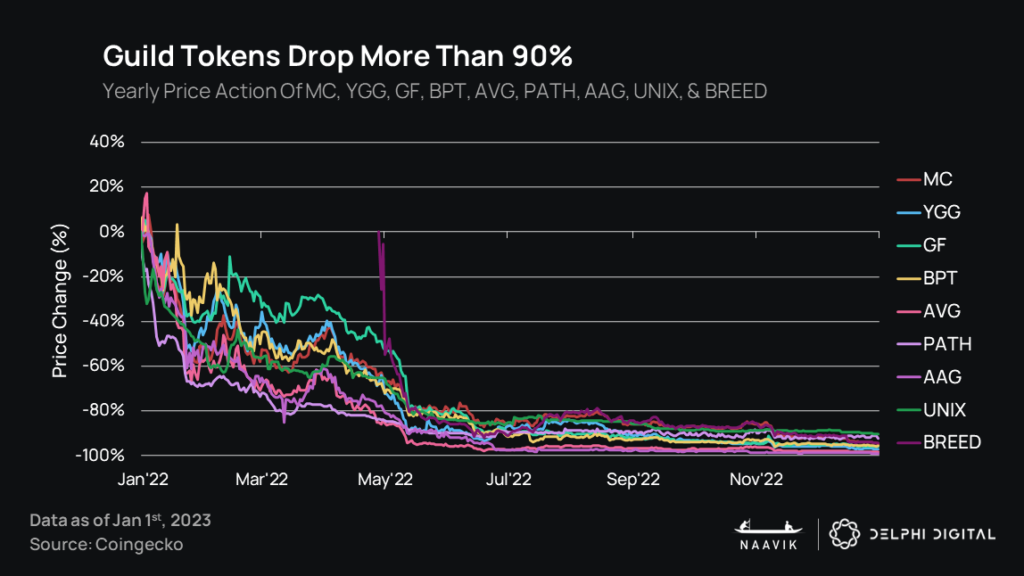

However, as in-game profits fell and the hype behind P2E died down, so did the demand for guilds and their scholarship programs. Since the core premise of games where the earning component is the primary motivator has collapsed, many guilds now face existential challenges. Token prices have since fallen from their highs in early 2022, and many of the more established projects are pivoting to try and better position themselves for survival.

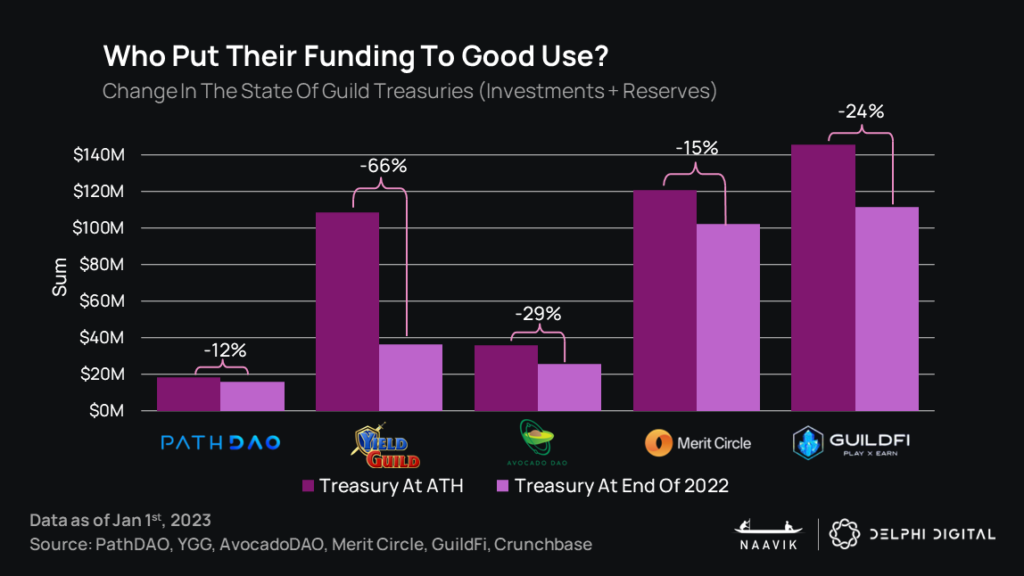

The majority of guild funding rounds were conducted at the peak of the P2E hype cycle in late 2021 and early 2022. The collective excitement surrounding the “future” of P2E at the time aided guilds in their ability to raise huge amounts of funding. GuildFi, for example, was able to raise a whopping $140M in only 72 hours in December 2021. As illustrated in the chart below, much of these funds came from public token sales, which presented a way for retail investors to increase their exposure to the P2E money machine. However, it still remains unclear in many cases what exactly the value accrual method is in terms of returning proceeds of investments to token holders.

Guilds went on to use these funds to invest in early-stage gaming projects, with most privately funded games having at least one guild on their cap table. However, the majority of these investments were for in-game assets in first-generation blockchain games. The fall in price of P2E assets has led to guild treasuries dropping significantly in size. For example, Yield Guild Games, which did well in growing its treasury to more than $100M, largely thanks to early investments into Axie Infinity, has seen its war chest drop 66%. Many of these investment activities looked questionable at the time but look doubly questionable in retrospect. Many guilds have seen their treasuries decimated, both through a decline in native token prices as well as poor capital allocation in illiquid in-game assets that don’t appear to have any organic demand.

It is worth mentioning that despite the arguable mismanagement of funds and declining treasuries, some organizations have done well to secure profits. Merit Circle, for example, locked in a total of $24.8M in realized profits, with notable asset sales in February ($4.8M), May ($4.6M), and July ($4.7M) this year. This is in large part thanks to the organization’s focus on VC-style investments over purchasing assets to share with scholars. However, without the management fees needed to sustain large VC firms, it is unclear how viable a guilds-as-investors model is in the long-term.

As we shift our focus to the future of guilds, a previous report by Naavik highlights how 99% of the estimated 24k web3 guilds will likely lack the funds or influence to make the necessary changes needed to survive the collapse of P2E gaming. The remaining 1% of guilds with larger reserves will be better positioned to pivot and survive long-term. However, the same P2E games that allowed guilds to prosper and grow have now proven that this value extraction-based business model is unsustainable. Essentially, guilds need to use their remaining funding to become something other than guilds to survive. To this end, many of the remaining 1% are frantically trying to diversify their value offerings and create more sustainable businesses.

There are a number of guilds that believe the answer lies in them going back to their core value proposition – user acquisition. Despite their role in funding early-stage gaming projects, a large portion of any guild's perceived value is the size of its community. YGG experienced impressive growth in the number of scholars over the past year. Growing almost 330% YoY, the guild currently reports more than 20,000 scholars, with 80% participating in at least one game outside of Axie Infinity.

Delphi has previously reported on the web3-native digital distribution landscape and how it aims to improve game discoverability. Guilds are in a unique position in this regard as they have existing communities that have already been onboarded into web3 and are more closely in line with typical player profiles. Guilds may, however, encounter challenges in monetizing these endeavors.

That being said, this has not stopped them from trying. In the second half of 2022, GuildFi focused its efforts on promoting partner projects to its existing community. As of Q3, this resulted in 80,000 people onboarded into these projects, 15,000 of whom actively participated in the games, and the distribution of 27,000 allowlist spots. In theory, guilds such as these, are an attractive partner to any gaming project as they present a cost-effective method for bootstrapping an initial player base. In practice, it remains to be seen what retention looks like over time following various in-game guild campaigns. Arguably, if guilds continue to introduce net value extractors to game economies, then they might actually be presenting a risk to new games.

Another area that many guilds are betting on is the development of esports-centric models. Creating revenue-generating businesses centered around competitive teams, merchandise, and sponsorships. Although this sector of gaming at large has struggled to find sustainable business models and is unlikely to take off in web3 any time soon, an area of interest that was explored more deeply in Delphi’s The Future of (Crypto) Gaming report is the role guilds will have in PlayFi gaming economies. In short, the PlayFi model allows organizations, such as guilds, to participate in the economies that revolve around (but entirely outside of) skill-based free-to-play games. In theory, this would be akin to the traditional sports model where streaming, advertising, merchandise, etc., directly benefit from, but do not tamper with, the actual sport itself. However, as previously mentioned, we have yet to see a web3 esports title attract widespread appeal, and in a world where less speculation drives down asset prices it is still unclear if guilds will end up operating in a similar fashion to modern PC arcades in South Korea and Pakistan to effectively grow competitive communities in underserved countries.

The fast-paced nature of web3 makes it hard to predict exactly what role guilds will play in the future of web3 gaming or if we will even refer to them as guilds for much longer. That said, the 1% of organizations that are able to successfully manage their large reserves do have the ability to explore a number of different verticals, such as content creation, investment management, community and education, technology products, on-chain identification, and value-add services. Whether or not these will evolve into profitable businesses is yet to be seen.

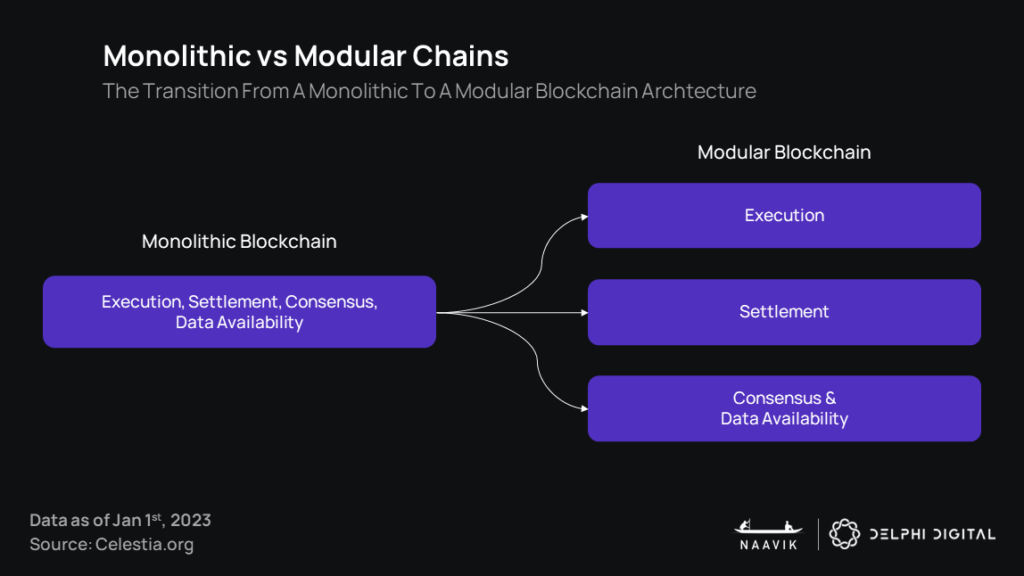

The State of Web3 Gaming Infrastructure

Just like the actual games it supports, infrastructure in web3 gaming is rapidly-changing. From the underlying blockchains that the entire industry is built upon to highly specific tools, developers can pick and choose from what is now a wide range of options. Here, we’d like to zero in on three segments of the landscape that experienced great change last year: wallets; the intersection of publishing (as a business model) and technological infrastructure; and L1s / L2s. Let’s explore them in turn.

Wallets

In 2022, the wallet remained an indisputable pillar of web3, both technologically (as a central repository for one’s assets, history, preferences, and more) and culturally (as a symbol of data portability, and, therefore, optionality for users). Adoption grew significantly: MetaMask’s parent company ConsenSys reported in March that the leading non-custodial wallet had “more than 30 million Monthly Active Users” (up 42% in just four months), a success that enabled ConsenSys to command an impressive $450M funding round.

A notable trend has been the rapid adoption of a multichain approach. Indeed, the growth of L2s like Polygon, Immutable, and Arbitrum, and of L1s such as Solana and Avalanche continues to expand the realm of possibilities for all stakeholders. Furthermore, the meta seems to be evolving towards MPC and smart contract wallets. Projects such as Sequence are laser-focused on gaming and are well positioned here.

For developers, a multichain world brings the promise of a greater addressable player base and vastly more liquidity. DeFi Kingdoms, which originally debuted on Harmony One in August 2021, has since expanded onto its own Avalanche subnet (in April 2022) and to the Klaytn network (in December). In both instances, the expansion was tied into the game’s narrative and presented as another Kingdom to explore, a sign that even technical matters can be profitably “eventized” in-game. As for players, multichain capabilities enable them to enjoy more, and more diverse, titles without having to consider which ecosystem they’re part of. This bypasses the need for tedious (and costly) transactions that would otherwise come from bridging and swapping assets between chains.

These new demands are pushing wallet providers to integrate with an increasing number of ecosystems. In January, MetaMask launched the beta of an in-app bridge aggregator that looks for “the best routes with time, cost, and security considerations for a better bridging experience” across bridges including Connext, Hop, Celer cBridge, and Polygon Bridge. In November, the Solana-focused Phantom added support for Ethereum mainnet and Polygon, stating: “With their emphasis on low transaction fees, security and scalability, there are amazing similarities between Polygon’s user base and ours.” As more leaders in this space – especially wallets historically associated with specific ecosystems – continue to partner with more chains, identities and assets alike will be able to move around more seamlessly, and barriers to participation will continue to fall.

This isn’t just about convenience, though: the fewer transactions, the fewer opportunities for mistakes exist throughout onboarding and playing. In other words, freeing players from the logistics lets them better enjoy the games they were trying to play in the first place. Developers should do everything in their power to facilitate that process.

Considering how eventful the year has been, security has grown into a general concern, and wallets happen to have a huge role to play in this fight. Cold wallet companies like Trezor and Ledger (unsurprisingly) reported a surge in sales after the FTX debacle, as consumers rushed to self-custody solutions. Granted, fund security may feel more central to DeFi users than to players: for most, the sums involved across games may not warrant the use of a cold wallet, especially since repeat transactions and signatures can add friction to the play experience. But security concerns coming from other areas of the market may well end up bleeding into gaming, too, upending practices for the better.

Publishing Platforms

From Axie Infinity to STEPN, some of the biggest breakout successes in web3 gaming to date have come from developers who built, distributed, and marketed their games on their own. In fact, because web3 gaming as a whole is still so nascent, there just hasn’t been a proper ecosystem of publishers to support game makers in their ambitions. That’s changing quickly and worth exploring in more depth.

Multiple companies are now aiming to serve as long-term partners to game developers across their needs. Several of them raised significant funding this year to be able to build and grow their own infrastructure, and to not just back but indeed acquire promising studios. Animoca — which Naavik covered early last year — raised another $110M last September, having already secured almost $360M earlier in January. In November, Fenix Games announced $150M in funding to acquire, invest in, and distribute web3 games. In 2021, Mythical had raised a total of $225M across multiple rounds. Given the current state of the market, this kind of backing could go a long way when it comes to building diversified portfolios, and eventually contribute to the sort of consolidation we hinted at earlier in this report.

By contrast with the web2 state of affairs, in which financing, marketing, and distribution have been the primary draws of publishers, web3 publishers are proving eager to showcase their technological might. Mythical Games’ Mythical Platform is a self-described “full-service system” featuring a “fully integrated marketplace;” “proprietary intelligence, market design and market intervention tools and services for ongoing economy management support;” a token manager; game services; and “built-in regulatory KYC/AML compliance and indemnity.” Meanwhile, Fenix Games is hoping to build “a redefined publishing group that leverages some of the traditional publishing functions” while augmenting them with a new one it calls “Game Market Economies.”

Web2 transplants are showing similar abilities. Africa-focused Carry1st, which is now exploring the potential of blockchain, already offers “a full-stack solution for monetizing and managing mobile games.” As a primarily hypercasual publisher, France’s Voodoo has long touted its ability to prototype, test, and monetize titles at scale. These skills could prove helpful as the company looks to debut its own blockchain ecosystem in Voodoo Infinity later this year. One particular promise in this offering lies in the upcoming, Polygon-based “Voodoo Coins” that will serve as a shared currency across games, and may attract outside developers looking to tap into Voodoo’s ecosystem-wide liquidity.

That all these companies would focus on technological infrastructure speaks to web3’s specificity and to what they think the market needs at this point in time. With ever more new chains and tools popping up, developers could definitely use some help composing the best possible stack for their games. Merging the technological (with end-to-end offerings) and business sides (the actual publishing) into a single platform makes for a clear value proposition and enables developers to do their best work without having to look for distinct partners in either one of these areas.

It should be noted that even though these publishers are web3-friendly — some of them, web3-first, even —, they’re not web3-only. Voodoo, for instance, made a reputation as a publisher before it decided to dive into web3, and will no doubt continue to operate in web2, where most of their business comes from. Meanwhile, Fenix Games made it clear that it will serve “all game models – premium, free to play, and web3 gaming across all platforms.” This offers some welcome optionality: a developer can test the waters, gradually implement web3 capabilities with a publisher’s support, and only go all-in if or when it makes the most business sense for their game.

It remains to be seen if new competitors enter the fray. As noted earlier, Sky Mavis is now trying to build off its IP and technology to attract and publish Axie-inspired third-party titles. With multi-game portfolios of their own, studios like Vulcan Forged could also legitimately provide guidance to others when it comes to growing their games. Plus, it’s unlikely that Voodoo will be the only web2 mobile gaming publisher to eye web3 in a meaningful way for long. Meanwhile, multiple guilds launched so-called “launchpads” – part of their broader reconversion efforts – that aim to support developers ahead of launch: for example, Merit Circle Studios debuted in April to “bring a mix of capital and expertise to work side by side with developers to help them solve problems, fill knowledge gaps and give the project the best chance of success.” It may be easier said than done. Succeeding as a publisher requires an ability to bet on the best teams, something the guilds have hardly excelled at in their VC-like era.

The State of L1s and L2s

Ethereum’s Dominance

It’s no secret that web3 gaming initially emerged on Ethereum. At first, Ethereum’s head start, capabilities, and the legacy of pioneers such as CryptoKitties were enough to attract developers. Over time, the continued efforts of the open source community toward better security, scalability, and gas efficiency (e.g. ERC-1155) gave game makers ever more reasons to favor the network. Incidentally, the setbacks of multiple L1s this year have reinforced this lead. From Solana’s outages and hacks, to Ronin’s attack, to Luna’s collapse, multiple chains that had made gaming an important part of their value proposition proved vulnerable while Ethereum remained resilient. With total verified smart contract deployment increasing more than 50% in 2022, Ethereum has further solidified its position as the most trusted infrastructure for web3 gaming.

To widen adoption, all eyes are now on L2s – the growing number of chains aiming to bring scalability to Ethereum while leveraging core functionalities such as data availability and security. Several of these players have been focused on gaming from the get go. With gas-free minting and trading and high transaction speeds, ImmutableX has managed to attract AAA titles like Gods Unchained and Illuvium, as well as confirm a number of games that will migrate from competing L1/L2s, such as Ember Sword and Cross The Ages. In Q3 2022 alone, the platform “onboarded over 50 games and has an additional 1,000 games being built in a test environment.” Unfortunately, a recent partnership with GameStop, which initially took the form of a grant with seemingly no vesting conditions and led to instant 8-figure token dumps, further reiterated the wild west nature of the industry. However, the project has since gone on to implement a milestone-based grant program seeking to drive volumes that has thus far been successful.

However, when looking bigger picture, Immutable co-founder and CEO Robbie Ferguson reiterated how large the opportunity is and how well Immutable is positioned:

“Web3 gaming is now the most invested-in category within crypto and one of the most funded nascent tech categories in the world with $14B in under two years. Incredible talent has flooded the space. In 2023 we must solve for: repeatable, sustainable economies and business models, radically mainstream-friendly user experience, and games good enough to have millions of retained players. This must be productized and offered to developers in a platform that any traditional developer can build with incredibly quickly. Enforceable royalties, TPS, security, and reliability will become table stakes that are expected of any solution, and Immutable is proud to lead in each of these categories.

We’re thrilled to be helping build this vision by building a platform 100% focused on gaming with Immutable since 2017. In the last third of 2022, we’ve onboarded more games to IMX than we have in the company’s lifetime combined. Games on Immutable have the most funding of any L1 / L2 ecosystem in the world after L1 Ethereum. This year we’ll see some of web3’s biggest titles going live on IMX: Illuvium, Ember Sword, Guild of Guardians, IMVU, and more. 2023 will be a year of focused building without noise - if web3 gaming is truly delivering on its value proposition to players, progress should be entirely decorrelated from macro.”

Meanwhile, Polygon has been ramping up its gaming efforts through non-stop ecosystem building, striking large-scale, widely-celebrated partnerships and supporting developers with both funding and an ever-growing tech stack. Specifically, after committing $1B to zk-rollups last year, the company continued to advance its zkEVM & Plonky2 offerings. These will go on to directly compete alongside ImmutableX and underdog zkSync, which recently raised $200M to expand its ecosystem in areas including gaming. Still, Polygon’s growth is not without its drawbacks: the chain’s monolithic design showed cracks in January with sluggish performance during the launch of Sunflower Farmers. Of course, much of that slowdown was due to inefficient developer implementation that has since been fixed with the relaunch and rebrand of Sunflower Land.

Even so, Polygon is moving fast, improving quickly, and is a fun team to watch. Ryan Wyatt, CEO of Polygon Studios, told us: