Hi Everyone. Thanks for tuning in for another week of Naavik Digest. If you missed last week’s edition, we wrote about Multiversus — the road ahead for their retention and cross-platform strategy & the value of their IP. Check it out and let us know your thoughts!

This Week on The Metacast

AI Art: DALL-Eks or High-value Disruptive Innovation? — In this Metacast episode, Matt Dion and David Amor join your host Maria Gillies to discuss:

- AI Art Applied to Games: How will innovation disrupt game art pipelines?

- Sony Acquires Savage Game Studios: What’s next for Sony’s mobile games?

- AAA Crypto Games - Gamescom: Is it meaningful for AAA games to integrate blockchain elements?

You can find us on YouTube, Spotify, Apple Podcasts, Google Podcasts, YouTube, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: Limit Break Raises a $200M Pre-Launch Round

Source: Final Fantasy Wiki | The name of the company is in part inspired by Final Fantasy’s Limit Break mechanic

This was the first week all summer that it felt like we were back in a full force funding environment. To cap it off, the ex-Machine Zone (MZ) team announced they raised $200M (at a reported $1.8B valuation!!) from a suite of investors like Paradigm, Standard Crypto, Buckley Ventures, Coinbase, FTX, and Anthos participating. For context, MZ previously exited to AppLovin back in 2020. We first learned of MZ co-founder and former CEO Gabe Leydon’s new initiative during his interview on Invest Like The Best almost a year ago.

It’s not every day we hear about $200M pre-launch raises, but there’s clearly something here to be excited about. MZ pioneered new ways to engage and monetize whales, and the new web3 paradigm allows gaming to continue to push the boundaries on what it means to have whales as both owners and as key determinants to inflation, gameplay, and monetization. While Limit Break is still pre-launch, this post will compile some of the information we’ve seen to try to complete a more holistic picture of the massive raise.

What We Know:

Source: Dune via Sixdegree

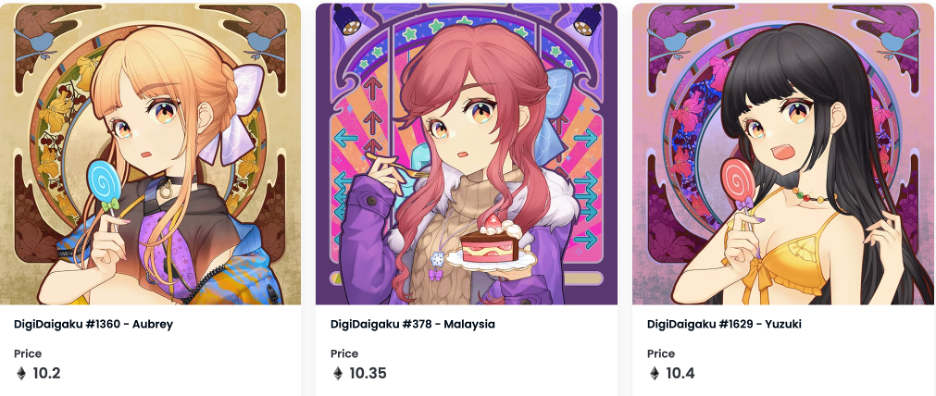

The team dropped a 2022 NFT collection called DigiDaigaku. It’s unclear if there will be more genesis drops.

- Each NFT functions like a factory for future assets, meaning that they can be used to generate future NFTs through mechanics like airdrops. Most recently, genesis holders were airdropped Spirits.

- According to the VentureBeat article on the raise, the company now has 50 employees, 80% of whom are former Machine Zone employees. Previous cofounder Halbert Nakagawa also joins.

- This NFTs will be part of an ecosystem of games under the Limit break umbrella.

What Is Free-to-Own?

Source: OpenSea

In blockchain gaming, it seems that we get a new buzz word every other day — the latest to enter our lexicon is free-to-own. In a post about the subject, Alok Vasudev of Standard Cryptoi writes:

F2O is a natural evolution in a decades-long power shift from the game developer to the player The first video games were arcade games where players had to pay every time they played the game. Next came console games where players had to pay a high one-time price (e.g. $60) for a game that they could then play unlimited times. Early mobile games, which followed, continued the console model but with a much lower one-time price (e.g. $1). Mobile games evolved into free-to-play (F2P) where players no longer needed to pay at all to play the game and game devs needed to earn the right over time to get paid – typically by selling in-game assets.

F2O takes this one step further. Game devs give away a portion of the assets they'd otherwise have sold to players. Players co-own the game economy alongside the game devs. F2P is “freemium”; F2O is “less than free”. F2O is still a work in progress but its core mechanism involves offering players of a game (or future game) the opportunity to mint – for free – digital assets of value within a game economy. The assets are built as NFTs so players have true ownership of the digital assets they acquire for free. The NFTs have a creator royalty mechanism where game devs make money as a percentage of the game economy’s “GDP”.”

It's a solid articulation, and one in which the illusion of F2P is turned on its head. The community-based and open nature of a blockchain game creates healthier incentives for both players and developers despite the fears of traditional gamers. But core to this idea (and why it needs to be on blockchain) is for a few reasons:

- “Neutral payments and commerce rails”, which means that there is App Store / Google Play that fee – this allows for orders of magnitude more flexibility in building the game

- There is no microtransaction limit cap at $100. The definition of a “whale” (a person who spend a lot of money) is now uncapped and wholly changed. It also means that an NFT’s value is uncapped.

- As owners of the NFT, the whale or the player becomes a key determinant to how the game progress vis-a-vis inflation, trading, and more — the holder can provide feedback during the game’s development but also acts as a game master of sorts. Additionally, owners only make money if the game makes money which aligns incentives.

What Justifies Such a Large Raise?

While I don’t think Limit Break is conceptually or fundamentally different (indeed, it feels like an extension of Free to Play with some unique NFT mechanics), here are a few reasons why it makes sense they raised at high valuation and had negotiating power on their ownership stake (selling ~10%):

- Gabriel Leydon knows what it takes to build top grossing titles (on 3x repeat), and has grossed $4.5B+ in revenue during his tenure at Machine Zone.

- They’ve built games with deep and highly complex economies before in the 4x genre. Additionally, the team is made up of some of the best F2P talent in the industry. If any team can figure it out, it’s this one.

- From my colleague, Manyu: “when the entire early F2P market was focused on hitting 40% D1 retention and maximizing the top of the funnel to make sure of 1% conversion rate is a large enough pool of payers, MZ went in the completely opposite direction of being totally okay with a 20% D1 but monetized thick retention long tail. I think that says a lot about his instinct and risks he's willing to take to be the number one.” If he has an insight about whale behavior in web3, he’s the person to execute on it.

Importantly, we believe the team has found the right balance on what to focus on — fractional ownership and trading, with an NFT strategy that will be heavily tied to an ecosystem of games. These product decisions might set the foundation for game with longevity and sustainability. And for VC firms funding this company, it’s as much about brand-building and being part of a company that pioneered a new model of play as it as about generating venture-scale returns.

What’s Next For Limit Break?

The question that comes to mind for me is how different this actually is from F2P. Leydon and team have a ton of learnings from their MZ games, but the same concepts still apply: a long-tail of players that can be highly monetized, a public ambition to reach 100M+ players & the marketing costs associated with that, and building a great game with a deep economy. He also understands player demand to get a critical mass of people playing the game.

Fortunately, the Limit Break team has been building the game in stealth for the past year and change, so my assumption is that they at least have a demonstrable product. The Digidagaku collection has been successful in garnering an initial marketing push / kicking off the “factory concept” and is testament to the high ARPU audience that anime commands in both Eastern and Westernaudiences that we explored in our Genshin Impact game deconstruction (interestingly, they’re not the only anime-based gaming company building in web3 games). Let’s see if they can attract enough players through their marketing initiatives to a webGL-based game.

And yet, the core insight for the game around how to find, engage, and monetize whales still stands. We write in Naavik Pro: “high-spending players are often seen as doing so as a way to pay to win, and he corrects this misconception by saying that they are actually motivated to play to judge. He clarifies further that the big spenders want to be kings and the ones others come to for help and support. This aligns with some of the innovations in web3 like DAO governance and even aspects of land ownership.”

The team has a lot to prove out — speculators, NFT hoarders, a successful marketing strategy, a well developed game, the free-to-own business model, and more; but, it also seems they have a winning insight and the capital / ownership structure of the company to give them the leeway to experiment and win. In the meantime, while everything ramps up and NFT holders can track along with the game, we can enjoy Leydon’s Twitter shenanigans. (Written by Fawzi Itani)

#2: Weekly News Roundup

Source: 343 Industries

Meta’s Standalone Gaming App is Shutting Down: Earlier this week Meta announced that it plans to sunset its standalone gaming app, Facebook Gaming. The app, originally released back in 2020, was meant to serve as a hub for the company’s gaming investments, which are reportedly second only to Twitch in hours streamed according to StreamElements. The death of the app itself doesn’t spell the end for the company’s gaming investments (YouTube shut down its own gaming-centric platform in 2019), but it does highlight the broader quality problem the company is facing. Most notably, Meta’s viewership numbers are often inflated due to the company’s inability to manage spam and pirated content. Shifting away from a standalone platform doesn’t mean Meta isn’t interested in games anymore; rather it’s more likely that this is the first step to bolstering investments in polish, moderation, and content — a deep focus on other priorities like Horizon and advertisements.

Halo Infinite Announces New Content, and New Delays: Nearly a year after launch, Halo: Infinite continues to roll out content at a blisteringly slow pace. The latest issue for the title came to head earlier this week when developer 343 Industries announced the game’s second online season would be extended to March, lasting a total of over 10 months. Packaged with news about the cancellation of split screen co-op mode and additional delays for the title’s custom game browser, the number of development issues for Microsoft’s flagship title continue to pile up. Leadership turnover coupled with the franchise’s inexperience with a live-ops model are the likely culprits for the delays, but they may not mean death for the title. Microsoft has already stated outright that they intend to keep Halo: Infinite running for 10+ years, and early leaks from the game’s upcoming Forge mode look promising. It will be interesting to see if 343i can truly bring the game back even after so many delays. And meanwhile, one of it direct competitors Splitgate announced that they are focusing all new development on a new titles vs. improving Splitgate iteratively.

Sony & Tencent Acquire a Bigger Stake in FromSoftware: Sony and Tencent are increasing their stakes in Elden Ring develop FromSoftware to a combined total of 30%. Attributed primarily as an opportunity to secure additional funding for game development, parent company Kadokawa also noted that the partnerships will allow them to develop more powerful and mobile-friendly IP. There’s no doubt that Elden Ring’s success has up-leveled FromSoft to new heights, with the company already announcing it has several new titles in development. That being said, it’s interesting to see mobile mentioned in the weeks following Sony’s acquisition of Savage Games, with the company continued promise to deepen its hold in mobile by 2025. It’s a half-step in a year already filled with consolidation and acquisitions, but nevertheless a savvy move from all three parties as they deepen their relationships.

🎮In Other News…

📊Funding & Acquisitions:

- Sony and Tencent have increased their stake in FromSoftware (to ~30%+), the developer behind Elden Ring. Link

- The Ex-Machine Zone founders raised $200M for their latest project, Limit Break. Link

- Temasek joined a $100M funding round for Animoca. Link

- Xterio launched out of stealth announced a $40M round led by a suite of investors, including FunPlus, Makers Fund and FTX Ventures. Link

- NetEase acquired French studio Quantic Dream. Link

- Sony acquired Savage Game Studios, which has been working on a AAA mobile live service action game. Link

- Stacked raised $13M for a web3 Twitch. Link

- Nazara acquired WildWorks. Link

- Proxi raised $6M in a round led by Griffin Gaming Partners. Link

- Sprocket Games announced a $5M raise led by BITKRAFT. Link

📊Business:

- Nintendo games sales data. Link

- Google Play Games beta is coming to Windows in select markets and with 50 games. Link

- Facebook announced it would shut down its standalone gaming app. Link

- Garena laid off some of its staff and slowed down various strategic projects. Link

🕹Culture & Games:

- Robin Games debuted PLAYHOUSE, an interior design game. Link

- Logitech teased its upcoming gaming handheld. Link

- Xbox Game Pass announced its family & friends subscription tier. Link

- Halo Infinite roadmap and Forge. Link

- 1047 Games, which raised $100M last year, will develop a new game instead of focusing on Splitgate. Link

👾Miscellaneous Musings:

- An empirical study of delayed games on Steam. Link

- China’s video game makes tap overseas markets. Link ($)

- GeoGuessr tricks and tips. Link

- The Future of On-Chain Gaming. Link

🔥Featured Jobs

- a16z: Investment Team Analyst (Remote)

- Disney: Business Games Analyst (Remote)

- Hidden Leaf Games: Product Manager (Remote)

- Naavik: Content Contributor (Remote)

- Naavik: Games Industry Consultant (Remote)