Warner Brothers Entertainment’s MultiVersus has been making headlines since the open beta (free-to-play 2v2 brawler) available about a month ago. Developed by Player First Games, it was the top video game by sales in July on Xbox and third on Playstation, according to The NPD Group. The game has been hailed as a “shameless mashup” of the much beloved franchise Super Smash Brothers, but with an even more unlikely selection of IPs.

When I heard that Lebron James and Batman were being pitted against Arya Stark and Bugs Bunny, I had to block out my Sunday to see what this madness was about. What I found was pretty much what I expected — a Super Smash copycat that was slightly less polished than its muse, with some incremental innovations and a hilariously random cast of 20 characters (and growing). What makes this launch particularly interesting, though, is the big opportunity MetaVersus represents for the parent company Warner Bros. Discovery and their associated IPs.

MultiVersus vs. Super Smash Brothers

Given how similar Multiversus is to Smash, it probably makes more sense to cover what sets the game apart. There are two key areas that make MultiVersus different from Smash:

- Character Mastery System — Characters in "MultiVersus" can level up and acquire new skills, called Perks. The awards that players can obtain by using Character Mastery bars are exclusive to each combatant. Additionally when characters on the same team use the same Perks, it will act as a multiplier of that effect. This brings us to another core element of the game.

- Team Synergy — While both 1v1 and free for all versions of the game are available, the game mechanics strongly encourage cooperative play. Each character receives a class designation of either bruiser, tank, mage, assassin or support which indicates how they can be used. Many of the character’s moves, especially those of the support class, are designed explicitly to help a teammate. For example, Wonder Woman can use her lasso to pull a teammate back from falling off the map.

The combination of these two elements introduces a learning curve that can keep players engaged longer than the repetitive gameplay and lack of map diversity would typically entail. It also requires players to be far more strategic in their player choice and gives Multiversus a distinct flavor from its famous 2D platform fighter counterpart.

Monetization

There are two types of currency in Multiversus. Gleamium is the premium currency that can be purchased in game stores or by purchasing one of the three founders packs (which also come with character tickets to redeem and unlock characters). Gold is the grind currency which is earned through free gameplay. A Battle Pass is also an option for accelerated progression. These currencies allow players to purchase three different types of content:

- Characters will without question be the primary source of monetization. While free-to-play players start off with access to a rotating selection of characters, many players will want to purchase their favorite superhero or cartoon character. WB will choose the most popular and relevant characters from their truly massive list of IPs and make them available for purchase. What will be interesting to see is if they introduce an element of scarcity and make characters available for a limited amount of time in order to further drive hype for these character drops. In contrast, Super Smash Brothers simply added new characters which became a bit unwieldy for new players.

- Cosmetics are slightly less compelling than exploring your favorite character and the new combinations to boot, but I was impressed with the opportunity to put Lebron James in a Robin outfit (Batman’s side-kick). Additional cosmetics include badges, and emotes.

- Perks are the third way that Multiversus monetizes. Progression through the Character Mastery System mentioned above can be accelerated with purchases, but you need to progress the character to level 9, which is an interesting way to make players earn their ability to spend.

We can conclude from its chart-topping success that the Founder’s Packs have done quite well. It is unclear how well the game monetizes on an a la carte basis, however, and whether Multiversus will be able to keep spenders spending over time.

Multiversus May Have A Retention Problem

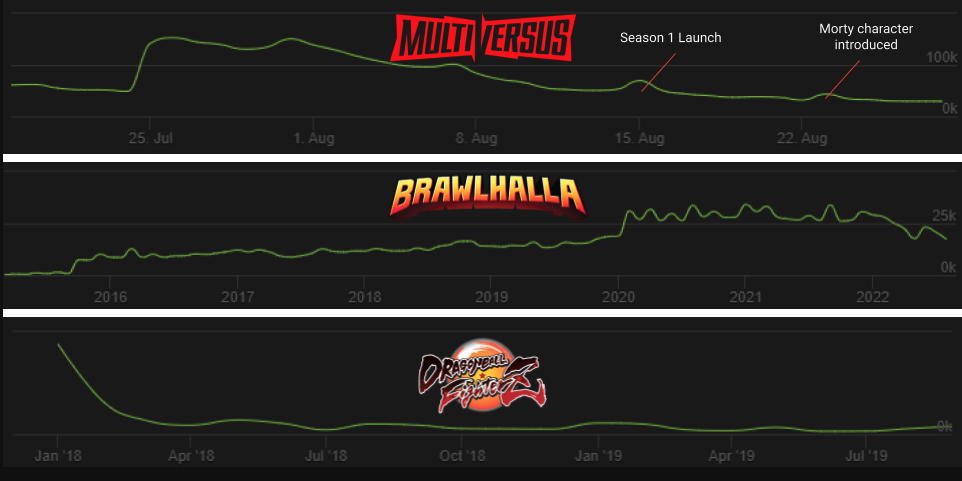

Multiversus is free-to-play and cross-platform with the exception of Nintendo Switch and mobile (for now). This combined with a compelling assortment of characters has opened the acquisition funnel to the tune of 20M players as of August 22nd. Headlines have suggested that the game is a smashing success (pun always intended). However, a look at Steam charts concurrent players tells a story of strong interest but difficulty retaining players, with concurrent players down 86% from its peak on Tuesday, July 26th.

Bearing in mind that the Steam absolute numbers are a far cry from Xbox and Playstation and come from a very different player base, I do think this directionally indicates that Multiversus has its work cut out for them on retention. While attrition is expected for any game with a big launch like Multiversus, the concerning part for Multiversus’ Steam chart is that the launch of Season 1 and the introduction of Morty only showed a short-lived blip. Compare this to a new character introduction on Brawlhalla, which reportedly spiked concurrent players by 60% before leveling off up 50% a few weeks later.

Multiversus As A Transmedia Launchpad

If the introduction of Morty was any indication, future updates will likely have to go beyond quiet character additions to really drive engagement in the game. It will be interesting to see if Warner Bros is able to create a transmedia moment (like Sonic did) with the launch of the Black Adam movie slated for October 22nd. If executed well, movie goers would be driven to Multiversus and vice versa. This is in addition to the 12 other DC shows on the horizon for HBO Max. Discovery streaming service might make for great cross-promotion opportunities as well. For example, HBO Max subscribers could get a character for free when they link their accounts, a la Prime Gaming.

Furthermore, let’s also not forget the role that live-streaming plays here — so long as streamers on Twitch, Youtube and Facebook are playing Multiversus, that’s additional exposure for these IPs that will only enhance their long-term value. Finally, although WB has said they will focus on their own existing intellectual property, having access to this highly engaged audience will serve as a bargaining chip whenever WB Discovery looks to acquire new IP.

Multiversus’ Future Is Competitive And Mobile

While there are many opportunities ahead to open the funnel, Player First Games will need to make sure the game is capable of retaining and monetizing those players further. New game modes were part of Super Smash Brother’s roadmap and that will be the case for Multiversus as Classic Arcade mode and Ranked mode are in the Season 1 roadmap. At the same time, Multiversus was designed for competitive play and we are just starting to see the emergence of tournaments with real money, though the decision to launch without Ranked play has left some scratching their heads.

There is also an expected mobile version of the game which, I anticipate will be cross-play given the simple graphics and the fact that the game is conducive to short play sessions. This could increase engagement substantially like it did for Epic’s Fortnite.

In sum, the Multiversus launch was huge, but additional innovation may be required from Player First Games if they are to capture the transmedia opportunity that this game has latent. Improving the polish, launching new game modes and maps, and having mobile crossplay and progression are all ways to change the direction of the concurrent player trend. I’m excited to see what’s next for Multiversus and its thrilling cast of characters. (Written by David Taylor)

#2: Beatstar: The Western World Finds its Rhythm

This is the introduction to a full game deconstruction of Beatstar, written by Niek Tuerlings. Check out Naavik Pro to request a demo, read the full write-up, and access our entire research library.

Approximately a year ago, Space Ape released Beatstar worldwide, and (as predicted) it has grown into the world’s most lucrative mobile rhythm game. Throughout its first year, the game has significantly evolved in order to achieve this, which means it’s a great time for a status update!

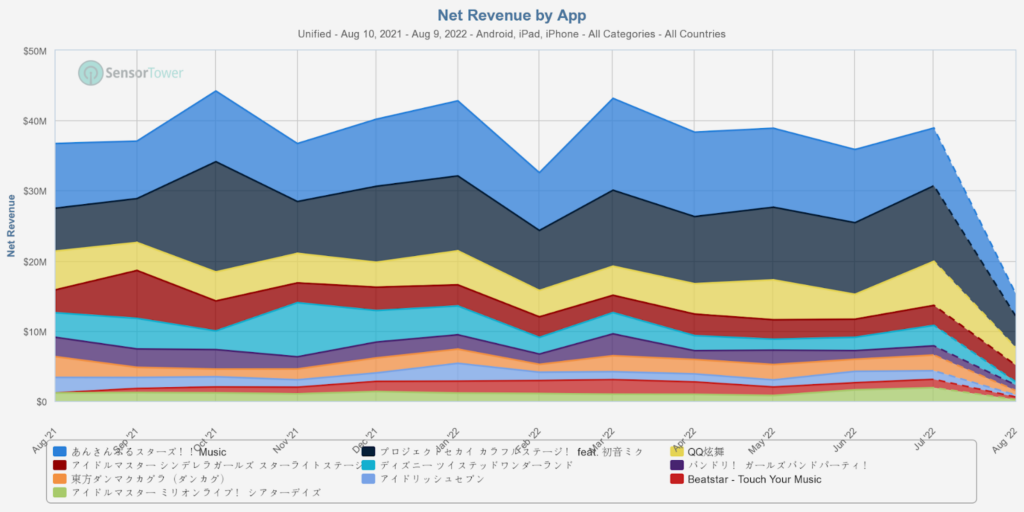

Let’s begin by putting the whole genre into perspective. There is only one country in the world where Beatstar’s numbers are just so-so when compared against its competitors — Japan (to no one's surprise). Over the past 12 months, the rhythm games segment grossed about $825M in Japan alone. As the worldwide gross totaled ~$1B, this means 82.5% of rhythm game revenue was generated in the land of the rising sun.

In fact, the genre is so extremely popular in Japan that, according to Sensor Tower, all-time RPDs for Japan’s top-3 rhythm games are an unbelievable $187, $155, and $105. Taking this knowledge into account, with a mere RPD of $1.41, Beatstar still ranks eighth in the world in terms of absolute revenue over the last year, as it serves audiences all around the globe.

When looking at IAP earnings over the last year, Beatstar is the only non-Japanese game in the top-10 rhythm games.

Additionally, a disclaimer: When it comes to western market-oriented games, the world did see specific ‘beat matching’ games similar to Beatstar before its release. Here’s a short breakdown of some of its most influential predecessors.

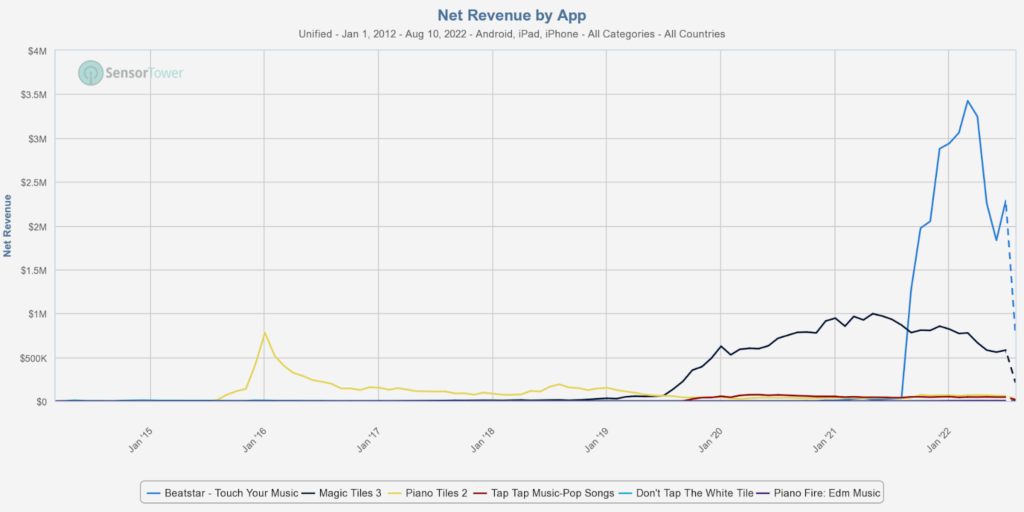

In 2014, the first successful mobile rhythm game, Piano Tiles - Don’t Tap The White Tile by Cheetah Mobile, became a sudden hit, as described in this hilariously outdated VentureBeat article. The game pioneered the well-known vertical scrolling trail on mobile, taking inspiration from console hits like Guitar Hero, Rockband, and the likes. The game was minimalist and monetized through banners and interstitial ads.

In January 2016, Cheetah’s next game, Piano Tiles 2, raked in an incredible 51M downloads in its first month while also modernizing its monetization by adding IAPs into the mix. It became pretty famous as well, even resulting in some people (successfully) trying to automate its gameplay. The game is still being updated regularly to this day. A year after, when the decline of Piano Tiles 2 officially set in, Singaporean developer Amanotes released and started scaling its game, Magic Tiles 3. It managed to reach 10M monthly downloads and has been keeping that up until this day. Both of these games have by now reached half a billion downloads each in their lifetimes, taking the crown when it comes to the absolute number of downloads for any mobile rhythm game.

So, all of that said, what is so interesting about Space Ape’s Beatstar? It’s not performing extraordinarily well in terms of downloads, having already dipped below its two biggest competitors (good ol’ Magic Tiles 3 and newcomer Piano Fire: EDM Music) raking in only about 30% of their monthly downloads. The special attributes about Beatstar are its masterful execution, its modern monetization strategy, and its outstanding licensing efforts.

Until Beatstar’s launch, Magic Tiles 3 and Piano Tiles 2 (for a very short time) have been the only beat-matching games on mobile (outside of Japan) to monetize players using IAPs (in addition to frequent ad placements being the main revenue driver). However, last year at this time, Beatstar literally changed the game by prioritizing immersive, AA quality gameplay, clearly vying for long-term retention first and foremost. While its competition is riddled with interstitial ads and features mostly karaoke-quality covers of viral songs, Beatstar’s (by now 300) songs are purely original, as licensed with the authentic artist and features opt-in ads only.

Both Magic Tiles 3 and Piano Tiles 2 were launched by hypercasual publishers and therefore the in-game ad/IAP monetization strategies were in sync with their UA scaling strategies. Beatstar, on the other hand, hasn't gone the hypercasual UA route (showcased by having opt-in ads only) but instead doubled down on IAPs; it is now able to acquire a higher quality audience compared to its hypercasual counterparts.

Last July, confirming the game’s success, Supercell announced that it was investing $37M more into Space Ape to grow Beatstar. This proves that, even with its relatively low RPD, the game’s business case seems very solid, mostly because of a lack of competition and high virality (due to the pickup-and-play nature of its core gameplay and its music library of popular tracks) resulting in a low CPI. Next to the acquisition of more (expensive) players, the added funding will most likely be used to scale up the team, add more songs to the game’s library, and more rapidly expand the live-ops feature set. This is very much needed, as feature variation is currently still the biggest (but certainly not unresolvable) limitation of the game’s performance.

Right after its launch, thorough & in-depth deconstructions of the game’s relatively lean set of launch features were published, but at the time it didn’t have any strong monetization features or any live-ops yet. This is why now is a great time to check in and see what’s been added since and how it led to Beatstar’s trajectory. In this essay we will go through the game’s new features to project its future trajectory and try to answer the million-dollar-question: Can Beatstar scale and keep its momentum?

Read on for:

- A view on the game’s licensing and UA efforts

- A quick breakdown of the game’s core features and unique selling propositions

- A full deconstruction of improvements made to the game during its first year

- An analysis of Beatstar’s live-ops (as it stands)

- An inquiry into the game’s monetization strategy

- Prognosis and advice with regards to Beatstar’s future

Content Worth Consuming

Unrequited Lovin (Mobile Dev Memo): “The decline in AppLovin’s Apps business unit sits poignantly in juxtaposition with a feature of the Unity-ironSource merger that I didn’t fully appreciate at first pass: the combined Unity-ironSource company achieves a 50/50 revenue split across the Creation and Growth business units, which I take to be analogs to the Create and Operate business units for which Unity currently reports results. This is possible because revenues from ironSource’s Supersonic Games publishing business, under the proposed merger, would be booked under the Creation business unit.” Link

Everseed Deep Dive (Vader Research): “In this episode, Everseed co-founder & CEO Kenneth Liu joins Vader Research Podcast. Everseed is one of the most anticipated web3 games under development. All 3 co-founders have previously worked together at Riot Games (creator of League of Legends, Valorant, Teamfight Tactics).” Link

Are Video Games Recession-Proof? Sort-of, experts say. (WaPo): “During the 2008 recession, the video games industry was heralded as one bright spot in the economy. Described as recession-proof, the industry showed resilience by selling million of copies of the Nintendo Wii and DS systems, even as banks folded and the housing market crumbled. In today’s economy, though, analysts say the video game industry may be not as invincible as a Super Star-powered Mario. Copies of games — and the microtransactions they sometimes contain — are getting more expensive. Prices on virtual reality hardware are going up. As the U.S. economy contracts and people re-examine their financial budgets, analysts say video game spending may be on the decline.” Link

Why Microsoft Needs To Drag Call of Duty Into The Future (Protocol): “Microsoft and Sony have been waging an increasingly bitter battle over Call of Duty. Over the past two weeks, the feud has spilled out into the public through regulatory filings in countries like Brazil and New Zealand, which, unlike the U.S., publish such documents for all to see. Microsoft’s goal is to convince regulators worldwide that its landmark acquisition of Call of Duty parent Activision Blizzard for close to $70 billion should get the greenlight. Sony's goal, on the other hand, is to raise the alarm about its primary gaming rival owning one of its biggest cash cows, and whether the PlayStation playbook of platform exclusivity might be turned against Sony if Microsoft decides to make Call of Duty exclusive in some way to Xbox or its Game Pass subscription service.” Link

🔥Featured Jobs

- a16z: Investment Team Analyst (Remote)

- Disney: Business Games Analyst (Remote)

- Hidden Leaf Games: Product Manager (Remote)

- Naavik: Content Contributor (Remote)

- Naavik: Games Industry Consultant (Remote)