This piece was written by Lars Doucet and Dan Cook, and originally distributed on GameDeveloper.com - it has been republished here with approval from the authors.

Land Speculation and Why It Sucks

If you are designing a multiplayer game with a “digital land economy,” especially one that involves significant investment of time or money by players, you might be headed for a problem.

Over the 30-year history of MMOs, whenever an online multiplayer game features “land-like assets,” it predictably suffers from a digital land crisis or housing crisis that plays out in an eerily similar manner to ones we observe in the real world – there's not enough land for everyone, and so a crucial resource that depends on it (such as housing), gets scalped by speculators rather than used for its intended purpose. Sectors of the economy that depend on access to land go into recession, and any game features that depend on it become unfun for everybody except the elite few who bought in early.

Ultima Online, a seminal MMORPG that has been running continuously for decades, suffers from a housing crisis that started in the 1990's and persists to this day:

UO's saving grace is that player housing is a "nice to have" feature that's not fundamental to the experience, so the crisis only ruins one small part of the game. Unfortunately we are seeing more and more games launch where virtual land is the entire point of the game, which makes them far more vulnerable to this problem.

Here's a typical headline we've been seeing a lot in mainstream outlets like The New York Times, Business Insider, CNBC, Fortune, Reuters, etc.:

That quote isn't the endorsement they think it is. These virtual worlds are headed for a problem much more severe than we've seen in the past, and for many of them it could already be too late to avert disaster.

By George, don't let the same thing happen to your game.

What This Essay Covers

We want to help game designers decrease harmful land speculation that hurts player retention and player engagement. It is not an overstatement to say these dynamics can destroy a game. This paper offers a practical guide to implementing a remedy: a Land Value Tax (LVT) specially calibrated for virtual worlds.

Land Value Tax is a real-world policy proposal most commonly associated with the Georgist movement, which you can read about in extensive detail here.

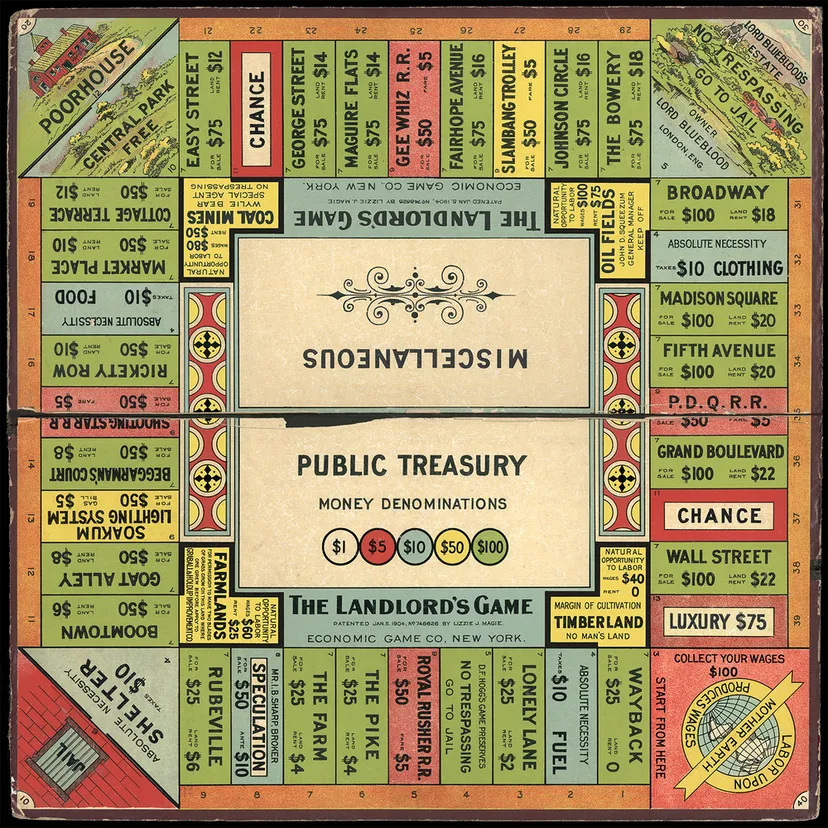

Georgism and game design actually have a long and rich history together – the board game you know today as Monopoly is a direct descendant (some would say shameless rip-off) of The Landlord’s Game, created by the Georgist game designer Elizabeth Maggie:

As game designers, we want a blueprint for combating unwanted speculation; ideally one that we can actually communicate to engineers and put in a functioning game. Despite its impact, this topic is not widely discussed. There’s a lot of important ideas to cover:

- What is a “land crisis” in a virtual world?

- What “land-like assets” look like in virtual spaces

- Georgist-style taxes on land income as a means of mitigating speculation

- Non-intuitive impacts of a Land Value Tax

- Considerations for the practical implementation of Land Value Taxes in a virtual world

What is a "Land Crisis?"

In the non-digital world we’re all pretty familiar with what a “housing crisis” is – the price to buy and rent houses goes up faster than both general inflation as well as people’s wages, so more and more of people’s wages go to paying their rent or their mortgage.

But why does the price keep going up? The price of building material and construction labor can fluctuate, sure, but not by enough to explain the massive surge in housing costs. The key driver of housing scarcity is actually land scarcity – you can always build more houses, but there’s a limited amount of land to build them on, especially in desirable locations close to jobs where people actually want to live.

Furthermore, those that already own land often become “NIMBYs” who lobby for restrictive building and zoning policies that restrict other landowners from building, because more housing could help meet demand, in turn lowering the market value of the NIMBY’s existing properties.

A land crisis is therefore a root cause of a housing crisis, and ultimately affects not just housing, but the entire economy at large. Land even has an outsized effect on worker pay in labor markets, because the need for workers to pay escalating rent erodes their savings cushion and gives employers undue leverage in negotiations.

In any case, you can be sure you're facing a land crisis when you see a 5,500 square foot empty lot in the heart of San Francisco going for $2.5 million dollars:

What is a Land Crisis in a Virtual World?

This phenomenon is not limited to the real world. Here are some signs of a land crisis in a virtual world:

- Speculation: People acquire and hold land not because they intend to use it, but because they hope that its value will go up over time

- Limited class mobility: The player base becomes divided into landed “aristocrats” and landless “peasants,” with the peasants locked out of core features of the game

- Reduced UGC: If land is the basis for user-generated content (UGC), we see less UGC, and of lower quality, than we would otherwise. The peasants don’t have the resources to participate, so they don’t

- Black markets: If formal trade of land is restricted, we tend to see black markets in land (Ultima Online). These lead to scams and a loss of trust

- Perverse behaviors: Players are incentivized to pay high non-monetary costs for land (such as using multiple coordinated accounts aided by bots and macros to stake out a plot that becomes available at a random time)

- Escalating costs: If formal trade of land is unrestricted, we tend to see sky-high prices and rents for land

- Reduced user growth: To the degree land is core to the game, we tend to see a stifling effect on user growth as new players have no way to get the assets they need to meaningfully participate

Note that this isn’t just about “housing,” it’s about “land,” whether the game designers intended for players to be able to “possess” it or not. Here’s a practical example witnessed by Raph Koster, lead designer of Star Wars Galaxies:

- “in [Star Wars] Galaxies … there was ample room for everyone to own a house if they chose – but people did things like build player cities atop the entrances to dungeons to monopolize access to resources.”

The above example is pretty similar to the behavior of the medieval Robber Barons, who famously stretched chains across the Rhine so they could extract tolls from passing ships.

Here’s another example: a bunch of players camping a land plot scheduled to go up for sale in Final Fantasy XIV, a popular MMORPG:

There’s far more demand for housing plots in FFXIV than there is available land, and no formal market that allows land or houses to be bought or sold. Instead, when a plot is relinquished, a hidden timer starts counting down. At a random moment over the next 24 hours, the plot will silently become available for sale for a fixed price, and the first person to make an offer gets it.

In practice this means that if you want to secure a plot of land, you need to get yourself and a bunch of friends (or automated bots) to camp the spot and click continuously on the placard, hoping to catch the moment it goes live. The lack of a formal market for land has not made land any cheaper, it has simply shifted the price from being denominated in money-dollars, to time-dollars and pain-in-the-butt-dollars.

If you want to see the extents to which this drives people, just check out this video (warning, language):

Land speculation should not be taken lightly. Left to its own devices it can make your game completely inaccessible to new players and suck all the fun out of the game as the economy grinds to a halt.

By George, a Land Value Tax would solve this.

What is a Land Value Tax?

A Land Value Tax is a special kind of tax that does three very important things:

- Differentiates “Land” assets from “Improvements”

- Any “building” in our virtual world can be separated into two distinct assets: 1) the land itself, and 2) the improvements (homes, structures, factories, orchards, irrigation, etc) that sit on top of the land. Any kind of durable upgrade or stationary investment counts as an “improvement.” Land Value Taxes tax only the land, and leaves the improvements untaxed.

- Heavily tax squatting on land

- By placing a heavy tax on the land asset, you make it expensive to simply buy land and hold it for no reason, or for speculative reasons (waiting for the price to go up).

- Incentivizes adding profitable improvements to land

- Players should only want to buy land if they plan to build something productive on top of it that at the very least pays the land tax. This is a strong incentive to build useful stuff instead of just squatting and sucking up rent, or holding the land out of use and waiting for its value to go up.

Note that Land Value Tax behaves differently from a conventional Property Tax. Property taxes tax both the land and its improvements, and can lead to perverse incentives (such as punishing you for building stuff, and rewarding you for keeping it vacant). The key is to tax the land and only the land.

But why just land? Because assets that are truly "land-like" are special - they gatekeep access to core features and/or economic privileges, and you can't make any more of them. That makes it easy for landowners to collectively corner the market on land and dictate terms to everybody else.

What Happens without LVT?

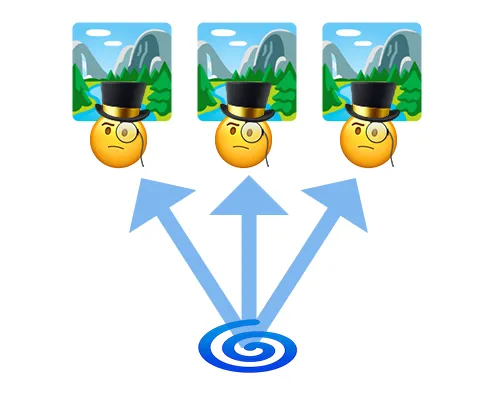

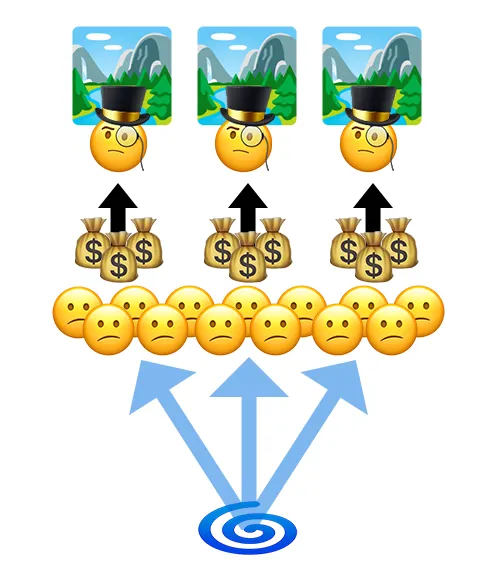

Without LVT – ie, the typical status quo – It will be expensive to buy land, but cheap to hold land. Here’s how it typically plays out:

Phase 1: First mover advantage

The first players into the game are able to acquire land cheaply. They corner the supply of valuable land.

Phase 2: Second mover disadvantage

The next wave of new players move into the game. They need to buy land and there isn’t any available. So they pay the existing land owners a premium to either buy or rent it.

Phase 3: Speculators flourish

Both the rental income and the selling value of land will tend to increase while the game population is growing, which makes it a tempting target for speculators. These land hoarders intentionally sit on their treasure trove of land and wait for someone with bigger pockets or more desperate needs to come along and pay them a guaranteed profit. There’s no real economic downside (for the speculators) to continue this price ratcheting cycle, so it flourishes.

Rent

This is all exacerbated if the land owners can charge rent. They don’t have to wait for a full land sale to realize their profit! Instead they can gain an ongoing revenue stream at zero incremental cost. Forever.

Consolidation

As long as the above cycle continues, a speculator can realize a better return on their investment by buying even more land, rather than by applying the land they already have productively, or by investing in improvements. The gains from land they already own gets reinvested in hoarding even more land.

All this leads to the inevitable replications of a virtual world land crisis. When new players stop arriving, the economy grows stagnant, players leave, and the game gains the stink of a place where having fun is impossible.

What Happens with LVT?

It will become cheap (or even nearly free) to buy land, but expensive to hold land.

This ensures that only people who intend to do something productive with land will bother to hold land. Those who were holding it for speculative purposes with no intent to really do anything with it except hope its value will increase, will instead sell or abandon their claims to land, making much more land available. Those who wish to do something with land will build improvements upon it that cause the property to generate more income than the tax, justifying the cost of holding it.

This tends to solve two problems in one stroke:

- Removing speculative scalpers who hold onto scarce assets unproductively

- Ensuring that land organically finds its way into the hands of those who want to put it to its highest and best use.

Does this work?

Georgism is, at this point in history, a well-researched economic policy. If you pore through the literature, you’ll see 140+ years of various experiments and theoretical discussions. The consensus is that these policies generally seem to work and do in fact reduce speculation. But Georgism isn’t widely implemented (yet) because real world politics sucks. The real world is full of entrenched powers that really don’t want to give up their eternal profit engines, so meaningful change has been lurching at best.

Seeing as this is a practical paper about virtual worlds, we’ll only reference these arcane economic discussions if they are immediately relevant to the topic of game design.

Study of Land Value Taxes in a virtual world context has been limited so far, but the theoretical basis for it is strong, and there is already some evidence of LVT-like policies in other virtual worlds that suggest the ideas do in fact transfer:

- Economist Ramin Shokrizade, with no formal knowledge of Georgist theory, fixed EVE Online’s land recession simply by directing CCP Games to assess a “high enough” holding fee to land-like spaceship factories, which had the effect of dissuading speculators.

- The housing crisis observed in Ultima Online and Final Fantasy XIV are both in line with what the Georgist model predicts.

- Early signs from the economies of blockchain games Axie Infinity, Decentraland, and The Sandbox – all premised on virtual land sales – are also right in line with Georgist predictions.

If you want to explore real world Georgism more on your own and the evidence that backs it up, here are several useful essays that include many citations:

- Book Review: Progress and Poverty

- Does Georgism Work: Is Land a Really Big Deal?

- Does Georgism Work: Can Landlords Pass Land Value Tax on to Tenants?

- Does Georgism Work: Can Unimproved Land Value Be Accurately Assessed Apart from Buildings?

Differences between the Digital and the Physical World

Virtual Land Value Taxes are inspired by real world Land Value Taxes, but they are not exactly the same. The virtual world has a whole set of different properties that create very different design constraints.

To put it pithily:

- In the physical world, a policy maker is a politician or a bureaucrat.

- In the digital world, a game designer is more like a god.

Semi-Phenomenal, Nearly-Cosmic Power...

Here are some of a designer’s god-like powers:

- Control over matter. Create and destroy digital assets at will – including land!

- God’s eye view. View any and all transactions in the digital economy in perfect detail.

- Bend space. Designs are unconstrained by the laws of Euclidean geometry.

- Cleanly divide real estate. Pick a house off the land, stick it in someone’s pocket.

- Ultimate lawgiver. Change any rule, or even the laws of physics, at will.

- The world is your laboratory. Create parallel “shards” for experiments and A/B tests.

- Smite evildoers. Ban any player for any reason.

There’s a catch, however…

...Itty Bitty Living Space

Don’t get too high an opinion of yourself. You’re a lesser god at best. Yes, you have powers over your digital world that earthly rulers could never dream of, but only in that one domain, and you are still constrained by the limits of the finite plane on which you exist.

Here are some of your limitations:

- Participation is voluntary: Players can and will leave the game if they are not enjoying the experience. Bad policies that result in player churn will still kill your game.

- Physical costs. On the prime material plane, servers aren’t free.

- Implementation costs. Artists and programmers also aren’t free.

- Player activity escaping the simulation. Out-of-game black markets and other forms of player collusion exist and will wreak havoc on your virtual world.

- Not truly omniscient. You can only see what your servers log.

- Players have free will. And they will both surprise you and defy you.

- Hacking & security costs. Pesky Prometheuses will try to break into Mt. Olympus (Just ask Sky Mavis).

- Central planning failures. Don’t think it can’t happen to you (Just ask Sky Mavis).

Other Key Differences

More specific to the concept of LVTs, a lot of the basic economic elements that such a policy is based on need to be radically reinterpreted in the context of a digital world.

- Land: Physical land doesn’t exist in digital worlds. There are constructs that look and behave a lot like land. But this is an illusion and the details of how land is implemented matter immensely.

- Rent: The mechanic of players renting to other players is rather rare in traditional games, but is becoming particularly popular in blockchain games. A common purpose of such a feature is to offer a way for players to engage with the economy when crucial assets have very high prices. Of course, those high prices are themselves often a symptom of a virtual world designed as a financial vehicle first and a game second. But suffice it to say, some games let you rent assets to other players, with the return of the asset upon expiry of the contract enforced by software rather than courts of law.

- Taxes: Virtual worlds tend to use faucet-and-drain economies where digital assets can be created and destroyed on whim. Virtual taxes generally act as yet another arbitrary sink, often in service of a player incentive. Much of real-world concerns about levying taxes to pay for communal services barely apply.

It is easy to just assume that everyone knows what “land” is. But in virtual worlds these need to be recreated from first principles. Certain assumptions become design choices. Is land finite? In the real world, that’s obviously true. In the virtual world, it is a choice. And how does “location” work? In the real world we take Euclidean geometry and conventional physics for granted – you can’t be in two places at once, you can’t instantly warp from one location to another, etc., but these need not be so in a virtual world.

With all that properly understood, let’s talk about how to actually implement a digital Land Value Tax in a virtual world.

Implementing Digital Land Value Tax

There are four basic steps to implementing a digital Land Value Tax policy:

- Identify “land-like assets”

- Separate “improvements” from “land”

- Discover the full market value of land (ideally as both rental income and as selling value)

- Levy a Land Value Tax that captures 85-100% of land rents

There are a few other baseline requirements that your virtual world must first fulfill for this to work, of course:

- Land must be tradeable

- There must be some kind of currency to levy the tax in

Keep in mind that if you don’t make land tradeable, or provide some sort of currency for your economy, players may simply provide both features themselves. If land cannot be formally traded between accounts in-game, players will form a black market to buy, sell, and trade accounts out-of-game, or provide services that do whatever it takes to move an asset from one account and into another one. And if you don’t provide an official currency, players will find some other commodity in game to stand in for one and use that.

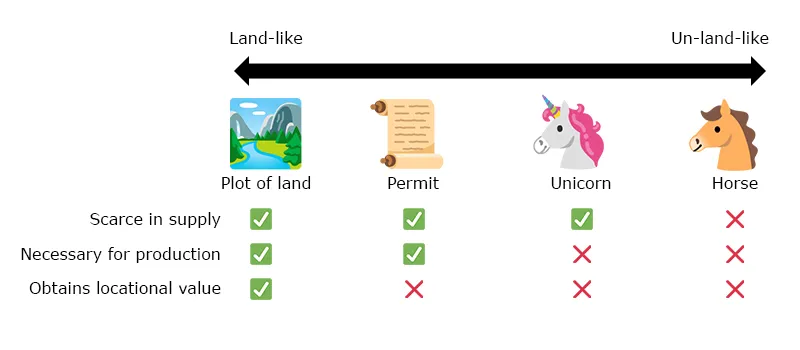

Step 1 - Identify Land-Like Assets

Your first step should be to evaluate your design and identify land-like assets. But what is a “land-like asset”? Generally speaking it’s any thing you can own that fulfills three requirements:

- Is strictly scarce and cannot be produced

- Is necessary for production or gameplay

- Is more or less valuable because of its location

(Also, it goes without saying that the asset must have a significant degree of persistence and be identifiable to the community – if it’s ephemeral or highly instanced it’s not a good candidate for a land-like asset)

Scarce / Non-produced

The asset must be something that players cannot make. It needs to be essentially finite in supply, pre-provided by the developers themselves as part of “the world,” and come with the expectation that only a certain amount of it will be provided.

Occasional expansions in the land supply weaken this property but don’t necessarily break it. If new land is created only very rarely, this property will mostly hold throughout the lifetime of your game. The key thing that drives it is players’ expectations about the supply of land over long time horizons.

Necessary for production or gameplay

The asset must be something players must possess in order to do certain things in the game, particularly in the game’s economy. This allows those who possess this asset to “gatekeep” those kinds of “production.” The more important these things are, the more valuable the land becomes.

Obtains value from location

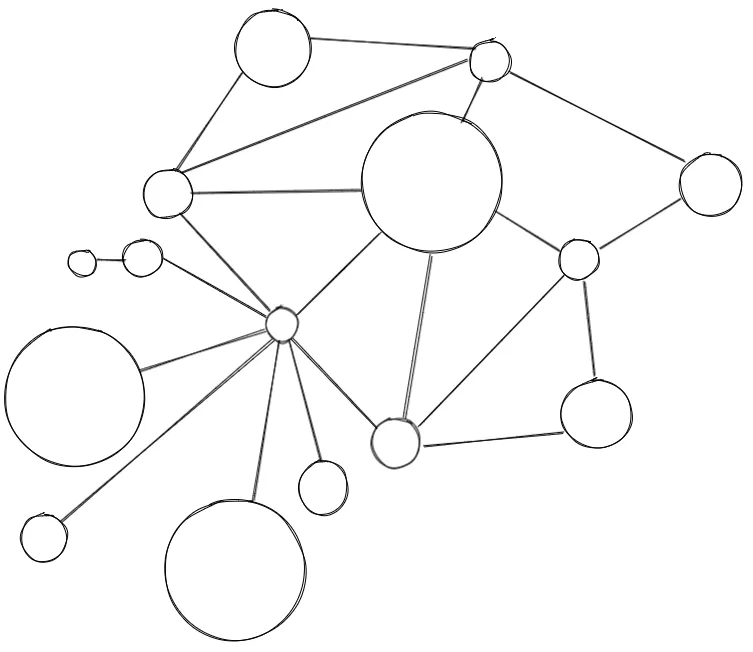

The asset must be more valuable as a function of its connection to other sources of value in a network of connected nodes.

Networks, not geography: In virtual spaces it is useful to talk about network graphs instead of geographic space because games regularly break from boring old Cartesian planes with all sorts of hyperlinks

- In a space game with wormholes between systems, the graph of wormholes and the cost of travel and value flowing from at each nearby node determines the value of any given locational node.

- In player housing, houses may be instanced and allow for instantaneous fast travel between locations. The cost of transport drops to zero and eliminates all differences from location.

Locational costs: Let’s break that down a little. In the most basic case, location in a network determines transport and holding costs.

- Flat land, being essentially a Cartesian plane, is a topologically rigid network where each location has a fixed distance from other locations.

- If the piece of land you own is near town and travel time is shorter because of that closeness, then the land gains some value due to its location. A player says “I’m willing to pay more for this land because it reduces the cost of travel time when going to town.”

This is a really important property because it makes each parcel of land non-fungible, and it’s another way in which land can be said to be “scarce.” There’s plenty of land in the Nevada desert but nobody cares. There’s only one Manhattan and everybody wants a piece of it.

Locational value flows: The network connections can also provide value to a location.

- Land can have value based on resources and affordances provided directly by the developers

- By building close to key resources, value flows from these nodes across the graph to the location.

Let's use an illustration as an example. Taking our network graph from before, let's say each node represents a piece of land, the size of the node represents the market value of its "inherent" developer-provided resources and affordances, and lines connecting nodes represent travel connections. Let's say owning a plot entitles you to everything it produces as well as to charge a fee for people and goods to move across it.

Which one of these nodes is most valuable? The small red one, or the big blue one?

That's right, the small red one. Even though it's the smallest node and has the least "natural" direct resource benefits, it's the best strategic location on the graph. The blue node produces lots of resources, and has lots of neighbors, but all those neighbors have multiple other nodes they can partner with, too. Meanwhile red sits at a strategic bottleneck. If anyone on the southwest part of the graph wants to do business with anyone on the northeast, and vice versa, they have to do it on red's terms.

Doesn't have to be literal

A land-like asset does not have to be represented in-game as “land”, it simply needs to have the above three properties. Furthermore, land-like assets can exist on a sliding scale of more land-like to less land-like depending on how many of the 3 properties they fulfill, and how strongly.

In EVE Online, spaceship factories were land-like assets. Even though we would consider factories “capital” in the real world, in EVE the factories were all provided directly by the developers, you couldn’t make any more, and were absolutely necessary for the production of spaceships. This is a textbook example of a digital land-like asset, despite the thematic set dressing of a “factory.”

People create value

Much of the value generated in a virtual world is social capital. We often think of value in terms of ‘stuff’ but in a virtual economy assets are mostly illusionary. What isn’t an illusion is our relative relationships inside the virtual world with other human beings. They are real, we are real and we care deeply about our standing with others.

Land-like assets have adjacency to those other people. They help codify and mediate relationships, status and social support.

If you look carefully, you can track large portions of location value to social network adjacencies with either strong benefits or lowered costs. To consider Manhattan again, the land is primarily valuable because of the proximity to all the people here and the services they provide. Otherwise it would just be a worthless island.

This insight is in some sense the heart of Georgism as a political movement. Land is valuable because the community around it is valuable. The community creates the value, but the speculators and the rentiers capture it. Even if we didn't care about fairness, speculation and rentierism are not good recipes for building a vibrant online community.

Case Study

The more land-like the asset is, and the more important it is to the game’s economy, the worse we expect the land recession to be.

As a practical example, let’s consider the fictional ClicheQuest XII: Twilight of Subtitles, a promising new MMO game from equally fictional developer Wellspring Game Systems.

ClicheQuest XII has many assets that players can own, buy, and sell, but let’s consider just four of them: plots of land, guild permits, mystical unicorns, and common horses.

Plots of Land

These are scarce in supply and each one is also necessarily unique (given that at minimum each is permanently fixed to a particular location). In CQXII, resources are gathered from land, and all structures must be built on land. This makes access to land “necessary for production” because without land you can’t participate in major parts of the game. Finally, the location of the land matters. As other players regularly gather in particular locations, land closer to those settlements will become more valuable. This is due to the agglomeration effect. CQXII land is a fully land-like asset, and thus a prime asset for speculators that will yield the greatest returns.

Permits

These are tradeable deeds granted by in-game authorities and are similar to real-world taxi medallions. Players who wish to engage in certain economic activities such as building temples or brewing potions must first obtain the respective permit from the priest’s guild or the witch’s guild. Each guild issues only a fixed number of permits, but within its own category, one permit is as good as any other. In this sense permits are non-unique and thus “fungible.” Permits are necessary for production because the game will literally not allow you to do certain things without the right permit in your inventory. Permits have many properties in common with land in that they gate-keep access to the economy: an enterprising witch doesn’t have to brew her own potions, she can let an apprentice operate under her permit and charge the apprentice rent for the privilege. However, permits aren’t tied to a particular location and thus don’t obtain locational value the same way land does. They’re somewhat land-like, but not all the way there. There will be speculative interest in permits, but not as much as in land.

Unicorns

Unicorns are a special kind of mount in CQXII. They aren’t necessary for production, but they are very nice to have because they are swift, loyal, and impervious to all forms of harm. Only 10,000 unicorns exist on any given server, and the developers have sworn to never create any more. Since Unicorns aren’t tied to a particular location, they don’t obtain locational value. The only way unicorns are “land-like” is that they are scarce in supply. But because they aren’t truly necessary for production, it’s not a big deal if you don’t own a unicorn. There is some speculative interest in holding unicorns due to their scarcity. That said, in the long term most of the value of bids will be based on their inherent utility, given that unicorn ownership doesn’t gatekeep participation in the economy itself.

Horses

Horses are a common type of mount. They are very useful and nice to have, but they aren’t necessary for production, they aren’t scarce, and they don’t obtain locational value. If you want to buy a horse all you have to do is go to your local horse breeder and buy one. And if that particular breeder won’t sell you one, another one will. Worst case scenario, you can just go out into the wild and try to tame a wild stallion yourself. Horses have little speculative interest because owning one doesn’t grant you any real leverage over anybody else; their value is entirely derived from their utility.

Step 2 - Separate "Improvements" from "Land"

The next step is to distinguish between land-like assets and “improvements” that have been made to or built upon them. In the real world the most typical example of an “improvement” is a building, but technically speaking anything that makes land more valuable that comes from applying labor or capital counts as an improvement. Plowing a field, irrigating it, or planting an orchard on it all count as improvements. In the context of a game both “upgrades” and “buildings” count as “improvements.”

If your game does not include any features whereby players may “improve” on land-like-assets, then there is nothing to be done here. In that case, all you need to do is ensure that there is a healthy sale and/or rental market so that you can derive land purchase prices and rental income directly from observation. If there are improvement mechanisms (such as building construction), then you must take special care in your implementation to make it as easy as possible to separate the market value of improvements from the market value of unimproved land.

In the real world, separating land from improvements is a complex but feasible task. You should therefore be able to implement a Land Value Tax in almost any kind of online multiplayer game with much less difficulty than in the real world. There are, however, certain choices that could make your job easier.

Total market information

If you take good care to log all market transactions from the game’s first day of operation, you give yourself a huge advantage that would make real-world assessors green with envy. Having complete and comprehensive data makes any numerical estimation method much more powerful. This assumes of course that your economy is healthy and is not pushing a large volume of transactions off onto a black market that is invisible to you.

Every home can be a mobile home

The greatest affordance we have in the digital world is that we can, in principle, move any player-created structure or improvement anywhere we want. We may still wish to constrain players’ ability to do this themselves, but the point is that the power is available to the game developers. It is perfectly feasible to let the player pluck the house off a plot of land, stuff it in their inventory, and sell the land bare.

Fungible improvements

In the real world, most houses can’t be trivially moved from one spot to another, and even then no two houses are exactly alike – especially considering varying amounts of wear and tear. In the digital world it is perfectly plausible for certain structures to be perfectly interchangeable commodities, and degradation of virtual goods doesn’t exist unless you explicitly implement it. This makes it much easier to assess the value of improvements as there is less variation to consider between assets.

Step 3 - Discover the full market value of land

In order to levy a Land Value Tax, we must first assess the value of land. And what do we mean by “land value?” There’s two different kinds:

- Land selling value

- Recurring land income

Land income drives land selling value (aka land price), not the other way around. The amount someone is willing to pay for land is the net present value of the recurring income the land generates – the amount of money you expect the land to produce over some time horizon, adjusted for how patient you are. This income can be literal monetary income, benefits the land provides that someone is willing to pay money for, or a mix of both.

In any case, whether you’re assessing selling value or income, all assessments are based on a simple algebraic equation:

T = I + L

Total Market Value = (Improvements Value) + (Land Value)

If you know any two of these values, you can derive the third, known as the “residual.”

But we must also take care to assess at full market value. Full market value specifically means the value an asset would obtain in the market under “fair and unconstrained” conditions. As a counter-example, if your dad sells you a valuable plot of land for $1, he’s intentionally selling it for less than full market value; he’s essentially giving you a gift. So we should exclude any such non-"arm’s length" transactions as a basis for assessments.

The goal is to discover the full market selling value of every land parcel in our virtual world. We have three main ways we can do this:

- Assessment

- Short-term leases with auctions

- Harberger taxes

- Modified Harberger Taxes

- Blood Taxes

Assessment

In the real world, property assessors use a variety of complex methods for estimating the value of land separately from that of buildings, typically something like hedonic regression.

In the digital world, we can just accept separate bids on the land and the improvements for any given property in the game, and thus generate cleanly separated valuations directly from the market. Any player may offer to buy just the land or just the improvements. If the land alone is sold, the improvements are stuffed into the owner’s inventory. If the improvements are sold, they go into the buyer’s inventory and the owner’s land becomes bare.

This allows you to collect true market data about how players value land and improvements separately.

To estimate the value of assets that have not had recent market transactions, you compare those to recently sold comparable properties in the area, making adjustments for differences. In practice you can automate this procedure with either a linear regression model or a machine learning model that uses a dataset built from your observed market transactions and the properties of your assets (with location being a highly salient property). You will want to ensure that your model not only has predictive value for the hold-out set of data you use to evaluate the model during training, but also that it actually accurately predicts the value of future transactions.

Pros:

- Good price discovery

- Can be retrofitted into an existing land economy

Cons:

- Requires you to do math and book-keeping

There are other ways to perform price discovery of land-like assets for the purposes of levying an LVT, or even replacing LVT with a different kind of policy that achieves many of the same goals. Let’s look at those next.

Short-term leases

In this model the “government” (ie the developer) “owns” the actual title to all the land in the game, and simply leases it out. Every player becomes a de-facto tenant and must renew their lease at the end of the rental term.

At the end of the rental term, the land goes up for auction, and the player who wins the auction becomes the next holder of the land. There are many, many, kinds of auctions, but a popular one for this sort of purpose is the Vickrey Auction – all bids are secret, the winner is whoever gives the highest bid, and the price the winner pays is the amount of the second highest bid. The advantage of this kind of auction is that each bidder is incentivized to bid the maximum amount the asset is actually worth to them, without worrying about what others are likely to bid. This is because if the bidder wins the auction, they will not pay the amount of their own bid, but the lower amount bid by whoever came in second place. In the event that there is only one bidder, that person wins the auction regardless of what they bid, the "next highest bid" is zero, and the asset may be had for free.

Although it is essential that bids are kept secret from other bidders, the game developer can and should access that information for purposes of price discovery. Once the auction has been conducted we have three things: 1) a willing buyer, 2) a winning market price, and 3) a range of bids.

The downside to this approach is that it’s more aggressive than an LVT. Land Value Taxes are an ongoing signal to the player to make the best use of their land or sell it to someone who will, but the choice is still ultimately theirs. When a short-term lease expires, the owner could lose the land simply by losing the auction. Also, land income values cannot be reassessed by this method on any more frequent time interval than the term of the lease itself, whereas the traditional methods could (in theory) reassess values on any schedule.

Pros:

- Simple to implement

- Excellent price discovery

Cons:

- Exposes the landowner to the risk of a forced sale at the end of the auction term

- Harder to retrofit into an existing game, best implemented from the start

Harberger Taxes

This method was popularized by the book Radical Markets. In this system everyone self-assesses the value of their own property. They just come up with a number and write it down, that’s the value of their property. In our case, we would only need to have players do this for land-like assets.

Two crucial things happen next:

- Players pay taxes based on that valuation

- Anyone has the right to purchase the asset for that valuation in a forced sale

This unusual method is supposed to balance incentives: you have an incentive to not value your item too high to avoid paying taxes, but you also have an incentive to not value your item too low lest it be bought off of you. Ideally a rational player will be forced to discover the true market value of their asset in this way. A price that is not so high you can’t bear to pay the taxes, but is not so low that you’d be unwilling to take that much money in exchange for it.

To put it another way:

Most people would accept an offer to buy their house for a billion dollars, but not for 1 dollar.

Most people would be glad to pay an annual X% tax on 1 dollar, but not on a billion dollars.

The entire idea of Harberger taxes is to find the sweet spot in the middle of that range, for every piece of property. This could be one way for getting players themselves to conduct price discovery for land-like assets.

There are downsides. For one, it assumes a certain level of sophistication on the user’s behalf. One can easily imagine novice players under- or over- pricing assets and running into trouble. There could also be innocent mistakes with huge consequences such as misplacing a decimal point or a zero. If you try to ameliorate this with some auto-populated default value, players will probably heavily gravitate towards it, defeating the point of the self-assessment.

This method can also force the current landowner off the property with little notice and no recourse, which is a huge issue and likely makes it a non-starter for many virtual worlds.

There are proposed ways to modify Harberger Tax schemes to get around the abrupt forced sale problem, but they make the implementation even more complex.

Modified Harberger Taxes

In classic Harberger taxes, if a buyer is willing to pay more than the valuation, they get it right away. In a modified version proposed by Fabricio Nakata, you instead make the prospective buyer put their offer money into an escrow account (this is an implementation detail that the game developer would manage). The owner may then decide to either accept the offer or reject it.

If they reject the offer, the property’s valuation immediately rises to match the value of the rejected offer, and the rejected buyer is rewarded with a bounty – an amount equal to the additional tax that will now be levied because of the increased valuation (for e.g. 1-2 months or whatever the appropriate duration of time is). If the owner of the property wants their assessment lowered, they may do so by changing their self-valuation, but must put money in a “bounty bond” account that is sufficient to pay out the bounty if someone comes along and offers a higher price for the property and the owner chooses to reject it.

Pros:

- Excellent price discovery

Cons:

- Exposes the landowner to forced sales (in classic Harberger)

- Larger complexity burden (in modified Harberger)

- Punishes simple mistakes and unsophisticated players

There’s another way to modify the concept of Harberger Taxes, specifically in the context of video games, which we call “Blood Taxes.”

Blood Taxes

If you squint, Harberger Taxes look a little bit like balancing the costs of attacking and defending territory, only with money instead of weapons. The player wants to invest a certain amount in “defense” to protect their land, but not so much that they consume more resources than the land is worth, defeating the point of holding it in the first place. Since we’re talking about video games here, there’s no reason you couldn’t implement such a system with actual attacking and actual defending.

Redirecting a portion of land income to building fortifications and garrisoning defenders is akin to paying taxes, and funding an invading army to seize the land is akin to offering a buyout price. Since it is typically much cheaper to defend something than to attack it, the attacker must spend proportionately more to seize the land than it costs for the defender to protect it. The attacker is willing to do this because the ultimate prize is the recurring income of the land. If the attacker can push the defender to the point where all their income is gobbled up by defense spending, the defender may even choose to simply abandon the territory rather than keep up the fight.

The “price” here is ultimately paid in “blood” rather than in money, and the “taxes” aren’t collected by anyone, but this is a video game where taxes often just go straight into a sink, so there’s not much difference on that score.

Naively, “blood taxes” are more akin to a property tax rather than a land tax, because if invaders can capture improvements built by the defenders, that could serve to increase the price attackers are willing to pay and that defenders must respond to. To make sure blood taxes only fall on land, one would need to modify the gameplay such that improvements cannot be seized by an invading army, only the bare land. There are two ways to do this. One is to instantly raze all improvements on conquered land (a hefty transaction cost to the “seller” that imposes significant deadweight loss). Another way would be to pluck the vanquished defender’s castle off the land, stick it in the defender’s pocket as a consolation prize, and send them on their way. Giving defeated players some portion of the value of their destroyed base is a fairly common mechanic already, so this fits in.

Virtual world economies are driven by faucets and drains and must constantly sink value to stave off the ever-present specter of runaway inflation, so this particular implementation isn’t as outlandish as it first appears.

The biggest limitation to blood taxes is that the thematic set dressing and PVP framing is not appropriate for every type of game and should thus not be regarded as a universal solution.

Pros:

- No worrying about market transactions and taxes, just let people fight

- Don't bore players to death with tax policy, just kill them to death

Cons:

- Needs modification otherwise it’s just a property tax

- Exposes the landowner to straight-up violent conquest

- Inefficiency of war causes “assessment errors” for both attackers and defenders

- Requires a battle and conquest mechanic

- Changing the battle system could have unintended economic consequences

Our Recommendation

Every game is different so we can't point to any specific price discovery solution as universally appropriate. But generally speaking we rank them in this order:

- Short-term leases

- Assessment

- Harberger Taxes

Short-term leases with Vickrey auctions are simple and give you direct access to land income market values, but they can be harder to retrofit into existing games.

Assessment can work well and can be used to drop an LVT policy into an existing game, but you'll need to do some math and carefully track transaction records.

Harberger Taxes are interesting and theoretically brilliant, but are probably a hard sell to players and raise UX concerns.

That said, all of these are excellent candidates, and you should evaluate all of the choices and make the right decision for your particular game. Even better, get your game economist to run a controlled A/B experiment. If you do, write to us and tell us the results!

Step 4 - Levy a Land Value Tax that captures 85-100% of land rents

Okay, so we’ve identified the land-like assets, we’ve separated land from improvements, and we’ve accurately assessed the full market selling value of all the land. What’s next?

The next step is to actually levy the tax. Decide on a time interval (say, once a month), pick a tax rate to apply, and then charge landowners the tax. If someone doesn’t pay their tax, the land is confiscated and sold at auction to the public (throw in a grace period if you feel like, it's your virtual world).

Determining the Tax Rate

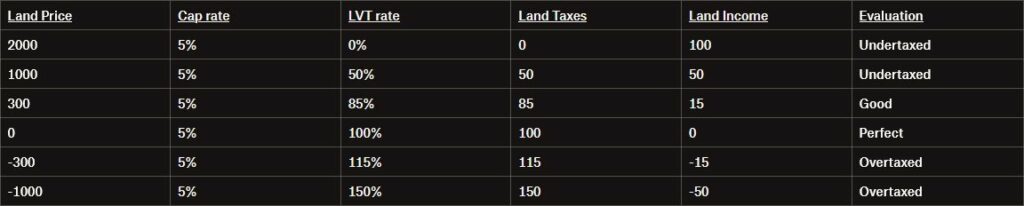

Orthodox Georgism proposes a tax rate of 85-100% on the recurring rental income generated by land. The basic idea is that the selling price of land should approach zero. Let that be your north star: if land still has a large selling price, your LVT is too low. If land is being abandoned and players have to be paid to hold it (the selling price is negative), then your LVT is too high.

Wait! That’s weird!

If we levy a Land Value Tax, and we get it exactly right, and the price of the land goes to zero, and we base the tax on the land value, which is now zero… isn’t there a problem here?

This is a common point of confusion, but it's actually not that hard to disentangle it. First let's nail down some precise terms:

Land Selling Value, refers to the actual selling price of land in the market, which “prices in” any taxes the holder of the land has to pay.

Land Income, is the market value of the recurring benefit that the land itself produces. It is land income that drives land selling value, not the other way around. Land Income is unchanged by Land Value Tax. The land’s productivity doesn’t go down. But the Land Selling Value does change.

Bear with us while we step through some math and explain. Here's the formula for Land Selling Value:

S = (I - T) / D

Land Selling Value = (Land Income - Land Taxes) / Discount Rate

Discount Rate represents how much one values a dollar today versus a dollar tomorrow. Even if some land could theoretically generate an infinite amount of benefits if I held on to it forever, I'm not going to live that long. I care about my investment's value tomorrow, and next year, and maybe even over the next few decades, but I don't care about it's value in 5,000 years. The less patient I am, the higher my discount rate, and the less I'm willing to pay for the same piece of income-generating land.

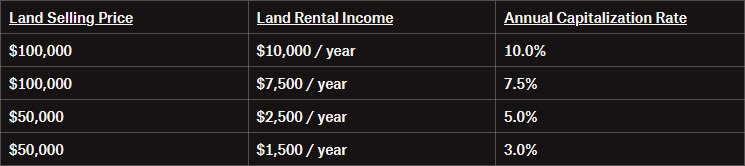

Here are some example calculations using a 5% annual discount rate, showing how a change in land taxes affects the selling value:

What this example hopefully makes clear is that LVT is a tax on the recurring land income, not the selling price. We are not proposing a recurring tax anywhere close to the actual full purchase price of a plot of land.

If your game has a rental mechanic then you should have lots of transaction records for the rental price of land. This should allow you to build a model that gives you an accurate assessed rental income value for every piece of land. Tax that at 85-100%, and adjust accordingly until you observe that the land’s selling price is approximately zero. You don’t need to get it perfect, in fact it’s preferable to undershoot the Land Value Tax by a little bit just to be safe (hence the 85% lower bound).

Evidence suggests you can see good results even without a perfectly calibrated 100% LVT. Economist Ramin Shokrizade, with no formal knowledge of Georgist theory, fixed EVE Online’s land recession simply by directing CCP Games to assess a “high enough” holding fee to land-like spaceship factories, which had the effect of dissuading speculators.

But what if you don’t have a rental mechanic or only have selling values in your transaction logs? In that case you’ll need to work out the land income indirectly.

Capitalization Rate

The capitalization rate is the ratio between the selling price of land and how much income it generates for the owner. If you have a rental mechanic, you can calculate this ratio easily. But if you don’t, you’ll need to measure income in another way, such as assessing the market value of all the resources and other benefits that a player generates over a unit of time by holding the land.

For context, in the real world annual capitalization rates tend to be somewhere between 3-10% of the selling value of land. If you have absolutely no idea what an appropriate capitalization rate for your virtual world is, start by guessing somewhere in the 3-10% range, observe what happens to the selling price of land, and adjust up or down accordingly. Remember – your goal is to get the selling price of land to approach zero without going negative.

If you are levying a full 100% LVT, then the tax rate and the capitalization rate will be the same. If you are levying an 85% LVT, then the tax rate will be 85% of the capitalization rate.

Here are some examples of how land selling price and land rental income relate to the capitalization rate:

Note that in the real world capitalization rates tend to vary both by location and by property type (commercial vs. residential, urban vs. rural, etc) and we would expect to see similar results in the digital world. The rule of thumb is that the safer the investment, the lower the capitalization rate.

We should expect people's time horizons to be significantly shorter in virtual worlds than in the real world; a game with a large player base regularly logging in over many years is a rare specimen. Capitalization rates should probably be considered on a timescale of months rather than years for this reason.

Setting the Tax Rate

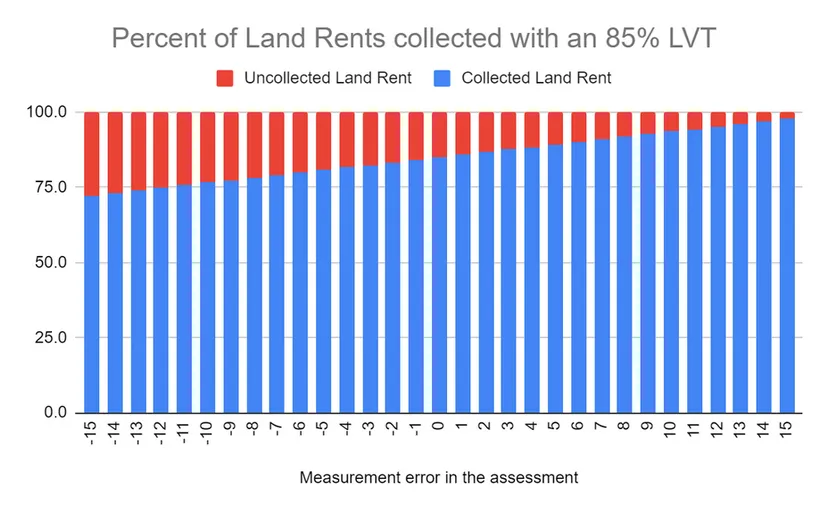

In the real world, modern Georgists suggest that collecting 85% of recurring land income is an adequate upper limit. This allows for a sliver of land rents to go to the landowner, while allowing for a substantial safety margin in the case of assessment errors. Collecting LVT should be thought of as a game of “The Price is Right” – you get close to the true value without going over. We want to drive the selling price of land down to zero, but we don’t want to drive the selling price negative.

If you collect 85% of assessed land income (aka land rents), you allow yourself an error range slightly wider than plus or minus 15%. Given the enhanced precision of data in a virtual world, this should be quite a comfortable margin:

Using Land Selling Price to Test LVT Accuracy

As you collect more land income, that piece of land’s selling price approaches zero.

So how do you know if your LVT is accurate? Look at the price of land in the market. If it’s close to zero, you’re doing a good job. If it’s a lot more than zero, there’s still a lot of uncollected land income. And if it’s less than zero, meaning you have to pay people to get them to willingly hold land, you’re taxing it too much. And if the land selling price is exactly zero, you’re doing great, leave the tax rate unchanged.

The key is that land income is unaffected by LVT. The land’s fundamental productivity doesn’t change if you tax it, but who is collecting that same amount of land income does. You have the privilege of observing both the amount that you, the “government,” are collecting, as well as what any tenants are being charged. From these two figures you can always know the total amount. It’s on this basis that you can calculate the full untaxed market value of the land.

That said, you can also just guess, and then iteratively adjust the land taxes until the market responds with land prices approaching zero, knowing this signals that your tax rates are appropriate. What’s the land income for a parcel of land whose price has been driven to exactly 0? Exactly the amount you’re currently charging in taxes!

How to Spend the Money

Okay, great, we've done all the hard work and we've levied this tax that's crushed perverse incentives to speculate, and now the market only rewards people who are actually interested in participating in the game and building cool stuff within it.

But... didn't we also raise a bunch of money with those taxes? What are we gonna do we do with it? Well, first it depends what kind of money you raised.

Fake Money

Most traditional MMO’s that lack “real money” economies will simply delete the money raised by an LVT. This is for two reasons: 1) the in-game currency is useless for funding real world development costs, and 2) the primary economic challenge of traditional MMO’s is MUDflation, where endgame players accumulate lots of money with nothing to sink it in, flooding the market with currency and driving down the market price of high-end items. Given that housing is a traditional end-game “money sink” mechanic, LVT is a natural solution to this problem.

Real Money

By “real money” we mean a game in which you can cash out virtual currency for real world currency through any number of intermediaries (black markets, crypto, paypal, banks, etc). There are plenty of systems in which you can only cash in real money (Steam Wallets are a good example), and these don't count.

If your economy runs on “real money,” two things change.

The first is you are much more vulnerable to having criminals use your game for money laundering and your players become valuable targets for account theft, but that is beyond the scope of this particular paper.

The second thing that changes is that the same currency players use to trade in-game could also obtain real world value for you, the developer. What can you do with the money?

- Keep it. Because why not?

- Employee bonuses. Give it to your employees, they deserve it.

- Reinvest it. The Henry George Theorem, derived by Nobel Laureate Joseph Stiglitz, predicts that spending on “pure public goods” causes land values to rise proportionately, and other research suggests that a partial effect holds for other kinds of public spending. A real-money LVT game could use the stimulating effects of LVT on user generated content, and the tendency of “public spending” by the developer on new features to soak into land values, and set up a self-funding flywheel.

- Universal Basic Income. Henry George was an early proponent of what we now call UBI, called a “Citizen’s Dividend” in his time. You take the taxes collected by LVT and share them out equally among your players. In this way your player base, which is one of the key things that makes your game grow in value, are at least partially compensated for the value they are creating. In the digital world this immediately throws up some red flags about who gets to count as a player. You will have to avoid the problem of people signing up under 10 different accounts to get multiple UBI payments.

Closing Thoughts

If you're building a virtual world that includes land-like assets, you need to be careful about perverse incentives that can attract land speculators who will suck all the fun out of your game and crash your in-game economy.

To fix this, you must identify land-like assets, separate the value of "improvements" from that of "land," measure the selling value and/or recurring income of the land, and then levy a Land Value Tax that captures 85-100% of the land income. This creates a "use it or lose it" holding fee that properly aligns incentives, ensuring that only people who want to use land-like assets for their actual intended purpose will hold onto them.

But a few questions still linger.

What About Blockchain and NFTs?

The good news is that, having exhaustively investigated Blockchain and NFT technology, we conclude that there is nothing in current practice (and very little in theory) that can be done in games with these technologies that cannot be accomplished just as easily (or more easily) with conventional solutions.

So if you’re making a Blockchain or NFT game, anything in this policy paper should be just as applicable, with the exception that you are in a worse position for adjudicating disputes as you lack the power to reverse fraudulent transactions and hacks that occur on an immutable blockchain. Also, the high valuations currently chasing blockchain games will also give you a much more aggressive set of financially motivated bad actors to contend with.

Good luck!

Can't you just make more land?

Yes, you certainly can. If land supply can increase as necessary, that makes it less scarce, which makes the asset less "land-like" economically speaking. This is Second Life's approach to land, more or less.

But creating more land isn't always a solution. Maybe your server cost structure has limits, so you can't just spin up tons of new housing blocks (as is commonly alleged about Final Fantasy XIV).

Furthermore, it's hard to escape the agglomeration effect. Land has value for three reasons: location, location, location. This comes from proximity to centers of economic activity, valuable resources, and most importantly, people. So even on an infinite plane, some locations will always be more valuable than others. America has plenty of empty land, but a patch of desert is no replacement for New York City. Likewise, Ultima Online has plenty of servers, but there's no replacement for the Atlantic shard.

What if I already pre-sold a bunch of land?

This is the case for a lot of blockchain games like Decentraland, Axie Infinity, and The Sandbox, who have sold millions of dollars worth of land in advance of most (or any) of their land-based features coming online.

We're sorry to say this, but you might be hosed.

When you pre-sell land, you attract a certain class of investor who expects a return on that asset. And because you've used both the metaphor and the mechanics of land from the real world, they're expecting it will play out the same way: buy land when it's cheap, wait for people to move in and start building stuff, and see the investment rise in value.

When the predictable land crisis hits, you are faced with two terrible choices:

- Protect land scarcity, angering the landless and cutting off user growth, OR

- Make concessions to the landless, sparking a landowner revolt

There's signs of the second one starting to bubble in the Axie Infinity community as we speak, it wasn't hard to find responses like these in the wake of a Q&A about their upcoming land gameplay:

We don't envy anyone who has painted themselves into this corner. Our best advice to everyone else is to not put yourself there in the first place.

Building a virtual world is no easy task, but by George, you can do this.

And Land Value Tax can help.