Introduction

Axie Infinity, the former poster child of blockchain gaming and the game that coined the term “Play to Earn,” has fallen on hard times as this “digital nation” reels from a recession prompted by declining player growth and plummeting token values. After the initial troubles began, North Korean hackers stole over half a billion dollars in crypto assets from the bridge that connects Ronin, the game’s private blockchain, to Ethereum. This was soon followed by a sector-wide crypto crash, a major fall in stock markets, and growing fears of a coming recession in the global economy.

Before we unpack all that, let’s take a step back. We first detailed how Axie Infinity’s developer Sky Mavis achieved fame and fortune in Naavik’s inaugural blockchain game deconstruction in November of last year: Axie Infinity: Infinite Opportunity or Infinite Peril? Sky Mavis was still riding high at the time but was beginning to see signs of slowing growth. We concluded our piece with this:

- Axie Infinity’s business model, for the moment, depends on continued growth in its user base and continued fresh money entering the system to prop up the value of Axies, $AXS, and $SLP. The pace of that new user growth is also critical, because any slowdown in the breeding and selling of Axies to new players will lead to a decline in revenue. We think this outcome is likely over the coming months barring any unforeseen spike in new users. In Sky Mavis’ own words, “this is unsustainable.” Of course, as Keynes probably didn’t say, “the market can stay irrational longer than you can stay solvent.”

- What really matters for Axie Infinity’s future is whether Sky Mavis can provide credible future plans for new features that will ground the game in a more stable source of recurring revenue that meets the expectations of all stakeholders. This hope squarely rests on the potential of the land-centric user-generated content efforts (some players need to be willing to spend without expecting a financial return), but we’re still hesitant to assume that these particular plans will lead to outsized, sustainable success. Fortunately, it’s relatively early, and there’s still time to tweak certain economic flaws and re-optimize upcoming features for greater success.

- The greatest risks are two-fold. First, there’s the risk that the game’s player base will remain firmly within the “play-to-earn” crowd without attracting significant numbers of players happy to simply play the game for fun and put new money into the system without expecting a return. So far the game has attracted little attention in the developed world outside of crypto enthusiasts and investors, likely due to its particularly high barriers to entry. Second, we’ve yet to see how upcoming features will bring more stability to the economy and recurring revenue to Sky Mavis / AXS holders. If this isn’t resolved, the inherent unsustainability of the current model will eventually show its face and lead to economic turmoil. If it is resolved, however, exponential upside remains.

- The only resource Axie Infinity lacks is time. Its meteoric growth has brought with it meteoric expectations, and the entire blockchain gaming sector is watching. Sky Mavis’ core task is to keep hope in a sustainable future alive with clear, consistent, and timely messaging. And then, it must deliver the goods.

That was more than six months ago. Since then, Sky Mavis has released a new Free to Play version of their game titled “Axie Infinity: Origin” (For the sake of clarity we will refer to the original version of the game simply as “Axie Infinity”, and the new F2P version as “Axie Origin”). They have also revealed detailed new plans for achieving a sustainable and flourishing economy that goes well beyond a single game.

Axie Infinity is a game of particular interest given its status as the flagship blockchain game and its deep ties to the most prominent investors and yield guilds in the space. Our goal is not only to evaluate Axie Infinity’s fortunes and available choices, but also to learn from this highly salient case study so that future projects — including those by Sky Mavis — can best learn from its experience. As always, our analysis flows directly from the available data, and our sincerest wish is to help each project move towards constructive and successful solutions.

Let us now see if Sky Mavis’ efforts have been sufficient to overcome their challenges.

Player Population Decline

We begin by looking at the most important statistic, daily active users (DAUs):

This figure comes from a detailed spreadsheet that Sky Mavis co-founder Jeff “Jihoz” Zirlin fills out every Monday. The relevant stat is described as “DAU (in-game battlers).” It is not clear whether this includes data from Axie Origin, so we will make the conservative assumption that it doesn’t, giving Sky Mavis the benefit of the doubt.

Daily active users peaked in December, shortly after we published our initial report, and has steadily declined ever since. Over the last four months, the player base has shrunk at a consistent rate of over a quarter million DAUs each month. If this decline is not halted immediately the game’s userbase faces imminent collapse.

This is a particularly scary statistic, so even though it comes directly from Sky Mavis we ought to do two things before issuing any pronouncements: 1) check it against every other data source we can find just to be absolutely sure, and 2) consider every argument for why and how the player base might swiftly bounce back.

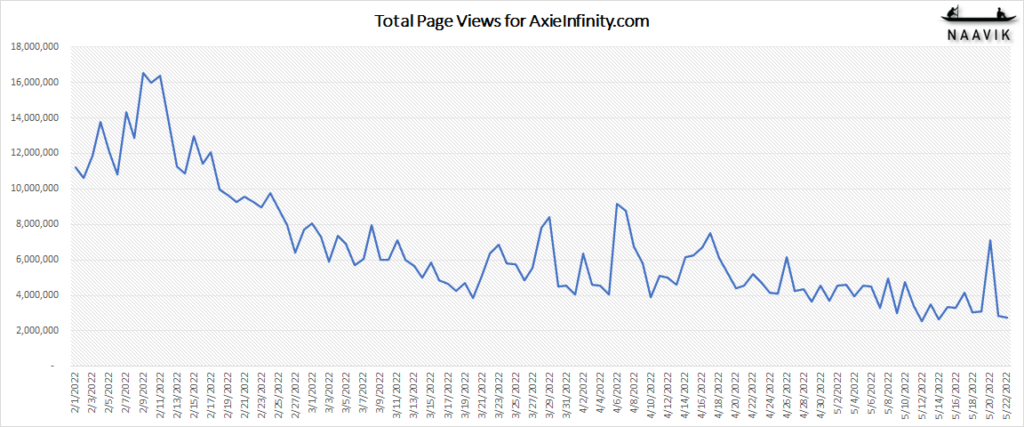

First, let’s check other data sources. If we look at traffic stats to the main AxieInfinity.com website, we see a similar decline over the last four months. Given that both versions of the game can only be downloaded from this specific website, web traffic is a reasonable proxy for ongoing player growth.

If we look at regional traffic, we see that 41.9% comes from the Philippines, and 7.4% comes from Venezuela, which means that half of all traffic still comes from these two countries alone.

We can cross-reference the overall decline in traffic and DAUs with search interest. Global keyword searches from Google Trends for “Axie Infinity” have declined on a similar trajectory, including in the Philippines and Venezuela:

This gives us three credible sources that all agree that the game’s population is steadily declining.

That said, what if all we are seeing here is a migration of users away from the original Axie Infinity game and into Axie Origin? If that were case, the above numbers wouldn’t necessarily signify a problem.

If users have really been moving over to Axie Origin, we would expect to see an increased search volume for the new game’s title. We find that “Axie Origin” is the favored keyword search for the new game given that results for “Axie Infinity Origin” are negligible, so if we compare interest in “Axie Origin” to “Axie Infinity” we see relatively minimal search interest for the new game:

This leaves the possibility that keyword searches for “Axie Origin” do not capture the full picture; perhaps players are searching for the generic term “Axie Infinity” and then downloading Axie Origin — and even perhaps at higher rates given the F2P nature of Axie Origin. If this were the case, searches for “Axie Infinity” would represent the combined interest in both games. Even this would lead us back to the same conclusion, however: new growth in Axie Origin appears insufficient to offset decline in the base game. The similar decline in traffic to AxieInfinity.com (the only place either game can be downloaded from) further supports this conclusion. Given that Axie Origin remains in its very early stages, this is not shocking (and may change), but it’s still worth noting.

Let’s now dig into video interviews to see if we can get stats directly from Sky Mavis. In a conversation with Nico Vereecke on Naavik’s own Crypto Corner on May 3rd 2022, Sky Mavis’ Game Product Lead Philip La said Axie Origin had 300,000 users on its first day, April 6, 2022. You can watch the full video here:

Two weeks later on May 18th 2022, Growth Lead Jeff “Jihoz” Zirlin gave the following statistics for Origin on a Twitch Dev Chat:

- 535,000 total unique devices

- 599,000 total unique accounts

- 268,000 monthly active users

- 160,000 weekly active users

Finally, on June 14th, the team announced on the official Axie Infinity substack that they had seen a total of 600,000 registered accounts for Axie: Origin, but gave no other statistics.

A straightforward reading of these figures suggests that Axie Origin had fewer active users across an entire month than it had on its first day, suggesting significant issues with retention. (Again, yes, it’s early but still worth noting.)

But perhaps we are misreading these statistics or are missing important context. Just to be sure, let’s look solely at Jihoz’s figures. It is well established in F2P game analysis that DAUs for a given time period are significantly less than weekly active users, so it would be generous of us to assume that Axie Origin had no more than 160,000 DAUs for Jihoz’s time period. Given that Jihoz’s spreadsheet posted a decline of 423,638 DAUs for Axie Infinity across the month of May, Axie Origin‘s player growth is simply not yet strong enough to offset the decline of its predecessor.

Axie Origin is still in Alpha, and one could say it’s unreasonable to expect it to pull in large player numbers prior to full release and the launch of its token economy. Even should this hypothesis prove true, however, it would still raise two concerns. First, if players are waiting for Origin’s token economy to launch, it would be further evidence that the Axie ecosystem chiefly attracts financially motivated players. Second, Sky Mavis would still have to deal with a rapidly declining population until the 1.0 launch, at which point they will not be faced with the task of switching active players over from one game to another but the much more difficult challenge of reactivating people who have quit playing entirely. It hearkens back to how we wrapped up our initial deconstruction: The only resource Axie Infinity lacks is time.

In any case, given four independent sources — two of which come from Sky Mavis themselves — there can be no doubt that the player base of the entire Axie Infinity ecosystem is in decline. We also established in our last article that the game’s business model is fundamentally dependent on player growth, and we predicted that should player growth decline, it would portend trouble for the token economy. So were we right?

Effects on the Token Economy

Axie Infinity Shards (AXS)

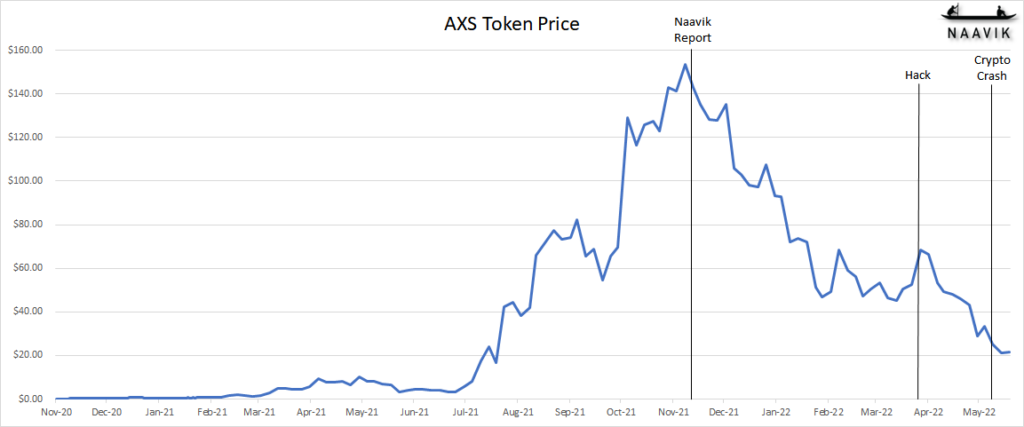

Let’s start by looking at the market cap of Axie Infinity Shards (AXS), the game’s governance token and chief investment vehicle.

As of our last report, the AXS token had just reached its peak value of $9.77 billion, plunging to just $3 billion towards the end of January. It briefly stabilized and recovered towards the end of March before the hack was first publicized and then declined swiftly afterwards. A sector-wide crash of the entire crypto market began as early as May 5th when Bitcoin first fell to its lowest price in 9 months and lost 10% of its value in a single day on May 9th. The value of AXS has not recovered since, and all the gains investors made since August of last year have been completely wiped out. This decline is not overly unique among blockchain games — most game-related tokens have been rocked — but it’s worth noting nonetheless, particularly because it began earlier than most others.

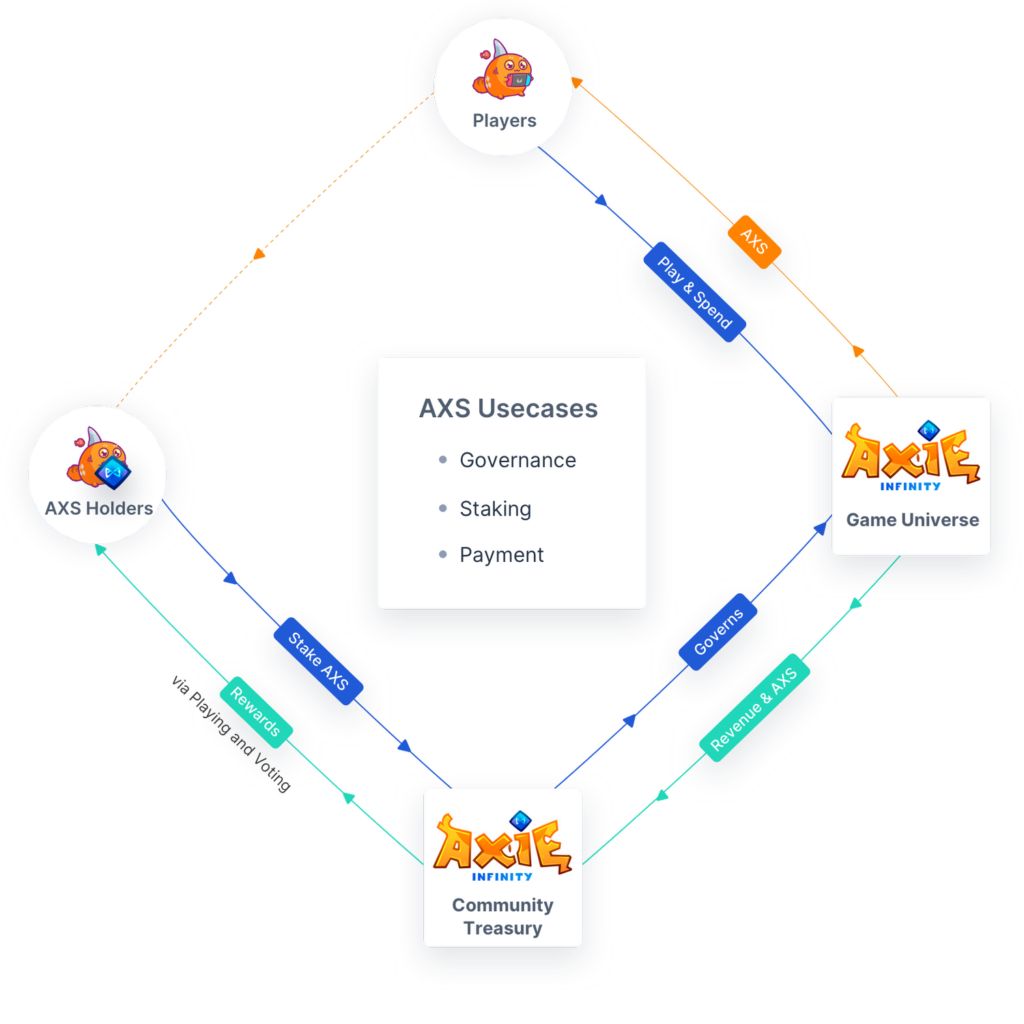

AXS plays many roles in the Axie Infinity economy. First, it is the most straightforward way to make a bet on the fortune of the Axie Infinity games. Second, it is spent as a portion of breeding fees. Third, holding it confers voting privileges in governance. Fourth, it can be staked in order to gain rewards. Fifth, it is given out as a reward by playing the game, chiefly through leaderboards.

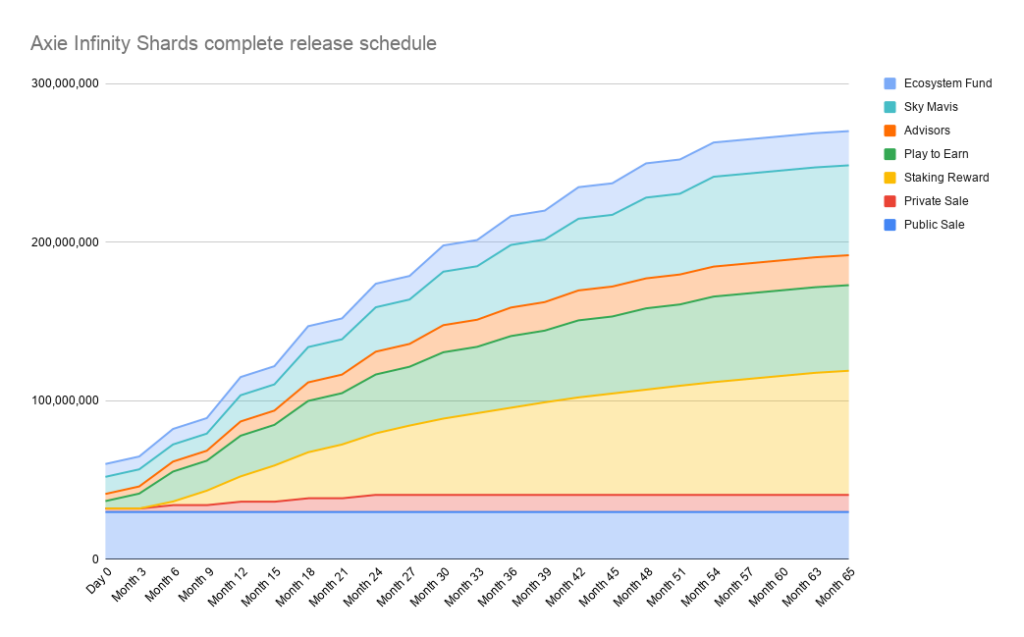

AXS tokens are unlocked according to a set schedule that will take 65 months in total. Given that AXS first launched in November of 2020, we should expect the supply to cap out around April of 2026:

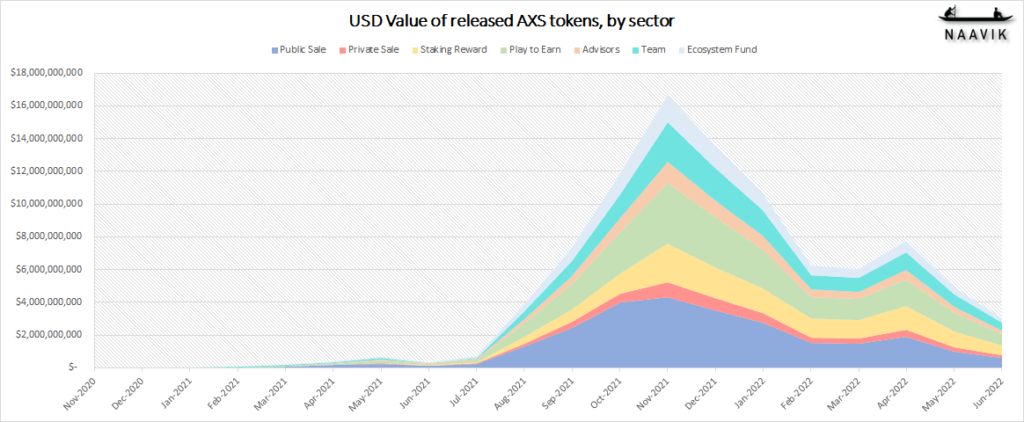

One way to better understand how the AXS ecosystem looks at a high level is to take the above graph and multiply each data point by the spot price of AXS on that date, effectively giving us a view of how much dollar value has been allocated to each sector over time:

This graph shows that even though the nominal supply of AXS across all sectors has increased by 28% since November of last year, the total dollar value of all those tokens has declined by 82%. If we zoom in on Sky Mavis’ share of the AXS tokens (21% of the total supply), we can see that the paper value of the company’s core stake has declined from a peak of $2.5 billion to $743 million as of this writing.

That gives us an idea of how AXS has fared for Sky Mavis and its investors, but what does the picture look like for players?

One of the primary ways players can acquire AXS is through competing for top spots on the Axie Infinity leaderboards. One of Sky Mavis’ recent sustainability initiatives has been to move the game away from a “Play-to-earn” paradigm and towards “Play-and-earn,” an admission that only the most skilled players should expect to be able to earn money going forwards. In this way the focus of the game becomes more on rewarding highly competitive players rather than everybody. There is plenty of precedent for this in traditional eSports, where only an elite cadre of players (professionals) are able to earn money, so it’s an approach that does at least work in principle.

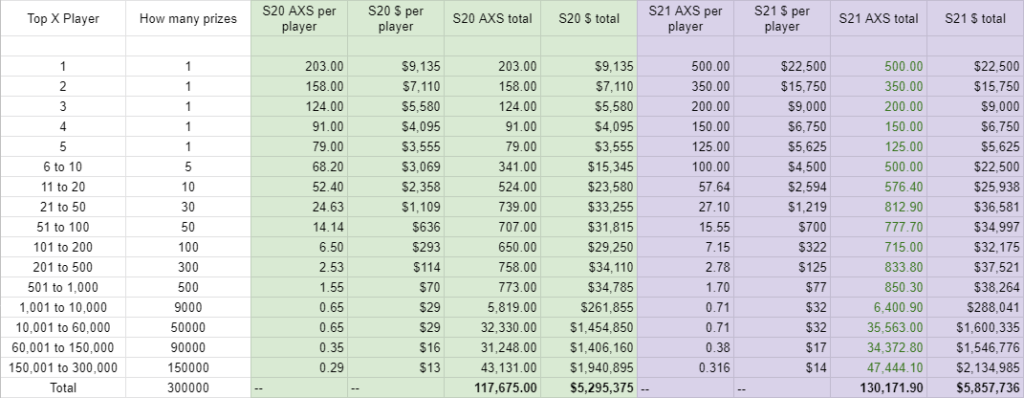

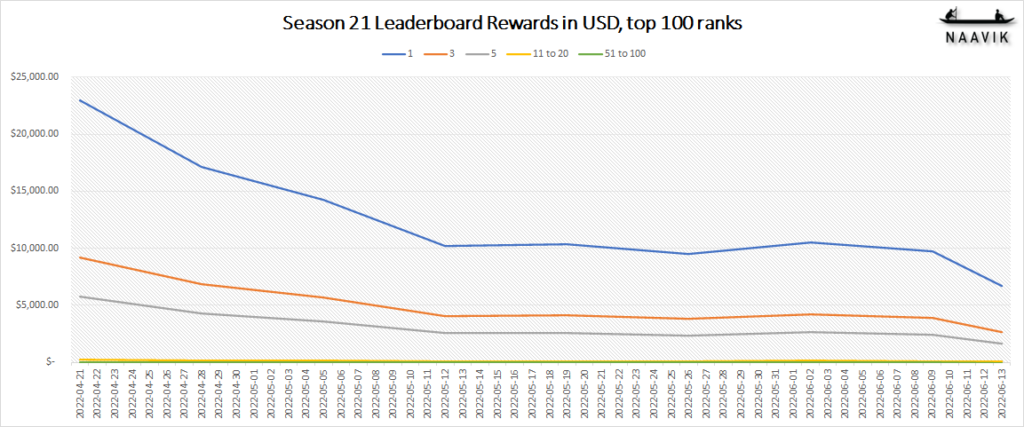

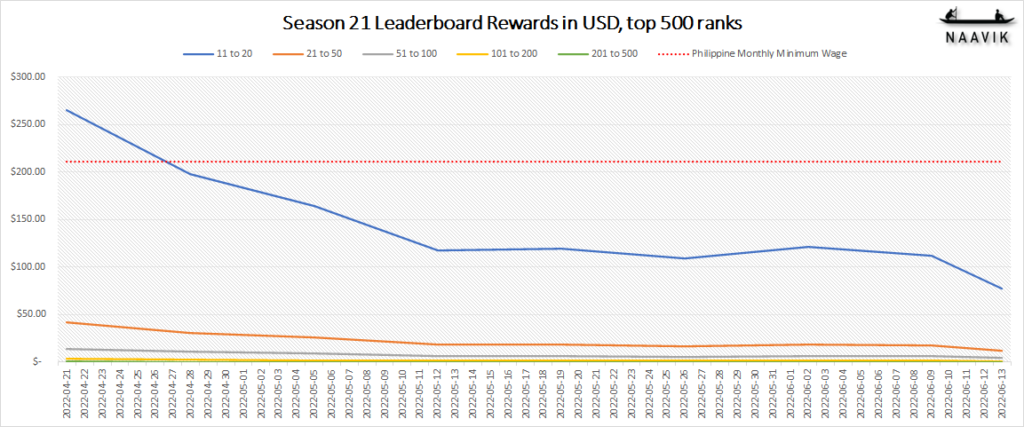

Let’s examine the leaderboard reward structure for the two most recent seasons. Season 20 was announced on February 3 and ran from February 9th to March 22nd. Season 21, the final season of the original Axie Infinity game, started on April 25th and will last until June 24. Sky Mavis provided the following reward breakdown:

How much money were the top 100 players actually taking home? Here’s how the USD value of the volatile AXS tokens given out in Season 20 as individual leaderboard prizes has evolved over time:

The 203 AXS tokens rewarded for first place would have been worth a little more $10,000 on the first day of the season. The value declined somewhat in the middle and then surged briefly right at the end. If the first place player cashed out right at the season end, they could have kept over $14,000. If they held on to their winnings until this writing, however, their value would have fallen to $2,712 for a loss of over 81%.

That’s still a lot amount of money to earn for playing a game for a month, but keep in mind that’s the first place reward in a highly competitive game, and the earnings decline from there. Securing a place in the top 20 would garner only $700 at today’s prices, less than what a normal mid-to-low-ranking player could have earned just by farming the SLP token for a month last July (see next section).

If we zoom into the lower ranks, we can see that anyone who held onto their AXS reward tokens until today earned less than the monthly Philippine minimum wage from their leaderboard rewards.

If we look at a graph of Season 21 rewards, we get the following picture:

Sky Mavis valued the top prize of 500 AXS at $22,500 in its spreadsheet, but that USD value has dropped by over half to $6,680 with about a week left to go in the season. Even at that depressed value, however, top players would still likely earn more than they did last season. Of course, this improved earning potential for the top ranks came at the cost of reduced rewards for lower ranks. Anyone outside of the top 10 can no longer expect to earn even Philippine minimum wage from AXS leaderboard rewards:

What about staking rewards? In the whitepaper, Sky Mavis lays out a schedule for staking rewards given out each month in the form of AXS tokens. These rewards give people an incentive to lock up their AXS tokens (increasing the scarcity of tokens traded publicly), which is meant to give the token some stability. If we add up the cumulative amount of tokens allocated so far for each month and multiply by the AXS price in USD for that date, we can see that the total cash value of all staking rewards first peaked last December.

Price fluctuations along with further token emissions briefly brought us back to that peak in April 2022, but the value of all AXS staking rewards ever allocated has now sunk to a level not seen since last year. Ongoing token rewards are not sufficient to offset the ongoing decline in the underlying price of the token.

Whether players were earning AXS through staking, buying and holding, or earning it through play, the outcome seems the same — the value has mostly evaporated and continues on a downwards trend.

But AXS isn’t the only asset in play. Axie Infinity has three other tokens of concern: Smooth Love Potion (SLP), Axie NFTs, and Land NFTs.

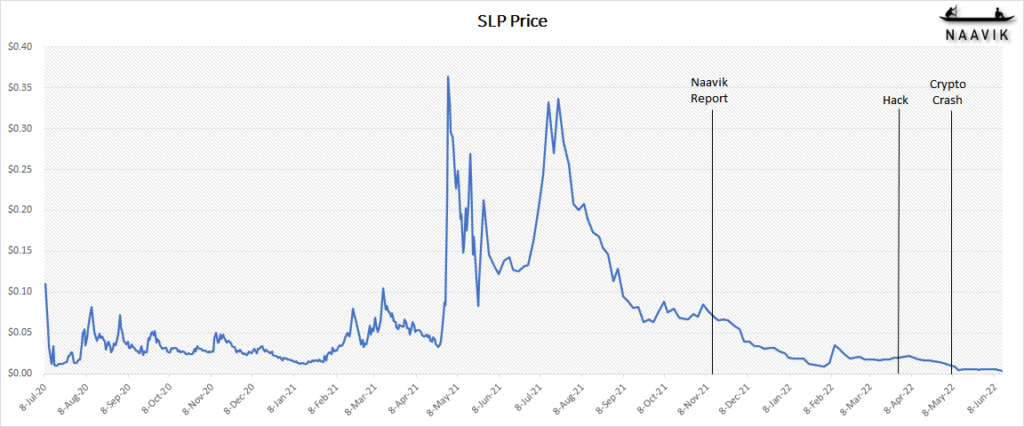

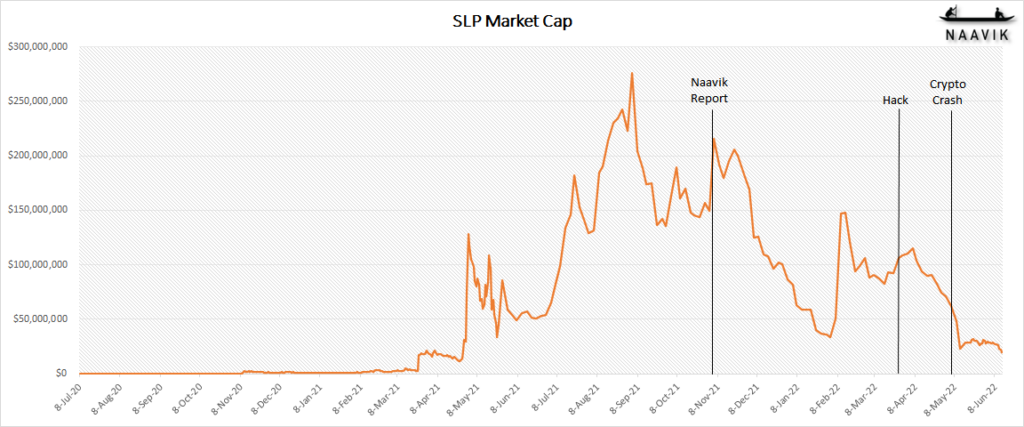

Smooth Love Potion (SLP)

Here’s a chart of the price of SLP, the inflationary in-game currency used to breed new Axies and the chief reward players earn and cash out in the original game.

We can see that the price has declined precipitously, a trend that was already under way when we wrote the last report. This doesn’t give the whole picture, however, because everyone knows SLP is inflationary. Perhaps the market cap of SLP is a better representation of this token’s health?

At the time of our last report, the market cap was still holding steady. It declined from there until February when Sky Mavis made a major announcement that Axie Origin’s release was imminent. A precipitous decline began shortly after the publication of the hack and continued through the crypto crash. The total market cap of SLP has now returned to values not seen since April of 2021. Anyone who held onto this token in the meantime waiting for a pump has likely lost most of their investment.

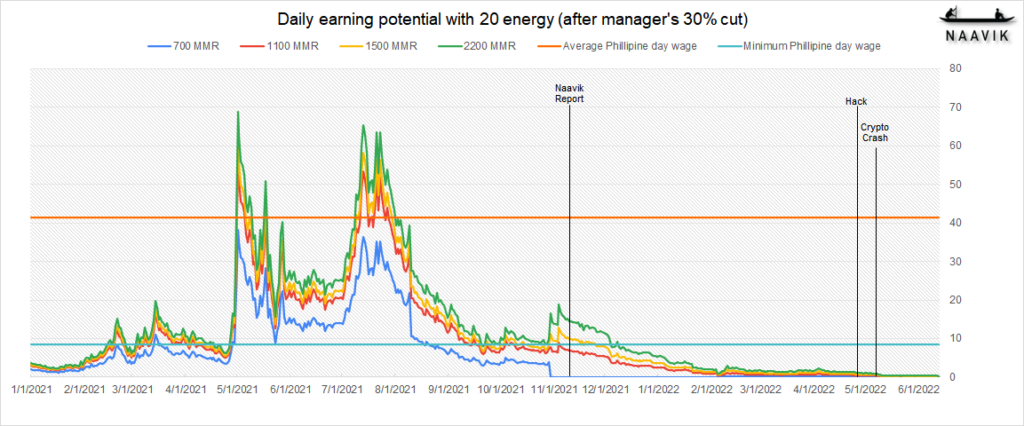

The single best way to understand SLP is to look at it through the eyes of the median Axie Infinity player — a scholar in the Philippines playing the game daily for income. (Remember: in Part 1 we discerned that the typical player treated the game like a job, hence the high retention rates at the time.)

This graph reflects what a typical Philippine scholar is able to earn from the game and how that income compares to the average and minimum day wages for that country. We are assuming the manager takes only 30% of the scholar’s earnings, which is a conservative estimate — interviews with managers and scholars alike indicate that most managers take more than that, with 50% being the most commonly given figure.

(Note: The average daily wage in the Philippines we are using is $41.49. We sourced the monthly figure from Statista, multiplied by 12, and then divided by 258 working days. The minimum daily wage in the Philippines we are using is $8.45. We sourced the annual figure from the official website of the Department of Labor and Employment of Philippines, averaged out across all minimum wage regions and classes, and divided by 258 working days.)

As of our last report, daily earnings potential had already collapsed for most players. Recent changes to SLP rewards had briefly increased rewards for high-skilled players but at the cost of severely limiting rewards for low-skilled players. Back then, players at the 1100 MMR threshold were already starting to dip down below the minimum day wage line and players below that were earning nothing. Players above that threshold, however, had enjoyed a temporary boost. Let’s zoom in for a closer look at what’s changed since the beginning of 2022:

By January 2022, the earnings of even the most highly skilled players had fallen well below the minimum Philippine daily wage of $8.45. Incomes for players of every skill level have continued to plummet ever since.

As of this writing, we estimate that a scholar with an MMR rating of 2200 can earn only 31 cents a day, and that’s if we assume their manager takes only 30%; if the manager takes 50% they would earn just 22 cents. In the best-case scenario where a player owns their own Axies and keeps 100%, they would still be making a mere 44 cents a day. Keep in mind that all of those scenarios are for the absolute best players in the game; we have come a long way since the heady days of the Axie Infinity documentary when low-ranking players were making more than $30 a day, mid-ranking players were effortlessly surpassing the average Philippine day wage of $41.49, and top players were taking home $60 or more.

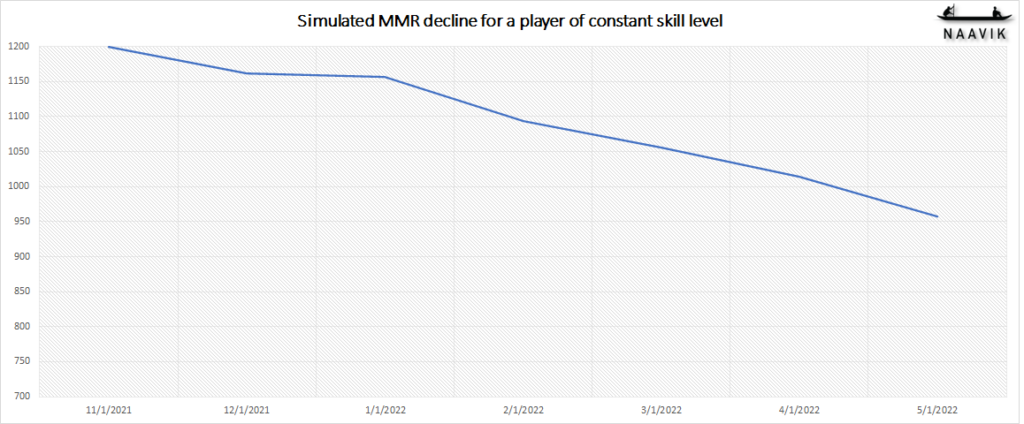

Furthermore, we have seen players complaining that their MMR scores have dropped over time and their earnings with it; this is a natural byproduct of low-skilled players progressively leaving the game. Sky Mavis reduced earnings for the lowest-ranked players to zero just before our last report, which gave low-skilled players and bot farms little incentive to keep playing. With no easy players to feed on, the MMR rankings of the players just above them declined, an effect that cascaded through the entire player base.

The upshot is that a player of a constant skill level (i.e., someone who gets no better and no worse at the game over time) should expect to see their MMR go down as the player base shrinks and the lowest tier of competitive players continues to slough off. To visualize this, we built a simple model based off of Axie Infinity’s declining DAU figures combined with standard MMR rules, assuming that population decline principally comes from the least competitive players leaving when their earnings drop. Such a model yields the following graph over six months:

At today’s prices and SLP reward policies, a 1200 MMR scholar can expect to earn 13 cents a day, but our model suggests that a 1200 MMR scholar from last November with no change to their underlying skill would likely achieve a mere 950 MMR today, putting their daily earning potential at less than 3 cents.

However you slice it, the price, market cap, and daily earnings potential of SLP have all declined, meaning this token is no longer a reliable vehicle for earning daily income, and anyone who has held on to it as an investment has seen its value evaporate.

This is apparently not a cause for concern for Yield Guild Games, the largest Axie Infinity guild. We asked them how their scholarship model has evolved in the face of this decline, to which they replied with the following image and statement:

- From YGG’s Q1 2022 Community Update, there are 29,548 YGG scholarships across YGG’s network where 25,382 are Axie Infinity scholars.

- YGG’s scholarship model is unchanged, providing a 70% share for scholars, 20% for Scholarship Managers (who are responsible for training and mentoring scholars), and 10% for YGG. YGG is scaling its scholarship offerings through the launch of region-specific subDAOs including YGG SEA (YGG Southeast Asia), IndiGG (YGG India), Ola GG (Hispanic communities worldwide) and BAYZ (Brazil). YGG is continuing to expand its subDAO model across the world to address challenges and opportunities in local markets and ensure language-specific content, education and hyper-localized support is made available for player onboarding.

Let’s now move on to the Axie NFTs themselves.

Axie NFTs

Axie NFTs have experienced perhaps the steepest decline of any asset in the game, declining from a peak floor price of $340.76 last August all the way down to $3.33 as of this writing, a decline of 99%.

This is a direct consequence of declining user growth. A decline in players sets off a self-reinforcing downward spiral: less demand for Axie NFTs depresses their prices, which leads to less rewards for breeders, which leads to less demand for SLP, which depresses SLP’s price and depresses rewards for players, which in turn causes less demand for Axies as fewer players want to join.

This is exacerbated by the fact that until recently Axies were immortal, meaning their supply could only go up. Sky Mavis did release a feature where Axies could be “released” back into the wild, effectively deleting or “burning” them from the game’s economy. So far this has only taken place once during the January 20 - February 20 Lunar New Year event, which allowed players to “release” Axies in exchange for cosmetic items that they could display on Axie Land in the upcoming unreleased third game mode.

To date, less than 150,000 Axies have been “released,” compared to a grand total of 11,321,386 Axies still in existence. In short, only ~1.3% of total Axie NFTs have ever been burned, doing little to stem the tide of ongoing Axie inflation. But perhaps there is a silver lining — Axies are cheap now. Could the collapse in Axie prices have made it easier for players to get in and start earning?

To measure this, we divide the Axie floor price for the given day by the expected earnings for the same day at various MMRs, and then multiply by three. This gives us the number of days players at each skill level will need to play to earn enough to buy three Axies at current prices; effectively how long it would take an owner to earn back their investment.

Elite 2200 MMR players used to be able to earn back enough to buy three Axies in 12 days, but today that same task will take them 22. Non-elite players with 1100 MMR, on the other hand, would need to play for almost two months to earn back their investment at today’s values (still a decent yield but not a wage). Keep in mind that if the player population continues to decline, daily prices will fall along with the players’ expected MMR and therefore their earning potential, greatly increasing the time required to break even. In short, Axie NFTs haven’t held their value, and their earning potential has fallen faster than the cost to acquire them.

What about land NFTs?

Land NFT Floor Prices

Sky Mavis has been in the virtual real estate market for over three years now, making its first digital land sales way back in May of 2019. Land was originally pitched as a feature for an upcoming game mode where players could gain resources, build structures, and battle computer-controlled monsters. The forthcoming land gameplay, also known as “Project K,” was pitched as not just a game, but a full-blown platform, with third party developers deploying custom Axie-themed experiences and hosting them on land plots. In this way Project K would become a sort of gateway to the “Axie Metaverse.”

The value proposition was clear — buy Land NFTs now, and their value will increase over time as Project K and the greater Axie ecosystem gets built up around them. Unlike Axies, Land NFTs are strictly scarce in supply, making them of particular interest to investors anticipating increased demand.

As best we can tell, the Axie real estate bubble has deflated, with land values falling to their lowest values ever.

The cheapest land type (Savannah) still goes for $1,136 dollars a plot, but this is still a 94% decline from its peak price of $18,403 in December 2021. Anyone who invested in land since the game’s market first took off has seen all that value evaporate, and it’s a fair question whether the land plots will be able to retain what value they have left when the long-awaited and repeatedly delayed land gameplay finally releases. We’ll address land in further detail when we discuss Project K in depth below.

And with that, our overview of the state of all the major tokens in the Axie Infinity ecosystem is complete.

Our Model vs What Actually Happened

This is a good opportunity to test some of our assertions from the last article and hold ourselves to account. Last time, we built a simple model that showed that even if Axie Infinity’s player base continued to grow, a mere slowdown in that growth would be sufficient to cause financial trouble for its chosen business model. For most game business models, a decline in growth will not lead to an absolute decline in revenue, because ongoing revenue is a function of total users. This doesn’t apply to Axie Infinity’s business model, which uniquely monetizes growth itself.

The following graph shows the historical daily active users prior to the publication of our last report, the positive but slowing growth curve that our toy model assumed, and what actually happened to Axie Infinity:

Our model’s purpose was not to make a concrete prediction, but rather to show that even in the face of continued user growth we would expect revenue to fall so long as the pace of growth were to slow. Given that player growth has not just slowed but gone negative, the actual situation is far worse than our model forecasted.

Our modestly pessimistic model predicted that a gradual slowdown in user growth would lead to declining monthly revenue, which would have signaled major cause for trouble given the sky-high expectations of investors. Instead, what happened in the face of negative user growth was a sudden and complete collapse in monthly revenue.

Sky Mavis‘ Business Model

It’s important to distinguish between revenue to Sky Mavis and revenue to the community treasury. Sky Mavis is the company that develops and operates the Axie games, and the community treasury is a decentralized autonomous organization that Sky Mavis has set up but does not control. Instead, the treasury is governed collectively by everyone who holds AXS tokens — or at least it will be once progressive decentralization finally arrives. The community treasury is a completely separate money-holding entity from Sky Mavis, and it has two chief purposes: 1) fund third party development in the Axie Infinity universe, and 2) do whatever the community of AXS holders decides. Let’s look at each entity separately and understand where and how they get their money.

Sky Mavis’ funding comes from two key places: 1) investors and 2) holding AXS tokens. In terms of investments, the company has raised three separate post-seed rounds: a series A in May 2021 for $7.5 million, a series B led by A16z in October 2021 for $152 million, and an emergency round led by Binance in April 2022 for $150 million. This means Sky Mavis raised $309.5 million in cold hard cash over the course of the last year alone. That’s a significant war chest, enough to fund a development studio for years under normal circumstances, especially one based out of Vietnam. Most importantly, it’s denominated in good old fashioned dollars, which are unlikely to experience significant swings in value.

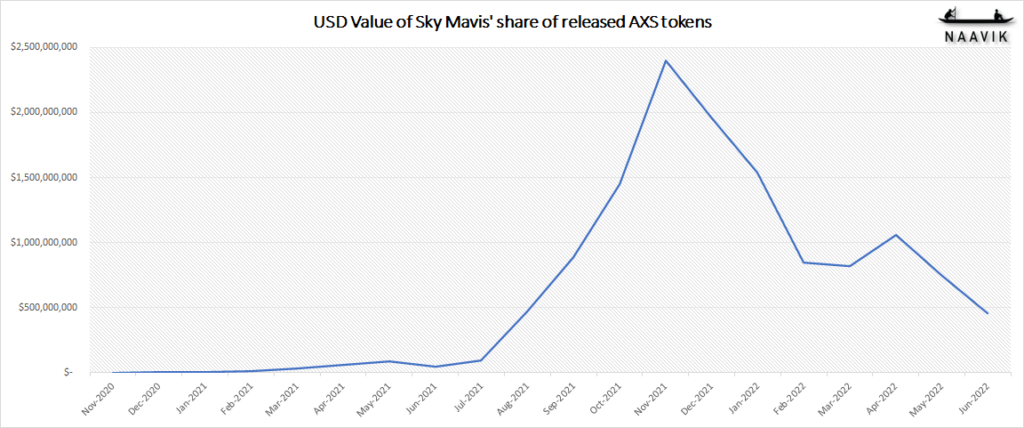

Ongoing revenue is a different story, however. Per the whitepaper, Sky Mavis doesn’t make money off of Axie Infinity directly but simply receives a set number of AXS tokens every month (21% of the total) as part of the overall allocation schedule. If we count up the cumulative amount allocated so far it looks like this:

If we multiply that by the USD value of AXS tokens, we get this chart we saw earlier:

Sky Mavis’ cumulative AXS token wealth peaked at $2.4 billion in November and has now declined to $457 million, an overall drop of 81% in just seven months. Note this is not an 81% decline in monthly revenue but an 81% write-down of accumulated token wealth to date. This exposes one of the greatest risks of building a revenue model on top of a volatile cryptocurrency — booked revenue can quickly lose significant value after you’ve earned it. Sky Mavis could hedge against this by regularly cashing AXS out for fiat, but it’s unlikely they would have sufficient liquidity in the market to do so without crashing the price.

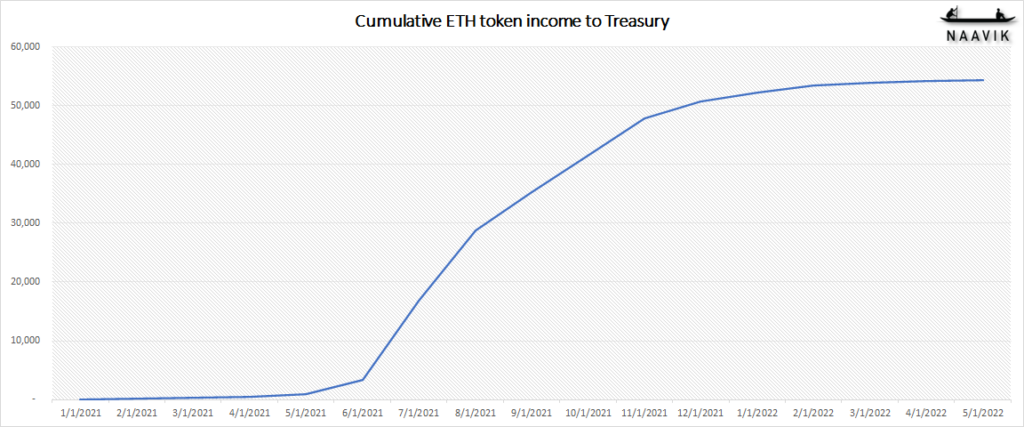

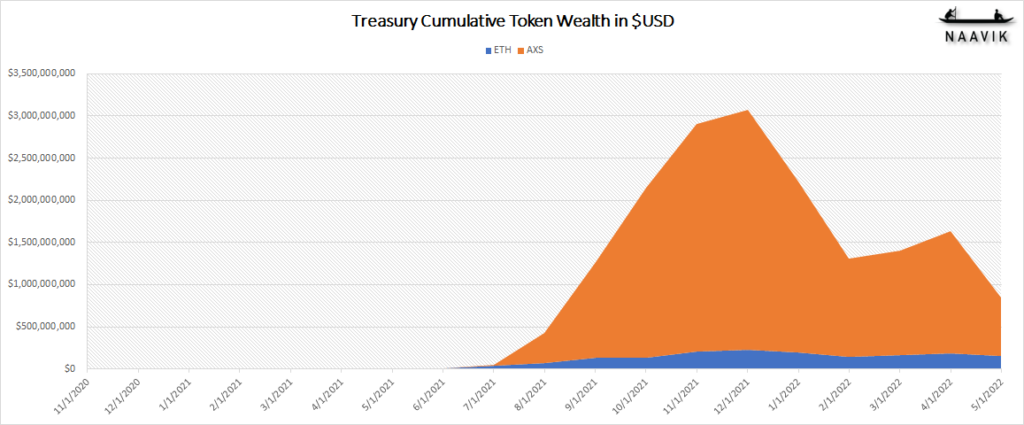

Now let’s look at the treasury. The treasury earns revenue from two sources: 1) from AXS tokens spent breeding Axies and 2) from a share of ETH tokens spent trading NFT assets on the marketplace. We’ve already seen that the dollar value of ongoing treasury revenue has declined, but let’s break it down into the original tokens to see what’s going on.

Here’s the cumulative nominal token income to the treasury in both AXS and ETH:

We can clearly see that nominal monthly token income has flatlined for both revenue sources.

Now, let’s take each of those cumulative figures and multiply them against each token’s value in $USD for that point in time and see how the overall dollar value of total cumulative token wealth sitting in the treasury has evolved over time:

Again, this is not a graph of ongoing monthly revenue. This is a graph of the present dollar value of all the assets sitting in the treasury.

Two things are happening here:

- No meaningful amount of new income is flowing into the treasury

- Much of the value already stored in the treasury has evaporated

Okay, so what does this all mean for the Axie Infinity ecosystem and Sky Mavis’ future plans?