Ubisoft, like all big AAA publishers, couldn't ignore mobile as a platform. As we’ve outlined before, there are 6 key strategies to transitioning to mobile – but is Ubisoft’s strategy working?

Like most large PC and console publishers, Ubisoft has, up until now, mixed developing its own games, acquiring titles, and acquiring mobile studios. Today, we look at Ubisoft’s mobile M&A to date, and dig into why acquiring mobile studios might not be the right play.

Reviewing Ubisoft’s M&A Activities

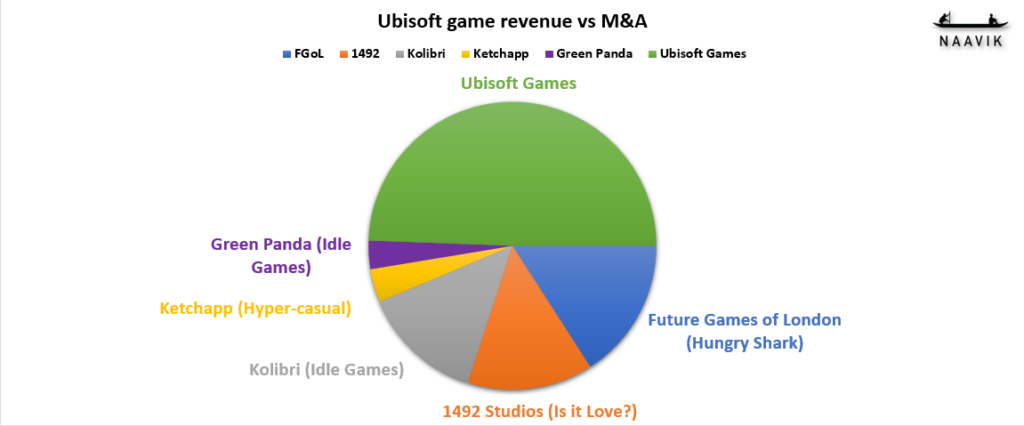

Ubisoft started releasing mobile games in 2012 and likely due to issues getting early traction, started making acquisitions the very next year. The terms of many of these acquisitions were undisclosed, so we can’t compare the purchase cost to revenue generated, but most of the studios were acquired during respective peaks, so we can assume Ubisoft likely overpaid for at least some of them.

As a quick caveat, it’s worth noting that hypercasual primarily generates revenue through ad monetization instead of IAP, so that genre will be under-represented here.

- 2013: Future Games of London was acquired for its successful Hungry Shark game. It was renamed Ubisoft London in early 2023, but recently announced it would be shutting down, with the Hungry Shark series moved to Ubisoft Barcelona. The majority of its contribution was the Hungry Shark series, which is also the most profitable mobile IP per game that Ubisoft has produced to date.

- 2016: Ketchapp was acquired at the peak of hypercasual for its expertise in mobile advertising and cross-promotion. Revenue contribution is difficult to estimate due to these games being ad-based, but it’s worth noting that outside of the usual quick hits, Ketchapp did produce two popular games using Ubisoft’s Prince of Persia IP.

- 2018: 1492 Studio was acquired for its popular narrative dating game series “Is it love?”. The studio initially provided good revenue across a variety of titles, but its success has since diminished with only a few games still doing well.

- 2019: Green Panda Games was acquired for its early success in idle games. Unfortunately this company didn’t have any huge breakout hits post-acquisition and with revenue spread across a number of middling apps it is likely the worst performing buyout.

- 2020: Kolibri was acquired for having a single breakout idle game success, Idle Miner Tycoon. Since the acquisition the many attempts at trying to replicate the success have mostly failed except for some recent traction on Idle Bank Tycoon. Thankfully Idle Miner Tycoon has managed to bring in significant revenue single-handedly.

Other acquisitions worth mentioning that are not focused on mobile, but have contributed to Ubisoft’s revenue is RedLynx (2011) of Trials fame, and Blue Mammoth Games (2018), developer of Brawlhalla. RedLynx became Ubisoft RedLynx and contributes to multiple games on PC, console and mobile. It also had a large hand in South Park: Phone Destroyer development and is working on the upcoming Rainbow Six Mobile. Blue Mammoth Games is still focused on Brawlhalla, which does generate some mobile revenue, although it’s not huge.

Reviewing Ubisoft’s Mobile Games

Ubisoft has mixed developing mobile games based on its popular franchises as well as attempting to create new IP. There have also been a few ports of much older games like Heroes of Might & Magic III and Rayman.

Franchise IP

It’s a little surprising to find that Ubisoft has released seven Might & Magic mobile games, and to far greater success than IPs like Rabbids, which has seen pretty poor returns. Simply dividing the number of apps by their revenue makes it even more obvious which IP just fits mobile better: Just Dance stands out as by far Ubisoft’s single best performer, with just one game bringing in $0.5M last quarter despite being initially released in 2014. RedLynx’s IP, gained through acquisition, seems to either perform well (Trials Frontier) or pretty poorly (the three DrawRace games).

Original Mobile IP

Ubisoft has had real trouble launching new, mobile-first IP. Its best performer by far is Growtopia, but this mobile-first IP wasn’t created by Ubisoft, but rather acquired from a smaller developer five years into its success. Ubisoft managed to sustain revenue for some time, and the revenue shown here is only post-acquisition (2017-2023). Horse Haven World Adventures has also quietly performed well.

M&A vs Internal Development

Looking at Ubisoft’s mobile studio acquisitions over time, it’s clear that the company often buys at the peak, but when there’s a single, very strong hit that can either be made to last (Growtopia, Idle Miner Tycoon) or expanded into sequels (Hungry Shark). These studios rarely produce new hits post-acquisition, though, and especially not new IP. While delivering multiple hits is something many studios struggle with and is partially the nature of the industry we’re in, there is also something to say about Ubisoft’s lacking ability to identify and acquire value accretive targets.

Based on this, and now that mobile is a much more mature market, going forward Ubisoft should really question whether acquiring specific games and IPs is a better play versus buying entire studios. Ubisoft has generally done a decent job of continuing successful IP on PC and console, and provided the right internal studios are tasked with execution, can do the same for mobile.

In terms of internal development, Ubisoft has had a fairly low success rate at creating mobile spinoffs of its larger franchises. Might and Magic is the odd one out here as it’s been adapted to RPG, Gacha PvP, Auto-Chess and 4X versions due to the flexibility of the IP. But the degree of success these efforts have seen isn’t very impressive either.

It’s also fair to say that Ubisoft has had a terrible success rate at creating brand new IP for mobile, despite attempts like Hungry Dragon and The Mighty Quest for Epic Loot. As much as its soft launched Boom! Superbrawl looks interesting, Ubisoft’s track record suggests a bet against it.

All that said, the M&A vs Internal Development lens might be a good backward-looking lens, but doesn’t fully capture Ubisoft’s forward-looking opportunities.

Looking Ahead

Ubisoft is now trying to port its strongest IPs over to mobile while finding ways to retain the core gameplay. This is the case with Rainbow 6 Mobile, currently in soft-launch, and The Division Resurgence, which launched a multi-territory closed beta this week. Seeing as the core audience for most of Ubisoft’s IP generally haven’t wanted spin-offs, it makes sense to try and better adapt the gameplay. PC gamers already live in a world where the ports are often handicapped by adapting from console first and mobile is a much more difficult environment with a severe lack of controls that suite most AAA experiences.

While Call of Duty mobile managed to really simplify the experience, it’s already a relatively simple FPS. Rainbow Six: Siege on the other hand is even more complex than Apex Legends and that game has already come and gone. Ubisoft Winnipeg have done a fantastic job of translating all of the essentials to mobile in its current soft launch form, but it will be an uphill battle to retain mobile players without severely compromising the competitive integrity, and the game’s very hardcore nature will test the limits of how far the market has shifted from casual to mid-core and further. Despite being a fantastic port there’s a pretty strong chance of audience mismatch, especially when it comes to the game’s monetization as it’s “ticket system” for playing and unlocking operators is actually pretty good, core players might see it as greedy and compare it to Diablo Immortal.

The Division Resurgence on the other hand seems like a stronger candidate to adapt successfully to a mobile audience. Mobile games have already strayed pretty heavily into MMORPG territory successfully and as long as the real-time combat aspects of The Division series are handled well then it’s just a matter of making sure the gameplay can support a more drop-in and out playstyle than its console/PC predecessor. MMORPGs have also been much easier to adapt to monetization and retention mechanisms standard to F2P although there is no guarantee that Ubisoft executes perfectly on this. Based on the previously given roadmaps, the regional beta starting this week should pretty quickly lead into a Q1 2024 Soft Launch where Ubisoft can fine tune based on metrics. With The Division 2 growing a bit stale post Warlords of New York DLC this might actually be a perfect time to pull in an idle fanbase for the franchise.

Both games look to have done a solid job of adapting the source gameplay while adjusting for mobile expectations. If these find success, they provide another path forward for Ubisoft on mobile – but the big question is whether or not its core gamers will be there to embrace them. Hopefully Ubisoft is including a good mix of players in its Soft Launch and closed betas to ensure that its either satisfying or growing the demographic of each IP.

There is also a final third option for Ubisoft beyond simply acquiring studios and games, or doing a better job internally adapting its own: Co-development. Tencent’s heavy investment in Ubisoft has also opened up opportunities to leverage its development skill for franchises both companies are now banking on. Tencent’s subsidiary Level Infinite has been developing the first strong attempt at adapting Assassin’s Creed to mobile with the upcoming Jade entry (set in China of course). We’ve mentioned Call of Duty Mobile multiple times and that was developed by another developer under Tencent, TiMi. Level Infinite are also handling some regional Asian publishing for The Division Resurgence so the developer has some strong motivation to get things right and continue to deepen the relationship with Ubisoft IP.

It’s a little early to tell how well Level Infinite will be able to pull off the adaptation (early reviews are mixed) and its recent mobile games have been a mixed bag with Arena Breakout doing well, but Undawn seeming to miss the mark a bit. Even if AC: Jade doesn’t perform as expected, the co-development relationship between Ubisoft and Tencent is likely to continue for some time and will probably produce more success than the acquisitions we’ve covered here.

A Word from Our Sponsor: WINDWALK

Windwalk builds community software to enhance your relationship with customers

Windwalk builds digital communities and the technologies necessary to accelerate them.

Windwalk offers a portfolio of services to top gaming companies in addition to the flagship software offering — Harbor. Harbor is an end-to-end community software that empowers community owners to monitor their community’s pulse, gamify the community experience, and collect actionable insights across a growing number of digital channels.

Integrating a game product with Harbor allows community owners to learn how players are interacting with their products and build toward more engaging and rewarding experiences. Combined with Windwalk’s guidance as an industry leader in community management, Harbor is the first step in your product’s community revolution.

In Other News

Funding & Acquisitions

- Squido Studio raises CA$1.5M in funding round.

- China's Bytedance is talking to likely buyers about gaming unit Moonton's sale.

- Transcend Fund raises nearly $60M for second seed fund to invest in games and entertainment.

- Bezi raises $13M to enable user-generated and collaborative 3D design.

- Nordcurrent snaps up River End Games and is to publish the studio's upcoming single player title.

- Gaming M&A activity hit $B during Q3, according to consultancy DDM.

- SBI Holdings reveals ¥100B fund to bolster Web3 in Japan.

Business & Product:

- Steam Deck 2 will be a "generational increase" as original sells"multiple millions".

- Roblox stock soars as Q3 results surpass expectations.

- Nexon’s Q3 2023 smashes records with 78% revenue rise in North America and Europe.

- Remedy's upcoming free-to-play title Vanguard to become premium.

- Gravity’s mobile revenues rise 95.7% YoY with worldwide Ragnarok success.

- Newzoo: Global games market expected to increase 2.6% in 2023.

- Unity 6 debuts next year with AI-powered innovations and platform updates.

- Thunderful H1 revenue gets a 4% bump.

- Mobile marketing budgets have dropped 20%, says AppsFlyer.

- GameSquare Q3 results show FaZe acquisition fills funding gap.

Miscellaneous

- Xbox Game Pass adds former PS exclusive Rollerdrome in November.

- Supercell opens up Creator Program to up-and-coming influencers.

- Twitch gets an 8% bump in viewership for October.

- Google DeepMind breaks new ground with ‘Mirasol3B’ for advanced video analysis.

- Bandai Namco names Nintendo-focused team Studio 2 and Studio S.

- Digital Bros is posed to cut 30% of its workforce.

- Amazon lays off 180 gaming employees, shuts down Crown Channel.

- Humble Games affected by layoffs.

- Samsung Gaming Hub adds Boosteroid cloud gaming service.

- 68% of UK games developers are suffering from skill shortages.

Our Design Consulting Services

Today we’re highlighting our full lifecycle design services. This includes customised game deconstructions, core/metagame concepting, feature design, economy modeling, gameplay balancing, monetisation design, and much more across platforms and genres. Here is what one of our clients had to say.

“We’ve had a couple of very productive engagements with the Naavik team of experts. With their external perspective and extensive industry knowledge, the conversations and reports that were generated during our work together helped our studio enhance and shape the future of the games.”

- Elad Lebovitch, Founder & CEO at Banditos Studio

If you’d like to learn more and engage us, reach out here! Also check out our expanded consulting service portfolio here.