Hi everyone — welcome to another issue of Naavik Digest! If you missed our last one, be sure to check out our breakdown of blockchain game Sorare and how the fantasy football platform is demonstrating what a sustainable web3 title should look like. In this issue, we’re discussing Ubisoft’s ongoing struggles and what it might take for the company to turn the business around.

FTC Halts Microsoft’s Acquisition / AI Narrative Gaming / EA Restructuring

In this week's Roundtable, the crew discusses what M.O.B.A. Network's acquisition of Wargraph for $54 million means for indie Overwolf projects. We also dive into the FTC's temporary restraining order halting Microsoft’s Activision Blizzard deal in addition to Roblox's new mature content system and whether it might hurt user retention. Also on the agenda: Hidden Door's playtest of a generative AI-driven narrative game using the Wizard of Oz IP and a discussion on what EA splitting up its sports entertainment divisions means for the company. Join us for all the latest games business news with Felipe Mata, Matt Dion, and host Devin Becker.

You can find us on YouTube, Spotify, Apple Podcasts, Google Podcasts, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1 Has Ubisoft Hit the Bottom?

Written by Aaron Bush, Naavik Co-Founder

Naavik Digest has chronicled Ubisoft’s struggles for years, and while it’s never fun to criticize one of our industry’s most prominent publishers, it’s understandable why it needed to be done. After all, this type of performance — Ubisoft’s stock falling over 80% from its highs — doesn’t happen for good reasons:

However, today I want to raise a very different question: Has Ubisoft officially hit bottom? Is now the time for a turnaround? This might sound perplexing given how we’ve seen the company’s results underperform in recent quarters, but to best understand why the company might be turning the corner, let’s first take a step back and remember how Ubisoft found itself in the doldrums:

- Game delays: Delaying games is natural, especially due to COVID, but delaying a game like Skull & Bones six times is not. Doing so consumes resources and makes the odds of such projects ever generating positive returns far less likely.

- Underperforming releases: Sadly, several of Ubisoft’s released games have missed the mark financially. More recently, this includes titles like Just Dance 2023 and Mario + Rabbids: Sparks of Hope, but the list gets longer the farther back you look.

- Live-ops struggles: In a related issue, you can zoom back to The Division’s 2016 release to start spotting signs of trouble. Despite being Ubisoft’s fastest-selling game ever at the time, the franchise lost over 90% of its audience within three months due to a lack of fresh content. Although the company did level up with The Division 2 in 2019, fresh live-ops issues crept up elsewhere, such as in that year’s other major release of Ghost Recon: Breakpoint, which sits at a 58 Metascore. Launching too early and without adequate post-launch planning has held back several of Ubisoft’s releases in recent years.

- Culture problems: In 2020, the company faced new allegations of sexual harassment and an ineffective HR system. That led to notable firings, new hirings (like a Head of Diversity and Inclusion), and general restructuring. I don’t know how effective those changes have been, but when culture problems exist — and even when management is actively trying to solve them — it creates a large distraction from creating great games.

- Strategic misses: I’ll never fault companies for taking chances, but Ubisoft’s string of strategic failures adds up: mobile-related acquisitions (like Kolibri Games and Green Panda Games) turned out to be value destructive, Ubisoft Quartz’s NFT efforts faced major backlash, early support of Stadia was futile, Ubisoft+ doesn’t really move the needle, and many new projects (including on mobile) have had to be scaled back.

- Bloat: Ubisoft has approximately 20,000 employees and generated $2 billion in revenue over the past 12 months — equating to around $100,000 in revenue per employee. For context, Activision Blizzard, Electronic Arts, and Take-Two Interactive have revenues per employee of roughly $443,000, $550,000, and $399,000, respectively. Ubisoft’s competitors, all of which are much larger by valuation, also employ far fewer people.

- A questionable deal with Tencent: In September of last year, Tencent invested a fresh $296 million to raise its stake in Ubisoft. The benefits to Ubisoft include leveraging Tencent’s mobile prowess and access to China, but weirdly, the deal valued Ubisoft at $10 billion, which is well above the value at the time and far above today’s $3.5 billion market cap. Plus, the transaction went into the Guillemot family’s holding company instead of just publicly traded shares. In short, this transaction solidified the Guillemot family’s control of Ubisoft and made it far harder for external sources (like activist investors) to shake things up. But should the family who helped bring about all of the above issues be firmly in control? It’s a question worth asking.

Unsurprisingly, all of the above bullets have led to financial underperformance essentially every quarter over the past two to three years. Over the past 12 months, for example, Ubisoft’s bookings fell 18%, operating cash flow margins collapsed to -20%, and net debt expanded to roughly $900 million. That’s not a sustainable way to operate — and it puts context around why the company’s stock is currently trading where it did in literally the year 2000. Something major needs to change.

Now, turning a ship as large as Ubisoft around is incredibly complex and entails the sum of 10,000 little things. However, what would the broad strokes of a turnaround entail? In my view, a turnaround would be driven by three main endeavors: refocused initiatives, a streamlined team, and doubling down on live-ops. In short, less is more.

How is Ubisoft faring on these fronts? Let’s dive in.

Refocused Initiatives

Focusing on the biggest and best projects is important partially because gamers are increasingly flocking to the largest franchises. Also, smaller or more middle-of-the-pack games won’t move the needle for big publishers, and mobile hits are harder to come by (especially for teams lacking mobile expertise). In Ubisoft’s case, that means easing up on smaller projects (think Roller Champions, new VR games, or rushing into a new Mario + Rabbids sequel) and doubling down on the biggest franchises like Assassin’s Creed, Far Cry, and Tom Clancy. This is not to say new franchises (or new styles of games leveraging key IP) can’t or shouldn’t be fostered, but those bets made should be even pickier.

Fortunately, Ubisoft is leaning in this direction. As of Q1, the company had canceled seven projects across VR, mobile, and console/PC in recent months. Not all of these cancellations are great news (like the Prince of Persia Remake), but leaning away from what Ubisoft isn’t best at makes a world of sense.

Furthermore, it appears the company is clearly expanding its focus on Assassin’s Creed, both with October’s release of Assassin’s Creed Mirage, which will play more like an older installment (less RPG, more linear and stealth-based), and the still-mysterious Infinity platform that will house and bring together all things Assassin’s Creed in one spot. Plus, Tencent is co-developing codename “Project Jade,” a new mobile, China-themed installment that should open the franchise to new audiences on mobile and in Asia.

Lastly, the new Star Wars Outlaws bet, which looks kind of like a Starfield-meets-Star Wars crossover, looks promising, and it’s hard to know what to make of the company’s Avatar: Frontiers of Pandora game yet. But those are big, more-focused bets.

A Streamlined Team

It’s hard to overstate just how lackluster and unsustainable a revenue per employee of $100,000 is for a major publisher. The number can fluctuate heavily depending on the timing of major releases, but being a fraction of the competition is still a bad place to be. Even if revenue doubled, Ubisoft’s revenue per employee would still be less than half its Western counterparts.

Notably, a couple of months ago, Ubisoft announced a “strategic reorganization of its European business subsidiaries” with “an expected net reduction of its non-variable cost base by at least €200 million over the next two years.” This isn’t fun, but it essentially means shutting down offices, laying off some staff, and potentially divesting certain assets. In April, the closure of European sales offices led to 60 people being laid off. In May, 60 more employees were laid off from customer service roles. And, more generally, Ubisoft’s employee count declined by about 1,000 over the past few months — with natural turnover being a driver as well.

Doubling Down on Live-Ops

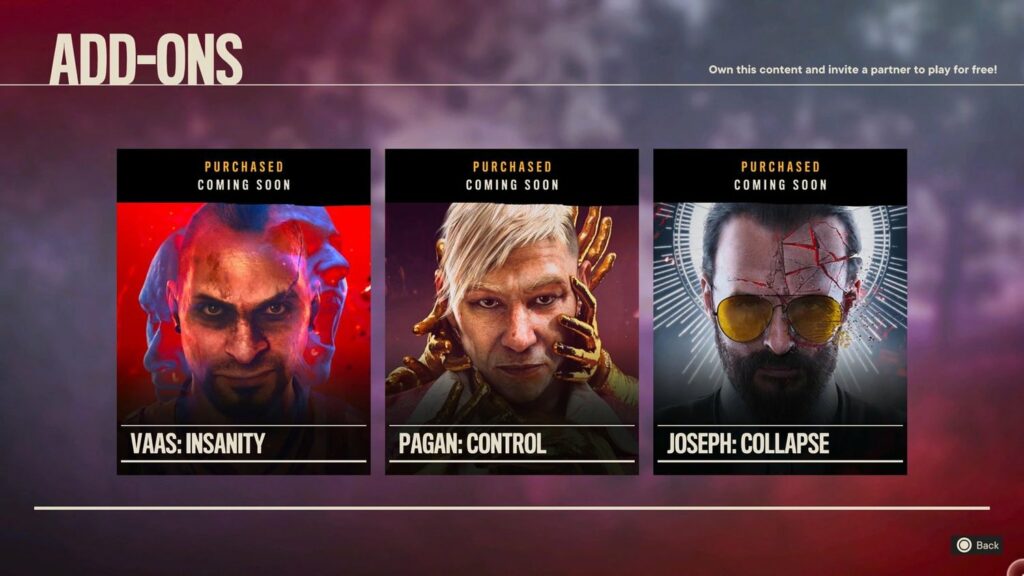

In some sense, live-ops don’t matter if projects get canceled or indefinitely delayed. But if the company is to truly refocus on the biggest, most important bets, then it needs to ensure that those bets can retain superior engagement over longer periods of time. In some sense, Ubisoft has improved from its past; games like Far Cry 6 and Assassin’s Creed Valhalla both have three DLCs each, and Assassin’s Creed’s longer-term engagement appears to have increased over recent installments.

This is a fine start for more single-player experiences, but if Ubisoft wishes to level up multiplayer Tom Clancy-related games or really find its footing in F2P (like in the upcoming XDefiant, a FPS arena shooter), then Ubisoft will need to invest more heavily in industry-leading live-ops capabilities. We’ll see how all of that pans out, and it’s fair to be skeptical, but clearly there’s been some progress since the days of 2016 to 2019.

Is It Enough? Is Ubisoft Turning a Corner?

No, and yes. It’s likely not enough, but the fact that there is at least minor progress in every important dimension — better focus, some streamlining, and slowly improving live-ops — shows that Ubisoft is rowing in a better direction. The financials obviously don’t show any of this yet, but small signs of change are there. And since the market is forward-looking, it wouldn’t surprise me (barring any substantial delays or cancellations) if we’ve now seen Ubisoft’s lows.

But again, are the changes enough? From what is publicly known, I don’t think so. While the steps to refocus on more important and promising projects look directionally right — and frankly, it’s hard to comment on future live-ops capabilities from afar — the streamlining of the business itself is not nearly as aggressive as it should be. For context, Ubisoft’s revenue is less than one-third the size of its largest competitors despite having several thousand more employees. Instead of layoffs in 60-person groups (while boasting 448 current job openings), it should (and I hate to say it) be thinking 100x bigger. What does cutting 6,000 roles (30% of the workforce) look like? Why can’t a hiring freeze be put in place in more areas?

It might sound unsympathetic, but streamlining projects (including fewer types of in-house projects) means less to work on. All the other major publishers show that operations can be handled far more efficiently, and we’ve even seen companies like Meta show how similar percentage cuts (while reducing management layers) allow for increased talent density and faster day-to-day progress. Plus, Ubisoft should be looking to put itself in a more financially robust position if it ever wants to pursue any big new opportunities in the future, like paying off debt or new M&A.

I’m sure there are European labor laws I’m less privy to — such as the challenges of making outsize changes with unionized workers in France — and perhaps there are even divestment discussions (of IP / studios) that no one is aware of. But more aggressively streamlining is such an obvious business move that I’m quite shocked it hasn’t happened. Looking to reduce the non-variable cost base by “€200 million over the next two years” represents about a 10% margin, which is notable, but doesn’t mean as much as it might appear when operating losses this past year were triple that amount.

Let me close with an anecdote. Over the past decade, one of the games industry’s top performers was Capcom (which 10x-ed in 10 years). After a long period of underperforming both critically and financially in the early 2010s, Capcom’s management finally made big, hard decisions — relocating development, closing studios, refocusing on top franchises in bigger ways, reinvesting in critical infrastructure — that were tough at the time but did set the organization up for profound and positive long-term change.

For this analogous reason (paired with Ubisoft’s slimmed-down yet leveled-up pipeline), I’m hesitantly calling a market bottom with Ubisoft. I’m also noting that instead of taking steps in the right direction, the company should, and can, be making leaps. This isn’t investment advice or a bet on outsize growth and value creation from here — the team has much more to prove — but the option exists if management is brave enough to make big, hard decisions. Compared to Capcom, history won’t exactly repeat, but there’s little reason it can’t rhyme.

#2 Xbox Goes to Court, Final Fantasy Impresses & Nintendo Fills Its Calendar

Xbox and PlayStation duke it out. Microsoft’s court battle with the U.S. Federal Trade Commission over the Activision Blizzard deal kicked off on Thursday with some explosive revelations via now-public court documents, including emails from PlayStation chief Jim Ryan and Xbox Game Studios head Matt Booty. Microsoft also made a blunt admission in court docs that it “lost the console wars” to Sony and is now struggling to compete.

- In what became the first of several bombshell headlines to come out of the trial’s first day, an email from Ryan just days after Microsoft announced the acquisition in January 2022 indicated that the PlayStation boss has known all along that the deal is not about withholding games from Xbox’s competitors (and instead about expanding the Xbox ecosystem and audience). “It is not an exclusivity play at all,” Ryan wrote in the private email. “They’re thinking bigger than that.”

- Ryan went on to say that Sony would be “more than OK” and that the company expected Call of Duty would stay on PlayStation, flying in the face of the public position Sony put forth in statements and court filings in the months after.

- Later on, a 2019 email from Booty indicated that Microsoft’s position on supporting Nvidia’s cloud gaming platform amounted to “No effing way.” Since then, however, Microsoft and Nvidia’s relationship has changed, and the two companies now have a deal in place (and many more deals with other providers) to support Xbox and Activision titles on GeForce Now.

- Other testimony from Booty and Bethesda’s Pete Hines revealed that the publisher’s upcoming Indiana Jones game will follow Starfield and Redfall as an Xbox exclusive.

- Another shocking revelation came from Xbox ecosystem lead Sarah Bond, who revealed during testimony that Activision Blizzard CEO Bobby Kotick used Sony’s market leader position to extract a more generous console revenue share from Microsoft by threatening to keep Call of Duty off Xbox entirely.

- The trial will continue this week and wraps up Thursday. We’ll have more in-depth coverage of court doc revelations and further testimony reveals, including from Xbox chief Phil Spencer’s time on the stand, to come in Tuesday’s issue. But the entire fate of the deal now effectively depends on what the judge here decides, as Microsoft’s legal team has already said it may abandon the deal if the FTC is successfully granted an injunction.

Final Fantasy XVI comes out strong. The latest mainline Final Fantasy entry from Square Enix launched on Thursday to strong reviews, including a Metacritic score of 88 and plenty of praise for the game’s bombastic combat encounters, slick action RPG combat system, and darker and grittier tone.

- Helping the hype machine was a fantastic demo that allowed players to experience the first few hours (effectively the prologue). The demo also included the ability to mess around with some of the skills and summons using a more decked-out version of protagonist Clive.

- We don’t yet have a lot of insight into how the game might be performing over its opening weekend, but FFXVI will be an interesting test case for a number of reasons. For one, it’s the first mainline Final Fantasy game since FFXV way back in 2016, which has sold more than 10 million copies, so performance here will tell us whether appetite for the franchise is waning or keeping steady. Additionally, this new entry is a timed PS5 exclusive, which will necessarily put a ceiling on its sales performance.

- The longer-term success of the game may very well depend more on its eventual Xbox and PC versions — and we may not hear anything from Sony or Square Enix on sales data for quite some time. But for now, it’s worth noting that there is a limited number of customers FFXVI will be available to (the roughly 40 million-plus PS5 owners). That will require tempering our expectations.

Nintendo rounds out the year. The latest Nintendo Direct aired last Wednesday and filled the gaps in the company’s 2023 release calendar.

- This time around, there was plenty of Mario. Nintendo announced a new side-scrolling entry in the long-running platformer series called Super Mario Bros. Wonder. The new title sports a more opinionated art style and some interesting new transformation abilities, including the opportunity to turn into an elephant.

- Arguably the biggest surprise of the Direct presentation was the confirmation of an official Super Mario RPG remake. The classic 1996 game, originally developed in partnership with Final Fantasy maker Square Enix (then Squaresoft), will be coming to the Switch in November. It will feature an updated art style and what appears to be a largely untouched story and combat system in the vein of the Link's Awakening remake.

- Nintendo rounded out the showcase with a slew of more minor announcements and reveals: A new WarioWare mini-game collection called WarioWare Move It! due out in November; some long-awaited gameplay of Pikmin 4; the return of Detective Pikachu in a confirmed sequel to the 2016 3DS game; and new DLC for Pokémon Scarlet and Violet called The Teal Mask and The Indigo Disk, both coming sometime this holiday season.

🔥Featured Jobs

- Coda Payments: Managing Director, Publisher Partnerships (Los Angeles, U.S. / Hybrid)

- FunPlus: Senior Community Manager (Barcelona, Spain / Remote)

- LILA Games: Lead Gameplay Engineer (Remote)

- MY.GAMES: Game Designer (Remote)

- Nexus: Head of Sales (Remote)

- Supersocial: Game Designer (Remote)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below. We've made the job board free for a limited period, so as to help the industry during this period of layoffs. Every job post garners ~50K impressions over the 45-day time period.

Since 2019, Naavik has consulted with 200+ gaming studios, financial institutions, and other ecosystem companies on wide-ranging projects across various industry verticals.

Our services are delivered through a highly experienced, industry-bred group of consultants and include:

- Product, design economy & live-ops strategy

- Market research activities

- Investment and M&A due diligence

- Brand marketing & User acquisition support

- And more!

Need help on a project? Reach out below, and we'll get back to you shortly.