Hi everyone — welcome to another issue of Naavik Digest! If you missed our last one, be sure to check out our piece on what catalyzed the current moment for TV and film adaptations of gaming IP and what it means for the industry’s future. In this issue, we’re discussing the blockchain game Sorare and how the fantasy sports platform is demonstrating what a sustainable web3 title should look like.

What’s Next for Move-to-Earn Pioneer Stepn?

“Move-to-earn” pioneer Stepn exploded in popularity in the first half of 2022, peaking at 3 million MAU and 800,000 DAU while generating $123 million in Q2 2022 profit alone. The mobile app, which rewards users who “wear” the company’s NFT sneakers, was a major driver in introducing users to web3, but growth has stalled during the current crypto winter. In this episode, host Niko Vuori talks to Stepn COO Shiti Manghani about what’s next for the company, its ambitions to build an entire ecosystem around $GMT, the native Stepn cryptocurrency, and why Stepn views itself as a game rather than a fitness or lifestyle app.

You can find us on YouTube, Spotify, Apple Podcasts, Google Podcasts, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1 How Sorare Demonstrates a Sustainable Web3 Model

Written by Devin Becker, Naavik Contributor

Nearly all of the earliest web3 games have collapsed, in part due to fundamentally unsustainable economics and weak gameplay. As a result, web3 gaming as a whole carries a bad reputation in many circles. But in this piece, we’re discussing one of the more notable exceptions: the fantasy sports game Sorare, the success of which is proving that not all web3 games are hyped up and unsustainable.

Based on a relatively simple concept, Sorare has been refined since its inception in 2018. The game is essentially a form of fantasy soccer that makes use of NFT player trading cards. Players construct a team of five players, each occupying different positions, using the NFT cards they own. The aim is to score points based on these players' real-life match performances over a three- to four-day period. Sorare also hosts tournaments and leaderboard contests with the opportunity to win rare cards and in some cases even cash prizes, which are paid out in ETH, and physical rewards like signed jerseys and Sorare merch.

In some respects, the staying power of this concept is unsurprising. Trading cards, particularly those pertaining to sports, have a long-standing history in the physical world, complete with active secondary markets. There have also been successful businesses constructed around the intense interest in fantasy sports, a concept dating back to simulation games such as Strat-o-matic baseball.

Launched on Ethereum in 2019 by developers Nicolas Julia and Adrien Montfort, Sorare has experienced significant growth in the years since. The game recorded over $343 million in secondary market volume in 2022, and $88.6 million in the first five months of 2023, according to Cryptoslam. While the volume has clearly declined compared with the highs of last year, the game’s ability to survive a significant drop in volume without going into a death spiral points to Sorare’s overall sustainability.

Additionally, the company has successfully secured multiple investment rounds, the most recent being a $680 million Series B round that valued the company at $4.3 billion in September 2021. It’s unlikely Sorare has retained such a sky-high valuation now that the NFT frenzy of 2021 has died down, but the funding has nonetheless helped Sorare continue building and adding new sports. The team has even broadened its focus beyond soccer to incorporate basketball and baseball through partnerships with the NBA in October 2022 and the MLB in July 2022.

Sorare’s Business Model

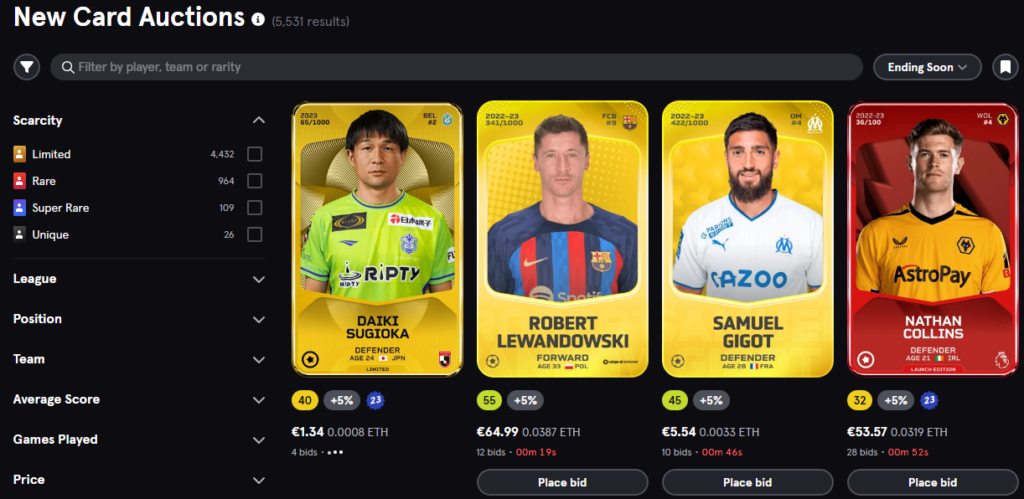

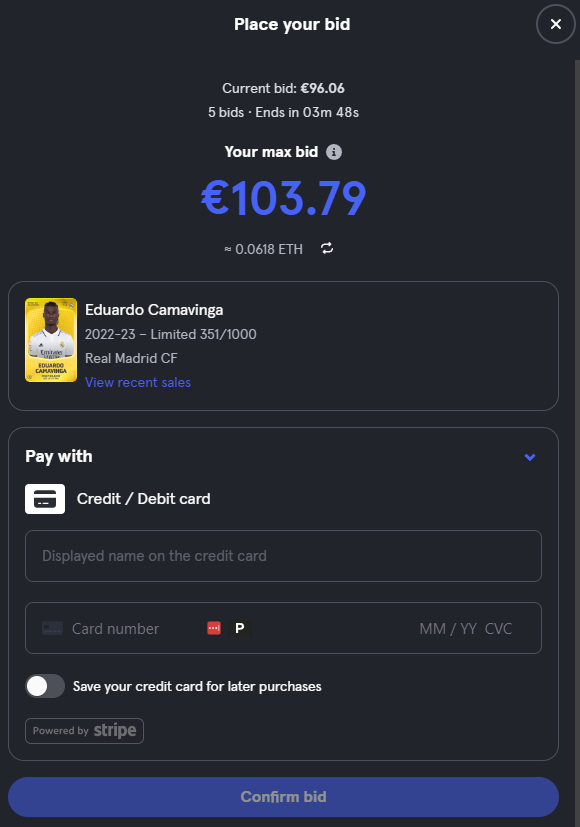

Sorare's business model, while relatively straightforward for a web3 game, is more of an innovative twist on a traditional trading card distribution system. Instead of selling blind booster packs of cards for new seasons, Sorare holds live auctions for the cards, offering different quantities based on their rarity. Seasons in Sorare follow the duration of the seasons of the real-life sport, as the fantasy aspect depends on the metrics of the real-life matches being played.

With auctions being competitive, highly desirable cards end up selling for significantly higher prices than less desirable ones, especially considering higher rarity cards offer a better chance at winning bigger cash prizes. While Sorare doesn’t disclose revenue or total prize amounts, some previous estimates have put the amount of revenue going to prizes at 10%. The majority of tournaments reward cards rather than cash (ETH) prizes as well, which may help offset revenue redistribution. Card prices in auctions have dropped over the last year, according to player reports, but it's possible the introduction of baseball and basketball card auctions combined with a new 5% secondary market transaction fee could help make up for the decline in revenue.

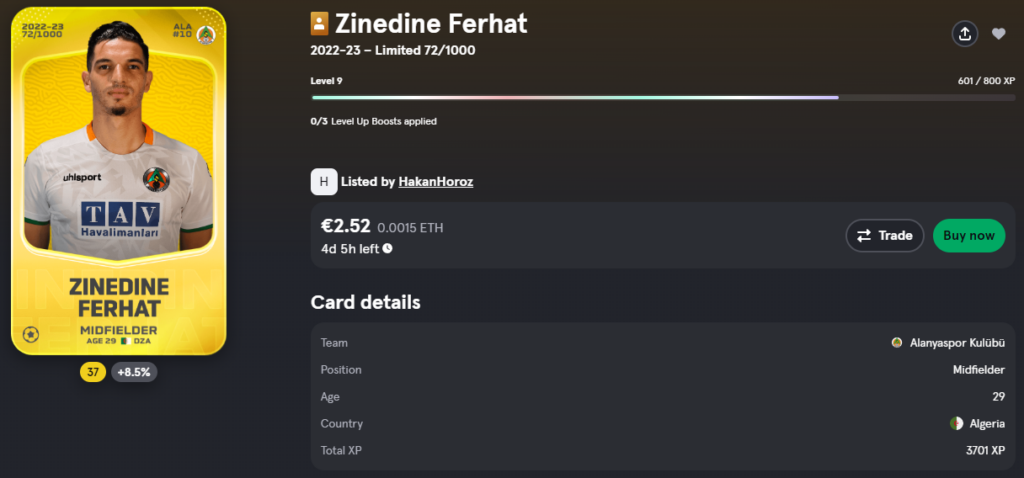

Card rarity dictates the exact quantity of a player's card that can exist for a given season, with rarities being Common (unlimited copies), Limited (1,000 copies), Rare (100 copies), Super Rare (10 copies), and Unique (1 copy). Common cards, which are distributed for free to new players, are not tradable, meaning all tradable cards have a maximum limit of 1,000 copies. By utilizing the auction model to distribute newly minted cards, Sorare fosters competition among its more savvy players, or "managers,” as they are referred to in the game’s parlance. Managers compete for rare and valuable players, with the proceeds going to the Sorare developers. The system, however, generously allows older copies of players’ cards to be used while granting a point bonus of 5% to current season cards as an incentive to upgrade.

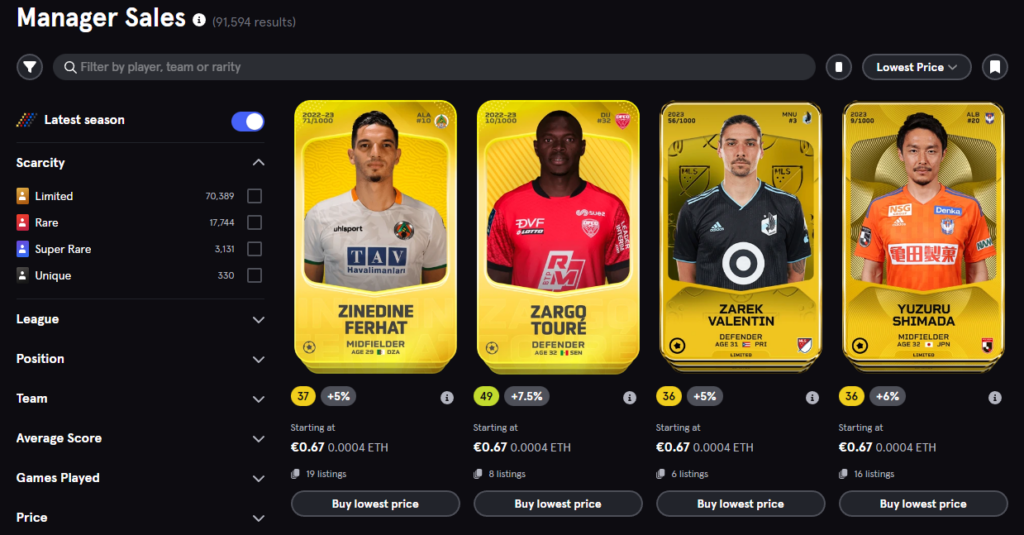

Intriguingly, Sorare didn't initially monetize secondary market trades and simply covered the gas cost for secondary sales. However, as Ethereum became too expensive to run natively, the game transitioned to a Starknet-based Layer 2 solution (similar to Immutable X) to process transactions more affordably. Sorare operates a peer-to-peer marketplace for managers to buy and sell cards. In recent months, the company began charging a 5% transaction fee to foster economic sustainability during slower growth periods.

For managers, a significant aspect of the game involves scouting both new card auctions and the "manager sales" marketplace for lucrative deals on cards to use in upcoming matches, as well as offloading players who might underperform in the future. Managers may also consider acquiring a current season version of a player for the 5% bonus.

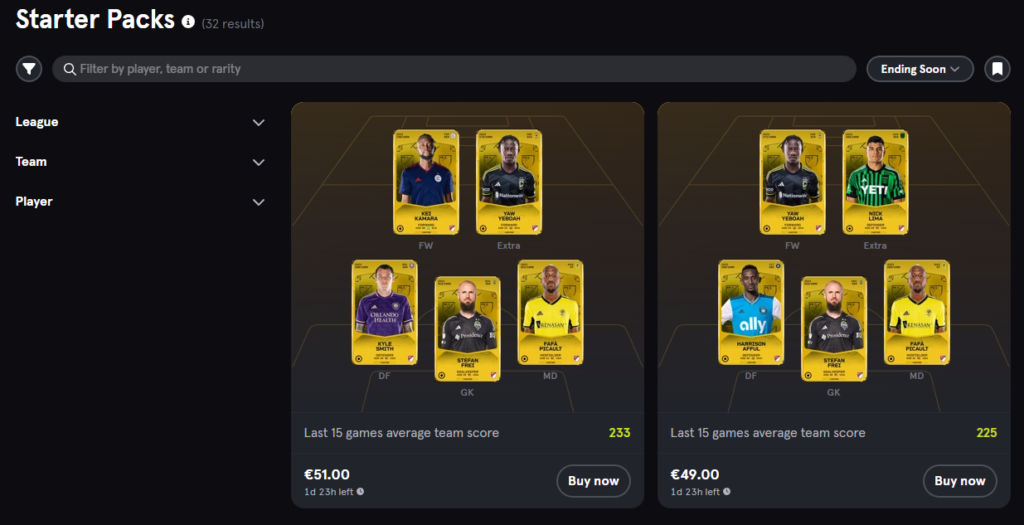

To assist new managers, Sorare introduced Starter Packs, offering five decent player cards at a discount compared to those cards’ market price. However, these are exclusively available to managers who have never made a card purchase. Like most physical trading card games, participation requires some level of financial investment. Consequently, the game commands a fairly high average spend, with even budget-conscious online guides suggesting a $500 starting investment. To stimulate managers' pursuit of rarer player versions, the game features tournaments with minimum card rarity requirements. As discussed above, prizes for these tournaments include cards of different rarities and/or cash rewards in the form of ETH.

To foster retention and encourage managers to invest in cards, the cards themselves possess player levels with varying ranges based on rarity. As a card is used across various fantasy teams, it accumulates XP, which determines its level and associated scoring bonus. This arrangement enables shrewd managers to enhance the scoring potential of players they obtained at a bargain by entering the player cards in training tournaments designed specifically for leveling up player cards at 2x the XP. To prevent misuse of this system for card resale value, Sorare halves a card’s XP when it changes ownership. Depending on the levels and XP amounts, this could result in a drop of one to five levels.

Why Sorare Is Succeeding

It's worth examining the features and decisions that have contributed to Sorare's success and sustainability, even in a bear market. Notably, the game lacks a native token, opting instead to use ETH and focus on NFTs. That these NFTs have a huge range of values prevents the price fluctuations of a single token from having a drastic effect on the game’s health. Having a token would have exposed the game to greater volatility and raised the barrier to participation, too. Skyweaver is another web3 game that does something similar with its trading cards, using USDC on Polygon as its token of exchange.

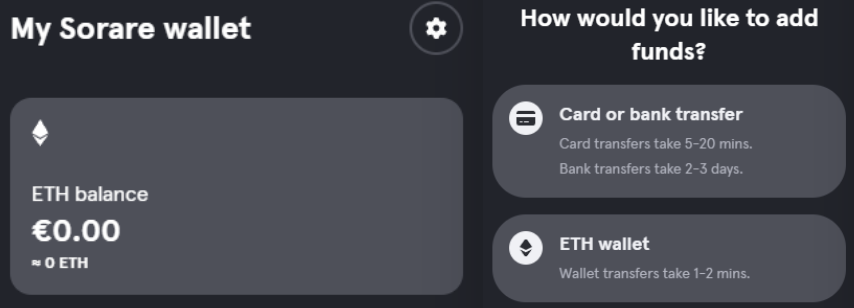

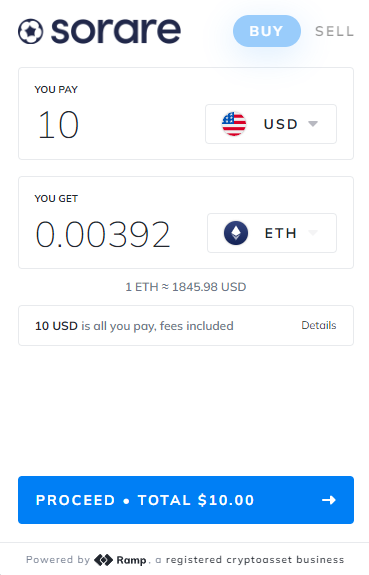

Choosing to use ETH instead of a proprietary Sorare token also significantly simplifies transactions. It facilitates the use of on-ramp providers like Ramp and Moonpay without necessitating an exchange or substantial token liquidity. Sorare has a robust partnership with Ramp, offering a much lower minimum transaction ($7 when tested) compared to the typical $30 minimum when using Moonpay.

Moreover, Sorare enhances convenience by permitting auction bids for new cards using credit card payments processed by Stripe or Google Pay. These easy on-ramps enable potential players to dive into the game without needing to grapple with the complexities of crypto, particularly given the game's provision of a semi-custodial wallet.

While serious engagement with Sorare requires financial investment, anyone can start playing the game for free using Common cards by simply creating an account. This approach allows players to familiarize themselves with the game swiftly without confronting crypto or wallet hurdles. A single account can be used across all three available sports — soccer, basketball, and baseball — each of which has comprehensive tutorials for onboarding using the free, non-tradable cards. All three sports use a near-identical economy design with small exceptions like the NBA allowing for private league play with friends and the MLB having larger team sizes (seven instead of five). With the NBA and MLB being newer additions after the NFT bull market, these sports haven’t seen the same traction as soccer, but they are still getting a moderate level of participation.

The introduction of Starter Packs, purchasable using a credit or debit card, significantly eases the transition into more serious gameplay. For crypto natives, these purchases can still be made using ETH. The cards in the Starter Packs are of Limited rarity; these tradable NFTs can potentially be leveled up and sold. The fact that cards can be used in future seasons mitigates any hesitation about joining partway through a season while still incentivizing the acquisition of new cards in the following season.

As Sorare is sports-based, it offers an advantage over typical trading card games in terms of purchasing frequency. In most trading card games, players tend to buy the majority of their desired cards immediately upon the release of a new card set, with purchasing activity dipping significantly until the next set's release. Depending on the appeal of the cards in each set and the frequency of releases, there may be huge swings in buying behavior that can either bolster or undermine the game's economic viability.

However, in a fantasy sports model like Sorare, there's a continuous incentive to buy new cards in each set, irrespective of their desirability. More frequent mid-season buying and selling keeps the game dynamic. Restricting tournament participation based on card rarity also stimulates mid-season purchases of higher-rarity cards. As EA discovered with FIFA Ultimate Team, the purchasing behavior around playable annual sports cards is incredibly robust. This trend is further magnified by the introduction of rookie players and team changes.

Another advantage of being sports-based is the access to a vast addressable market beyond typical web3 gamers. The player base for crypto-native web3 gaming, while growing, is still relatively small compared to traditional gaming. Not only do the three sports featured in Sorare have substantial fan bases, but a significant portion of these sports fans are already familiar with the concept of fantasy sports, requiring little instruction to understand the game's dynamics. Additionally, the long-standing tradition of collecting licensed player trading cards resonates with many sports fans. Consequently, explaining Sorare to a large section of the adult population isn't a significant challenge, as is the case with many web3 gaming projects.

Lastly, the values and prices in Sorare aren't driven by erratic FOMO behavior, as is also the case with so many web3 games. Instead, the speculative aspect of the game is a logical, integral part of the experience. The cards hold inherent value to sports fans, and when combined with the prospect of winning money through tournaments, there is a more sustainable sense of value. The monetary prizes are funded from a fraction of the revenue Sorare generates and are paid out in a form that is far more liquid and akin to cash than any game-created token. Like all games, the sustainability of Sorare depends on generating fresh revenue. However, as long as Sorare continues licensing real-world teams and players, the content can remain fresh as long as the sport itself sticks around.

Sorare also makes smart use of a third-party website tool ecosystem, a feature of using the blockchain that many other web3 trading card titles, such as Splinterlands and Gods Unchained, have also embraced. Players of these types of games are often looking for data around performance, market activity, prices, and ratings, yet there is only so much Sorare itself can provide for players. By having on-chain data, the game exposes information for others to build on without always requiring an explicit API.

Websites like Sorare Data have built subscription models around providing useful market and scouting information for hardcore players to deepen engagement and expand outreach. The openness of the public blockchain ledger combined with the composability of smart contracts opens a lot of opportunity to build permissionless ecosystems around games that Sorare is benefitting from.

At a high level, Sorare leverages repeatable attributes that helped set up a more sustainable web3 gaming model:

- Gameplay that appeals to a broad, traditionally non-web3 audience (sports fans)

- NFTs that represent a collectible that retains value over time

- Using ETH (a reasonably stable and liquid token) instead of creating and trying to maintain a new one

- A consistent source of revenue that can be converted to cash without adverse effects

- Tournament prizes that are profitable and sustainable by being small proportional to player spend

- A revenue source that doesn’t depend on devaluing its own tokens for cash flow

- A free-to-play model (although the free parts aren’t tradable) that is friendly to those lacking web3 knowledge and makes onboarding and first purchases easier

- Earning that requires investment, skill, and knowledge instead of just grinding or more up-front investment

- Card acquisition and NFT trading that is part of the fun of the game so players can appreciate those aspects of the game outside of their earning potential

Although many upcoming web3 games are leaning into complex economy design around tokens, more teams should take a page out of Sorare’s playbook: Sometimes keeping it simple is the best recipe for success.

#2 Top Movers & Deals: June 9th - June 16th

Written by Mario Stefanidis, CFA, Naavik Contributor

- For the week ending June 16th, 2023, the average return for gaming companies tracked by Naavik with a market capitalization exceeding $500 million was -1.1%. The S&P 500 returned 2.6% and the Nasdaq-100 returned 3.8%.

- CD Projekt (WSE: CDR) surged 32.5% after unveiling a new trailer for the Cyberpunk 2077: Phantom Liberty DLC at the Xbox Showcase on June 11th. The two-minute trailer featured the return of Keanu Reeves as Johnny Silverhand, as well as a new character played by Idris Elba, which had been confirmed last December. Critically, a concrete release date was announced for the first time, with the DLC slated for September 26th. Adding fuel to the CDR rally is the stock’s significant short interest on the WSE, which is reportedly the highest in the exchange’s history.

- Unity Software (NYSE: U) rose 17.3%, continuing its upward trajectory after Apple’s keynote at WWDC 2023, where the Apple Vision Pro mixed reality headset was unveiled. During the presentation, Apple revealed that Unity’s tools would be used to bring 3D apps and games to the new headset, which could boost revenue given third-party developers would need to leverage these tools as well. Furthermore, Unity released its annual Mobile Growth and Monetization Report on June 12th, to help customers monetize their software more effectively on the platform.

- IGG (SEHK: IGG) continues to be one of the most volatile stocks in Hong Kong, rebounding 19.3% after falling nearly 40% since May. According to data.ai, weekly IAP revenue has fallen by approximately 25% for the company’s two recent hit games Vikings Rise and Doomsday, from its peak in late May.

Most Notable Venture Financings

- French mobile games studio Million Victories raised $6.5 million in Series A funding, in a round led by Griffin Gaming Partners and Eurazeo. The studio plans on using the funding to further the development of Million Lords, its real-time strategy MMO game for Android and iOS, and to expand its team. Million Lords currently has 200,000 MAUs and 1.5 million downloads across platforms. The studio collaborated with YouTuber Mr. Beast last July for an in-game competition with an $18,000 prize pool.

- An additional £5 million was earmarked by the U.K. government for the U.K. Games Fund (UKGF), an amount that will grow to £13.4 million over the next two years. The fund, which was created in 2015 and is structured as a nonprofit, is one of a number of funds in the U.K. aimed at supporting creative industries. It provides funding to small and medium-sized enterprises in the game industry and is designed to help these companies develop their ideas into working prototypes or to achieve a market launch.

Most Notable Strategic Investments

- M.O.B.A. Network, a Swedish company that owns numerous gaming websites, purchased Wargraphs for up to €50 million. This sum includes a €25 million upfront payment and €25 million in incentives contingent on EBITDA 12 and 24 months out. Wargraphs is known for its flagship League of Legends companion app Porofessor, which provides live game search and real-time player statistics. The platform also provides insights into the performance of different builds, helping players optimize their champions. Other analytics tools have also been developed by the company for Teamfight Tactics and Legends of Runeterra. Wargraphs is a one-man French startup founded by Jean-Nicolas Mastin, who bootstrapped the venture without any external funding. Revenues for its last fiscal year amounted to €12.3 million. M.O.B.A. Network trades in Stockholm under the ticker MOBA and is down -24.8% year-to-date through June 16th.

- South Korean mobile games developer WeMade Play acquired a 20% stake in external developer StandEgg. The acquisition is aimed at creating two new titles around the Anipang IP, WeMade Play’s flagship mobile puzzle game that integrates social network aspects. Current Anipang spinoff games include Poker, Seotda, and Mahjong. WeMade Play was formerly known as SundayToz from 2009 to 2021. In December 2021, WeMade acquired SundayToz for ₩100 billion ($84 million), and subsequently changed the company’s name in March 2022. The acquisition included SundayToz’s subsidiaries Play Links and Flysher, which specialize in developing social casino games.

- Metaverse infrastructure company Improbable sold off its defense division to multi-family office NOIA Capital, as it plans to focus on metaverse applications. The London-based company had previously shut down its U.S. Defense & National Security subsidiary in December 2022 to focus on profitability in light of “very challenging macroeconomic conditions.” Improbable had previously sold off its majority stake in gaming developer Inflexion Games to Tencent last February. The company plans on continuing its virtual worlds effort for gaming and entertainment companies as well as public institutions.

🔥Featured Jobs

- Coda Payments: Managing Director, Publisher Partnerships (Los Angeles, U.S. / Hybrid)

- FunPlus: Senior Community Manager (Barcelona, Spain / Remote)

- LILA Games: Lead Gameplay Engineer (Remote)

- MY.GAMES: Game Designer (Remote)

- Nexus: Head of Sales (Remote)

- Supersocial: Game Designer (Remote)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below. We've made the job board free for a limited period, so as to help the industry during this period of layoffs. Every job post garners ~50K impressions over the 45-day time period.

Since 2019, Naavik has consulted with 200+ gaming studios, financial institutions, and other ecosystem companies on wide-ranging projects across various industry verticals.

Our services are delivered through a highly experienced, industry-bred group of consultants and include:

- Product, design economy & live-ops strategy

- Market research activities

- Investment and M&A due diligence

- Brand marketing & User acquisition support

- And more!

Need help on a project? Reach out below, and we'll get back to you shortly.