Fortnite has soared to new heights in recent months, thanks to Season OG and last month’s addition of three massive new game modes. The final new game revealed during December’s big announcement was Fortnite Festival, introduced by Eminem and developed by famed music game studio Harmonix.

But why is Epic jumping into the rhythm genre, and what does it mean for the broader intersection of music and gaming?

Whether or not Fortnite Festival stands the test of time, the fusion of music and gaming stands on the cusp of a new era. Though the business and cultural impact of music games peaked a decade and a half ago in the Guitar Hero/Rock Band era, recent developments point to a dynamic future for the genre just around the corner.

If we are to enter a music gaming renaissance, though, it will look quite different from what came before, thanks to an evolution in platforms, business models, and distribution in both the gaming and music industries.

The Rise and Fall of Music Gaming

Though the genre’s future will certainly look different than its past, music gaming’s rich history still holds key lessons for publishers, developers, and licensors.

In 1996, Konami’s Beatmania launched music-based gameplay into the mainstream, pioneering the now-ubiquitous mechanics of timing controller inputs to scrolling button prompts to simulate a song’s notes. Konami next launched an entire publishing label as it invested heavily into music games, soon spawning Dance Dance Revolution (DDR) — the first truly mass market music franchise.

In a follow-up to DDR, Konami contracted an up-and-coming Harmonix to develop Karaoke Revolution, the studio’s breakout hit. Harmonix then released the genre-defining Guitar Hero in 2005, in collaboration with peripheral manufacturer RedOctane, which also published the game before Activision acquired the developer. Harmonix, too, was quickly snapped up, with MTV parent Viacom purchasing the studio before releasing Rock Band in 2007, which grossed $1B in only 15 months, on top of the Guitar Hero franchise reaching $2B in revenue by 2010.

Meanwhile, Ubisoft’s Just Dance series, which was most popular on the Wii, competed with Call of Duty for top-selling game year-after-year.

However, also by 2010, after countless artist DLCs and spin-off games, Guitar Hero and Rock Band were put on hiatus. Harmonix was sold by Viacom and became an independent studio once again. Just Dance and a myriad of other titles slowly saw their popularity wane. The following decade was a long winter for music gaming.

The Current State of Music Games

So why is this genre becoming so interesting and dynamic again? Over the past few years, platform shifts in gaming slowly enabled novel forms of rhythm gameplay, new distribution channels, and the application of F2P business models. This has begun to lead consumers, previously burnt out by incessant and expensive peripherals and DLCs, back to the genre. At the same time, the music industry has changed significantly since 2010 (one of the sector’s lowest points), leading to a renewed interest in games as a monetization and growth channel.

Today’s music games tend to follow one of two core strategies:

- Fit the genre’s core gameplay into a modern distribution and monetization model - usually F2P.

- Innovate on the core gameplay in a creative way - often indie games monetized in a premium manner.

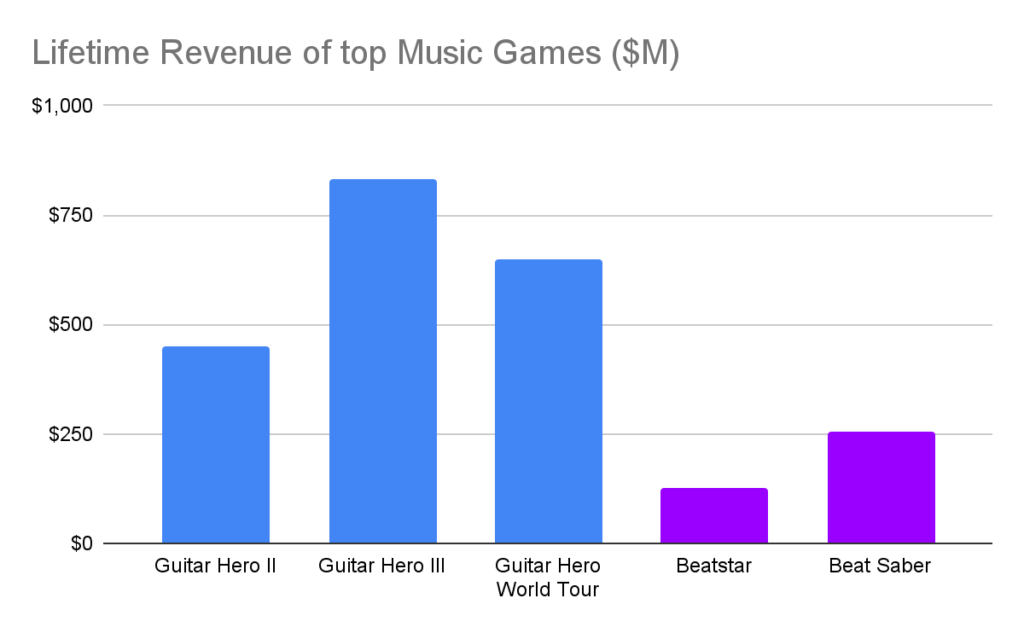

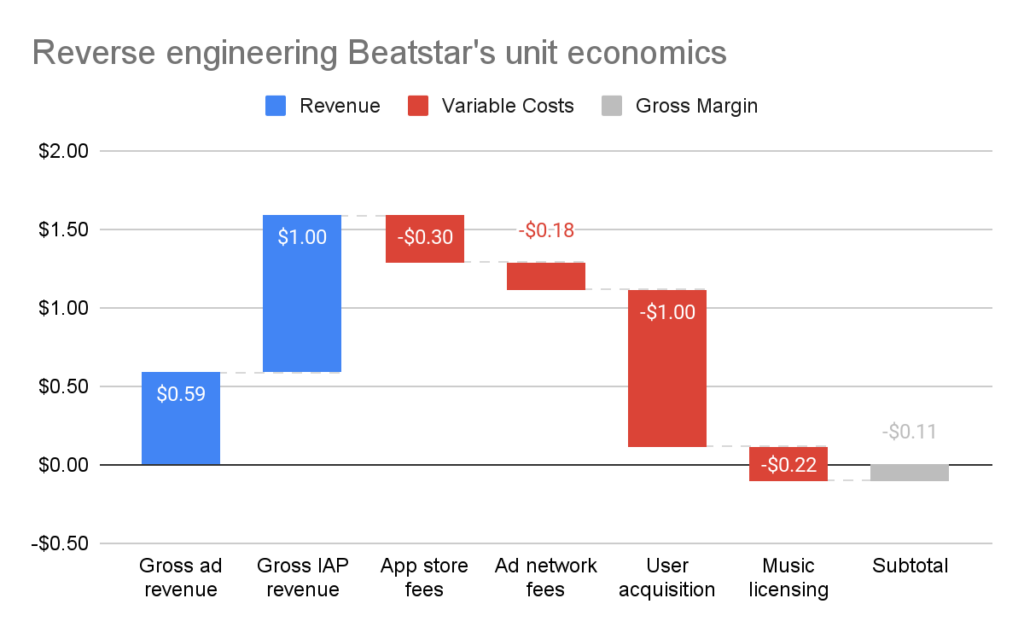

The most widely played music game today is Beatstar from Space Ape a mobile phenomenon that generated 38M downloads, 2.5B songs played, and $73M in revenue during its first year on the market (with a gross $46M of that coming from IAPs, according to data.ai, leaving an estimated $27M in ad revenue). The title applied a slick, modern F2P model to the core gameplay of music games of yore (sans hardware peripherals) with great success, featuring licensed pop songs from top artists. Beatstar is currently sitting at close to 5M monthly active users, with an estimated $128M in lifetime revenue.

Interestingly, while Beatstar may have broad reach thanks to its mobile F2P model, Beat Saber, the VR title, leads the genre in revenue. According to the WSJ, the title accumulated $255M in lifetime revenue by October 2022, with an estimated 1.47M MAU at the time. In many ways, Beat Saber harkens back to the previous era of music games: It is a premium title that sells DLC song packs a la carte, and requires expensive hardware to play. As a result, it can more heavily monetize its relatively smaller user base compared to a title like Beatstar.

These two case studies point to the opportunity afforded by new platforms like mobile and VR, which did not exist during the previous era of music gaming. There is certainly still room for growth on both platforms, which is likely to be driven by many of the same artist- and genre-based tactics that drove such tremendous success in the late 2000s. Space Ape, for instance, recently released Country Star, a new SKU that takes Beatstar’s model and applies it specifically to a single genre, making it easier to target fans of that style of music.

There is not a straightforward accounting of the music gaming market opportunity, but some broad strokes can help to paint a picture of the genre. Looking at all mobile games within the music and music & rhythm subgenres on data.ai provides global (excluding China Android) annual net app store revenue of only $168M for 2023. Adding back an estimated 30% app store cut, and assuming a 60/40 IAP/ads monetization mix, brings the genre to about $400M in total topline revenue on mobile. Including Beat Saber, Just Dance, and even other music-related titles like Hi-Fi Rush might mean total annualized music gaming revenue is close to $500M.

When compared to the heyday of music circa 2007, when Guitar Hero III alone made $750M in 12 months, it's clear today’s music games are not even close to the genre’s high water mark. But it’s important to note that peripherals were arguably the key driver of those eye-watering sales figures, and therefore it's inaccurate to directly compare revenue from that era to today’s software-only titles.

However, even outside the music gaming market, as described above, music has a meaningful and growing business relationship with gaming. Many game publishers have long found ways to integrate music into their offerings in creative, impactful ways, while not necessarily embracing music-based gameplay. Riot Games has famously created virtual K-pop idol groups from its IP, while sports titles have long been a major channel for music discovery.

Economic Challenges in Music Gaming

Though we do stand on the precipice of a potential new era of growth for music games, the genre has unique, endemic challenges. These are obstacles which contributed to the format’s rapid demise around 2010, and which have since hampered a number of attempts at resuscitation.

Licensing popular music from a small handful of record companies is expensive. Music rights holders want to secure lucrative terms after experiencing incredible disruption in their business model last decade. Beatstar, for example, sent 22% of its revenue to licensors during its first year. Those fees make the unit economics for games featuring licensed music less tenable, and it's likely a driving reason why there was such a long period without any new hit games in the genre. In an age where UA costs and platform fees already threaten the profitability of gaming products, a reliance on licensed music and any revenue-sharing agreements it entails is an additional business hurdle for these titles.

While licensing can indeed pose a significant financial challenge to game publishers, it can simultaneously offer enormous value to artists. Aerosmith, for example, famously generated far more revenue from a single branded Guitar Hero spinoff title than any one of its recorded albums. Clearly, music licensing creates fantastic value – but an equitable division of that value among consumers, licensors, and licensees is what makes or breaks a game. As one of Space Ape co-founders told Barclays, “It is still incredibly difficult to define a partnership for a music game that works for all stakeholders.”

Successful music games have found their way around potentially prohibitive licensing costs. The first installment of Guitar Hero launched with tracks performed by cover bands, a cheaper but lower quality alternative to obtaining the rights to master recordings. More recently, Beat Saber succeeded in large part by pursuing an emerging platform (VR), likely receiving support from the platform that eventually turned into an outright acquisition, with a lean team of three developers, and relying on original, unlicensed music.

While Beatstar may or may not be profitable yet, it’s likely the Supercell-backed team is betting on higher monetization through cross-promotion of its spin-off titles, and additional revenue through artist and label promotions, while perhaps renegotiating licensing fees once its music game portfolio scales up. Record labels are keen to collaborate with games and gaming platforms (just look at Universal Music Group’s Roblox experience), especially if highly scaled games can deliver valuable new listeners, which may open the door for developers to get a bigger share of the value music games create.

Fortnite and Its Festival

At its core, Beatstar is a fairly typical F2P mobile game (and competes within that highly competitive market context), while Beat Saber is arguably even more traditional, as a premium PC/console title that relies on DLC song packs for revenue. Catching up to established business models, and bringing old models to new technologies, are viable strategies which we will likely see more of if the economics work – but they are merely a new synthesis of long-established gameplay and business models. Fortnite, on the other hand, stands to pioneer something more ambitious.

Fortnite has hosted integrated music-related experiences since Travis Scott’s famous concert in 2020, and it has since become home to a regular concert series and third-party branded islands from musical artists and other entities, along with a basic music creation mode. The platform has become a familiar partner to the music industry, and its players arguably already had more ways to interact with music than in any other game, even before the launch of Fortnite Festival.

But what is the potential of Fortnite’s new rhythm mode? Despite receiving less than stellar reviews, the Harmonix-developed game might be among the more ambitious of Fortnite’s new modes: Festival is in the business of selling music to one of the largest youth audiences a media product has ever assembled.

Fortnite as a new, highly scaled channel for both music discovery and monetization may eventually be a game changer for record labels and their artists. Though in a much healthier place than it was at the end of the Guitar Hero era, the music industry is still grappling with the prices it should charge to distributors like Spotify and YouTube, while simultaneously embracing and fending off TikTok, the latest (and thorniest) new channel to emerge. F2P, cross-platform UGC services like Fortnite and Roblox are among the only gaming products with remotely comparable audience sizes.

In addition, Fortnite has long nurtured music on its platform in creative ways, commands the attention of a coveted demographic, is among a small number of platforms that can drive scaled "appointment viewing" through music events and impact the news cycle (driving earned media), and can direct that attention to a given song or artist with a far higher level of engagement than the laid-back nature of Spotify or TikTok. Over time, we may see labels add Fortnite as a key pillar of their artist promotion strategies, in the same mix as (though less important than) live events and streaming – at least for certain artists who match Fortnite’s audience.

Fortnite’s nature as a UGC platform also intersects with the new Festival offering in interesting ways. In the past, both Guitar Hero and Rock Band had music creation modes, with the ability to upload those tracks to in-game networks for others to discover. Those features were often considered rudimentary and barely had time to reach an audience before the music game apocalypse. Fortnite’s deep and versatile UGC infrastructure may eventually support music creation in a much more robust, impactful way than its predecessors. If this is the case, it’s almost guaranteed that popular musicians native to Fortnite will emerge, in the same way they have done on YouTube and other platforms in the past.

Party like it’s 2007? The Future of Music Gaming

While Fortnite is best placed to bring music gaming into a new era, and Beatstar and Beat Saber will likely lead the way in revising the classic formula of song packs and spinoffs, music and gaming are likely to continue (re)converging over the coming years. It’s not dissimilar to gaming and Hollywood’s evolving, yet long-standing relationship.

New formats like smart TVs and connected fitness offer uniquely compelling visions of music-based gameplay. Duolingo is bringing its masterful gamified edtech approach to music teaching. And within traditional games, music-based titles like Sayonara Wild Hearts and Hi-Fi Rush continue to innovate on rhythm as a core gameplay mechanic. There’s even a chance the genre’s famed franchise Guitar Hero could make a return.

Many of the largest tech and gaming conglomerates also have a music business, including Sony, NetEase aand Tencent, and could explore possible revenue synergies and cross-promotion opportunities. Some record labels could explore developing relationships with consumers through games too: Top K-pop label HYPE, which counts BTS on its roster, is already publishing a number of games.

But if some gaming products can reach a large enough scale to serve as an effective discovery channel for music, and not just as a source for incremental monetization of music content, then the value proposition may shift to balance both the interests of the record labels and the new distribution channels.

This is Fortnite and Beatstar’s endgame, each with millions of users, and a stage of the relationship between supplier and distributor that TikTok has already reached. As gaming continues to proliferate both through established titles and new ones that originate on emerging platforms conducive to music gaming, the capacity for gaming to effectively distribute music will come into focus.

A Word from Our Sponsor: NEXUS

Build a Support-a-Creator Program with Nexus

Explore implementing a game-changing Support-a-Creator program with Nexus, the leading platform for live service PC, console, and mobile video games, designed for building holistic creator programs.

Through Nexus’s Support-a-Creator API, live service publishers can build world-class creator programs that drive significant growth in conversion, ARPPU, retention, and LTV. Nexus has partnered with leading live service publishers like Capcom, Grinding Gear Games, Hi-Rez Studios and Ninja Kiwi to build out their creator programs by managing creator onboarding, payments, analytics, attribution and so much more.

Partner with Nexus and benefit from their expertise while implementing your own Support-a-Creator program.