Hi everyone — welcome to another issue of Naavik Digest. If you missed our last one, be sure to check out our analysis of Unity’s generative AI ambitions and how the company’s early embrace of the technology could be an advantage. In this issue, we’re discussing why Hollywood’s current labor dispute is relevant to the nascent subscription gaming market and what the game industry should learn from film and TV.

We're also excited to announce that Naavik will be attending this year's Gamescom later this month. Naavik Co-founder Abhimanyu Kumar and Consulting Partner Jordan Phang will be in Cologne, Germany on August 23rd (Day 1) and available to discuss consulting relationships, content contributions, Naavik's new Open Gaming Research Initiative, and new team additions. They'll also be free if you just want to catch up and hear what Naavik has been up to lately. Submit a meeting request by clicking on the link below, and we look forward to seeing you at the business area!

Baldur’s Gate 3 Launch / Playtika Earnings / Dota 2 Arcade Shutdown

In this week’s Roundtable, the squad discusses the massively successful launch of Baldur’s Gate 3. Sebastian shares a story around monetizing Dota 2 Arcade mods under the nose of Valve’s lawyers in light of the recent Arcade shutdown. We also have an earnings discussion covering Playstudios and Playtika that leads to a deep exploration of the future of the social casino genre on mobile. Finally, we dig into the new web3 fighting game Wreck League from Animoca Brands subsidiary nWay, and discuss whether it has a chance in the market. Join us for all the latest games business news with Manyu Kumar, Maria Gillies, Sebastian Park, and host Devin Becker.

As always, you can find the Naavik Gaming Podcast on YouTube, Spotify, Apple Podcasts, Google Podcasts, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1 Why the Game Industry Should Avoid Hollywood's Subscription Crisis

By Carson Taylor, Naavik Contributor

Last month, film and TV actors joined screenwriters in a dual strike that has almost fully shut down the behemoth Hollywood content machine. At the core of these strikes is the changing economics of subscription-based streaming, which has emerged as the dominant business model for premium video entertainment.

While the nature of the strikes may be unique to Hollywood’s unionized labor, the concerns that writers, actors, and studios are arguing over are increasingly present in the game industry as well. Developers, publishers, and platforms all must pay close attention to what is happening in Hollywood — as the subscription model continues to establish itself within gaming, the industry will inevitably contend with the economics that have stopped Hollywood in its tracks.

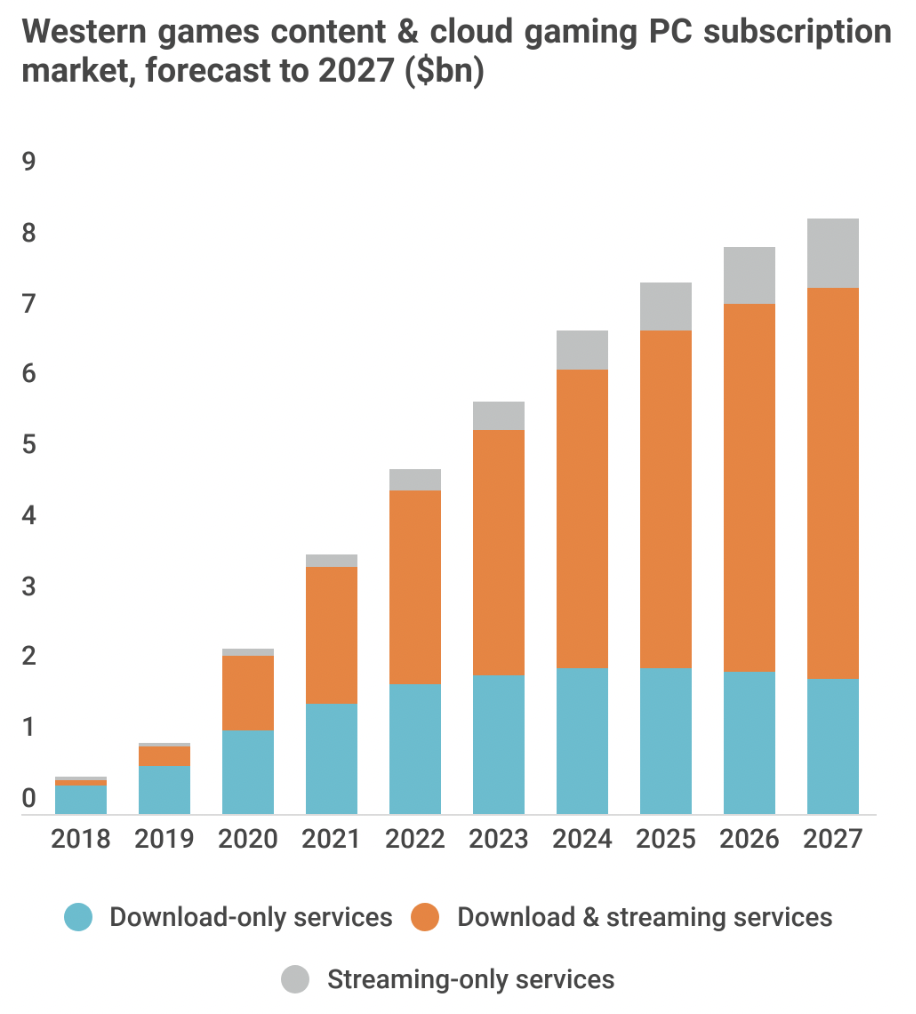

Gaming remains arguably the last big entertainment sector where subscription access to content streamed from the cloud has not become the dominant model. While there are many technical and business reasons for this distinction, content subscriptions have generally been growing in number, users, and revenue. Subscription is unlikely to ever displace free-to-play and premium models; it currently makes up only a small fraction of industry revenue. And while its growth has stalled recently, subscriptions remain an emerging and important part of the industry, which stands to especially benefit from continued investment by tech giants and progress in cloud gaming technologies.

Therefore, if subscription models have changed the economics of film and TV so drastically as to force an almost absolute shutdown of development and production of content, gaming must take notice. While the game industry largely has a different employment structure than Hollywood, preventing the chance of similar work stoppages, the overlap between these heavyweight entertainment sectors is blurring in all kinds of ways — labor included.

Despite Slowdown, Subscriptions Play an Important Role in Gaming’s Future

Subscription services have been common in gaming for decades to access online services and play MMOs, though only in the last five to six years have they evolved into the all-you-can-consume content platforms that are now ubiquitous in other forms of entertainment.

Microsoft launched Xbox Game Pass in 2017 as a download-based subscription model, and the company added cloud gaming to its Ultimate tier in 2020. PlayStation Plus began adding two free games per month back in 2010, when the service was more comparable with Xbox Live’s now-defunct Games with Gold program. But in 2022, Sony combined the service with PlayStation Now to offer Game Pass-style access to a large content library in addition to cloud gaming. On mobile, services like Apple Arcade, Google Play Games Pass, Netflix Games, and other smaller offerings have endured. But none with the exception of Game Pass has seen breakout growth.

Lately, subscription growth has slowed significantly: Research firm Circana reported games subscription growth was only 2% higher in April 2023 compared with the year prior. PlayStation Plus saw zero subscriber growth in the same period, and Game Pass growth has also slowed as its revenue has settled between 10% to 15% of Microsoft’s total gaming business. And only about 1% of Netflix subscribers have bothered to download any of the company’s available game titles.

Despite recent headwinds in both console- and mobile-based subscription growth, the sector could potentially grow much larger for a few key reasons. First, the market leader, Microsoft, is committed to putting blockbuster content on Game Pass to attract new users; September’s release of Starfield will be the biggest litmus test for this strategy to date. The pending Activision Blizzard acquisition is also part of this strategy.

Second, improvements in cloud gaming and its underlying infrastructure could eventually make the technology both economically and technically feasible, which would not only expand the addressable market beyond gaming-capable hardware, but also make the proposition more attractive to console, PC, and mobile gamers who are limited by storage space and computing power. Microsoft’s vision of a gaming service untethered to local hardware, where play can happen seamlessly on any screen, is dependent on such advancements.

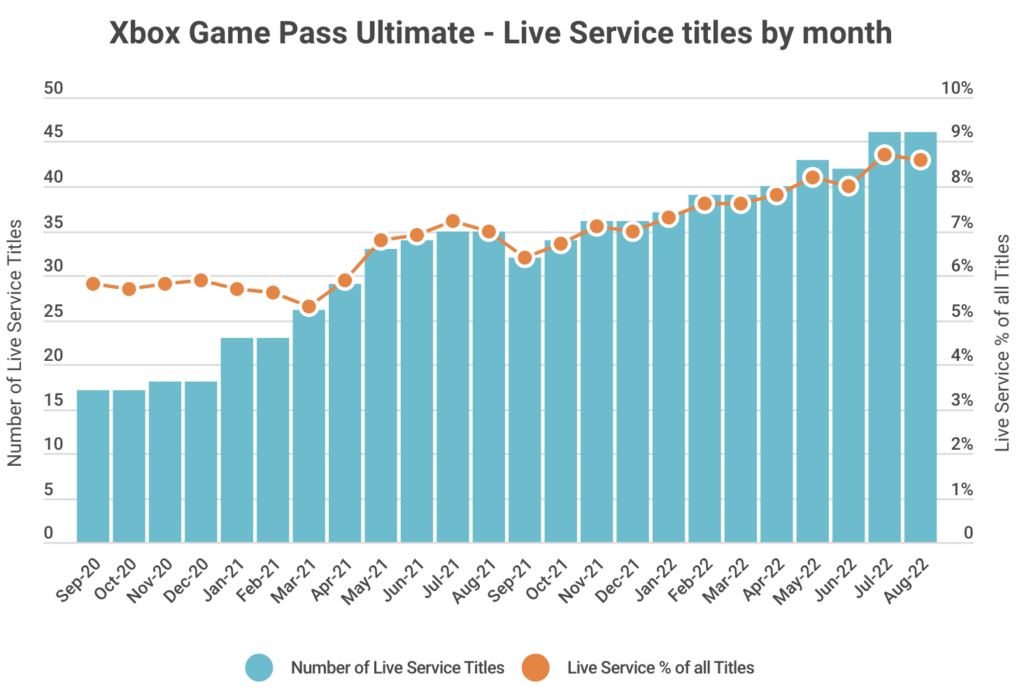

Such a future would likely have a content subscription service at its core, as streaming has been inexorably tied to subscriptions in music, television, and film — though it will very likely incorporate IAP-based free-to-play, advertising, and premium purchases as well. It’s also critical to note that gaming subscriptions take many forms — some top F2P titles feature in-game subscriptions, and even the now-ubiquitous battle pass monetization tool is considered by some to be a “light” subscription.

The Paradox of Success in Traditional Subscription Services

Content acquisition deals are typically structured with a dual focus on the "front end" and the "back end." The front end of the deal encompasses the upfront payment made to content creators or studios for the rights to stream their content on a platform. This initial sum serves as a baseline payment regardless of the content's performance. However, a significant part of the deal lies in the back end, where compensation is tied to the actual performance of the title on the platform. This performance-based component often includes royalties or additional payments that are contingent on viewership metrics, engagement, and other relevant performance indicators.

Video streaming platforms like Netflix tend to allocate a larger portion of their budget to upfront payments, while offering comparatively smaller backend incentives, usually in the form of bonuses if a show is renewed for multiple seasons, compared to traditional distribution channels. This is largely due to the revenue contribution to the platform being comparatively lower than what it would yield through traditional distribution avenues, especially in the case of a successful title.

Traditional methods encompass revenue streams from content purchase, syndication, international rights, substantial advertising income, and windowing (adding and removing content over time, rather than having it available indefinitely on the platform). These traditional revenue streams can be considerable for popular content.

However, in the typical subscription business, the only additional income from popular content stems from new subscribers it attracts, since existing subscribers pay nothing extra, and each new subscriber is only monetized through the fixed monthly fee. As famed director Steven Soderbergh described, “You can have a massive hit on your platform, but it’s not actually doing anything to increase your platform’s revenue.” While that hit piece of content might attract a larger audience on a subscription platform, the resulting revenue generation for the platform (and correspondingly, the back end compensation for the content creator) often tends to be lower compared to a scenario in which the content was released under a traditional model.

How Are Gaming Subscription Services Paying for Content?

Content deals for gaming subscriptions can be slightly different than those in video or music, but the same economics are unavoidable. Some services only offer upfront payments to studios and publishers. In March, Netflix’s Leanne Loombe told Axios, “As with film and TV our game deals are based on flat fees,” indicating a structure centered on upfront payments. A typical back end payout allows content suppliers to benefit when their title is a hit (albeit less so than if the content saw the same engagement using a traditional release) due to compensation based on usage. But deals that consist of only a fixed upfront payment mean developers don’t see any additional benefit even if their product becomes a hit.

This compromise can be a source of bittersweet irony for developers. Instead of trying to reach and convert customers within a crowded storefront, subscription services can bring a game to a much larger audience and increase the chances of a title becoming a hit. But if it does become popular, the financial upside is muted or nonexistent when compared to a storefront release of equivalent popularity. This makes the decision to release onto subscription platforms a risky gamble, both for big publishers and small indies.

| Subscription Service | Deal Structure | In-Game Monetization |

| Xbox Game Pass | Flexible; prefers upfront along with usage-based backend | Encourages IAP and live-services |

| PlayStation Plus | Upfront only | Supports IAP and live-services |

| Apple Arcade | Mixed, but skews upfront | Disallows IAP and ads |

| Netflix Games | Upfront only | Disallows IAP and ads |

| Google Play Pass | Usage-based backend only | Disallows IAP and ads |

There is a key difference between console-based services like Xbox Game Pass and PlayStation Plus, and their mobile counterparts like Netflix Games and Apple Arcade. While Xbox and PlayStation encourage IAP and live services (and split such revenue with developers in the typical 70-30 fashion), mobile subscription services loudly and proudly forbid both IAP and ad monetization in their games. Coupled with a tendency to avoid backend compensation in their content deals (with the exception of Google Play Pass), this means the only income developers often see are the upfront payments for the rights to the game and in some cases to pay for development costs.

Advantages of the Subscription Model

On the flip side, there are many benefits to subscription services for developers, and the industry at large. Subscriptions help to solve the discoverability problem by enabling smaller, more unique titles to reach larger audiences than if they were sold in a crowded storefront, which has the effect of stirring more creativity and risk-taking in content across the market. Titles like Obsidian’s gorgeous Pentiment wouldn’t exist without Game Pass, according to the game’s director.

Despite the challenges posed by upfront-only contracts and the prohibition on IAP and ad monetization, these types of deals do have certain upsides, especially for developers of smaller, single-player titles. For example, within models that instead rely on usage-based back end compensation, evergreen live service games from big publishers disproportionately benefit, since those titles drive more time spent on the service than a five-hour indie game. But upfront payments remove the incentive for developers to artificially extend a product’s playtime. Instead, these developers can still find success by creating a shorter, more focused experience.

Additionally, the “no ads or IAP” stipulations transfer monetization responsibility from the content to the subscription platform. That in turn frees developers to focus entirely on crafting an entertaining game without the pressure to monetize users themselves in the highly competitive mobile free-to-play market.

What Else Can Gaming Take From the Hollywood Strikes?

Though subscription economics are at the core of the dual strikes, there are additional factors behind Hollywood’s shutdown that have relevance to gaming. Film and TV creators are concerned about studios using artificial intelligence to replace some or all of their work and further reducing job security for the industry’s creative talent, a worry shared by many artists in gaming.

Despite sharing some of the same challenges posed by subscription models and AI’s role in creative work, there is a fundamental distinction between Hollywood and gaming that has caused the former to grind to a halt over these issues: unionized labor. By and large, film and TV creatives belong to trade unions representing writers, actors, and the like, while unions in gaming are uncommon in North America.

However, U.S. labor movements in gaming have grown over recent years, led largely by Activision Blizzard’s QA workers. Earlier this month, VFX workers at Marvel voted to unionize over working conditions — similarly skilled digital artists in gaming may be taking note. While there is little chance of a Hollywood-style, industry-wide strike occurring in gaming, developers will still be increasingly subject to the same concerns posed by subscriptions and AI over which their unionized counterparts are striking, but without the same recourse. This makes it especially prudent for game developers to approach the shifting economics of subscription models with extra care.

A Possible Future for Gaming Subscriptions

While subscription growth is not inevitable, as recent slowdowns have shown, it is still likely, especially when paired with advances in cloud gaming. It offers new challenges and benefits to developers, but the drastically different economics of subscription versus traditional content distribution (whether in gaming or television) are substantive enough to shut down production in some of the entertainment industry’s biggest sectors. As such, game developers, publishers, and platforms must pay attention to avoid or mitigate the situation in which Hollywood has found itself.

One of the best ways to foster a robust, dynamic, and equitable subscription environment, where the value created by this new model is maximized for both platforms and content creators, is to reconsider how content deals are structured. Subscription services should offer flexible terms that include both upfront and back end compensation, instead of relying solely on upfronts (which are unfair to developers who create hit titles) or usage-based back ends (which inevitably reward big live-service products over smaller games). Platforms need diversity of content to have a compelling consumer value proposition, and thus must sign different types of games that need different types of deals. Xbox has taken the lead in offering flexible deal terms to developers, while the relative rigidity of Netflix and others is less developer-friendly and ultimately limits the diversity of content on those platforms.

Subscription services should also be more open-minded about in-game monetization. Allowing IAPs and in-game advertising in some titles lets developers directly benefit from user engagement while simultaneously driving more platform revenue. This is also not a binary choice between offering quality entertainment to consumers and allowing additional in-game monetization. Again, Xbox leads the way here, while all the major mobile subscription services artificially limit incremental revenue both for themselves and their content partners.

Finally, Hollywood’s streaming services offer another lesson in creative monetization that gaming subscriptions should emulate for their own benefit as well as that of their developers. As competitive pressure has increased within video streaming, platforms have embraced monetization outside the traditionally fixed monthly fee. Advertising, ecommerce, windowing, syndication, and content purchases are proliferating as streaming platforms search for new revenue. Some of these strategies are already making their way to gaming subscriptions. As subscription services generate more sales beyond monthly fees, this additional income can then be shared amongst the platform and developers through flexible deals that are structured to maximize value for each content partner.

Expanding the revenue sources that subscription services can provide to platforms, and distributing those revenues more equitably to developers, could forestall some of the challenges bedeviling gaming’s Hollywood counterparts.

Sponsored by Nexus:

Explore implementing a game-changing Support-a-Creator program with Nexus, the leading platform for live service PC, console, and mobile video games, designed for building holistic creator programs.

Through Nexus’s Support-a-Creator API, live service publishers can build world-class creator programs that drive significant growth in conversion, ARPPU, retention, and LTV. Nexus has partnered with leading live service publishers like Capcom, Grinding Gear Games, Hi-Rez Studios and Ninja Kiwi to build out their creator programs by managing creator onboarding, payments, analytics, attribution and so much more.

Partner with Nexus and benefit from their expertise while implementing your own Support-a-Creator program.

#2 The Game Industry’s Rebound, Sony’s First-Party Delays & Netflix’s Game Controller

By Nick Statt, Managing Editor

2023’s return to growth. Market research firm NewZoo reported on Thursday that PC and console gaming are “booming once again” after the more corrective 2022 that saw the game industry experience a rare decline in global spending.

- NewZoo said the games market is on track to generate $187.7 billion in revenue this year, up nearly 3% year-over-year after the 5% drop in 2022 that was largely attributed to the first-ever decline in mobile game revenue.

- This year, mobile gaming is growing again, albeit very slowly at less than 1% compared to last year. NewZoo said “privacy-related monetization and user-acquisition challenges due to policies from Apple and Google” are still posing challengers for developers, but that mobile gaming will “continue to dominate the gaming landscape … [and] represents the most substantial portion of consumer numbers and spending.”

- This year, the growth is largely coming from console gaming, which is on track to grow 7.4% to more than $56 billion, alongside a 1.6% increase in digital PC game sales.

- “We now have an unprecedented PC and console games release calendar in 2023. Many pundits and journalists have tentatively dubbed 2023 as one of gaming’s best years ever,” NewZoo wrote. “Several of the biggest titles initially slated for 2022, 2021... all launched this year.”

- NewZoo said more growth is on the horizon, with the game industry slated to generate annual revenues of $212.4 billion in 2026.

Sony’s financial speed bumps. Sony reported Q1 FY2023 earnings last week that showed a rise in both software and hardware sales, but it wasn’t all good news. In particular, the company hinted at delays for several first-party titles. Additionally, the company’s 25 million-unit PS5 target may have been too ambitious.

- In its fiscal year forecast for FY2023, Sony listed a potential negative impact factor in the form of “changes in the launch dates of a portion of first-party titles.”

- There’s very little information about what Sony has planned for the future beyond this October’s release of Spider-Man 2 from Insomniac Games. We know Insomniac is also working on a Wolverine title, but there’s virtually no information on what other first-party studios like Santa Monica Studio, Guerilla Games, and Sucker Punch are currently working on.

- It’s also been a particularly quiet year for PlayStation Studios, with roughly 10 months between the launch of God of War: Ragnarök and Spider-Man 2, and no major first-party AAA release in the interim. Instead, Sony has released a handful of VR titles like Horizon Call Of The Mountain VR and third-party releases like June’s Final Fantasy XVI and next month’s Baldur’s Gate 3. Heading into next year, we should learn more about Sony’s live service lineup, including when it might start to arrive.

- The PlayStation division is still growing considerably, up 27% last quarter compared to last year, thanks to a 28% rise in software sales and an impressive 42% jump in hardware sales.

- But even this might not be enough, as Sony did admit that the 3.3 million PS5 units shipped last quarter put the company slightly under expectations, but Sony President Hiroki Totoki also said the company believes “there is ample possibility for us to catch up” and hit its 25 million-unit milestone for FY2023.

Netflix embraces the big screen. The streaming platform launched a new iOS app last week simply called “Netflix Game Controller” that ostensibly turns your iPhone into a way to control Netflix games on your television. But details are scarce.

- Netflix did not disclose which games would be playable on TV screens and instead labeled the app with the message “Coming soon to Netflix.” But a listing for the iPad version of the game appears to show a controller overlay similar to how some classic game ports for mobile are played using a touchscreen.

- We’ve known since March of this year that Netflix has been working on software that would turn a smartphone into a game controller rather than the more cumbersome process of developing a dedicated piece of hardware it would have to manufacture and distribute.

- There are a number of interesting implications for Netflix’s gaming ambitions once it begins supporting screens beyond the smartphone. Netflix gaming chief Mike Verdu said last fall the company is “seriously exploring” developing a cloud gaming service that would let it stream games to smart TVs, a scenario in which some type of controller would be necessary to play.

- The company also hired Halo veteran Joseph Staten in April to work on a major AAA game based on a brand-new IP, which Staten explicitly called a “multiplatform” project in his hiring announcement. Whether that game would be playable through Netflix on a smart TV, perhaps streamed from the cloud, seems unlikely, but the game appears to have only just started development.

- Whatever Netflix’s timeline is for expanding its growing library beyond mobile, it’s clear the company is getting even more serious about gaming. Last month, the company launched Oxenfree II: Lost Signals, arguably its most polished first-party game to date. It sure would be nice to play it on a TV, so let’s hope Netflix gets its smartphone controller operational sooner rather than later.

Featured Jobs

- Immutable: Business Development Manager (Remote)

- LILA Games: Backend Developer (Bangalore, India)

- Nexus: Head of Sales (Remote)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below. We've made the job board free for a limited period, so as to help the industry during this period of layoffs. Every job post garners ~50K impressions over the 45-day time period.