Welcome to Master the Meta, the #1 newsletter about the business of video games.

Hi everyone,

This week’s four main topics unintentionally share a common theme: reflecting on 2020. This newsletter issue isn’t a complete 2020 review by any means, but the topics included are a reminder that despite 2020’s clear challenges the video game industry rose to the occasion. Whether it’s celebrating the industry’s achievements, recapping what the biggest companies are up to, or continuing to cover ongoing consolidation, it’s exciting to look back, learn from and celebrate the past, and think about where things go from here.

#1: Recapping The Game Awards

The Game Awards is always a fun way to celebrate the industry and build hype around what’s coming next. The team behind the show also does a great job building a quality production. Let’s dig into some winners + announcements, and then I’ll share a couple broader observations.

First of all, this was the year of The Last of Us Part II. Not only did the praised game win Game of the Year, but also it won 6 of the remaining 30 awards including Game Direction, Narrative, Innovation in Accessibility, and more. Games like Ghost of Tsushima, Among Us, Final Fantasy VII Remake, and Hades also had standout performances. Plus, many individuals — like Valkyrae (Content Creator of the Year), Showmaker (Esports Athlete of the Year), Laura Bailey (Best Performance), and Sjokz (Esports Host of the Year) — were recognized for their great work.

The show also included a few interesting gaming announcements like Dragon Age 4, Ark 2, a new Among Us map, Sephiroth coming to Super Smash Bros, Perfect Dark, Master Chief coming to Fortnite, and much more.

Additionally, it’s interesting to reflect on what The Game Awards tells us about the state of the video game industry. One takeaway is that the attention gap between gaming culture and pop culture continues to close. Actors, actresses, and sports personalities (like Brie Larson, Tom Holland, Gal Gadot, and Stephen A Smith) were tapped to present awards, and, if anything, this trend is only going to grow. Second, the show is very PC/console heavy. While there is one mobile award (remember, out of 31 total awards), which Among Us won, the show doesn’t perfectly reflect the fact mobile is the largest and fastest growing segment of the industry. I understand why attention is mostly on the “traditional” segments of gaming, but I expect mobile to make a larger showing in the future (or maybe even spin up its own type of awards). Lastly, the show — probably much like the Oscars or Grammys — is very western-focused. Yes, there was some international exposure but perhaps not as much as there could be. As gaming goes global and Eastern companies, especially from China, steal global market share, it will be interesting to see how the show adapts.

All in all, the team put on a great awards show, and it’s amazing to think about how much progress the industry has made. It will also be fascinating to watch how the industry evolves from here and how it becomes portrayed in the way we celebrate it.

#2: Reflecting on Tencent’s 2020

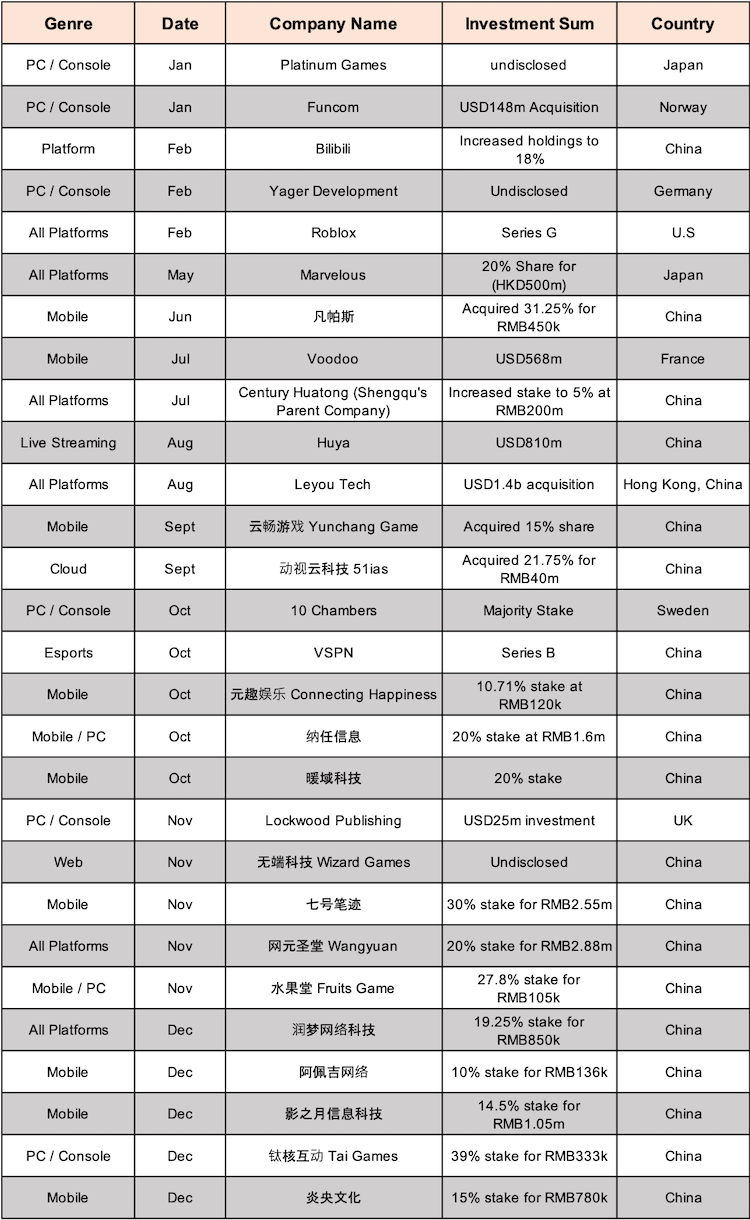

Tencent turned 2020 into a record investment year with 29 gaming-related deals (so far!). 20 of these deals are China-based companies and 9 are international studios. Contrary to public perception, this amount of activity is actually new for Tencent. Since 2005, Tencent has on average invested in less than 10 gaming-related companies annually. Before we get into the analysis regarding such a strategy shift, here’s the investment breakdown for the year:

Tencent’s international PC/Console strategy is fairly straightforward — take an existing PC IP with global appeal, broaden the company’s insights, and often turn it into a mobile game for broad distribution. This is a proven route for Tencent following the playbook of PUBG, League of Legends, and Counter Strike. We could likely see DayZ Mobile, The Cycle Mobile, and more in the coming years.

Interestingly, Tencent’s accelerating investment activity primarily revolves around increasing the number of early stage deals. In the past, most of Tencent’s deals were executed very methodically and focused on industry leaders (like Supercell, Riot Games, and Epic Games). However, 2020’s deals are more focused on early stage companies, plus niche genres, and were seemingly executed with greater speed. What changed?

One explanation floating around Chinese media points to Genshin Impact. Genshin Impact by Mihoyo not only burst onto the scene and immediately became a global top grossing game, but Mihoyo also completely circumvented Tencent’s ecosystem in China. 90% of ad spend went to Bilibili and Bytedance’s platforms, and players can’t even download the game on Tencent’s Myapp store. The meteoric rise of smaller, non-Tencent backed studios focusing on niche genres such as Mihoyo (Genshin Impact), Hypergryph (Arknights), and Papergames (Mr Love: Queen’s Choice) reveals that Tencent underestimated part of how the industry would evolve. Papergames (established less than 7 years) and Hypergryph (established less than 2 years) already command a net profit of RMB 1 billion each, with valuations of tens of billions RMB. Mihoyo’s valuation is now estimated to be more than RMB30 billion ($4.6 billion).

Of course, Tencent is doing just fine, and its gaming business still made meaningful progress this year despite being slower to certain trends. It can’t control everything. That said, Tencent now recognizes a new paradigm shift where player growth could come from anywhere, and the company is quickly adapting to ensure future growth from new sources decreasingly passes them by. (written by Owen Soh)

#3: YouTube Gaming’s Remarkable Year

YouTube Gaming shared some mind-boggling numbers this week about the platform’s 2020 progress. Over the past year, viewers watched over 100 billion hours of gaming content across 40+ million active gaming channels. Put into perspective, watch time doubled in only two years, and growth is happening across the globe.

The top viewed games of 2020 were:

-

Minecraft: 201B views

-

Roblox: 75B views

-

Garena Free Fire: 72B views

-

Grand Theft Auto V: 70B views

-

Fortnite: 67B views

Although perhaps none of this is surprising — each of these games is remarkable in its own way — Minecraft’s utter dominance stands out, especially since the game is now over a decade old.

There are also some impressive stats regarding creator milestones:

-

80,000+ creators hit 100,000 subscribers

-

1,000+ creators hit 5 million subscribers

-

350+ creators hit 10 million subscribers

Many (perhaps most) of these creators have been grinding on YouTube for years, but several are relatively new and have found breakout success.

Lastly, let me mention that 10 billion hours watched — roughly 10% of the total — were of live videos. This is an area that YouTube has been heavily investing in, and even though Twitch is still leading in terms of hours watched (I count 13+ billion hours watched Q1-Q3) and hours streamed (91% market share in Twitch’s core markets), YouTube is making substantial progress. The platform is set up to capture additional market share, and I think the “why” can be boiled down to three key reasons.

One, YouTube is far more global than Twitch will ever be (only one of YouTube’s top 10 live streamers from 2020 presents in English); this also helps them lead in mobile gaming. Two, because of YouTube’s mega-distribution (2+ billion users), it’s easier for them to become more of a one-stop video shop for both creators and viewers. And three, YouTube’s technical execution far exceeds Twitch’s; for example, Twitch recently told most streamers to delete their entire Twitch VOD libraries because of music copyright issues (uff!).

YouTube’s progress, especially in gaming, continues to be outstanding. We probably won’t see hours watched double again over the next two years, but YouTube is set up very well to continue improving, steal market share, and become the place for all things video across the globe.

#4: Consolidation Continues as MTG Snatches Hutch

Stockholm-based Modern Times Group (MTG) announced last Tuesday that they are acquiring Hutch Games for $275 million up front and an additional $100 million in possible earnouts. Hutch joins the previous acquisitions of InnoGames and Kongregate in the MTG family. Hutch's key titles include F1 Manager, Top Drives, and Rebel Racing.

According to MTG's press release, Hutch generated $56.3 million in revenues with a $13.3 million EBIT during the first nine months of 2020. This gives us a pretty solid foundation to estimate the basis of the valuation:

-

Assuming roughly 25% quarter-to-quarter growth for 2020 Q4 puts Hutch at about $82 million projected revenues in 2020.

-

Alternatively, estimating Hutch’s Q3 revenue at $22 million puts the forward-looking 12-month run rate at about $88 million.

-

These two approaches place the $275 million upfront price tag between a 3.1x and 3.5x in revenues, setting Hutch’s valuation towards the higher end in comparison with recent similar acquisitions.

Why use a revenue multiple instead of EBIT/EBITDA? I assert that for any growth-stage free-to-play company, revenue is the more important basis for valuation. This is due to the fact that as long as a company can profitably invest in user acquisition, growing revenue at breakeven or even below zero EBIT reaps the best benefits.

Two of Hutch’s key games were released last year, F1 Manager in May 2019 and Rebel Racing in November 2019. Most of the company’s recent revenue growth was realized between Q3 2019 and Q2 2020, and a significant portion originated from these new titles. Assuming that these games still have some potential to grow, Hutch’s relatively high profitability signals either a conservative risk position, a lack of cash to invest, or a lack of expertise in modern performance marketing. It's likely that MTG will look to boost Hutch's growth by helping them in one or more of these three areas. If the plan succeeds, it will for sure be a sweet deal for both Hutch and MTG.

Of course, MTG isn't the only Nasdaq Stockholm listed company active in M&A. In fact, Swedish corporate groups have been fighting it out on who completes the most acquisitions. We wrote about Stillfront extensively in the wake of their September Nanobit acquisition. In addition, Enad Global 7 reformed into a bigger entity as they effectively merged with Daybreak just two weeks ago; and it goes without saying that Embracer Group has been on a shopping spree all year, which we also analysed here.

That isn't to say that the rest of the world isn't following suit. 2020 is proving to be a year of record M&A activity in the industry, and all the heavy hitters are playing the same game. Just to name a few, AppLovin (MachineZone), Take-Two (PlayDots), Zynga (Peak) and Ubisoft (Kolibri) all successfully completed $100+ million acquisitions within the last 12 months. It will be fascinating to see whether 2021 turns into another super active year for further industry consolidation. (written by Miikka Ahonen)

🎮 In Other News…

-

Cyberpunk 2077 had over 8 million preorders and over 1 million concurrent players at launch (a record for single-player games). Link

-

World of Warcraft Shadowlands sold 3.7+ million units on day one and became the fastest selling PC title of all time (until Cyberpunk 2077 broke it two days later), and year-to-date the game had more people playing than anytime in the last decade. Link

-

Roblox delays its IPO to 2021. Giant day 1 pops like we’re seeing recently mean companies are leaving significant money on the table, which Roblox likely wants to avoid. Link

-

Nintendo beats PlayStation and Xbox as it shifts 1.3 million Switch's in China this year. Link

-

Gigantic, the company behind Clawee, raised another $7 million to expand online transformation of real world arcade games. Interesting. Link

-

Aglet raised another $4.5 million to build out its gamified virtual sneaker app. Link

-

Rollic (a Zynga subsidiary) acquired matching game Onnect for $6 million. Link

-

Apple takes aim at adtech hysteria over iOS app tracking change. Link

-

Facebook Gaming is launching the Black Gaming Creator Program. Link

-

Manticore’s new monetization system will give creators 50% of the revenue their content generates. Link

-

According to a study, 63% of gamers would spend more money in games if the items had real world value (something blockchain/crypto-oriented startups are focusing on). Link

-

Angry Birds Legends is plucked from development. Link

🖥 Content Worth Consuming

Meet Me in the Metaverse. “There are many competing visions for how we’ll build the Metaverse: a persistent, infinitely-scaling virtual space with its own economy and identity system. Facebook Horizon is an ambitious bet that it will be realized in VR. Epic Games is doubling down on a game-centric approach with Fortnite. But the most exciting part about the Metaverse is not its scope or infrastructure, but its potential to reinvent the way we interact with our friends and loved ones.“ Link

Joining Mobile's Most Exclusive Members Club. “About a year after the term 'HybridCasual' was first coined, an ever-increasing number of professionals in the mobile games industry are acknowledging its existence. Even so much that it might seem to start sounding a wee bit empty, hollow. A buzzword at best. On one side this is logical since it's a rather elusive term with a specific history behind it, as has been aptly deliberated by Will Freeman last July. On the other side it's not entirely helpful, as the term will only become increasingly fluffy and meaningless this way. Since we are currently exploring this direction at Voodoo as well, and as a fervent rectifier of things ranging from grammar to whether Mountain Goats are actually goats (no they aren't and yes, I'm fun at parties) I'll try to shed some light on games that seem to fit the definition very well and why this is the case.” Link

Apple Arcade, one year on: no killer games, can’t compete with free. “Now in September 2020, one year after launch, what do we really know about Arcade’s performance? To date, Apple has never released any subscriber numbers for Arcade, which is concerning. Additionally, it was a footnote at launch that the service would not be made available in many key Asian countries, including China, one of the biggest, if not the biggest depending on who you ask, mobile gaming markets. The main driver for this survey was to better understand where Arcade stands in the market, and among gamers, one year in, as I have yet to see such in-depth analysis to date, so I decided to take it upon myself to conduct one.“ Link

How Nadeshot built a 100 MILLION DOLLAR Esports Brand. “In the 10th episode of Creator Economics, Reed, Blake, and Nadeshot discuss everything 100T. From it's humble origins, to how it transitioned to it's current form.“ Link

After Grand Theft Auto and Minecraft, Balenciaga: The Video Game? “The fashion house has created a game to showcase its latest collection, and everyone can play.“ Link

Thanks for reading, and see you next week! As always, if you have feedback let us know here.