Welcome to Master the Meta, the #1 newsletter analyzing the business strategy of the gaming industry.

Hi everyone,

We’re thrilled to announce that Sensor Tower is now Master the Meta’s official mobile data partner! As many of you know, analyzing mobile games and the broader app economy is difficult when limited to publicly available data. Tracking mobile downloads, monetization, and rankings is impossible without the right tools. With Sensor Tower’s data platform, we’ll be able to take our analysis up another level — better understanding individual companies, games, and ongoing industry trends. You’ll start to see us use Sensor Tower’s data across our Weekly Metas and deep dives much more frequently in the future (even today!). It’s a powerful platform, and we’re excited to put it to work.

🎤 In the Media

As shared previously, we recently dissected Unity’s business ahead of the company’s IPO, which occurred on Friday! In a sign of the times, the company raised its IPO pricing from $34-$42 to $52, all to start trading at $75 (and now sitting at $68.35). For those doing the math, that makes Unity a roughly $18 billion business, trading at ~28x sales. This newsletter doesn’t provide investing guidance, but it’s safe to say that Unity will need to execute extremely effectively if it hopes to live up to these high expectations. Again, this says just as much about the current state of market psychology as it does about Unity.

If you want to learn even more about Unity, I (Aaron, here) talked about the company on a couple podcasts that published this week:

-

I joined the Deconstructor of Fun podcast with Jason Chapman (Konvoy Ventures) and Matthew Kanterman (Bloomberg Intelligence), hosted by Joseph Kim. Listen to it here.

-

Brandon Beylo also hosted me on the Value Hive podcast, in which we dive into Unity but also hit on my background and investing approach a bit more. Listen to it here.

🔍 Mini Deep Dive: Why Stillfront Acquired Nanobit

On September 17th, Stillfront Group announced its acquisition of Nanobit, thereby making the company now 15 studios strong! More notably, this is Stillfront’s 3rd acquisition already in 2020 — Storm8 (January 2020) and Candywriter (April 2020) — resulting in a very impressive rate of one acquisition per quarter. In this mini-deep dive, we take a look at possible reasons why this acquisitions makes so much sense for Stillfront.

📰 News

Sony’s PlayStation 5 showcase. The wait for the PS5’s pricing and release date details is finally over. The PS5 will launch on November 12th, and preorders (more on this in a bit) have technically begun. The PS5 will sell for $499.99 and the Digital Edition will sell for $399.99. This pricing is sound; $499.99 is the same price as the Xbox Series X, and charging $100 less for the Digital Edition, where the only difference is the lack of a disc drive, is savvy. A disc drive costs far less than $100 per unit, so PlayStation is losing margin on the upfront console transaction, but consumers who opt for the Digital choice are, by default, also opting to purchase their games digitally. This will drive more software sales through the PlayStation Store, and it’s ultimately higher margin for the business.

As I mentioned, preorders have technically started, but it was a fiasco. PlayStation said the preorders would begin with select retailers the following day, but many retailers began a day early. Either way, not giving players a heads up is suboptimal, but the disorganization definitely left most gamers — especially those who couldn’t order one before stock ran out — feeling let down. PlayStation admitted its mistake and aims to sort things out. Fortunately, this mess shouldn’t stifle any long-term results; if anything, it’s a sign that demand is extremely high. All that said, gamers may have to be patient and not expect to receive their consoles exactly on launch day.

Beyond the console details, PlayStation shared a bunch of new game announcements/trailers/gameplay during the showcase:

Games include: Final Fantasy XVI, Spider-Man Miles Morales, Hogwarts Legacy, Call of Duty Black Ops Cold War, Demon’s Souls, God of War: Ragnarok, and much more. A few of these are highly anticipated exclusives, which is a reminder that the primary reason the PS5 will outsell the Series X/S is because of its stacked list of exclusives.

The company also announced that PlayStation Plus (the monthly subscription that delivers online gameplay and occasional free games / discounts) will include free access to many classics from the PS4 era, which should add a bit more motivation for people to sign up. Sony is leaning far less into a services model than Xbox is, which is totally fine for now, but it’s something to begin thinking about the long-term implications of. All in all, the PlayStation 5 is set up to sell very well out of the gate.

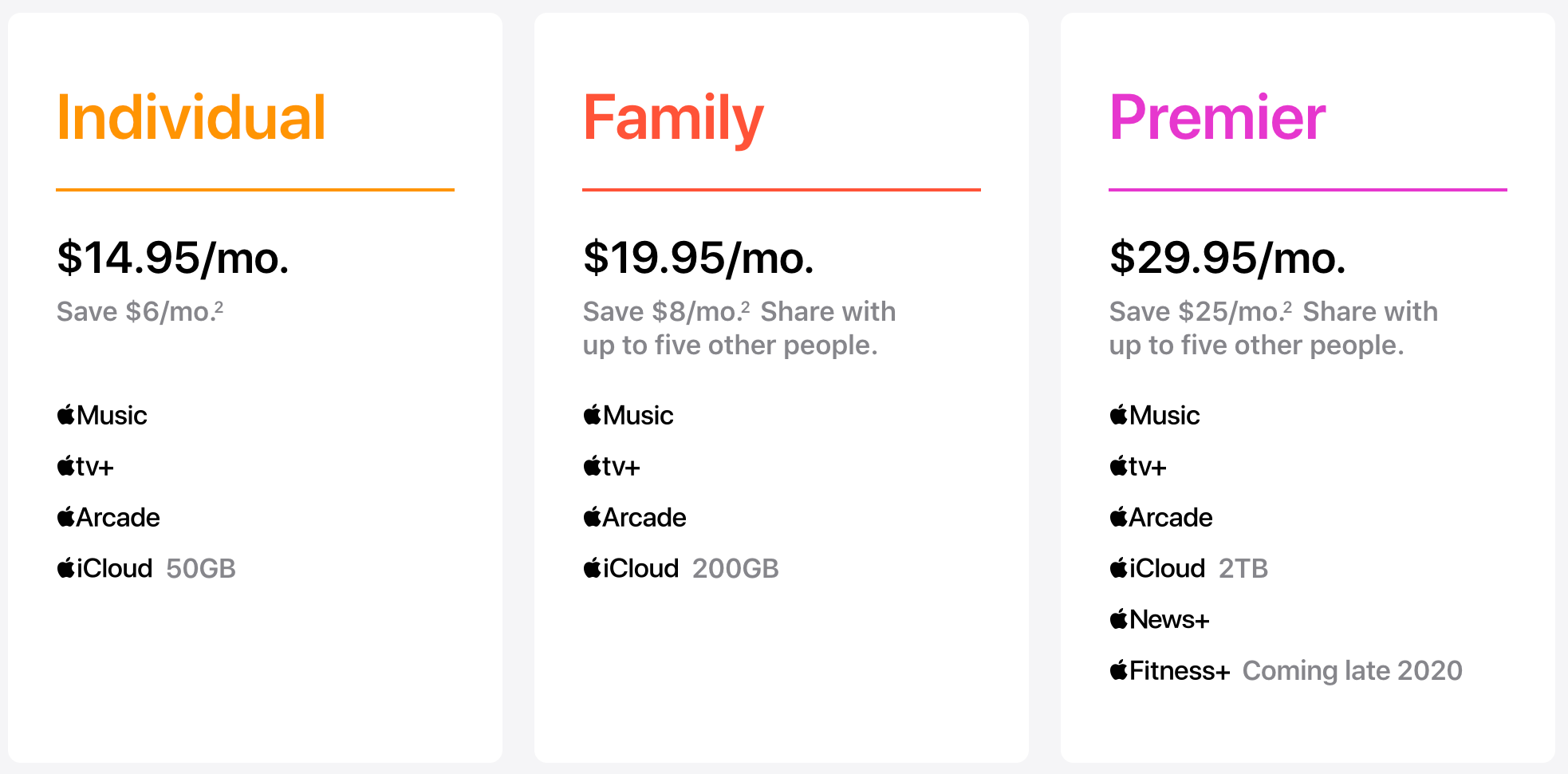

What Apple One mean for Apple Arcade? Apple One, the company’s new all-in-one subscription service, is making waves this week. Here are the three tiers:

Many people are optimistic because 1) it’s Apple, and 2) the bundle is mathematically a good deal. While I think Apple One will do fine — and it’s definitely smart to offer bundles — I suspect it won’t perform as well as many think. For one reason, it appears to center around Apple Music, which, sure, has 70+ million subscribers, but the music streaming market is still semi-fragmented and the service has half the market share of Spotify (~300 million MAUs, ~140 million subscribers). In other words, Apple’s linchpin service is one that only a minority of people use — and it’s probably wrong to assume a high % of people will switch because of the bundle. Further, if most people don’t want to switch from Spotify (or wherever) to Apple Music, then the value of the bundle becomes highly diminished. Second, both Apple TV+ and Apple Arcade remain relatively niche. Apple TV+’s content isn’t top of mind compared to the Netflix’s and HBOs of the world, and Apple Arcade faces both business model hurdles (most mobile gamers need to be persuaded into subscriptions vs free-to-play) and it lacks tentpole franchises/IP that naturally pull people in.

I expect this bundle will lead to a modest increase of Apple Arcade users (or at least people who try it out). However, nothing about this bundle improves on what the biggest issues with Apple Arcade are: games that stand out, pull gamers in, and retain them. Arcade needs more games with notable IPs that boast decent retention. It’s fine that Apple is working with tons of indie studios — there are certainly hidden gems among the mix — but that can’t be the only thing Apple chases if it seeks higher highs with Arcade. Winning over larger companies is tricky, because the business model (upfront investment + ongoing payments based on user engagement) provides Apple with the most upside (after all, they dictate the terms).

From a bigger picture perspective, the bundle isn’t all that bad. It will be good for millions of people (mostly Apple Music users) who seek to go deeper into Apple’s ecosystem, and Apple Fitness+, in particular, is a notable addition at the higher price point. But from a gaming perspective, it’s hard to see how this levels up Apple’s gaming efforts.

Facebook unveils the Oculus Quest 2. It’s difficult to get a perfect read on VR headset sales, but it’s pretty clear that VR sales have accelerated over the past year. The original Oculus Quest is a big part of that story, and we learned earlier this year that Oculus surpassed $100 million in cumulative Quest content sales. It’s a notable milestone, but still niche… and that will stay the case until a few things improve, in my opinion: 1) superior hardware (less grainy, superior motion tracking, etc.), 2) more content (Beat Saber can’t be the killer app forever), and 3) better ecosystem interoperability.

We’re far away from all three of those issues being fully solved for, but the Oculus Quest 2 pushes forward on the first front. I enjoyed this review from The Verge and won’t regurgitate everything, but here are a few tidbits that stand out to me:

-

The starting price dropped to $299 (from $399), which should unlock some demand. There are plenty of upgrades — storage, better head strap, etc. — that can boost the price, however.

-

The resolution of 1832 x 1920 pixels per eye is a step up, and the refresh rate should increase 25% to 90Hz. In other words, the experience is moderately more polished.

-

The controller interface is the same and mostly functional, although accurate hand tracking remains an area of ongoing improvement.

-

Oculus aims to host 200 titles at launch. That’s an improvement but still a sign that the ecosystem remains small. Some of the notable titles are exclusive, but Facebook is also setting Oculus up — with Link, a cord that connects the headset to PCs — to interoperate with other storefronts. For example, with Link Quest 2 users can download and play Half Life: Alyx via the SteamVR storefront. Wrangling with cords isn’t ideal, but it’s good that the option there.

-

Many people don’t like the fact that Oculus requires using a Facebook account. I tend to agree, but it’s not as huge of a deal as this fringe of the internet makes it out to be. After all, there are over 2.7 billion Facebook users.

In summary, the Oculus Quest 2 isn’t transformational, but it’s a clear improvement and likely a great choice for those thinking about buying a headset. The chicken-and-egg / hardware-and-software problem still persists, but as Half Life: Alyx indicates, we’re inching closer to having more mainstream hits. It’s unfortunate that the VR ecosystems are still mostly siloed, but Facebook is doing as good of a job as any making its ecosystem a worthwhile choice. We’re far away from the VR finish line, but I suspect that the Quest 2 will sell pretty well — relative to other headsets, at least — and it’s setting a better foundation for new hits to arise on. It’ll be fun to watch unfold.

-

Note: Ubisoft just announced Splinter Cell and Assassin’s Creed games for Oculus VR. Link

Bunch raised a $20 million Series A to improve its platform. The company’s app allows gamers to play their favorite mobile games together over video chat. It’s rare that we hone in on businesses at such early stages, but this deal stands out to us, so here are some quick takeaways:

-

Embedding video chat into mobile gaming is a simple yet brilliant idea. With friends, it can make the right games even more social and fun. And as we’ve seen in the past, finding ways to create new social/casual gamers not only helps certain games succeed but grows the entire industry.

-

Bunch is catching on like wildfire. Apparently MAUs have increased over 50x since March (although I’m unsure to what). There aren’t many better signals of success than that.

-

Not only is there buy-in from gamers, but there’s also rapid buy-in from studios/publishers. And not only is that buy-in related to embedding the technology, but companies like EA, Take-Two, Ubisoft, Supercell, Riot, Miniclip, and more are investing in Bunch this round. In other words, this is now a company that much of the industry at large wants to see win. And because of the industry-wide buy-in, it’s now harder for others to compete.

-

CEO Selcuk Atli is a proven serial entrepreneur, and it looks like he’s surrounded himself with a talented team.

It might be a while before we get more depth into the business, but it’s worth keeping Bunch on our collective radar. Link

Quick Hits:

-

Razer Fintech & Franklin Templeton are creating a digital wealth management platform for young adults. I’m enamored by how Razer is leveraging its gaming audience to build something much bigger (sort of like Sea Limited). Link

-

Here’s a good Twitter thread about August’s NPD data. “Consumer spending across video game hardware, content and accessories totaled $3.3B in Aug 2020, a 37% increase when compared to a year ago. Digital content on console, mobile and subscription were among largest growth segments.”

-

Gameloft acquired episode mobile storytelling games maker The Other Guys. Link

-

Embracer acquired Vertigo Games (VR) for €50m. Link

-

Multiscription announces Unleashd subscription service for free-to-play games. Worth keeping an eye on. Link

-

Bayes raises $6 million for global esports data platform. Link

-

Kakao Games IPOs in Korea. Link

-

The PUBG/India saga continues: “PUBG Corporation to Take Over PUBG Mobile From Tencent Games in India.” Link

-

Metacore raises $17.6 million from Supercell and launches Merge Mansion mobile game. Link

🖥 Content Worth Consuming

Interview with Take-Two Interactive CEO Strauss Zelnick (Protocol). “In a wide-ranging interview last week, Zelnick said that video games are now ‘the standard bearer of the entertainment business,’ expressed considerable skepticism about the prospects for cloud gaming, urged caution on Microsoft's new subscription and installment pricing plans, and explained why Red Dead Redemption is like an '80s boy band.” Link

China Gamers Report (Niko Partners). “The China Gamers Report provides a detailed analysis of gamer behavior and spending by geography, gender, and platform. It identifies the total addressable market for China by measuring gamer demographics (including gender, age, occupation, platform use, and more), gaming behavior (including where and when they discover and play games, engagement with popular game titles, spending and more), gamer motivations, gaming preferences, gaming platforms and devices, with comparative analysis by city tier, gender, platform, and gaming motivations.“ Link

Talk to Thorin: Andy Miller on Making NRG a Powerhouse and Why They Left Counter-Strike. “Andy Miller, founder and CEO of NRG, talks to Thorin about selecting franchised leagues, departing from Counter-Strike and building a dynasty in OWL.” Link

Will Facebook Horizon be the first step toward the metaverse? (Venture Beat Interview) “The excitement around a metaverse is growing, as it’s not just an idea from science fiction anymore. Facebook Horizon, a user-generated virtual reality world that is still in closed beta testing, might be one of the first steps toward creating one… Facebook Horizon is a place where maybe four to eight people in a group can gather for fun.” Link

Thanks for reading. See you next week!