Hi Everyone. We’re thrilled to announce our latest content collaboration partnership with Neil Long at mobilegamer.biz. Not too long ago, he started this publication to cover mobile games and F2P, and he’s been on a tear ever since. If you haven’t yet read mobilegamer’s content, check out this piece on Bacon & TikTok.

This Week on The Metacast

Is SKAN 4.0 the Solution to Scale iOS UA? — In this Metacast episode, David Amor and Matej Lancaric join Maria Gillies to discuss the latest strategies to scale user acquisition on iOS. The group also discusses marketing channel diversification and how big + small teams can approach marketing to drive the largest impact.

You can find us on YouTube, Spotify, Apple Podcasts, Google Podcasts, YouTube, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: Meta’s Latest VR Headset, Keynote, and Acquisitions

Anyone paying close attention to VR knows that there’s something interesting there — apps like TRIPP, Supernatural, and Zenith are all doing cool stuff — while admitting that a mass market breakthrough is still some time away. As of now, it’s obvious that Meta with its Meta Quest 2 (RIP Oculus) is leading the VR market, and its unit sales (15M+) are roughly on par with the Xbox Series consoles. Of course, this parity won’t last as console sales accelerate going into the holidays, and average time spent per user is certainly far higher on consoles. But it’s a market worth watching and therefore worth keeping an eye on Meta, which held its Meta Connect Keynote this week and announced the acquisition of three more VR gaming studios.

Let’s start with the keynote, which was unfortunately disappointing. There were a couple interesting pieces, but it was generally awkward and the example demos were disenchanting. For example, Horizon Worlds, which we know has lackluster engagement, looks like a worse Roblox, and the discussion about avatars was super cringe (especially the part about legs!). Again, that’s not to say there’s nothing interesting here, but it’s clearly early and not quite clicking.

Source: NBC News

The main highlight of the event was the announcement of the $1,500 Quest Pro, which starts shipping in a couple weeks. To be fair, it has cool features such as improved controllers, eye tracking, facial expression tracking (to make avatars more realistic), superior screen contrast, and high-resolution outward facing cameras (enabling early mixed reality). However, the device is destined to flop, at least in its earliest iterations. It still has notable limitations — low battery life, heavy headset, high price, etc. — that won’t be compelling to consumers. That doesn’t mean the device is pointless, though. It still enables Meta to push bleeding-edge tech in front of a larger audience, learn from how people use it, and eventually bring more of that functionality to lower price points.

Importantly, the Quest Pro also represents a notable expansion in strategy. It was clear since the launch of Horizon Workrooms, in which teams can conduct meetings with a greater sense of presence than video, that Meta is making a large bet on VR in the workplace. This premium enterprise-leaning device doubly confirms it, as does Meta’s newly announced partnership with Microsoft. In short, Microsoft is bringing Teams (along with some other enterprise tools) to Quest devices. This is an obvious win for Microsoft in the sense that it gets pure upside with negligible risk. Microsoft benefits from Meta putting all the hard work and billions in capital into making VR viable, and it will likely put its software on any VR device that has reach (the same playbook it successfully used with PC). This partnership provides some benefits for Meta — more workplaces may view Quest as a potential work tool and perhaps budget for it, at least to experiment — but it’s doubtful that many teams will pay up $1,500 per device at this point, and it raises the question of how much of the VR value chain Meta will be able to capture. Proponents of an “open metaverse” will like seeing Meta control fewer parts of the value chain (including enterprise software), but Meta’s investors may not love seeing other companies profitably benefit from the Quest while Meta continues burning money on it.

What does this all mean for games? Frankly, not much yet. The Quest Pro isn’t targeting gamers, VR in general is still too expensive and clunky to maximize multiplayer experiences, and even though part of the Microsoft partnership means Xbox Game Pass will launch on Quest devices, it won’t be a needle-mover (at least yet).

Source: Iron Man VR via Protocol

The more notable gaming angle of late is Meta’s recent acquisitions of Camouflaj (developer of Iron Man VR), Twisted Pixel (developer of Wilson’s Heart), and Armature Studio (which ported Resident Evil 4 to the Meta Quest 2). This continues an acquisition streak that started in 2019 with Beat Games (behind Beat Saber) and picked up steam last year. Owning content studios is a stark departure from Meta’s UGC-driven and capital-light roots, but it fits into the company’s ambition to kickstart the VR market through brute force. It’s also worth noting that given Meta’s high market share in VR headsets, it has started to see pushback from regulators regarding VR-related M&A. Obviously Meta is a big target for regulators in general, but in July the FTC sued Meta to stop the purchase of Within, the leader in VR fitness, expressing concern over Meta cornering that market. It seems a bit silly to me — enforcing antitrust in an incredibly nascent market is generally overkill and regulators will make mistakes — but it’s a sign that perhaps Meta will eventually face issues in the acquisition of VR gaming studios, too. It hasn’t happened yet, but with more eyes on Meta (not to mention Microsoft / Activision) these days and given its high VR market share, I wouldn’t rule out the possibility.

All in all, even if it makes sense to be skeptical about the near-term future of VR and Meta’s metaverse ambitions, it is still worth celebrating the ambition and investment that’s going into this emerging device category. And even though VR’s time in the mainstream is yet to come, it’s not worth overlooking the tech juggernaut that Meta is building (as long as it can retain top talent). It might not provide the highest shareholder returns, and Zuckerberg may have mistimed the market, but it still is pulling forward the future. It’s also worth remembering that even though this may be the “Blackberry era” of VR, perhaps the “iPhone era” will surprise us in its timing and direction. After all, people (especially gamers!) underestimated smartphones until Apple built and refined something consumers didn’t know they wanted. VR will likely never be as large of a market as smartphones, but perhaps history (and possible led by Apple again through a broader XR strategy) will eventually rhyme. (Written by Aaron Bush)

#2: Weekly News Round Up: One Big Thing

Source: Bain

Bain forecasts the gaming industry to grow to $300B: The future of video games is bright, indeed. According to Bain, the games industry will grow 9% CAGR over the next five years to $300B. To quickly summarize their report, there are three trends they think is driving this growth (though it’s unclear from the Bain report how the gaming industry will grow beyond where it is today):

- Technology Improvements: Higher fidelity game engines, 5G & increased processing power, VR, and more

- Metaverse Experiences: Immersive and interoperable virtual worlds that people (especially younger players) will spend time in

- New Monetization Models: F2P expansion, subscription offerings, and blockchain

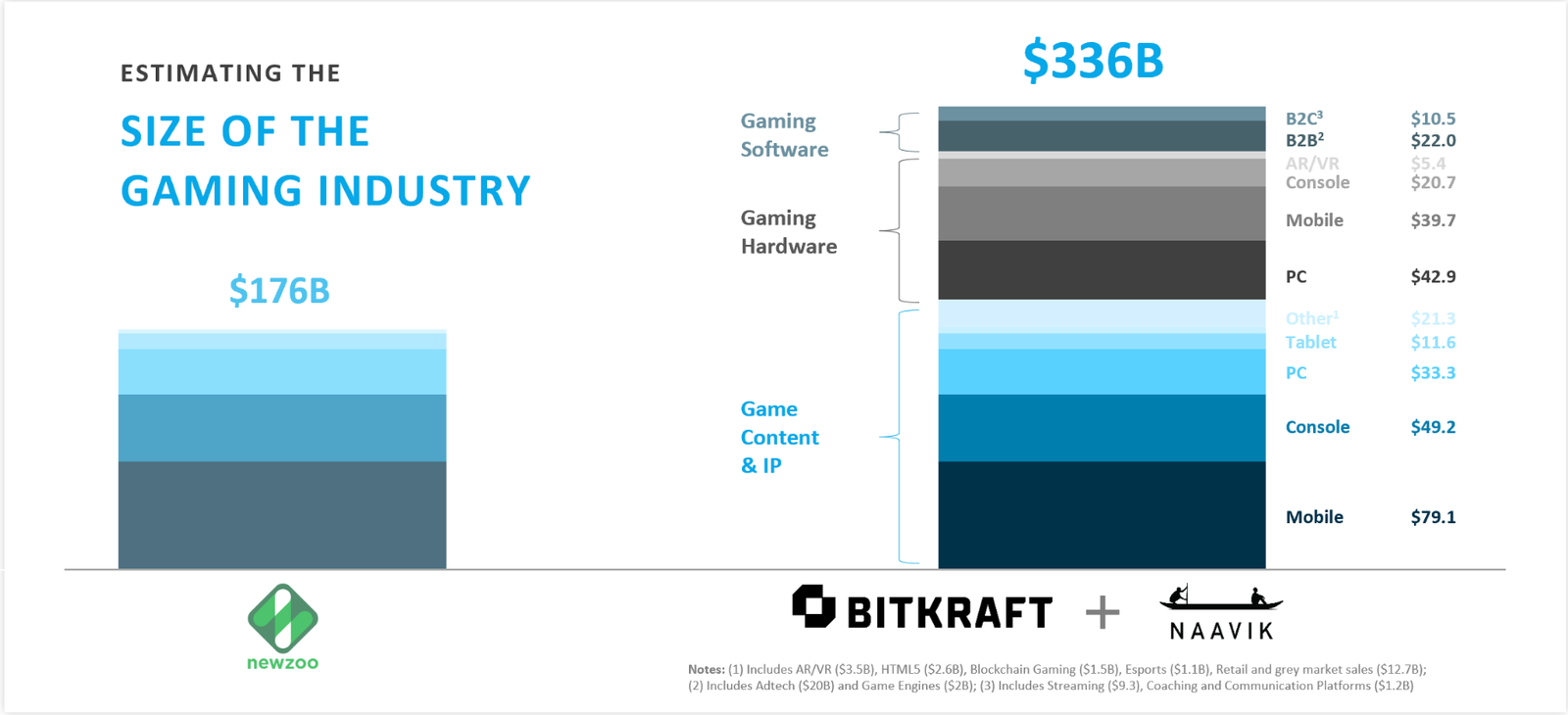

Last year, we also published a report in collaboration with BITKRAFT that led to a lot of productive discussions on the size of the games industry; regardless, it’s worth examining the breakdown of each category to understand some of the underlying drivers of the industry — what might grow, shrink, or plateau in the near- and long-term.

Source: Naavik

So much has changed since last year. There has been more M&A, IDFA effects are clear on the industry, and the plethora venture-backed studios in the space have just begun to launch their games. In fact, most signs — from financial reports to consumer spending reports — actually point to an industry contraction before renewed growth. The Bain report summarizes a compelling category that bleeds into media and “metaverses” more holistically, but the key components of what is considered “gaming” per se are unclear, particularly amid so much change in the industry.

🎮In Other News…

💸Funding & Acquisitions:

- Homa Games raised $100M. Link

- Meta announced that it bought three more VR studios. Link

- Muus Collective raised $5M from GGP. Link

- Flowstate Games raised $2M. Link

- Tribo raised $1.2M in a round led by Play Ventures and Sisu. Link

📊Business:

- Game Pass reportedly made $2.9B in 2021. Link

- Some more data on Game Pass / PS Plus partnerships — $2.5-$3.5M for ARK. Link

- Take-Two is shutting down Playdots. Link

- The SEC is probing BAC on unregistered asset offerings (read Amy Madison’s recent deep dive on legal in web3). Link

- Meta Quest Pro debuted at $1500. Link

🕹Culture & Games:

- Xbox Game Pass teamed up with Meta Quest. Link

- Limit Break bought a Super Bowl ad slot (the MZ playbook?). Link

- Overwatch 2 hit 25M players. Link

- Ready Player Me launched an API for avatar interoperability. Link

- FIFA 23 saw 10.3M players on launch week. Link

👾Miscellaneous Musings:

- Game studio TikTok analysis. Link

- More scrutiny from regulators on Activision. Link

- The importance of security for games. Link

- Meta mechanics in games. Link

- Card Crawl Adventure 1st month post-mortem. Link

This Week In Naavik Pro

Looking for more great games industry analysis? Check out Naavik Pro!

This week the Naavik Pro team published:

- A deconstruction of Tower of Fantasy with significant comparative analysis to Genshin Impact

- Our latest blockchain gaming monthly update, including data on new launches, active users, transaction volumes, and fundraising

- An updated game radar with takes on Soccer Manager 2023, Unhappy Racoon, and Civilization: Reign of Power

- Analysis on Playtika's latest studio closure, Sega's first steps into web3, and Horizon's $40M raise

Up next, we'll publish deconstructions on Survivor.io, Upland, June's Journey, and Marvel Contest of Champions. We're also going to be digging into several highly anticipated blockchain games, as well as continued analysis of the industry’s most important F2P, web3, and financial market developments.

If interested in learning more or signing up, request a demo below.

🔥Featured Jobs

- Legendary Play: Senior System & Economy Designer (Remote)

- Bungie: Director of Product Management (Remote — US)

- Guerrilla Games: Technical Animation Manager (Amsterdam, Netherlands)

- Manticore: Head of HR and Recruiting (Remote)

- Naavik: Content Contributor (Remote)

- Naavik: Games Industry Consultant (Remote)