Hi Everyone. As a reminder, we’re teaming up with Deconstructor of Fun and Phoenix Games to host a Royal Beach Party at Gamescom. The event be the evening of August 24th. Interested in learning more details and RSVPing? You can register here — or at least join the waitlist. We can’t wait to see you then!

This Week on The Metacast

TikTok’s Sticky Algorithm Plus Games Equals Success? —In this week’s Metacast, Aaron Bush, Anil Das-Gupta and Lars Doucet, join Maria Gillies to discuss:

-

Earnings Update: What’s next for Activision Blizzard and Ubisoft?

-

Google’s Interstitial Ads Rules: Do the new rules spell doom for the hyper-casual mobile genre?

-

TikTok’s Mini-games: How do games help deliver TikTok’s strategy?

You can find us on YouTube, Spotify, Apple Podcasts, Google Podcasts, YouTube, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: Nintendo Reports Misses in Q2 Earnings

Source: The Verge

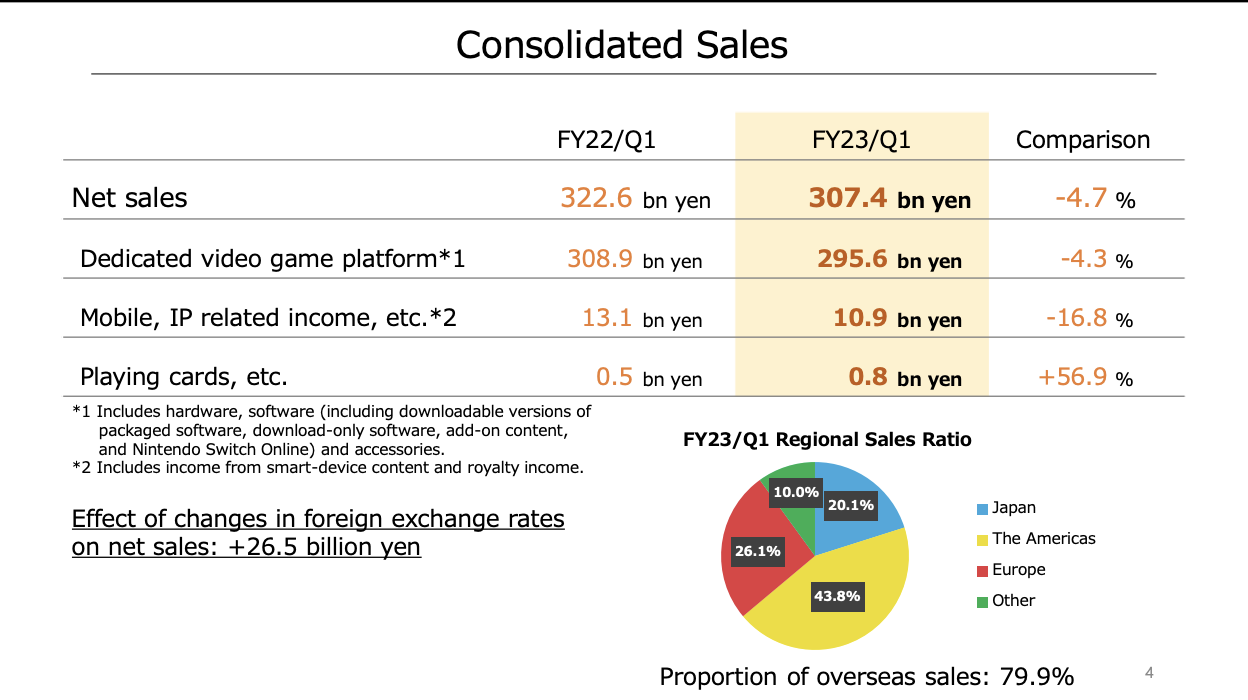

FY23 is not off to a strong start for Nintendo, which reported worse-than-expected quarterly earnings. Attributed in large part to production struggles (combined with a global chip shortage), and fueled by the increasingly weak yen, the company reported a decrease of nearly 23% in hardware sales since this time last year.

It’s another data point outlining the current bumps for the console market. But while Microsoft continues to bet the house on a subscription-centric future powered by differentiated content, and Sony doubles down on exclusivity as a differentiating factor, it's interesting to analyze the increasingly narrow position Nintendo finds itself as the third biggest console producer. According to the NPD, subscription was the only part of the games industry that showed growth in Q2, having 15% growth. New entrants like Steam Deck have differentiated from the pack by building a platform around an open access ecosystem. Meanwhile Sony and Xbox continue to push the space forward through investments in expansionary efforts like xCloud and Playstation’s recent partnership with Backbone.

When it comes down to it, Nintendo’s competitive advantage is built on key pillars: differentiated hardware and beloved first party IP. This quarter’s earnings give us a good look into the state of both advantages.

Earnings

Source: Nintendo

On the whole, sales declined for both Switch and Mobile platforms for the second quarter in a row. Much of the quarter’s sales were buoyed by first party titles, namely the launch of Nintendo Switch Sports and Mario Strikers: Battle League. These two titles have historical support from Nintendo fans (with the added benefit of the Switch’s growing online capabilities this time around). The company attributed much of the decline to hardware constraints and a lack of sales powered by third-party titles. There were no major releases of games like Monster Hunter: Rise, which have historically driven strong sales.

Source: Nintendo

While hardware sales have trended negatively, the one silver lining in the quarter is Nintendo’s download-only software numbers, which grew 16% YoY and now make up 53% of the company’s total software sales. To be fair, the company has historically fallen behind on online services but it bodes well for the business that online services and DLCs are growing at a clip that signals a need for further investment. Additionally, gross profit margins on hardware remained high given production efficiencies on the new Switch OLED systems.

I believe Nintendo can increase this digital-only market share to offset any current and future declines in hardware sales. It helps that the company’s biggest titles are made in-house (all four of its million-seller titles this quarter are first-party games), but if Nintendo wants to build more momentum, it’ll need to push third-party developers in a similar direction. The company has done a good job of this with its growing indie community since the Switch’s launch — is there a world where they deploy the same incentive structure and marketing energy to larger third-party digital titles as well?

Even with a larger digital market share, Nintendo’s over-dependence on hardware sales is still something the company will have to come to terms with after the COVID bump. Of course, every quarter won’t have a 23% YoY decline, but an over-dependence on first-party titles to make up the difference when things go south feels like a perpetual flaw in Nintendo’s operating model.

Realistically, the path to revenue diversification for Nintendo is tough given some of the company’s older, more fixed mindsets. In my mind, there are two limitations most representative of this concern:

First-Party Dependency: Nintendo has, and seemingly always will, rely on in-house titles to cover any gaps in their business. While the company has acquired a handful of studios over the last few years to make spin-offs and secondary titles for their best IP, Mario or Kirby can only sell so much - the company needs more games with more IP to scale further.. Case in point is that the company has only released two first-party titles this quarter, and only have four more scheduled for next quarter. A large portion of the Switch’s all-time highest sellers are from companies outside Nintendo, so the vision is possible. The company will need to ramp up efforts to make it sustainable.

Mobile Deprioritization: Despite making up only 3.5% of total revenues this quarter, the substantive decrease in royalty and smart device income from last year is telling that Nintendo is slow to monetize IP outside of its ecosystem. Fire Emblem Heroes makes up the lion’s share of the company’s impact here. The company even notes the decrease is largely fueled by a lack of new mobile content in 2022 as compared to the same time last year. It’s obvious the company has cooled its mobile ambitions in favor of more “creatively” engaging opportunities. However, when market conditions and supply shortages create risk in the company’s primary (and frankly only) revenue stream, it brings into question the validity of the company’s strategy here. This mentality, and Nintendo’s approach to building mobile titles overall, would have to change in a significant way if they wanted to get over this mindset.

While both of these perspectives represent a more conservative approach to business, it’s clear that Nintendo’s competitive advantages remain standing on solid ground. For the first time in the company’s history, all of its attention is focused on a single device, meaning that the problems of split demand like we saw between the Wii U and 3DS is a thing of the past. We can also expect sales to remain constant, thanks to an ever-growing library of first-party content over the years. It’s not a path that leads to explosive growth, but it is a tried and true strategy that will work.

If there’s one place worth being optimistic about, it’s how Nintendo continues to invest outside of games. The brand has expanded its IP into toys, an upcoming movie, an animation studio, and two theme parks over the last few years. It’s also apparent there’s opportunity for even more digital subscription offerings. Ownership of some of the world’s most famous IP is a powerful business strategy, and we can expect it to bear fruit so long as Nintendo executes correctly. I’ll be eager to see how these new investment’s compound, and if Nintendo can finally find a way to leverage growth beyond its go-to-market. (Written by Max Lowenthal)

#2: Weekly News Roundup

Source: skillz

Skillz Implosion: Remember when Skillz, the skill-based real money gaming app, used to be a $15B company? With a stock price down 96% from its high, it’s easy to wonder what happened. We previously questioned the size of Skillz' market, the platform's appeal to developers, and the quality of management. The company’s latest quarterly results paint a clear picture that the situation is even worse than most would’ve expected. Quarterly revenues were down 18% year-over-year, full year guidance was dramatically reduced, and the company continues to burn about as much cash flow as it earns in revenue. It also recently hired a new CFO. With a broken business model, lack of appeal to developers, and a culture that many don't want to be a part of, there’s not a lot of reason to be optimistic about the future of this business. We’ll explore the situation — what happened, what’s next, and what we can learn — much more in this week’s Naavik Pro issue.

Square Enix Highlights: As a reminder, Square Enix sold its Crystal Dynamics and Eidos studios to Embracer for $300M. The money from this sale will be used to strengthen the company’s core games business. According to a review from David Gibson, Square Enix is looking to do a studio portfolio review, where many of their Western studios may no longer be 100% owned, and plans to allocate resources back to its Japan titles. This is all a strategy around capital efficiency, and after the sale, the company will have $1.4B in cash to expand game investments (current game dev costs are at around $840M) to develop new IPs and titles. We wrote: “Square Enix's domestic business in Japan has flourished. Just to name a few successes: Final Fantasy, Dragon Quest, and Romancing Saga mobile titles are generating hundreds of millions in yearly revenue; and the cross-platform online game FFXIV has taken over World of Warcraft as the go-to massively multiplayer online game. Considering this, plus the fact that the company has been looking for an out from the high-stakes AAA business for years, the divestiture makes a lot of sense.” Importantly, this money won’t go into new investment domains but rather into Square Enix’s core domains.

Tencent Looks To Buy Stake in Ubisoft: Amid domestic regulatory concerns, Tencent is reportedly looking to purchase a minority stake in Ubisoft at ~100 Euros per share. It currently owns 5% of the company. This would be Tencent’s first major foreign investment since 2020 and represents an important strategic asset for the company, which has been looking to diversify its offerings internationally to console and PC. With a strong back catalog and a slate of upcoming titles, Ubisoft seems like a great strategic fit — “As will be the case with many gaming companies over the next few months, the focus will be on pushing out new titles (Ubisoft has 20+ in development including F2P and AAA), and about stabilizing top-line in a potentially recessionary environment. Ubisoft also announced a strategic mobile partner and the delay of several titles, including a game based on the Avatar film series”.

🎮In Other News…

📊Funding & Acquisitions:

-

Earnings: Skillz | EA | Nintendo | Square Enix | Bandai Namco | Sega

-

Tencent is hoping to buy an additional stake in Ubisoft. Link

-

The founders of Machine Zone announced a raise (led by Paradigm and Standard Crypto) for their latest company, a web3 gaming company called Limit Break. Link

-

InfiniteWorld acquired Super Bit Machine for web3 expansion. Link

-

AO Labs raised $4.5M from a suite of web3 investors. Link

📊Business:

-

DDM reported $4.8B total invested in video games across 217 deals in Q2. Link

-

“Subscriptions were the only segment of the video game industry that showed growth during Q2, rising by 15%”. Link

-

Jam City laid off 17% of its workforce. Link

-

Roblox is hiring for a web3 engineer. Link

-

Unity is considering a spin off of its Chinese division. Link

-

Tencent and Logitech announced a cloud gaming partnership to develop a handheld. Link

🕹Culture & Games:

-

Blizzard reportedly canceled their WoW mobile game, which was in collaboration with NetEase. Link

-

Mobile gaming and VTubers are two growing areas for livestreaming on YouTube Gaming. Link

-

Loaded, the talent consultancy, is opening up a new studio division in a similar strategy as 100T. Link

👾Miscellaneous Musings:

-

YGG’s community update. Link

-

Consumer insights into the blockchain gaming landscape. Link

-

“Just like that, Netflix is suddenly kind of great at games”. Link

-

How popular streamers deal with stalkers. Link

-

Game Jam submissions, engine breakdown. Link

🔥Featured Jobs

-

Discord: Manager, Strategic Revenue Finance (San Francisco, CA)

-

Hidden Leaf Games: Product Manager (Remote)

-

Naavik: Content Contributor (Remote)

-

Naavik: Games Industry Consultant (Remote)