Educational games have come a long way since the 1970s and 1980s, beginning with titles like Brøderbund’s Where in the World is Carmen Sandiego? and Don Rawitsch's Oregon Trail (which has sold over 65M copies).

By the 1990s, companies like The Learning Company and Brøderbund further advanced the genre using PC CD-ROMs for more interactive and visually rich content. This foundation paved the way for the next era of educational games, which since the mid-2000s, have become more digital, more online, more mobile-centric, and UGC-oriented.

Despitethis extended history, many researchers think we’re still in the early days. According to King’s Research, for instance, the kids' educational game market is projected to increase from $4.19B in 2022 to $20.58B by 2030 (an approximately 23% CAGR). While this estimate should be taken with a massive grain of salt, it represents a confluence of factors that is shaping a new wave of how kids can learn through gamified experiences.

In particular, both the Roblox and Minecraft platforms have made significant commitments to education. Minecraft's education platform, Minecraft Education now hosts over 600 lessons, and Roblox is committed to having 100M students engaged in learning by 2030. Additionally, the success of gamified learning platforms like Kahoot!, with over 8M active educators and $169M in revenue in 2022, underscore the increasing demand for gamified learning.

Despite this recent growth, the educational gaming sector still grapples with the tricky balancing act between educational quality, engaging gameplay, and monetization. This often results in skewed stakeholder incentives, as traditional education games might prioritize learning at the expense of entertainment and commercial success. Additionally, marketing to young children adds complexity since they are not direct buyers, requiring strategies that appeal to both young users and their decision-makers, typically parents or educators.

More recently, the COVID-19 pandemic boosted interest in gamified education, and paired with kids’ growing access to mobile devices and technology in classrooms, we foresee a new era of educational games. So let’s break down the key trends.

Mobile Gaming

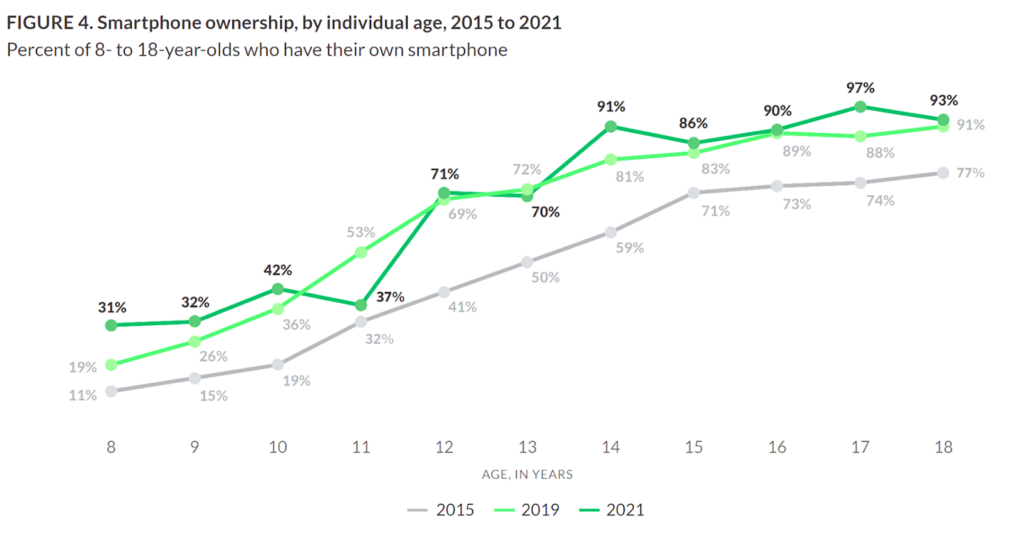

The popularity of kids’ educational games is largely attributed to the dominance of mobile gaming and the increasing penetration of mobile devices. As you can see in the chart below, each successive generation leans on mobile more than the last.

This trend is also reflected on Roblox, where 60% of the user base is under the age of 16. The company says 78% of all user sessions are on mobile, and the average game session across all devices is three hours.

Mobile device shipments to American K-12 schools saw a 90% spike in 2020, largely due to the effect of the pandemic and federal funding programs like the CARES Act. This surge led to about 80% of domestic schools integrating technology, particularly mobile devices, into their education programs.

Echoing this trend, a Common Sense Media census (as seen below) revealed an increase in mobile device ownership among younger students. Specifically, the number of 8-year-olds in the U.S. owning mobile devices nearly doubled from 2015 to 2019 and almost tripled by 2021.

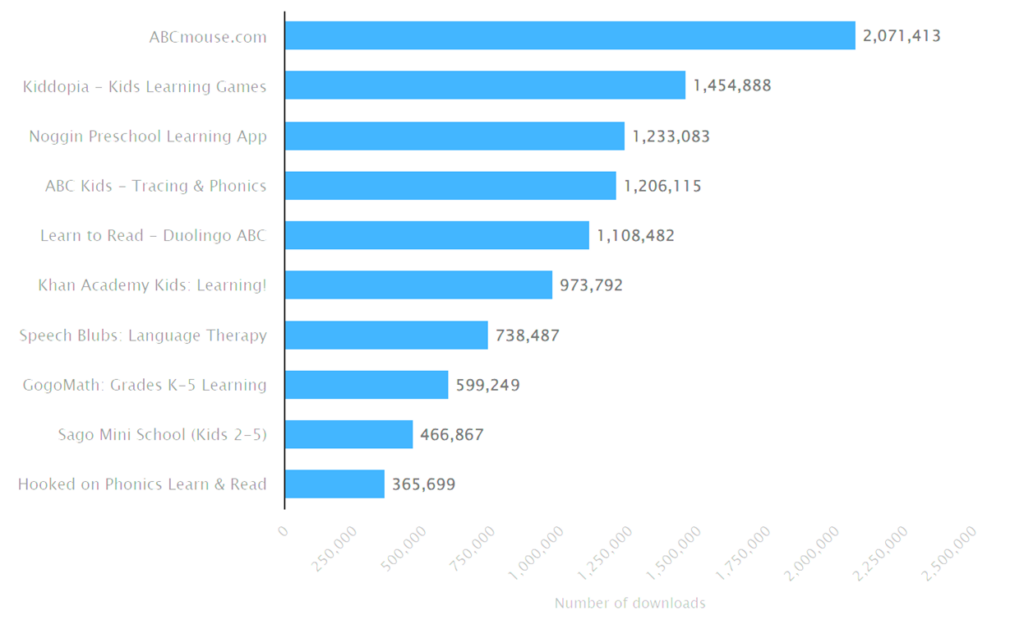

ABCmouse by Age of Learning is a prominent example of success here. Since its 2010 launch, the company has created over 850 interactive lessons, hundreds of subject-specific games, and thousands of gamified activities in both free and subscription formats. As of 2023, it ranks as the top educational game for children on Android and iOS with over 2M downloads last year.

Initially consumer-focused, Age of Learning expanded into the educational sector around 2020-2021 with pilot programs in Florida and California, leading to ABCmouse's integration in 70,000 classrooms and nearly half of U.S. public libraries. Two million downloads is still quite low in the grand scheme of things, but this dual-market approach illustrates that there is a significant opportunity for educational gaming to engage both the mobile consumer market and the educational sector within classrooms.

Leading learning apps for children in the United States in 2023(as of October 2023), by downloads

Educational game platforms like ABCmouse, Kiddopia, and Noggin boast thousands of play-based activities, and illustrate that the integration of multiple subject-specific games and gamified learning tools into one platform is key for sustained success. This presents a significant hurdle for new entrants, particularly those launching and distributing standalone educational games, as they navigate a market increasingly dominated by multifaceted platforms that already have a foot in the classroom.

However, this landscape is not without opportunities and new contenders. FabuLingua focuses on innovative subject-specific, or in this case language-specific games; Legends of Learning has a growing array of over 2K curriculum-aligned math and science games. Both these games underscore the potential for other educational games and platforms to challenge established players. And as more teachers who are gamers themselves enter the market, educators should become increasingly open-minded to using gaming-oriented educational tools.

UGC Platforms and The Next Generation of Educational Games

In the current educational gaming landscape, popular platforms like Minecraft, Fortnite, and Roblox are taking center stage, and all three are carving out important, yet distinct, roles in educational gaming.

Minecraft Education operates separately from mainstream Minecraft as a paid subscription-based service, and is more educator-driven and curriculum-focused. It boasts an impressive engagement with over 200M Minecraft Hour of Code sessions and a library of more than 600 premade lessons. The platform’s distinctiveness from mainstream Minecraft helps it maintain a focus on professional educational content creation, enabling educators to create their own lessons.

2023 initiatives such as the Artemis Missions in collaboration with NASA and the Schools Reinventing Cities project with C40 Cities further underscore this commitment to delivering quality educational experiences.

Fortnite is carving out its own path in educational gaming as it transitions from a popular game to a UGC platform through UEFN. This has expanded its potential for education, showcased through initiatives like offering educators free lesson plans like the Lives After Death: The Pyramids of Giza experience.

Fortnite's Creative Mode has also opened pathways for both experienced developers and creative users to contribute to the platform’s educational landscape. It’s still very early days for UEFN, but this is a trend worth paying attention to.

In contrast, Roblox's ecosystem, bolstered by its accessible Lua coding language and user-friendly Roblox Studio toolkit, provides the most accessible and active creative environment among leading UGC platforms. It also supports the most kids in one ecosystem, and its player base continues to expand year after year as younger players age up and gain access.

One of Roblox’s most important educational initiatives has been its $25M Roblox Community Fund (RCF). The initiative has supported educational game developers like Filament Games, which has now led the creation of three educational games in the platform:

- Mission: Mars – attracting over 3.2M visits and teaching the engineering design process in collaboration with the Museum of Science in Boston (2022)

- Robot Champions – with 569.2K visits, developed with FIRST® to simulate robotics tournaments (2023)

- Distance Dash – reaching 39.2K visits, focusing on physics education in partnership with NWEA (2023)

Yes, these numbers pale in comparison to the platform’s most popular experiences, but this type of content is on an unmistakable positive trajectory, and new education-minded creators continue to build new experiences, from smaller studios like Tiny Comet to independent creators and users.

This trend is exemplified by games like Math Answer or Die, a simple math quiz-like game from BlueFish Studio. Math Answer or Die has grown rapidly since its creation last year, amassing over 145M visits in under a year, including more than 45M in the past three months alone. It also sustains an average session time of seven minutes, significantly exceeding the three-minute average of games like Mission: Mars.

Math Answer or Diesum of total visits over the last three months

Another standout example is Lua Learning by Zack Ovits, also known as Boatbomber in the Roblox community. Beginning his coding journey at the age of 12, Zack used Roblox to develop the experience, which has over 4M visits, and teaches Lua programming through play, gamified mechanics, and engaging tutorials. It won Most Educational Game at the 2020 Bloxy Awards and propelled Zack to establish Torpedo Software, an initiative dedicated to creating high-quality educational games.

Games like Math Answer or Die and Lua Learning are the tip of the iceberg for where this trend is heading.

Looking Ahead

The rise of mobile, UGC platforms, and the simple fact that more kids and educators are gamers is making the future of education more gamified. And as these platforms grow, more creators will be incentivized to create fun, engaging, and educational content for them.

However, it's important to acknowledge that educational games extend beyond UGC and mobile technologies. Traditional gaming companies, like Ubisoft with its Assassins’ Creed-based Discovery Tour, are also impacting education, offering immersive historical explorations.

Smaller developers are making their mark too. Intercept Games’ Kerbal Space Program has become recognized as an educational game due to its accurate simulation of rocket construction, space exploration, real-world physics, and engineering principles – even attracting attention from NASA.

Lastly, even though mobile and UGC have become massively popular, new technologies and platform shifts are on the horizon. VR/AR, not to mention the surge in AI-based tools, will almost certainly become part of the gamified educational equation in the future.

In fact, there are already teams building at the bleeding edge. The LittleLit Kids AI Learning App harnesses AI to foster a self-directed and personalized learning journey for children, enabling them to create bespoke and impactful stories and games that reflect their imaginations and learning styles. Similarly, companies like Osmo and PlayShifu are combining AR with physical play in interactive games, enhancing critical thinking skills through a unique blend of digital and tangible experiences.

As we venture deeper into this future, two things are clear: New technologies will continue to transform education, and making education fun on these emerging platforms will be increasingly in demand. The next big educational games may not top the charts, but they likely will outshine their historic peers in new and interesting ways.

A Word from Our Sponsor: NEXUS

Build a Support-a-Creator Program With Nexus

Explore implementing a game-changing Support-a-Creator program with Nexus, the leading platform for live service PC, console, and mobile video games, designed for building holistic creator programs.

Through Nexus’s Support-a-Creator API, live service publishers can build world-class creator programs that drive significant growth in conversion, ARPPU, retention, and LTV. Nexus has partnered with leading live service publishers like Capcom, Grinding Gear Games, Hi-Rez Studios and Ninja Kiwi to build out their creator programs by managing creator onboarding, payments, analytics, attribution and so much more.

Partner with Nexus and benefit from their expertise while implementing your own Support-a-Creator program.

Content Worth Consuming

Space Ape’s PGC Talk P1 (Space Ape Games): “Last week Space Ape Games product OG and 10 year mobile FTP vet Geoffrey Gilles shared a presentation at Pocket Gamer Connects London about our investment in content tools in Chrome Valley Customs. Here's a re-roll of that presentation. Apologies for the janky edit but Linkedin only supports videos up to 15 mins so I'll post the back half of it tomorrow. This was our first level balancing tool so if you're a pro and have any tips for how we might improve on it then please get in touch with Geoff or me. ”

Space Ape’s PGC Talk P2 (Space Ape Games): “This is the second part of Geoffrey Gilles excellent presentation on the content and level balancing tools behind our new puzzle game, Chrome Valley Customs.”

Choose Your (ad)Venture (Ep. 10) (Gamecraft): “Mitch and Blake discuss the nuances of game financing. They begin by explaining how the publishing model of advances against royalties functions, and what the expected costs and benefits are for both the developer and publisher.After a brief discussion of bootstrapping, they do a deep dive on venture capital financing for games. They reveal how venture capital firms make money, drawing a sharp contrast with how traditional game publishers make money. This leads to a conversation about the implied promises that game”

How to Get TikTok Influencers To Cover You Game And Gain Millions of Impressions (How to Market a Game): “TikTok has proven to be a potent source of wishlists (read case studies of going viral on TikTok here and some TikTok tips here). However, this week I have a new TikTok strategy to potentially earn thousands of wishlists: leveraging TikTok influencers. The team behind cozy room decorator game Momento, recently earned 1,600,000 views and helped trigger bonus visibility from Steam. ”

Making a successful video game Kickstarter in 2024 (Game Discover Co): “While we’re not claiming that crowdfunding site Kickstarter is a major funding source for most video games, a quick peruse of its ‘video games’ category shows ‘cozy farming game’ Tales of Seikyu at $250k raised from 4,400 backers, and Blizzard-y RTS Stormgate just finished funding at $2.4 million from 28,000+ backers. These numbers pale in comparison to the board game category. When we last looked at video game Kickstarters, video games raised around $24 million USD in 2021, compared to a whopping $272 million USD for tabletop games. But it’s still useful for certain sizes and notorieties of studio!”

In Other News

💸 Funding & Acquisitions:

- Skybound hires ex-EA biz dev exec as it ponders acquisitions.

- Chris Heatherly’s Great Big Beautiful Tomorrow casual party games studio lands $3M.

- Stoke Games raises $5.5M to create strategic shooter game.

- Stoke Games raises $5.5M to create strategic shooter game.

- FromSoftware owner acquires Octopath Traveler developer.

- Supervillain Labs will launch Web3 games in partnership with investor Aptos Labs.

- Runescape maker Jagex sold to investors for estimated $1.1B.

📊 Business & Products:

- Ubisoft beats its sales targets in Q3, net bookings at $675M.

- European video game sales dip by over 7% in January.

- Sega revenues rise to $2.7B.

- Nexon's revenue grew by 20% in 2023.

- Jury awards Skillz $42.9M in patent infringement trial.

👾 Miscellaneous:

- How Dubai wants to be the center for games and esports.

- How to Prepare Your Multiplayer Game For Steam's Next Fest.

- Humble Bundle raised $14M for charity in 2023.

Our Gamification Consulting Services

Today, we’re highlighting our gamification consulting services! Applying game mechanics to all sorts of applications has proven to boost retention, engagement, and revenue — but doing it right can be harder than it seems. More specifically, Naavik offers constructive gamification deconstructions, gamification workshops, and ongoing flexible support. Here is what one of our clients had to say.

"We have been very happy with the support Naavik provided to Sleepagotchi. They have an incredible expert network, with world-class game designers, narrative designers, and UA specialists. The team helps us in developing and stress-testing new game core loops, think deeply about our game constraints, and something that is rare for a consulting partner - care deeply about our mission and vision."

- Anton Kraminkin, Founder & CEO of Sleepagotchi

If you’d like to learn more, reach out here! Also check out our expanded consulting service portfolio here.