Hi Everyone. Thanks for tuning in to another week of Naavik Digest. If you missed last week’s edition, we wrote about regulatory concerns surrounding ATVI / MSFT (prior to the FTC filing to sue them). Please check it out and let us know what you think. With that, let’s dive into this edition.

Is Cross-Platform The New Golden Strategy?

Should studios lean away from an all-in mobile strategy and pursue cross-platform? What is the impact of Intel’s vision to revive Moore’s Law? In this episode, we dive into the latest game business news with Tammy Levy, David Amor, and your host Maria Gillies.

You can find us on YouTube, Spotify, Apple Podcasts, Google Podcasts, YouTube, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: App Store Gets a Pricing Upgrade

Apple’s App Store regulations have been one of the hottest topics in gaming. Often centered around the company’s 30% in-app transaction fee, we’ve already seen headlines as both industry mainstays like Epic and burgeoning web3 companies like Magic Eden face uphill battles in finding ways to work within the confines of App Store policy. Leaders from companies like Twitter and firms like Galaxy have come out to question the impact of take-rates on what has become a product that generates tens of billions of dollars each year.

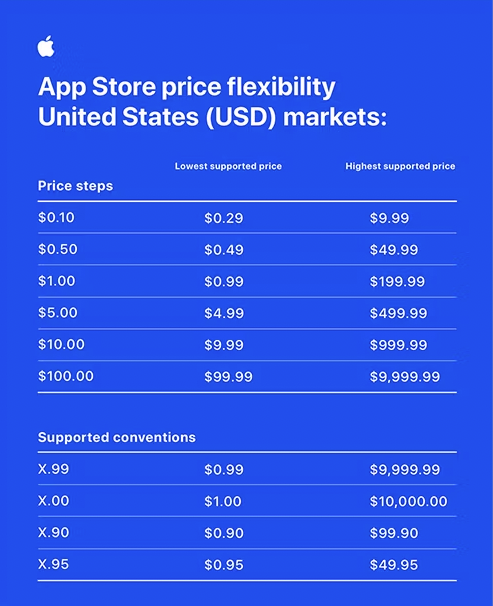

While the company’s take rate often finds itself at the center of conversation, it was Apple’s pricing policy that received an overhaul earlier this week. The policy change will equip developers with over 600 new options for pricing their apps, giving them flexibility to set prices between $0.29 to $10,000 (as compared to the $0.99 to $999 limitations previously.) The news also allows developers to move away from the traditional $X.99 convention set by Apple years ago. Driven in large part by a class-action lawsuit from 2021, the change is the latest in a series of decisions which have required the company to give ground on their App Store control. The change will also provide developers with the ability to adjust pricing on a country by country basis in an effort to better optimize costs in the face of foreign exchange rates, which comes as particularly welcome news after the company had a string of price increases in the EU and Asia earlier this fall.

It’s no secret that Apple has been heavy-handed when it comes to pricing in the past. There have historically been fewer than 100 pricing options available to developers globally, and approval for any app over $999 required special access from the company via a difficult to access form. It’s interesting to finally see a few holistic changes on the tail of what’s been a fraught 24-months for the mobile giant, capped off with the recent announcement of the UK regulator’s pending probe into Apple and Google as a mobile-centric duopoly.

While battles around App Store fee structures and monopolistic practices continue to play out in the courtroom, it's also interesting to consider the very immediate impact these changes will have on the broader mobile games industry. As my colleague Becky Matthew noted in a recent write-up for Naavik Pro the F2P mobile gaming has been significantly growing year after year, with over six billion people now owning a smartphone worldwide. Making up over 52% of the total gaming market, our analysis with data.ai notes that mobile gaming accumulated over $61B in revenue in 2021.

With such a substantive foothold in the market, any adjustments to pricing or monetization will undoubtedly have downstream effects on the broader industry. Mobile game developers have already been searching for alternative forms of revenue in the wake of IDFA, which impacted some mobile developers upwards of 10 - 20%. Meanwhile, games continue to make up nearly 70% of App Store revenue. Changes are surely on the horizon.

One such change of note is the increased price tag that Apple has provided developers — allowing purchases up to $10,000 will have less oversight. Various pockets of the gaming industry point to a higher willingness to pay from a small subset of consumers that were previously difficult to cater to. Less than 10% of consumers make up a majority of the revenue generated by mobile titles today. Put another way, the mobile market is already very top-heavy when it comes to consumer spend. Meanwhile, consumers in the burgeoning web3 space have shown willingness to spend upwards of $11,000 for NFTs companies like Limit Break and others. There’s also the looming presence of Apple’s rumored 2023 AR/VR expansion, which will undoubtedly create a market for higher priced IAPs upon launch thats to the introduction of more complex hardware.

On the UA side of things, new pricing flexibility unlocks further optimizations for games to grow. As we noted in a recent Naavik Pro F2P Market analysis, iOS D30 Retention and Downloads are mostly stable post-IDFA; UA is getting harder to perfect. The increase in data privacy has led to declining revenues across the mobile space as monetizing users from a growing download base proves to be tougher and tougher. It’s a large reason why companies are spending more time extending the longevity of games with progressions systems, social mechanics and live-ops. We could probably learn how to optimizes prices in these longer lifecycle games to drive higher ROI from a variety of customer profiles.

It’s not hard to imagine how offering more differentiated pricing for in-game cosmetics or cheaper experience-boosting IAPs could drive marginal revenue, or maybe even incentivize players to spend when they wouldn’t have otherwise. It’s also worth noting that there’s already precedent to suggest we may see some impact here. In an interesting study on price elasticity in Candy Crush researchers noted that radical discounts led to increased spending from middle-tier consumers. While the study found that profits and revenue remained largely unchanged, the genre-specific sample size has me skeptical that we won’t at least see some sort of uptick in revenue optimization in the future.

The use cases from expanding pricing mechanics feel very organic in nature. Lifetime memberships, both bigger and smaller tiers of IAPs, and increased spend in A/B pricing tools and testing all feel like very tangible and likely outcomes from the recent news. In my mind, the open question is which mobile genres are best equipped to make use of Apple’s new price changes. Whale-friendly genres like Midcore and Casino titles should be able to make good use of the policy’s higher price tags, while more IP-centric genres like the recently renewed Idle Games space should be able to further optimize spend from long-time fans. There’s certainly potential for mobile monetization to be impacted from the news, but what remains to be seen is the intensity of that impact. Will we see noteworthy swings in IAP-forward mobile genres? (Written by Max Lowenthal)

#2: Weekly News Round-Up

Game Awards 2022: Geoff Keighley’s annual gaming event has some big news, including details on sequels for Hades and Death Stranding, as well as plenty of awards for 2022 mainstays like Elden Ring and God of War: Ragnarok. We’ve often appreciated the legitimacy that a highly-produced consumer-facing show like The Game Awards brings the industry, but it also serves as a reminder as to why gaming is so different from the broader media landscape. The unique nature of the platform/developer relationship, combined with the intrinsic investment of time that gaming requires has always left the show feeling like a shadow of something with more mass appeal. While Keighley should be lauded for the value that his works brings the industry, there’s a hole in how E3 or PAX might be a better representation of gaming than awards ever will be.

Betting Returns to Esports: Unikrn, the esports gambling start-up that was purchased by betting powerhouse Entain nearly a year ago, returned to the public eye last week. Led by ex-Twitch VP Justin Dellario, the platform has started out with a public rollout in Canada and Brazil, with plans to expand to more highly regulated regions in the coming months. It’s an interesting prospect to consider that when a league-wide revenue sharing agreement for something like the LCS gambling could make esports franchises a more sustainable business model when paired with streaming and merchandising rights, Gambling certainly isn’t the singular answer to esports’ monetization problem, but its not hard to imagine a brand like FaZe leaning heavily into the model provided that the company can navigate legal hoops.

Epic Rolls Out Kids Features: It’s pretty cool to see tech & gaming companies increasingly prioritize kids safety across platforms. Just this week Epic Games rolled out something they call “cabined accounts”, which asks for consent from a guardian on certain features (this comes from their acquisition of SuperAwesome). Importantly, kids are an entirely different user segment and function as a valuable top of funnel for future consumer purchases. Servicing them early will only continue to be of benefit and we expect companies like Riot, Activision, etc. (that are not necessarily kid-forward) to follow suit. Kids don’t want to be relegated to the iPad, and gaming companies will continue to understand how to create safe environments for them without jeopardizing their player experience.

🎮In Other News…

💸Funding & Acquisitions:

- Cubzh raised $3M for its next-generation Minecraft. Link

- Founders Fund led a $2.3M pre-seed into The Mirror. Link

📊Business:

- The FTC is suing Microsoft over the Activision acquisition. Link

- Goddess of Victory: Nikke has exceeded $100M in first month revenue. Link

- Apple launched a variety of new pricing guidelines, including new price points. Link

🕹Culture & Games:

- Epic Games rolled out cabined accounts to provide a better kids gaming experience. Link

- Speaking of Epic Games, Fortnite graphics are looking better and better. Link

- Tumblr year in review. Link

- Best of Quest 2022. Link

- Google Play’s Best Apps & Games. Link

- A recap of The Game Awards. Link

👾Miscellaneous Musings:

- This NASCAR driver used a GameCube move in his race. Link

- A Post-mortem of a mobile indie game studio. Link

- Learning to play Minecraft with VPT. Link

This Week In Naavik Pro

Looking for more great games industry analysis? Check out Naavik Pro!

This past week the Naavik Pro team published:

- A new game radar on three upcoming blockchain titles: Guild of Guardians, Phantom Galaxies, and Illuvium

- A deconstruction on Puzzles & Survival - the 4x title that has found success in a post-IDFA world

- A F2P market update covering Appsflyer’s new retention report, and the shutdown for Boom Beach Frontlines

- Analysis on Fenix Games’ recent $150M raise and the economy reveal for Big Time

Next up, we’re deconstructing Arknights and Marvel Snap, writing an esay on Candy Crush’s 10-year journey, releasing new blockchain market update, and writing a research essay on the Myria ecosystem!

If interested in learning more or signing up, request a demo below.

🔥Featured Jobs

- Stillfront: SVP Operations Management & Processes (Stockholm, Remote - Europe)

- Legendary Play: Senior System & Economy Designer (Remote)

- Nexus: Account Manager (Remote)

- Capcom: Business Development Manager - Esports (Remote - USA)

- Activision: Associate Manager - Global Digital Commerce (Santa Monica, CA)

- Naavik: Content Contributor (Remote)

- Naavik: Games Industry Consultant (Remote)