Hi everyone. We have a fun newsletter with a bunch of diverse topics for you today. We’re also about to begin conducting interviews with gaming industry leaders, and we’re pumped to share those transcripts with you starting next month. Stay tuned!

For now, here’s your weekly roundup and analysis of what’s happening in the video game industry…

#1: Supercell’s Revenue Drops (Again)

Last Tuesday saw the release of the latest of the Supercell founder-CEO Ilkka Paananen’s yearly posts. Think of it as Supercell's take on the dusty shareholder letter format: instead of pitching to investors, it's an eclectic mix of addressing Supercell fans and the game industry. Finnish law requires even privately-held limited liability companies to report their financials quite openly, which is also the case for Supercell. Paananen's letter rightfully addresses this as well. The last year saw Supercell's revenue decline 7 percent to €1.3 billion; EBITDA declined 21 percent to €406 million.

It needs to be said that these are remarkable numbers for a game studio that employs only 300-odd people. Even so, Supercell has failed to see a year of growth since their peak year in 2015. While the company is often quick to sidestep this by claiming that it is not very numbers-driven, it's definitely a disappointment. Meanwhile, the industry at large has seen double-digit yearly growth. Notably, 88.1 percent of the company is owned by Tencent, who certainly wouldn't mind seeing the numbers go up instead of down.

Supercell has historically been adamant about their approach to stay small and keep their game teams independent. The typical "cell"—as Supercell refers to their teams—is rarely larger than 20 developers. Early-stage cells can literally be a couple of developers doing their own thing in a nondescript corner of the office. In new game development, the merits of this approach cannot be overstated. Combining this structure with world-class developers has rewarded Supercell with some of the biggest games ever made, including Clash of Clans, Clash Royale, and Brawl Stars.

As recent launches from Hay Day Pop to Rush Wars have failed to take off, Supercell's growth has rested entirely on its live games. The past years have only cemented what we already knew about growing live games: no matter the type of the game you are running, you need a steady flow of great content to keep players engaged and spending. Creating content is a lot of work, and keeping up with competitors that don't employ similar team size restrictions has proven tricky for Supercell. Hay Day has been long since triumphed over by the content machine that is Playrix's Township, and in strategy games there's a long line of contenders willing to do whatever it takes to claim market share from Clash of Clans. Plus, it’s clear that Clash Royale is currently in a bit of a rough patch.

However, we are already seeing glimpses of the new Supercell, which appears (slightly) more willing to evolve its approach than in years past. The Brawl Stars team, presumably the largest Supercell team by headcount so far, already employs 30 developers. In addition, Supercell is drawing from its community to source more and more quality content for its games. We already know that Supercell is home to some of the sharpest minds in games. That's why we eagerly look forward to Supercell taking its live ops game to the next level this year. (written by Miikka Ahonen)

#2: Stillfront Reports FY 2020 Results

On Wednesday, Stillfront Group delivered its Q4 and FY 2020 earnings report. The quarter’s results continue to make the company look good:

-

-

19 gaming studios and 1000+ professionals across 15 countries

-

22 million MAUs, which is +274% YoY and yet to include players from 3 new acquisitions

-

42 current live games with 20+ titles in the pipeline for soft-launches in 2021

-

~$127 million in bookings, which is +96% YoY and paired with a 37% adjusted EBIT margin

-

~$26 million in free cash flow prior to acquisitions and financing

-

~$425 million in cash and debt reserves waiting to be put to good use

-

As we covered in our Stillfront deep dive, the company’s selective mobile-first acquisition strategy, decentralized operations culture, focus on group synergies, and capital allocation skill continues to work. Stillfront’s recent results showcase a strong underlying business with a decent amount of financial flexibility to continue to fuel further growth through M&A. For context, they’ve been able to maintain a steady rate of one acquisition per quarter even over the pandemic-ridden 2020. Most recently, Stillfront acquired Moonfrog Studios for $90M, the company’s first foray into the Indian games scene.

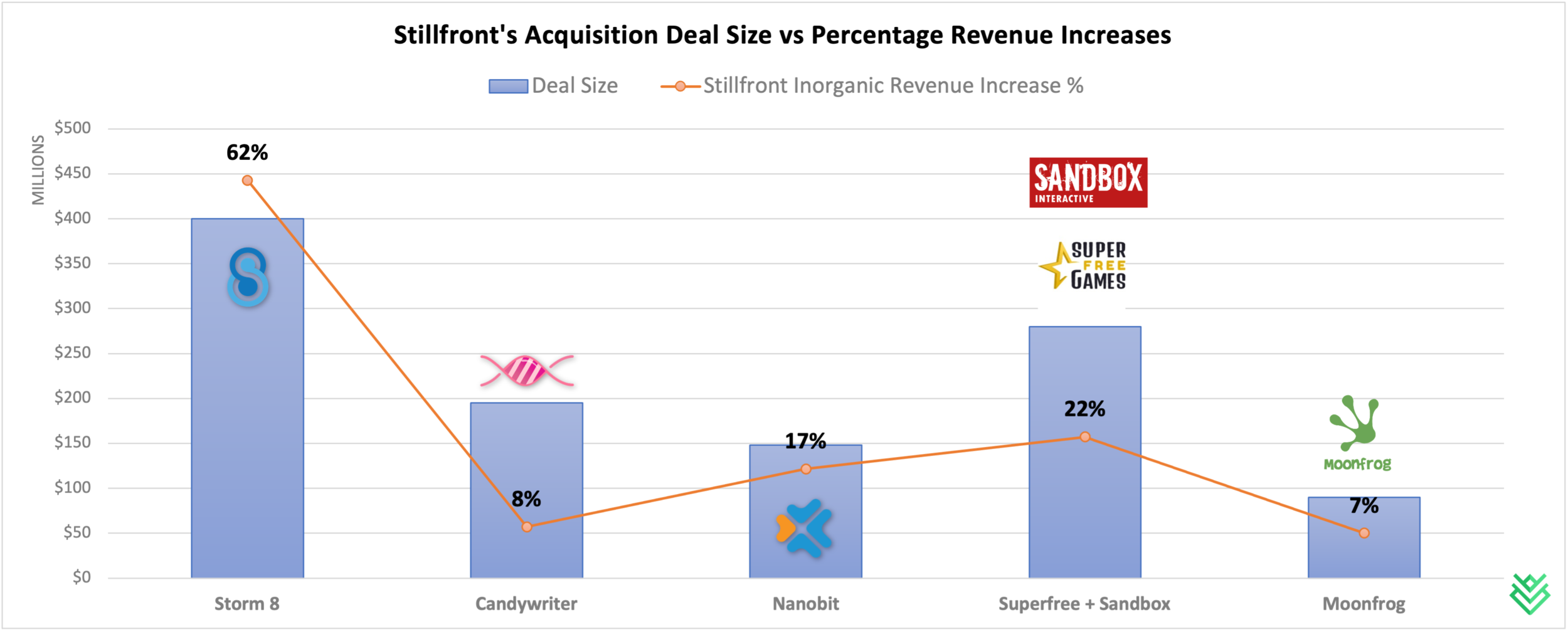

As we analyzed in Embracer’s case (and see across industries), even though building a federation of entrepreneurs and teams is fascinating, quality growth by acquisition is a tough treadmill to stay on long-term. This is probably underscored by the current pace of mobile games industry consolidation, which is showing no signs of slowing down. Stillfront is and will continue to live in a highly competitive M&A market with a limited pool of proven high quality studios that not only have long lifecycle games but also are looking to join a Stillfront-like entity to unlock their next stage of growth. And the reality is that Stillfront will not always acquire the creme-de-la-creme, which means maintaining healthy growth over the long-term will mostly come down to performing increasingly larger acquisitions of high performing studios. As seen below, Stillfront’s $400 million acquisition of Storm 8 speaks for itself versus other acquisitions over the last 12 months.

This chart shows the size of various deals (blue bar) as well as the revenue increases each acquisition immediately contributed (orange markers).

M&A isn’t everything, of course. Pushing for continued organic growth — a function of both new product launches and stellar live operations — is another source of value creation. Organic growth is a decent proxy of whether Stillfront’s older acquisitions continue to contribute upside and whether Stillfront’s group-wide synergies are actually paying off as expected. According to management, current organic growth is “decent,” and this is important to maintain as access to fitting M&A targets ebbs and flows. We’ll also want to study what type of returns on invested capital management is able to achieve over time as more and more capital gets used for acquisitions.

All in all, new mobile game launches aren’t guaranteed successes, and revenue growth through live operations is all about slow and steady growth. Continued organic growth is important, but M&A is still Stillfront’s key driver going forward — the prime source of opportunity and risk. We’ll keep an eye on Stillfront in the quarters and years ahead, and it’ll be interesting to see what deals they strike next.

Sponsored By GamerSpeak

GamerSpeak helps game companies with revenue of $200k+/mo increase their revenue and retention by 30% in 6 months or less with new or legacy titles.

We help game companies who:

-

Have limited insight into what will keep their super users interested in their game for a long time

-

Are looking for a long-term solution for increased revenue and retention

-

Have few or no existing strategy guides.

-

Have players who are unsure how the mechanics of the game work, and are not confident with their purchases.

In 4-6 months we deliver:

-

An increase of 15-30% of revenue and retention

-

Authentic player insights that lead to a clear understanding of what players want

-

Detailed recommendations for improving monetization and engagement with new features, in-app purchases, events, VIP programs, etc.

-

Strategy guides that educate players on all game mechanics, levels, features, events, and in-app purchases

"GamerSpeak’s insights into our users contributes about 30% ($300,000/mo) of our revenue and retention."

— Youngjun Hong: Producer, Netmarble F&C

Increase your game’s revenue and retention up to 30% in 6 months or less with GamerSpeak. Click here to see more case studies:

#3: Dissecting China’s Gaming Landscape

In the world of China games publishing, Tencent and NetEase are household names. Plus, Bytedance, which is increasingly known for its massively popular TikTok/Douyin app, is investing heavily into the gaming space as well. But who are the rest? China’s mobile games market is around $41 billion, serving over 660M gamers in Mainland China. Unfortunately, Chinese games companies don’t get much love in the global press, so let’s showcase a few here by breaking them out into four (completely made up) buckets:

Kingmakers:

Kingmakers are game developers or publishers who own large platforms, which gives them an edge in game distribution. For example, XD owns TapTap, a platform that’s become a total game changer in China, because it allows developers to distribute games with a Sweeney-approved 0% revenue share cut on China Android. As covered in our Genshin Impact breakdown, the game launched exclusively on TapTap, and IGG has also signed a deal with them for exclusive launches going forward. Another increasingly popular example is Bilibili, the largest long-form UGC video platform in China right now (think Crunchyroll meets YouTube). The ACG-focused video platform has 200 million monthly active users and boasts a high adoption rate among Gen Z (1 out of 2 Zoomers born after ’95 is on Bilibili). Bilibili has written big checks for esports right, recently signed deals for Fall Guys Mobile and Dead Cells, and almost definitely has more in the works.

Legacy Giants:

Legacy Giants are large game developers or publishers that earn most of their revenue in China. They are usually companies that did well in the browser game days and successfully transitioned to mobile. These teams’ huge war chests and strong focuses on the midcore / hardcore / MMO genre makes them a staple on China’s Top 100 Grossing list. Companies in the category include Shengqu, Yoozoo, Aligame, Perfect World, CMGE, Giant Network, 37 Games, and more.

Global Explorers:

The Global Explorers are developers or publishers that earn most of their revenue outside of China. These teams often take a global-first approach, and then launch the Chinese version of the games much later. You’ve definitely heard of these games, such as Habby’s Archero, Lilith’s AFK Arena, IGG’s Lords Mobile, FunPlus’s Guns of Glory, Magic Tavern’s Project Makeover, and Long Tech’s Last Shelter.

Independents:

Independents are self-publishing developers with one or two hit games that consistent place on China’s Top 100 Grossing list. These include miHoYo’s Genshin Impact & Honkai Impact 3, Pandada’s Ninja Must Die 3, Hypergryph’s Arknights, Happy Element’s Anipop, Qcplay’s Strongest Snail, and more.

This piece paints a broad outline and admittedly lacks detail, but we’ll spotlight many of these companies in the coming months. Comment or reply if you have any requests! Also, most of the publishers mentioned in this article are looking to publish international titles in China, which presents plenty of opportunity. (written by Owen Soh, China Market Entry Consultant)

#4: Artie Pivots to Take On Instant Games

Artie is an interesting startup I (Aaron, here) have an eye on. The company, whose original goal was to make AI-driven augmented reality avatars, has changed course, raised $10 million, and is now pioneering instant mobile games that can be played within social media, messaging, and video apps.

Why are instant games like this interesting? One popular reason — which gets extra attention these days thanks to Epic Games vs Apple — is that instant games bypass app stores and therefore the 30% fees that come with them. Additionally, not needing to download an app reduces friction, which means that conversion rates between impressions and players will be higher than traditional mobile games. Related, since these games are shared via social media, the best (or funniest) games will be positioned to go viral on sites with millions to billions of users, which reduces customer acquisition costs. And for companies and celebrities with massive followings, instant games can be another way to build engagement and potentially monetize. Sure, there are plenty of execution details to sort through — and most instant games will of course fail to gain traction — but it’s undeniable that this is a zone worth paying attention to.

Artie stands out for a few key reasons:

-

Unlike most instant games platforms, Artie’s SDK (coming soon) supports games made with Unity. Not only are basically all mobile developers familiar with Unity, but it means many types of quality-looking and quality-feeling instant games are possible.

-

Once you click on a link to play, game assets and data are cloud-delivered but graphics are rendered on the users’ devices. This means fast-paced games may have issues, but it minimizes most latency issues, data concerns, and makes most types of games playable.

-

Supposedly the company already has celebrity partnerships locked down for its first few games.

Promising, cross-platform tech that unlocks new UA opportunities and gameplay form factors is worth watching… but what could go wrong? To start, this cross-platform approach theoretically bypasses Apple’s storefront and rules (until they say otherwise), but it still means UA is dependent on major platforms like Facebook, TikTok, WhatsApp, or YouTube. These platforms can issue their own restrictions, but they could also become competitors with their own developer tools, instant games, and priorities. Having access to lots of different apps decreases the odds of getting screwed by concentration risk, but it’s something I wonder about. Instant games also seem to benefit those with large, pre-existing followings, and I also can’t help but think that instant games are a perfect area for a new UGC-enabled platform to take off (and I’m unsure if Artie is optimizing for that).

And, of course, there are still a ton of best practices to figure out, and not all genres, developers, and early adopters will succeed. Retaining users and therefore monetizing effectively is also a big question mark and could keep instant games relatively niche. There’s additionally a lot riding on Artie’s initial game launches, which could help determine the momentum at which prospective developers test the platform. Lastly, It’s worth pointing out that Artie isn’t alone in the instant game world. Playco, which we wrote about before, is also giving instant games a go with mixed results so far. That’s not the best sign for Artie, but it’s still the early days.

All in all, Artie is innovating on what instant games can be and how they work. There’s still plenty to sort out, the SDK isn’t quite accessible, and there aren’t clear signs of success yet, but I look forward to seeing where Artie specifically and instant games more broadly go from here.

🎮 In Other News…

-

EA completes its purchase of Codemasters. Link

-

There’s plenty of news out of Blizzcon, including updates on Diablo IV and Overwatch 2. Link

-

Nintendo unveiled a new Nintendo Direct, leading with a Splatoon 3 announcement. Link

-

Colossi Games secures $2.5 million in seed funding. Link

-

Netmarble doubles full-year profits for 2020 + acquires Kung Fu Factory. Link

-

Twitch and Facebook Gaming break viewership records. Link

-

Zynga announced Star Wars: Hunters, a free-to-play game for the Nintendo Switch. Link

-

Record year for Remedy despite no new game releases. Link

-

GDC drops in-person plans for 2021 event. Link

-

Striker VR raises $4 million for VR gun peripheral. Link

-

PC gaming hardware and accessories spending grew 62% in the US in 2020. Link

-

Paradox reveals new subscription service for Crusader Kings 2. Interesting business model shift. Link

-

As interest in crypto spikes again, Nvidia is nerfing crypto mining capabilities on its new graphics cards to avoid shortages. Link

-

'LinkedIn for gamers' Efuse raises $6m. Link

-

Saudi sovereign fund invests over $3 billion in major game publishers. Link

🖥 Content Worth Consuming

Unity CFO Kim Jabal interview: Understanding the tradeoff between market share and profits. (VentureBeat) “We talked about the concerns of investors — from the COVID-19 situation to the Identifier for Advertisers (IDFA), where Apple has chosen to focus on user privacy over targeted advertising. The latter will likely be Unity's advertising revenues, which are a big source of revenue. Overall, Unity has benefited from the enthusiasm for games during the pandemic as players try to distract themselves from reality during lockdown. Unity’s mission is to turn everybody into game developers, and that’s where it has been investing a lot of its resources.” Link

Interview: Microsoft's Head of Cloud Gaming James Gwertzman Talks Past, Present, and Future of Gaming Tech. (Gamerant) “Game Rant recently conducted an interview with James Gwertzman, the head of cloud gaming at Microsoft. Gwertzman was a fountain of knowledge and insight, providing a wealth of information on cloud computing, cloud services, and things to come in the games industry. From the future of machine learning to the history of cloud services, Gwertzman gave us a lot to think about. Considering the success of his company, PlayFab, after its acquisition by Microsoft, he's probably right in most of his prognostications too.” Link

Tomorrow on Rovio - Matthew Ball. (Spotify) “It’s hard to talk about gaming in 2021 and not come across references to the Metaverse. Fortnite, Roblox and Minecraft can all lay claim to be building it (in their own way) with many others trying to get in on the action. Who will be the first to successfully build The Metaverse is a question ripe for discussion and few have spent more time thinking about it than Matthew Ball.” Link

Embracer Group | Future, Synergy, and Focusing on the Long-term. (Gamemakers). “We get a comprehensive and in-depth discussion talking about industry consolidation/consolidators and more specifically about the Embracer Group. In a unique discussion, we get a very holistic perspective on Embracer speaking to: Lars Wingefors Group CEO, Kenshi Arasaki from A Thinking Ape, Ken Go from DECA Games and Randy Pitchford from Gearbox.” Link

‘Final Fantasy XIV’ director discusses the challenges of building an always-online game. (Washington Post) “Final Fantasy XIV: A Realm Reborn” is now considered the ultimate success story of how an always-online multiplayer game can recalibrate after high-profile failure. Like a “Snyder’s Cut” for fantasy role-playing games, except with a proven track record of 20 million monthly players, and one of the longest shelf lives of any online video game.” Link

Thanks for reading, and see you next week! As always, if you have feedback let us know here.