Hi Everyone! Today we have an exciting announcement - we’re thrilled to welcome Maria Gillies as a host of The Metacast! Originally from Portugal and currently in the UK, she’s been a gamer since childhood and currently works at Hutch as a PM on Top Drives. As the second host of The Metacast, she will be taking the Roundtables mantle from Nico and infusing the segment with her own unique flavor. It’s such a pleasure to have her aboard and don’t forget to check her first episode out below!

Roundtable #34: Network effects, User Acquisition Fundamentals, & F2P vs Web3 UA

In this Metacast episode, Matej Lancaric, Chong Ahn and Nico Vereecke join your host Maria Gillies to discuss:

-

Network Effects: Animoca Brands investment strategy has a “rising tide lifts all boats” approach explored our previous newsletter edition.

-

User Acquisition Fundamentals: Matej, Naavik’s in-house UA expert lays out the fundamental principles and best practices in user acquisition.

-

F2P vs Web3 UA: exploring the similarities and differences between UA for free-to-play and Web3 games.

If you would like us to discuss any other gaming-related topics, do reach out at [email protected]. We’d love to hear your general thoughts and feedback too! You can find us on Spotify, Apple Podcasts, Google Podcasts, our website, or anywhere else you listen to podcasts.

#1: Earnings Roundup: Take-Two, Capcom, and Nexon

Earnings season always feels like it comes in like a tidal wave and subsides slowly. With all the major acquisitions and our coverage last quarter, I’ll be recapping a few companies that we haven’t necessarily talked about lately. Interestingly, it was reported that after they merged ESL / FaceIt for $1B+, the Saudi Wealth Fund bought minority stakes in Capcom and Nexon (it also disclosed that it owns shares in EA and Take-Two), two companies I write about today. There’s a lot to watch and consider this earnings seasons coming off of a January’s acquisition spree. With that, let’s dive into the recap.

Take-Two

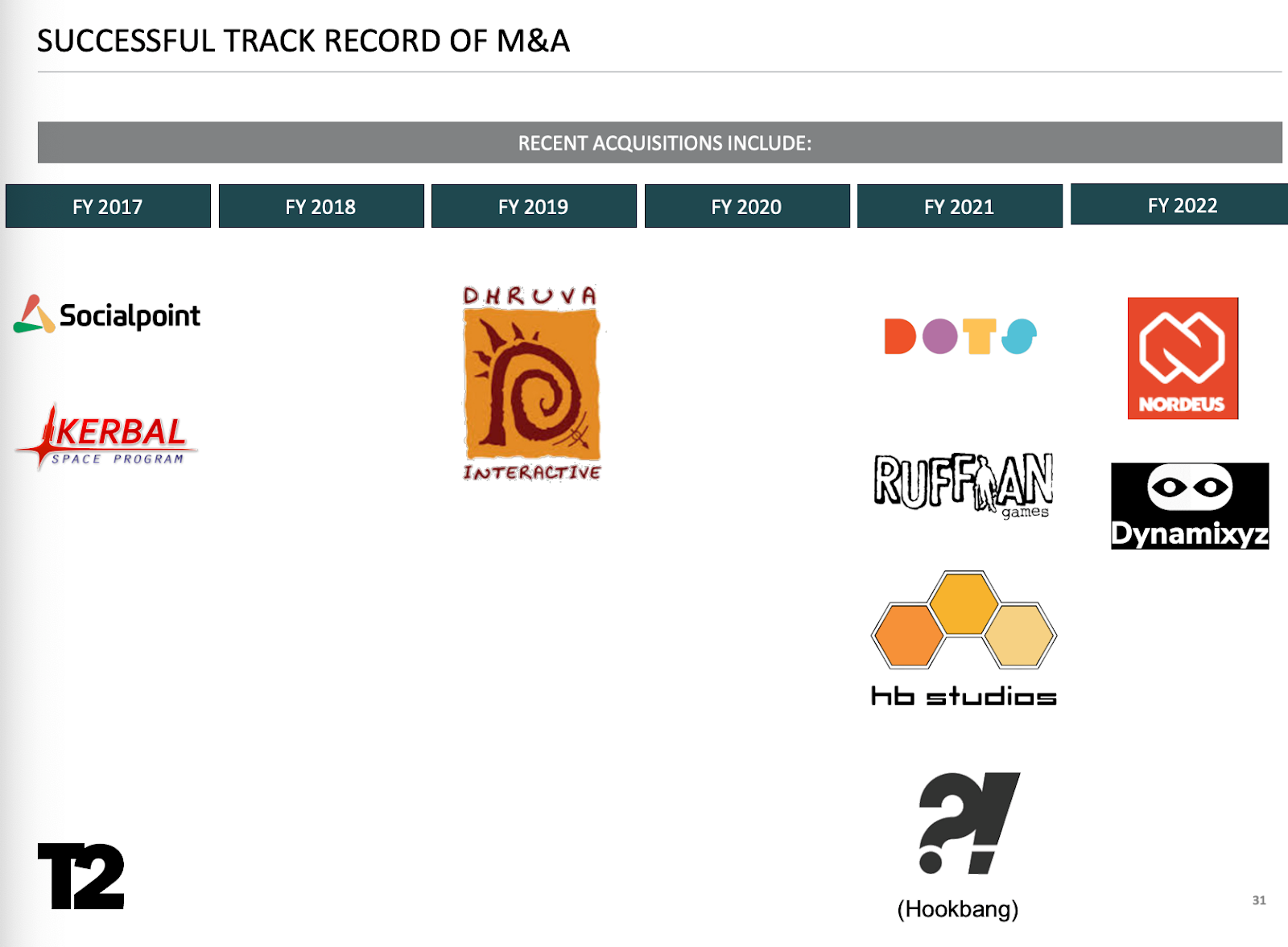

The Numbers: Take Two reported $866M in net bookings. The noteworthy call out for Take-Two is that 88% of its net bookings are now delivered digitally – GTA’s IP, 2K and RDR2 are the biggest drivers of this.

Key Takeaways: As we can see from the largest contributors to net bookings, Take-Two can further diversify its array of titles that drive significant revenue. For instance, even with their four-plus studios, mobile only accounts for 8% of bookings (vs. Console’s 75%). To this end, Take-Two recognizes a few key business drivers: expanding mobile offerings, pursuing emerging opportunities such as expanding into under-penetrated markets like China and driving toward recurrent consumer spending (65% of current total spend). They’re accelerating toward these goals.

Source: Take-Two’s Investor Presentation

What’s Next: implementing new business models, including subscriptions, F2P, and standalone online titles. In this regard, all eyes are on the acquisition of Zynga to 1) develop mobile titles across the hypercasual spectrum, 2) go increasingly cross-platform, and 3) mitigate IDFA for Take-two’s mobile studios. They’ve already identified about $500M revenue synergies and $100M cost synergies, and will likely continue to expand out Zynga’s recurring revenue streams. While this deal hasn’t yet closed, there will be a continued focus on M&A as well as continuing to invest in the company's strong development pipeline. The company still has a lot of cash ($2.7B left on hand) to make any necessary splashes in the market.

Capcom

The Numbers: Capcom reported strong quarterly results, with 21% operating growth YoY. Unsurprisingly, video games drive the ~75% of Capcom’s revenue at the highest margins (~40%) growing ~25% YoY. This past quarter, they drove $774M in revenue on $307M operating income, a new high for them.

Source: Seeking Alpha

Key Takeaways: Capcom’s core franchises include Resident Evil, Monster Hunter and Street Fighter. The company had two major growth drivers this past quarter: the release of Resident Evil Village (surpassed 5.7M shipped units) and Monster Hunter Rise (8M+ units sold in one year). Capcom’s forte is in console followed by PC. It does not have a strong mobile presence, but it’s not hard to imagine that they’ll leverage their strong IP into new cross-platform positions.

What’s Next: Capcom is entering the next quarter from a position of strength and growth, having demonstrated that its IP is resilient and able to expand. There are rumors of a Resident Evil 4 remake and a new Street Fighter in the works, but more so, Capcom has an increased focus on bringing this IP across mediums. Resident Evil, for example, will be in partnership with FB Reality Labs to launch in VR – if well-executed the potential is significant given the uptick in Oculus sales. Lastly, and the elephant in the room, is M&A, which Capcom can operate on both ends of the spectrum. This company has deep IP (MH / Resident Evil / Street Fighter) and experience in building it out across generations. At a ~$6.6B market cap, this makes them an attractive acquisition target for larger companies looking to strengthen an IP position and build out console expertise. However, Capcom also sits on a relatively strong cash position of $558M and can leverage this for synergies in cross-platform / mobile development, addressing some of their clear gaps, and build out existing games.

Nexon

The Numbers: Nexon reported solid earnings mostly because this was a reset year for them to invest in growth and 2020 was a tough year for comps. They delivered ~$470M in revenue (decreased 18% YoY) on ~$26M in operating income decreased 81% YoY). Revenue for 2021, decreased 6.3% YoY to $2.3B. This past year, Korea and China made up 83% of their revenue mix, of which 72% was driven by PC and 28% by mobile.

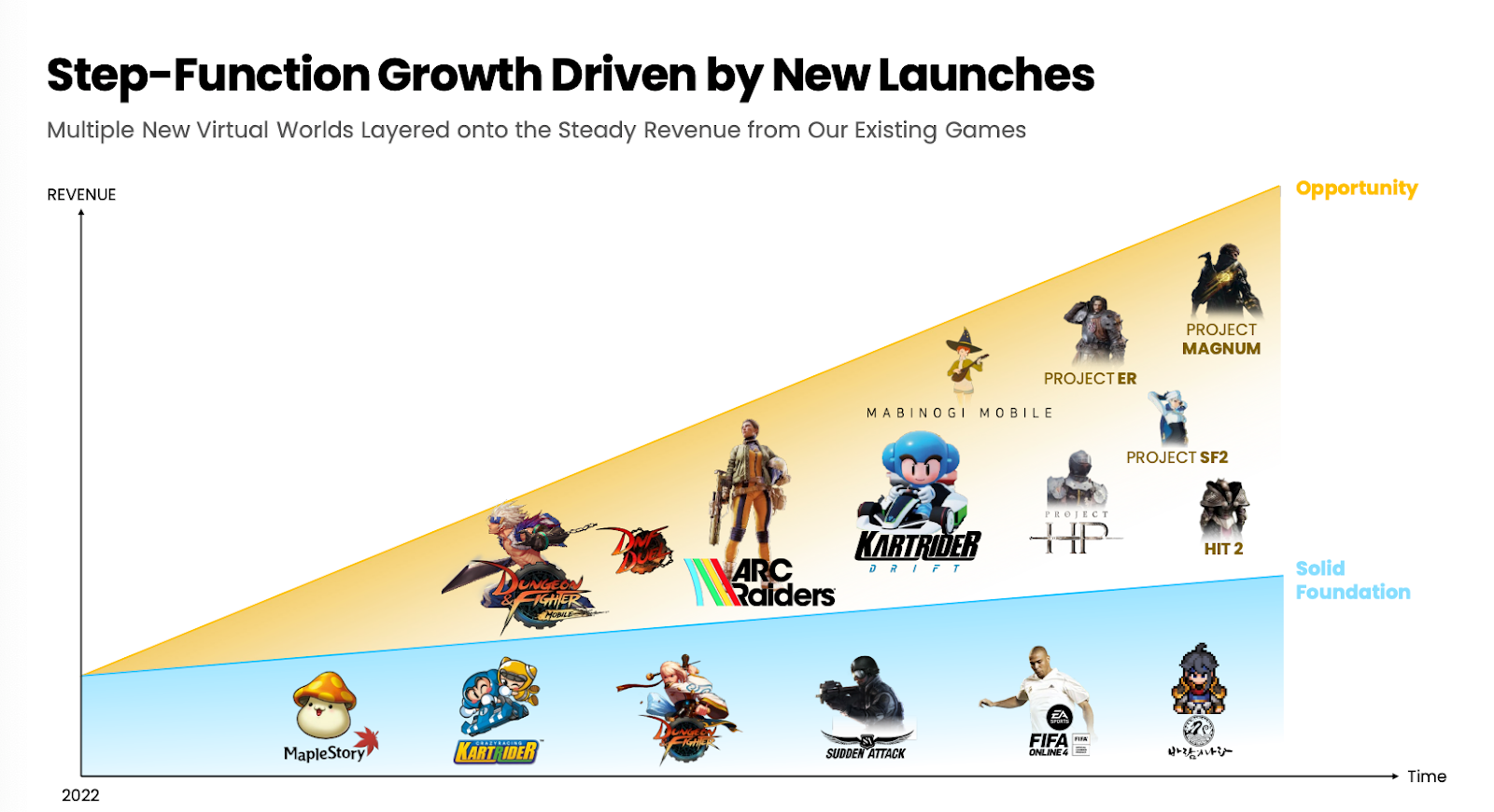

Key Takeaways: Nexon has been investing deeply in a few aspects: 1) new games that deliver higher operating income to be able to reinvest capital, 2) technology to build and operate “virtual worlds”, and 3) better IP to expand their audience. Nexon has framed 2021 and their performance as an “investing in growth” year – strengthening monetization strategies, content, and leadership in core titles like China’s Dungeon&Fighter (this IP has generated over $18B+ in lifetime revenue) and Korea’s MapleStory ($3B+ in lifetime franchise revenue). Nexon is in a strong position to be able to reinvest cash on its balance sheet into its IP pipeline for titles that are immersive and online, which further reiterates their intention to invest in virtual worlds.

Source: Nexon’s Investor Presentation

What’s Next: 2022 might gear up to be a big year for Nexon compared to the headwinds it faced in 2021. It’ll be their biggest year of new releases with four-plus titles slated for launch, not including existing IPs like Dungeon&Fighter localized for other regions. It appears that two of Nexon’s cornerstone tenets will be to expand their IP across markets and platforms, and to build better user experiences for their immersive titles. They’re in a really good position to do this, securing partnerships to develop mobile titles for IP like Warhammer and building out their tech to better scale existing and upcoming titles, reflective of their ambitious pipeline on PC, mobile, and console. I’m personally excited by Nexon’s ability to execute on IP expansion in key regions outside of Asia – there’s a lot of risk being in China (21% of bookings), but they’ve demonstrated expertise in PC (65% of bookings) and mobile (35% of bookings). It’s time to deliver outside of their core areas. Similar to Capcom, Nexon is in a unique position in that it can operate on both sides of the M&A spectrum: as an acquisition target because 1) of its Asia market and PC / mobile expertise, and 2) of its strong IP pipeline at a ~$19B market cap, but also as an acquirer to bolster console and NAMER / EMEA exposure with $~3B in cash on its balance sheet. (Written by Fawzi Itani)

#2: Epic Game Store’s 2021 Review

Source: Epic Games

Earlier this month, Epic Games released a 2021 lookback on the performance of their games marketplace, the Epic Game Store (EGS). While the write-up was filled with plenty of numbers, there are a few specific metrics that stood out to me:

-

EGS generated $840M in spend (20% YoY Growth)

-

The company had 194M users across 2021 (+30M vs 2020)

-

Third-party developers made up 36% of total spend on EGS, up 12% from 2020

-

The company had over 756M games claimed through their free game program

From the looks of the report, EGS is growing in every direction. More users are using the product more frequently to buy more games. However, one number in the report that caught my eye is third-party developers spend, and more specifically that only 36% of EGS’s total sales were generated by third-party games. While it’s never been a secret that most of Epic’s newest businesses, including EGS, have been financed by Fortnite and other first-party Epic titles, the surprisingly low mix of Epic vs Non-Epic sales could be a cause for concern. If the company truly wants to create a more developer-first marketplace for games and the flywheel with other services, they need to cater to players and titles that are outside the broader Epic ecosystem. To be fair, 36% of sales isn’t an insignificant amount. But comparing that to a competitor like Valve, which has mostly opted toward making Steam a third-party developer marketplace, the number is stark. How can Epic continue to raise this number to create a more self-sustaining business?

Epic’s history toward third-party success has been fraught, not without its obstacles — to date Epic’s third-party onboarding strategy has been exclusively centered around minimum guarantees. The plan was simple: the company would front external developers large sums of money to be on their marketplace in order to mitigate risk and entice developers into their ecosystem. This was a substantive bet for the EGS team — they reportedly invested north of $130 million in their first batch of third-party games. And while the deal was successful in bringing hit games like Metro Exodus to the platform, sales didn’t pan out in the way Epic envisioned. As Simon Carless noted in his analysis of one of the many Epic vs. Apple document releases (which I highly suggest reading), minimum guarantees only resulted in the company recouping only 20% of their investment across 70% of subsidized games. Since, Epic has changed its approach, opting instead to invest in their new self-publishing business as the main pathway to third-party success. Why does this matter?

On paper, Epic’s self-publishing model sounds more promising than its minimum guarantee approach. The company offers third-party developers financing, distribution, technical support, and marketing for their titles at the click of a button. It’s a full-service go-to-market offering that comes with the added benefit of more games for EGS. While the service only launched in beta in 2021, I think it could be the solution to EGS’s third-party sales problem. My optimism comes from the deeper benefits that developers capture via publishing as compared to minimum guarantees. While guarantees decrease financial risk, they don’t ensure that a game will actually get into the hands of players, or that a developer will be able to develop the IP into something sequel-worthy. Meanwhile with publishing agreements, developers can build deeper, longer-terms relationships with Epic with better support than they would get from just a minimum guarantee.

On Epic’s side, building the relationships and launching new titles can also help bolster the company in a myriad of ways. If Epic does a good job publishing the game, developers will almost certainly come back to them for their next launch rather than finding an alternative or investing in in-house publishing. Increased publishing opportunities also means Epic has a higher chance to land the next big hit on EGS first, before it can be discovered on Steam. This is a huge opportunity for growth. To set some context, the top games on Steam today regularly average over 200,000 concurrent players, which is nearly 2% of EGS’s 2021 total peak concurrents across the year. Imagine if Epic could launch a title responsible for increasing its user base by 2% on its own. Self-publishing these titles also creates opportunity for Epic to become the exclusive home of bigger hits and to catalyze a better flywheel for its other services. The possibilities from a successful publishing business are numerous — its not hard to imagine a world where EGS launches a service like Microsoft Games Pass, combining a variation of minimum guarantees, current free-game UA strategy, and an enticing publishing agreement for developers. This could be an EGS-only bundle that brings in new users and brings in more sustainable revenue sources.

As we look ahead into 2022, I plan to continue to keep a close eye on EGS’s publishing arm as a source of growth for their third-party revenue streams. Epic has already announced that they plan to launch the service publicly in 2022, and is likely diverting the resources they had previously saved for minimum guarantees into their publishing business over the course of the next few months. (Written by Max Lowenthal)

🎮 In Other News…

💸 Funding & Acquisitions:

-

Polygon raised a massive $450M round. Link

-

Everyrealm, which invests in all aspects of virtual land, raised a $60M Series A from a variety of crypto and gaming investors. Link

-

Metafy, a marketplace for video game coaching, raised a $25M Series A. Link

-

Salad Ventures raised $13.5M to build Guild infrastructure for P2E gaming. Link

-

Strider announced a $3M seed for DAOs to enable game creators. Link

📊 Business:

-

Microsoft makes it clear that games will be cross-platform, marking a shift in console strategy. Link

-

Gala Games committed $5B toward its NFT expansion efforts, $2B of which is expected to go to games. Link

-

Meta Quest store revenue quadrupled the past three years. Link

🕹️ Culture & Games:

-

Tom Holland in Uncharted and what that means for Hollywood’s entry into gaming. Link

-

Bunch pivoted to a social x gaming metaverse from a group video chat app. Link

-

Riot Games launched its latest game (made by Riot Forge) exclusively for Netflix’s mobile games platform. Link

-

Nintendo Direct recap. Link

👾 Miscellaneous Musings:

-

With the success of recent its Master Duel games, an interesting look at Yu-Gi-Oh’s Meta. Link

-

Apple Arcade breaks free-to-play, but not how you’d think. Link

-

Cris Tales’ marriage of JRPG inspirations and Colombian charm. Link

-

Predicting the games industry’s biggest trends of 2022. Link

-

Nostalgia is a big business. Link

🔥 Featured Jobs

-

Mighty Bear Games: Senior Technical Artist (Singapore)

-

Mighty Bear Games: DevOps Engineer (Singapore)

-

Proxima: Head Of Decentralized Economies (Remote)

-

Beamable: Product Manager, LiveOps Portal (Remote)

-

Guild of Guardians: Head of Partnerships (Remote)

-

Polygon Studios: VP Gaming (Remote)

-

Ello Technology: Lead Unity Engineer (SF; Remote)

-

Naavik: Content Contributor — Writer (Remote)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below.

Thanks for reading, and see you next week! As always, if you have feedback let us know here.