Hi Everyone! Today we have an exciting announcement:

We’re thrilled to welcome Helo Yoshioka as the newest member to our consulting team! She comes with a background and passion for economy design, and has been in the industry since 2011. Previously, she worked at Wooga, Tapps Games and even founded an indie collective of seven people called Catavento Games. At Naavik, her key focus will be in providing game and economy design consulting for F2P and blockchain projects. We’re so excited to welcome her aboard!

Naavik Exclusive: Roundtable #30

In this Metacast episode, Yonatan Raz-Fridman, Devin Becker and Abhimanyu Kumar join your host Nicolas Vereecke to discuss:

-

Take Two buys Zynga for $12.7 billion

-

Is Roblox exploiting young game developers?

As always, you can find us on Spotify, Apple Podcasts, Google Podcasts, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: Unpacking Take-Two’s Acquisition of Zynga

Source: Wccftech

2022 is already making gaming history. Last week, Take-Two Interactive announced its intention to acquire Zynga for approximately $12.7 billion ($9.86/share), marking it the largest gaming acquisition ever.

For comparison:

-

In 2021, Microsoft acquired Zenimax (Bethesda) for $7.5 billion

-

In 2016, Tencent (via a consortium) purchased an 80%+ stake in Supercell at a valuation of $10.2 billion

-

In 2016, Activision Blizzard acquired King for $5.9 billion

So yes, this is a big deal! Let’s take a quick look at the numbers, dig into the rationale behind the deal, and then wrap up with some thoughts on the combined company and what it says about the broader industry.

The Numbers

Take Two will acquire Zynga for $9.86 per share, which is roughly 20% below its 52-week high but a 64% premium over the price at the time of announcement. The deal is a mix of cash and stock, and it should close in the first half of this year. Zynga shareholders will receive (per share) $3.50 in cash and $6.36 in Take-Two stock (based on the price at the time of the announcement). The exact stock numbers may shift as Take-Two stock moves, but the terms are locked.

In order to pay roughly $4.5 billion in cash to Zynga shareholders, Take-Two will tap into its balance sheet (currently a net cash position of $2.06 billion) and take on an extra $2.7 billion in debt. This obviously weakens the company’s balance sheet — especially since Zynga is also a net-debt business (barely) — but the combined company will generate abundant cash flows, so adding low interest rate debt isn’t a concern.

The stock side of the deal is, in some ways, more interesting. In effect, the combined company will be ~70% owned by existing Take-Two shareholders and ~30% owned by existing Zynga shareholders. 30% is a lot to give up in one transaction!

There’s technically a 45-day go-shop clause, so it’s possible that another suitor comes along and offers a better deal (which would trigger termination fees). However, that’s unlikely to occur given how few companies could handle the large price tag. Activision Blizzard has its hands full, EA is still digesting Glu, and it’s a geopolitical impossibility for major Chinese companies like Tencent and NetEase.

The combined company, if viewed over the past 12 months, would have generated $6.1 billion in bookings and $769 million in adjusted operating cash flow (pro forma). The combined company is also targeting a 14% compound annual growth rate (CAGR) in bookings over the next three years, which is solid growth. This is likely influenced by the launch of a new Rockstar game, but it’s still a big step up and a positive note about the future.

Why Is Take-Two Buying Zynga?

For one — as we can see from previous acquisitions of Social Point, Playdots, and Nordeus — it’s obvious that CEO Strauss Zelnick has been itching to grow Take-Two’s mobile presence. These actions were a start but neither moved the needle in a huge way nor led to a unified mobile strategy. Given Take-Two’s clear desire to be viewed as a titan of industry alongside Activision and EA, making a bigger move into mobile is unsurprising and largely predictable.

One major benefit to Take-Two is less about the games and more about the business model. Take-Two — given its occasional blockbuster hits with IP like Grand Theft Auto (GTA), Borderlands, BioShock, and Red Dead — has always produced a lumpy revenue stream. And lumpy revenue streams are often misunderstood and devalued by the market. Zynga, on the other hand, with its collection of forever franchises and ongoing bold beats, delivers fairly steady revenues. Adding Zynga’s recurring revenue streams into the mix will make Take-Two a more predictable business, which may be assessed more favorably in public markets.

Additionally, this acquisition comes with mobile leadership and a structure that already supports multiple, mostly autonomous mobile studios. Rolling up essentially all of Take-Two’s mobile operations under Zynga’s proven leaders and systems will take time (and may ruffle some feathers) but is a likely synergy. This mostly distributed approach is also how Take-Two operates, so it’s a clean fit. Zynga’s CEO and President, Frank Gibeau and Bernard Kim, respectively, will be sticking around to lead the integration. Before joining Zynga, Frank spent 23 years at EA in various leadership roles, so it’s not crazy to think there may be a long-term path at Take-Two for Frank to continue leading.

Beyond adding recurring revenue and integrating talented leaders and systems, most other notable synergies are debatable:

-

Could Zynga take Take-Two’s IPs to mobile? Maybe in some abstract ways, but as we’ve seen at Activision Blizzard with King, even talented mobile teams can’t attack all genres well. If GTA, Take-Two’s largest brand, pursued mobile in a big way, it’s hard to see a Zynga studio successfully leading that charge.

-

It’ll likely also take some time before any exciting, needle-moving cross-platform projects emerge.

-

Further, perhaps there’s a way to build and extend a more unified data collection / targeting system across the combined company; however, it’s hard to see many cross-promotions becoming great fits since Zynga’s and Take-Two’s audiences are quite different (except perhaps across Take-Two’s existing mobile studios).

-

There may also be some cost reductions from duplicative overhead, but that’s not worth celebrating, and it wouldn’t make much of a dent anyway.

-

It’s also worth keeping an eye on brain drain; lucrative exits, especially when getting tucked into even larger operations, can sometimes disincentivize employee retention. Many achievement-oriented employees may look for more upside elsewhere.

Last thought: the deal appears fairly expensive, especially given Zynga’s struggles of late and compared to what Activision paid for King a few years back (which, in hindsight was a worthwhile buy given Candy Crush’s longevity). Sure, the market is in a different place now — and maybe there’s more we don’t know — but Take-Two is giving up quite a bit to lock Zynga down. The boldness is a change of pace given Take-Two’s traditionally conservative approach to M&A, but if Take-Two can deliver on its 14%+ CAGR goals then the combined company will well set for success.

Why Would Zynga Want To Be Acquired?

Let’s start by giving credit where it’s due. Yes, Zynga is getting acquired at a lower price ($9.86) than it IPOd at in 2011 ($10), but that simple view masks a tremendous turnaround effort that current management executed over the past six years. After multiple successful studio acquisitions and bringing to life an impressively scaled live ops strategy, Zynga became an industry juggernaut once more. For a while, given its successful studio tuck-ins, pipeline of new releases, bold-beats-driven organic growth, and plenty of capital to continue deploying, it seemed like Zynga was on a great track for continued growth.

So what changed? The short answer is Apple’s IDFA deprecation. Suddenly, player acquisition efforts became more challenging, causing Zynga to lighten up its advertising spend, which led to decelerating revenue performance. In order to find growth in new places, Zynga pursued deals like Rollic (hypercasual) and Chartboost (an ad platform), which expanded the scope of the business but not in a transformationally positive way. As growth slowed and Zynga’s scope expanded, the stock got punished. And when an acquisitive company’s stock price falls, its shares are less usable as a currency for acquisitions, which creates a bit of a double-whammy. Honestly, even though I knew Apple's privacy changes would have a notable effect on customer acquisition efforts, I still underestimated (along with most of the market) just how different the post-IDFA world would be for Zynga.

In short, Zynga was still a solid business but struggling to organically grow. We can therefore intuit that if management was willing to sell at a price of $9.86, they didn’t feel confident in Zynga’s ability to chart a path back up to all-time highs in the near- to mid-term. Instead, it’s likely that management viewed a 64% premium as a great win given the circumstances.

Now What?

It’s safe to assume that the deal will go through in the coming months and that the integration of mobile teams will take some time, but given Zynga’s current struggles, I doubt that it will propel Take-Two’s growth rates in the near-term, but Take-Two has more irons in the fire. Take-Two won’t immediately benefit from Zynga’s relatively high margin recurring revenues. On top of continued success in franchises like NBA 2K, I agree with other analysts that Take-Two’s three year guidance likely includes the launch of another Rockstar game (among other things). Will it be GTA 6? No clue, maybe not. Will this game actually come out on time? Who knows, but given the additional mobile revenue, any delays will hurt less than they used to. Take-Two is well positioned to step up even more as a leading publisher, and I genuinely look forward to seeing how they’ll execute and evolve in the next few years. I lean optimistic.

It’s also worth noting that if Zynga — which is best in class in many ways — is struggling to grow and turned to a buyout, other mobile games companies likely are too. A mobile deal like Zynga will be hard to top, but there certainly are other mobile companies looking to get snatched up with similar premiums. 2022 may not be quite as active with M&A as 2021 was, but I’d guess that a major focus of M&A this year will revolve around mobile consolidation. Furthermore, as industry giants like Microsoft, Sony, EA, and Tencent seek out additional growth (and even newer entrants like Netflix and Amazon look to find their places), mega-deals may keep popping up. Zynga broke the record, but it might not hold it for long. (Written by Aaron Bush)

#2: China’s Gaming Crackdown

Source: SCMP

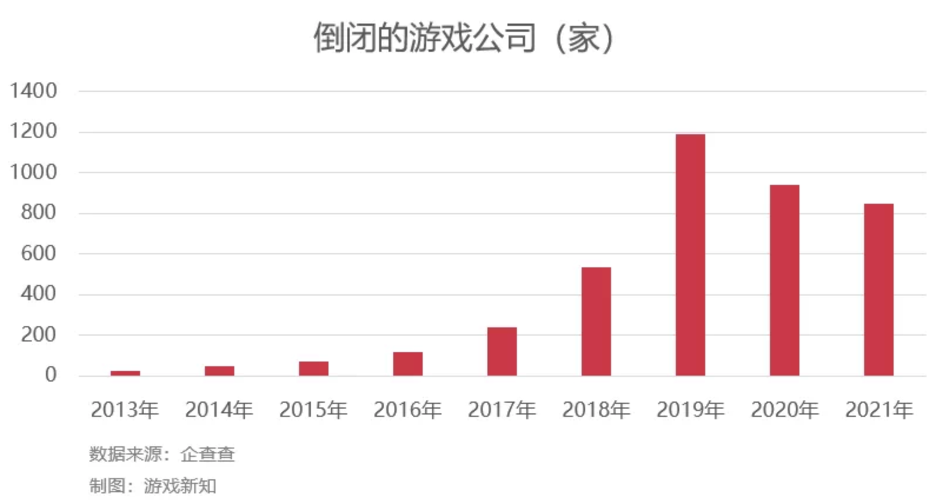

The South China Morning Post kicked off 2022 with a banger of a headline: “China gaming crackdown: freeze on new video game licenses extends into 2022 as 14,000 gaming-related firms shut down.” In a country where there are 40,000 gaming-related firms, this is quite impactful. Digging deeper, however, the number of closures (of interest) is closer to ~850 (businesses with a least one patent), according to Niko Partners. The 14,000 numbers represents businesses on all parts of the video game value chain that have been deregistered since the summer, a clear increase from the 18,000 gaming-related firms that closed across all of 2020. It's hard to say when exactly approvals will resume, but it's clear that the Chinese government is attempting to push talent into other industries, and it puts a huge damper on the industry's domestic growth potential.

Either way you look at it – 14K or 850 – the numbers aren’t too healthy (the caveat here is the 850 numbers is a declining trend, YoY, and that there are more games companies in China than ever before at <40,000. This discussion is more nuanced than 14K). The bigger issue in my opinion is that there has been an eight-month stretch without any approvals, a process that’s already insanely difficult to get past and where 80-100 games typically would be approved each month. This number is now zero.

Source: Weixin; shows declining trends of company closures. This signals healthy competition and adapting business models. Should current regulatory trends continue, we may expect to see more business closures in 2022, though. These are businesses that have at least one software copyright

There’s no point in speculating the reasoning behind this, but one of the important takeaways is that Chinese supergiants like Tencent and Netease are losing control of the regulatory picture. As they’re usually the funnels for foreign games into China, and with fewer games being domestically produced, they’re shifting their gaze outward. As we outlined here, Chinese gaming companies need to develop global markets to survive and thrive.

The way I see it is there are three paths forward, all of which are mutually inclusive to one another:

1) To participate in the global M&A spree outlined by colleague Aaron above. Tencent is already a tenured first-mover in this space, with the ability to purchase at large and competitive multiples. Other mobile publishers will have to follow suit, and my prediction is that they start slowly in Asia and expand into Europe once the synergies prove out (although there are geopolotical tensions abound);

2) To build local presence in many geographies. TiMi Studios, for example, opened a variety of new studios this past year. Even, Supercell is expanding into North America to establish new presence and expertise;

3) To acquire domestic studios with experience shipping to a global audience through cross-platform (e.g Switch, mobile) and PC (Steam). Mihoyo’s success with Genshin Impact is the canonical example, but there are a plethora of other studios with a history (and future potential) to ship games through Steam. In my opinion, this article had the best take on Steam’s publishing potential:

“The rise of Steam in China has also coincided with a wave of commercial and critical success for Chinese games overseas—and for many of those games, the platform’s been a critical part of their success. In fall last year, the free-to-play anime style RPG Genshin Impact, from mid-sized Shanghai studio Mihoyo, was released simultaneously on mobile and PC (although notably not on Steam) and quickly became one of the most popular games in the world. In January this year, Dyson Sphere Program, a sci-fi strategy sim from a six-person studio in Chongqing, was released on Steam and went on to sell over a million and a half copies. Most recently, Shanghai-based indie studio Pixpil’s gorgeous pixel-art RPG Eastward rocketed up both the Steam and Switch sales charts upon its release last month. And these are only the most prominent of the Chinese hits to have garnered global attention. Others like My Time at Portia and Bright Memory have also earned strong sales, while upcoming games like Black Myth: Wukong and ANNO: Mutationem have successfully generated a lot of hype among both Chinese and global players.”

Of course, there is always the possibility that China’s government shuts down the VPN version of Steam and fully commits to Valve’s China version; so, there is inherent platform risk to any studio building with the intention of launching on Steam. I still expect larger publishers to acquire these business for less competitive multiples because of the risk dependencies associated with distributing their games and then roll these smaller studios into their organizations, perhaps even on a global level. What I’d be most worried about is if publishers decelerate the rate at which they’re importing games into China and domestic early-stage funding for venture-backable studios lessens its pace.

A throwback to Roblox’s Propectus and their stated intentions to expand into China

Despite the daily regulatory changes, it remains that China is the largest games market in the world and an attractive market for any publisher (despite the hassle). And interestingly, as local players look to global markets, there are a few companies that are still doubling down their efforts there. Roblox is rebuilding its experiences to fit within China’s regulatory compliance framework. Minecraft has canonically been a big success in China. We also chatted above how Steam has built a China-compliant version. These are bright spots amid an increasingly strict regulatory environment. 2022 data on closures, approvals, and funding should provide more context on a way forward. (Written by Fawzi Itani)

🎮 In Other News…

💸 Funding & Acquisitions:

-

Take-Two announced it would acquire Zynga for $12.7B, the largest gaming acquisition ever. Barron’s | Stratechery | GI.biz

-

Team17 acquired Astragon Entertainment for $85.6M. Link

-

Yahaha Studios raised $50M for its no-code game development platform. Link

-

Fan Controlled Sports raised a $40M Series A from Delphi Digital and Animoca Brands. Link

-

Forte acquired N3twork’s Platform Technologies and Team. Link

-

Odyssey raised $4M for its metaverse stack for collaborative software. Link

📊 Business:

-

Drake Star reported that games M&A activity reached $85B in 2021. Link

-

Meta, Oculus, and Antitrust. Link

-

Niko Partners forecasts that the Middle Eastern gaming market will grow to be a $3.1B TAM by 2025. Link

🕹️ Culture & Games:

-

Worlde and IP Law: When happens when a hot game gets cloned. Link

-

Crypto Enthusiasts Meet Their Match: Angry Gamers. Link

-

“What sort of multiplayer is easier than an MMO?” Link

-

Bilibili is banning violent games like Witcher and GTA amid tightening restrictions. Link

👾 Miscellaneous Musings:

-

Coinbase hosted a Twitter Space on blockchain gaming. Link

-

Corentin Selz — 10,000 game experiments. Link

-

An NYT profile on Discord’s journey to becoming a social hub. Link

-

Rami Ismail on the difficulty of interoperability. Link

🔥 Featured Jobs

-

Polygon Studios: VP Gaming (Remote)

-

Rec Room: UGC Development Lead (Seattle; Remote)

-

Riot Games: Biz Ops Manager (LA)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below.

Thanks for reading, and see you next week! As always, if you have feedback let us know here.