Hi everyone. Our recent sample report — Axie Infinity: Infinite Opportunity or Infinite Peril? — has taken the internet by storm, and we’ve been thrilled to see the overwhelmingly positive reception. Remember to check it out and to sign up to our research portal if you want a new report on blockchain games each month, and keep an eye out for our next report coming early in December focused on Zed Run.

Last Sunday's most popular links included: Lumikai's piece on decoding the use cases for blockchain gaming, details behind the 100 ETH sale of Matthew Ball's Metaverse essay, and Brian Cho's Twitter thread on the intersection of Web3 + Gaming.

With that, let's dive into today's issue.

Naavik Exclusive: Crypto Corner #2 - Loot, The Hyperverse & The Future of Human Collaboration

“Loot is a time machine into the future of human collaboration and work. We are building the Star Wars of the next generation”

In this Metacast CryptoCorner episode, your host Nico is joined by Timshel and LordOfAFew to take a deep dive into the Lootverse. What emerges from the conversation is a mind-boggling journey into the Hyperverse. The Hyperverse is a place where hundreds of builders are collaborating in a trustless, permissionless, distributed, global, pseudonymous and asynchronous way.

It’s not clean. It’s not pretty. It might not go anywhere. But no one can stop them, and what might emerge could change the way we look at how humans work and collaborate.

As always, you can find us on Spotify, Apple Podcasts, Google Podcasts, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: InvestGame Gaming Deals Activity Report Q1-Q3

At InvestGame, we were stoked to partner with Naavik on our latest Q3 report. There’s a lot to uncover, but let’s dig in on some of the major insights.

For the first 9 months of 2021, we saw more deals than in 2020FY (667 vs. 664), and together, these deals bring 72% more in value than that of 2020 ($57.7B vs. $33.6B). The Gaming segment (as opposed to Platform&Tech, Esports, and Other sections) represented the biggest segment, occupying 75% of the total deal value ($43.4B), and 57% of the total closed deals number (382).

Compared to the Jan-Sep period of last year, Q1-Q3’21 showed a 2.5x growth in the cumulative deal value ($57.7B vs. $22.7B), and a 46% growth YoY in the number of deals (667 vs. 457), with substantial upsurge in all categories, including M&As ($27.9B vs. $8.4B), public offerings ($21.2B vs. $9.6B), and private investments ($8.6B vs. $4.7B). 224 M&As provided for nearly half (48%) of the closed deal value (with only one closed mega-deal — $1.4B acquisition of Playdemic by Electronic Arts), public offerings (Q3’21 had the biggest Public Offering YTD — $3.75B IPO of South Korean gaming holding Krafton). We also saw 59 transactions, accounting for around 37% of the total value, while private investments contributed 15% with 384 closed deals (with Sorare’s $680M round being the biggest private transaction).

Once again, BITKRAFT led on total deals closed, with 17 closed deals and the leading deal value of $122.5M. This was followed by Galaxy Interactive and Makers Fund. The top-15 VCs in deal volume have together invested approximately $2.5B of disclosed deal value in Q1-Q3’21, displaying a continued venture interest in the gaming industry. As for strategics, Tencent, unsurprisingly, closed a total of 69 deals for Q1-Q3’21 with overall disclosed deal value of $1.5B.

But of course the biggest hype train right now is the blockchain gaming: Q3’21 alone got an outstanding $1B+ deal value across 16 deals, while the cumulative Q1-Q3’21 deal value of $1.56B represents an overwhelming 34x growth YoY. The biggest rounds of Q1-Q3’21 were Sorare’s Series B ($680M), Dapper Labs’ Series B+ ($250M), and Forte’s Series A ($185M).

(Written by Anton Gorodetsky of InvestGame in collaboration with Naavik)

Sponsored by Growth Fullstack

Turn your data into powerful insights - Free Trial!

“Game developers need help to make sense of the post-IDFA world of mobile marketing." - Hernan Zhou, CTO, Lucky Kat Studios

Growth FullStack does just this - helping developers and mobile marketers navigate the privacy-first marketing landscape - without expensive data science.

-

Simply collect the data that you need (from sources such as SKAdNetwork, AppLovin, and many others);

-

Store it in the way you want (using platforms like Google BigQuery, Amazon S3 and others);

-

Gain insights via an intuitive dashboard built on top of the data (such as Metabase, Tableau and others);

And optimize your campaign's activity using off-the-shelf or custom analyses.

Growth FullStack offers affordable insights via a no-code, plug-and-play model that lets you get back to making great games and apps.

#2: Devolver Digital IPOs

Source: Screen Rant

A little over a week ago, Devolver Digital, a publisher of indie games, went public on the London Stock Exchange, raising $261M at a ~$1B market cap. In the grand scheme of recent tech and gaming IPOs, this one felt relatively small but it’s notable for its timing relative to gaming macro trends, recent successes, and expansion ambitions. Let’s dive in.

Source: Devolver Digital’s S-1

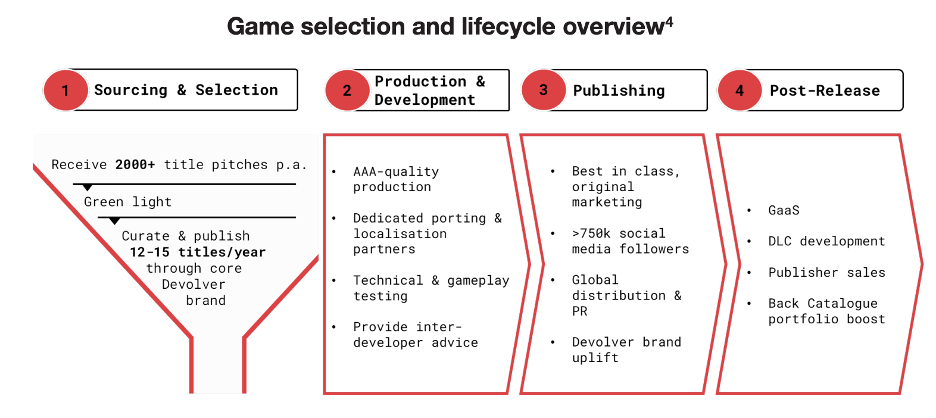

As a game publisher, Devolver Digital’s biggest value add its brand exposure and marketing expertise. Its model can be boiled down into a curation service of distributing promising games across relevant platforms. In a world where there are so many options to choose from (the canonical problem of platforms like Steam), it pays dividends to have access to titles that players know will be expertly crafted and curated. The company says it best in their S-1:

“Demand for quality content has surged in recent years. This benefits Devolver in a couple ways:

-

Platforms and stores will provide advanced payments for exclusivity over a new title for a fixed period post-release. The advanced payments can offset some or all of the cost of development and publishing, substantially de-risking Devolver’s model.

-

Subscription services will pay publishers for bundles of back catalogue games to use on their platforms, providing Devolver with another lever to monetize its back catalogue. Devolver’s strong brand in the indie space means that the Group attracts high-quality game ideas from developers. This contributes to the Group’s track record for publishing high-quality titles that consistently score well with critics and gamers, fueling a virtuous circle that drives increased demand for games published by Devolver.”

We’re seeing this play out in tangible ways. Sony disclosed that it had acquired a 5% stake in Devolver, signaling heightened ambitions for games partnerships amid frenzied acquisitions. Large companies like Sony and Microsoft will focus on these partnerships to drive high quality games rather than necessarily outright acquiring the studios for higher and higher costs. Further, Devolver has also made clear its intention to develop stronger relationships with Netease, Bilibili, Tencent, and others to continue expanding into other geographies.

Source: Devolver Digital’s S-1

Over its tenure, Devolver has partnered with third-party developers on ~90 titles, but in the past year alone the company acquired four studios (bringing its total studio count up to eight). Perhaps the most interesting storyline to unpack for Devolver Digital is the company’s developing effort around developing first-party IP. Owning IP will allow Devolver to build out multiple titles and extend lifetime revenue while also diversifying revenue away from partnership dependencies. We’ve seen this roll-up strategy play out numerous times through Microsoft’s acquisitions, and through companies like Stillfront and Embracer. Devolver, however, is unique in its deep indie focus:

-

Croteam (October 2020): acquired for $27M; notable titles include Talos Principle & Serious Sam

-

Good Shepherd (January 2021): acquired for $41.3M; notable titles include Monster Train and John Wick Hex

-

Nerial (April 2021): acquired for $17.4M; known for its expertise in narrative games

-

Firefly (Jun 2021): acquired for $27.5M; known for its depth in RTS’s like Stronghold

Lastly, Devolver’s acquisition strategy and IPO is nothing but timing. According to the S-1, the company’s revenue increased 262% YoY from 2019 (~$59M) to 2020 (~$213M), which was largely driven by Mediatonic’s Fall Guys (~$150M in revenue). This illustrates a few important points:

-

Hits are fundamental inflection points for publishers like Devolver, because they enable reinvestment back into first-party IP.

-

Third-party IP is transient, no matter the relationships. Epic Games acquired Mediatonic earlier this year, which means that Devolver no longer has publishing rights.

-

Hits with live ops and DLC can generate outsized returns for a publisher that has a deep indie, one-time payment focus.

While Devolver’s revenue is still steadily increasing YoY (~60% in 2021 compared to 2019; 2020 excluded due to its outlier status), 2020 was a step function change for Devolver’s balance sheet and the IPO accomplishes much the same goal of being able to reinvest back into IP. Only time will tell what the publisher’s next big hit will be, but through partnerships with big gaming companies and first-party development, Devolver is setting itself up for a slow roll into their next inflection. (Written by Fawzi Itani)

📚 Content Worth Consuming

Where Gaming Rises Next (VentureBeat): “For the presentation, M2 Insights’ Wanda Meloni sat down with The Games Fund’s Maria Kochmola, Carry1st’s Cordel Robbin-Coker, and Lumikai’s Salone Seghal who all explained how tastes are different around the world. And those diverging tastes have affect how studios make games. That is true of studios in India, Eastern Europe, and Africa. And it reflects a bustling global market for games and the creation of game products.” Link

Microsoft and The Metaverse (Stratechery): “It’s certainly the question of the season: what is the Metaverse? I detailed the origin of the term in August; that, though, was about Neal Stephenson’s vision and how it might apply to the future. For the purpose of this Article I am going to focus on my personal definition of the Metaverse, how I think it will come to market, and explain why I think Microsoft is so well placed for this opportunity. Here is the punchline: the Metaverse already exists, it just happens to be called the Internet.” Link

The Industry of LandLords: Exploring the Assetization of the Triple-A Game (Sage Journals): “The monetization of the modern Triple-A game has undergone severe changes, as free-to-play revenue models and game as a service distribution strategy have become standard for game developers. To date, the established tradition of the industry’s political–economic analysis focused on the value extraction and user exploitation of video game as a cultural commodity, centered on the video game as generating value through the selling of boxed or digital units. In this article, we present a new analytical framework grounded in understanding the modern video game as an asset that continuously generates revenue for its owners. This theoretical lens encapsulates the changes in contemporary game development, distribution, and value generation. To demonstrate, we apply it to the analysis of the monetization strategies of three recent free-to-play Triple-A titles: Fortnite (2017), Apex Legends (2019), and Call of Duty: Warzone (2020).” Link

“Play-to-Earn Gaming” and How Work is Evolving in Web3 (Future): “In today’s episode we’re talking about an emerging model of gaming called play to earn, in which players can make actual money based on how much time and effort they put into a game. Play to earn is also part of broader trends — the changing relationship between players and platforms, new incentives for participants in blockchain-based networks, and the new internet era that is coming to be known as a web3.” Link

🔥 Featured Jobs

-

Virtex: Partnerships Director (Remote, Global)

-

BebopBee: Community + Player Experience Manager (Menlo Park, CA)

-

Immutable: BD Exec, Gaming (Remote, US/EU)

-

Ubisoft: Junior Technical Artist (Bucharest, Romania)

-

Hypixel: Senior Game Designer (Remote, Global)

-

Piepacker: Tech Director (Remote, EU)

-

Playco: Financial Planning & Analysis Consultant (Remote, US)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below.

Thanks for reading, and see you next week! As always, if you have feedback let us know here.